This

publication

has

been developed

by

the U.S.

Department

of

Labor,

Employee Benefits Security Administration

(EBSA).

To

view

this and

other

publications, visit the agency's website

at

dol.gov/ agencies/ebsa.

To order publications, or to speak

with

a benefits advisor, contact

EBSA

at

askebsa.dol.gov.

Or

call

toll

free:

1-866-444-3272

This material

will

be

made

available

in

alternative format

to

persons

with

disabilities

upon

request:

Voice

phone: (202)

693-8644

If

you are deaf, hard

of

hearing,

or

have a speech d isabi I ity, please dial 7-1-1

to access telecommunications relay services.

This

booklet

constitutes a small

entity

comp

I

iance

guide

for

purposes

of

the

Smal I Business Regulatory Enforcement

Fa

irness A

ct

of

1996.

Reporting and Disclosure

Guide for Employee

Benet Plans

U.S. Department of Labor

Employee Benets Security Administration

December 2022

This Reporting and Disclosure Guide for Employee Benet Plans

is a quick reference tool for certain basic reporting and disclosure

requirements under the Employee Retirement Income Security Act

(ERISA). It has been prepared by the U.S. Department of Labor’s

Employee Benets Security Administration (EBSA) with assistance

from the Pension Benet Guaranty Corporation (PBGC).

The rst chapter, beginning on page 2, provides an overview of the

common disclosures that administrators of employee benet plans

are required to give participants, beneciaries, and certain other

individuals under Title I of ERISA. The chapter has three sections.

• Basic Disclosure Requirements for Pension and Welfare Benet

Plans

• Additional Disclosure Requirements for Welfare Benet Plans

That Are Group Health Plans

• Additional Disclosure Requirements for Retirement Plans

The second chapter, beginning on page 17, provides an overview of

reporting and disclosure requirements for dened benet pension

plans under Title IV of ERISA. PBGC administers these provisions.

The chapter focuses primarily on single-employer plans and has

four sections.

• Pension Insurance Premiums

• Standard Terminations

• Distress Terminations

• Reportable Events and Other Reports

The third chapter, beginning on page 21, provides an overview of

the Form 5500 and Form M-1 Annual Reporting requirements. The

chapter consists of two quick reference charts.

Introduction

• Pension and Welfare Benet Plan Form 5500 Quick Reference

Chart

• Form M-1 Quick Reference Chart.

On page 27, there is a list of EBSA and PBGC resources, including

agency websites where laws, regulations, instructions, and other

ocial guidance on ERISA’s reporting and disclosure requirements

are available. Readers should refer to these resources for the

most complete information on ERISA’s reporting and disclosure

requirements.

Not all ERISA reporting and disclosure requirements are reected

in this guide. For example, the guide does not focus on disclosures

required by the Internal Revenue Code or the provisions of ERISA

for which the Department of the Treasury and Internal Revenue

Service (IRS) have regulatory and interpretive authority. For

information on IRS notice and disclosure requirements, please visit

the IRS website at irs.gov/Retirement-Plans/Retirement-Plan-

Reporting-and-Disclosure. This guide also does not focus on new

disclosure requirements added by the Consolidated Appropriations

Act, 2021. For more information on the Consolidated

Appropriations Act, 2021, including the No Surprises Act, see dol.

gov/agencies/ebsa/laws-and-regulations/laws/no-surprises-act.

This Department of Labor publication has been updated as of

December 2022. Please be sure to check EBSA’s website at dol.gov/

ebsa for the current laws and regulations on the reporting and

disclosure provisions included in this publication.

1

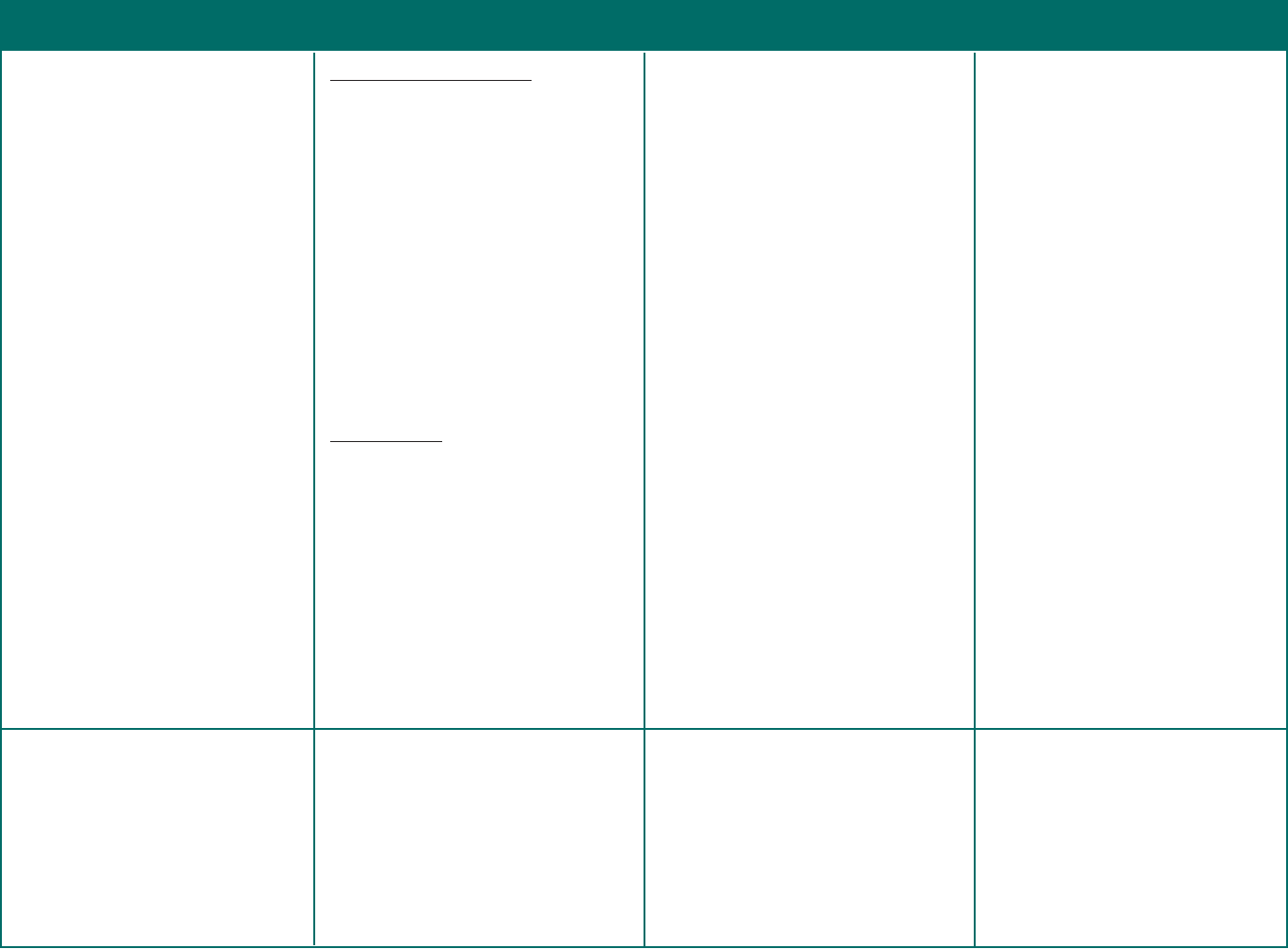

Document Type of Information To Whom When

Overview of ERISA Title I Basic Disclosure Requirements

Summary Plan Description (SPD)

Summary of Material Modication

(SMM)

Summary Annual Report (SAR)

Notication of Benet Determination

(Claims Notices or “Explanation of

Benets”)

The SPD is the primary way to inform

participants and beneciaries about their

plan and how it operates.

It must be wrien for an average participant

and be comprehensive enough to inform

people of their benets, rights, and

obligations under the plan.

Must accurately reect the plan’s contents

and may not contain outdated information

from more than 120 days before its initial

disclosure.

See 29 CFR §§ 2520.102-2 and 2520.102-3 for

style, format, and content requirements.

The SMM describes modications to a

plan and changes to the information that is

required to be in the SPD.

The distribution of an updated SPD satises

this requirement.

See 29 CFR § 2520.104b-3.

The SAR is a narrative summary of the Form

5500.

See 29 CFR § 2520.104b-10(d) for the format.

This notication provides information

regarding benet claim determinations.

Adverse benet determinations must include

the required disclosures (for example, the

specic reason(s) for the denial of a claim, a

reference to the specic plan provisions on

which the benet determination is based,

and a description of the plan’s appeal

procedures).

• Participants

• Beneciaries receiving benets

Also see “Plan Documents” below for

persons who have the right to obtain the

SPD upon request.

See 29 CFR § 2520.102-2(c) for provisions on

foreign language assistance when a portion

of plan participants are only literate in the

same non-English language.

• Participants

• Beneciaries receiving benets

Also see “Plan Documents” below for

persons with the right to obtain SMM upon

request.

• Participants

• Beneciaries receiving benets

The SAR is not required for dened benet

pension plans to which Title IV applies and

that instead provide the annual funding

notice (see below).

Claimants, including:

• Participants

• Beneciaries

• Authorized claims representatives.

To participants: within 90 days of

becoming covered by the plan.

To beneciaries: within 90 days after rst

receiving benets.

A plan has 120 days after becoming subject

to ERISA to distribute the SPD.

Otherwise, once every 5 years for amended

plans.

Once every 10 years for all other plans.

See 29 CFR § 2520.104b-2.

Within 210 days after the end of the plan

year in which the change is adopted.

Within 9 months after the end of the

plan year, or 2 months after the due date

for ling Form 5500 (with an approved

extension).

Requirements vary depending on the

type of plan and the type of benet claim

involved.

See 29 CFR § 2560.503-1 for the claims

procedures requirements.

Section 1: Basic Disclosure Requirements for Retirement and Welfare Benet Plans

2

Note: Plan administrators of retirement plans can provide the relevant disclosures below on paper or furnished electronically. To provide disclosures electronically,

the plan administrator can either post them on a plan website or send them directly to participants, for example, by text message or by email, and must comply with

notication requirements, among other requirements, of the Department’s electronic disclosure regulation. There are a number of protections for participants receiving

electronic disclosures, including the right to request paper copies or to opt out of electronic delivery. The plan administrator also needs to take reasonable steps to protect

the condentiality of participants’ personal information online.

1

Please refer to the Department’s regulations and other guidance for information on the extent to which charges may be assessed to cover the cost of providing particular information, statements, or documents to

participants and beneciaries required under Title I of ERISA. See, e.g., 29 CFR § 2520.104b-30.

1

Document Type of Information To Whom When

Document Type of Information To Whom When

2

The term “group health plan” means an employee welfare plan to the extent that the plan provides medical care to employees or their dependents directly or through insurance, reimbursement, or otherwise.

3

COBRA generally applies to group health plans of employers who employed 20 or more employees during the prior calendar year. Provisions of COBRA covering state and local government plans are administered by

the Department of Health and Human Services. COBRA does not apply to plans sponsored by certain church-related organizations.

Plan Documents The plan administrator must provide

copies of certain documents upon wrien

request and must have copies available for

examination.

The documents include the latest updated

SPD, the latest Form 5500, the trust

agreement, and other documents that dictate

how the plan is established or operated.

• Participant

• Beneciaries

Also see 29 CFR § 2520.104a-8 regarding

the Department’s authority to request

documents.

Within 30 days after a wrien request.

Plan administrators must make copies

available at principal oce of the plan

administrator and certain other locations as

specied in 29 CFR § 2520.104b-1(b).

Section 2: Additional Disclosure Requirements for Welfare Benet Plans That Are Group Health Plans

2

3

Section 1: Basic Disclosure Requirements for Retirement and Welfare Benet Plans, continued

Summary of Material Reduction in

Covered Services or Benets

COBRA General Notice

3

COBRA Election Notice

3

This summary explains any group health

plan amendments or changes in information

required to be in SPD that constitute a

“material reduction in covered services or

benets,” such as an increase in premiums

See 29 CFR § 2520.104b-3(d)(3) for

denitions.

This notice informs employees and spouses

of their right to purchase temporary

extension of group health coverage when

coverage is lost due to a qualifying event.

See 29 CFR § 2590.606-1.

For more information, visit dol.gov/

agencies/ebsa/laws-and-regulations/laws/

COBRA.

A model notice is available at dol.gov/sites/

dolgov/les/EBSA/laws-and-regulations/

laws/cobra/model-general-notice.docx.

This notice informs qualied beneciaries

of their right to elect COBRA coverage

when they experience a qualifying event.

It also includes information about other

coverage options available, such as through

a Marketplace.

Participants.

• Covered employees

• Covered spouses

• Covered employees

• Covered spouses

• Dependent children who are qualied

beneciaries

Generally, within 60 days after adopting

a material reduction in group health plan

services or benets.

See 29 CFR § 2520.104b-3(d)(2) for when

a plan may alternatively have 90 days to

provide the required information.

When group health plan coverage begins.

Generally, within 14 days after the

employer or qualied beneciary noties

the plan administrator of the qualifying

event.

Document Type of Information To Whom WhenDocument Type of Information To Whom When

4

Notice of Unavailability of COBRA

Notice of Early Termination of COBRA

Coverage

Medical Child Support Order (MCSO)

Notice

National Medical Support (NMS)

Notice

See 29 CFR § 2590.606-4.

For more information, visit dol.gov/

agencies/ebsa/laws-and-regulations/laws/

COBRA.

A model notice is available at dol.gov/sites/

dolgov/les/EBSA/laws-and-regulations/

laws/cobra/model-election-notice.docx.

This notice informs an individual that they

are not entitled to COBRA coverage.

See 29 CFR § 2590.606-4(c).

This notice informs a qualied beneciary

that their COBRA coverage will terminate

earlier than the maximum period of

coverage.

See 29 CFR § 2590.606-4(d).

A MCSO notice is a notication from a plan

administrator that states it has received an

order directing the plan to provide health

coverage to a participant’s noncustodial

children and includes the procedures the

plan is required to adopt for determining

whether the MCSO is qualied.

See ERISA § 609(a)(5)(A) for requirements.

An NMS notice is used by the state agency

responsible for enforcing health care

coverage provisions in a MCSO.

See ERISA § 609(a)(5) and 29 CFR §

2590.609-2 for requirements.

Depending upon certain conditions, the

employer must complete and return Part

A of the NMS notice to the state agency, or

it must transfer Part B of the notice to the

plan administrator for a determination on

whether the notice is a qualied MCSO.

Individuals who notify the administrator

of a qualifying event but whom the

administrator determines are not eligible for

COBRA coverage.

Qualied beneciaries whose COBRA

coverage will terminate earlier than the

maximum period of coverage.

• Participants

• Any child named in a MCSO

• The child’s representative

• State agencies

• Employers

• Plan administrators

• Participants

• Custodial parents

• Any child named in a MCSO

• The child’s representative

However, if the employer is also the plan

administrator, the administrator has 44

days after the qualifying event to provide

the notice.

If the plan provides that COBRA

continuation coverage starts on the date of

loss of coverage, the administrator must

provide the notice within 44 days of the

date of loss of coverage due to a qualifying

event.

Generally, within 14 days after being

notied by the individual of the qualifying

event.

As soon as possible after the administrator

determines that coverage will terminate.

The plan administrator must issue

the initial notice, which must include

procedures for determining qualication

promptly after receiving the MCSO.

Then, the administrator must issue a

separate notice of whether the MCSO is

qualied within a reasonable time after

receiving the MCSO.

Within 20 days after the date of the NMS

notice or sooner if reasonable, the employer

must either send Part A to the state agency,

or Part B to the plan administrator.

The administrator must then promptly

notify aected persons of receipt of the

notice and explain the procedures for

determining if it is qualied.

Within 40 business days after the date of

the NMS notice or sooner, if reasonable, the

administrator must complete and return

Part B to the state agency and provide the

required information to aected persons.

Document Type of Information To Whom When

Notice of Special Enrollment Rights

Employer CHIPRA Notice

Wellness Program Disclosure

Newborns’ Act Description of Rights

This notice describes the group health

plan’s special enrollment rules, including

the eligible employee’s right to special

enroll within 30 days after the loss of

other coverage, marriage, birth of a child,

adoption, or placement for adoption.

See 29 CFR § 2590.701-6(c) for requirements

and a model notice.

The employer must inform employees of

possible premium assistance opportunities

available in the state they reside.

A model CHIPRA notice is available at dol.

gov/sites/dolgov/les/EBSA/laws-and-

regulations/laws/chipra/model-notice.doc.

See 75 FR 5808-11 for more requirements.

This disclosure must be given by any group

health plan that oers a health-contingent

wellness program to obtain a reward.

The notice must disclose the availability

of a reasonable alternative standard or the

possibility that the applicable standard

can be waived. It must also include contact

information to obtain the alternative and

a statement that recommendations of an

individual’s personal physician will be

accommodated.

See 29 CFR § 2590.702(f)(2)(v) for

requirements and model language.

This statement must be included in a

group health plan’s SPD. The statement

must describe the federal or state law

requirements that apply to the plan or

health insurance coverage that relate to a

hospital length of stay in connection with

childbirth.

If the federal law applies in some areas

in which the plan operates and state law

applies in other areas, the statement should

describe the federal or state requirements

applicable to each area.

See 29 CFR § 2520.102-3(u) for requirements

and model language.

Employees eligible to enroll in a group

health plan

All employees, regardless of enrollment or

eligibility status.

Participants and beneciaries eligible to

participate in a health-contingent wellness

program to obtain a reward

Participants

Under certain circumstances, the employer

may be required to send Part A to the state

agency after the plan administrator has

processed Part B.

At or before the date the employee is rst

oered the opportunity to enroll in the

group health plan.

Annually.

In all plan materials that describe the terms

of a health-contingent wellness program

(both activity-only and outcome-based

wellness programs).

For outcome-based wellness programs,

this notice must also be included in any

disclosure that an individual did not

satisfy an initial outcome-based standard.

If the plan materials merely mention that

a program is available, without describing

its terms, this disclosure is not required.

In the Summary Plan Description.

5

Document Type of Information To Whom When

Document Type of Information To Whom When

6

Michelle’s Law Enrollment Notice

Women’s Health and Cancer Rights Act

(WHCRA) Notices

Mental Health Parity and Addiction

Equity Act (MHPAEA) Criteria for

Medically Necessary Determination

Notice

MHPAEA Claims Denial Notice

MHPAEA Increased Cost Exemption

Grandfathered Plan Disclosure/Notice

Summary of Benets and Coverage

(SBC) and Uniform Glossary

This notice must include a description of

the Michelle’s Law provision for continued

coverage during medically necessary leaves of

absence.

See ERISA section 714 (c).

This notice describes required benets for

mastectomy-related reconstructive surgery,

prostheses, and treatment of physical

complications of mastectomy.

This notice must explain the criteria for

medically necessary determinations related to

mental health/substance use disorder benets.

See 29 CFR § 2590.712(d)(1).

This notice must provide the reason for any

denial of reimbursement or payment for

services related to mental health/substance use

disorder benets.

See 29 § CFR 2590.712(d)(2).

A group health plan claiming MHPAEA’s

increased cost exemption must provide a

notice of the plan’s exemption from the parity

requirements.

See 29 CFR § 2590.712(g)(6)

This notice must disclose that the plan is

grandfathered and must include contact

information.

See 29 CFR § 2590.715-1251(a)(2).

The SBC is a template that describes the

benets and coverage under the plan. A

uniform glossary denes important health

coverage and medical terms.

See 29 CFR § 2590.715-2715(a) and (c).

The required SBC template is available at

dol.gov/sites/dolgov/les/EBSA/laws-and-

regulations/laws/aordable-care-act/for-

employers-and-advisers/sbc-template-new.

pdf.

• Participants

• Beneciaries

Participants

• Any current or potential participant

• Beneciary

• Contracting provider

• Participants

• Beneciaries

• Participants

• Beneciaries

• EBSA

• State regulators

• Participants

• Beneciaries

• Plans (provided by group health

insurance issuers)

• Participants

• Beneciaries

With any notice regarding a requirement

for certication of student status for

coverage under the plan.

Note that under the Aordable Care Act,

plans cannot deny or restrict coverage

for a child under the age of 26 based on

student status.

Upon enrollment and annually.

Upon request.

Upon request or as otherwise required by

other laws.

If using the cost exemption.

In any plan materials describing the

benets or health coverage.

With enrollment materials and upon

renewal or reissuance of coverage.

To special enrollees by the date the SPD

is required to be provided (90 days from

enrollment).

Also, within 7 days upon request.

Document Type of Information To Whom When

Summary of Benets and Coverage:

Notice of Modication

Notice Regarding Designation of a

Primary Care Provider

The Uniform Glossary is available at dol.

gov/sites/dolgov/les/EBSA/laws-and-

regulations/laws/aordable-care-act/

for-employers-and-advisers/sbc-uniform-

glossary-of-coverage-and-medical-terms-

new.pdf.

The SBC must include both a website

link where an individual can review

the Uniform Glossary as well as contact

information for obtaining a paper copy.

If a plan makes a material modication in

any of the plan terms that would aect the

content of the SBC, the plan must provide

notice of the change.

This does not apply to changes that occur in

connection with a renewal or reissuance.

See 29 CFR § 2590.715-2715(b).

If a non-grandfathered plan requires a

participant or beneciary to designate

a primary care provider, the plan must

provide notice of the terms of the plan

or coverage regarding designation of a

primary care provider. The notice must

include the following:

• Participants have the right to designate

any participating primary care

provider who is available to accept the

participant.

• Participants can designate any

participating pediatrician for a child.

• The plan does not require

authorization or referral for OB/

GYN care by a participating OB/GYN

professional.

See 29 CFR § 2590.715-2719A(a)(4).

For plan years beginning on or after January

1, 2022, grandfathered plans must also

provide this information. See 29 CFR §

2590.722.

Model language is available at dol.gov/sites/

dolgov/les/EBSA/laws-and-regulations/

laws/aordable-care-act/for-employers-

and-advisers/patient-protection-model-

notice.doc.

• Participants

• Beneciaries

Participants

Within 60 days before the date on which

the change will become eective.

With the Summary Plan Description or

any other similar description of benets

7

Document Type of Information To Whom When

Document Type of Information To Whom When

8

Internal Claims and Appeals and

External Review Notices

External Review Process Disclosure

Internal Claims and Appeals

Non-grandfathered plans must provide a

notice of adverse benet determination and

a notice of nal internal adverse benet

determination.

See 29 CFR § 2590.715-2719(b)(2)(ii)(E) for

specic content requirements.

Model notices are available at:

• dol.gov/sites/dolgov/les/EBSA/

laws-and-regulations/laws/aordable-

care-act/for-employers-and-advisers/

revised-model-notice-of-adverse-

benet-determination.doc

• dol.gov/sites/dolgov/les/EBSA/

laws-and-regulations/laws/

aordable-care-act/for-employers-

and-advisers/revised-model-notice-

of-nal-internal-adverse-benet-

determination.doc

External Review

After an external review, the independent

review organization (IRO) will issue a notice

of the nal external review decision.

See 29 CFR § 2590.715-2719 (c) and (d) for

requirements.

For plan years beginning on or after January

1, 2022, the external review requirements,

including the disclosure requirements,

apply to grandfathered plans for claims

subject to the No Surprises Act.

A model notice is available at dol.gov/sites/

dolgov/les/EBSA/laws-and-regulations/

laws/aordable-care-act/for-employers-

and-advisers/revised-model-notice-of-

nal-external-review-decision.doc.

Non-grandfathered plans following a state

external review process must provide a

description of the external review process.

For plan years beginning on or after January

1, 2022, the external review requirements,

including the disclosure requirements,

apply to grandfathered plans for claims

subject to the No Surprises Act.

See 29 CFR § 2590.715-2719(c) for more

information.

For internal claims and appeals:

• Claimants

For external review, by the IRO to:

• Claimants

• The plan

• Participants

• Beneciaries

For internal claims and appeals, the

timing varies based on the type of claim.

For external review, the timing varies

based on the type of claims and whether

the state or the federal process applies.

See 29 CFR § 2590.715-2719 for more

information.

In the SPD, policy, certicate, or other

evidence of coverage.

Document Type of Information To Whom When

EBSA Form 700

Employer Notice to Employees of

Coverage Options

Individual Coverage Health

Reimbursement Arrangement (ICHRA)

Notice

EBSA Form 700 is used to claim an

accommodation from the requirement to

cover certain contraceptive services without

cost-sharing. Other methods to invoke an

accommodation, such as providing a notice

to the Secretary of Health and Human

Services (HHS), are also available.

EBSA Form 700 is available at dol.gov/sites/

dolgov/les/EBSA/laws-and-regulations/

laws/aordable-care-act/for-employers-

and-advisers/ebsa-form-700.pdf.

Information about providing notice to

HHS is available at dol.gov/sites/dolgov/

les/EBSA/laws-and-regulations/laws/

aordable-care-act/for-employers-and-

advisers/model-notice-to-secretary-of-hhs.

pdf.

Employers subject to the Fair Labor

Standards Act must provide a notice

informing the employee of the existence of

the Marketplace, the potential availability of

a tax credit, and that an employee may lose

the employer contribution if the employee

purchases a qualied health plan.

See Technical Release 2013-02 & FLSA 18B

for requirements.

A model notice is available at dol.gov/sites/

dolgov/les/EBSA/laws-and-regulations/

laws/aordable-care-act/for-employers-

and-advisers/model-notice-for-employers-

who-oer-a-health-plan-to-some-or-all-

employees.doc.

This notice informs employees of the

availability of an ICHRA from their

employer and its terms, including the right

to opt out. The notice must describe the

potential availability of the premium tax

credit and explain that if the individual

accepts the ICHRA, the individual will

not be able to claim a premium tax credit

for individual health insurance coverage.

Additionally, the notice must explain

if the ICHRA is considered aordable,

the individual won’t be able to claim a

premium tax credit even if they opt out.

A model notice is available at dol.gov/sites/

dolgov/les/ebsa/laws-and-regulations/

rules-and-regulations/completed-

rulemaking/1210-AB87/individual-

coverage-model-notice.pdf.

For EBSA Form 700:

• The plan’s health insurance issuer

• Third-party administrator

The notice to the Secretary of HHS should

be sent to HHS by email or mail.

All employees, regardless of plan eligibility

or part-time or full-time status.

Participants

When an organization wishes to claim

an accommodation from the requirement

to cover certain contraceptive services

without cost-sharing.

To all new employees.

At least 90 calendar days before the

beginning of each plan year.

For any participant not eligible at the

beginning of the plan year (or not

eligible when the notice is provided to

participants before the beginning of the

plan year): the notice should be provided

by the date when the participant is rst

eligible.

For any participant employed by an

employer that was established less than

120 days before the rst plan year of the

ICHRA: by the date when the participant

is rst eligible.

9

Document Type of Information To Whom When

Transparency in Coverage –

Disclosure to the Public

Transparency in Coverage –

Disclosure to Participants and

Beneciaries

Non-grandfathered plans and issuers must

post on a public website machine-readable

les on network rates and out-of-network

allowed amounts and billed charges for

plan years beginning on or after January 1,

2022.

FAQs Part 49 deferred enforcement of this

requirement until July 1, 2022 (and deferred

enforcement for a machine-readable le on

prescription drugs while the responsible

agencies consider, through notice-and-

comment rulemaking, whether the

requirement remains appropriate).

Non-grandfathered plans and issuers

must provide an online price comparison

tool (and in paper form, upon request)

containing price and provider information

concerning health benets that allows an

individual to compare the cost sharing that

the individual would be responsible for

paying.

July 1, 2022

For plan years beginning on or after

January 1, 2023, the 500 items and

services identied by the Department

of Labor, available at hp://www.cms.

gov/healthplan-price-transparency/

resources/500-items-services. For plan

years beginning on or after January 1,

2024, all covered items or services

The public

• Participants

• Beneciaries

10

Document Type of Information To Whom When

Periodic Pension Benet Statement

(Individual Benet Statement)

Statement of Accrued and

Nonforfeitable Benets

The content of this statement varies

depending on the type of plan.

In general, all statements must indicate total

benets and total nonforfeitable pension

benets, if any, that have accrued, or the

earliest date on which benets become

nonforfeitable.

Benet statements for an individual account

plan must also provide:

• the value of each investment to which

assets in the individual account have

been allocated and

• two illustrations of the account balance

as a stream of estimated monthly

lifetime payments (one as a single life

annuity and one as a qualied joint

and survivor annuity).

Model language is available at dol.gov/

sites/dolgov/les/EBSA/employers-

and-advisers/plan-administration-and-

compliance/retirement/model-benet-

statement-supplement.pdf.

Benet statements for individual account

plans that permit participant investment

direction must also include:

• an explanation of any limitation or

restriction on the participant’s or

beneciary’s rights under the plan to

direct an investment;

• an explanation of the importance of a

well-balanced and diversied portfolio,

including a statement of the risk that

holding more than 20 percent of a

portfolio in the security of an entity

(such as employer securities) may not

be adequately diversied; and

• a notice directing the participant

or beneciary to the Department

of Labor’s website for information

on individual investing and

diversication.

See ERISA § 105.

This statement lists total accrued benets

and total nonforfeitable pension benets, if

any, that have accrued, or the earliest date

on which benets become nonforfeitable.

See ERISA § 209.

• Participants

• Beneciaries

Participants

11

Section 3: Additional Disclosure Requirements for Retirement Plans

For individual account plans that permit

participants to direct their investments

At least once each quarter.

In addition, upon request from a

beneciary who does not receive

statements automatically, limited to one

request during any 12-month period.

For individual account plans that do not

permit participants to direct their

investments

At least once each year.

In addition, upon request from a

beneciary who does not receive

statements automatically, limited to one

request during any 12-month period.

For dened benet plans

At least once every 3 years.

Alternatively, dened benet plans can

satisfy this requirement if at least once

each year the administrator provides

notice of the availability of the pension

benet statement and the ways to obtain

such statement.

In addition, upon wrien request, limited

to one request during any 12-month

period.

Upon request, upon termination of service

with the employer, or after the participant

has a 1-year break in service.

Statements provided upon request are

limited to one request during any

12-month period.

Document Type of Information To Whom When

Suspension of Benets Notice

Notice of Transfer of Excess Pension

Assets to Retiree Health

Benet Account

Domestic Relations Order (DRO)

and Qualied Domestic Relations

Order (QDRO) Notices

Notice of Signicant Reduction in

Future Benet Accruals

Notice of Failure to Meet Minimum

Funding Standards

This notice informs employees that their

benet payments are being suspended

during certain periods of employment or

reemployment.

See 29 CFR § 2530.203-3 for requirements.

This noties stakeholders that dened

benet plan excess assets are being

transferred to a retiree health benet

account.

See ERISA § 101(e) for requirements.

These notices state that a plan administrator

has received a DRO. They must include the

procedures for determining whether a DRO

is qualified and explain whether the

administrator has determined that the DRO

is qualified.

For more information, see ERISA § 206(d)(3)

(G)(i) and the EBSA booklet QDROs: The

Division of Retirement Benefits Through

Qualified Domestic Relations Orders.

This notice explains any plan amendments

to dened benet plans and certain dened

contribution plans that provide for either

a signicant reduction in the rate of future

benet accruals or the elimination or

signicant reduction in an early retirement

benet or retirement-type subsidy.

See 26 CFR § 54.4980F-1 for further

information

This notice declares a failure to make

a required installment or other plan

contribution to satisfy the minimum

funding standard within 60 days of

contribution due date. (Not applicable to

multiemployer plans).

See ERISA § 101(d) for more information.

Employees whose benets are suspended.

The employer sponsoring the pension plan

from which transfer is made must give

notice to:

• The Secretaries of Labor and the

Treasury

• Each employee organization

representing plan participants

• The plan administrator

The plan administrator must notify:

• Participants

• Beneciaries

• Participants

• Alternate payees. For example:

• Spouse

• Former spouse

• Child

• Other dependent of a participant

named in a DRO as having a right

to receive all or a portion of the

participant’s plan benets

• Participants

• Alternate payees under a QDRO

• Contributing employers

• Certain employee organizations

• Participants

• Beneciaries

• Alternative payees under QDROs

12

Only one statement is required if there

are consecutive 1-year breaks in service.

During the rst month or the payroll

period in which the withholding of

benet payments occurs.

Within 60 days before the date of the

transfer.

The employer notice also must be

available for inspection in the principal

oce of the administrator.

The initial notice, which must include

both an acknowledgement that the plan

administrator received a DRO and the

procedures for determining a DRO

qualication, must be issued promptly

after receiving the DRO.

A separate notice of whether the DRO is

qualied must be issued within a

reasonable time after receiving the DRO.

Within a reasonable time, generally 45

days, before the eective date of a plan

amendment subject to ERISA, except as

provided in regulations from the

Secretary of the Treasury.

See § 204(h) of ERISA and IRC § 4980F.

Within a reasonable period of time after

the failure.

Notice is not required if a funding waiver

is requested in a timely manner.

However, if the waiver is denied, the

notice must be provided within 60 days

after the denial.

• Participants

• Beneciaries

• Participants and beneciaries of

individual account plans aected by

such blackout periods

• Issuers of aected employer securities

held by the plan

Participants and beneciaries on whose

behalf an investment in a QDIA may be

made

Each participant to whom the arrangement

applies.

• Participants

• Beneciaries receiving benets

• Alternate payees receiving benets

• Labor organizations representing

participants under the plan

• Each employer of a multiemployer

plan that is a party to a collective

bargaining agreement pursuant to

which a plan is maintained or who

would be subject to withdrawal

liability

13

Section 404(c) Plan Disclosures

Notice of Blackout Period for

Individual Account Plans

Qualied Default Investment

Alternative (QDIA) Notice*

Automatic Contribution

Arrangement

Notice*

Annual Funding Notice

For certain information, before the time

when investment instructions are to be

made.

For other information, upon request.

Generally, at least 30 days but not more

than 60 days advance notice.

• At least 30 days before the date of

plan eligibility, or

• At least 30 days before the date of

any rst investment in a QDIA on

behalf of a participant or bene-

ciary, or

• On or before the date of plan

eligibility if the participant has the

opportunity to make a permissible

withdrawal within the rst 90 days.

Also, annually at least 30 days in advance

of each plan year.

See 29 CFR § 2550.404c-5

Within a reasonable period before the

plan year.

For large plans: Within 120 days after the

plan year.

For small plans: Before the date on which

the annual report is led or before the

latest date the annual report must be led

(including extensions), whichever is

earlier.

A small plan is dened as having 100 or

fewer participants on each day during

the plan year preceding the notice year.

Document Type of Information To Whom When

This notice contains investment-related

and certain other disclosures for

participant-directed individual account

plans described in 29 CFR § 2550.404c-

1. This includes a blackout notice for

participant-directed individual account

plans described in ERISA section 404(c)

(1)(A)(ii), as described below.

Special rules apply for qualied

investment options under ERISA section

404(c)(4)(C).

This notice provides advance notice of

any period of more than 3 consecutive

business days when there is a temporary

suspension, limitation, or restriction

under an individual account plan

on directing or diversifying plan

assets, obtaining loans, or obtaining

distributions.

See ERISA § 101(i) and 29 CFR §

2520.101-3 for further information on the

notice requirement.

This notice informs participants and

beneciaries of:

• the circumstances under which

contributions or other assets will be

invested on their behalf in a QDIA,

• the investment objectives of the

QDIA, and

• the right of participants and

beneciaries to direct investments

out of the QDIA.

See 29 CFR § 2550.404c-5.

See also ERISA § 514(e)(3).

This notice informs participants of

their rights and obligations under an

automatic contribution arrangement.

See ERISA § 514(e)(3).

This notice provides basic information

about the status and nancial condition

of a dened benet pension plan,

including:

• the plan’s funding percentage;

• assets and liabilities;

• demographic information

regarding active, retired, and

separated from service participants;

• the funding policy;

• endangered, critical, or critical and

declining status;

*Use of the IRS sample Automatic Enrollment Notice posted on the IRS website may be used to satisfy these two notice requirements. See Field Assistance Bulletin 2008-03, Question 8.

Document Type of Information To Whom When

• PBGC

• Each employee organization

• Each employer that has an obligation

to contribute to the plan

• Participants

• Beneciaries receiving benets

• Each labor organization representing

participants under the plan

• Each employer that has an obligation

to contribute to the plan

Any employer who has an obligation to

contribute to the plan.

• Participants

• Beneciaries

14

Multiemployer Plan Summary Report

Multiemployer Pension Plan

Information Made Available on Request

Multiemployer Plan Notice of Potential

Withdrawal Liability

Notice of Funding-based Limitation

Within 30 days after the due date of the

annual report.

Within 30 days of wrien request.

A requester is not entitled to receive more

than one copy of any report or applica-

tion during any 12-month period.

Generally, within 180 days of a wrien

request.

Generally, within 30 days after a plan

becomes subject to a specied funding-

based limitation.

Also, any other time determined by the

Secretary of the Treasury.

See IRS Notice 2012-46.

• explanation of events having a

material eect on liabilities or

assets;

• rules on termination or insolvency;

• a description of the benets

guaranteed by PBGC;

• annual report information;

• information disclosed to PBGC, if

applicable; and

• any additional information the

plan administrator elects to

include.

See ERISA § 101(f) and 29 CFR §

2520.101-5.

This report contains certain nancial

information, such as:

• contribution schedules,

• benet formulas,

• number of employers obligated to

contribute,

• number of participants on whose

behalf no contributions were made

for a specied period of time,

• number of withdrawing

employers, and

• withdrawal liability.

See ERISA § 104(d).

This information includes copies of

periodic actuarial reports; quarterly,

semi-annual, or annual nancial

reports; and amortization extension

applications.

See ERISA § 101(k) and 29 CFR §

2520.101-6.

This notice provides an estimated

amount of the employer’s withdrawal

liability and how such estimated

liability was determined.

See ERISA § 101(l).

The plan administrator of a single-

employer or multiple-employer

dened benet plan must provide

a notice of specied funding-based

limits on benet accruals and benet

distributions.

See ERISA § 101(j).

Document

Type of Information

To Whom

When

Notice of Right to Divest

Disclosures required for the Fiduciary

Safe Harbor for Automatic Rollovers

to Individual Retirement Plans for

Certain Mandatory Distributions

Exceeding $1,000.

Notice of Plan Termination pursuant

to the Safe Harbor for Distributions

from Terminated Individual Account

Plans

• Participants

• Alternate payees with accounts

under the plan

• Beneciaries of deceased

participants

See ERISA § 204(j).

Separating participants subject to

mandatory distributions under the

Internal Revenue Code.

Participants or beneciaries in

terminated individual account plans

Within 30 days before the rst date on

which the individuals are eligible to

exercise their rights.

Before mandatory distributions are made.

The disclosure will be sucient if

provided in conjunction with the notice

required under Code section 402(f),

which must be provided to a plan

participant no less than 30 days and no

more than 180 days before the date of a

distribution.

See IRS Notice 2009-68.

During the winding up process of the

plan termination.

Participants and beneciaries have 30

days from the receipt of the notice to elect

a form of distribution.

15

This notice advises participants of

their right to sell company stock

and reinvest the proceeds into other

investments available under the plan.

The notice must also describe the

importance of diversifying the

investment or retirement account

assets.

See ERISA § 101(m).

IRS Notice 2006-107 provides a model

notice.

To qualify for the safe harbor, a plan

duciary must provide participants

with a SPD or SMM that describes the

plan’s automatic rollover provisions.

This must include a disclosure that if

a participant is subject to mandatory

distribution and fails to make an

election regarding a form of benet

distribution, the participant’s account

balance will be rolled over into an

individual retirement plan.

See 29 CFR § 2550.404a-2.

A plan duciary (including a qualied

termination administrator) must

provide a notice to participants and

beneciaries of the plan’s termination,

distribution options, and procedures

to make an election.

In addition, the notice must:

• provide information about the

account balance;

• explain, if known, what fees,

if any, will be paid from the

participant or beneciary’s

retirement plan; and

• provide the name, address,

and telephone number of the

individual retirement plan

provider, if known, and of the

plan administrator or other

duciary from whom information

about the termination may be

obtained.

See 29 CFR § 2550.404a-3.

Document

Type of Information

To Whom

When

Notice of Critical or Endangered Status

Participant Plan and Investment Fee

Disclosures

Plan Service Provider Disclosures

• Participants

• Beneciaries

• The bargaining parties

• PBGC

• The Department of Labor

Participants and beneciaries with

the authority to direct their own

investments in individual account

plans.

Plan duciaries responsible for hiring

pension plan service providers.

Within 30 days after the plan actuary’s

annual certification, if the actuary

certifies that the plan is in critical or

endangered status.

For a model critical status notice, see

dol.gov/sites/dolgov/files/EBSA/

about-ebsa/our-activities/public-dis-

closure/status-notices/critical/model-

notice.doc.

General information about the plan and

potential administrative and individual

costs, as well as a comparative chart of

key information about plan investment

options: Annually (at least once in any

14-month period).

Statements of the dollar amount of

administrative and individual fees that

were charged to participants’ accounts:

Quarterly.

This information may, in certain

circumstances, be included in the plan’s

SPD and participants’ Periodic Pension

Benet Statements.

Generally, reasonably in advance of

entering into a contract or arrangement

with the service provider.

See 29 CFR § 2550.408b-2(c) for

provisions on when changes or updates

to previously disclosed information

must be provided.

16

The sponsor of a multiemployer dened

benet pension plan must provide notice if

the plan is in critical or endangered status

because of funding or liquidity problems.

The notice must include an explanation

of the possibility that certain adjustable

benets may be reduced.

See IRC § 432.

These disclosures include information

about the administrative and investment

costs of participation in 401(k)-type plans.

The disclosures should include general

information about the mechanics and

structure of the plan, such as how to give

investment directions. It also includes

information about the plan’s administrative

costs (e.g., recordkeeping, legal) and

individual charges that may be assessed to

participants (for loans, QDROs, etc.).

They should also include:

• a comparative chart with information

about the plan’s investment options,

including investment fees and

expenses,

• performance and benchmark data,

• a website link that leads to

supplemental investment information,

and

• a glossary of terms to assist

participants in understanding the

plan’s investment options.

See 29 CFR § 2550.404a-5.

Certain plan service providers must

provide detailed information about the

compensation, both direct and indirect,

that they will receive for providing services

to pension plans.

Service providers may also have to provide

information to assist plans in complying

with other ERISA reporting and disclosure

requirements, such as the Form 5500

Annual Report and Participant Plan and

Investment Fee Disclosures.

See 29 CFR § 2550.408(b)-2(c) for denitions

of which service providers must comply

and the specic disclosures that must be

provided.

17

*Premium lings must be submied via PBGC’s online application, My Plan Administration Account (My PAA). Premium payments may be made online or via paper check. My PAA and

more information can be found at PBGC’s website (pbgc.gov) by clicking on Employers & Practitioners and then Premium Filings.

Overview of Basic PBGC Reporting and Disclosure Requirements

Document Type of Information To Whom When

Document Type of Information To Whom When

Section 1: Pension Insurance Premiums (for covered single-employer and multiemployer dened benet plans)

(ERISA §§ 4006 and 4007; 29 CFR Parts 4006 and 4007)*

Section 2: Standard Terminations (for covered single-employer dened benet plans)

(ERISA §§ 4041 and 4050; 29 CFR Parts 4041 and 4050)

Comprehensive Premium Filing

Notice of Intent to Terminate

Form 500 - Standard Termination Notice

Notice of Plan Benets

Form 501 - Post-Distribution

Certication

This ling provides information about the

premium owed for the plan year, including

supporting data.

This provides notice about a plan’s

proposed termination and the termination

process.

This form is used to provide notice of a

plan’s proposed termination and provides

plan data.

This notice provides information on each

person’s benets.

This form is used to certify that the

distribution of plan assets has been properly

completed.

Generally, by the 15th day of the 10th

full calendar month in the plan year.

At least 60 and no more than 90 days

before the proposed termination date.

If potential insurers are not known at

this time, a supplemental notice must be

provided no later than 45 days before

distribution date.

No later than 180 days after the

proposed termination date.

No later than the time Form 500

(Standard Termination Notice) is led

with PBGC.

Within 30 days after the last distribution

date for plan benets, or within 60

days after the last distribution if email

certication is sent to PBGC within 30

days after the last distribution date.

PBGC may assess a penalty for late

ling of a Form 501 only if it is led

more than 90 days after the distribution

deadline (including extensions).

• PBGC

• Participants

• Beneficiaries

• Alternate payees

• Union

PBGC

• Participants

• Beneciaries

• Alternate payees

PBGC

18

Document Type of Information To Whom When

Section 3: Distress Terminations (for covered single-employer dened benet plans)

(ERISA §§ 4041 and 4050; 29 CFR Parts 4041 and 4050)

At least 60 days and no more than 90

days before the proposed termination

date, except with PBGC approval.

By the time Form 600 (Notice of Intent to

Terminate) is led with PBGC.

Within 15 days after the plan

administrator:

• receives an aected party’s request

for the information, or

• provides new information to PBGC

that relates to a previous request.

Concurrent with request to Bankruptcy

Court.

By the 120th day after the proposed

termination date.

PBGC

• Participants

• Beneciaries

• Alternate payees

• Union

• Participants

• Beneciaries

• Alternate payees

• Union

PBGC

PBGC

This form is used to provide notice of

a plan’s proposed distress termination,

demonstrate satisfaction of distress criteria,

and provide plan and sponsor/controlled

group data.

This notice provides notice about a plan’s

proposed distress termination and the

termination process.

A plan administrator must disclose

information it has submied to PBGC in

connection with a distress termination.

See ERISA § 4041(c)(2).

Note that a plan administrator or a plan

sponsor must also disclose information it

has submied to PBGC in connection with a

PBGC-initiated termination.

See ERISA § 4042(c)(3).

This provides notice of a sponsor’s/

controlled group member’s request to

Bankruptcy Court to approve the plan

termination based upon a reorganization

test.

This form is used to provide information

on the plan and suciency of plan assets to

provide benets.

Form 600 - Distress Termination

Notice of Intent to Terminate (NOIT)

Notice of Intent to Terminate to

Aected Parties Other than PBGC

Disclosure of Termination

Information

Notice of Request to Bankruptcy

Court to Approve Termination

Form 601 (and Schedule EA-D) -

Distress Termination Notice, Single-

Employer Plan Termination

Document Type of Information To Whom When

Form MP-100 (Missing Participants) This form is used to report information

about participants and beneciaries covered

by a terminating plan that the plan cannot

locate.

Generally, the same as the Form

501 due date. (See above for the

timing.)

PBGC

18

19

Document Type of Information To Whom When

Form 602 - Post-Distribution

Certication for Distress

Termination

Form MP-100

This form certies that the distribution of

plan assets has been properly completed

and the plan is sucient for guaranteed

benets.

This form is used to report information

about participants and beneciaries covered

by a terminating plan that the plan cannot

locate (required only if the plan is sucient

for guaranteed benets).

PBGC

PBGC

Within 30 days after the distribution of

plan assets is completed.

PBGC may assess a penalty for late ling

of a Form 602 only if it is led more than

90 days after the distribution deadline

(including extensions).

Generally, the same as the Form 602 due

date. (See above for the timing.)

Section 4: Reportable Events and Other Reports (for covered single-employer dened benet plans)

Form 10 - Post-Event Notice of

Reportable Events

Form 10-Advance - Advance Notice

of Reportable Events

This form is used to report information

relating to an event, the plan, and the

controlled group when there is a(n):

• failure to make a required contribution,

• active participant reduction,

• change in controlled group,

• application for funding waiver,

• liquidation,

• loan default, and

• various other events.

See ERISA § 4043 and 29 CFR Part 4043.

This form is used to report information

relating to an event, the plan, and the

controlled group when there is a:

• change in controlled group,

• liquidation,

• loan default,

• transfer of benet liabilities, and

• various other events.

This requirement applies to privately held

controlled groups with plans that have

aggregate unfunded vested benets over

$50 million and an aggregate funded vested

percentage under 90 percent.

See ERISA § 4043 and 29 CFR Part 4043.

Within 30 days after the plan

administrator or contributing sponsor

knows (or has reason to know) the event

has occurred.

At least 30 days before the eective date

of the event. Extensions may apply.

PBGC

PBGC

Document Type of Information To Whom When

20

Document Type of Information To Whom When

This form is used to report information

relating to the plan and controlled

group if the plan has aggregate missed

contributions of more than $1 million.

See ERISA § 302(f)(4) and 29 CFR Part

4043, subparts A and D.

These notices advise of a substantial

cessation of operations and provide

information about an employer’s election

to make additional contributions to an

aected plan.

See ERISA §§ 4062(e) and 4063(a).

This notice advises of certain withdrawals

of substantial employers and asks PBGC

to determine the resulting liability.

See ERISA § 4063(a).

This ling provides actuarial and nancial

information for certain controlled groups

with substantial underfunding.

See ERISA § 4010 and 29 CFR Part 4010.

Form 200 - Notice of Failure to Make

Required Contributions

Reporting following a Substantial

Cessation of Operations (ler may

use Form 4062(e) Series – Notices

Following a Substantial Cessation of

Operations)

Reporting of Withdrawal of

Substantial Employer

Annual Financial and Actuarial

Information Reporting

PBGC

PBGC

PBGC

PBGC

Within 10 days after the contribution

due date.

Varies depending on the event required

to be reported to PBGC.

Within 60 days after the event.

Within 105 days after the close of the

ler’s information year, with a possible

extension for certain required actuarial

information until 15 days after the ling

deadline for annual report (Form 5500).

Overview of Form 5500 and Form M-1 Annual Reporting Requirements

The Form 5500 ling requirements vary depending on whether the ler

is a small plan with fewer than 100 participants as of the beginning of the

plan year, a large plan with 100 or more participants as of the beginning

of the plan year, or a DFE.

After this section, there is a quick reference chart that describes the basic

Form 5500 ling requirements. Certain small plans may be eligible to le

the simplied Form 5500-SF instead of the Form 5500. Check the chart to

determine a plan’s eligibility.

A “one-participant” plan which is required to le the Form 5500-EZ

may elect to le online with EFAST2’s IFILE or through an EFAST2-

approved vendor rather than ling a Form 5500-EZ on paper with the

IRS. For instructions on how to le the Form 5500-EZ on paper, see the

instructions for the Form 5500-EZ which can be found at www.irs.gov/

pub/irs-pdf/i5500ez.pdf, or call the IRS at 1-877-829-5500.

The Form 5500 and the Form 5500-SF led by plan administrators and

the Form 5500 led by GIAs are due by the last day of the 7th calendar

month after the end of the plan or GIA year (not to exceed 12 months

in length). See the Form 5500 and the Form 5500-SF instructions for

information on extensions up to an additional 2 ½ months. The Form

5500 led by DFEs other than GIAs are due no later than 9 ½ months

after the end of the DFE year.

Certain employee benet plans are exempt from the annual reporting

requirements or are eligible for limited reporting options. The major

classes of plans that are exempt or eligible for limited reporting are

described in the Form 5500 and the Form 5500-SF instructions. All

welfare plans required to le Form M-1, Report for Multiple Employer

Welfare Arrangements (MEWAs) and Certain Entities Claiming

Exception (ECEs), must le an annual report in the Form 5500 Annual

Return/Report series regardless of plan size or type of funding.

1

1

See 78 Fed. Reg. 13781, 13796, 13899 (Mar. 1, 2013).

Form 5500 Annual Reporting Requirements

The Form 5500 Annual Return/Report series is used by plan

administrators and certain direct ling entities (DFEs) to satisfy annual

reporting obligations under ERISA and the Internal Revenue Code. The

Department of Labor, the IRS, and PBGC publish

• Form 5500, Annual Return/Report of Employee Benet Plan

• Form 5500-SF, Short Form Annual Return/Report of Small Employee

Benet Plan

The IRS publishes Form 5500-EZ, Annual Return of a One-Participant

Retirement Plan or a Foreign Plan.

DFEs are investment or insurance arrangements that plans can

participate in. They include:

• master trust investment accounts (MTIAs),

• bank common/collective trusts (CCTs),

• insurance pooled separate accounts (PSAs),

• 103-12 investment entities (103-12 IEs), and

• group insurance arrangements (GIAs).

All DFEs are allowed to le the Form 5500 directly with EBSA, but it is

mandatory for MTIAs. If an employee benet plan participates in a CCT,

PSA, 103-12 IE, or GIA that les a Form 5500 as a DFE, then it is eligible

for certain annual reporting relief in connection with the plan’s own

Form 5500 ling requirement.

All Forms 5500 and Forms 5500-SF must be led online using the ERISA

Filing Acceptance System (EFAST2). Filers may use EFAST2’s web-based

IFILE ling system or an EFAST2-approved vendor. All delinquent and

amended lings of Title I plans must also be submied through EFAST2.

More information about ling with EFAST2 is available at efast.dol.gov.

21

Check the EFAST website at efast.dol.gov and the latest Form 5500

and Form 5500-SF instructions for information on who is required to

file, how to complete the forms, when to file, EFAST2-approved

software, and electronic filing options. You can also visit dol.gov/

agencies/ebsa/key-topics/reporting-and-filing/form-5500 to view the

Form 5500 and the Form 5500-SF. Schedules and instructions are also

posted on that website.

Form M-1 Annual Reporting Requirements

Administrators of multiple employer welfare arrangements (MEWAs)

and certain other entities that oer or provide medical care coverage

to employees of two or more employers are generally required to le

the Form M-1, Report for Multiple Employer Welfare Arrangements

(MEWAs) and Certain Entities Claiming Exception (ECEs). After this

section, there is a quick reference chart on reporting requirements for

MEWAs and ECEs.

The Form M-1 must be

led online using the M-1 Online Filing System.

You can le the Form M-1 and nd more information, including

frequently asked questions, at askebsa.dol.gov/mewa.

22

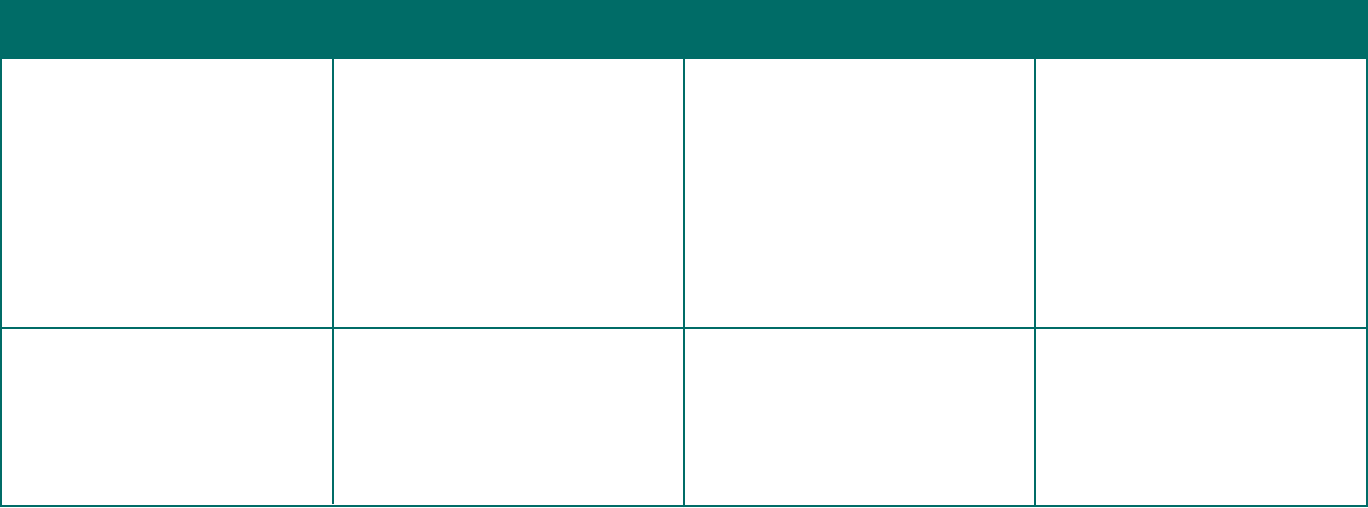

Large Pension Plan Small Pension Plan

2

Small Welfare Plan

2

Large Welfare Plan DFE

Form 5500

Schedule A

(Insurance Information)

Schedule C (Service

Provider Information)

Schedule D (DFE/

Participating Plan

Information)

Schedule G (Financial

Schedules)

Schedule H (Financial

Information)

Schedule I

(Financial Information)

Must complete.

3

Must complete if plan has

insurance contracts.

Must complete Part I if

service provider was paid

$5,000 or more, Part II if

a service provider failed

to provide information

necessary for the

completion of Part I, and

Part III if an accountant or

actuary was terminated.

Must complete Part I if plan

participated in a CCT, PSA,

MTIA, or 103-12 IE.

Must complete if Schedule

H, lines 4b, 4c, or 4d are

“Yes.”

3

Must complete.

3, 5

Not required.

Must complete.

Must complete if plan has

insurance contracts.

Must complete Part I if

service provider was paid

$5,000 or more, Part II if

a service provider failed

to provide information

necessary for the

completion of Part I, and

Part III if an accountant or

actuary was terminated.

Must complete Part I if plan

participated in a CCT, PSA,

MTIA, or 103-12 IE.

Must complete if Schedule

H, lines 4b, 4c, or 4d are

“Yes.”

Must complete.

5

Not required.

Must complete.

Must complete if plan has

insurance contracts.

4

Not required.

Must complete Part I

if plan participated in

a CCT, PSA, MTIA, or

103-12 IE.

4

Not required.

Not required.

Must complete.

4

Must complete.

3

Must complete if plan has

insurance contracts.

4

Not required.

Must complete Part I if plan

participated in a CCT, PSA,

MTIA, or 103-12 IE.

4

Not required.

3

Not required.

Must complete.

4

Must complete.

Must complete if MTIA,

103-12 IE, or GIA has

insurance contracts.

MTIAs, GIAs, and

103-12 IEs must complete

Part I if service provider

paid $5,000 or more,

and Part II if a service

provider failed to provide

information necessary

for the completion of

Part I. GIAs and 103-12

IEs must complete Part

III if accountant was

terminated.

All DFEs must complete

Part II, and DFEs that

invest in a CCT, PSA,

or 103-12 IE must also

complete Part I.

Must complete if

Schedule H, lines 4b, 4c,

or 4d for a GIA, MTIA, or

103-12 IE are “Yes.”

All DFEs must complete

Parts I, II, and III. MTIAs,

103-12 IEs, and GIAs

must also complete Part

IV.

5

Not required.

23

Quick Reference Chart of Form 5500, Schedules, and Attachments (Not Applicable for Form 5500-SF Filers)

*1

*See footnotes for certain exemptions and other technical requirements. All footnotes for this chart are on page 24.

Large Pension Plan Small Pension Plan

2

Small Welfare Plan

2

Large Welfare Plan DFE

Schedule MB

(Actuarial Information)

Schedule R

(Pension Plan

Information)

Schedule SB

(Actuarial Information)

Accountant’s Report

Must complete if

multiemployer dened

benet plan or money

purchase plan subject

to minimum funding

standards.

6

Must complete.

7

Must complete if

single-employer or

multiple-employer dened

benet plan, including an

eligible combined plan

and subject to minimum

funding standards.

Must aach.

Must complete if

multiemployer dened

benet plan or money

purchase plan subject

to minimum funding

standards.

6

Must complete.

4, 7

Must complete if

single-employer or

multiple-employer dened

benet plan, including an

eligible combined plan

and subject to minimum

funding standards.

Not required unless

Schedule I, line 4k, is

checked “No.”

Not required.

Not required.

Not required.

Must aach.

3

Not required.

Not required.

Not required.

Not required.

1

This chart provides only general guidance. Not all rules and requirements are reected. Refer to specic Form 5500 instructions for complete information on ling requirements (e.g., Who Must File and What To File). For

example, a pension plan is exempt from ling any schedules if the plan uses Code section 408 individual retirement accounts as the sole funding vehicle for providing benets. See Limited Pension Plan Reporting.

2

Pension plans and welfare plans with fewer than 100 participants at the beginning of the plan year that are not exempt from ling an annual return/report may be eligible to le the Form 5500-SF, a simplied report.

In addition to the limitation on the number of participants, a Form 5500-SF may only be led for a plan that is exempt from the requirement that the plan’s books and records be audited by an independent qualied

public accountant (but not by reason of enhanced bonding), has 100 percent of its assets invested in certain secure investments with a readily determinable fair market value, holds no employer securities, and is not a

multiemployer plan. See Who Must File.

3

Unfunded, fully insured, or combination unfunded/fully insured welfare plans covering fewer than 100 participants at the beginning of the plan year that meet the requirements of 29 CFR 2520.104-20 are exempt

from ling an annual report. See Who Must File. Such a plan with 100 or more participants must le an annual report, but is exempt under 29 CFR 2520.104-44 from the accountant’s report requirement and completing

Schedule H, but MUST complete Schedule G, Part III, to report any nonexempt transactions. See What to File. All Plans required to le Form M-1, Report for Multiple-Employer Welfare Arrangements (MEWAs) and Certain

Entities Claiming Exception (ECEs) must le a Form 5500 regardless of plan size or type of funding.

4

Do not complete if ling the Form 5500-SF instead of the Form 5500.

5

Schedules of assets and reportable (5%) transactions also must be led with the Form 5500 if Schedule H, line 4i or 4j is “Yes.”

6

Money purchase dened contribution plans that are amortizing a funding waiver are required to complete lines 3, 9, and 10 of the Schedule MB in accordance with the instructions. Also see instructions for line 5 of

Schedule R and line 12a of Form 5500-SF.

7

Schedule R should not be completed when the Form 5500 Annual Return/Report is led for a pension plan that uses, as the sole funding vehicle for providing benets, individual accounts or annuities (as described in

Code section 408). See the Form 5500 instructions for Limited Pension Plan Reporting for more information.

Not required.

Not required.

Not required.

Must aach for a GIA or

103-12 IE.

24

Document Type of Information To Whom When

MEWAs and ECEs Quick Reference Chart: Form M-1

1

This form includes:

• MEWA or ECE custodial and nancial

information,

• states in which coverage is provided,

• insurance information,

• number of participants covered,

• information about enforcement actions,

and

• information about compliance with Part

7 of ERISA, including any litigation

alleging non-compliance.

Administrators of MEWAs and ECEs that

oer or provide coverage for medical care

to employees of two or more employers

(including one or more self-employed

individuals) are generally required to le the

Form M-1.

An ECE is an entity that claims it is not a

MEWA due to the exception in the denition

of MEWA for entities that are established

and maintained under or pursuant to one or

more agreements that the Secretary of Labor

nds to be collective bargaining agreements.

An ECE must le this report during the rst

three years after the ECE is originated. For

more information on this exception, see 29

CFR § 2510.3-40.

1

This chart provides only general guidance, and not all rules and requirements are reected.

Form M-1

Report for Multiple Employer Welfare

Arrangements (MEWAs) and Certain

Entities Claiming Exception (ECEs)

EBSA

25

Annual Report

Generally, due by March 1st of the year after the

calendar year for which report is required. A

60-day extension is available.

For ECEs, an annual report is required to be led

only if the ECE was last originated within the 3

years before the annual ling due date.

MEWA Registration

A MEWA may have to register more than once

during the reporting year. MEWA registration

generally is required:

• 30 days before operating in any state

• Within 30 days of knowingly operating

in any additional state or states that were

not indicated on a previous Form M-1

ling

• Within 30 days of operating with regard

to the employees of an additional

employer (or employers, including one or

more self-employed individuals) after a

merger with another MEWA

• Within 30 days of the date the number of

employees receiving coverage for

medical care under the MEWA is at least

50 percent greater than the number of

such employees on the last day of the

previous calendar year

• Within 30 days of experiencing a material

change as dened in the Form M-1

instructions

ECE Origination

An ECE may be originated more than once during

the reporting year. ECE origination lings generally

must be made:

• 30 days before operating with regard to

the employees of two or more employers

(including one or more self-employed

individuals)

• Within 30 days from when ECE begins

operating following a merger with

another ECE (unless all of the ECEs that

participate in the merger previously were

last originated at least 3 years prior to the

merger)

• Within 30 days from when the number of

employees receiving coverage for

medical care under the ECE is at least 50