www.pwc.com

Copyright © 2016 PricewaterhouseCoopers LLP, a Delaware limited liability partnership. All rights reserved. PwC refers to the U

sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structur

www.pwc.com

Business

combinations and

noncontrolling interests

Global edition

This publication has been prepared for general informational purposes, and does not constitute professional advice on facts and

circumstances specific to any person or entity. You should not act upon the information contained in this publication without

obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or

completeness of the information contained in this publication. The information contained in this publication was not intended or

written to be used, and cannot be used, for purposes of avoiding penalties or sanctions imposed by any government or other

regulatory body. PricewaterhouseCoopers LLP, its members, employees, and agents shall not be responsible for any loss

sustained by any person or entity that relies on the information contained in this publication. Certain aspects of this publication

may be superseded as new guidance or interpretations emerge. Financial statement preparers and other users of this

publication are therefore cautioned to stay abreast of and carefully evaluate subsequent authoritative and interpretative

guidance.

The FASB Accounting Standards Codification® material is copyrighted by the Financial Accounting Foundation, 401 Merritt 7,

Norwalk, CT 06856, and is reproduced with permission.

Copyright © IFRS

®

Foundation. All rights reserved. Reproduced by PricewaterhouseCoopers LLP with the permission of IFRS

Foundation. Reproduction and use rights are strictly limited. No permission granted to third parties to reproduce or distribute.

The International Accounting Standards Board and the IFRS Foundation do not accept responsibility for any loss caused by

acting or refraining from acting in reliance on the material in this publication, whether such loss is caused by negligence or

otherwise.

i

PwC guide library

Other titles in the PwC accounting and financial reporting guide series:

□ Bankruptcies and liquidations

□ Consolidation and equity method of accounting

□ Derivative instruments and hedging activities

□ Fair value measurements, global edition

□ Financial statement presentation

□ Financing transactions

□ Foreign currency

□ IFRS and US GAAP: similarities and differences

□ Income taxes

□ Leases

□ Loans and investments

□ Property, plant, equipment and other assets

□ Revenue from contracts with customers, global edition

□ Stock-based compensation

□ Transfers and servicing of financial assets

□ Utilities and power companies

ii

Acknowledgments

The Business combinations and noncontrolling interests, global edition, represents the efforts and

ideas of many individuals within PwC. The following PwC people contributed to the contents or served

as technical reviewers of this publication:

Kassie Bauman

Cathy Benjamin

Nicole Berman

Wayne Carnall

Brett Cohen

Larry Dodyk

Donald Doran

Sarah Fleischer

Katie Hurley

Marc Jerusalem

Chenelle Manley

Andreas Ohl

Cody Smith

John Wayne

Shiri Wertman

Valerie Wieman

Special thanks

Special thanks to all the other resources within PwC that contributed to the overall quality of this

guide, including the final editing and production of the document.

iii

Preface

PwC is pleased to offer our global accounting and financial reporting guide for Business combinations

and noncontrolling interests. This guide has been updated as of December 2017.

In January 2017, the FASB issued final guidance that revises the definition of a business. The changes

to the definition of a business will likely result in more acquisitions being accounted for as asset

acquisitions across most industries, particularly real estate and pharmaceuticals. The definition of a

business also affects many other areas of accounting, including disposals, consolidation, and segment

changes. BCG 1 discusses the revised definition and new framework, as well as the effective date and

transition.

In January 2017, the FASB issued final guidance that eliminates Step 2 of the current goodwill

impairment test, which requires a hypothetical purchase price allocation to measure goodwill

impairment. A goodwill impairment loss will instead be measured at the amount by which a

reporting unit’s carrying amount exceeds its fair value, not to exceed the carrying amount of goodwill.

BCG 9 discusses the new goodwill impairment model, as well as effective dates and transition.

References to US GAAP and IFRS

Definitions, full paragraphs, and excerpts from the FASB’s Accounting Standards Codification and

standards issued by the IASB are clearly designated, either within quotes in the regular text or

enclosed within a shaded box. The remaining text is PwC’s original content.

References to other chapters and sections in this guide

When relevant, the discussion includes general and specific references to other chapters of the guide

that provide additional information. References to another chapter or particular section within a

chapter are indicated by the abbreviation “BCG” followed by the specific section number (e.g., BCG

2.3.1 refers to section 2.3.1 in chapter 2 of this guide).

References to other PwC guidance

This guide focuses on the accounting and financial reporting considerations for business combinations

and noncontrolling interests. It supplements information provided by the authoritative accounting

literature and other PwC guidance. This guide provides general and specific references to chapters in

other PwC guides to assist users in finding other relevant information. References to other guides are

indicated by the applicable guide abbreviation followed by the specific chapter or section number. The

other PwC guides referred to in this guide, including their abbreviations, are:

□ Fair value measurements, global edition (FV)

□ Financial statement presentation (FSP)

□ Financing transactions: debt, equity and the instruments in between (FG)

□ Income taxes (TX)

Preface

iv

□

Leases (LG)

□

Property, plant, equipment and other assets (PPE)

□

Stock-based compensation (SC)

In addition, PwC’s Accounting and reporting manual (the ARM) provides information about various

accounting matters in US GAAP.

PwC guides may be obtained through CFOdirect (www.cfodirect.com), PwC’s comprehensive online

resource for financial executives, a subscription to Inform (www.pwcinform.com), PwC’s online

accounting and financial reporting reference tool, or by contacting a PwC representative.

Guidance date

This guide has been updated and considers guidance as of December 1, 2017. Additional updates

may be made to keep pace with significant developments. Users should ensure they are using the most

recent edition available on CFOdirect (www.cfodirect.com) or Inform (www.pwcinform.com).

Other information

The appendices to this guide include guidance on professional literature, a listing of technical

references and abbreviations, definitions of key terms, and a summary of significant changes from the

previous edition.

* * * * *

This guide has been prepared to support you as you consider the accounting for transactions and

address the accouting, financial reporting, and regulated regulatory matters relevant to business

combinations and noncontrolling interests. This guide should be used in combination with a thorough

analysis of the relevant facts and circumstances, review of the authoritative accounting literature, and

appropriate professional and technical advice.

We hope you find the information and insights in this guide useful.

Paul Kepple

US Chief Accountant

Revenue from contracts with customers, global edition (RR)

□

v

Table of contents

1 Scope

1.1 Chapter overview ........................................................................................................ 1-2

1.2 Definition of a business– before adoption of ASU 2017-01 ..................................... 1-3

1.2.1 Development stage enterprises ................................................................... 1-5

1.2.2 The presence of goodwill ............................................................................. 1-5

1.2.3 Distinguishing a business from an asset or group of assets ...................... 1-5

1.2.4 Identifying market participants when determining whether an

acquired group is a business ....................................................................... 1-7

1.2.5 Distinguishing a business from an asset or group of assets ...................... 1-7

1.3 Definition of a business – after adoption of ASU 2017-01 ....................................... 1-11

1.3.1 The screen test ............................................................................................. 1-12

1.3.1.1 Single asset .................................................................................. 1-13

1.3.1.2 Similar assets .............................................................................. 1-13

1.3.1.3 Gross assets ................................................................................. 1-15

1.3.2 The framework ............................................................................................. 1-16

1.3.2.1 Evaluating the framework when outputs are not present ........ 1-16

1.3.2.2 Evaluating the framework when outputs are present .............. 1-18

1.3.3 The presence of goodwill ............................................................................. 1-21

1.4 Identifying a business combination .......................................................................... 1-21

1.4.1 Stapling transactions and dual-listed companies ...................................... 1-23

1.4.2 Merger of equals, mutual enterprises, and “roll-up” or “put-together”

transactions .................................................................................................. 1-23

1.4.3 Exchanges of assets between companies .................................................... 1-24

1.4.4 Multiple transactions that result in the acquisition of a business ............ 1-24

1.4.5 Transactions excluded from the scope of ASC 805 and IFRS 3 ................ 1-25

1.5 Identifying a joint venture [joint arrangement] ....................................................... 1-26

1.6 Common control business combinations .................................................................. 1-27

1.7 US GAAP and IFRS differences: definition of control ............................................. 1-27

1.7.1 US GAAP ...................................................................................................... 1-27

1.7.2 IFRS .............................................................................................................. 1-28

Table of contents

vi

1.7.3 Investment entity—IFRS ............................................................................. 1-29

1.7.4 Investment companies—US GAAP ............................................................. 1-30

2 Acquisition method

2.1 Chapter overview ........................................................................................................ 2-2

2.2 The acquisition method ............................................................................................. 2-2

2.3 Identifying the acquirer ............................................................................................. 2-3

2.3.1 New entity formed to effect a business combination ................................. 2-5

2.3.2 Other considerations in identifying the acquirer ....................................... 2-7

2.4 Determining the acquisition date .............................................................................. 2-8

2.4.1 Determining the acquisition date for a business combination achieved

without the transfer of consideration ......................................................... 2-9

2.5 Recognizing and measuring the identifiable assets acquired, liabilities assumed,

and any noncontrolling interest in the acquiree ....................................................... 2-9

2.5.1 Assets that the acquirer does not intend to use ......................................... 2-11

2.5.1.1 Defensive intangible assets ........................................................ 2-11

2.5.2 Asset valuation allowances .......................................................................... 2-11

2.5.3 Inventory ...................................................................................................... 2-12

2.5.4 Contracts ...................................................................................................... 2-12

2.5.4.1 Loss contracts ............................................................................. 2-12

2.5.5 Intangible assets .......................................................................................... 2-13

2.5.6 Reacquired rights ......................................................................................... 2-13

2.5.6.1 Determining the value and useful life of reacquired rights ...... 2-14

2.5.7 Property, plant, and equipment .................................................................. 2-15

2.5.7.1 Government grants ..................................................................... 2-16

2.5.7.2 Consideration of decommissioning and site restoration costs 2-16

2.5.8 Income taxes ................................................................................................ 2-16

2.5.9 Recognition of assets held for sale—US GAAP [IFRS] .............................. 2-17

2.5.10 Employee benefit plans ............................................................................... 2-17

2.5.11 Payables and debt ........................................................................................ 2-19

2.5.12 Guarantees ................................................................................................... 2-19

2.5.13 Contingencies ............................................................................................... 2-20

2.5.13.1 Initial recognition and measurement—US GAAP ..................... 2-21

2.5.13.2 Subsequent measurement—US GAAP ....................................... 2-22

Table of contents

vii

2.5.13.3 Contingent liabilities—IFRS ....................................................... 2-24

2.5.14 Indemnification assets ................................................................................. 2-24

2.5.15 Recognition of liabilities related to restructurings or exit activities ......... 2-26

2.5.16 Deferred or unearned revenue .................................................................... 2-27

2.5.17 Deferred charges arising from leases .......................................................... 2-27

2.5.18 Classifying or designating identifiable assets and liabilities ..................... 2-28

2.5.19 Financial instruments—classification or designation of financial

instruments and hedging relationships ...................................................... 2-30

2.5.20 Long-term construction contracts .............................................................. 2-30

2.5.20.1 Percentage of completion method—prior to adoption of

ASC 606 [IFRS 15] ...................................................................... 2-31

2.5.20.2 Completed contract method—US GAAP only prior to

adoption of ASC 606 ................................................................... 2-31

2.6 Recognising and measuring goodwill or a gain from a bargain purchase .............. 2-31

2.6.1 Goodwill ....................................................................................................... 2-31

2.6.2 Bargain purchase ......................................................................................... 2-32

2.6.3 Measuring and recognizing consideration transferred.............................. 2-33

2.6.3.1 Share-based payment awards .................................................... 2-33

2.6.3.2 Consideration transferred includes other assets and

liabilities of the acquirer ............................................................. 2-33

2.6.4 Contingent consideration ............................................................................ 2-34

2.6.4.1 Contingent consideration—US GAAP ........................................ 2-34

2.6.4.2 Contingent consideration—IFRS ............................................... 2-40

2.6.5 Classification of contingent consideration arrangements—US GAAP

and IFRS examples ...................................................................................... 2-42

2.6.5.1 Contingent consideration arrangements requiring

continued employment ............................................................... 2-50

2.6.5.2 Existing contingent consideration arrangements of an

acquiree—US GAAP .................................................................... 2-51

2.6.5.3 Existing contingent consideration arrangement of an

acquiree—IFRS ........................................................................... 2-51

2.6.5.4 Effect of contingent equity issued in a business combination

on earnings per share ................................................................. 2-52

2.6.5.5 Contingent consideration—seller accounting ........................... 2-53

Table of contents

viii

2.6.6 Noncontrolling interest ............................................................................... 2-57

2.6.6.1 Redeemable noncontrolling interest—US GAAP ...................... 2-58

2.6.7 Calls and puts related to the noncontrolling interest ................................ 2-61

2.6.7.1 Calls and puts related to the noncontrolling

interest—US GAAP ..................................................................... 2-61

2.6.7.2 Calls and puts related to the noncontrolling interest—IFRS ... 2-67

2.6.8 Treatment of a previously held equity interest in an acquiree .................. 2-70

2.6.9 Business combinations achieved without consideration transferred ....... 2-71

2.7 Assessing what is part of a business combination transaction ................................ 2-71

2.7.1 Employee compensation arrangements ..................................................... 2-73

2.7.2 Reimbursement arrangements between the acquiree and the acquirer

for transaction costs incurred ..................................................................... 2-74

2.7.3 Settlement of preexisting relationships between the acquirer

and acquiree ................................................................................................. 2-75

2.7.3.1 Calculating the gain or loss on settlement of

preexisting relationships ............................................................ 2-76

2.7.4 Settlement of debt ........................................................................................ 2-78

2.7.6 Financial instruments entered into by the acquirer in contemplation

of a business combination ........................................................................... 2-80

2.8 Example of applying the acquisition method ........................................................... 2-81

2.9 Measurement period adjustments ............................................................................ 2-83

2.10 Reverse acquisitions ................................................................................................... 2-86

2.10.1 Reverse acquisition (merger) involving a nonoperating public shell

and a private operating entity ..................................................................... 2-87

2.10.2 Consideration transferred in a reverse acquisition .................................... 2-88

2.10.3 Presentation of consolidated financial statements .................................... 2-89

2.10.4 Noncontrolling interest in a reverse acquisition ........................................ 2-92

2.11 Applying the acquisition method for variable interest entities and

special purpose ........................................................................................................... 2-95

2.12 Conforming accounting policies of the acquiree to those of the acquirer ............... 2-97

2.13 Continuing transition requirements ......................................................................... 2-97

2.13.1 Income tax transition provisions ................................................................ 2-97

2.13.1.1 Acquired tax benefits disclosure ................................................ 2-99

2.14 Contingent consideration of an acquiree .................................................................. 2-99

2.7.5 Acquisition-related costs ............................................................................. 2-79

2.7. Transaction service arrangements .............................................................. 2-80

2.10. Computation of earnings per share in a reverse acquisition ...................... 2-93

Table of contents

ix

3 Employee compensation arrangements

3.1 Chapter overview ........................................................................................................ 3-2

3.2 Assessing what is part of the consideration transferred for the acquiree ............... 3-3

3.3 Contingent payments—determining whether the arrangement is compensation .. 3-4

3.3.1 Golden parachute and stay bonus arrangements....................................... 3-7

3.4 Exchange of employee share-based payment awards .............................................. 3-8

3.4.1 Determining the fair value attributable to precombination and

postcombination services ............................................................................ 3-11

3.4.1.1 Awards with graded-vesting features ........................................ 3-14

3.4.2 Service required after the acquisition date is equal to or greater than

the original service requirement ................................................................. 3-17

3.4.3 Service required after the acquisition date is less than the original

service requirement ..................................................................................... 3-17

3.4.3.1 Acquiree awards with an automatic change in

control provision ......................................................................... 3-18

3.4.3.2 Acquiree awards with a discretionary change in

control provision ......................................................................... 3-19

3.4.4 Excess fair value of the acquirer’s replacement award .............................. 3-19

3.4.5 Acquiree awards that continue after the business combination ............... 3-20

3.4.6 Awards with performance or market conditions ....................................... 3-20

3.4.7 Illustrative summary of attributing fair value to precombination and

postcombination services ............................................................................ 3-22

3.5 Cash settlement of employee share-based payment awards.................................... 3-25

3.5.1 Initiated by the acquirer .............................................................................. 3-25

3.5.2 Initiated by the acquiree .............................................................................. 3-26

3.6 Other arrangements ................................................................................................... 3-27

3.6.1 “Last-man-standing” arrangements ........................................................... 3-27

3.6.2 “Dual trigger” arrangements ....................................................................... 3-28

3.7 Postcombination accounting for share-based payment awards .............................. 3-30

3.8 US GAAP and IFRS differences—income tax effects of share-based

payment awards ......................................................................................................... 3-32

3.8.1 Accounting for the income tax effects of replacement awards—IFRS ...... 3-32

3.9 US GAAP and IFRS difference—recognition of social charges ................................ 3-34

4 Intangible assets acquired in a business combination

4.1 Chapter overview ........................................................................................................ 4-2

Table of contents

x

4.2 Intangible assets and the identifiable criteria .......................................................... 4-2

4.2.1 Contractual-legal criterion .......................................................................... 4-3

4.2.2 Separability criterion ................................................................................... 4-4

4.2.3 Examples of applying the identifiable criteria ........................................... 4-5

4.3 Types of identifiable intangible assets ...................................................................... 4-6

4.3.1 Marketing-related intangible assets ........................................................... 4-8

4.3.1.1 Trademarks, trade names, and other types of marks ............... 4-8

4.3.1.2 Trade dress, newspaper mastheads, and internet

domain names ............................................................................. 4-9

4.3.1.3 Noncompetition agreements ...................................................... 4-9

4.3.1.4 Customer-related intangible assets ........................................... 4-10

4.3.1.5 Customer contracts and related customer relationships .......... 4-10

4.3.1.6 Noncontractual customer relationships .................................... 4-12

4.3.1.7 Customer lists ............................................................................. 4-13

4.3.1.8 Customer base ............................................................................. 4-13

4.3.1.9 Order or production backlog ...................................................... 4-13

4.3.2 Artistic-related intangible assets ................................................................ 4-14

4.3.3 Contract-based intangible assets ................................................................ 4-14

4.3.3.1 Contracts to service financial assets .......................................... 4-15

4.3.3.2 Employment contracts ............................................................... 4-15

4.3.3.3 Use rights .................................................................................... 4-16

4.3.3.4 Insurance and reinsurance contract intangible assets ............. 4-16

4.3.3.5 Favorable and unfavorable contracts ........................................ 4-16

4.3.3.6 At-the-money contracts .............................................................. 4-18

4.3.3.7 Lease agreements (accounted for under ASC 840 or

IAS 17) ......................................................................................... 4-18

4.3.4 Technology-based intangible assets ........................................................... 4-25

4.3.4.1 Intangible assets used in research and

development activities ................................................................ 4-26

4.3.4.2 Patented technology, unpatented technology, and

trade secrets ................................................................................ 4-26

Table of contents

xi

4.3.4.3 Computer software, mask works, databases, and

title plants ................................................................................... 4-26

4.4 Complementary intangible assets and grouping of other intangible assets ........... 4-27

4.4.1 Assessment of other factors in determining grouping of

complementary assets—US GAAP .............................................................. 4-28

4.5 Intangible assets that the acquirer does not intend to use or intends to use

differently than other market-participants ............................................................... 4-28

4.6 Summary of intangible assets and typical useful life characteristics found

in major industries ..................................................................................................... 4-30

4.7 Private company accounting alternative for intangible assets acquired in a

business combination under US GAAP ..................................................................... 4-34

4.7.1 Customer-related intangible assets ............................................................ 4-34

4.7.2 Noncompetition agreements ....................................................................... 4-36

4.7.3 Disclosures ................................................................................................... 4-36

4.7.4 Transition and related considerations ........................................................ 4-36

5 Partial acquisitions, step acquisitions, and accounting for changes in the

noncontrolling interest

5.1 Chapter overview ........................................................................................................ 5-2

5.2 Definition and classification of the noncontrolling interest .................................... 5-2

5.2.1 Measurement of the noncontrolling interest—fair value method ............. 5-3

5.2.2 Measurement of the noncontrolling interest—proportionate share

method—IFRS .............................................................................................. 5-3

5.3 Accounting for changes in ownership interest ......................................................... 5-4

5.4 Accounting for partial and step acquisitions ............................................................ 5-7

5.4.1 Fair value method ........................................................................................ 5-7

5.4.2 Remeasurement of previously held equity interest in a business or

VIE and recognition of gains and losses ..................................................... 5-7

5.4.3 Examples of the fair value method ............................................................. 5-8

5.4.4 Fair value considerations ............................................................................ 5-12

5.4.5 Consideration of goodwill when noncontrolling interest

exists—US GAAP .......................................................................................... 5-12

5.4.6 Consideration of goodwill when noncontrolling interest

exists—IFRS ................................................................................................. 5-12

5.4.7 Bargain purchase in a partial or step acquisition—US GAAP

companies and IFRS companies choosing the fair value method............. 5-13

5.4.8 Partial acquisition and step acquisition—proportionate share

method—IFRS .............................................................................................. 5-14

Table of contents

xii

5.4.9 Bargain purchase in a partial or step acquisition—proportionate

share method—IFRS .................................................................................... 5-17

5.5 Accounting for changes in ownership interest that do not result in

loss of control ............................................................................................................. 5-19

5.5.1 Parent company accounting for an equity-classified freestanding

written call option on subsidiary’s shares .................................................. 5-28

5.5.2 Parent company accounting for employee stock option issued

by a subsidiary.............................................................................................. 5-31

5.5.3 Accounting for a transaction in which a noncontrolling interest in a

wholly owned subsidiary is exchanged for a controlling interest in

another entity ............................................................................................... 5-31

5.5.4 Accumulated other comprehensive income considerations ...................... 5-33

5.5.5 Accumulated other comprehensive income considerations when the

parent disposes of a group of assets in a consolidated foreign entity ....... 5-34

5.5.6 Acquisition of a noncontrolling interest through a business

combination ................................................................................................. 5-35

5.5.7 Acquisition of additional ownership interests in a variable interest

entity—US GAAP .......................................................................................... 5-37

5.6 Changes in interest resulting in a loss of control...................................................... 5-37

5.6.1 Loss of control—US GAAP........................................................................... 5-38

5.6.2 Loss of control—IFRS .................................................................................. 5-38

5.6.3 Accounting for changes in interest if control is lost ................................... 5-39

5.6.4 Retained noncontrolling investment .......................................................... 5-43

5.6.5 Nonreciprocal transfer to owners ............................................................... 5-44

5.6.6 Multiple transactions or agreements that result in loss of control ........... 5-44

5.6.7 Multiple transactions or agreements that result in gaining control ......... 5-45

5.7 Attribution of net income and comprehensive income to controlling and

noncontrolling interests ............................................................................................. 5-45

5.7.1 Attribution of losses to noncontrolling interests in excess of carrying

amount of noncontrolling interests ............................................................ 5-46

5.7.2 Attribution of other items to noncontrolling interests in excess of

carrying amount of noncontrolling interests–US GAAP ........................... 5-46

5.8 Recognition of gain or loss by investor in a joint venture—IFRS ............................ 5-47

5.9 Accounting for transaction costs associated with sale or purchase of

noncontrolling interest .............................................................................................. 5-47

5.10 Required disclosures and supplemental schedule ................................................... 5-47

5.11 Classification of financial instruments as noncontrolling interest .......................... 5-48

Table of contents

xiii

6 Common control transactions

6.1 Chapter overview ........................................................................................................ 6-2

6.2 Common control transactions under US GAAP ....................................................... 6-3

6.2.1 Assessing whether common control exists ................................................. 6-4

6.2.1.1 Common control and control groups ........................................ 6-5

6.2.1.2 Entities consolidated under the variable interest

approach (the variable interest entities subsections

of ASC 810-10) ............................................................................ 6-6

6.2.1.3 Entities with a high degree of common ownership .................. 6-6

6.2.2 Nature of the transfer .................................................................................. 6-9

6.2.2.1 Specialized accounting considerations ...................................... 6-9

6.2.3 Accounting and reporting by the receiving entity ...................................... 6-12

6.2.3.1 Basis of transfer .......................................................................... 6-12

6.2.3.2 Guidance for presenting a change in reporting entity .............. 6-14

6.2.3.3 Determining the on-going reporting entity in certain

common control transactions .................................................... 6-15

6.2.3.4 Noncontrolling interest in a common control transaction ....... 6-17

6.2.3.5 Goodwill impairment and reporting unit assessment .............. 6-20

6.2.3.6 Deferred taxes ............................................................................. 6-22

6.2.3.7 Last-In, First-Out (LIFO) inventories ....................................... 6-23

6.2.3.8 Conforming accounting policies ................................................ 6-23

6.2.4 Accounting and reporting by the contributing entity ................................ 6-23

6.2.4.1 Accounting for the transfer ........................................................ 6-23

6.2.4.2 Allocation of contributed entity goodwill .................................. 6-25

6.2.4.3 Transfers to owners .................................................................... 6-26

6.3 Common control transactions under IFRS ............................................................... 6-27

6.3.1 Assessing whether common control exists ................................................. 6-28

6.3.1.1 Common control and control groups ........................................ 6-29

6.3.1.2 Entities with a high degree of common ownership .................. 6-31

6.3.2 Transitory common control ........................................................................ 6-32

Table of contents

xiv

6.3.3 Nature of the acquisition—group of assets or net assets

versus business............................................................................................. 6-34

6.3.4 Business combinations versus reorganisations ......................................... 6-34

6.3.5 Predecessor values method ......................................................................... 6-34

6.3.5.1 Basis of transfer .......................................................................... 6-34

6.3.5.2 Financial statement presentation .............................................. 6-36

6.3.6 Noncontrolling interest in a common control business combination ...... 6-36

6.3.7 Accounting and reporting by the selling (contributing) entity ................. 6-39

7 Asset acquisitions

7.1 Chapter overview ........................................................................................................ 7-2

7.2 Assets acquired in an exchange transaction ............................................................. 7-2

7.2.1 Initial Recognition ....................................................................................... 7-2

7.2.2 Initial measurement .................................................................................... 7-3

7.2.2.1 Nonmonetary transactions accounting—US GAAP .................. 7-3

7.2.2.2 Nonmonetary transactions accounting—IFRS ......................... 7-4

7.2.3 Allocating cost (the fair value of consideration given) .............................. 7-4

7.2.4 Accounting for an asset acquisition versus a business combination ........ 7-5

7.2.5 Accounting after acquisition ....................................................................... 7-12

7.2.6 Acquisition of intangible assets disclosures ............................................... 7-12

8 Accounting for intangible assets postacquisition—US GAAP

8.1 Chapter overview ........................................................................................................ 8-2

8.2 Indefinite-lived intangible assets .............................................................................. 8-2

8.2.1 Reclassification of intangible assets between indefinite-life and

finite-life categories ..................................................................................... 8-3

8.2.2 Renewable intangible assets ........................................................................ 8-3

8.2.3 Reacquired rights ......................................................................................... 8-4

8.2.4 Intangible assets used in research and developmental activities .............. 8-4

8.2.4.1 Enabling technology ................................................................... 8-5

8.3 Impairment of indefinite-lived intangible assets ..................................................... 8-5

8.3.1 The indefinite-lived intangible asset impairment test ............................... 8-6

8.3.1.1 The qualitative indefinite-lived intangible asset

impairment assessment.............................................................. 8-7

Table of contents

xv

8.3.1.2 Selecting an indefinite-lived intangible asset for the

qualitative assessment ................................................................ 8-8

8.3.1.3 Considering the results of prior fair value measurements

in the qualitative assessment ..................................................... 8-9

8.3.1.4 Periodically refreshing an indefinitve-lived asset’s

fair value ...................................................................................... 8-10

8.3.2 The quantitative indefinite-lived intangible asset impairment test .......... 8-10

8.3.2.1 Unit of accounting for indefinite-lived intangible assets ......... 8-10

8.4 Assets that an acquirer does not intend to actively use, including

defensive assets .......................................................................................................... 8-14

8.5 Financial statement presentation and disclosure guidance ..................................... 8-15

9 Accounting for goodwill postacquisition—US GAAP

9.1 Chapter overview ........................................................................................................ 9-2

9.2 Identify reporting units .............................................................................................. 9-3

9.2.1 Operating segments as the starting point for determining

reporting units ............................................................................................. 9-4

9.2.2 Reporting unit may be an operating segment or one level below ............. 9-5

9.2.3 Discrete financial information and business requirement

for components ............................................................................................ 9-5

9.2.4 Components are combined if economically similar ................................... 9-6

9.2.5 Aggregation of components across operating segments is

not permitted ............................................................................................... 9-6

9.2.6 Periodic reassessment of reporting units ................................................... 9-7

9.2.7 Summary of impact of reporting levels on determining

reporting units ............................................................................................. 9-7

9.3 Assigning assets and liabilities to reporting units .................................................... 9-10

9.3.1 Assigning assets and liabilities relating to multiple reporting units ......... 9-9

9.3.2 Assigning corporate assets and liabilities ................................................... 9-12

9.3.3 Interaction between assigning assets and liabilities to reporting units

and segment reporting................................................................................. 9-12

9.3.4 “Full” allocation for entities with a single reporting unit .......................... 9-12

9.3.5 Guidance for specific balance sheet components....................................... 9-12

9.4 Assigning all recorded goodwill to one or more reporting units ............................. 9-16

9.4.1 Determination and recognition of goodwill in partial acquisitions .......... 9-18

9.4.2 Goodwill attributable to controlling and noncontrolling interests ........... 9-19

Table of contents

xvi

9.4.3 Determination of fair value for the noncontrolling interest ...................... 9-20

9.4.4 Reassignment of goodwill as an acquirer’s reporting

structure changes ......................................................................................... 9-20

9.4.5 Translation of goodwill denominated in a foreign currency ..................... 9-22

9.4.6 Documentation to support goodwill assignment ....................................... 9-23

9.4.7 Other considerations ................................................................................... 9-24

9.4.7.1 Subsequent resolution of certain matters arising from

acquisitions recorded prior to the adoption of ASC 805

that may continue to impact goodwill ....................................... 9-24

9.4.7.2 Litigation stemming from a business combination .................. 9-25

9.5 Impairment model ..................................................................................................... 9-26

9.5.1 Timing considerations for goodwill impairment testing ........................... 9-27

9.5.1.1 Triggering events for goodwill impairment testing .................. 9-28

9.5.1.2 Annual goodwill impairment testing dates ............................... 9-31

9.6 The qualitative goodwill impairment assessment .................................................... 9-33

9.6.1 Selecting reporting units for the qualitative assessment ........................... 9-36

9.6.2 Considering the results of prior fair value measurements in the

qualitative assessment ................................................................................. 9-36

9.6.3 Periodically refreshing a reporting unit’s fair value .................................. 9-37

9.6.4 An entity’s assertion of its annual qualitative assessment ........................ 9-37

9.6.5 Qualitative assessment for reporting units with zero or negative

carrying amounts ......................................................................................... 9-38

9.7 Fair value considerations ........................................................................................... 9-39

9.7.1 Determining the fair value of a reporting unit ........................................... 9-39

9.7.2 Determining the fair value of reporting units to which goodwill has been

assigned ........................................................................................................ 9-40

9.7.3 Considerations unique to determining the fair value of reporting units

when using the income approach ............................................................... 9-42

9.7.4 Considerations unique to determining the fair value of reporting units

when using the market approach ................................................................ 9-43

9.7.5 Use of quoted market price of a reporting unit on a single date ............... 9-45

9.7.6 Use of more than one valuation technique to estimate the fair value of

a reporting unit ............................................................................................ 9-46

9.7.7 Reconciling the aggregate fair values of the reporting units to

market capitalization ................................................................................... 9-46

9.8 The quantitative goodwill impairment test............................................................... 9-48

Table of contents

xvii

9.8.1 Step one: fair value of the reporting unit .................................................... 9-48

9.8.1.1 Additional considerations for performing step one – prior

to adoption of ASU 2017-04 ....................................................... 9-48

9.8.1.2 Additional considerations for performing step one – after

adoption of ASU 2017-04 ........................................................... 9-49

9.8.1.3 Reporting units with zero or negative carrying amounts –

after adoption of ASU 2017-04 ................................................. 9-52

9.8.2 Step two: implied fair value – before the adoption of ASU 2017-04 ........ 9-52

9.8.2.1 Application of step two of the impairment test for goodwill .... 9-53

9.8.2.2 Step two may not always result in an impairment loss ............ 9-54

9.8.2.3 Consistency between the fair values used to test

indefinite-lived intangible assets for impairment and step

two of the goodwill impairment test .......................................... 9-54

9.8.2.4 Consistency of valuation methodologies between ASC 805

and step two of the goodwill impairment test ........................... 9-54

9.8.2.5 Estimate of an impairment loss if assessment is not

completed before issuing financial statements ......................... 9-56

9.9 Other impairment assessment considerations ......................................................... 9-56

9.9.1 Deferred income tax considerations when determining the fair

value of a reporting unit and the implied fair value of goodwill of

a reporting unit ............................................................................................ 9-56

9.9.1.1 Income tax effect of goodwill impairment loss – after

adoption of ASU 2017-04 ........................................................... 9-61

9.9.2 Impairment of goodwill shortly after acquisition ...................................... 9-63

9.9.3 Interaction with impairment testing for other assets ................................ 9-63

9.9.4 Impairment testing when a noncontrolling interest exists ....................... 9-64

9.9.4.1 Fair value of a noncontrolling interest may differ depending

on whether a noncontrolling interest exists above the

reporting unit or within the reporting unit ............................... 9-69

9.9.4.2 Impairment testing when a noncontrolling interest exists

and the reporting unit contains goodwill from

multiple acquisitions .................................................................. 9-70

9.9.4.3 Impairment testing of goodwill for separate subsidiary

financial statements.................................................................... 9-72

9.9.4.4 Impact of impairment at a subsidiary level on impairment

testing at the parent level ........................................................... 9-72

Table of contents

xviii

9.9.5 Equity-method investment goodwill not subject to the ASC 350-20

impairment test ............................................................................................ 9-73

9.9.6 Allocation of impairment to goodwill components for tax purposes ........ 9-74

9.9.7 Different aggregation of goodwill for ASC 740-10 and ASC 350-20......... 9-81

9.10 Disposal considerations ............................................................................................. 9-81

9.10.1 Impairment testing in connection with the disposal of a business ........... 9-82

9.10.2 Expectation of a disposal ............................................................................. 9-82

9.10.3 Assets held for sale ....................................................................................... 9-82

9.10.4 Disposal of the business .............................................................................. 9-83

9.10.5 Allocation of goodwill in a spin-off ............................................................. 9-85

9.10.6 Allocation of goodwill for a nonmonetary exchange transaction .............. 9-86

9.11 Presentation and disclosures ..................................................................................... 9-87

9.12 Private company accounting alternative ................................................................... 9-87

9.12.1 Amortization of goodwill .............................................................................

9-89

9.12.2 Amortization after initial adoption .............................................................

9-89

9.12.3 Impairment model ....................................................................................... 9-90

9.12.4 Level to test goodwill for impairment ......................................................... 9-90

9.12.5 Frequency of impairment testing ................................................................

9-90

9.12.6 The goodwill impairment test .....................................................................

9-90

9.12.7 Measurement of an impairment loss ..........................................................

9-91

9.12.8 Allocation of an impairment loss ................................................................

9-93

9.12.9 Disposal considerations ...............................................................................

9-94

9.12.10 Presentation and disclosure ........................................................................ 9-94

10 Postacquisition accounting issues—IFRS

10.1 Chapter overview ........................................................................................................ 10-2

10.2 Overview of impairment testing under IAS 36 ......................................................... 10-2

10.3 Accounting issues for the acquirer ............................................................................ 10-3

10.3.1 Indemnification assets ................................................................................. 10-3

10.3.2 Contingent consideration ............................................................................ 10-4

10.4 Intangible assets ......................................................................................................... 10-5

10.4.1 Grouping intangible assets .......................................................................... 10-5

10.4.2 Intangible assets—useful lives ..................................................................... 10-6

10.4.3 Renewal periods ........................................................................................... 10-6

10.4.4 Reacquired rights ......................................................................................... 10-6

Table of contents

xix

10.4.5 Indefinite useful lives .................................................................................. 10-7

10.4.6 Acquired in-process research and development ........................................ 10-7

10.4.7 Intangible assets that the acquirer does not intend to use ........................ 10-7

10.4.8 Amortization ................................................................................................ 10-7

10.4.9 Specific issues in impairment testing of intangible assets ........................ 10-8

10.5 Goodwill ...................................................................................................................... 10-10

10.5.1 Goodwill and the valuation choice for noncontrolling interests ............... 10-11

10.5.2 Allocating goodwill impairment losses to controlling and

noncontrolling interests .............................................................................. 10-12

10.5.3 Disposals and group reorganizations with goodwill .................................. 10-16

10.6 Impairment of assets .................................................................................................. 10-16

10.6.1 Scope of IAS 36 ............................................................................................ 10-16

10.6.2 Indicators of impairment ............................................................................ 10-17

10.6.3 Determination of cash-generating units ..................................................... 10-18

10.6.4 Grouping cash-generating units.................................................................. 10-19

10.6.5 Allocating assets and liabilities to cash-generating units .......................... 10-20

10.6.6 Determining recoverable amount—fair value less costs of disposal ......... 10-21

10.6.7 Determining recoverable amount—value in use ........................................ 10-22

10.6.8 Cash flows for value in use .......................................................................... 10-22

10.6.9 Selection of a discount rate ......................................................................... 10-23

10.6.10 Recognizing an impairment loss ................................................................. 10-23

10.6.11 Reversing an impairment loss ..................................................................... 10-24

11 Other business combination considerations

11.1 Chapter overview ........................................................................................................ 11-2

11.2 Insurance industry considerations ............................................................................ 11-2

11.2.1 Accounting for business combinations ....................................................... 11-2

11.2.2 Distinguishing between a business combination, a reinsurance

transaction, and an asset acquisition .......................................................... 11-3

11.2.3 Acquired insurance and reinsurance contracts in a business

combination ................................................................................................. 11-4

11.2.4 Insurance contract intangible assets and liabilities related to

insurance contracts acquired in a business combination .......................... 11-4

11.2.4.1 Insurance contract intangible asset and liabilities related to

acquired non-life short-duration and financial guarantee

insurance contracts under US GAAP ......................................... 11-4

Table of contents

xx

11.2.4.2 Insurance contract intangible asset and liabilities related

to acquired long-duration insurance contracts

under US GAAP .......................................................................... 11-6

11.2.4.3 Insurance contract intangible asset and liabilities related

to acquired insurance contracts under IFRS ............................ 11-8

11.2.4.4 Postcombination accounting for insurance contract

intangible asset and liabilities related to insurance

contracts acquired in a business combination .......................... 11-8

11.2.5 Other intangible assets recognized in a business combination .................

11-9

11.2.6 Contingent commissions and sellers’ claim liability guarantees .............. 11-10

11.3 Pushdown accounting ................................................................................................ 11-11

11.3.1 Scope ............................................................................................................. 11-11

11.3.2 Identifying the acquirer is the first step ..................................................... 11-11

11.3.3 Considerations when making the pushdown election ............................... 11-12

11.3.4 Change-in-control events ............................................................................ 11-12

11.3.5 When to make the pushdown accounting election .................................... 11-13

11.3.6 Applying pushdown accounting .................................................................. 11-13

11.3.7 Other considerations ................................................................................... 11-14

11.3.7.1 Expenses incurred on behalf of a subsidiary ............................. 11-15

11.3.7.2 Foreign currency translation ...................................................... 11-15

11.3.7.3 Tax bases ..................................................................................... 11-15

Appendices

A Professional literature ......................................................................................... A-1

B Technical references and abbreviations ........................................................ B-1

C Key terms ................................................................................................................. C-1

D Summary of significant changes ....................................................................... D-1

PwC 1-1

Chapter 1:

Scope

Scope

1-2

1.1 Chapter overview

This chapter discusses the key characteristics of a business and identifies which transactions require

the application of business combination accounting. Business combination accounting is referred to as

the “acquisition method” in ASC 805, Business Combinations (ASC 805), and in International

Financial Reporting Standard 3 (revised 2008), Business Combinations (IFRS 3) (collectively, the

“Standards”). Determining whether the acquisition method applies to a transaction begins with

understanding whether the transaction involves the acquisition of one or more businesses and

whether it is a business combination within the scope of the Standards.

Some differences exist between the definitions of a business combination under US generally accepted

accounting principles (US GAAP) and International Financial Reporting Standards (IFRS). The

converged definitions use terms that US GAAP and IFRS define differently in other nonconverged

standards. For example, the Standards state that for a business combination to occur, an acquirer

must obtain control over a business. US GAAP and IFRS define control differently. That difference

may lead to divergent accounting results. IFRS 10, Consolidated Financial Statements (IFRS 10),

incorporates the concepts of effective control and substantive potential voting rights, whereas US

GAAP does not.

New guidance

In January 2017, the FASB issued Accounting Standards Update 2017-01, Clarifying the Definition of

a Business. The changes to the definition of a business will likely result in more transactions being

accounted for as asset acquisitions rather than business combinations across most industries. The

definition of a business also affects many other areas of accounting, including disposals, consolidation,

and reporting unit determinations.

For public business entities, the guidance is effective for financial statements issued for fiscal years

beginning after December 15, 2017, and interim periods within those fiscal years. For all other entities,

the amendments are effective for financial statements issued for fiscal years beginning after December

15, 2018, and interim periods within fiscal years beginning after December 15, 2019. Early adoption is

permitted, including adoption in an interim period. Prospective application is required.

Guidance on whether an acquired group is an asset acquisition or a business combination

before and after adoption of ASU 2017-01 is covered in BCG 1.2 and 1.3, respectively.

Note about ongoing standard setting

As of the content cutoff date of this guide (December 2017), active FASB and IASB (collectively, the

“Boards”) projects may result in amendments to existing guidance. This includes the third phase in

the definition of a business project in which the FASB may revisit the accounting differences between

asset and business acquisitions and disposals.

Additionally, the IASB issued an exposure draft in June 2016 proposing to clarify the definition of a

business under IFRS 3, Business Combinations. The proposed amendments are substantially the same

as the amendments issued by the FASB in ASU 2017-01. A key distinction is the screen test (discussed

in BCG 1.3), which is required under US GAAP is optional in the IASB’s proposal. The proposed

amendments will likely result in more acquisitions being classified as asset acquisitions although the

impact is expected to be less significant compared to US GAAP. The new definition cannot be applied

under IFRS until guidance is issued and must be applied in accordance with the transition provisions.

Scope

1-3

Financial statement preparers and other users of this publication are encouraged to monitor the status

of these projects, evaluate the effective dates and determine the implications on accounting,

presentation and disclosure.

1.2 Definition of a business — before adoption of ASU

2017-01

All transactions in which an entity obtains control of one or more businesses qualify as business

combinations. The Standards establish the following principle for identifying a business combination:

Excerpts from ASC 805-10-25-1 and IFRS 3.3

An entity shall determine whether a transaction or other event is a business combination by applying

the definition in this Subtopic [IFRS], which requires that the assets acquired and liabilities assumed

constitute a business. If the assets acquired are not a business, the reporting entity shall account for

the transaction or other event as an asset acquisition.

It is straightforward in most cases to determine whether a group of acquired assets and assumed

liabilities (i.e., an integrated set of activities and assets) is a business. However, this determination can

be complicated in some instances, including when the fair value of the acquired group is concentrated

in just one or a few assets, or when the acquired group produces little or no revenue.

As discussed in ASC 805-10-55-5 and IFRS 3.B7, an acquired group must have inputs and processes

that make it capable of generating a return or economic benefit for the acquirer’s investors to be

considered a business. Economic benefits can occur in many forms, such as dividends, capital

appreciation, or cost reductions.

The Standards define a business, inputs, processes, and outputs as follows:

Excerpts from ASC 805-10-20, ASC 805-10-55-4 and IFRS 3.A, IFRS 3.B7

A business is an integrated set of activities and assets that is capable of being conducted and managed

for the purpose of providing a return in the form of dividends, lower costs, or other economic benefits

directly to investors or other owners, members, or participants.

A business consists of inputs and processes applied to those inputs that have the ability to create

outputs. Although businesses usually have outputs, outputs are not required for an integrated set to

qualify as a business. The three elements of a business are defined as follows:

a. Input: Any economic resource that creates, or has the ability to create, outputs when one or more

processes are applied to it. Examples include long-lived assets [non-current assets] (including

intangible assets or rights to use long-lived assets [non-current assets]), intellectual property, the

ability to obtain access to necessary materials or rights, and employees.

b. Process: Any system, standard, protocol, convention, or rule that when applied to an input, or

inputs, creates or has the ability to create outputs. Examples include strategic management

processes, operational processes, and resource management processes. These processes typically

are documented, but an organized workforce having the necessary skills and experience following

rules and conventions may provide the necessary processes that are capable of being applied to

Scope

1-4

inputs to create outputs. Accounting, billing, payroll, and other administrative systems typically

are not processes used to create outputs.

c. Output: The result of inputs and processes applied to those inputs that provide or have the ability

to provide a return in the form of dividends, lower costs, or other economic benefits directly to

investors or other owners, members, or participants.

Inputs and processes that are not used to create outputs are generally not considered significant to the

determination of whether the acquired group is a business. As discussed in ASC 805-10-55-4 and IFRS

3.B7, whether the acquired group includes or excludes certain administrative or support processes,

such as accounting, payroll, and other administrative systems, generally will not impact the

determination of whether a business exists.

Not all of the inputs and associated processes used by the seller need to be transferred to be

considered a business. Under ASC 805-10-55-5 and IFRS 3.B8, a business exists if a market-

participant (see BCG 1.2.4) is capable of continuing to manage the acquired group to provide a

return (e.g., the buyer would be able to integrate the acquired group with its own inputs and

processes). Inputs and associated processes used by the seller that were not transferred, but that can

be easily obtained, indicate the acquired group is a business. See BCG 1.2.4 for further information.

The nature of the elements (i.e., inputs, processes, and outputs) of a business varies based on industry,

structure (i.e., locations of operations), and stage of development. The analysis of whether the

necessary elements in an acquired group constitute a business is fact specific. A new or developing

business may not have or need as many inputs, processes, or outputs as a larger established business.

Additionally, the absence of an element generally found in a business does not mean that the acquired

group does not constitute a business. As discussed in ASC 805-10-55-6 and IFRS 3.B9, while nearly all

businesses have liabilities, an acquired group need not have any liabilities to be considered a business.

An acquired group or acquired input that contains no processes is not a business.

ASC 805-10-55-5 and IFRS 3.B8

To be capable of being conducted and managed for the purposes defined, an integrated set of activities

and assets requires two essential elements—inputs and processes applied to those inputs, which

together are or will be used to create outputs. However, a business need not include all of the inputs or

processes that the seller used in operating that business if market participants are capable of acquiring

the business and continuing to produce outputs, for example, by integrating the business with their

own inputs and processes.

The acquirer’s intended use of an acquired group of activities and assets is not a factor in the

determination of whether an acquired group constitutes a business. As detailed in ASC 805-10-55-8

and IFRS 3.B11, it is also not relevant whether the seller operated the acquired group as a business.

For example, the fact that the acquirer intends to split the acquired group into components, sell some

of the components, and integrate the remaining ones, does not impact the determination of whether

the acquired group as a whole is a business.

Scope

1-5

1.2.1 Development stage enterprises

Development stage enterprises that have no revenues may still be considered businesses. ASC 805-10-

55-7 and IFRS 3.B10 include key factors to consider to determine if a development stage enterprise is a

business, including whether:

□ Planned principal operations have begun

□ Employees, intellectual property, and other inputs and processes are present

□ A plan to produce outputs is being pursued

□ Access to customers that will purchase the outputs can be obtained

Not all of these conditions need to exist for a development stage enterprise to qualify as a business. For

example, under previous US GAAP, a development stage enterprise typically was not considered a

business until it had commenced its planned principal operations. Although a factor to consider, that

would not be a prerequisite under the Standards. Generally, a development stage enterprise that has

employees capable of developing a product will be considered a business.

1.2.2 The presence of goodwill

Under ASC 805-10-55-9 and IFRS 3.B12, it is presumed that a business exists when goodwill is present

in the acquired group. Evidence to the contrary would be needed to overcome this presumption.

Therefore, the presence of goodwill in the acquired group implies that the acquired group is a

business, and any inputs or processes that may be missing are unlikely to prevent the acquired group

from providing a return to its investors. An acquirer should consider whether all of the tangible and

intangible assets in the acquired group have been specifically identified, recognised, and correctly

valued before determining whether goodwill is present.

The lack of goodwill in an acquired group does not create a presumption that the acquired group is not a

business. An acquired group may constitute a business without any goodwill being present (e.g., a

bargain purchase as discussed in BCG 2.6.2).

1.2.3 Distinguishing a business from an asset or group of assets

Uncertainty may exist as to whether a transaction is the acquisition of a business or a group of assets.

The Standards provide a framework for making this determination. Under this framework, an entity:

□ Identifies the elements in the acquired group

□ Assesses the capability of the acquired group to produce outputs

□ Assesses the impact that any missing elements have on a market participant’s ability to produce

outputs with the acquired group

An entity should first identify the elements in the acquired group. If an asset or group of assets

(physical or intangible) is not accompanied by any associated processes, the acquired group is likely a

group of assets, not a business. Identifying the accompanying inputs and associated processes might

be difficult. For example, a company that purchases a hotel might consider the purchase to be a single

asset. However, in most cases, the company also acquires other inputs (e.g., employees, computer

Scope

1-6

equipment, furniture and fixtures, and other assets) and associated processes (e.g., a reservation

system, operating systems, procedures, and policies). Also, the acquired hotel may be a longstanding

operation that has a recognised name and regular customers. These factors taken together indicate

that the hotel is a business.

Next, the entity should analyze the acquired group’s capability to produce outputs—that is, to generate

a return to its investors, which may include dividends, capital appreciation, and cost reductions. If it is

determined that the acquired group is not capable of producing outputs, the entity would need to

identify the missing elements that will make the acquired group capable of doing so. After identifying

the missing elements, the entity should determine whether those elements can be provided by market

participants. As described in ASC 805-10-55-5 and IFRS 3.B8, a market participant may be able to

replace the missing elements by integrating the acquired group into its own operations. Missing

elements that can be easily replicated or obtained should be considered replaceable by market

participants. If market participants are not expected to be able to replace the missing elements and,

thus, manage the acquired group in a way that would provide a return to its investors,

ASC 805-10-55-5 and IFRS 3.B8 indicate that the acquired group would not be considered a business.

The ability of market participants to continue to manage the acquired group to provide a return

without the missing inputs and processes is a matter of judgment and is based on the individual facts

and circumstances.

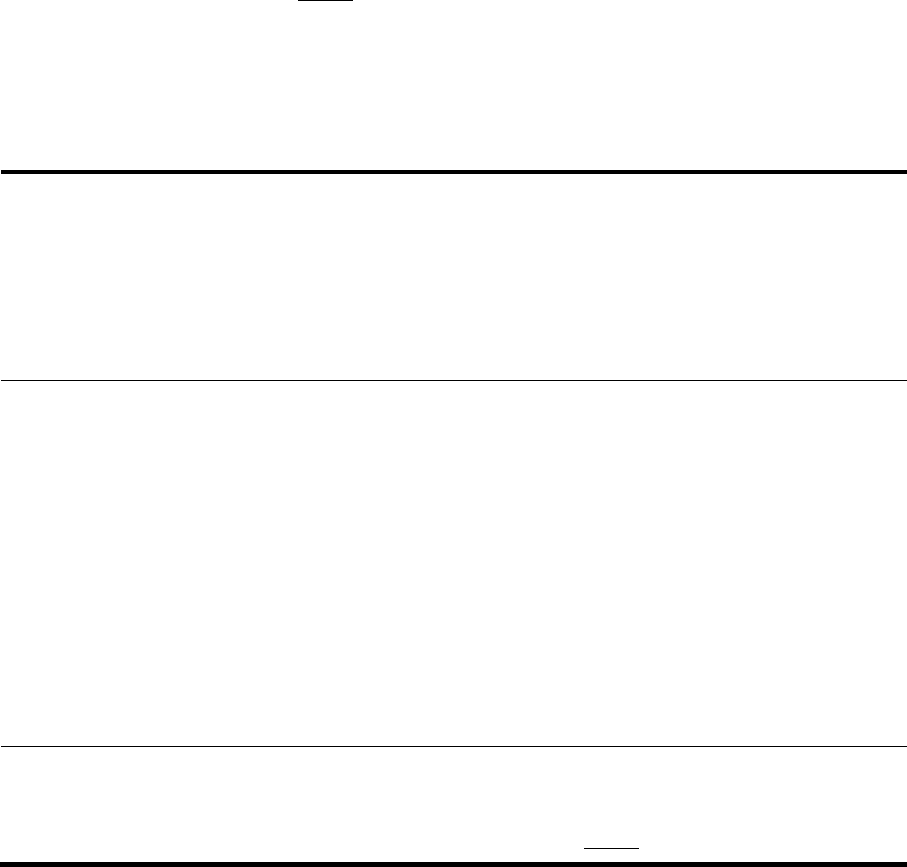

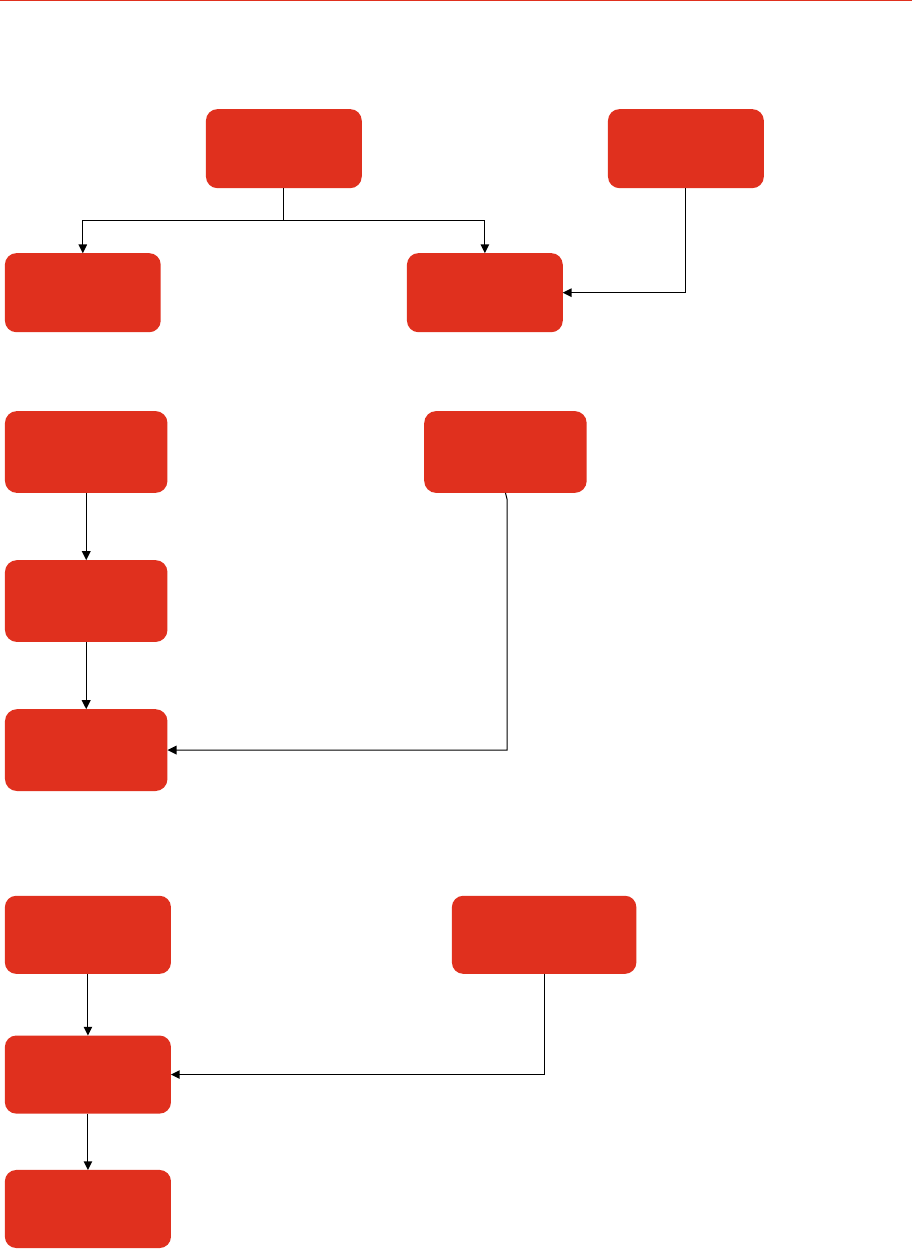

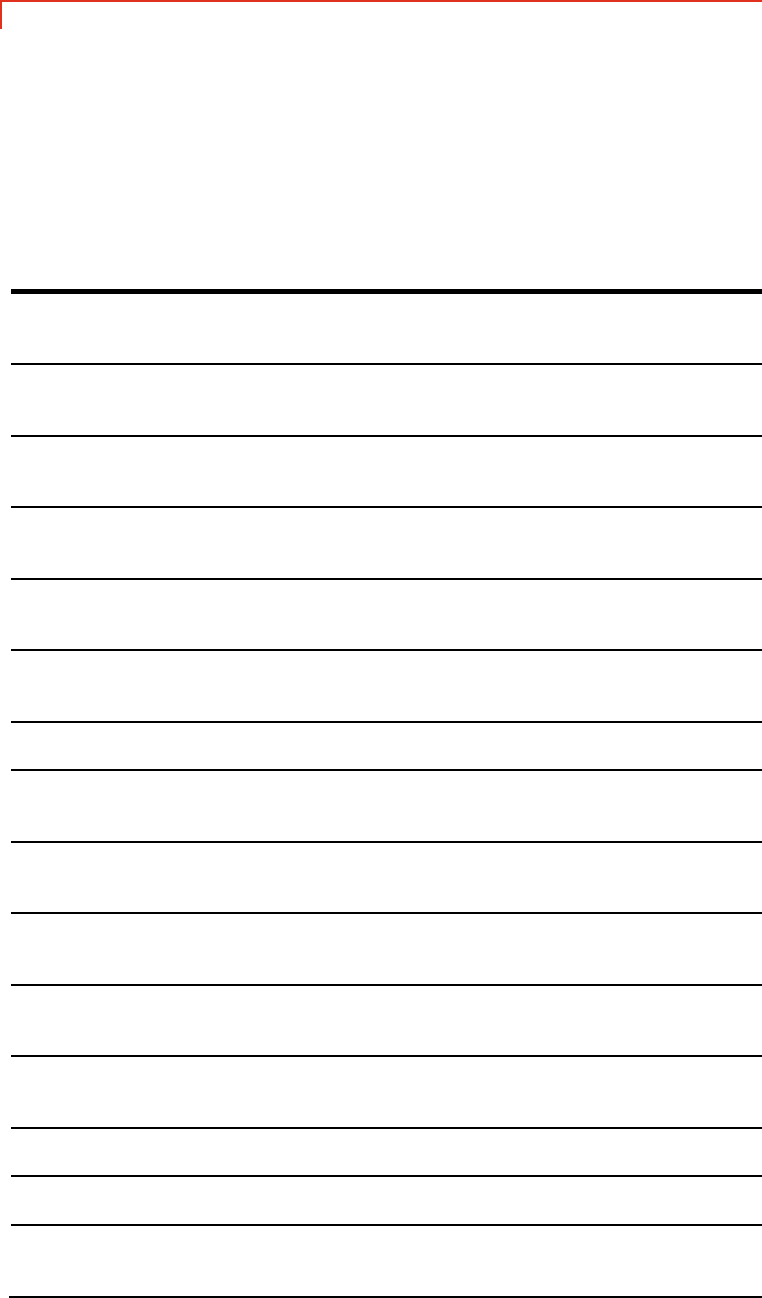

Figure 1-1 provides a framework to help determine whether a transaction is the acquisition of a

business or a group of assets.

Figure 1-1

Distinguishing a business from an asset or group of assets

Framework

Step 1:

Identify elements in the

acquired group

Step 2:

Assess capability of

the group to produce

outputs

Step 3:

Assess market

participants ability to

produce output

Input

What did the acquirer buy?

Output

What did the acquirer get

and want to get out of this

acquisition?

Process

Are there any existing process(es) transferred to the acquirer to produce the output?

Process

Are there any process(es)

attached to the inputs?

AssetsBusiness

Business Assets

Yes No

Yes

No

Yes

Yes No