WP/19/120

U.S. Investment Since the Tax Cuts and Jobs Act of 2017

by Emanuel Kopp, Daniel Leigh, Susanna Mursula, and Suchanan Tambunlertchai

IMF Working Papers describe research in progress by the author(s) and are published

to elicit comments and to encourage debate. The views expressed in IMF Working Papers

are those of the author(s) and do not necessarily represent the views of the IMF, its

Executive Board, or IMF management.

© 2019 International Monetary Fund WP/19/119

IMF Working Paper

Western Hemisphere and Research Departments

U.S. Investment Since the Tax Cuts and Jobs Act of 2017

Prepared by Emanuel Kopp, Daniel Leigh, Susanna Mursula, and Suchanan

Tambunlertchai

1

Authorized for distribution by Nigel Chalk and Benjamin Hunt

May 2019

Abstract

There is no consensus on how strongly the Tax Cuts and Jobs Act (TCJA) has stimulated

U.S. private fixed investment. Some argue that the business tax provisions spurred

investment by cutting the cost of capital. Others see the TCJA primarily as a windfall for

shareholders. We find that U.S. business investment since 2017 has grown strongly

compared to pre-TCJA forecasts and that the overriding factor driving it has been the

strength of expected aggregate demand. Investment has, so far, fallen short of predictions

based on the postwar relation with tax cuts. Model simulations and firm-level data suggest

that much of this weaker response reflects a lower sensitivity of investment to tax policy

changes in the current environment of greater corporate market power. Economic policy

uncertainty in 2018 also subdued investment growth, although to a lesser extent.

JEL Classification Numbers: D2, D8, E2, E62, E65, H25, H32, L1.

Keywords: Investment, fiscal policy, market power, uncertainty.

Authors’ E-Mail Addresses: [email protected], [email protected], [email protected],

1

We are grateful to Nigel Chalk, Benjamin Hunt, Benjamin Carton, Carlos Caceres, Karel Mertens, and

numerous IMF seminar participants for helpful comments, to Peter Williams and Dan Pan for excellent research

assistance, and to Javier Ochoa for superb editorial support.

IMF Working Papers describe research in progress by the author(s) and are published to

elicit comments and to encourage debate. The views expressed in IMF Working Papers are

those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board,

or IMF management.

The Tax Cuts and Jobs Act (TCJA) signed into law on December 22, 2017, made significant

changes in the personal and business income tax systems.

2

A central objective of the law was to

lower the tax burden on businesses and encourage them to increase investment. The TCJA

permanently cut the statutory corporate income tax rate from 35 to 21 percent and introduced

temporary capital expensing, allowing companies to fully deduct certain types of capital

spending from their pre-tax earnings.

3

It also introduced international tax provisions aimed at

encouraging companies to repatriate foreign earnings and invest them in the United States. The

cost of the TCJA is estimated at some US$1.9 trillion over 10 years (Congressional Budget

Office 2018).

4

More than a year after the passage of the TCJA, there is no consensus on how strongly it has

stimulated private fixed investment. Some argue that, by lowering the cost of capital, the TCJA’s

tax provisions have significantly increased business investment (Council of Economic Advisers

2019). Others argue that businesses have used only a small portion of the cash freed up by the

TCJA to increase investment (Krugman 2018, for example). It may be that a full assessment of

the effects of the TCJA will need to await availability of more data, including to reflect lags in

the issuance of regulations for certain provisions of the law.

This paper presents a preliminary assessment, based on available data, of the performance of

U.S. investment since the passage of the TCJA from three different angles. First, we take stock

of how private investment has performed since 2017 compared to forecasts made before the

TCJA. To put U.S. investment performance into international perspective, we also conduct this

comparison for other advanced economies. We additionally examine whether U.S. investment

growth has been broad-based or driven by specific investment categories or economic sectors.

Second, we investigate how much of the investment growth in 2018 reflects the strength of

aggregate demand. In particular, we assess how much of the rise in non-residential (business)

investment compared with pre-TCJA forecasts is explained by the theoretical relationship

between investment and expectations of future demand. Third, we assess the investment outturn

against what could have been expected based on the empirical literature on how economic

activity and investment respond to postwar U.S. changes in tax policy.

Our findings indicate that U.S. non-residential (business) investment growth since 2017 has been

strong. As we report in Section I, the level of U.S. business investment reached by the end of

2018 was about 4.5 percent higher than forecasters had generally anticipated in the Fall of 2017,

before the enactment of the TCJA. On a Q4/Q4 basis, business investment growth in 2018 was

greater than had been anticipated by 3.5 percentage points. This overperformance was stronger

than that seen in other advanced economies, where investment growth was broadly in line with

2

The law’s formal title is “HR1: An Act to provide for reconciliation pursuant to titles II and V of the concurrent

resolution on the budget for fiscal year 2018.”

3

The TCJA allows 100 percent expensing on new investments in assets with less than 20-year depreciable life

through 2022, to be reduced by 20 percentage points per year thereafter. For an overview of the TCJA, see Chalk,

Keen and Perry (2018).

4

This estimated cost incorporates macroeconomic feedback effects, as estimated by the CBO. Without these effects,

the estimated static cost is about US$2.3 trillion (CBO 2018).

4

or below expectations. Components of U.S. business investment that grew especially strongly

compared to pre-TCJA forecasts were equipment and software, and intellectual property.

At the same time, the overall strength in aggregate demand appears to have been the primary

driver of the rise in business investment since 2017. As Section II reports, the rise in business

investment is consistent with a forward-looking accelerator model in which investment responds

to expectations of future overall demand, as measured by private-sector forecasts of growth in

the non-investment part of output. This suggests that factors that raised aggregate demand—

including the rise in disposable income from the TCJA and higher government spending from the

2018 Bipartisan Budget Act (BBA)—encouraged companies to expand capacity to meet the

incremental customer demand. There appears to be little unexplained component of business

investment beyond the expected demand effect. Other factors, such as reductions in the cost of

capital, thus appear to have played a relatively minor role. This result is consistent with surveys

of both large and small companies, which show that only 10-25 percent of businesses attributed

planned increases in investment to the 2017 changes in the tax code. Moreover, balance sheet

data for listed (S&P500) firms suggest that only about 20 percent of the increase in corporate

cash balances since the passage of the TCJA has been used for capital and R&D spending. Much

of the remainder was used for share buybacks, dividend payouts, and other asset-liability

planning and balance sheet adjustments.

In addition, we find that the investment response to the TCJA thus far has been smaller than

would have been predicted based on the effects of previous U.S. tax cut episodes. As Section III

explains, empirical studies based on postwar U.S. data suggest that the impact of tax cuts on

GDP and investment typically peaks within the first year. When the estimates from these studies

are calibrated to the scale of the TCJA tax cuts, following Mertens 2018, the predicted impact on

GDP in 2018 averages 1.3 percentage points, and the predicted impact on business investment is

5.2 percentage points on a Q4/Q4 basis. The actual increases in GDP and investment growth

since the passage of the TCJA compared with pre-TCJA forecasts have been below these

predictions, at 0.7 and 3.5 percentage points, respectively.

In Section IV, we investigate two factors that may have dampened the output and investment

response to the TCJA compared to previous postwar episodes of tax cuts: increased economic

policy uncertainty and greater corporate market power.

A large literature finds a negative relation between policy uncertainty and business investment.

5

We draw on this literature to quantify the impact of the rise in policy uncertainty indices since

2017, which has occurred in the context of growing uncertainty regarding trade and other

policies in the United States and other countries. We find that policy uncertainty has played a

role in subduing investment growth in 2018.

In a novel contribution, we investigate the role of market power in stunting the impact of the

TCJA on business investment compared to previous postwar episodes of tax cuts. A growing

5

See, for example, Bernanke (1983); Bloom, Bond, and Van Reenen (2007); Handley and Limão (2015); Baker,

Bloom, and Davis (2016).

5

literature documents a widespread rise in market power in advanced economies over the past

several decades.

6

To our knowledge, our paper is the first to investigate the link between the rise

in market power and the potency of tax policy changes.

7

8

We start by presenting simulation

results from the IMF’s Global Integrated Monetary and Fiscal (GIMF) general equilibrium

model, which show that a cut to the corporate tax rate theoretically produces a considerably

smaller response in investment, output, employment, and real wages when corporate markups are

high. Next, we investigate if this theoretical result is also borne out empirically using firm-level

investment and employment data for 17 advanced economies, a narrative dataset of fiscal shocks

(Guajardo, Leigh, and Pescatori 2014), and estimates of markups at the firm level (Díez, Leigh,

and Tambunlertchai 2018). We find that the impact of tax changes on investment and

employment is significantly smaller in firms with higher markups. Similar results hold when

looking only at 2018 data for U.S. publicly listed companies. Firms with higher estimated

markups increased investment (and investment growth) by less in 2018 than those firms who

were pricing closer to marginal cost. Section V concludes.

I. HOW HAS U.S. PRIVATE INVESTMENT PERFORMED SINCE 2017?

To investigate the strength of investment since the passage of the TCJA, we compare the 2018

outturn in real private fixed investment with the forecast made before the TCJA was enacted. We

use forecasts from the Fall 2017 vintage of the IMF’s World Economic Outlook (WEO) database,

which were explicitly based on the assumption of unchanged U.S. fiscal policies.

9

Projections

from this vintage are in line with those made by other forecasters at around the same time, such

as those available from Consensus Economics and the Survey of Professional Forecasters. To

investigate the possibility that the Fall 2017 vintage of forecasts may have reflected positive

anticipated effects of the TCJA, we check the evolution of forecasts for 2018 going back as far as

2015—well before the current administration took office and discussions of the TCJA were in

the public domain—and find no systematic change in the forecasts of 2018 growth over that

period (Figure 1). Actual investment outturns compared to forecasts made in the Fall of 2017 are

thus likely to be informative regarding the causal effects of the TCJA, as well as of other major

policy changes that occurred around the same time, such as passage of the BBA, which increased

government spending.

Our results show that U.S. real private fixed investment in 2018 significantly outperformed pre-

TCJA expectations. In addition, such a pickup in investment was not observed in other advanced

6

See De Loecker and Eeckhout (2017); Díez, Leigh, and Tambunlertchai (2018); De Loecker and Eeckhout (2018);

and IMF (2019).

7

Krugman (2018) suggests that monopoly power is a factor that has diminished the impact of the TCJA on

investment.

8

Higher market power may additionally affect the optimal level of investment even in the absence of tax policy

changes (see Díez, Leigh, and Tambunlertchai 2018). However, in this paper, we investigate a separate issue––

whether market power affects the effectiveness of tax policy changes in raising investment.

9

The Fall 2017 WEO explains (p. 13) that the forecasts were based on the assumption of unchanged U.S. fiscal

policies. The Fall 2017 WEO was compiled on the basis of information available through September 18, 2017.

6

economies. Figure 2 shows comparisons of real private fixed investment outturns in 2018 against

forecasts for the United States and other advanced economies. While total real private fixed

investment in the other countries performed largely as expected or underperformed compared to

forecasts, in the United States investment exceeded pre-TCJA expectations by 2.2 percent. Real

private fixed investment in the United States already started outperforming forecasts in

2017Q4.

10

The strong performance in real private fixed investment in 2018 was led by non-residential

(business) investment, which overperformed pre-TCJA forecasts by 4.7 percent, as Figure 3

reports. On a Q4/Q4 basis, business investment growth in 2018 was greater than had been

anticipated by 3.5 percentage points.

11

By contrast, residential investment fell below the pre-

TCJA forecast in 2018. Growth in business (non-residential) investment was broad-based across

categories of business investment. The equipment and software and IP categories saw the highest

growth and accounted for most of the business investment deviation from the pre-TCJA forecast,

as shown in Figure 4. Investment in structures started the year strongly, but then tapered and,

overall, contributed little to the growth in business investment in 2018.

12

The pickup in investment in 2018 also coincided with higher oil prices and a pickup domestic oil

production. Accordingly, some have suggested that the strength of business investment growth in

2018 came primarily from the energy sector (Arnon 2018 and Smith 2018). Our own analysis of

the oil sector’s contribution to different types of investments is shown in Figure 5.

13

We find that

the oil sector accounts for virtually all of the growth in the structures category of investment in

2017 and 2018. Structures investment has moved closely with oil prices in previous years as

well. However, the oil sector contributes little to non-structures (equipment, software, and IP)

investment. We conclude that the oil sector’s role in driving overall business investment growth

in 2018 was relatively small.

10

CEA (2019) attributes the pickup in investment in 2017Q4 to firms already shifting forward their investment in

reaction to news that full expensing for new equipment would be retroactive to September 2017.

11

We use the National Income and Product Accounts data from the Bureau of Economic Analysis. Business

investment (non-residential fixed investment) growth in 2018 was 7.0 percent on a Q4/Q4 basis. Using an

alternative measure of business investment—the sum of private nonresidential fixed investment by (a) nonfinancial

corporate business; (b) nonfinancial noncorporate business, and (c) financial institutions, based on the Distribution

of Gross Domestic Product data from the Federal Reserve’s Financial Accounts of the United States—real business

investment growth in 2018 was 7.4 percent (Q4/Q4). For 2017, the rates of business investment growth based on the

above two measures are, respectively, 6.3 and 6.4 percent on a Q4/Q4 basis.

12

This small contribution also reflects the relatively small share of structures investment in total business investment

(around 20 percent).

13

Our analysis is based on the National Income and Product Accounts statistics, which includes mining activity.

7

II. HOW MUCH OF THE HIGHER INVESTMENT REFLECTS THE STRENGTH OF AGGREGATE

DEMAND?

To understand the role that the TCJA has played in raising investment, we first assess how much

of the investment growth can be explained by the prevailing strength of aggregate demand. We

do so by comparing the evolution of business investment with the predictions of a standard

forward-looking accelerator model that links investment choices to expectations of future

product demand.

The standard accelerator model of investment predicts that firms increase investment when

opportunities for selling their products arise.

14

Strong economic conditions that generate large

current and expected future sales are therefore likely to spur new investments. The TCJA was

widely expected to generate greater product demand as cuts to personal income taxation were

deficit financed and raised households’ disposable income. This demand boost was further

strengthened by the increased government spending in the BBA that was signed into law on

February 9, 2018. Taking this into account, companies would have planned to increase their

investment in anticipation of future demand. This would have happened in addition to any

response to changes in the user cost of capital.

The empirical specification of the forward-looking accelerator model we estimate uses real-time

private-sector forecasts to capture expected demand growth. The equation we estimate is:

(1)

where

denotes real business investment in the IP and equipment and software categories, and

denotes the forecast of growth over the next quarters, taken from Consensus

Economics. To address the fact that current investment may be related to future expected

investment, which is part of expected output growth, we conduct the estimation using the

Consensus Economics forecast of the non-investment part of output (GDP excluding

investment). We use the 4-quarter-ahead Consensus Economics forecast of non-investment

output growth (so = 4 in equation 1). The sample spans 1983Q4-2016Q4. Based on the model

estimates, we make out-of-sample predictions for 2017Q1-2018Q4. We exclude structures

investment from our estimation to avoid introducing the afore-mentioned volatility induced by

oil price fluctuations.

Our results suggest that U.S. investment growth since 2017 reflects expectations of strong

aggregate demand. Figure 6 reports the actual and predicted values for business investment under

the afore-mentioned accelerator model specification. The model provides a close fit with actual

investment. The fact that there is little unexplained strength in investment since 2017 suggests

14

The standard accelerator model is derived as in Jorgenson and Siebert (1968). The empirical specification for the

model typically follows Oliner, Rudebusch, and Sichel (1995):

, where

denotes real business investment and

denotes the change in the desired capital stock, which, in turn, is assumed

to be proportional to the change in output:

. The analysis typically includes 12 lags of the changes in

output (N = 12) and the equation is normalized by the lagged capital stock,

, to address potential

nonstationarity.

8

that factors beyond expectations of aggregate demand—such as the lower user cost of capital

associated with the reduced corporate tax rate and the full capital expensing––have played a

relatively minor role in stimulating investment since 2017. Alternatively, it could be that the tax

reform had a greater positive effect that was offset by other contemporaneous developments (as

we discuss in Section IV).

The demand-based interpretation of the strength in business investment since 2017 is consistent

with responses to company surveys. The Small Business Surveys conducted by the National

Federation of Independent Business (NFIB), which covers over 2,000 firms with fewer than 100

employees across a broad range of sectors, show that the net percentage of firms expecting

higher real sales over the next six months started to climb in 2017, signaling rising demand

conditions. At the same time, and in line with our results, business surveys also suggest that only

a small proportion of firms directly attribute increases in planned investment to the TCJA. In the

quarterly Business Conditions Survey conducted by the National Association of Business

Economics (NABE), only 11 percent of surveyed firms attributed the acceleration of their

investment to the TCJA while only 4 percent reported redirecting investment or hiring to the

United States as a result of the TCJA.

15

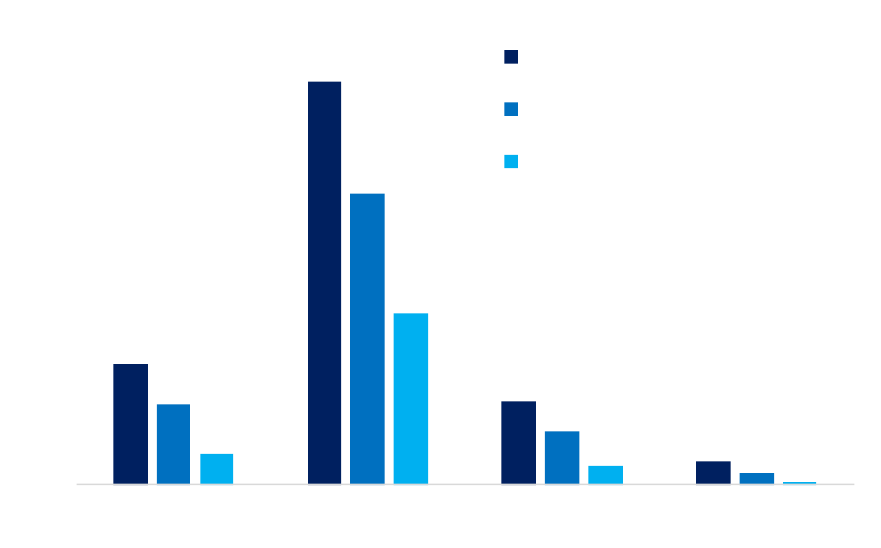

Firms’ responses by broad sectors are reported in Figure

7. The goods producing sector was the more likely to have accelerated or redirected business to

the US in response to the TCJA while the service sector was the least likely to do either. An

analysis by Hanlon, Hoopes, and Slemrod (2018) of earnings conference calls of S&P500

companies in 2018Q1 reveals that only 22 percent of firms mentioned planned increases in

investment that were linked to the TCJA (with the retail sector being the most likely to make

such an announcement). Similarly, a survey of the NFIB focusing on the TCJA, fielded between

February and April 2018, reveals that only 24 percent of small business owners planned to use

their tax savings to increase business investments.

16

The relatively small share of firms attributing planned increases in investment to the TCJA

contrasts with the large tax savings companies have received. Publicly available U.S. Treasury

data indicated that corporate tax revenue in FY2018 fell by US$92 billion—a 31 percent drop.

Where then have firms put the incremental free cash from the TCJA? Figure 8 shows an analysis

of the use of funds of S&P500 companies since end-2017. Only about 20 percent of the

incremental cash outflow post-TCJA went towards capital expenditure or R&D while the rest

went towards share buybacks, dividends, and other activities. While this use of cash does not

directly lead to capital formation, it may indirectly affect consumption and investment as the

cash is reallocated across the economy.

Overall, these results are consistent with earlier work that finds that expectations of product

demand are a principal driver of business investment decisions. Similarly, earlier research (IMF

15

Following the passage of the TCJA at end-2017, the Business Conditions Survey conducted quarterly by the

National Association of Business Economics began including the following question in 2018: Has your firm

changed any hiring or investment decisions as a result of the 2017 Tax Cuts and Jobs Act? a) has your business

accelerated investment?; and b) has your business redirected hiring/investment to the U.S.?

16

In the NFIB survey about the TCJA, 51 percent of small business owners expected to pay less in federal income

tax in 2018. Of those, 47 percent reported planning to increase business investment with their tax savings.

9

2015, for example) found that the weak performance of business investment in the aftermath of

the Great Recession primarily reflected the weakness of aggregate demand rather than other

factors associated with changes in regulations or policy uncertainty.

III. HOW HAS INVESTMENT PERFORMED COMPARED WITH THE HISTORICAL RELATION

BETWEEN TAX CUTS AND INVESTMENT?

A large literature assesses the macroeconomic effects of postwar U.S. tax changes.

17

The

principal methods to address the problem that tax revenue changes may be endogenous to

economic conditions have been the structural vector autoregression (SVAR), as in the seminal

work of Blanchard and Perotti (2002) or the narrative approach pioneered by Romer and Romer

(2010), which uses historical policy documents to identify tax policy changes motivated by long-

term considerations rather than a response to prospective economic conditions. More recently,

Mertens and Ravn (2013) combine these two approaches to estimate the macroeconomic effects

of personal and income tax changes. While the studies differ in methodologies and estimates of

the tax multiplier, they all conclude that changes in taxes typically have substantial effects on

output and investment, with the impact on growth peaking within the first year.

To obtain a prediction of the impact of the TCJA on real GDP and investment, we use the results

of Mertens (2018) who applies estimates from existing studies of postwar U.S. tax policy

changes to calibrate the impact of the individual, business, and international tax provisions of the

TCJA. The studies are those of Blanchard and Perotti (2002), Caldara and Kamps (2017), Favero

and Giavazzi (2012), Mertens and Ravn (2013), Mertens and Ravn (2014), Mertens and Ravn

(2012), and Romer and Romer (2010). Mertens (2018) applies the results of these studies to the

tax provisions of the TCJA, as described by the Joint Committee on Taxation (2017) and

summarized in Table 1. Overall, Mertens (2018) estimates that the impact of the TCJA on real

GDP growth in 2018 should have been in the range of 0.9 to 1.8 percentage points on a Q4/Q4

basis. To obtain the predicted impact on investment, we scale the GDP responses predicted by

Mertens (2018) by the ratio of the business investment and GDP responses to changes in

business and personal income taxes as estimated by Mertens and Ravn (2013). Overall, we

calculate that the implied predicted rise in business investment would be between 3.4 and 7.2

percentage points on a Q4/Q4 basis.

The actual increases in real GDP and business investment in 2018 compared with pre-TCJA

forecasts—0.7 and 3.5 percentage points, respectively—fall at the low end of the afore-

mentioned estimated impacts based on historical tax changes. Figure 9 presents the various

estimates of the effect on GDP and investment from the TCJA alongside the actual impact. We

focus on the impact defined as the real outturn compared with the Fall 2017 WEO forecast.

Results are similar compared to pre-TCJA forecasts from Consensus Economics and the Survey

17

See, for example, Blanchard and Perotti (2002); Romer and Romer (2010); Favero and Giavazzi (2012); and

Mertens and Ravn (2013).

10

of Professional Forecasters (SPF).

18

Overall, we conclude that investment has, so far, fallen

short of predictions based on the postwar relation with tax cuts.

IV. WHAT MAY HAVE HELD BACK INVESTMENT?

We focus on two potential explanations for why investment may have fallen short of what could

have been expected based on the U.S. postwar historical relation between tax changes and

investment, albeit recognizing that other factors may simultaneously be at play.

The first is heightened economic policy uncertainty which may have caused firms to delay their

investment plans. The other is that the rise in market power, as documented in a number of

recent studies, may have rendered tax considerations less important in firms’ investment

decisions. Other countervailing factors may have been at work, including investment adjustment

costs (although adjustment costs would have been present in previous postwar episodes of tax

cuts as well) and the fact that a number of regulations are still being issued and aspects of the

code may not yet be clear.

A. Policy Uncertainty

Economic theory suggests that when investment is irreversible, uncertainty about future

conditions generates an option value of waiting for more information and thereby curbs

investment (Bernanke 1983). The impact of uncertainty on investment may also occur through

changes in the credit spread (Gilchrist and others 2014) or spending cutbacks by households

(Baker and others 2016). The negative relationship between uncertainty and investment has been

confirmed empirically. Panousi and Papanikolaou (2012) report that a rise in firm-specific

uncertainty leads managers to underinvest, especially when they own a larger fraction of the

firm. Baker and others (2016) find that economic policy uncertainty reduces investment rates

among firms with exposure to government spending or shifts in regulatory policy.

After the TCJA was enacted at end-2017, trade disagreements increasingly made headlines,

adding to economic policy uncertainty. Figure 10 shows the evolution over time of indices for

trade policy uncertainty (TPU) and economic policy uncertainty (EPU) for the United States, as

developed by Baker, Bloom, and Davis 2016. Both indices climbed substantially during 2018.

To quantify the impact of economic policy uncertainty on investment decisions in the United

States, we estimate a VAR model on quarterly data over the period 1990Q1-2018Q2 to derive

the impulse response of real business investment to shocks to the EPU Index for the United

States over the sample period. In line with earlier studies, we find that economic policy

uncertainty has a negative impact on business investment. As shown in Figure 11, increased

uncertainty during 2018, as measured by the EPU index, is estimated to have cumulatively

18

The CEA (2019) calculates the actual impact of the TCJA on GDP at 1.4 percentage points. The non-TCJA

baseline growth for 2018 consistent with such an impact on GDP would, given the CEA (2019) forecast for 2018

growth of 3.2 percent, be 1.8 percent. With GDP growth forecasts tracking well above 2 percent through much of

2017, such a low baseline for 2018 growth would be significantly below pre-TCJA forecast made in real time and

difficult to reconcile with the strong economic conditions already prevailing.

11

reduced investment by about 0.4 percent. This impact is modest compared with the afore-

mentioned predicted investment growth impact of 3.4 to 7.2 percentage points based on the

historical relation with tax changes. Similarly, Altig and others (2019) estimate that effects from

trade policy uncertainty on investment in 2018 have been modest, based on a Federal Reserve of

Bank of Atlanta Survey of Business Uncertainty (SBU), which includes around 1,000 U.S.

private companies. They estimate that policy uncertainty resulting from tariff hikes and trade

policy tensions reduced capital investment in 2018 by 1.2 percent.

19

B. The Role of Market Power

A growing literature suggest that, over the last few decades, corporate market power has

increased in the United States and other advanced economies. Díez, Leigh, and Tambunlertchai

(2018) document a rise in markups across advanced economies, with, for the United States, a

sales-weighted average increase in corporate markups of 42 percent from 1980 to 2016 (Figure

12). Their findings are broadly consistent with those of De Loecker and Eeckhout (2017, 2018)

and IMF (2019), based on different datasets.

The rise in markups has been associated with rising overall profitability at the firm level and

greater concentration at the industry level, suggesting increased corporate market power and a

rise in monopoly rents. A potential question regarding the increase in estimated markups is

whether it is driven by firms recouping fixed costs of intangible investments rather than a rise in

market power. However, as documented in the afore-mentioned studies, the rise in markups is

strongly correlated with measures of overall profitability at the firm level, suggesting that the

recouping of fixed costs is not driving the estimated rise in markups. Similarly, the finding of

rising markups holds up when the estimation methodology controls for overhead cost at the firm

level, which suggests that technological change associated with shifts in overhead costs is not

driving the estimated rise in markups.

A larger share of monopoly rents in corporate profits would imply that corporate taxes are less

distortionary, with tax incidence increasingly falling on rents rather than on the normal return to

capital. In such an environment, a cut to the corporate income tax rate would increase post-tax

monopoly profits but induce a smaller behavioral response in production and investment

decisions. A tax cut today, therefore, could be expected to have a smaller impact than as

documented in previous studies using U.S. postwar data purely due to the changing nature of the

industrial structure in the United States This is the possibility we investigate.

Role of Market Power: Model Simulations

To investigate the role of market power in dampening the investment sensitivity to tax changes,

we first use simulations of the Global Integrated Monetary and Fiscal Model (GIMF) model, a

multi-region dynamic general equilibrium model developed by IMF staff for policy analysis.

20

In

19

Altig and others (2019) estimate that the negative impact on manufacturing capital investment was greater, at -4.2

percent, reflecting the greater sensitivity of the sector to international trade.

20

See Kumhof, Laxton, Mursula, and Muir (2010) for an overview of the GIMF model’s structure.

12

the GIMF model, greater market power is captured by the higher markups of price over marginal

cost. The corporate income tax revenue-to-GDP ratio is defined by the following standard

accounting identity:

(2)

where

is the effective corporate tax rate,

is the return to capital, is the depreciation rate,

and capital stock to GDP. The parameter is the markup of price over marginal cost, thus

represents monopoly profit. The rental rate of capital covers the depreciation rate and,

once the corporate tax has been paid, the cost of loanable funds. Therefore, distortions implied

by the corporate income tax can be expressed by the following standard equation:

(3)

where is the risk-free rate. In equilibrium, the steady state share of investment in GDP is

determined by the rental rate of capital, the weight of capital in the production function (), the

depreciation rate, and the markup, as follows:

(4)

.

Equation (4) illustrates the standard theoretical result that, in steady state, higher markups imply

lower investment. Our focus, is, however, not on the steady-state relation between markups and

investment but, instead, on the relation between markups and the responsiveness of investment to

tax cuts.

In this context, the afore-mentioned theoretical link between market power and the investment

response to a tax cuts applies. However, there is also an additional channel. Greater market

power, with larger markups () implies, other things equal, a larger corporate income tax-to-

GDP ratio and, hence, that the same ex-ante cut to tax revenue requires a smaller decrease in the

effective corporate tax rate. The smaller decrease in the effective tax rate in turn means a smaller

reduction in distortions which diminishes the positive impact on investment. Higher markups

also mean, as already mentioned, a lower steady-state investment ratio which, when coupled with

the lower investment impact from the same reduction in tax revenue, a smaller increase in GDP.

To illustrate these effects, we simulate the macroeconomic impact of a corporate tax cut

equivalent to 1 percent of GDP in three states of the world—one where firms have low markups

of 10 percent, one with medium markups of 25 percent, and one with markups of 60 percent.

These markup calibrations correspond, approximately, to the afore-mentioned estimates of U.S.

markups in 1980, 1990, and in 2016. Simulation results confirm that the tax cut induces smaller

responses in GDP, investment, wages, and employment when the level of markups is higher.

Figure 13 summarizes the effects on these variables ten years after the tax cut. The increase in

investment in the low markup world corresponding to markups at the level estimated for 1980 is

13

more than double the investment response in the high markup world corresponding to the level

of markups estimated for 2016.

21

Role of Market Power: Firm-Level Empirical Estimates

We next investigate whether the theoretical prediction that higher markups dampen firms’

reactions to tax cuts holds up empirically by assessing how firm-level investment and

employment have responded to changes in fiscal policy.

Evidence from fiscal shocks in OECD countries

We first estimate the effect of tax policy changes on corporate investment and employment for a

panel of advanced economies by combining three datasets. For firm-level investment and

employment data, we use the Thompson Reuters Worldscope dataset with a sample starting from

1980 for advanced economies. For firm-level markups, we use the estimates of Díez, Leigh, and

Tambunlertchai (2018). For estimates of fiscal shocks, we use the narrative dataset of Guajardo,

Leigh, and Pescatori (2014), which covers the 1978-2009 period for 17 OECD countries. To

shed light on the effects of tax policy changes, we focus on the authors’ series of tax-based fiscal

shocks, where changes in taxation account for the majority of the budgetary impact. The authors

construct the series of fiscal shocks based on the historical record and exclude fiscal policy

changes that policy documents suggest were motivated by prospective cyclical conditions. They

also present evidence that the identified fiscal shocks are orthogonal to news regarding economic

conditions.

The equation we estimate has the firm’s investment rate—capital expenditure as a share of the

previous year’s capital stock—as the dependent variable on the left-hand side.

22

On the right-

hand side, the main variable of interest is the interacted term between the fiscal shock and firm-

level markups. The equation we estimate is:

(5)

where

is the investment rate of the th firm in the th sector in country in year ,

is

the fiscal shock, and

the markup. The equation controls for firm (

) and time (

) fixed

effects. The inclusion of fixed effects allows us to isolate the relation with markups, after

controlling for features of individual firms and broader macroeconomic developments. To shed

light on how market power may influence firm-level employment behavior, we also re-estimate

equation (5) with

denoting employment growth. The variable denotes additional controls,

21

The 10-year horizon illustrated is chosen for illustrative purposes and the relative magnitudes of the responses are

similar over shorter horizons.

22

The capital stock is measured by data for property, plant, and equipment available in Worldscope.

14

which, in the baseline specification includes the markup,

. A limitation of our focus on

publicly traded firms is that their behavior may be different from that of privately held firms.

23

The estimation results, reported in Table 2, suggest that a tax-based fiscal expansion raises firm-

level investment and employment, but that higher markups dampen the effect. To address the

potential concern that the results are driven by sector-specific developments and factors, we also

estimate equation (5) with additional controls, namely sector-time dummies, finding that the

negative effect from the interaction term holds.

To illustrate the economic significance of the results, Figure 14 plots the investment and

employment responses for the different levels of markups found in the sample. A rise in

corporate markups 40 percent, roughly equivalent to the rise in markups in the United States

between 1980 and 2016, as estimated by Díez, Leigh, and Tambunlertchai (2018), reduces the

investment response to a 1 percent of GDP tax-based fiscal expansion by 45 percent. A more

moderate rise in market power of 28 percent, equivalent to the difference between U.S. markups

in 2016 and the post-war U.S. average, reduces the investment response by about 37 percent.

24

The estimated weakening in the impact of tax cuts on corporate investment and employment

behavior as market power rises is broadly in line with the afore-mentioned GIMF simulation

results.

Evidence for U.S. firms in 2018

To provide evidence linked more directly to the effects of the TCJA and the behavior of U.S.

firms, we examine 2018 data available for S&P500 companies. We estimate an equation for the

growth rate in firm-level capital expenditure in 2018, as well as for the change in the growth rate

in firm-level capital expenditure, as follows:

(6)

.

where

is the capital expenditure growth or the change in the capital expenditure growth,

respectively, for company in industry as a function of the (log) markup () of company in

2016. Estimates of the company markups come, as before, from Díez, Leigh, and

Tambunlertchai (2018). The equations estimated include industry-fixed effects to account for the

fact that companies in different industries may have differed in how they responded to the TCJA

23

At the same time, the firms in our sample account for a large share of national economic activity and thus cast

light on macroeconomically relevant developments. For 2016, the U.S. firms in the sample have sales equivalent to

79 percent of U.S. GDP.

24

To approximate the postwar U.S. level of market power, we assume that the level of markups in the 1950s through

the 1970s is equal to the average level of markups in the 1980s. This assumption is consistent with the estimates of

De Loecker and Eeckhout (2017) for the pre-1980 period. Combining this assumption with our estimates of markups

for the 1980-2016 period implies a postwar average markup of 1.25 (25 percent). The estimated markup in 2016 is

1.60 (60 percent). Based on these markup levels and the coefficient estimates in Table 2 (column 1) implies that a

rise in markups from the postwar average level to the 2016 level reduces the investment rate response to a 1 percent

of GDP tax-based fiscal expansion from 0.92 percentage point to 0.58 percentage point, implying a reduction in the

response of 37 percent ((0.58/0.92) - 1).

15

and may have responded differentially to other developments in 2018, such as, for example,

shifts in oil prices.

We find that companies with higher markups in 2016 increased investment by less in 2018. The

estimation results, reported in Table 2, imply that a 50 percent increase in markups reduces firm-

level investment growth by 2.9 percentage points. In the second specification, we address the

possibility that stronger market power could weaken investment growth in general (as suggested

by IMF 2019 and Gutiérrez and Philippon 2018, for example) and not only following tax cuts.

We investigate whether the change in capital expenditure growth in 2018 was related to the

degree of market power. The results suggest that the change in capital expenditure growth was

less positive for companies with greater markups in 2016. A 50 percent increase in markups

reduces the change in capital expenditure growth by an estimated 7.4 percentage points.

These results hold up to a number of robustness checks. We address the possibility that firms

with more market power and higher markups in 2016 may have systematically faced lower tax

rates, and that this correlation affects the estimated coefficient on markups in equation (6). We

re-estimate equation (6) while also controlling for the effective tax rate for firm (defined as

income tax paid in percent of pre-tax income) in 2016. The estimation results are very similar to

those reported in Table 3 and the coefficient on the initial tax rate is statistically

indistinguishable from zero. These results imply that the results are not being driven by any such

relation and that the investment responses did not significantly vary with initial tax incidence.

We also address the possibility that firms facing financing constraints and a negative shock in

2016, which potentially lowered markups in that year, may have cut investment in 2016 and then

sought to catch up on their investment plans once economic conditions improved in 2017 and

2018. We allow for this possibility by controlling for investment growth and the change in

investment growth in 2016, respectively, finding very similar results to those reported in Table 3,

suggesting that this factor is not driving the results. In addition, we verify that the results are not

driven by any given industry. We repeat the estimation of equation (6) while excluding each

major industry from the sample, finding similar results.

Overall, our results suggest that market power has played a significant role in shaping the

response of corporate investment to the TCJA. When combined with the observation that market

power has increased in recent decades, the results help to explain why investment growth may

have fallen short of predictions based on the historical relation between tax changes and

investment.

C. Putting Things Together

The factors identified above help account for the apparent shortfall in the investment response

compared with the historical relation with tax cuts. To summarize their respective contributions,

Figure 15 shows the predicted and actual impact of the TCJA on business investment growth in

2018 along with a decomposition of the gap compared with the average impact identified in the

literature on postwar U.S. tax changes.

In Figure 15, the predicted impact of the TCJA represents the average of the studies described in

Section III. We also include the predicted additional boost to business investment coming from

the BBA. To do this, we assume that the BBA had an effect on GDP of 0.2 percent, based on an

16

assumed government expenditure multiplier of one-half which is in the conservative range of the

literature. A larger multiplier would further increase the gap between the predicted and actual

response of investment. We translate this effect on GDP into an effect on business investment

based on the range of estimates of the link between investment and output in the literature (as

discussed in IMF 2015, for example). Together, based on these historical relations, the two

pieces of legislation should have increased investment by 5.7 percentage points compared with

the pre-TCJA baseline.

The actual impact is defined, as before, as the difference between the business investment growth

outturn in 2018 and the forecast produced for the Fall 2017 IMF WEO, which, as already

discussed, is 3.5 percentage points. The outturn thus fell short the predicted impact by 2.2

percentage points (5.7 – 3.5).

High corporate markups account for much of the gap between the predicted and actual response

of investment. To approximate the contribution of greater market power to the observed gap, we

use the difference between the level of markups estimated in 2016 and on average in the postwar

period, the sample on which past studies of the effects of tax cuts are based. As already

mentioned, a rise in markups from levels prevailing in the postwar period to the level estimated

in 2016 significantly reduces the estimated response of investment and can, here, explain 1.3

percentage points of the 2.2 percentage point gap. The rise in corporate market power therefore

offers an explanation for why investment has not been stronger. Our estimate from Section IV.A

suggests that policy uncertainty can account for an additional 0.4 percentage point of the gap,

leaving an unexplained residual of 0.5 percentage point.

D. Other Factors

In addition to policy uncertainty and market power, other factors may explain the shortfall in

investment in 2018 compared to predictions based on the historical relation between tax cuts and

investment.

First, the considerable complexity of the new tax regime, combined with the current lack of

complete regulations on the changes to the tax code, especially its international aspects, could be

a reason why some firms have not responded more strongly thus far. The new international tax

provisions increase tax liabilities for multinational companies and may thus offset some of the

benefits from the lower statutory rate and the full expensing of capital expenditure. The finding

by Hanlon, Hoopes, and Slemrod (2018) that multinational firms were the less likely than other

firms to make ex ante announcements about planned increases in investment lends some support

for this explanation.

Second, the timing of the TCJA may have played a part in undercutting its potency. At the time

of its passage, the U.S. economy was in the midst of an economic expansion. A number of

empirical studies suggest that the macroeconomic effects of changes in fiscal policy are smaller

during periods of economic expansion (Auerbach and Gorodnichenko 2012, and others based on

government spending changes; for a dissenting view, see Owyang, Ramey, and Zubairy 2013).

On the other hand, a corporate tax cut at a time when capacity constraints are closer to becoming

binding could, at least in principle, have provided a stronger effect by amplifying project returns.

17

V. CONCLUSION

In the year following the passage of the TCJA, U.S. business investment grew strongly compared

to pre-TCJA forecasts and outperformed investment growth in other major advanced economies.

Evidence suggests that the overriding factor supporting that growth has been the strength of U.S.

aggregate demand, likely propelled by higher disposable household income or wealth gains due

to the tax cuts and the government spending stimulus from the BBA which occurred

simultaneously. While the increase in business investment is undoubtedly positive for economic

activity as it increases capital stock and supports productive capacity, the aggregate demand

boost could fade as the spending bill and personal income tax cuts expire.

Investment growth in 2018 was also below predictions based on the historical relation between

tax cuts and investment as identified by a range of studies in the empirical literature. We estimate

that policy uncertainty and, especially, the stronger corporate market power compared to

previous postwar episodes of tax policy changes reduced the relative impact of the TCJA on

business investment. The rise in corporate market power can account for a large part of the

observed gap, offering a new explanation for why investment has not been stronger. Once these

two factors are accounted for, other factors appear to have played a limited role (or their effects

may have offset one another).

Our results suggest that in an environment of rising market power, corporate tax cuts become

less effective at raising investment. They also support the notion that reducing economic policy

uncertainty could result in further growth in business investment.

18

References

Altig, D., N. Bloom, S. J. Davis, B. Meyer, and N. Parker, 2019. “Tariff Worries and U.S.

Business Investment, Take Two.” Federal Reserve Bank of Atlanta Macro Blog Post,

February 25, 2019.

Arnon, A., 2018. “The Price of Oil is Now a Key Driver of Business Investment.” Blog Post,

Tax Policy, Economic Growth, Penn Wharton Budget Model.

Auerbach, A. and Y. Gorodnichenko, 2012. “Measuring the Output Responses to Fiscal Policy.”

American Economic Journal: Economic Policy, 4(2): 1-27

Blanchard, O. and R. Perotti, 2002. “An Empirical Characterization of the Dynamic Effects of

Changes in Government Spending and Taxes on Output.” Quarterly Journal of

Economics 117 (2002), pp. 1329–1368.

Baker, S. R., N. Bloom, and S. J. Davis, 2016. “Measuring Economic Policy Uncertainty.” The

Quarterly Journal of Economics, 131(4):1593–1636.

Bernanke, B. S., 1983. “Irreversibility, Uncertainty, and Cyclical Investment.” The Quarterly

Journal of Economics, 98(1):85–106.

Bloom, N., S. Bond, and J. Van Reenen, 2007. “Uncertainty and Investment Dynamics.” The

Review of Economic Studies, 74(2):391–415.

Caldara, D. and C. Kamps, 2017. “The Analytics of SVARs: A Unified Framework to Measure

Fiscal Multipliers.” Review of Economic Studies 84 (3), pp. 1015–1040.

Chalk, N., M. Keen, and V. J. Perry, 2018. “The Tax Cuts and Jobs Act: An Appraisal.” IMF

Working Paper No. 18/185.

Congressional Budget Office, 2018. “The Budget and Economic Outlook: 2018 to 2028,” April

2018.

Council of Economic Advisers, 2019. Economic Report of the President.

De Loecker, J. and J. Eeckhout, 2018. “Global Market Power.” NBER Working Paper No. 24768

De Loecker, J., and J. Eeckhout, 2017. “The Rise of Market Power and the Macroeconomic

Implications,” NBER Working Paper No. 23687.

Díez, F., D. Leigh, and S. Tambunlertchai, 2018. “Global Market Power and Its Macroeconomic

Implications.” IMF Working Paper No. 18/137.

19

Favero, C. and F. Giavazzi, 2012. “Measuring Tax Multipliers. The Narrative Method in Fiscal

VARs.” American Economic Journal: Economic Policy 4 (2012), pp. 69–94.

Gutiérrez, G. and T. Philippon, 2018. "Ownership, Concentration, and Investment." AEA Papers

and Proceedings, 108: 432-37

Guajardo, J., D. Leigh, and A. Pescatori, 2014. “Expansionary Austerity? International

Evidence.” Journal of the European Economic Association, 12(4), 2014, pp. 949-68.

Hanlon, M., J. L. Hoopes, and J. Slemrod, 2018. “Tax Reform Made Me Do It!” NBER Working

Paper Series No. 25283.

Handley, K. and N. Limão, 2015. “Trade and Investment Under Policy Uncertainty: Theory and

Firm Evidence.” American Economic Journal: Economic Policy, 7(4):189–222.

IMF, 2015. “Private Investment: What’s the Holdup?” World Economic Outlook, Chapter 4,

April 2015.

IMF, 2019. “The Rise of Corporate Market Power and Its Macroeconomic Effects” World

Economic Outlook, Chapter 2, April 2019.

Jorgenson, D. W., and C. D. Siebert, 1968. “Optimal Capital Accumulation and Corporate

Investment Behavior.” Journal of Political Economy, 76(6): 1123-1151.

Joint Committee on Taxation, 2017. “Estimated Budget Effects of the Conference Agreement for

H.R.1, ‘The Tax Cuts and Jobs Act.’”

Krugman, P., 2018. “Why Was Trump’s Tax Cut a Fizzle?” New York Times. Nov. 15, 2018.

Kumhof, M., D. Laxton, S. Mursula, and D. Muir, 2010. “The Global Integrated Monetary and

Fiscal Model (GIMF) – Theoretical Structure.” IMF Working Paper No. 10/34.

Mertens, K., 2018. “The Near Term Growth Impact of the Tax Cuts and Jobs Act,” Federal

Reserve Bank of Dallas Research Department Working Paper 1803.

Mertens, K. and M. Ravn, 2012. “Empirical Evidence on the Aggregate Effects of Anticipated

and Unanticipated US Tax Policy Shocks”, American Economic Journal: Economic

Policy, 4 (2012), pp. 145–181.

Mertens, K. and M. O. Ravn, 2013, “The Dynamic Effects of Personal and Corporate Income

Tax Changes in the United States,” American Economic Review 2013, 103(4): 1212–

1247.

Mertens, K. and M. Ravn, 2014. “A Reconciliation of SVAR and Narrative Estimates of Tax

Multipliers.” Journal of Monetary Economics, 68 (2014), S1–S19.

20

Nation Association for Business Economics, 2018. “NABE Business Conditions Survey”

National Federation of Independent Business Research Center, 2018. “Small Business

Introduction to the Tax Cuts and Jobs Act: Part 1.”

Oliner, S., G. Rudebusch, and D. Sichel, 1995. “New and Old Models of Business Investment: A

Comparison of Forecasting Performance.” Journal of Money, Credit and Banking, 27(3):

806-826.

Owyang, M., V. Ramey, and S. Zubairy, 2013. “Are Government Spending Multipliers Greater

during Periods of Slack? Evidence from Twentieth-Century Historical Data." American

Economic Review, 103 (3): 129-34.

Panousi, V and D. Papanikolaou, 2012. “Investment, Idiosyncratic Risk, and Ownership,” The

Journal of Finance, Vol. 67, No. 3

Romer, C. D. and D. H. Romer, 2010. “The Macroeconomic Effects of Tax Changes: Estimates

Based on a New Measure of Fiscal Shocks”, American Economic Review, 100 (2010), pp.

763–801.

Smith, Karl W., 2018, “It’s Not a Trump Boom, It’s an Oil and Gas Boom,” Bloomberg Opinion,

September 14, 2018.

21

Figure 1. Evolution of Forecasts of Growth for 2018

(Percent)

Source: Vintages of IMF staff and Consensus Economics forecasts of growth in 2018 from Spring 2015 to Fall 2017.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

2015 2016 2017

Real GDP

IMF Consensus Economics

0.0

1.0

2.0

3.0

4.0

5.0

2015 2016 2017

Real Business Investment

IMF Consensus Economics

22

Figure 2. Real Private Fixed Investment: United States and Other Advanced Economies

(Index; 2015Q4 = 100)

Source: IMF staff forecasts and national accounts data for actual outturns. Figure indicates economies using

International Organization for Standardization (ISO) three-letter codes. Vertical line indicates 2017Q4.

10 0 10 5 11 0 11 5

2015 2016 2017 2018 2 01 9

A c tua l

F all 20 17 fo reca st

U S A

100 105 110 115

2 01 5 2 01 6 2017 2 018 2019

D E U

10 0 10 5 11 0 11 5

2015 2016 2017 2018 2 01 9

F R A

100 105 110 115

2 01 5 2 01 6 2017 2 018 2019

G B R

10 0 10 5 11 0 11 5

2015 2016 2017 2018 2 01 9

IT A

100 105 110 115

2 01 5 2 01 6 2017 2 018 2019

JP N

23

Figure 3. U.S. Real Private Fixed Investment

(Index; 2015Q4 = 100)

Source: IMF staff forecasts. Vertical line indicates 2017Q4.

10 0 10 5 11 0 11 5

2015 2016 2017 2018 2 01 9

A c tua l

F all 20 17 fo reca st

P riva te In ves tm e n t

100 105 110 115

2 01 5 2 01 6 2017 2 018 2019

R esid e ntial

10 0 10 5 11 0 11 5

2015 2016 2017 2018 2 01 9

B u sin ess

100 105 110 115

2 01 5 2 01 6 2017 2 018 2019

E qu ip m en t

10 0 11 0 12 0 13 0

2015 2016 2017 2018 2 01 9

IP

90 95

100 105

2 01 5 2 01 6 2017 2 018 2019

S tru ctu re s

24

Figure 4. Business Investment Level: Deviations from Forecast

(Percentage point contributions to deviation from Fall 2017 cumulative growth forecast)

Source: National Income and Product Accounts and authors’ calculations. Solid line indicates total business

investment deviation from Fall 2017 WEO forecast. Bars indicate contributions to total.

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

2017 2018 2019

Equipment IP Structures

25

Figure 5. Business Investment: Oil vs. Non-oil Sector

Source: National Income and Product Accounts and author calculations

Note: Data for the oil sector includes mining activity.

26

Figure 6. Accelerator Model: Real Business Investment

(Log index)

Note: Accelerator model predictions for equipment and IP investment obtained by multiplying the predicted value

for the investment rate by the lagged capital stock. Vertical line indicates 2017Q4.

7.6

7.6 5

7.7

7.7 5

20 1 7 2018 2019

A ctu al

A cce le rator m od el

F all 2 01 7 fo recas t

27

Figure 7. Firm Survey Responses

a. Accelerated investment as a result of TCJA?

(Percent responding “yes”)

b. Redirected hiring/investment to US due to TCJA?

(Percent responding “yes”)

Source: National Association of Business Economics’ Business Conditions Survey

Note: TUIC = Transportation, Utilities, Information, and Communication; FIRE = Finance, Insurance, and Real

Estate.

Accelerated investment in response to TCJA (percent)

0

10

20

30

40

50

60

70

80

90

100

All Goods TUIC FIRE Services

2018Q1 2018Q2 2018Q3 2018Q4

Redirected hiring/investment to U.S. in response to TCJA (percent)

0

10

20

30

40

50

60

70

80

90

100

All Goods TUIC FIRE Services

2018Q1 2018Q2 2018Q3 2018Q4

28

Figure 8. Use of Incremental Cash Since TCJA

(Percent of total)

Source: S&P Global database and author calculations.

29

Figure 9. Impact of Tax Cuts and Jobs Act on 2018 Growth: Actual vs. Predicted Based on

Existing Empirical Estimates

(Percent; Q4/Q4)

Source: Mertens (2018) and IMF staff forecasts. Consensus denotes Consensus Economics. SPF denotes Survey of

Professional Forecasters.

Note: Actual impact denotes real outcome for GDP and business investment growth compared to IMF staff forecast

made in Fall 2017, which was conditional on unchanged U.S. fiscal policy.

0.0 1.0 2.0

Mertens and Ravn (2013)

Mertens and Ravn (2014)

Romer and Romer (2010)

Mertens and Ravn (2012)

Favero and Giavazzi (2012)

Blanchard and Perotti (2002)

Caldara and Kamps (2017)

Actual

GDP

(Percent)

0.0 2.0 4.0 6.0 8.0

Business Investment

(Percent)

30

Figure 10. Trade Policy Uncertainty and Economic Policy Uncertainty

Source: Baker, Bloom, and Davis (www.PolicyUncertainty.com)

Note: EPU is a composite of news-based policy uncertainty index (10 newspapers), tax code expiration data, and

economic forecaster disagreement. The news-based index is constructed from searches for articles containing the

term 'uncertainty' or 'uncertain', the terms 'economic' or 'economy,' and one or more of the following terms:

'congress', 'legislation', 'white house', 'regulation', 'federal reserve', or 'deficit'. TPU is a news-based index (2,000+

newspapers) that satisfy economic policy uncertainty terms as well as a set of trade-related policy terms.

Figure 11. Estimated Effect of Economic Policy Uncertainty on Investment in 2018

Source: Baker, Bloom, and Davis (www.PolicyUncertainty.com), authors’ calculations

Note: The figure shows the cumulative impact of increased economic policy uncertainty on real business

investment, estimated from a vector autoregression model.

32

Figure 13. Macroeconomic Impact of 1 Percent of GDP Corporate Income Tax Cut

(Percent; Year t = 10)

Sources: GIMF simulations. Calibration of markups based on estimates for the U.S. in Díez, Leigh, and

Tambunlertchai (2018).

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

Real GDP Real investment Real wage Employment

Low markups (1980 level)

Medium markups (1990 level)

High markups (2016 level)

33

Figure 14. Estimated Effect of Tax-based Fiscal Expansion of 1 Percent of GDP vs. Markup

Note: Dashes indicate 90 percent confidence interval.

-.5

0

.5

1

1 .5

2

P erc e nt ag e po in ts

.5 1 1 .5 2 2 .5

Ma rku p

Inve stm en t ra te

-.5

0

.5

1

1 .5

2

P erc e nt ag e po in ts

.5 1 1 .5 2 2 .5

Ma rku p

E m ploy me nt

34

Figure 15. Predicted vs. Actual Growth of Business Investment in 2018

(Percentage points; deviation from pre-TCJA baseline)

Note: Predicted impact of TCJA denotes predicted impact of Tax Cuts and Jobs Act (TCJA) based on existing

empirical studies of postwar U.S. tax changes (average of studies described in text). Predicted impact of Balance

Budget Act (BBA) denotes estimated effect of rise in government spending associated with BBA approved in 2018.

Policy uncertainty denotes estimated impact of rise in policy uncertainty in 2018. Market power denotes estimate of

reduced effectiveness of TCJA compared with previous postwar episodes of tax changes due to higher level of

market power in 2018 than during postwar period. Actual denotes difference between 2018 growth outcome and Fall

2017 forecast. Residual denotes other factors contributing to difference between predicted impact of TCJA and BBA

and Actual.

35

Table 1. Budgetary Impact of the Tax Cuts and Jobs Act

(Percent of pre-TCJA projected GDP)

Note: Table reports static budgetary impact estimates from Joint Committee on Taxation (2017) in percent of

Congressional Budget Office (June 2017) fiscal year GDP projections.

Provision 2018 2019 2020 2027

Total -0.7 -1.4 -1.2 0.1

Individual Tax Reform -0.4 -0.9 -0.8 0.3

Pass-through tax cut -0.1 -0.2 -0.2 0.0

Other -0.2 -0.7 -0.6 0.3

Business Tax Reform -0.6 -0.6 -0.5 -0.2

Reduction in CIT rate (35% to 21%) -0.5 -0.6 -0.6 -0.6

Expensing of capital spending -0.2 -0.2 -0.1 0.0

Other 0.0 0.1 0.2 0.3

International Tax Reform 0.3 0.2 0.1 0.0

Memorandum

Pass-through and CIT rate cut -0.6 -0.8 -0.8 -0.6

36

Table 2. Estimated Effect of Tax-based Fiscal Expansion of 1 Percent of GDP on Firm

Investment and Employment

(Percentage points)

Equation estimated:

Note: Clustered standard errors in parentheses. *** p<0.01, ** p<0.05, * p<0.1. Equations estimated are for the

investment rate (columns 1-3) and employment growth rate (columns 4-6) as the dependent variable (),

respectively, for company in industry and country . Explanatory variables are the country-level fiscal shock in

year ,, the (log) markup () of company in year , and the interaction of the two variables. Equations include

the estimated (log) markup as an additional control, as well as firm- and year-fixed effects. Equations in columns (2)

and (5) include country-time fixed effects. Equations in columns (2) and (5) include both country-time- and

industry-time-fixed effects. Estimates of company markups come from Díez, Leigh and Tambunlertchai (2018).

Data for the fiscal shocks come from Guajardo, Leigh, and Pescatori (2014).

(1) (2) (3) (4) (5) (6)

Fiscal shock 1.218*** 1.487***

(0.108) (0.126)

Fiscal shock × markup -1.374*** -1.117*** -1.406*** -1.756*** -0.700* -1.048**

(0.389) (0.420) (0.416) (0.392) (0.424) (0.429)

Firm FE Yes Yes Yes Yes Yes Yes

Time FE Yes Yes

Country × time FE Yes Yes Yes Yes

Industry × time FE Yes Yes

Number of observations 204,251 204,251 204,251 190,207 190,207 190,207

R-squared 0.074 0.093 0.114 0.035 0.062 0.073

Investment rate

Employment growth

37

Table 3. Cross-section Estimation Results: U.S. S&P 500 Companies in 2018

Equation estimated:

.

Note: Clustered standard errors in parentheses. *** p<0.01, ** p<0.05, * p<0.1. Equations estimated are for the

growth rate in firm-level capital expenditure and the change in the growth rate in firm-level capital expenditure in

2018 as the dependent variable (), respectively, for company in industry as a function of the (log) markup () of

company in 2016. Equations include industry-fixed effects. Estimates of the company markups come from Díez,

Leigh and Tambunlertchai (2018).

CapEx Growth in 2018

Δ CapEx Growth in 2018

Markup (log) in 2016 -0.057** -0.147***

(0.026) (0.050)

Industry fixed effects Yes Yes

Observations 344 342

R-squared 0.098 0.056