1 of 5

Supplementary Product Disclosure Statement

15 June 2024

This document is a Supplementary Product Disclosure Statement (SPDS) issued by

Avanteos Investments Limited ABN 20 096 259 979 AFSL 245531 (AIL), as Trustee for

Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557.

This SPDS supplements the FirstChoice Wholesale Personal Super and Pension:

• Product Disclosure Statement, Issue No 2023/2 dated18 November 2023 (PDS), and

• SPDS dated 16 March 2024.

This SPDS must be read together with the above PDS and SPDS, available free of charge:

• on our website cfs.com.au, or

• by calling us on 13 13 36.

Unless otherwise specied, terms used and dened in the PDS and SPDS have the same meaning in thisSPDS.

The purpose of this SPDS:

• To replace First Sentier Investors as the investment manager of the:

• First Sentier Equity Income option with Martin Currie and rename the option to Martin Currie Australia

Equity Income (includes Pre-Retirement (TTR) Pension)

• First Sentier Developing Companies option with Longwave Capital and rename the option to Longwave

Australian Small Companies

• First Sentier Future Leaders option with Investors Mutual and rename the option to Investors Mutual

Future Leaders

• First Sentier Australian Bond option with Macquarie Asset Management and rename the option to

Macquarie Australian Fixed Interest (includes Pre-Retirement (TTR) Pension)

• First Sentier Global Credit Income option with Janus Henderson and rename the option to Janus

Henderson Diversied Credit (includes Pre-Retirement (TTR) Pension)

• First Sentier Diversied Fixed Interest option with Macquarie Asset Management and rename the option

to Macquarie Dynamic Bond (includes Pre-Retirement (TTR) Pension)

• First Sentier Target Return Income option with Daintree Capital Management and rename the option to

Daintree Core Income.

• To remove all references to the T. Rowe Price Australian Equity option, which is no longer available to

newinvestors.

• To update fees and costs for the Ausbil Australian Active Equity, Investors Mutual Australian Share,

PlatinumAsia and Platinum International options.

• To update fees and costs for the Ausbil TTR Australian Active Equity, Investors Mutual TTR Australian Share,

Platinum TTR Asia and Platinum TTR International options.

FirstChoice Wholesale Personal Super and Pension

2 of 5

Update to SPDS dated

16 March 2024

Section 4 – Risks of investing

Pages 2 – Remove ‘First Sentier Target Return

Income’ option from the table in the ‘Section 4 –

Risks of investing’ section.

Updates to PDS dated

18November 2023

Section 5 – Fees and

other costs

Pages 11 to 17 – The following information

provides the updated ‘Cost of product for 1year’

for the investment options outlined above:

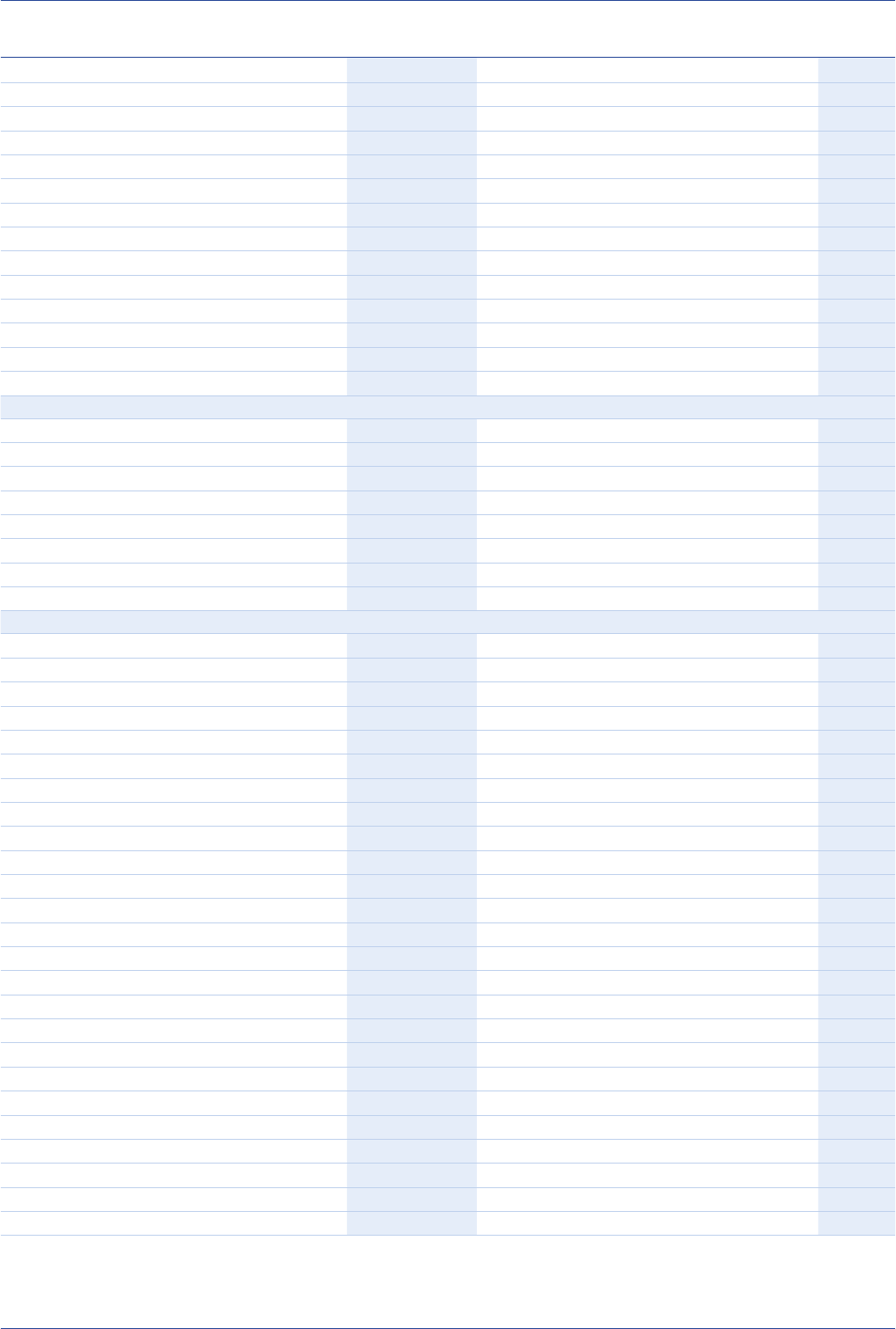

Cost of product for 1 year

FirstChoice Wholesale Personal Super

Option name Cost of

product

Single-Manager Single-Sector

Short duration xed interest

Daintree Core Income $350

Janus Henderson Diversied Credit $365

Diversied xed interest

Macquarie Dynamic Bond $345

Australian xed interest

Macquarie Australian Fixed Interest $245

Australian share

Ausbil Australian Active Equity $505

Investors Mutual Australian Share $600

Martin Currie Australia Equity Income $555

Australian share – small companies

Investors Mutual Future Leaders $795

Longwave Australian Small Companies $620

Global share – emerging markets

Platinum Asia $820

Specialist share

Platinum International $860

FirstChoice Wholesale Retirement Pension

Option name Cost of

product

Single-Manager Single-Sector

Short duration xed interest

Daintree Core Income $350

Janus Henderson Diversied Credit $365

Diversied xed interest

Macquarie Dynamic Bond $345

Australian xed interest

Macquarie Australian Fixed Interest $245

Australian share

Ausbil Australian Active Equity $495

Investors Mutual Australian Share $595

Martin Currie Australia Equity Income $545

Australian share – small companies

Investors Mutual Future Leaders $805

Longwave Australian Small Companies $620

Global share – emerging markets

Platinum Asia $830

Specialist share

Platinum International $860

FirstChoice Wholesale Pre-Retirement Pension

Option name Cost of

product

Single-Manager Single-Sector

Short duration xed interest

Janus Henderson TTR Diversied Credit $365

Diversied xed interest

Macquarie TTR Dynamic Bond $345

Australian xed interest

Macquarie TTR Australian Fixed Interest $250

Australian share

Ausbil TTR Australian Active Equity $500

Investors Mutual TTR Australian Share $605

Martin Currie TTR Australia Equity Income $560

Global share – emerging markets

Platinum TTR Asia $830

Specialist share

Platinum TTR International $860

3 of 5

Pages 18 to 31 – The following information provides the updated ‘Fees and costs’ for the

investmentoptions outlined above:

Additional explanation of fees and costs

Fees and costs – FirstChoice Wholesale Personal Super

Option name

Total administration

and investment fees

and costs (p.a.)

Administration

fees and costs

(p.a.)

Investment fees

and costs (p.a.)

2

Performance

fee (p.a.)

1

Buy/sell

spread (%)

6

Single-Manager Single-Sector

Short duration xed interest

Daintree Core Income 0.70%

5, 8, 9

0.20% 0.50%

5, 8

0.15

Janus Henderson Diversied Credit 0.73%

5

0.20% 0.53%

5

0.15

Diversied xed interest

Macquarie Dynamic Bond 0.69%

5, 8

0.20% 0.49%

5, 8

0.20

Australian xed interest

Macquarie Australian Fixed Interest 0.49%

5

0.20% 0.29%

5

0.10

Australian share

Ausbil Australian Active Equity 1.01%

10

0.20% 0.81%

10

0.15

Investors Mutual Australian Share 1.20%

10

0.20% 1.00%

10

0.20

Martin Currie Australia Equity Income 1.11%

5, 10

0.20% 0.91%

5, 10

0.05

Australian share – small companies

Investors Mutual Future Leaders 1.34%

5

0.20% 1.14%

5

0.20

Longwave Australian Small Companies 1.24%

5, 10

0.20% 1.04%

5, 10

0.20

Global share – emerging markets

Platinum Asia 1.62%

10

0.20% 1.42%

10

0.15

Specialist share

Platinum International 1.67%

10

0.20% 1.47%

10

0.10

Fees and costs – FirstChoice Wholesale Retirement Pension

Option name

Total administration

and investment fees

and costs (p.a.)

Administration

fees and costs

(p.a.)

Investment fees

and costs (p.a.)

2

Performance

fee (p.a.)

1

Buy/sell

spread (%)

6

Single-Manager Single-Sector

Short duration xed interest

Daintree Core Income 0.70%

5, 8, 9

0.20% 0.50%

5, 8

0.15

Janus Henderson Diversied Credit 0.73%

5

0.20% 0.53%

5

0.15

Diversied xed interest

Macquarie Dynamic Bond 0.69%

5, 8

0.20% 0.49%

5, 8

0.20

Australian xed interest

Macquarie Australian Fixed Interest 0.49%

5

0.20% 0.29%

5

0.10

Australian share

Ausbil Australian Active Equity 0.99%

10

0.20% 0.79%

10

0.15

Investors Mutual Australian Share 1.19%

5, 10

0.20% 0.99%

10

0.20

Martin Currie Australia Equity Income 1.09%

5, 10

0.20% 0.89%

9, 10

0.05

Australian share – small companies

Investors Mutual Future Leaders 1.34%

5

0.20% 1.14%

5

0.20

Longwave Australian Small Companies 1.24%

5, 10

0.20% 1.04%

5, 10

0.20

Global share – emerging markets

Platinum Asia 1.63%

10

0.20% 1.43%

10

0.15

Specialist share

Platinum International 1.67%

10

0.20% 1.47%

10

0.10

8 The investment fees and costs for this option will increase effective from 1 August 2024.

9 The performance fee for this option was removed effective 1 June 2024.

10 The investment fees and costs for this option will decrease effective from 1 July 2024.

+= +

+= +

4 of 5

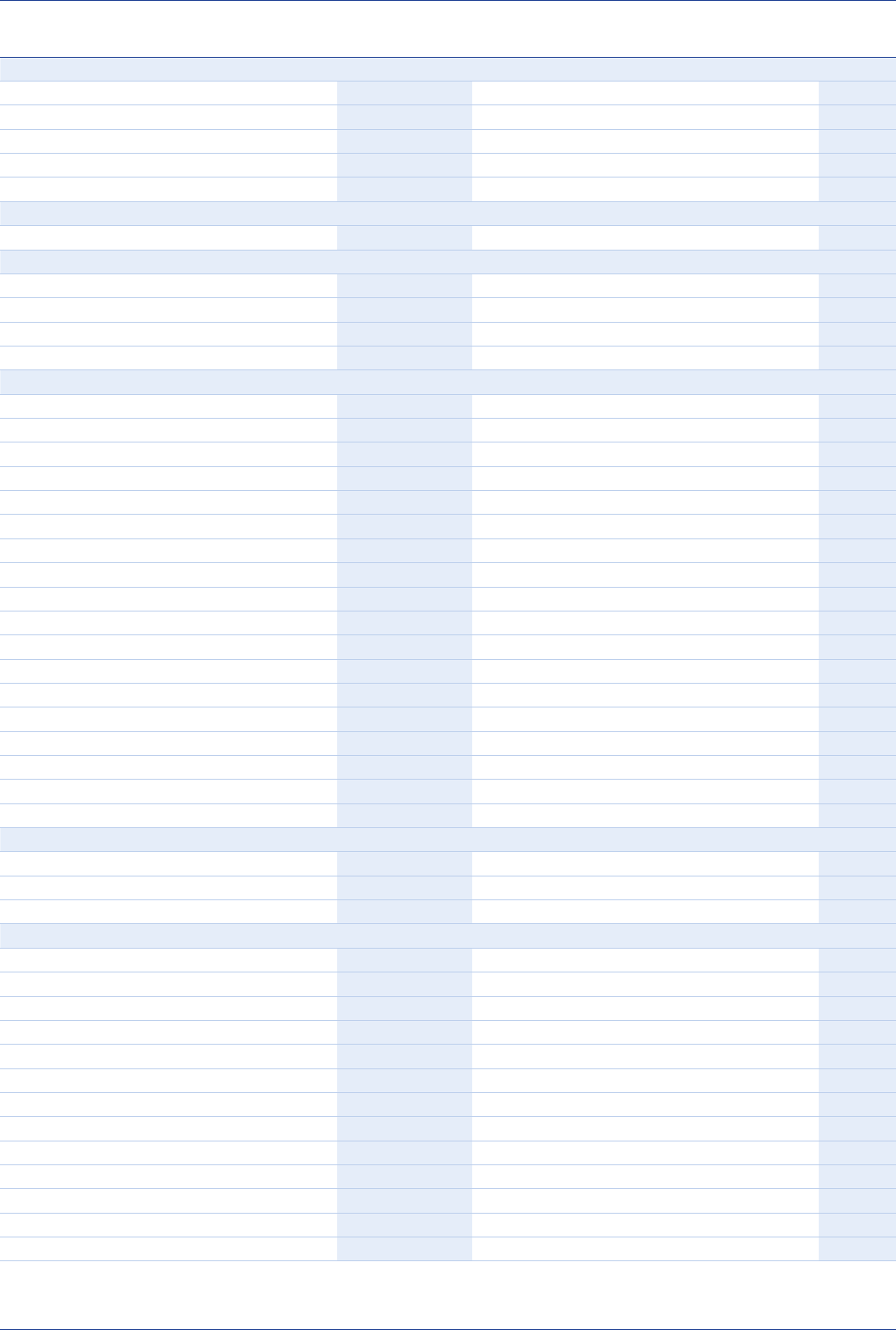

Fees and costs – FirstChoice Wholesale Pre-Retirement Pension

Option name

Total administration

and investment fees

and costs (p.a.)

Administration

fees and costs

(p.a.)

Investment fees

and costs (p.a.)

2

Performance

fee (p.a.)

1

Buy/sell

spread (%)

5

Single-Manager Single-Sector

Short duration xed interest

Janus Henderson TTR Diversied Credit 0.73%

6

0.20% 0.53%

6

0.15

Diversied xed interest

Macquarie TTR Dynamic Bond 0.69%

6, 8

0.20% 0.49%

6, 8

0.20

Australian xed interest

Macquarie TTR Australian Fixed Interest 0.50%

6

0.20% 0.30%

6

0.10

Australian share

Ausbil TTR Australian Active Equity 1.00%

9

0.20% 0.80%

9

0.15

Investors Mutual TTR Australian Share 1.21%

9

0.20% 1.01%

9

0.20

Martin Currie TTR Australia Equity Income 1.12%

6, 8

0.20% 0.92%

6, 8

0.05

Global share – emerging markets

Platinum TTR Asia 1.63%

9

0.20% 1.43%

9

0.15

Specialist share

Platinum TTR International 1.67%

9

0.20% 1.47%

9

0.10

8 The investment fees and costs for this option will increase effective from 1 August 2024.

9 The investment fees and costs for this option will decrease effective from 1 July 2024.

Pages 36 to 49 – The following information provides the updated ‘Transaction costs’ for the investment

options outlined above:

Transaction costs – FirstChoice Wholesale Personal Super

Option name

(A)

Gross transaction

costs (p.a.)

3

(B)

Costs recovered

(p.a.)

(C)

Net transaction

costs (p.a.)

3

(C=A-B)

Single-Manager Single-Sector

Short duration xed interest

Daintree Core Income

1

0.03% 0.03% 0.00%

Janus Henderson Diversied Credit

1

0.06% 0.06% 0.00%

Diversied xed interest

Macquarie Dynamic Bond

1

0.06% 0.06% 0.00%

Australian xed interest

Macquarie Australian Fixed Interest

1

0.04% 0.04% 0.00%

Australian share

Ausbil Australian Active Equity 0.03% 0.03% 0.00%

Investors Mutual Australian Share 0.05% 0.05% 0.00%

Martin Currie Australia Equity Income

1

0.02% 0.02% 0.00%

Australian share – small companies

Investors Mutual Future Leaders

1

0.29% 0.04% 0.25%

Longwave Australian Small Companies

1

0.07% 0.07% 0.00%

Global share – emerging markets

Platinum Asia 0.08% 0.06% 0.02%

Specialist share

Platinum International 0.08% 0.03% 0.05%

+= +

5 of 5

Transaction costs – FirstChoice Wholesale Retirement Pension

Option name

(A)

Gross transaction

costs (p.a.)

3

(B)

Costs recovered

(p.a.)

(C)

Net transaction

costs (p.a.)

3

(C=A-B)

Single-Manager Single-Sector

Short duration xed interest

Daintree Core Income

1

0.05% 0.05% 0.00%

Janus Henderson Diversied Credit

1

0.07% 0.07% 0.00%

Diversied xed interest

Macquarie Dynamic Bond

1

0.08% 0.08% 0.00%

Australian xed interest

Macquarie Australian Fixed Interest

1

0.05% 0.05% 0.00%

Australian share

Ausbil Australian Active Equity 0.03% 0.03% 0.00%

Investors Mutual Australian Share 0.06% 0.06% 0.00%

Martin Currie Australia Equity Income

1

0.03% 0.03% 0.00%

Australian share – small companies

Investors Mutual Future Leaders

1

0.31% 0.04% 0.27%

Longwave Australian Small Companies

1

0.09% 0.09% 0.00%

Global share – emerging markets

Platinum Asia 0.11% 0.08% 0.03%

Specialist share

Platinum International 0.10% 0.05% 0.05%

Transaction costs – FirstChoice Wholesale Pre-Retirement Pension

Option name

(A)

Gross transaction

costs (p.a.)

3

(B)

Costs recovered

(p.a.)

(C)

Net transaction

costs (p.a.)

3

(C=A-B)

Single-Manager Single-Sector

Short duration xed interest

Janus Henderson TTR Diversied Credit

1

0.29% 0.29% 0.00%

Diversied xed interest

Macquarie TTR Dynamic Bond

1

0.52% 0.52% 0.00%

Australian xed interest

Macquarie TTR Australian Fixed Interest

1

0.14% 0.14% 0.00%

Australian share

Ausbil TTR Australian Active Equity

0.19% 0.19% 0.00%

Investors Mutual TTR Australian Share

0.09% 0.09% 0.00%

Martin Currie TTR Australia Equity Income

1

0.04% 0.04% 0.00%

Global share – emerging markets

Platinum TTR Asia 0.16% 0.13% 0.03%

Specialist share

Platinum TTR International 0.10% 0.05% 0.05%

The PDS is otherwise unchanged. The information contained in this SPDS is general information only and does not take into account your individual objectives, nancial or

taxation situation or needs. You should read the SPDS carefully (together with the PDS) and assess whether the information is appropriate for you and consider talking to a

nancial adviser before making an investment decision. 30046/FS8305/0624

1 of 5

Supplementary Product Disclosure Statement

16 March 2024

This document is a Supplementary Product Disclosure Statement (SPDS) issued by

Avanteos Investments Limited ABN 20 096 259 979 AFSL 245531 (AIL), as Trustee for

Colonial First State FirstChoice Superannuation Trust ABN 26 458 298 557.

This SPDS supplements the FirstChoice Wholesale Personal Super and Pension Product Disclosure

Statement, IssueNo 2023/2 dated 18 November 2023 (PDS).

This SPDS must be read together with the above PDS.

The PDS is available free of charge:

• on our website cfs.com.au, or

• by calling Investor Services on 13 13 36.

Unless otherwise specied, terms used and dened in the PDS have the same meaning in this SPDS.

Purpose of this SPDS:

• To update information about CFS’s Privacy Policy

• To add three new investment options in FirstChoice Wholesale Personal Super, FirstChoice Wholesale

Retirement Pension and FirstChoice Wholesale Pre-Retirement Pension:

• Drummond Dynamic Plus

• Innity Core Australian Equity

• Innity SMID Australian Equity

• To update information about ‘Other operating expenses and abnormal costs’.

FirstChoice Wholesale Personal Super and Pension

2 of 5

Product Disclosure Statement

Update information about

CFS’s Privacy Policy

The following information replaces that found

on the inside front cover of the PDS under the

‘Privacy’section.

Privacy

Your personal information is important to us.

The CFS Privacy Policy may be accessed at

cfs.com.au/privacy. Our Privacy Policy outlines how

we manage personal information and covers:

• information we collect

• how we use your information

• who we exchange information with

• keeping your information secure

• accessing, updating and correcting your

information

• making a privacy complaint.

You should read this information when you apply

to make an investment in our products and also

when you transact with us. We regularly update

this information, so it’s important to check the

most up-to-date Privacy Policy available online at

cfs.com.au/privacy. You can also obtain a copy of

that information, free of charge, by calling us on

13 13 36.

If you do not want to receive any direct marketing

information, including telemarketing, please call

us on 13 13 36 to opt out. You may also opt out of

direct marketing by updating your communication

preferences online, or click the ‘unsubscribe’ option

on any marketing communications from us.

You consent to how we deal with the collection, use

and disclosure of your personal information when

you apply to make an investment in or otherwise

transact on the products available. This consent

continues to operate even though your relationship

with us may come to an end, in order for us to

comply with our data retention obligations.

Add three new

investment options

Section 4 – Risks of investing

The following table replaces that found on page8

in the PDS under ‘Additional disclosure required for

hedge funds and other complex options’

Option name

Antipodes Global

Aspect Absolute Return

Aspect Diversied Futures

Brandywine Global Income Optimiser

CFS Alternatives

Drummond Dynamic Plus

First Sentier Target Return Income

Perpetual Share-Plus Long-Short

Platinum Asia

Platinum International

PM Capital Enhanced Yield

PM Capital Global Companies

Sage Capital Equity Plus

Section 5 – Fees and other costs

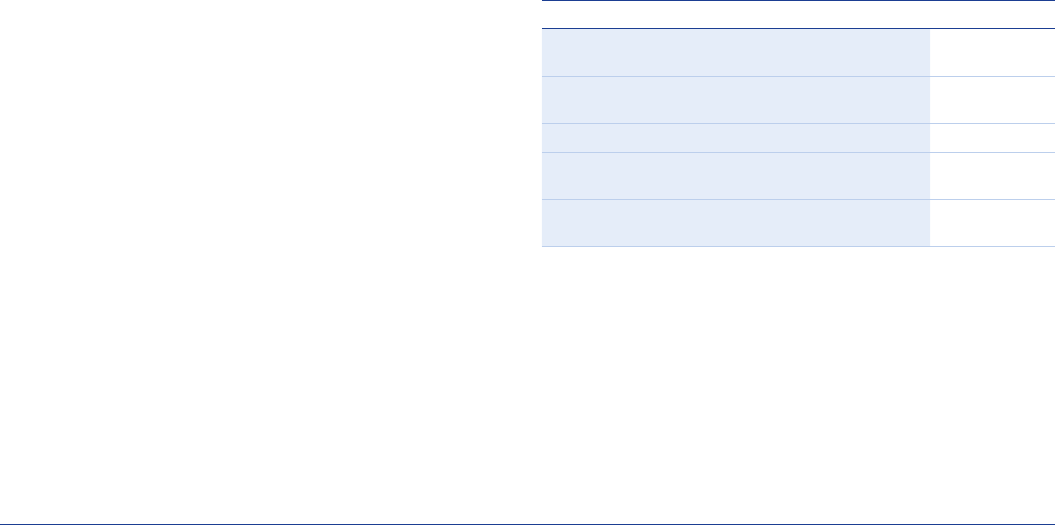

Cost of product for 1 year

The following information is in addition to that

found in the ‘Cost of product for 1 year’ section on

pages 12 to17.

FirstChoice Wholesale Personal Super

Option name Cost of product

Diversied Real Return

Drummond Dynamic Plus $530

Australian Share

Innity Core Australian Equity $445

Australian Share – Small Companies

Innity SMID Australian Equity $560

3 of 5

FirstChoice Wholesale Retirement Pension

Option name Cost of product

Diversied Real Return

Drummond Dynamic Plus $530

Australian Share

Innity Core Australian Equity $445

Australian Share – Small Companies

Innity SMID Australian Equity $560

FirstChoice Wholesale Pre-Retirement Pension

Option name Cost of product

Diversied Real Return

Drummond TTR Dynamic Plus $530

Australian Share

Innity TTR Core Australian Equity $445

Australian Share – Small Companies

Innity TTR SMID Australian Equity $560

Additional explanation of fees and costs

The following information is in addition to that found in the ‘Fees and costs’ section in the PDS.

FirstChoice Wholesale Personal Super

Pages 19 to 21 – the following investment options have been added:

Option name

Total administration

and investment fees

and costs (p.a.)

Administration

fees and costs

(p.a.)

Investment fees

and costs

(p.a.)

2

Performance fee

(p.a.)

1

Buy/sell spread

(%)

6

Diversied Real Return

Drummond Dynamic Plus 1.05%

5

0.20% 0.85%

5

0.20

Australian Share

Innity Core Australian Equity 0.89%

5

0.20% 0.69%

5

0.20

Australian Share – Small Companies

Innity SMID Australian Equity 1.07%

1,5

0.20% 0.87%

5

0.00%

1,5

0.20

FirstChoice Wholesale Retirement Pension

Pages 24 to 26 – the following investment options have been added:

Option name

Total administration

and investment fees

and costs (p.a.)

Administration

fees and costs

(p.a.)

Investment fees

and costs

(p.a.)

2

Performance fee

(p.a.)

1

Buy/sell spread

(%)

6

Diversied Real Return

Drummond Dynamic Plus 1.05%

5

0.20% 0.85%

5

0.20

Australian Share

Innity Core Australian Equity 0.89%

5

0.20% 0.69%

5

0.20

Australian Share – Small Companies

Innity SMID Australian Equity 1.07%

1,5

0.20% 0.87%

5

0.00%

1,5

0.20

FirstChoice Wholesale Pre-Retirement Pension

Pages 29 and 30 – the following investment options have been added:

Option name

Total administration

and investment fees

and costs (p.a.)

Administration

fees and costs

(p.a.)

Investment fees

and costs

(p.a.)

2

Performance fee

(p.a.)

1

Buy/sell spread

(%)

5

Diversied Real Return

Drummond TTR Dynamic Plus 1.05%

6

0.20% 0.85%

6

0.20

Australian Share

Innity TTR Core Australian Equity 0.89%

6

0.20% 0.69%

6

0.20

Australian Share – Small Companies

Innity TTR SMID Australian Equity 1.07%

1,6

0.20% 0.87%

6

0.00%

1,6

0.20

=

=

=

+ +

+ +

+ +

4 of 5

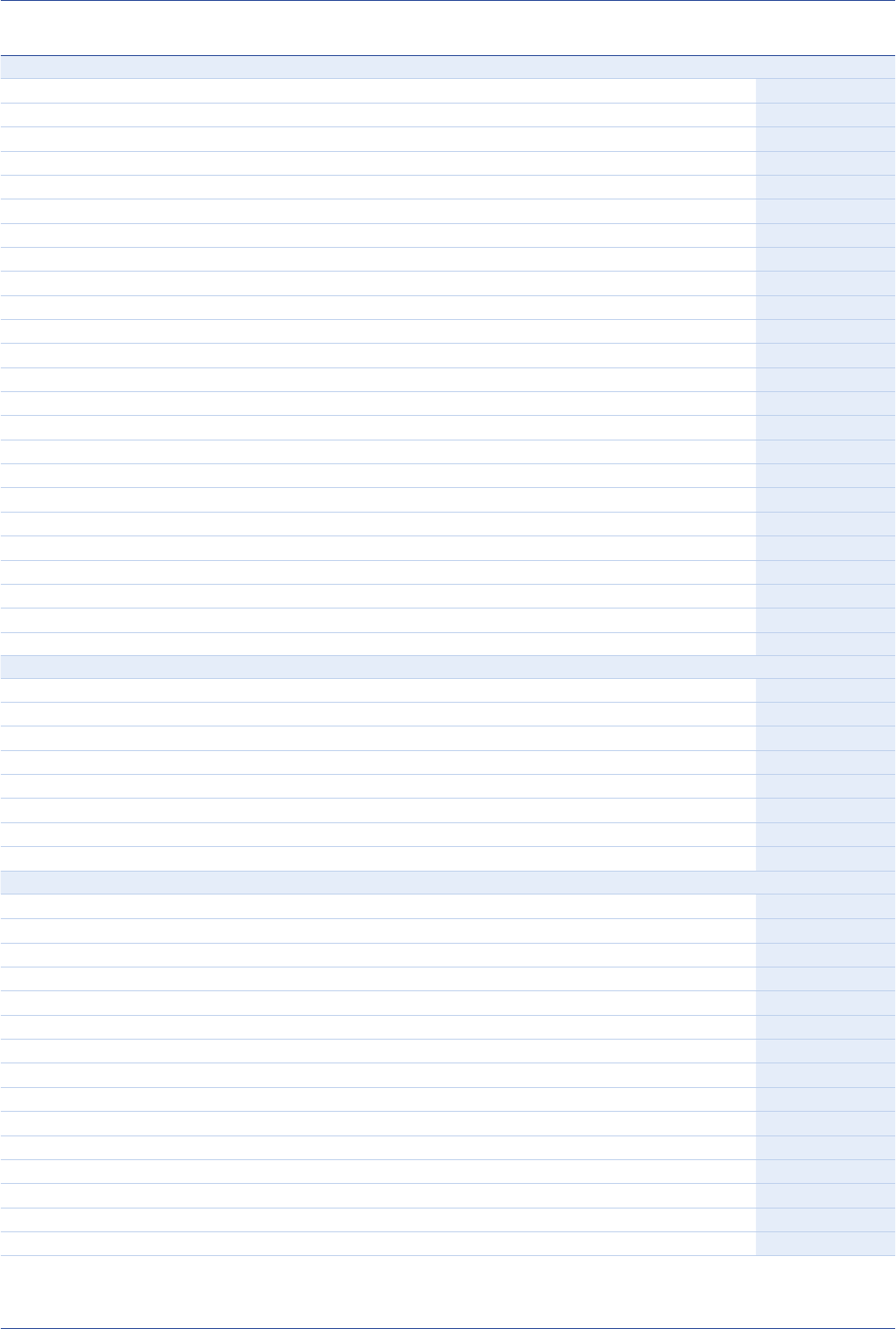

The following information is in addition to that found in the ‘Transaction costs’ section in the PDS.

FirstChoice Wholesale Personal Super

Pages 37 and 39 - the following investment options have been added:

Option name

(A)

Gross transaction

costs (p.a.)

3

(B)

Costs recovered

(p.a.)

(C)

Net transaction

costs (p.a.)

3

(C=A-B)

Diversied Real Return

Drummond Dynamic Plus

1

0.09% 0.08% 0.01%

Australian Share

Innity Core Australian Equity

1

0.20% 0.20% 0.00%

Australian Share – Small Companies

Innity SMID Australian Equity

1

0.25% 0.20% 0.05%

FirstChoice Wholesale Retirement Pension

Pages 42 to 44 - the following investment options have been added:

Option name

(A)

Gross transaction

costs (p.a.)

3

(B)

Costs recovered

(p.a.)

(C)

Net transaction

costs (p.a.)

3

(C=A-B)

Diversied Real Return

Drummond Dynamic Plus

1

0.09% 0.08% 0.01%

Australian Share

Innity Core Australian Equity

1

0.20% 0.20% 0.00%

Australian Share – Small Companies

Innity SMID Australian Equity

1

0.25% 0.20% 0.05%

FirstChoice Wholesale Pre-Retirement Pension

Pages 47 and 48 - the following investment options have been added:

Option name

(A)

Gross transaction

costs (p.a.)

3

(B)

Costs recovered

(p.a.)

(C)

Net transaction

costs (p.a.)

3

(C=A-B)

Diversied Real Return

Drummond TTR Dynamic Plus

1

0.09% 0.08% 0.01%

Australian Share

Innity TTR Core Australian Equity

1

0.20% 0.20% 0.00%

Australian Share – Small Companies

Innity TTR SMID Australian Equity

1

0.25% 0.20% 0.05%

5 of 5

Update information about

‘Other operating expenses

and abnormal costs’

The following information replaces the

‘Otheroperating expenses and abnormal costs’

section onpage 50 in the PDS:

Cost and expenses relating to the Fund

Subject to superannuation law, the trustee has the

discretion to recover the ongoing operating costs

and expenses that relate to the Fund out of the

assets of the Fund. The trust deed does not place

any limit on the amount of these costs that can be

paid out of the Fund. Where the recovered expenses

affect your account, they are reflected in the fees

and costs shown.

The PDS is otherwise unchanged. The information contained in this SPDS is general information only and does not take into account your individual objectives, nancial or

taxation situation or needs. You should read the SPDS carefully (together with the PDS) and assess whether the information is appropriate for you and consider talking to a

nancial adviser before making an investment decision. 29891/FS8275/0324

Issue No 2023/2, dated 18 November 2023

Colonial First State FirstChoice Wholesale Personal Super USI FSF0511AU

Colonial First State FirstChoice Wholesale Pension USIFSF0510AU

FirstChoice Wholesale Personal Super and FirstChoice Wholesale Pension areoffered

from the Colonial First State FirstChoice Superannuation Trust ABN26 458 298 557

by Avanteos Investments Limited ABN 20 096 259 979 AFSL 245531

Personal Super

and Pension

Product Disclosure Statement

FirstChoice Wholesale

This document is the Product Disclosure Statement (PDS) for FirstChoice

Wholesale Personal Super and Pension. The PDS also includes references to the

following documents which contain statements and information incorporated by

reference and which are taken to be included in the PDS:

• FirstChoice Investment Options Menu

• Reference Guide – FirstChoice Wholesale Personal Super and Pension

• FirstChoice Wholesale Personal Super Insurance booklet

• Reference Guide – Complex Funds

• Reference Guide – FirstChoice Managed Accounts

• Thrive+ Sustainable Investment Charter.

A reference to ‘the PDS’ includes a reference to all of these documents. You

should assess whether the product is appropriate for you and speak to your

nancial adviser before making a decision to invest in the product. You should

also read the PDS and all statements and information incorporated by reference

into the PDS before making a decision about the product. You can obtain a copy

ofthat information, free of charge, by calling us on 13 13 36, visiting our website

atcfs.com.au/fcwps, or from your nancial adviser.

You should regularly review how the superannuation and taxation laws affect you

with your nancial adviser.

If any part of the PDS (such as a term or condition) is invalid or unenforceable under

the law, it is excluded so that it does not in any way affect the validity or enforceability

of the remainingparts.

FirstChoice Wholesale Personal Super and FirstChoice Wholesale Pension (‘the

funds’) are offered through the Colonial First State FirstChoice Superannuation

Trust ABN 26458 298 557 (‘FirstChoice Trust’). The FirstChoice Trust is a public

offer superannuation fund which offers personal super, employer super and

pensionproducts.

The FirstChoice Trust is a resident, regulated superannuation fund within the

meaning of the Superannuation Industry (Supervision) Act 1993 and is not subject

toa direction not to accept contributions.

This PDS is issued by Avanteos Investments Limited (‘AIL’, ‘the trustee’, ‘we’, ‘our’ or

‘us’), the trustee of the FirstChoice Trust. Colonial First State Investments Limited

ABN 98 002 348 352 AFSL 232468 (CFSIL) is the responsible entity of the underlying

managed investment schemes into which the FirstChoice Wholesale product (both

super and pension) invest.

Colonial First State (CFS) refers to Superannuation and Investments HoldCo Pty

Limited ABN 64 644 660 882 and its subsidiaries which include AIL and CFSIL.

CFSismajority owned by an afliate of Kohlberg Kravis Roberts & Co. L.P. (KKR),

with the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 (CBA)

holding a signicant minority interest.

The insurance provider is AIA Australia Limited ABN 79 004 837 861 AFSL 230043

(AIA Australia, the ‘Insurer’). AIA Australia is part of the AIA Group. The insurance

cover is provided under policies issued to the trustee. AIA Australia is not part

of the CFS group of companies. CFS and its subsidiaries, CFSIL and AIL, do not

guarantee the obligations or performance of AIA Australia or the products it offers.

The investment performance and the repayment of capital of AIL products is not

guaranteed. Investments in the funds are subject to investment risk, including loss

ofincome and capital invested.

The issue of this PDS is authorised solely by AIL. Apart from AIL, no other CFS

entities are responsible forany statement or information contained within the PDS

relating to thefunds.

The trustee may change any of the terms and conditions contained or referred to in

the PDS, subject to compliance with the Trust Deed and laws and, where a change is

material, the trustee will notify you in writing within the timeframes provided for in

the relevant legislation.

Information contained in this PDS which is not materially adverse information is

subject to change from time to time and may be updated via our website and can be

found at any time by visiting www.cfs.com.au/product-updates. A paper or electronic

copy of any updated information is available free of charge on request by contacting

us on 13 1336.

An interest in the funds cannot be issued to you unless you complete the application

form attached to or accompanied by either a paper or an electronic copy of thePDS.

The trustee of the funds is not bound to accept an application.

The offer made in this PDS is available only to persons who are receiving the PDS within

Australia and accepting the offer within Australia. It does not constitute an offer in any

other country or jurisdiction including the European Union. Accordingly the applicant

must have an Australian residential address at the point of opening an account.

You should note that unless an investment option is suspended, restricted or

unavailable you may withdraw from an investment option in accordance with our

normal processes.

The investment managers of the investment options available for investment through

the funds have given, and not withdrawn, their consent to be included in the PDS in

the form and context in which they are included. The investment managers are acting

as investment managers only for the relevant options. They are not issuing, selling,

guaranteeing, underwriting or performing any other function in relation to the options.

CFSIL reserves the right to outsource any or all of its investment management

functions, including to related parties, without notice to investors.

Taxation considerations are general and based on present taxation laws, rulings and

their interpretation as at 18 November 2023. You should seek professional tax advice

on your situation before making any decision based on this information.

AIL is also not a registered tax (nancial) adviser under the Tax Agent Services Act

2009 and you should seek tax advice from a registered tax agent or a registered tax

(nancial) adviser if you intend to rely on this information to satisfy the liabilities or

obligations or claim entitlements that arise, or could arise, under a taxation law.

The information provided in this PDS is general information only and does not take

account of your objectives, personal nancial or taxation situation or needs. Because of

this, before acting on the information, you should consider its appropriateness having

regard to these factors. You should consider obtaining nancial advice relevant to your

personal circumstances before investing. You should also consider the PDS before

making any decision to acquire, or continue to hold, an interest in either of the funds.

All monetary amounts referred to in the PDS are, unless specically identied to the

contrary, references to Australian dollars.

FirstChoice and FirstNet are trademarks of Colonial First State Investments Limited.

The Target Market Determinations (TMD) for our nancial products can be found

at www.cfs.com.au/tmd and include a description of who the nancial product is

appropriate for.

Trustee contact details

Avanteos Investments Limited

GPO Box 3956

Sydney NSW 2001

Telephone 13 13 36

Email [email protected]om.au

Contents

1 About Colonial First State 1

2 Benets of investing with FirstChoice Wholesale 1

3 How super and pensions work 2

4 Risks 5

5 Fees and other costs 9

6 Taxation 53

7 Insurance in FirstChoice Wholesale Personal Super 55

8 How to open an account, cooling‑off period,

nancialadvice and complaints 56

Privacy

Your personal information is important to us. The CFS Privacy Policy may be

accessed at www.cfs.com.au/privacy

Information about how we collect, use, exchange and protect your personal

information is also set out in the Reference Guide – FirstChoice Wholesale

Personal Super and Pension. Our Privacy Policy outlineshow we do this

andcovers:

• information we collect

• how we use your information

• who we exchange information with

• keeping your information secure

• accessing, updating and correcting your information

• making a privacy complaint.

You should read this information when you apply to make an investment in

our products and also when you transact with us. We regularly update this

information, so it’s important to check the most up-to-date Privacy Policy

available online.

If you do not want to receive any direct marketing information, including

telemarketing, please call us on 13 13 36 to opt out.

You consent and agree to how we deal with the collection, use and disclosure

ofyour personal information as set out in the current Reference Guide –

FirstChoice Wholesale Personal Super and Pension when you apply to make

an investment in or otherwise transact on the products available. This consent

continues to operate even though yourrelationship with us may come to an end.

Product Disclosure Statement 1

1 About Colonial First State

At Colonial First State, we’ve been helping Australians

withtheir investment needs since 1988.

We’re one of Australia’s leading nancial services

organisations that provides investment, superannuation

and pension products to individual, corporate and

superannuation fund investors. Our investment

management expertise spans Australian and global shares,

property, xed interest and credit, cash and infrastructure.

Our business has been built on people who exercise good

judgement and are acknowledged as leaders in their

respective elds of expertise. We’ve succeeded by doing

the small things well, and we’re absolutely dedicated to

thenancial wellbeing of our investors.

Colonial First State’s consistent, disciplined approach to

investing has been recognised by many awards within the

investment management industry.

For further information about Colonial First State, please

refer to the ‘About Us’ section on cfs.com.au

2 Benets of investing with

FirstChoice Wholesale

FirstChoice Wholesale is designed to help you achieve

your super and retirement goals. FirstChoice Wholesale

providesyou with exceptional value, service and choice.

Value

We are committed to providing you with a competitively

priced product that gives you value for money. We seek

toprovide a great platform for a competitive price.

Service

Our brand is synonymous with service excellence.

Youwillreceive fast and personal service.

Product options

Depending on your lifestage, you can choose to have

a superannuation account, pre‑retirement pension

(commonly referred to as a transition to retirement

pension), or account based pension. Refer to section 3

‘Howsuper and pensions work’, for more information.

Investment options

You can access more than 180 investment options from over

70 well‑respected Australian and international investment

managers (except for pre‑retirement pension members

who have access to a limited investment menu ofover 130

investment options).

These options include specialist boutique investment

managers, across different asset classes such as shares,

xed interest, property, term deposits and cash, giving you

real choice and diversity so that you can tailor an investment

portfolio to meet your needs. You can choose one option or

a combination of different options, and transfer your money

between investment options at any time.

You can choose from:

• multi‑manager portfolios that are pre‑mixed for you

• single manager options allowing you to tailor‑make

yourportfolio

• a range of FirstChoice Managed Accounts within our

FirstChoice Managed Accounts service, if you have

anadviser.

FirstChoice Managed Accounts are tailored investment

portfolios managed by us in consultation with an appointed

portfolio consultant, your adviser’s dealer group or licensee.

Once you select to invest in a FirstChoice Managed Account,

your portfolio will be regularly reviewed for you. For more

details, you should consult with your nancial adviser or refer

to the Reference Guide – FirstChoice Managed Accounts.

Warning: Before choosing an investment option or a

range of investment options in which to invest, you

should consider the likely investment return of each

option, the risk of investing in any or all of those options

and your investment timeframe.

When you are invested in FirstChoice Wholesale, your money

is combined with other investors’ money in FirstChoice

Wholesale. Each option invests in an underlying ‘pool’ which

is managed according to the option’s objectives. Each option

has a different level of risk and potential level of returns.

Personal customer service every time

We understand that our success depends on our ability to

provide you with great service – every time. We have some

of the most dedicated and highly trained people in the

market, and we constantly aim for exceptional service.

FirstNet makes it easy

You can access up‑to‑date information on your investments

at any time via FirstNet.

FirstNet e-Post

e‑Post is the fast and secure way to submit original forms

and requests via FirstNet, our secure online service. You no

longer need to post the originals, saving you time and effort.

You will receive an instant email conrmation when you

submit your request and a reference number.

Receive informative material

As a member in FirstChoice Wholesale, you can look forward

to receiving:

• iQ magazine

• annual statements

• conrmation letters.

2 FirstChoice Wholesale Personal Super and Pension

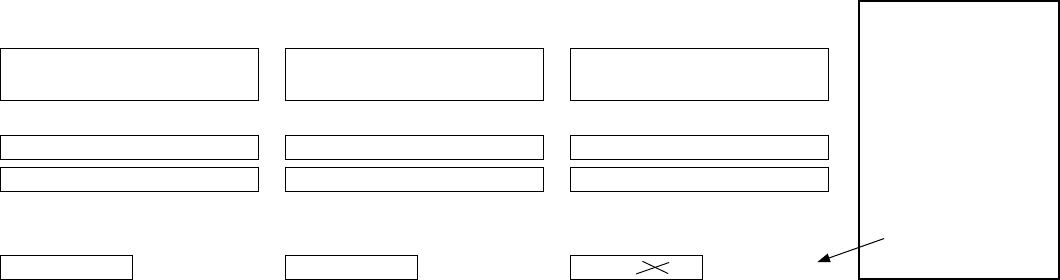

Minimums

FirstChoice Wholesale

Personal Super

FirstChoice

Wholesale Pension

Initial investment

1

No minimum $20,000

1

Account balance $1,500 Not applicable

3

Additional investment No minimum Not applicable

Regular investment

plan (monthly)

1

$100 per month

1

Not applicable

Switch No minimum No minimum

Withdrawal

2

No minimum

2

No minimum

2

Insurance for FirstChoice

Wholesale Personal Super

You can choose from:

• Death only cover

• Death and Total and Permanent Disablement (TPD) cover

• Salary Continuance Insurance (SCI) cover.

You should refer to section 7 ‘Insurance in FirstChoice

Wholesale Personal Super’ for more information.

Transfers between FirstChoice Wholesale

Super and Pension products

FirstChoice Wholesale Personal Super and FirstChoice

Wholesale Pension are offered from the same FirstChoice

Trust. This may allow us to offer you a refund of buy/

sell spreads where you transfer between like‑for‑like

investment options, between these FirstChoice products.

For more information, refer to section 3 ‘How super and

pensions work’.

Estate planning

Estate planning is important as it provides you with more

certainty about who will receive your death benet when

you die.

In the event of your death, a death benet will become

payable from the super fund either to:

• your dependants or your legal personal representative

nominated on your valid ‘Non‑lapsing death benet

nomination’ form, or

• your reversionary beneciary (pension accounts only)

– the pension continues to be paid to this person after

yourdeath, or

• in any other case, your legal personal representative,

tobe distributed in accordance with your Will or the

lawsofintestacy.

You should read the Investment Options Menu and all the

statements and information incorporated by reference in

the Reference Guide – FirstChoice Wholesale Personal

Super and Pension, available online at cfs.com.au/fcwps

or by calling 13 13 36. The material relating to

investments may change between the time you read

thePDS and the day you sign the application form.

3 How super and pensions work

What is super?

Super is a long‑term form of savings which is designed to be

paid to you when you retire. For most people, your employer

will contribute to your super.

The Federal Government provides a number of tax

concessions to super making it a tax‑effective way to save

for your retirement. These include generally applying a 15%

tax rate to concessional contributions and taxing earnings

at a maximum of 15%. Additionally, your super benets

can generally be paid to you tax free after age 60. Refer to

section 6 ‘Taxation’, for more information.

Contributing to your super

If you are an employee, your employer is generally required

to contribute a percentage of your ordinary time earnings

(earnings for your ordinary hours of work) to a super fund for

you. In addition to the contributions made by your employer,

you can contribute to your super fund for yourself (or your

spouse can do so on your behalf).

There are different types of contributions that can be made

to your super fund. The main types of contributions are:

• Compulsory employer contributions – these are

contributions an employer is required to make on your

behalf by law. They include Superannuation Guarantee

contributions and contributions required under an

industrial award.

• Voluntary employer contributions – these are

contributions an employer makes on your behalf in

excess of any compulsory contributions. They include

salary sacrice contributions, where you negotiate to give

up some of your pre‑tax salary in return for additional

employer contributions.

• Personal contributions – these are contributions that

you make for yourself. Depending on your circumstances,

you may be entitled to claim a tax deduction for the

amount of the contribution, or you may be entitled to a

Government co‑contribution.

• Spouse contributions – these are contributions that you

make for your spouse.

• Other third party contributions – these are contributions

made by a third party, other than an employer or

yourspouse.

The Federal Government applies caps to the different types

of contributions. Contributions made in excess of these caps

may be subject to signicant additional tax up to the top

marginal tax rate (plus applicable levies). Refer to section 6

‘Taxation’, for more information.

Consolidating your super

You may have super accounts in other funds. Consolidating

your accounts will help you keep track of your super balance

more easily and may mean you pay less fees.

It’s important to consider whether you’ll lose any existing

insurance cover after consolidating your super funds and

whether your remaining cover is sufcient.

You can consolidate super accounts through themyGov

website www.my.gov.au.

1 We may accept amounts less than the minimum, at our discretion.

2 Subject to minimum account balance requirements and normal conditions of release. For those account based pensions that are pre-retirement pensions,

someconditions apply to withdrawals. Refer to the Reference Guide – FirstChoice Wholesale Personal Super and Pension for further details.

3 We have the discretion to close your account once it falls below $3,000 or if your pension payment is more than your account balance.

Product Disclosure Statement 3

You may have more than one super account in our FirstChoice

product range which includes, FirstChoice Employer Super and

FirstChoice Wholesale Personal Super. If you hold multiple

accounts, we will inform you in writing and you can choose to

consolidate your accounts if you wish. We may use your TFN

tohelp identify if you have morethan one super account.

If you have a nancial adviser, we recommend that you

speak with them about whether consolidating is the best

option for your situation.

Accessing your super

Generally, you can’t fully access your super until after you

reach your preservation age and retire.

Your preservation age is set by the Federal Government.

Ifyou were born before 1 July 1960, your preservation

age is 55. If you were born later, your preservation age is

between ages 56 and 60 depending on your date of birth.

Tond out your preservation age, go to www.ato.gov.au

Once you have full access to your super, you can commence

an account based pension to allow you to use your super

money as an income stream, as well as make lump sum

withdrawals.

Alternatively, if you have reached your preservation age,

youcan commence a pre‑retirement pension (without

needing to meet any other requirements such as retiring).

Other ways in which you may be able to access your

super(conditions of release) include:

• reaching preservation age and ceasing gainful employment

(at any time) and having no intention of being gainfully

employed for 10 or more hours per week in the future

• ceasing gainful employment after reaching age 60

• reaching age 65

• nancial hardship

• compassionate grounds

• permanent incapacity

• a terminal medical condition

• death

• temporary incapacity

• eligible withdrawals under the First Home Super

SaverScheme

• departing Australia superannuation payment

(forformertemporary residents only).

How your super is valued

FirstChoice Wholesale Personal Super is an accumulation

super product which is designed to help you accumulate

and grow your savings for your retirement.

You’ll have an account balance which changes over time

(for example due to contributions received, net investment

returns, and fund costs). When a contribution is made

to your account, it will be used to purchase units in your

chosen investment options. For example, if you make

a contribution of $100 and the entry unit price for your

chosen option is $1.00, you’ll will receive 100 units.

The value of your units will fluctuate due to the receipt

of investment income and changes in the value of the

underlying assets held in each option (except for FirstRate

options, where the number of units change as a result of the

payment of interest). The unit price you receive will also be

affected by other factors such as the payment of fees and

costs, and taxes from either your account or the assets of

your investment options in which you are invested.

Other costs that relate specically to you, such as the payment

of insurance premiums or adviser service fees, may also be

deducted from your account via the withdrawalof units.

This means that your account balance can fluctuate on a

daily basis depending on market movements, the costs of

running the fund and any expenses that relate specically

toyour account.

The following table provides a number of factors which may

impact the value of your superannuation account.

Things that may increase your

super account balance

Things that may reduce your

super account balance

• Contributions, such as

employer, personal and

spouse contributions.

• Rollovers from other funds.

• Increases in the unit price of

an option due to the accrual

of investment income and

changes in the market value

ofthe underlying assets.

• Family law payment splits

received and spouse

contribution splitting

payments received.

• Co‑contributions or low

income super tax offset paid

by the Government.

• Tax (including tax levied on

contributions and the fund’s

investment income).

• Decreases in the unit price of

an investment option due to

changes in the market value of

the underlying assets.

• Benet payments (lump sum

and income stream payments).

• Fund fees and charges.

• Insurance premiums or

adviser service fees.

• Family law payment splits and

spouse contribution splitting

payments.

What is a pension?

A pension is a regular income stream achieved by drawing

upon your superannuation once you have reached

preservation age for pre‑retirement pensions or met a

relevant condition of release for account based pensions.

FirstChoice Wholesale Pension offers the payment of the

following types of pensions:

• a pre‑retirement pension

• an account based pension.

Depending on your personal circumstances, a pension may

be a tax‑effective way of receiving income. Investment

earnings of account based pensions are not subject to tax.

For pre‑retirement pensions, a maximum of 15% tax on the

investment earnings is applicable.

1

If you commence a pension

before you reach age 60, tax may be withheld from your

pension payment amounts. Please refer to section 6 ‘Taxation’

for more information about the tax treatment ofpensions.

Your regular income is based on a percentage of your

account balance as at 1 July each year. In the rst nancial

year that you commence your pension, a percentage of your

account balance as at the commencement date of your

pension is used instead.

The pension ceases to be paid to you when your account

balance is reduced to zero.

2

You should speak with your nancial adviser about whether

a pension account may be appropriate for your individual

objectives, nancial situation andneeds.

1 Once you reach age 65 or notify us that you have met another eligible condition of release, your pension will be treated as a retirement phase account based

pension, and will no longer be subject to tax on investment earnings.

2 We have the discretion to close your account once it falls below $3,000 or if your pension payment is more than your account balance.

4 FirstChoice Wholesale Personal Super and Pension

How a pension account is valued

Your account balance is initially equal to your rollovers and

super contributions made to commence your pension. Once

you commence a pension you cannot invest additionalmoney.

The money invested to establish your pension is used to

purchase units in your chosen investment options. For

example, if you invest $100,000 and the entry unit price for

your chosen option is $1.00, you’ll receive 100,000 units.

The value of your units will fluctuate due to the receipt

of investment income and changes in the value of the

underlying assets held in each option (except for FirstRate

options, where the number of units change as a result of

the payment of interest). The unit price you receive will also

be affected by other factors such as the payment of certain

fees and costs, and taxes from either your account or the

assets of the investment options in which you are invested.

Account deductions which may cause your pension account

balance to reduce include:

• pension payment amounts and other super benets

paidto you

• fees and costs as well as benets paid due to a release

authority (e.g. the release of excess contributions)

• family law payment split.

Account based pensions

If you commence an account based pension, we must pay

you at least a minimum pension payment amount each

year (rounded to the nearest 10 whole dollars) but you can

choose to receive as much income above that amount that

you wish, or withdraw a lump sum benet at any time.

Your minimum pension payment, which is calculated each

year, is calculated by multiplying your account balance as

at 1 July (or as at the commencement of your pension if

your pension commenced during the nancial year) by a

percentage factor depending on your age (see the section

titled ‘Minimum pension payment requirements’, below for

details). There is no maximum pension payment amount

you must receive from an account based pension.

There is a cap

1

on the total amount of your superannuation

savings you can use to commence retirement phase income

streams, which include account based pensions. The ATO

tracks how much you transfer to retirement phase pensions,

in a notional ‘transfer balance account’ available on my.gov.au.

Your transfer balance account includes the value of existing

retirement phase income streams at 30June 2017 and the

starting value of new retirement phase income streams from

1 July 2017. Please refer to the Reference Guide – FirstChoice

Wholesale Personal Super and Pension for further information.

Pre-retirement pensions

Pre‑retirement pensions are typically available to members

who have reached their preservation age. A pre‑retirement

pension is also known as a ‘transition to retirement pension’.

It is similar to an account based pension, except that it is

designed to supplement your income in the later years of

your working life, before you retire.

Minimum pension payment requirements (as outlined in the

section titled ‘Minimum pension payment requirements’

below) are applicable to pre‑retirement pension accounts.

A pre‑retirement pension is also restricted to a maximum

pension payment amount each year of 10% of your account

balance as at 1 July (or, in the rst nancial year that you

commence your pension, your account balance as at the

date of commencement).

In addition, there are restrictions on when you can take

an additional lump sum super benet from your account

balance while you are receiving a pre‑retirement pension.

Your pre‑retirement pension will convert to the rules of an

account based pension (with no maximum pension payment

amount or restrictions on lump sum super benets) on the

earlier of the date that:

• you notify us that you have met an eligible condition

of release (refer to the Reference Guide – FirstChoice

Wholesale Personal Super and Pension for details), or

• you turn age 65.

Initially, your pre‑retirement pension will not increase your

transfer balance account. However, when your pre‑retirement

pension converts to the rules of an account based pension,

it will also become a retirement phase income stream and

be included in your transfer balance account. Refer to the

Reference Guide – FirstChoice Wholesale Personal Super

andPension for further information.

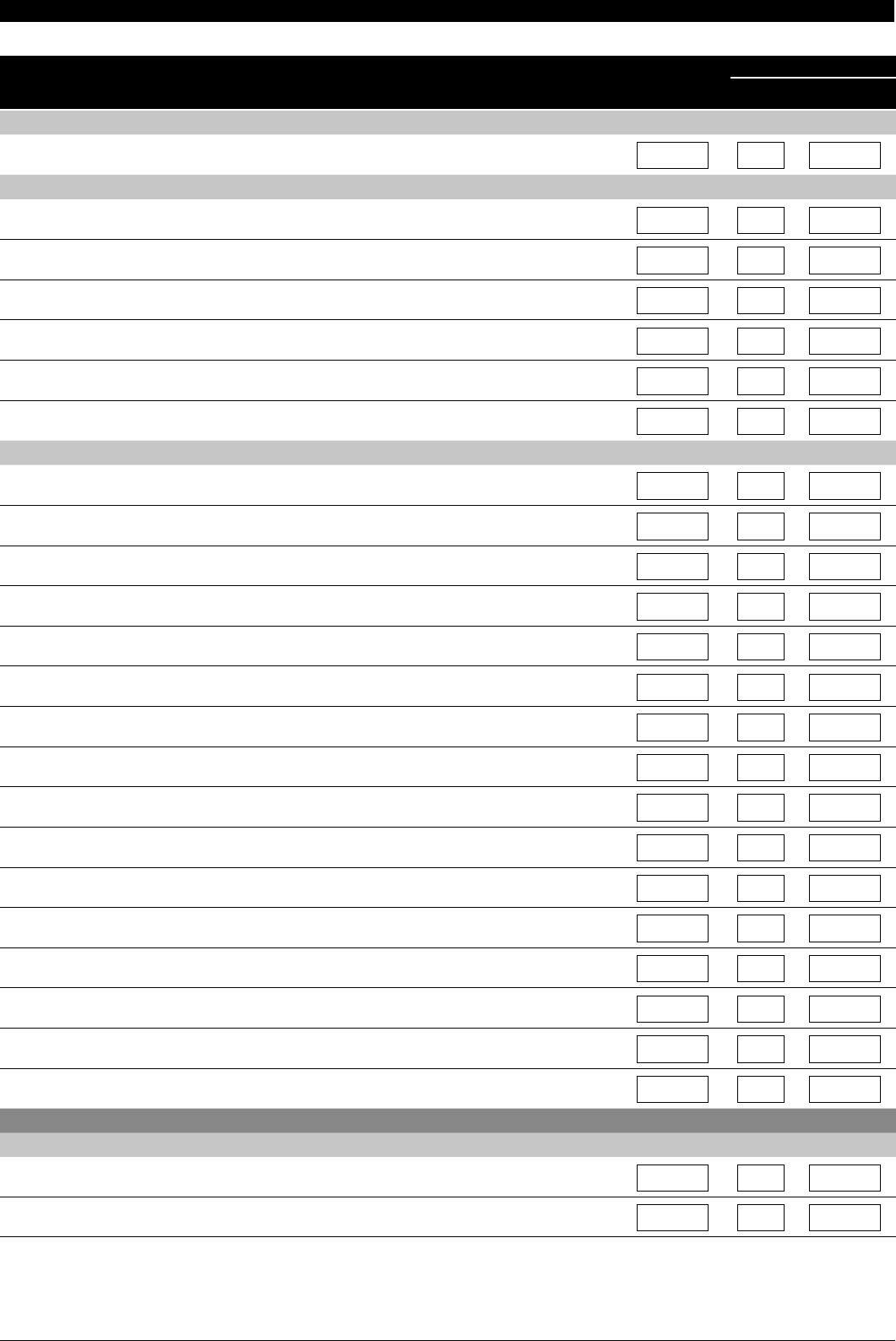

Minimum pension payment requirements

The percentage factors used to calculate minimum

drawdown requirements for account based pensions are

shown in the following table.

Age Minimum percentage factor

Under 65 4%

65 to 74 5%

75 to 79 6%

80 to 84 7%

85 to 89 9%

90 to 94 11%

95 or over 14%

The Government may change these pension minimums at

any time. If required by law, we may adjust your minimum

pension payment amount (or maximum for pre‑retirement

pensions) to comply with the legislation.

We must pro rata your minimum pension payment amount

in the rst nancial year of your pension for the number of

days remaining in the nancial year. If you commence your

pension on or after 1 June, no minimum pension payment

amount is required to be made for that nancial year.

SuperFirst Transfer Facility

The SuperFirst Transfer Facility is a temporary account that

allows you to consolidate your super savings (including

super held by other super funds) and make additional super

contributions before:

• commencing your pension for the rst time, or

• rolling over an existing pension, with the addition of the

funds in SuperFirst, and commencing a new pension.

Refer to the Reference Guide – FirstChoice Wholesale

Personal Super and Pension for further details.

1 This cap is the ‘transfer balance cap’. If you commence a retirement phase income stream for the rst time in 2023–24, your cap is $1.9 million. If you

commenced one in an earlier year, your cap is a lower value.

Product Disclosure Statement 5

Transfers between Super and Pension

FirstChoice Wholesale Personal Super and FirstChoice

Wholesale Pension are offered from the same FirstChoice

Trust. Many of the same investment options are offered in

both products which may allow us to offer you a refund of

buy/sell spreads where you transfer between like‑for‑like

investment options, between these FirstChoice products.

When you transfer from FirstChoice Wholesale Personal

Super to FirstChoice Wholesale Pension, any tax liability

willbe deducted.

If you hold a FirstRate Term Deposit option, you can

transfer your super benet from FirstChoice Wholesale

Personal Super to FirstChoice Wholesale Pension

and retain this investment without incurring an early

withdrawaladjustment.

If you transfer from a pre‑retirement pension to an account

based pension in FirstChoice Wholesale Pension, you’ll not

incur a buy/sell spread. This is because we’ll process the

transfer using net asset value unit prices.

With the exception of pension payments, this transfer is

the only transaction that can occur on your account on

the day of transfer. All other requested transactions will

be processed as soon as practical, after this transfer has

beencompleted.

For more information about early withdrawal adjustments,

please refer to the Reference Guide – FirstChoice Wholesale

Personal Super and Pension.

Please refer to section 6 ‘Taxation’, for more information

about taxation.

4 Risks

Understanding investment risk is important in successfully

developing your investment strategy. Before you consider

yourinvestment strategy, it is important to understand that:

• all investments are subject to risk

• there may be a loss of principal, capital or earnings

• different strategies carry different levels of risk

depending onthe assets that make up the strategy

• assets with the highest long‑term returns may also

carrythehighest level of short‑termrisk.

When considering your investment, it is important

tounderstandthat:

• the value of investment options will go up and down

• returns are not guaranteed

• you may lose money

• previous returns don’t predict future performance

• laws affecting superannuation and pensions may change

• the amount of your superannuation savings may not

beadequate for your retirement

• your level of risk will vary, depending on your age,

investment timeframe, where other parts of your money

are invested and how comfortable you are with the

possibility of losing some ofyour super in someyears.

Different investments perform differently over time.

Investments that have provided higher returns over the longer

term have also tended to produce a wider range of returns.

These investments are generally described as more risky, as

there is a higher chance of losing money, but they can also give

you a better chance of achieving your long‑term objectives.

Investments that have provided more stable returns are

considered less risky, but they may not provide sufcient long‑

term returns for you toachieve your long‑term goals. Selecting

the investments that best match your investment needs and

timeframe is crucial inmanaging thisrisk.

Your adviser can help you understand investment risks,

including those applicable to complex options, and design

aninvestment strategy that is right foryou.

General risks for all investment options

The main risks which typically affect all investment

optionsare:

Market risk

Investment returns are influenced by the performance of

themarket as a whole. This means that your investments

can be affected by things like changes in interest rates,

investor sentiment and global events, depending on which

markets or asset classes you invest in and the timeframe

you are considering.

If you are invested in the FirstRate Saver or FirstRate Saver

Non‑Auto‑rebalancing investment options, while returns

are generally stable, a low interest rate environment may

impact the future growth of your super. Investing in these

investment options may result in a very low or negative

return. This will depend on prevailing market interest rates,

fee amounts charged, the proportion of your super invested

in these options and your total super account balance.

Security and investment-specic risk

Within each asset class and each option, individual securities

like mortgages, shares, xed interest securities or hybrid

securities can be affected by risks that are specic to that

investment or that security. For example, the value of a

company’s shares can be influenced by changes in company

management, its business environment or protability. These

risks can also impact on the company’s ability to repay its debt.

Management risk

Each option in the PDS has an investment manager to

manage your investments on your behalf. There is a risk

thatthe investment manager will not perform to expectation.

Management risk may arise from the use of nancial models

by the investment manager to simulate the performance of

nancial markets. The performance of nancial markets may

differ to that anticipated by the nancial models.

Liquidity risk

Liquidity risk refers to the difculty in selling an asset for

cash quickly without an adverse impact on the price received.

Assets such as shares in large listed companies are generally

considered liquid, while ‘real’ assets such as direct property

andinfrastructure are generally considered illiquid. Under

abnormal or difcult market conditions, some normally liquid

assets may become illiquid, restricting our ability to sell them

and to make withdrawal payments or process switches for

investors without apotentially signicantdelay.

Please note: For FirstRate options, in the event we have

initiated awithdrawal from deposits held with CBA, other

than at your direction, the payment of any withdrawals or

switches requested by you may be delayed for a period no

greater than 35 days.

Counterparty risk

This is the risk that a party to a transaction such as a swap,

foreign currency forward or stock lending fails to meet

its obligations such as delivering a borrowed security or

settling obligations under a nancial contract.

6 FirstChoice Wholesale Personal Super and Pension

Legal, regulatory and foreign investment risk

This is the risk that any change in taxation, corporate or

other relevant laws, regulations or rules may adversely

affect yourinvestment.

In particular, for funds investing in assets outside Australia,

your investment may also be adversely impacted by

changes in broader economic, social or political factors,

regulatory change and legal risks applicable to where the

investment ismade or regulated.

Environmental, social and governance(ESG)

and climate risk

The value of individual securities may be influenced by

environmental, social and governance factors. These risks

may be real or perceived and may lead to nancial penalties

and reputational damage. For example, environmental risks

include waste and pollution, resource depletion and land

use. Social risks are where the investment may be impacted

by social, labour and human rights risks and include health

and safety. Governance risks can impact sustainability

of an investment and cover business practices such as

board diversity and independence, voting procedures,

transparency and accountability.

Climate change also poses a risk – not only to the

environment, but also to the broader economy and valuation

of an investment. Typically, climate change risks can be split

between physical and transition risks.

• Physical risks refer to the direct impact that climate change

has on our physical environment. For example, acompany’s

revenue may be reduced due to weather events and this

may reduce the value of the company’s shares.

• Transition risks refer to the much wider set of changes

in policy, law, markets, technology and prices that

may be needed to address the mitigation and adaption

requirements which are necessary for the transition to a

low carbon economy.

Securities lending risk

If investment options engage in securities lending, there is

a risk that the borrower may become insolvent or otherwise

become unable to meet, or refuse to honour, its obligations

to return the loaned assets. In this event, the option could

experience delays in recovering assets and/or accessing

collateral which may incur a capital loss. Where an option

invests any collateral it receives as part of the securities

lending program, such investments are also subject to the

general investment risks, and in some cases credit risk, as

outlined in this PDS.

Investment performance risk from

sustainability exclusions

Some investment options will exclude certain industries from

their portfolios in accordance with their sustainability criteria.

This means that their portfolios will differ from that of

traditional funds not predominantly focused on sustainable

investment. As a result, the investment performance may

deviate from traditional funds in the short to medium term.

Over the longer term, the expected risk and return objectives

are likely to be consistent with traditional funds.

Option-specic risks

Currency risk

Investments in global markets or securities which are

denominated in foreign currencies give rise to foreign currency

exposure. This means that the Australian dollar value of these

investments may vary depending on changes in the exchange

rate. Investment options in the PDS which have signicant

currency risks adopt different currency management

strategies. These strategies may include currency hedging,

which involves reducing or aiming to remove the impact

of currency movements on the value of the investment,

whereassome investment options remain unhedged.

Information on the currency management strategy for

each option with a signicant currency risk is set out in

thatoption’s description in the Investment OptionsMenu.

Because different options have different currency

management strategies, you should consult your nancial

adviser on the best approach foryou.

Derivatives risk

Derivatives are contracts between two parties that usually

derive their value from the price of a physical asset or

market index. They can be used to manage certain risks

ininvestment portfolios or as part of an investment strategy.

However, they can also increase other risks in a portfolio

or expose a portfolio to additional risks. Risks include:

thepossibility that the derivative position is difcult or

costly to reverse; that there is an adverse movement in the

asset or index underlying the derivative; or that the parties

do not perform their obligations under the contract.

In general, investment managers may use derivatives to:

• protect against changes in the market value of

existinginvestments

• achieve a desired investment position without buying

orselling the underlying asset

• leverage a portfolio

• manage actual or anticipated interest rate and credit risk

• alter the risk prole of the portfolio or the various

investmentpositions

• manage currencyrisk.

Derivatives may be used in an option to provide leverage

andmay result in the effective exposure to a particular

asset, asset class or combination of asset classes exceeding

the value of the portfolio. The effect of using derivatives

toprovide leverage may not only result in capital losses

but also an increase in the volatility and magnitude of the

returns (bothpositive and negative) for theoption.

As nancial instruments, derivatives are valued regularly, and

movements in the value of the underlying asset or index should

be reflected in the value of the derivative. Information on

whether an option in this PDS uses derivatives, such as futures,

options, forward currency contracts and swaps, is outlined in

the strategy of the option inthe Investment OptionsMenu.

Credit risk

Credit risk refers to the risk that a party to a credit

transaction fails to meet its obligations, such as defaulting

under a mortgage, a mortgage‑backed security, a hybrid

security, a xed interest security or a derivative contract.

Thiscreates an exposure to underlying borrowers and the

nancial condition of issuers of these securities.

Term deposit risk

An investment in FirstRate Term Deposits provides a xed

interest rate. This means you are protected from decreases

in interest rates during the term of your investment.

However, you may not be able to take advantage ofinterest

rate increases should interest rates rise during the term of

your investment.

Product Disclosure Statement 7

Early withdrawal risk

These FirstRate deposit choices are designed tobeheld

fora specied period.

• FirstRate Term Deposit options for terms uptoand

including 12 months

Should you need to withdraw or switch from FirstRate

Term Deposits prior to the maturity date, the interest

rateapplying on the amount withdrawn is reduced.

• FirstRate Term Deposit options for terms greater

than12 months

Withdrawals of all or part of your investment before

the end of the specied period may be subject to an

adjustment (reduction) to the withdrawal proceeds

because of therecovery of costs and other charges

connected with withdrawal. It is possible that you may

receive back a net amountthat is less than the amount

ofinitial principal invested.

The amount of the reduction considers reasonable costs

incurred in connection with termination or replacement of

funding for the FirstRate deposit. These costs can include

break costs, administrative costs and replacement

funding costs. Some major influences that may affect the

size of the withdrawal costs are:

• market interest rates are higher than when you

acquiredthe term deposit

• liquidity in the nancial markets

• market pricing of credit risk

• the term remaining for theoffer.

Further details about early withdrawal adjustments for

FirstRate Term Deposits are contained in the Reference

Guide – FirstChoice Wholesale Personal Super and

Pension, available online at cfs.com.au/fcwps or by

calling1313 36.

Gearing risk

Some of the options in the PDS use gearing. Gearing

means that theoption borrows so that it can invest more

to increase potential gains. Gearing can magnify gains and

always magnies losses fromthe option’sinvestments.

For an option geared at 50%, if the growth of underlying

investments is less than the option’s borrowing and

administration and investment fees and costs, then it is

unlikely that the geared option will outperform an equivalent

ungeared portfolio. Consequently, a geared option will not

always magnify market gains (particularly in a low return

environment), butit will always magnify marketlosses.

In extreme market conditions, you may lose all your capital.

We suggest you consult a nancial adviser regarding the

impact ofthese investments on your overall portfolio.

Short selling risk

Some of the options in the PDS use short selling. Short

selling means the option sells a security it does not own

totry and prot from a decrease in the value of the security.

This is generally done by borrowing the security from another

party to make the sale. The short sale of a security can

greatly increase the risk of loss, as losses on a short position

are not limited tothe purchased value of the security.

Short selling strategies involve additional risks such as:

Liquidity risk

In certain market conditions, an option that adopts a

short selling strategy may not be able to reverse a short

position because the security it needs to buy may not be

available for purchase ina reasonable timeframe or at all.

In this event, losses may bemagnied.

• Leverage risk

Whilst short selling can often reduce risk, it is also

possible for an option’s long positions and short positions

to both lose money at the sametime.

• Prime broker risk

When short selling is employed, the assets of the

investment option are generally held by the prime

broker (which provides broking, stock lending and other

services). As part of this arrangement, assets may be

used by or transferred to the prime broker under a

securities lending arrangement which will also expose

the option to securities lending risk. There is a risk that

the prime broker does not return equivalent assets or

value to the option (for example, because of insolvency).

This would have a substantial negative impact on the

value of your investment. This risk is managed by having

arrangements with large, well‑established and globally

operating prime brokers. If you would like details of our

prime broker, please contactus.

If an option uses short selling, this is detailed in the strategy

ofthe option – refer to the Investment OptionsMenu.

Emerging markets risk

Due to the nature of the investments in emerging markets,

there is an increased risk that the political and/or legal

framework may change and adversely impact your

investments. This could include the ability to sell assets.

Options that invest in global markets may have exposure

toemerging markets.

Term risk

Risk associated with investing funds at a xed rate of

interest for a specied term. If interest rates rise ‑ including

owing to factors such as inflation ‑ then the investor could

have obtained more returns from investing for a shorter

term, multiple times.

Equity risk

Risk, or the potential for variability in returns ‑ which comes

from investing in companies, generally driven by growth in

earnings and dividends.

Small cap risk

Risk associated with investing in smaller companies, which

generally exhibit higher growth rates, while also carrying

greater risk compared to larger companies.

Valuation risk

Risk that the value of an asset is mis‑stated. This is due to

the potential disparity between an asset’s accounting value

as compared to its actual fair market value when traded.

Measuring assets at fair value across time ensures equity

for members as they invest into, withdraw from or switch

between different investments and options.

8 FirstChoice Wholesale Personal Super and Pension