JOBNAME: No Job Name PAGE: 1 SESS: 22 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

Decisions of the United States

Court of International Trade

䉬

Slip Op. 07–92

A

GATEC CORP., Plaintiff, v. UNITED STATES, Defendant.

Before: Richard W. Goldberg, Senior Judge

Court No. 03–00165

[Plaintiff’s motion for summary judgment is denied, anddefendant’s motion for

summary judgment is granted.]

Dated: June 6, 2007

Weiss Berzowski Brady LLP (Barry R. White) for Plaintiff Agatec Corp.

Peter D. Keisler, Assistant Attorney General; David M. Cohen, Director Barbara S.

Williams, Attorney-in-Charge, International Trade Field Office, Commercial Litiga-

tion Branch, Civil Division, United States Department of Justice (James A. Curley);

Su-JinYoo, Office of Assistant Chief Counsel, Bureau of Customs and Border Protec-

tion, United States Department of Homeland Security, of counsel, for Defendant

United States.

OPINION

Goldberg, Senior Judge: This is a classification case brought by

plaintiff Agatec Corp., a distributor of electrical levels and accesso-

ries manufactured by Agatec France, against defendant U.S. Cus-

toms and Border Protection (‘‘Customs’’). Before the Court are the

parties’ cross-motions for summary judgment under USCIT Rule 56.

I. BACKGROUND

On February 6, 2002, Agatec imported a shipment of two varieties

of electrical laser levels, the A410S and the GAT120, along with sev-

eral accessories. In its import documentation, Agatec classified the

merchandise under subheading 9015.30.4000 of the Harmonized

Tariff Schedule of the United States (2002) (‘‘HTSUS’’). Customs liq-

uidated the merchandise on June 6, 2002 under subheading

9031.49.9000 of the HTSUS. Agatec timely protested Customs’ clas-

sification. After Customs denied the protest, Agatec commenced this

57

JOBNAME: No Job Name PAGE: 2 SESS: 22 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

case pursuant to 19 U.S.C. § 1514(a) and 28 U.S.C. §§ 2631–37. The

Court has jurisdiction under 28 U.S.C. § 1581(a).

II. RECORD CHARACTERISTICS OF THE

IMPORTED PRODUCT

The A410S and GAT120 products at issue in this case emit hori-

zontal or vertical beams of light allowing the user to find level and

plumb. See Tawil Aff. ¶ 3; Def.’s Resp. Pl.’s Stat. ‘‘Undisputed’’ Facts

2–3. Both laser levels can be used only in one dimension. Kiss Decl.

¶ 7. Their maximum operational range is 1000 feet. Id. ¶7(citing

Pl.’s Ex. A (The Level of Excellence) (Agatec’s product catalogue) at 6

&8).

Both levels are usually mounted on a tripod, especially when it is

helpful to give the laser some height off the ground. Tawil Aff. ¶ 7;

Def.’s Resp. Pl.’s Stat. ‘‘Undisputed’’ Facts 9. The levels may work in

tandem with a receiver which is mounted on an excavator or grade

rod to receive the level’s beam. Tawil Aff. ¶ 7; Def.’s Resp. Pl.’s Stat.

‘‘Undisputed’’ Facts 9.

The A410S and GAT120 levels are used in construction projects for

houses or small buildings, as well as landscaping for such struc-

tures. Kiss Decl. ¶¶ 6–7 & 9; Pl.’s Ex. C at 2 (instruction manual for

GAT120 electronic level); Pl.’s Ex. D at 2 (instruction manual for

A410S automatic laser). The instruction manual for the GAT120

level describes the product as ‘‘ideal for leveling applications in the

construction industry.’’ Pl.’s Ex. C at 2. It can be used for indoor and

outdoor projects. Id. Agatec’s product catalogue advertises the

GAT120 as ‘‘[i]deal for contractors who work primarily in horizontal,

but have occasional use for vertical alignment at short distances.’’

Pl.’s Ex. A, at 6. The instruction manual for the A410S level de-

scribes the product as ‘‘an automatic visible laser that can be used

for leveling, vertical alignment, plumbing and squaring. Applications

include installing suspended ceilings, technical flooring, partitions

and a variety of outdoor alignment work.’’ Pl.’s Ex. D at 2. Notwith-

standing its occasional outdoor applications, the A410S product was

‘‘designed with the interior contractor in mind,’’ Pl.’s Ex. A at 13, and

is used for ‘‘[i]nstalling and aligning tilt-up walls, partitions and

window and door frames’’ as well as ‘‘[s]quaring walls, decks, and

foundations.’’ Id. at 8. In addition to the functionality described in

the product catalogue and instruction manuals, Agatec president

Gabriel Tawil states that with the help of a receiver mounted on an

excavator, ‘‘the laser precisely measures the distance above or below

an established benchmark.’’ Tawil Aff. ¶ 3.

Customs produced an affidavit of Richard Kiss, the Chief of Sur-

vey for the New York District of the Operations Division of the U.S.

Army Corps of Engineers. Kiss describes the operability of these la-

ser levels as one of ‘‘lower order surveying,’’ which he defines in dis-

tinction to ‘‘higher order surveying.’’ See id. ¶¶ 5–7. ‘‘Higher order

58

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 3 SESS: 22 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

survey’’ levels require great accuracy and operate in three dimen-

sions. Kiss Decl. ¶¶5&7.TheU.S.Army Corps of Engineers ex-

ecutes ‘‘higher order surveying’’ projects such as preparing land or

hydrographic maps, establishing boundaries, preparing for the con-

struction of major public works such as dams, highways or bridges,

calculating the area of a piece of land, triangulating, or determining

the height of objects above or below some horizontal reference level.

See id. ¶ 5. Kiss lists representative ‘‘lower order surveying’’ applica-

tions as ‘‘smaller-scale foundation and landscaping work, and inte-

rior work such as finding level and plumb.’’ Id. ¶ 9.

III. CONTESTED HTSUS HEADINGS

Agatec believes that both the GAT120 and the A410S laser levels

are correctly classified under HTSUS 9015.30.4000. Customs classi-

fied the laser levels under HTSUS 9031.49.9000 and the parts and

accessories under HTSUS 9031.90.5800.

HTSUS subheading 9015.30.4000 covers:

Surveying (including photogrammetrical surveying), hydro-

graphic, oceanographic, hydrological, meteorological or geo-

physical instruments and appliances, excluding compasses; range

finders; parts and accessories thereof:

...

Levels:

...

Electrical....

HTSUS 9015.30.4000. By contrast, HTSUS subheading

9031.49.9000 covers:

Measuring or checking instruments, appliances and machines, not

specified or included elsewhere in this chapter; profile projectors;

parts and accessories thereof:

...

Other:

...

Other....

Id. 9031.49.9000. HTSUS subheading 9031.90.5800 covers ‘‘parts

and accessories...of other optical instruments and appliances,

other than test benches....’’Id. 9031.90.5800.

IV. STANDARD OF REVIEW

‘‘[S]ummary judgment is proper ‘if the pleadings [and the discov-

ery materials] show that there is no genuine issue as to any material

fact and that the moving party is entitled to a judgment as a matter

of law.’ ’’ Celotex Corp. v. Catrett, 477 U.S. 317, 322 (1986) (quoting

U.S. COURT OF INTERNATIONAL TRADE

59

JOBNAME: No Job Name PAGE: 4 SESS: 22 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

Fed. R. Civ. P. 56(c)) (alteration added).

1

‘‘In ruling on cross-motions

for summary judgment, the court must determine if there exist any

genuine issues of material fact and, if there are none, decide whether

either party has demonstrated its entitlement to judgment as a mat-

ter of law.’’ Am. Motorists Ins. Co. v. United States, 5 CIT 33, 36

(1983). The appropriate standard of review consists of two separate

inquiries: (1) a de novo review of Customs’ legal interpretations of

the tariff headings, see 28 U.S.C. § 2640(a)(1); and (2) a non-

deferential review of Customs’ factual findings subject to a presump-

tion of correctness in favor of Customs, see id. § 2639(a)(1). Cf. Uni-

versal Elec., Inc. v. United States, 112 F.3d 488, 493 (Fed. Cir. 1997)

(holding that ‘‘as a practical matter’’ the presumption of correctness

‘‘has force only as to factual components’’ of a Customs classification

decision).

V. DISCUSSION

A. Is HQ 965484 Entitled to Judicial Deference?

When reviewing a Customs classification, the Court is not bound

by the authority of any Customs ruling or interpretation. However,

where Customs has issued a thorough and logical ruling that reflects

its expertise in administering its detailed statutory scheme and ac-

cords with its previous interpretations, such decision may ‘‘claim re-

spect’’ in proportion to its persuasiveness under Skidmore v. Swift &

Co., 323 U.S. 134 (1944). United States v. Mead Corp., 533 U.S. 218,

221 (2001); see id. at 235.

Here, Customs argues in favor of extending Skidmore deference to

HQ 965484, a prior Customs classification ruling analyzing whether

certain merchandise was a ‘‘surveying instrument’’ as understood by

HTSUS heading 9015. In that ruling, Customs responded to a pro-

test by TLZ, Inc., a company that had imported three varieties of

‘‘electro-mechanical pendulum-based leveling system’’ using a laser

diode. HQ 965484 at 1. The laser diode is suspended on a pendulum

and uses gravity to find true level. See id. All three items were uti-

lized in construction projects to ‘‘align pipes, piers, and posts; square

foundations, walls, decks, window frames and door frames; plumb

walls, posts and door frames; set drainage grades; and furnish refer-

ence points for HVAC (heating, ventilation, air conditioning), light-

ing, sprinkler systems and skylights.’’ Id. In short, TLZ’s products

were in some respects similar, though by no means identical, to

Agatec’s laser levels. Customs analyzed the relevant HTSUS head-

ings and determined that TLZ’s laser diodes were not described in

HTSUS heading 9015. That determination rested on two alternative

1

‘‘When the Court’s rules are materially the same as the [Federal Rules of Civil Proce-

dure (‘‘FRCP’’)], the Court has found it appropriate to consider decisions and commentary

on the FRCP in interpreting its own rules.’’ Former Employees of Tyco Elec. v. U.S. Dep’t of

Labor, 27 CIT 380, 385, 259 F. Supp. 2d 1246, 1251 (2003).

60

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 5 SESS: 22 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

premises: (1) ‘‘protestant has not established that these goods are

used for surveying or that they are surveyor’s levels’’; and (2) the

goods ‘‘are within the exclusion of [Explanatory Note] 90.15....’’Id.

at 2. The cited Explanatory Note suggested that ‘‘levels (air bubble

type, etc.) used in building or constructional work’’ are not covered

by HTSUS heading 9015. The entirety of the agency’s analysis of

that issue is as follows:

We find that the [TMZ laser diodes] are within the exclusion of

EN 90.15, excerpted above. The laser diode aids these goods in

determining true level. Therefore, we find that they are not de-

scribed in heading 9015, HTSUS.

Id.

Customs contends that the Court should defer to the HQ 965484’s

holding ‘‘that construction laser levels are classifiable under Head-

ing 9031 and not Heading 9015....’’Def.’s Br.17–18. The problem

with that contention is that HQ 965484 says nothing of the sort. In

sum, HQ 965484 contains a straightforward recitation of the statu-

tory HTSUS text, as well as two factual findings: (1) that TLZ had

failed to prove that their laser diodes were used in surveying and (2)

that the TMZ laser diodes fell within the ‘‘construction levels’’ exclu-

sion of the explanatory note.

It is inappropriate to apply Customs’ findings in one highly fact-

specific classification ruling to a different product. See Structural

Indus., Inc. v. United States, 356 F.3d 1366, 1371 (Fed. Cir. 2004)

(‘‘[P]rior rulings with respect to similar but non-identical items are

also of little value in assessing the correctness of the classification of

a similar but not identical item.’’). The factual findings contained in

HQ 965484 respect an import product that is similar, though by no

means identical, to the A410S and GAT120 laser levels. No deference

is therefore due to Customs’ classification of the TLZ laser diodes.

On the other hand, if Customs is arguing that HQ 965484 articu-

lates a broad principle that all construction levels – and not merely

the TMZ laser diodes – are classifiable under heading 9031, HQ

965484 is hardly the sort of thorough and logical explanation to

which a court may defer under Skidmore. Indeed, no fair reading of

the ruling could countenance such an expansive interpretation. The

agency’s decision in that protest review remained focused squarely

on the product at issue, and avoided generalized characterizations of

construction levels. The Court finds that for purposes of this case

HQ 965484 is not entitled to Skidmore deference.

B. Are Agatec’s A410S and GAT120 Levels, Along with Their Acces-

sories, Classifiable Under Heading 9031 of the HTSUS?

The U.S. Court of Appeals for the Federal Circuit’s statement of

law in Orlando Food Corp. v. United States applies equally to this

case:

U.S. COURT OF INTERNATIONAL TRADE

61

JOBNAME: No Job Name PAGE: 6 SESS: 22 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

The proper classification of merchandise entering the United

States is directed by the General Rules of Interpretation

(‘‘GRIs’’) of the HTSUS and the Additional United States Rules

of Interpretation. The HTSUS scheme is organized by head-

ings, each of whichhas one or more subheadings; the headings

set forth general categories of merchandise, and the

subheadingsset forth a more particularized segregation of the

goods within each [heading] category. At issue in this case are

two headings of the HTSUS and their accompanying subhead-

ings....

140 F.3d 1437, 1439 (Fed. Cir. 1998). Under GRI 1, a court is to con-

strue the competing headings to determine the heading under which

the merchandise at issue is classifiable. See id. (citing GRI 1,

HTSUS). The express terms of heading 9031 exclude any imported

merchandise that could be classified under heading 9015. See

HTSUS 9031 (including measuring or checking instruments ‘‘not

specified or included elsewhere in this chapter’’). As such, the parties

agree that the critical question in this case is whether heading 9015

applies to the merchandise.

The Federal Circuit has similarly provided guidance as to how

courts should construe HTSUS language:

HTSUS terms are construed according to their common and

commercial meanings, which are presumed to be the same ab-

sent contrary legislative intent. In construing a tariff term, the

court may rely on its own understanding of the terms as well as

upon lexicographic and scientific authorities. The court may

also refer to the Explanatory Notes accompanying a tariff sub-

heading. While these notes are not controlling legislative his-

tory, they are nonethelessintended to clarify the scope of

HTSUS subheadings and to offer guidance in their interpreta-

tion.

Len-Ron Mfg. Co., Inc. v. United States, 334 F.3d 1304, 1309 (Fed.

Cir. 2003) (citations omitted). In a case such as this, where the rel-

evant tariff classification is controlled by use, Customs must classify

the merchandise ‘‘in accordance with the use in the United States at,

or immediately prior to, the date of importation, of goods of that

class or kind to which the imported goods belong, and the controlling

useistheprincipaluse....’’Additional U.S. Rule of Interpretation 1.

‘‘Principal use’’ is the use that ‘‘exceeds any other single use.’’ Lenox

Collections v. United States, 20 CIT 194, 196 (1996) (quotation

marks omitted).

Agatec argues that its laser levels are electrical ‘‘surveying’’ equip-

ment. Agatec relies heavily on the 2002 decision Heli-Support v.

United States, which contains a helpful discussion of prior judicial

interpretations of HTSUS heading 9015. See Heli-Support, Inc. v.

United States, 26 CIT 352 (2002). The imported product at issue in

62

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 7 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

Heli-Support was a helicopter – or aircraft – mounted high precision

instrument used to measure topography with a laser for later carto-

graphic use. See id. at 353. The court stressed the broad scope of

HTSUS heading 9015, noting that surveying includes more than

‘‘mere surface examinations’’ and was intended to include items that

are not the traditional tools of a surveyor’s trade. Id. at 355–56. Ulti-

mately, the court held that the imported product was classifiable un-

der heading 9015 and that the plaintiff’s interpretation of heading

9015 to include only instruments ‘‘used in the practice and science of

surveying by a surveyor’’ was incorrect. Id. at 356.

In finding that the imported instruments fell within the scope of

heading 9015, the court drew on three dictionary definitions of the

terms ‘‘survey’’ and ‘‘surveying.’’ Surveying, according to the Colum-

bia Encyclopedia (2d ed. 1950), is defined as ‘‘the science of finding

the relative position on or near the earth’s surface. Boundaries, ar-

eas, elevations, construction lines, and geographical or artificial fea-

tures are determined by the measurement of horizontal and vertical

distances and angles and by computations based in part on the prin-

ciples of geometry and trigonometry.’’ Id. Encyclopedia Americana

(1953) defines ‘‘surveying’’ as

the science of determining the positions of points on the earth’s

surface for the purpose of making therefrom a graphic repre-

sentation of the area. By the term earth’s surface is meant all of

the earth that can be explored – the bottoms of seas and rivers,

and the interior of mines, as well as the more accessible por-

tions. It includes the measurement of distances and angles and

the determination of elevations.

Id. The court then quoted a third and final definition of ‘‘surveying’’

from Webster’s Third New International Dictionary of the English

Language (1981) (‘‘Webster’s’’):

1. Survey:...2: to determine and delineate theform, extent,

and position of (as a tract of land, acoast, or a harbor) by taking

linear and angular measurements and by applying the prin-

ciples of geometry and trigonometry....

2. Survey:...3a:theprocess of surveying an area of land or

water: the operation of finding and delineating the contour, di-

mensions, and position of any part of the earth’s surface

whether land or water (a topographic and hydrographic, of a lo-

cality)....

Id. at 355–56.

Consideration of the three definitions cited in Heli-Support results

in a complicated picture. All three definitions would seem at first

blush to accommodate Agatec’s laser levels, which are capable of ex-

ecuting ‘‘precise[ ] measure[ments of] the distance above or below an

U.S. COURT OF INTERNATIONAL TRADE

63

JOBNAME: No Job Name PAGE: 8 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

established benchmark.’’ Pl.’s Stat. Mat. Facts Not Dispute ¶ 4. Re-

calling, however, that use designations must be made on the basis of

a product’s principal use, see Lenox Collections, 20 CIT at 196, it is

obvious that Agatec’s laser levels are not ‘‘surveying’’ instruments

and are therefore not classifiable under heading 9015. Nowhere in

the laser levels’ instruction manuals or catalogue product descrip-

tions does Agatec mention its levels’ ability to measure distance. The

laser levels themselves are incapable of spatial measurement; only

with the help of a mounted receiver device, such as the MR80S, can

they do so. See id. ¶¶ 4 & 17.

Still other infirmities undermine Agatec’s attempt to fit its laser

levels into the cited definitions. It is not enough that a product be

able to measure distance precisely; all three definitions include addi-

tional definitional prerequisites. For example, they all invoke the

‘‘earth’s surface’’ as a benchmark for the surveying measurements.

The Columbia Encyclopedia refers to the measurement of distances

and angles ‘‘on or near the earth’s surface.’’ Heli-Support 26 CIT at

355. Encyclopedia Americana requires that the measurements be

made relative to the ‘‘earth’s surface’’ itself. Id. Webster’s refers to

‘‘delineating the contour, dimensions, and position of any part of the

earth’s surface.’’ Id. Agatec’s laser levels operate chiefly in a con-

struction environment, and are not principally measuring positions

relative to the earth’s surface.

2

The A410S instruction manual lists its primary applications as

‘‘installing suspended ceilings, technical flooring, partitions and a

variety of outdoor alignment work.’’ Pl.’s Ex. D at 2. Indeed, the

A410S is designed for use by interior construction contractors, see

Pl.’s Ex. A at 13, a trade that is by definition involved in edifying

spaces that are distinct from the earth’s surface. The GAT120 level is

‘‘ideal for leveling applications in the construction industry.’’ Pl.’s Ex.

C at 2. Nowhere in the instruction manuals and the product cata-

logues is it suggested that the laser levels are used to measure the

2

The Explanatory Note to heading 9015 provides explicitly that some instruments used

in ‘‘constructional work’’ are included in heading 9015. It lists the varieties of instruments

includable in heading 9015:

These are generally intended for use in the field, for example, in cartography (land or

hydrographic maps); in the preparation of plans; for triangulation measurements; for

calculating the area of a piece of land; in determining heights above or below some hori-

zontal reference level; and for all similar measurements in constructional work (building

roads, dams, bridges, etc.), in mining, in military operations, etc.

Explanatory Notes, Chapter 90.15, 1603 (2d ed. 1996). Read in context, the mention of ‘‘con-

structional work’’ refers back to the listed ‘‘similar measurements’’ that properly determine

the scope of heading 9015. It is the nature of those ‘‘similar measurements’’ with which the

Explanatory Note is concerned, and the reference to ‘‘constructional work’’ simply affirms

that surveying work is not excludable from the ambit of heading 9015 on account of its be-

ing ‘‘constructional’’ in nature. It is not, as Agatec seems to suggest, an independent expan-

sion of heading 9015 to cover all merchandise roughly analogous to surveying instruments

that is used in the ‘‘constructional’’ industry.

64

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 9 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

surface of the earth or determine the relative position of points to

the earth’s surface. Even the president’s affidavit, which is the only

evidence Agatec has produced referring to the measuring capabilities

of the laser levels, stops short of describing such use as the principal

use.

3

Looking at all the record evidence, references to construction

applications overshadow the sporadic mentions of direct measure-

ment of the earth’s surface. Measurements incident to man-made

construction projects may be taken ‘‘near’’ the earth surface and

therefore such measurements are not excludable for that reason

from the Columbia Encyclopedia’s definition. However, the Encyclo-

pedia Americana and Webster’s require the determination of posi-

tions of points on the earth’s surface. As such, those definitions are

not susceptible to a reading that would include Agatec’s laser levels.

4

Webster’s reports an alternative definition of ‘‘survey’’ that does not

refer to the earth’s surface as a benchmark. ‘‘To survey’’ is defined as

‘‘to determine and delineate the form, extent, and position of...by

taking linear and angular measurements and by applying the prin-

ciples of geometry and trigonometry.’’ Heli-Support, 26 CIT at 355.

This definition does not require the measurements to be relative to

the earth’s surface. On the other hand, it requires the taking of lin-

ear and angular measurements and the application of geometric and

trigonometric principles. Agatec’s laser levels are capable of measur-

ing in one dimension only and there is no evidence that they can

measure angles. See Kiss Decl. ¶ 7; Pl.’s Resp. Def.’s Stat. Mat. Facts

Not Dispute ¶ 13. Moreover, Agatec has not adduced any evidence at

all to establish how geometric or trigonometric principles may be ap-

plied to the data obtained from the laser levels’ measurements to dis-

cern the form and the position of objects.

As a final note, the Court should address the Explanatory Note to

heading 9015, invoked in support of both parties’ arguments. The

Explanatory Note explicitly includes instruments used ‘‘in determin-

ing heights above or below some horizontal reference level.’’ Ex-

planatory Notes, Chapter 90.15, at 1603. The Explanatory Note con-

cludes with the following limitation: ‘‘This heading does not

cover . . . [l]evels (air bubble type, etc.) used in building or construc-

tional work (e.g., by masons, carpenters or mechanics), and plumb-

3

Agatec’s product catalogue has a separate section for ‘‘Construction/Surveying Equip-

ment.’’ See Pl.’s Ex. A at 1 (providing table of contents for product catalogue). Neither the

GAT120 nor the A410S is included in that section. See id. at 20–22 Instead, both appear in

the ‘‘General Construction’’ section. See id. at 6 & 8.

4

The Encyclopedia Americana definition also requires the surveying measurements to

be made ‘‘for the purpose of making therefrom a graphic representation of the area.’’ Heli-

Support, 26 CIT at 355. Nowhere in the record is it suggested that Agatec’s laser levels may

be used in such a capacity. Furthermore, nowhere is it suggested that the targeted opera-

tors of Agatec’s laser levels create graphic representations based on the measurements reg-

istered by the laser levels.

U.S. COURT OF INTERNATIONAL TRADE

65

JOBNAME: No Job Name PAGE: 10 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

lines (heading 90.31).’’

5

Id. at 1604. The Explanatory Note, which of

course in no way hems the Court’s discretion to interpret the various

headings, see Len-Ron Mfg., 334 F.3d at 1309, sets up a mutually ex-

clusive set of categories: (1) instruments used in determining heights

above or below a horizontal reference level and (2) instruments that

are levels used in building or constructional work. As noted above,

the A410S and GAT120 laser levels seem to fit both descriptions. The

principal use of the products will control, and the record demon-

strates that such use is apparently that of a level used in construc-

tion work. Thus, the Explanatory Note supports the Court’s indepen-

dent finding that the common dictionary meanings prevent a

classification of the A410S and GAT120 laser levels under heading

9015 of the HTSUS.

C. If Agatec’s A410S and GAT120 Levels Are Not Classifiable Under

Heading 9015, Are They Classifiable under Heading 9031?

Heading 9031 includes ‘‘[m]easuring or checking instruments, ap-

pliances and machines, not specified or included elsewhere in this

chapter....’’Heading 9031, HTSUS. ‘‘Checking’’ is the present parti-

ciple of ‘‘check,’’ which Webster’s defines as ‘‘to inspect and ascertain

the condition of esp. in order to determine if the condition is satisfac-

tory’’ or to ‘‘investigate and ensure accuracy, authenticity, reliability,

safety, or satisfactory performance of.’’ Webster’s 381. ‘‘Measuring’’ is

the present participle of ‘‘measure,’’ which Webster’s defines as ‘‘to

lay off, mark, or fix (a specified distance or extent) by making mea-

surements’’ or ‘‘to appraise in comparison with something taken as a

criterion.’’ Id. 1400. The A410S and GAT120 laser levels are optical

instruments that aid in leveling, alignment, plumbing, and squaring

for building and construction projects. See supra Part II at 3. In ad-

dition, they may measure distance in one dimension. See id. These

functionalities obviously constitute measuring and checking as de-

fined by Webster’s and therefore classifiable under heading 9031.

Subheading 9031.49 includes those measuring or checking instru-

ments that (1) are ‘‘other optical instruments and appliances’’ and (2)

are not used for inspecting semiconductor wafers. See HTSUS

9031.49. The Explanatory Note to subheading 9031.49 provides that

‘‘[t]his subheading covers not only instruments and appliances which

5

Agatec also argues that the exclusionary clause of the Explanatory Note covers air

bubble levels only. See Pl.’s Reply 10. On Agatec’s reading, the exclusionary note differenti-

ates between electrical levels (which are covered by heading 9015) and non-electrical levels

(which are not). A quick glance at the text of the Explanatory Note suffices to demonstrate

the incorrectness of that position. The parenthetical reads ‘‘airbubble type, etc.’’ The use of

‘‘et cetera’’ (albeit complicated by the puzzling choice of ‘‘e.g.’’ later in the same sentence)

must mean that ‘‘air bubble type’’ levels are intended merely as an illustrative example of a

level ‘‘used in building or construction work’’ rather than a further turn in the already laby-

rinthine classification apparatus of heading 9015. The relevant distinction, then, is between

levels used in construction work and surveying instruments.

66

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 11 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

provide a direct aid or enhancement to human vision, but also other

instruments and apparatus which function through the use of opti-

cal elements or processes.’’ Explanatory Notes, Chapter 90.31, at

1658. The A410S and GAT120 laser levels utilize visible laser beams

to aid human sight when aligning, plumbing, squaring, and leveling.

They are therefore classifiable under heading 9031, subheading 49.

VI. CONCLUSION

After careful review of the record, the relevant HTSUS provisions,

and the parties’ thorough and thoughtful briefs, the Court finds that

Customs has conclusively established that Agatec’s A410S and

GAT120 laser levels were properly classified under HTSUS

9031.49.9000. There remain no genuine issues of material fact, and

judgment shall be entered in favor of Customs in this case.

䉬

AGATEC CORP., Plaintiff, v. UNITED STATES, Defendant.

Before: Richard W. Goldberg, Senior Judge

Court No. 03–00165

JUDGMENT

Upon review of the parties’ respective motions for summary judg-

ment, and upon due deliberation, it is hereby

ORDERED that Plaintiff Agatec Corp.’s Motion for Sum-

maryJudgment is DENIED; and it is further

ORDERED that Defendant U.S. Customs and Border Protection’s

Motion for Summary Judgment is GRANTED; and it is further

ORDERED that judgment be entered in favor of

DefendantUnited States Customs and Border Protection.

IT IS SO ORDERED

U.S. COURT OF INTERNATIONAL TRADE

67

JOBNAME: No Job Name PAGE: 12 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

Slip Op. 07–93

R

OBERT L. ANDERSON, Plaintiff, v. UNITED STATES SEC’Y OF AGRICUL-

TURE, Defendant.

Before: Pogue, Judge

Court No. 05–00329

[Defendant’s remand determination affirmed as to result.]

Dated: June 7, 2007.

Robert L. Anderson, Plaintiff pro se.

Peter D. Keisler, Assistant Attorney General; Jeanne E. Davidson, Director, Patricia

M. McCarthy, Assistant Director, Commercial Litigation Branch, Civil Division, U.S.

Department of Justice (David S. Silverbrand), for Defendant United States Secretary

of Agriculture.

OPINION AND ORDER

Pogue, Judge: In Anderson v. United States Sec’y of Agric.,30

CIT

, 462 F. Supp. 2d 1333 (2006) (‘‘Anderson I’’)

1

, the court re-

manded an initial determination from the United States Depart-

ment of Agriculture (‘‘USDA’’) denying Plaintiff ’s application for

Trade Adjustment Assistance (‘‘TAA’’) on the basis of the agency’s

summary conclusion that Mr. Anderson’s net fishing income had not

declined during the 2000 to 2003 time period. The court found not in

accordance with law the agency’s refusal to consider Mr. Anderson’s

claim that his net income, reported on an accrual basis, had declined

during the relevant time period.

The USDA filed its first remand determination with the court on

December 11, 2006. Reconsideration upon Remand of the Application

of Robert L. Anderson. (‘‘First Remand Determination’’). In its first

remand determination, the USDA did not, as directed by the court in

Anderson I, consider Mr. Anderson’s accrual-basis claim, but rather

once again found, relying solely on the net fishing income line as pre-

sented on Mr. Anderson’s tax return as submitted to the Internal

Revenue Service (‘‘IRS’’), that Mr. Anderson’s income did not decline

from the marketing year to the qualifying year. First Remand Deter-

mination. Upon review of the first remand determination, the court

again remanded the determination to the USDA, ordering the USDA

to comply with the court’s initial remand order. Anderson v. United

States Sec’y of Agric., 30 CIT

, 469 F. Supp. 2d 1300 (2006)

(‘‘Anderson II’’). On February 9, 2007, the USDA issued its second re-

mand determination, finding that using the accrual method of ac-

counting, Mr. Anderson’s income did decline over the period from the

marketing year to the qualifying year, and as such found that Mr.

1

Familiarity with the court’s decision is presumed.

68

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 13 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

Anderson would be entitled to a TAA payment. Reconsideration upon

the Second Remand of the Application of Robert L. Anderson (‘‘Sec-

ond Remand Determination’’). The court affirms the results of

USDA’s second remand determination.

DISCUSSION

As discussed in the court’s opinion in Anderson I, Mr. Anderson

was part of a group of salmon fishermen that had been certified by

the USDA as eligible for TAA. To continue the two-part process for

obtaining TAA benefits, Mr. Anderson was then required to demon-

strate that he was personally qualified for such assistance, by pro-

viding evidence to the USDA that his net fishing income had de-

clined over the relevant two-year period. Anderson I,30CITat

,

462 F. Supp. 2d at 1334.

The net fishing income line on Mr. Anderson’s IRS returns indi-

cated that his income had actually increased between 2002 and

2003. Id. at 1335. Mr. Anderson, however, provided other supporting

information in conjunction with his TAA application. Id.

2

Mr. Ander-

son claimed that this other information documented that, considered

on an accrual basis, Mr. Anderson’s net fishing income had actually

declined over the period in question. The USDA never considered

Mr. Anderson’s supporting information, deeming it unnecessary to

do so, because the net fishing income line on his tax return had indi-

cated an increase in income.

The court found that the USDA’s determination failed to consider

an important aspect of the problem presented and was therefore not

in accordance with law. Id. at 1342. Specifically, the court concluded

that the USDA’s blind application of its regulation 7 C.F.R.

§ 1580.102(2004), without any consideration of the fact that appli-

cants can report their income on either an accrual or cash basis,

leads to the possibility of the USDA treating similarly situated

people differently. Id. at 1339. Additionally, the court explained that

in adopting the definition of ‘‘net farm income,’’ the USDA did not

comment on how the regulatory definition would have the effect of

including or excluding people based on their election of cash or ac-

crual accounting, and why such effects would be legally acceptable.

Id. at 1342. The court remanded the determination to the USDA in

order that the USDA:

consider the reasonableness of its regulation as applied to Mr.

Anderson, in view of the differences in cash versus accrual ac-

counting, the inequities the agency’s application presents, and

the fact that applicants elect their accounting technique with-

out knowing that it could adversely impact their eligibility for

2

For example, Mr. Anderson cited evidence of delayed payment for fish sold.

U.S. COURT OF INTERNATIONAL TRADE

69

JOBNAME: No Job Name PAGE: 14 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

benefits in the future. On remand, the agency shall reconsider

its position and may reopen the record to permit an acceptable

alternative solution.

Id.

In the USDA’s first remand determination, the USDA refused to

comply with the court’s order. First Remand Determination; Ander-

son II,30CIT

, 469 F. Supp. 2d 1300. In doing so, the agency

cited the decision of the U.S. Court of Appeals for the Federal Circuit

(‘‘CAFC’’) in Steen v. United States, 468 F. 3d 1357 (Fed. Cir. 2006) as

standing for the proposition that the USDA’s ‘‘regulatory definition

of the term ‘net farm income’ as applied to fishing income was rea-

sonable and cannot be condemned as arbitrary, capricious, or mani-

festly contrary to the statute.’’ First Remand Determination at 1

(quoting Steen, 468 F. 3d at 1363). Based on the USDA’s reading of

Steen, the USDA determined that it had no obligation to evaluate

the reasonableness of its application, to Mr. Anderson’s accrual-basis

claim, of its regulation defining ‘‘net fishing income.’’ The agency

stated that Steen ‘‘explicitly rejected the [P]laintiff ’s argument that

the agency is barred from using the standards applied under the In-

ternal Revenue Code as a basis for makings [sic] its determination of

eligibility of cash benefits under the TAA program.’’ First Remand

Determination at 2.

3

Finding that the agency failed to comply with the court’s remand

order by reading the holding of Steen too broadly, the court once

again remanded the matter to the USDA. Anderson II,30CIT

,

469 F. Supp. 2d 1300. The court noted that, in Steen, the CAFC ex-

plicitly qualified its holding regarding the net fishing income regula-

tion. Specifically, the CAFC stated: ‘‘Mr. Steen does not contend that

his tax returns distort the net amount of his income derived from all

fishing sources in the two relevant years....’’Anderson II, 30 CIT at

, 469 F. Supp. 2d at 1300–01; Steen, 468 F. 3d at 1364. Because

Mr. Anderson raised just such a claim—that his cash-basis tax re-

turns distorted the net amount of his income derived from all fishing

sources in the two relevant years—the court remanded the matter to

the USDA for reconsideration consistent with the court’s remand or-

ders. Anderson II, 30 CIT at

, 469 F. Supp. 2d. at 1301.

4

3

Notwithstanding the USDA’s assertion that it had no need to revisit the reasonableness

of the regulation as applied to Mr. Anderson, the USDA separately found that ‘‘based on the

evidence in the record, it [was] not possible to surmise how Mr. Anderson’s Schedule C’s

would have been calculated had he chosen the accrual method of accounting, nor is it pos-

sible to ascertain whether the IRS would have accepted them if they were submitted in such

a manner.’’ First Remand Determination at 2.

4

As the court further explained in Anderson II, the agency’s action in the first remand

was not only wrong on the law; it was also improper procedurally. The agency is not free to

disobey remand instructions by invoking its interpretation of precedent. Its choices are to

ask for rehearing, to accede or to fully comply under protest. Anderson II,30CIT

, 469

F. Supp. 2d.at 1301.

70

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 15 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

In the second remand determination the USDA reopened the

record, and requested additional documentation from Mr. Anderson,

advising him that:

Acceptable documentation includes supporting documentation

from a certified public accountant orattorney, or relevant docu-

mentation and other supportingdocumentation and other sup-

porting financial data, suchas financial statements, balance

sheets, and reportsprepared for or provided to the Internal Rev-

enue Serviceor another U.S. Government agency.

Second Remand Determination at 1.

5

In response to the Department

of Agriculture’s request, Mr. Anderson provided a letter from his ac-

countant, with accompanying Schedule C’s prepared using the ac-

crual form of accounting (as opposed to the cash form of accounting

originally used by Mr. Anderson in his tax returns). Id. at 3. The ac-

countant’s statement reconstructed Mr. Anderson’s cash-basis tax fil-

ing, to present accrual-basis Schedule C’s. Id. In the letter, Mr.

Anderson’s accountant also includes the normal tax-filing disclaimer,

stating:

Our compilation was limited to presenting in the form pre-

scribed by the Internal Revenue Service information that is the

representation of the owner. We have not audited or reviewed

the financial statements referred to above, and, accordingly, do

not express an opinion or anyother form of assurance on them.

***

This report is intended solely for the information anduse of

Robert L. Anderson and the United States Department of Agri-

culture for determining qualification under the Trade Adjust-

ment Assistance for Farmers program, and is not intended and

should not be used by anyone other than these specified par-

ties.

Second Remand Determination at 2; Letter from Charles E. Morgan,

CPA, Jason, Morgan & Hent, PLLC, to Mr. Anderson (Apr. 6, 2007),

Attach. to Pl.’s Resp. to USDA Letter (‘‘Reply Letter’’).

5

The Department of Agriculture based this advice upon its own regulation, 7 C.F.R.

§ 1580.301(e)(6). This regulation explains the form of documentation that can be provided

to demonstrate to the agency that an individual producer’s net fishing income was less than

that during the producer’s pre-adjustment year. The regulations state that an applicant

shall provide either:

(i) Supporting documentation from a certified public accountant or attorney, or (ii) Rel-

evant documentation and other financial data, such as financial statements, balance

sheets, and reports prepared for or provided to the Internal Revenue Service or another

U.S. Government agency.

7 C.F.R. § 1580.301(e)(6)(2004); see also Second Remand Determination at 2.

U.S. COURT OF INTERNATIONAL TRADE

71

JOBNAME: No Job Name PAGE: 16 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

In commenting on the information provided by Mr. Anderson in re-

sponse to the agency’s request for additional information, the USDA

stated that

[t]he agency does not regard this documentation which accord-

ing to his certified public account [sic] only relies upon Mr.

Anderson’s representations, rather than documentation or

other supporting financial data reported to the Internal Rev-

enue Service or another U.S. Government agency, without any

audit or review of the statements, in conjunction with the certi-

fied public accountant’s unwillingness to express an opinion or

any assurance on them, as complying with the certification that

his net fishing income was less than that during the pre-

adjustment year. The very purpose of requiring such documen-

tation is to verify the producer’s certification that his income

actually declined in order to determine eligibility for cash ben-

efits. Merely presenting Mr. Anderson’s representations on

Schedule C’s does not adequately support his certification that

his net fishing income was less than his income in the pre-

adjustment year. Furthermore, the certified public accountant’s

limiting the use of the report to Mr. Anderson and the Depart-

ment of Agriculture does not meet the requirement in the regu-

lation that the net fishing income be net profit or loss reported

to the Internal Revenue Service. 7 C.F.R. § 1580.102 (2004). In

addition, it appears that these revisions to his income are not

being reported to the Internal Revenue Service.

Second Remand Determination at 3.

Despite this analysis, the agency then determined, based on Mr.

Anderson’s submissions, that his ‘‘income on an accrual basis de-

clined from the pre-adjustment year, 2001, to the most recent mar-

keting year, 2002.’’ Id. at 3. Based on that finding, the USDA further

found that ‘‘[i]f this Court’s decision is the final decision after all op-

portunities for appeal have been exhausted, based upon an accrual

method of accounting...Mr.Anderson would be entitled to a TAA

payment.’’ Id. at 4.

6

6

The USDA, in its second remand determination, provided no further analysis of the

reasonableness of its application of its regulation to Mr. Anderson, but rather continued to

object to the usage of the accrual method of accounting to determine whether or not Mr.

Anderson’s net fishing income declined, stating:

[t]he agency disagrees with the application of the accrual method of accounting in deter-

mining whether Mr. Anderson’s net fishing income declined, because Mr. Anderson had

reported his net fishing income on a cash basis to the Internal Revenue Service, and is

only doing so under protest, in accordance with the Court’s Order.

Second Remand Determination at 2.

The court notes that in its initial opinion, it had directed the USDA to reexamine the rea-

sonableness of its regulation (and the regulation’s interaction with farmers’ legal right to

choose to report their business income on either a cash or accrual basis), as applied to Mr.

72

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 17 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

Mr. Anderson, in his Reply Letter, stated that he provided informa-

tion in accordance with the plain language of the USDA’s regulation

and the agency’s request to Mr. Anderson for supporting documenta-

tion. Mr. Anderson, a pro se plaintiff, stated, in his response:

I did provide supporting documentation from a CPA. This sup-

porting documentation was provided to the USDA, (a US gov-

ernment agency). The regulation asked me to provide support-

ing documentation from a CPA, OR a report prepared for, or

provided to a US government agency. I provided both.

Reply Letter at 2 (emphasis in original).

The plain language of the regulation, with which Mr. Anderson

sought to comply,

7

supports Mr. Anderson’s interpretation. 7 C.F.R.

§ 1580.301(e)(6)(2004); see Christensen v. Harris County, 529 U.S.

576, 588 (2000)(An agency’s interpretation of its own regulation is

not entitled to deference when it is contrary to the plain language of

the regulation). The USDA, as indicated by its comments quoted

above, seems to believe that its regulations require more than is

stated by their terms. This, however, in addition to ignoring the

plain language of the regulation, ignores the court’s two previous

rulings which require the USDA to evaluate the reasonableness of

its application of 7 C.F.R. § 1580.102,

8

upon which the USDA relies

for its definition and determination of net income, to Mr. Anderson.

Remand Determination at 2; Def.’s Resp. to Pl.’s Comments Upon

Remand at 5. The agency cannot have it both ways. If it wished to

invoke 7 C.F.R. § 1580.102 as a basis for rejecting Mr. Anderson’s fil-

ing, it was required to explain why its reasons for doing so were rea-

sonable and in accordance with law.

Despite the USDA’s refusal to evaluate the effects of its regulation

on individual producers, in light of the fact that farmers are in the

unique position of being permitted to choose accrual or cash account-

Anderson, in light of the fact that the regulation has the effect of treating similarly situated

people differently. Anderson I,30CITat

, 462 F. Supp. 2d at 1339; see Former Employ-

ees of Merrill Corporation v. United States,31CIT

, Slip Op. 07–46 at 27 (Mar. 28,

2007). The USDA has yet to make a reasonableness determination, as it first relied on Steen

to avoid evaluating the reasonableness of the application of the regulation, and then side-

stepped the issue altogether in the second remand determination by stating that it was ap-

plying the accrual method ‘‘only . . . under protest, in accordance with the Court’s order.’’

Second Remand Determination at 2. Accordingly, the court considers the issue waived.

7

Mr. Anderson claims, and Defendant does not dispute, that his attempts at compliance

with the USDA’s rules included a conversation with a contact person at the USDA in order

to ‘‘clarify exactly what the USDA wanted,’’ as the ‘‘USDA’s letter requesting supporting

documentation was not clear to [Mr. Anderson].’’ Reply Letter at 2 (emphasis in original). Ac-

cording to Mr. Anderson, he was told ‘‘that they wanted me to have a CPA recalculate my

2001 and 2002 fishing income on an accrual basis, using an IRS style format.’’ Id.

8

Under 7 C.F.R. § 1580.102, the USDA defines net farm in come as ‘‘net farm profit or

loss, excluding payments under this part, reported to the Internal Revenue Service Sched-

ules C or C-EZ for individuals or taxable income . . . during the tax year that most closely

corresponds with the marketing year under consideration.’’ 7 C.F.R. § 1580.102(2004).

U.S. COURT OF INTERNATIONAL TRADE

73

JOBNAME: No Job Name PAGE: 18 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

ing as a means of reporting their income, and despite the agency’s

seeming rejection of Mr. Anderson’s supporting information, the

USDA did approve the granting of TAA benefits to Mr. Anderson

pending the exhaustion of the agency’s opportunities for appeal.

Therefore, this court affirms the remand determination only as to

the results. See Hontex Enters., Inc. v. United States,30CIT

,

425 F. Supp. 2d 1315 (affirming the conclusion of a remand determi-

nation, but finding the summary and discussion sections not to be in

accordance with the remand instructions).

SO ORDERED.

䉬

Slip Op. 07–93

R

OBERT L. ANDERSON, Plaintiff, v. UNITED STATES SEC’Y OF AGRICUL-

TURE

, Defendant.

Before: Pogue, Judge

Court No. 05–00329

Judgment

This action has been duly submitted for decision, and this Court,

after due deliberation, has rendered a decision herein; now, in con-

formity with that decision, it is hereby

ORDERED that the United States Department of Agriculture re-

mand determination with respect to the application of Robert L.

Anderson is affirmed as to the results.

74

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 19 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

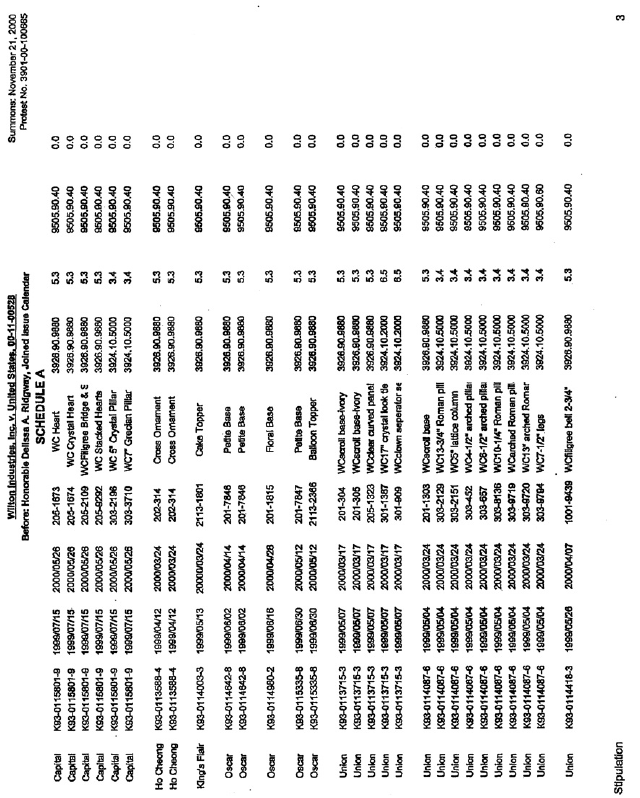

Slip Op. 07–94

W

ILTON INDUSTRIES,INC., Plaintiff,v.UNITED STATES, Defendant.

Court No. 00–11–00528

[Plaintiff’s Motion for Summary Judgment granted in part; Defendant’s Cross-

Motion granted in part; Judgment to enter accordingly.]

Dated: June 11, 2007

Neville Peterson LLP (John M. Peterson, Michael T. Cone, and Maria E. Celis), for

Plaintiff.

Peter D. Keisler, Assistant Attorney General; Barbara S. Williams, Attorney in

Charge, International Trade Field Office, Commercial Litigation Branch, Civil Divi-

sion, U.S. Department of Justice (Mikki Graves Walser); Yelena Slepak, Office of the

Assistant Chief Counsel, International Trade Litigation, U.S. Customs and Border

Protection, U.S. Department of Homeland Security, Of Counsel; for Defendant.

OPINION

RIDGWAY, Judge:

At stake in this action is the tariff classification of more than 280

articles imported by plaintiff Wilton Industries, Inc.–including cake

toppers, as well as wedding cake figurine/topper bases, separator

plates, pillars, columns, plate legs, and plate pegs; wedding cake

fresh flower holders, inserts, and bowls; place card holders; various

models and styles of bakeware; cookie cutters and cookie stamps;

cake picks; and cake presses and cooking tools. The merchandise

was imported from the People’s Republic of China through the Port

of Chicago between May 5, 1999 and July 22, 1999. All entries were

liquidated between March 17, 2000 and June 2, 2000.

Over the course of litigation, the parties have reached agreement

on the classification of 123 articles. See Stipulation (Oct. 16, 2002).

1

In addition, Wilton has abandoned its claims as to another 15 ar-

ticles. See Plaintiff ’s Amended Statement of Material Facts As To

Which No Genuine Issue Exists ¶¶2–6.

Now pending before the Court are the parties’ cross-motions for

summary judgment as to the 158 articles still at issue. Wilton con-

tends that all remaining merchandise is properly classifiable as ‘‘fes-

tive articles’’ under heading 9505 of the Harmonized Tariff Schedule

of the United States (‘‘HTSUS’’),

2

duty-free. See generally Memoran-

dum in Support of Plaintiff ’s Motion for Summary Judgment (‘‘Pl.’s

1

The parties have agreed that their Stipulation is to be incorporated into the Judgment

in this action. All articles subject to the Stipulation are classified as ‘‘festive articles’’ under

one of two subheadings of HTSUS heading 9505. See Stipulation.

2

All citations are to the 1999 version of the HTSUS (including all Section and Chapter

Notes, and the General Rules of Interpretation). In addition, except as otherwise noted, all

U.S. COURT OF INTERNATIONAL TRADE

75

JOBNAME: No Job Name PAGE: 20 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

Brief’’); Memorandum in Opposition to Defendant’s Cross-Motion for

Summary Judgment (‘‘Pl.’s Reply Brief’’); Supplement to Plaintiff’s

Memorandum of Points and Authorities (‘‘Pl.’s Supp. Brief ’’); Plain-

tiff’s Response to Defendant’s Supplemental Memorandum (‘‘Pl.’s

Supp. Reply Brief’’).

According to the Government, however, the U.S. Customs Service

properly classified the remaining merchandise under HTSUS head-

ing 3924, heading 3926, heading 7615, or heading 7323 (depending

on the item at issue),

3

liquidating it at rates of duty ranging from

3.1% to 6.5% ad valorem. See generally Defendant’s Opposition to

Plaintiff’s Motion for Summary Judgment and Cross-Motion for

Summary Judgment (‘‘Def.’s Brief ’’); Defendant’s Reply to Plaintiff ’s

Opposition to Defendant’s Cross-Motion for Summary Judgment

(‘‘Def.’s Reply Brief ’’); Defendant’s Supplemental Memorandum in

Opposition to Plaintiff ’s Motion for Summary Judgment and In Sup-

port of Defendant’s Cross-Motion for Summary Judgment (‘‘Def.’s

Supp. Brief ’’); Defendant’s Reply to Plaintiff ’s Supplement to Plain-

tiff’s Memorandum of Points and Authorities (‘‘Def.’s Supp. Reply

Brief’’).

For the reasons set forth below, both Plaintiff ’s Motion for Sum-

mary Judgment and Defendant’s Cross-Motion for Summary Judg-

ment are granted in part and denied in part.

I. Background

On its website – an online paradise for the aspiring Martha

Stewarts of the world – plaintiff Wilton Industries, Inc. promotes it-

self as ‘‘the number one preferred brand name in baking and cake

decorating products for over 50 years.’’

4

Wilton is both a retailer

(selling directly to the public, through its Online Store and its cata-

citations to the Explanatory Notes are to the 1996 version, the relevant provisions of which

were in effect in 1999.

3

HTSUS heading 3924 covers ‘‘Tableware, kitchenware, other household articles and toi-

let articles, of plastics,’’ while heading 3926 covers ‘‘Other articles of plastics and articles of

other materials of headings 3901 to 3914.’’ Heading 7615 covers ‘‘Table, kitchen or other

household articles and parts thereof, of aluminum; pot scourers and scouring or polishing

pads, gloves and the like, of aluminum; sanitary ware and parts thereof, of aluminum.’’ And

heading 7323 covers ‘‘Table, kitchen or other household articles and parts thereof, of iron or

steel; iron or steel wool; pot scourers and scouring or polishing pads, gloves and the like, of

iron or steel.’’

4

According to Wilton’s website, the Illinois-based company markets a wide range of prod-

ucts. Wilton’s Online Store includes a Baby Shop, a Bakeware Shop, Books & Videos, a

Cake Decorating Shop, a Candy Shop, a Cookie Shop, a Party Shop, a Seasonal Shop, a

Theme & Character Shop, a Wedding Shop, and Stationery.

Among other things, Wilton’s website also offers tips on cake decorating techniques, sug-

gested party ideas, recommended recipes and projects, details about contests, information

about Wilton’s own School of Cake Decorating & Confectionary Art (as well as information

on ‘‘Wilton Method’’ classes at locations nationwide), and an online ‘‘Discussion Forum’’ de-

voted to the exchange of ideas on cake decorating and similar arts.

76

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 21 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

log, the ‘‘Yearbook of Cake Decorating’’) and a wholesaler (selling to

general merchandise and specialty stores, such as Target, Wal-Mart,

and Michael’s).

5

5

Except as otherwise noted, the information in this section is drawn generally from the

Affirmation filed by Wilton, from the Statements of Material Facts Not in Dispute filed by

the parties, and from the pages printed from Wilton’s website and the pages from Wilton’s

Yearbook catalog which Wilton filed in support of its motion.

Throughout the course of litigation, the Government has criticized the quantum, the

quality, and the timing of the submission of Wilton’s evidence. Wilton, in turn, has criticized

the Government for proffering no evidence of its own (and, indeed, apparently conducting

little or no discovery in this matter). See Pl.’s Supp. Brief at 11–12; Pl.’s Supp. Reply Brief

at 5–6.

In Defendant’s Response to Plaintiff’s Statement of Facts, for example, the Government

emphasized that the exhibits filed with Wilton’s opening brief did not include depictions of

some of the bakeware and some of the cookie cutters and cookie stamps at issue (although

the Government failed to specify which were missing). See Def.’s Response to Pl.’s State-

ment of Facts ¶¶ 8–9; see also Def.’s Reply Brief at 10 n.3. The Government similarly criti-

cized Wilton for not filing affidavits in support of its case. See Def.’s Brief at 3, 21; Def.’s

Reply Brief at 9.

When Wilton later sought to cure the deficiencies in its exhibits, however, the Govern-

ment criticized Wilton’s submissions as ‘‘belated.’’ See, e.g., Def.’s Supp. Reply Brief at 1–2;

Letter to Court from Counsel for Defendant to Court (May 16, 2007). And the Government

has argued that the affirmation that Wilton filed should be stricken from the record on vari-

ous grounds. See generally Def.’s Reply Brief at 9–12.

To be sure, Wilton is obligated to submit proof documenting the nature of its merchan-

dise; and, to be sure, it largely defaulted on that obligation until relatively recently. It is not

the job of the court or opposing counsel to police the completeness of a party’s evidence, and

then notify that party of any deficiencies. The bottom line, however, is that the Government

has not even alleged – much less demonstrated – any actual prejudice as a result of Wilton’s

belated submissions in this action.

The Government’s objections to the affirmation that Wilton filed are also wide of the

mark. Accordingly, the Government’s motion to strike must be denied. The affirmation is

‘‘bare-bones,’’ to put it charitably. But the Government’s principal criticisms are that the af-

firmation is undated, and that the affiant was not in Wilton’s employ at the time of the

events at issue here. See generally Def.’s Reply Brief at 9–12. As a general matter, however,

‘‘the absence of the formal requirements of a jurat in a sworn affidavit does not invalidate

the statements [in the affidavit] or render them inadmissible.’’ Peters v. United States, 408

F.2d 719, 722 (Ct. Cl. 1969) (quoted in Pfeil v. Rogers, 757 F.2d 850, 859 (7

th

Cir. 1985)).

Thus, in the interests of justice, trial courts are admonished not to be ‘‘unnecessarily

hypertechnical and overly harsh on a party who unintentionally fails to make certain that

all technical, non-substantive requirements of execution are satisfied.’’ Pfeil, 757 F.2d at 859

(holding that district court erred in rejecting affidavits for lack of notarial seal); 11 James

Wm. Moore et al., Moore’s Federal Practice § 56.14[1][b] (3d ed. 2006). Certainly the Gov-

ernment has not suggested that the absence of a date on Wilton’s affirmation casts doubt on

the truth of any specific statement therein. See generally Pl.’s Supp. Brief at 12–13.

Moreover, the mere fact that the affiant was not in the employ of a company at the time

of specific events does not ipso facto mean that the affiant lacks the personal knowledge re-

quired to attest to facts that predate his or her tenure at the company. See Def.’s Reply Brief

at 9–10 (arguing that ‘‘there is no indication that [the affiant] has ever seen the merchan-

dise at issue, which was imported approximately three years prior to her assuming the posi-

tion of Vice President of Wilton’’). ‘‘[C]orporate officers are presumed to have personal

knowledge of acts of their corporation.’’ See 11 Moore’s Federal Practice § 56.14[1][c]. And it

is clear beyond cavil that ‘‘[p]ersonal knowledge ...doesnotrequirecontemporaneous

knowledge.’’ Id. (citing, inter alia, Dalton v. FDIC, 987 F.2d 1216, 1223 (5

th

Cir. 1993) (affi-

davit of corporate officer was not defective simply because he learned of transaction after it

had occurred)). Here, the Government has ‘‘produced no evidence to show that [Wilton’s affi-

ant] did not know what [s]he was talking about.’’ Zayre Corp. v. S.M. & R. Co., 882 F.2d

U.S. COURT OF INTERNATIONAL TRADE

77

JOBNAME: No Job Name PAGE: 22 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

Wilton sells the imported merchandise at issue (described in

greater detail below) as seasonal goods, and as goods associated with

certain special occasions. All of the merchandise is imported and sold

only in conjunction with holidays or other special occasions. Many of

1145, 1151 (7

th

Cir. 1989). Nor has the Government ‘‘produce[d] any evidence to specifically

cast doubt on [the affiant’s] credibility.’’ Id.; see generally Pl.’s Supp. Brief at 12–13.

At the eleventh hour (in the course of supplemental briefing), the parties have traded

barbs as to matters such as their respective evidentiary burdens and the effect of the pre-

sumption of correctness. See 28 U.S.C. § 2639(a)(1) (2000) (presumption of correctness).

Wilton argues that ‘‘once the plaintiff has provided a prima facie case, the government has

an obligation to provide its own evidentiary support for its claims that plaintiff ’s merchan-

dise is not entitled to classification under Heading 9505.’’ See generally Pl.’s Supp. Brief at

9–12. Wilton emphasizes: ‘‘[The Government] has not provided any factual evidence that

the subject merchandise should not be classified under Heading 9505. It has simply criti-

cized every aspect of [Wilton’s] evidence and stated that whatever has been provided is not

enough.’’ See Pl.’s Supp. Reply Brief at 5–6.

The Government argues – for the first time in its Supplemental Brief – that it ‘‘is not

required to produce evidence,’’ because, it asserts, ‘‘Wilton has failed to meet its burden of

contradicting Customs’ presumptively correct factual finding that the imported articles are

not ‘festive articles.’ ’’ See Def.’s Supp. Brief at 15–16 (quoting Saab Cars USA, Inc. v.

United States, 434 F.3d 1359, 1368 (Fed. Cir. 2006)).

In briefing these points, however, neither party has adequately addressed the interplay

of all relevant principles and doctrines. For example, the Government fails to acknowledge

that the parties are in agreement that no material facts are in dispute. See, e.g., Pl.’s Brief

at 13; Def.’s Brief at 2, 4, 6. And the statutory presumption of correctness attaches only to

Customs’ factual findings. Thus, where – as here – there are no disputes of material fact,

the presumption of correctness has no practical effect. See, e.g., Universal Elecs., Inc. v.

United States, 112 F.3d 488, 492 (Fed. Cir. 1997) (quoting Marbury v. Madison, 5 U.S. 137,

177 (1803)); id.(citing Goodman Mfg., L.P. v. United States, 69 F.3d 505, 508 (Fed. Cir.

1995)) (‘‘[W]e conclude that although the presumption of correctness applies to the ultimate

classification decision, [plaintiff] properly interprets Goodman as standing for the proposi-

tion that, as a practical matter, the presumption carries no force as to questions of law.’’).

As Wilton emphasizes, the Government similarly fails to acknowledge that it has cross-

moved for summary judgment, and ignores the implications of that fact. See Pl.’s Supp. Re-

ply Brief at 6. It is one thing for a party to defeat a movant’s motion for summary judgment;

it is something else entirely to prevail as cross-movant.

Finally, Saab – on which the Government seeks to rely heavily – was not a classification

case, and is thus distinguishable from the case at bar. See Saab, 434 F.3d at 1368. In classi-

fication cases, the Court has an independent obligation under Jarvis Clark to ascertain the

proper classification of merchandise in dispute. See Jarvis Clark Co. v. United States, 733

F.2d 873, 876 (Fed. Cir. 1984). And, as officers of the court, counsel have a duty to assist the

Court in that function. Even if Wilton had not made out a prima facie case for ‘‘festive ar-

ticles’’ classification of any of its merchandise, neither party has argued that the Court

would somehow be relieved of its Jarvis Clark obligation (and that the Government could

somehow, in essence, prevail on its cross-motion by default).

Fortunately, there is no need to definitively resolve such issues here. Notwithstanding

their posturing, the parties have steadfastly maintained throughout the course of litigation

– despite countless opportunities to indicate to the contrary (before, during, and after oral

argument) – that there are no disputes of material fact which would preclude summary

judgment in favor of either party. And, although the existing evidentiary record is thin on a

number of points, and does not afford the pristine basis for summary judgment that would

be optimal (and which a court is certainly entitled to expect), it is also abundantly clear that

a trial would serve no real purpose in this matter. See, e.g., Pl.’s Brief at 13 (stating that

‘‘[t]here is no genuine dispute of material fact’’); Def.’s Brief at 2 (noting that ‘‘[t]here is no

dispute between the parties regarding what the merchandise is or how it is actually used’’),

4 (‘‘Summary judgment is proper as there are no material facts in dispute.’’), 6 (‘‘Inasmuch

as the parties agree as to what the merchandise is and how it is used, this action is ripe for

summary judgment.’’).

78

CUSTOMS BULLETIN AND DECISIONS, VOL. 41, NO. 27, JUNE 27, 2007

JOBNAME: No Job Name PAGE: 23 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

the items are marketed in connection with a particular holiday –

such as Christmas, Valentine’s Day, or Halloween – and are designed

and intended specifically for use in celebration of that holiday. Other

goods are marketed for so-called ‘‘private festive occasions,’’ such as

birthdays, or weddings and anniversaries, and are similarly de-

signed and intended specifically for use on such an occasion.

The merchandise that Wilton sells in connection with a holiday

(such as Christmas, Valentine’s Day, or Halloween) is advertised and

marketed in the appropriate section of the ‘‘Seasonal Shop’’ of

Wilton’s Online Store (e.g., the Christmas, Valentine’s Day, or Hal-

loween section), and in the appropriate section of Wilton’s Yearbook

catalog (e.g., the Christmas, Valentine’s Day, or Halloween section).

In stores such as Target, Wal-Mart, and Michael’s, such holiday mer-

chandise is displayed and sold in the seasonal section or festive prod-

ucts section of the store. The stores display the holiday merchandise

only in the weeks immediately preceding the holiday with which the

merchandise is associated. Thus, for example, shoppers will not find

Christmas tree cookie cutters or Santa-shaped baking pans on dis-

play in stores in the summer months. Nor does Wilton offer such

merchandise in its Online Store or its Yearbook catalog, except in the

Christmas sections. In Wilton’s Online Store, in its Yearbook catalog,

and in the retail stores that carry Wilton’s merchandise (e.g., Target,

Wal-Mart, and Michael’s), Wilton’s holiday-specific merchandise is

displayed and marketed alongside other holiday merchandise, in-

cluding festive cookware, kitchenware, and bakeware (such as Hal-

loween cookie jars, Christmas dinnerware, or Valentine’s Day mugs,

depending on the holiday season).

Merchandise like the non-holiday merchandise at issue – wedding

and anniversary merchandise, and birthday and other non-holiday

bakeware, for example – is advertised and marketed in the ‘‘Wedding

Shop,’’ the ‘‘Theme & Character Shop,’’ or the ‘‘Novelty Shaped Pans’’

section of the ‘‘Bakeware Shop’’ of Wilton’s Online Store, and in the

‘‘Wedding,’’ ‘‘Famous Characters,’’ or ‘‘Novelty Pans’’ section of

Wilton’s Yearbook catalog (as appropriate). Stores such as Target,

Wal-Mart, and Michael’s display such merchandise year-round in the

‘‘wedding’’ and/or the ‘‘birthday’’ or ‘‘party goods’’ sections of their

stores (as appropriate).

As described in greater detail below, the remaining merchandise

at issue includes various styles of wedding cake separator plates, pil-

lars and columns, and plate legs; Cherub Place Card Holders; sev-

eral dozen different items of bakeware, as well as cookie cutters and

cookie stamps; and certain cake press sets.

A. The Merchandise At Issue

Wedding Cake Separator Plates, Pillars/Columns, and Plate Legs.

The wedding merchandise remaining at issue consists of wedding

cake ‘‘separator plates,’’ pillars and columns, and separator plate

U.S. COURT OF INTERNATIONAL TRADE

79

JOBNAME: No Job Name PAGE: 24 SESS: 25 OUTPUT: Thu Jun 21 09:59:04 2007

/orchid2/orchid2/267/80215/slipops

‘‘legs.’’ All of the items are made of plastic, and are designed to be

used together to separate the tiers of a multi-tiered wedding cake, to

enhance the cake’s appearance and appeal at wedding celebrations.

6

Separator plates support each of the tiers of a multi-tiered wed-

ding cake. The separator plates are typically round (ranging from six

to eighteen inches in diameter), but also come in other shapes, in-

cluding square, hexagon, oval, and heart-shaped. A separator plate

can be converted to a ‘‘base plate’’ (used to support the bottom tier of

a cake, generally the largest of the tiers) by the addition of one-inch

plate ‘‘legs.’’ Plate ‘‘pegs’’ – which are no longer at issue in this action

– are used to anchor the cake tiers themselves to the separator

plates, and to prevent the tiers of the cake from slipping off the sepa-

rator plates when the cake is cut. The coordinating pillars and col-

umns range from three to eleven inches tall, and are designed to

snap onto the undersides of the separator plates, to separate and

support each tier of the wedding cake.

Because they are visible parts of a tiered wedding cake as it is pre-

sented, items such as separator plates, pillars and columns, and

plate legs must be not only strong, but also aesthetically pleasing.

Thus, descriptions of the items emphasize their beauty, as well as

their strength and their stability. And, while the separator plates,

pillars and columns, and plate legs are actually made of plastic (and

thus are inexpensive enough to be disposable), they are designed to

look like they are made from finely-cut crystal and other expensive

materials. They are also sold in several different styles (some el-

egantly simple and others more ornate, some traditional and others

more modern), to coordinate with one another,

7

and to appeal to the

differing personal tastes of bridal couples by enhancing whatever

overall look they are seeking to create with their wedding cake.

Although Wilton claims that the merchandise is properly classifi-

able as ‘‘festive articles’’ under HTSUS heading 9505, Customs liqui-

dated the wedding cake separator plates, pillars, and columns as

‘‘Tableware, kitchenware, other household articles and toilet articles,

of plastics: Tableware and kitchenware: Plates, cups, saucers, soup

6

Multi-tiered wedding-type cakes are created using one of two methods – the ‘‘stacked’’

method (where one tier is stacked directly on top of the tier below it), or the ‘‘pillar construc-

tion’’ method (where a tier is held aloft – above the tier below it – through the use of pillars

or columns, in combination with separator plates).

7

Thus, for example, pillars and/or columns are used to separate the tiers of a multi-

tiered cake. Pillars are offered in styles including ‘‘Crystal-Look,’’ ‘‘Crystal-Look Spiked,’’