Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Navigating India's Capital

Markets

Evolving Horizons

Message

Capital markets play a crucial role in fuelling economic growth and development in the country. The Indian capital

market is poised for continued growth, driven by a young and aspirational population, rising incomes, and increasing

financial literacy.In the economy, this vibrant and dynamic marketplace not only generates wealth but also provides an

avenue for individuals and companies to raise funds for productive purposes, fostering entrepreneurship and

investment. The capital market also provides options for risk diversification for investors, leading to enhanced overall

financial inclusion and economic stability.

To enhance investor confidence and attract more participants, the Indian government has introduced measures such

as simplified regulations, improved corporate governance practices, and greater transparency in reporting standards.

Initiatives taken by the government are crucial to enhance the overall efficiency, security, and effectiveness in the

operations. These reforms are not just incremental changes; they are transformative leaps that will unlock India's true

potential. While the strength and accessibility of Indian markets have been ensured by regulatory framework and

technological advancements, it is crucial to further strengthen the regulatory environment, expand market

participation, and promote financial literacy to foster a thriving and inclusive capital market in India.

Viksit Bharat @2047 aims to transform India into a developed economy focussed on strengthening the capital markets,

technology, infrastructure, etc. that promote the achievement of this goal. Widening the reach of the capital markets will

help in smoothening the business functions as it enables them to have a wider and more accessible market to pool

funds, increasing market liquidity and thus promoting ease of business. The vision of a developed India also intends to

deepen financial inclusion in the economy, by making necessary amendments in the key sectors and hence catering

towards enhanced knowledge about the capital markets and their uses so that even small and medium enterprises can

invest in such markets. With promising economic indicators and sustainable development, we firmly believe that India

will emerge as a developed economy with thriving capital markets by the time we celebrate our 100 years of

independence.

The role of Capital market in meeting India's long-term funding requirements assumes huge significance. In this context,

ASSOCHAM jointly with Resurgent India Ltd. has come out with this Report on the subject highlighting various aspects of

the capital market. We hope that the contents of the Report will provide valuable insights to policymakers and industry

stakeholders and the deliberations at the summit will help in laying the roadmap for future growth and development of

the Indian capital market.

Deepak Sood

Secretary General, ASSOCHAM

Deepak Sood

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

India's equity market, now the 5th largest globally by market capitalization, has seen an exponential increase in

retail investor participation, a testament to the burgeoning confidence in India's financial policies and market

mechanisms. The Bombay Stock Exchange (BSE) now boasts the highest number of listed companies worldwide,

highlighting the depth and diversity of India's corporate sector. This growth has been fueled by relentless

innovations and regulatory fortifications by the Securities and Exchange Board of India (SEBI), which has been

pivotal in enhancing market transparency and investor protection. India's transition to the T+1 settlement cycle,

ahead of many developed and emerging economies, exemplifies the market's efficiency and its forward-

thinking approach to financial transactions.

The debt market presents a nuanced narrative. While the government securities (G-Sec) market demonstrates

robust liquidity and an expanding investor base, the corporate bond market remains relatively underexplored. It

has had to contend with a blend of regulatory constraints and operational complexities. However, recognizing

these challenges, SEBI and the Reserve Bank of India (RBI) have embarked on a commendable journey to

invigorate this sector. Introducing market makers to enhance liquidity, and the push for a uniform valuation

framework, will likely lead to a strategic shift towards a more dynamic and inclusive debt market.

This report is a compendium of insights and forward-looking statements. It's crafted for stakeholders across the

spectrum – from policy-makers and global investors to financial enthusiasts and the academic community –

offering a granular analysis of current trends, regulatory advancements, and the potential trajectory of India's

financial markets.

As we look towards the future, it's clear that India's financial markets are not just growing in size but are becoming

more sophisticated, inclusive, and aligned with global best practices. This evolution is a beacon of India's broader

economic aspirations and its unwavering commitment to becoming a central hub in the global financial

ecosystem.

Message

Jyoti Prakash Gadia

Managing Director, Resurgent India Ltd

Jyoti Prakash Gadia

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

TABLE OF CONTENTS

SR.NO CHAPTERS PAGE

1 Executive Summary 6

2

Contemporary Landscape of

Indian Capital Markets

9

3

Government Initiatives and Regulatory

Environment

19

4

5

6

Capital Markets for Indian SMEs

A Comparative Analysis

Key Findings

22

25

27

Executive Summary

Over the past two decades, India's financial markets have matured and grown to find a place amongst the

largest markets. As of December 2023, our market cap has hit a remarkable $4.379 trillion, placing it fifth among

the top 10 highest-valued countries worldwide.

The advent of digital platforms such as Zerodha Kite, Upstox Pro, Angel Broking Mobile App, Groww, ICICI Direct,

HDFC Securities Mobile Trading, Kotak Stock Trader, 5paisa Mobile App, Sharekhan App, Motilal Oswal MO Investor

App and Edelweiss Mobile Trader has catalysed a significant increase in retail investor participation in financial

markets. While the echoes of pandemic-induced uncertainties linger they have not dampened the enthusiasm

of market participants. Concurrently regulatory bodies are proactively instituting reforms designed to bolster the

transparency and stability of the financial markets promising a more robust framework for investors moving

forward.

India's equity market has evolved to become a benchmark of development and innovation, aligning itself with

global standards. It now proudly stands as the 5th largest in the world in terms of market capitalization. The

Bombay Stock Exchange (BSE), a flagship Indian exchange, is recognized for having the highest number of listed

companies worldwide. This growth is a testament to India's commitment to technological advancements and

regulatory enhancements. The surge in retail investor participation is particularly noteworthy, thanks to the

Securities and Exchange Board of India (SEBI)'s efforts towards investor education and protection. India's

pioneering move to the T+1 settlement cycle exemplifies its leadership in market practices, setting a precedent

for both developed and emerging markets.

The landscape of India's debt market, while robust for government securities in liquidity and investor

engagement, reveals the corporate bond segment's untapped potential. The corporate bond market faces

challenges including a preference for private placements, limited retail engagement, and regulatory and

operational complexities that deter risk-taking. Despite India boasting a large economy and a substantial

domestic government bond market, it remains excluded from major global government bond debt indexes. As a

result, it misses out on the substantial portfolio inflows typically associated with inclusion in these indexes. This

exclusion hinders India's ability to leverage its economic size and market potential to draw significant foreign

investment and diversify its funding sources. Expanding domestic financial markets will lead to a more efficient

distribution of investment funds and improved resource pricing, simplifying the execution of national agendas

for privatization and innovation.

A large share of Indian household income goes into savings. While more than half of it goes into physical assets

like gold and housing the rest goes into financial assets which are then available for investments by companies

and governments.

Capital formation in India involving public and private sectors witnessed an investment boom from 2004 to 2008

CHAPTER 1

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

6

India's Vision 2047 encompasses a broad and ambitious plan to transform the nation into a developed economy,

emphasizing significant advancements across various sectors, including capital markets, infrastructure,

technology, and social welfare. This vision aligns with the goal of creating a $30 trillion economy by leveraging

India's demographic dividend, technological innovation, and sustainable development practices. One of the key

aspects of this vision is the development and strengthening of capital markets as a crucial element for mobilizing

resources to fund infrastructure and foster economic growth.

With Vision 2047's emphasis on infrastructure, technology, and social welfare, there's a critical need to expand

and deepen capital markets. This involves introducing more diversified financial instruments, India’s inclusion in

a greater number of global indices, and enhancing market liquidity, thereby making it easier for businesses and

projects aligned with Vision 2047's goals to access funding. As of the end of 2022, foreign investors held less than

1% of the total outstanding government bonds. Greater influx of foreign investment into India's public sector will

unlock substantial resources and significantly bolster the capital accessible for the nation's economic

expansion. Broader index inclusion could help raise foreign involvement in India's government bond market to

10% from the existing 0.9% (source: Institute of International Finance).

Key Aspects of Vision 2047 and Capital Formation

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

with the Gross Fixed Capital Formation (GFCF) to GDP ratio peaking at 34.7% in 2008. Following the global financial

crisis this ratio moderated showing a downward trend until 2017 and slightly recovering in 2018.

Recent trends indicate a decline in household financial savings to 5.1% of GDP in FY 2023 from 7.2% in FY 2022

alongside an increase in financial liabilities from 3.8% to 5.8% of GDP. Despite these challenges the national

initiative ensuring universal access to bank accounts has established a robust framework to potentially elevate

financial savings.

7

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Fostering Innovation and Entrepreneurship

A key aspect of capital formation in the context of Vision 2047 is the support for innovation and entrepreneurship.

Capital markets can provide the necessary risk capital for startups and innovative projects that contribute to

technological advancements and sustainable development. By creating a favorable regulatory and investment

environment, India can attract more venture capital and private equity investment, essential for nurturing a

culture of innovation.

Strengthening Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs) have been identified as a crucial mechanism for accelerating infrastructure

development, a major pillar of Vision 2047. Capital markets can support PPPs by providing innovative financing

solutions, such as infrastructure investment trusts (InvITs) and municipal bonds. These instruments enable

private investment in public projects, ensuring efficient capital utilization and sharing of risks and rewards

between the public and private sectors.

Promoting Sustainable and Green Finance

Aligned with Vision 2047's focus on sustainable development, there's a growing importance of green finance

within capital markets. Encouraging the issuance of green bonds and other sustainable financial products can

direct capital towards environmentally friendly and sustainable projects. This not only supports India's

commitment to environmental sustainability but also opens up new investment avenues for socially responsible

investors.

Enhancing Financial Inclusion

Capital formation in the context of Vision 2047 also involves enhancing financial inclusion. By leveraging

technology to broaden access to capital markets, India can ensure that a larger segment of the population

benefits from economic growth. This includes facilitating small and medium-sized enterprises (SMEs) access to

public markets and providing retail investors with opportunities to invest in government and corporate bonds.

The vision also emphasizes ramping up government spending on education to global standards and unlocking

the healthcare services sector. These efforts aim to build human capital capable of supporting India's ambitious

economic growth and development goals. To support the vision of a tech-driven economy, three centres of

excellence for artificial intelligence are planned to be established in prestigious educational institutions. This

aligns with the goal of making AI in India and making AI work for India, fostering innovation and technological

advancement. India's Vision 2047 incorporates a strong emphasis on sustainable growth, including initiatives

like the National Hydrogen Mission aimed at making India a hub for green hydrogen production. This reflects a

broader commitment to green growth and climate action.

8

Contemporary Landscape of Indian Capital Markets

The 2024 outlook for the Indian stock market appears highly favourable, driven by robust economic growth,

strong corporate earnings and increased domestic investment. The optimism stems, in good measure, from

India's status as the fastest-growing major economy with growth expected to surpass at least 6% in the

foreseeable future, bolstering domestic equities. The surge in young Indian investors and mutual fund accounts

further supports this trajectory.

Foreign Institutional Investors (FIIs) and Foreign Direct Investment (FDI) have been instrumental in shaping

India's market dynamics, demonstrating worldwide confidence in its economic potential and significantly

contributing to market liquidity and overall sentiment. The latest figures indicate a strong foreign investment

presence in India's financial markets, showcasing both Foreign Institutional Investors (FIIs) and Foreign Portfolio

Investors (FPIs)'s active participation. This trend of substantial investments indicates continued confidence

among foreign investors in the Indian market's potential, despite some instances of selling in September 2023.

These investments reflect a broad-based endorsement of India's economic and market fundamentals,

suggesting that despite occasional market volatilities, the overall investor sentiment towards India remains

positive. The inflows from FII and FPI investments are crucial for India's financial market liquidity and can

significantly impact market movements and the rupee's exchange rate against other currencies. The Indian

government's efforts to liberalize regulations for foreign capital have significantly increased the attractiveness of

the Indian market for global investors. This regulatory liberalization, along with improved financial awareness

and better access to financial services, has notably influenced the influx of foreign institutional investments.

CHAPTER 2

Initial Public Offerings in India

The IPO market in India has experienced remarkable growth expanding from US$22 billion in 2021 to US$3.26

trillion in 2023. This surge can be attributed to a strong domestic capital market, a sizable retail investor base, and

an adaptable regulatory framework overseen by SEBI. The rise in IPO activity not only confirms India's status as a

major investment hub but also highlights the efficacy of SEBI's regulatory measures in fostering a fair and

transparent market environment. India's IPO landscape has been bustling with companies from various sectors

making their public debut.

In December 2023, Muthoot Microfin Limited, Inox India Limited, and India Shelter Finance Corporation Ltd came

up their IPOs. Notable companies like Ixigo, VLCC Healthcare, GPT Healthcare, Penna Cement, and Snapdeal are

poised to enter the public market aiming for significant capital raises through their IPOs. Additionally, firms such

as Rashi Peripherals, Platinum Industries, Exicom Tele-Systems, and Entero Healthcare Solutions are scheduled to

launch their IPOs covering a diverse range of industries from technology to healthcare.

The diversity of companies entering the public market reflects the vibrancy and growth potential of the Indian

economy. The Indian IPO market offers a mix of mainline and SME offerings accommodating a broad spectrum of

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

9

Recent Developments

SEBI has implemented several regulatory revisions aimed at bolstering transparency and safeguarding investor

interests within the capital markets. Notably the SEBI (Alternative Investment Funds) (Amendment) Regulations,

2024 have introduced notable modifications such as mandating Alternative Investment Funds (AIFs) to maintain

investments in dematerialized form unless certain exceptions apply with the objective of augmenting

transparency in investment holdings. Moreover, the amendment requires AIFs to designate a custodian for

securities safekeeping with specific guidelines outlined for custodians affiliated with the AIF's Sponsor or

Manager thereby ensuring autonomy and clarity in the custodial process.

Equity, commodities and forex derivatives segment remain the most vibrant parts of the Indian capital markets

and draws the attention of both retail and institutional participants. Over the span of three years leading up to

March, retail investor involvement in India's equity derivatives market surged by 500%.

According to the most recent data available, derivatives trading comprising futures and options commands a

significant share of trading volume in Indian capital markets with options trading alone representing 98% of all

derivatives contracts traded in India. This substantial presence of derivatives trading underscores the depth of

the market and the active involvement of both retail and institutional investors in these segments. The regulatory

authority, SEBI maintains continuous oversight of this activity to uphold market stability and safeguard investor

interests.

However heightened activity has also raised concerns among regulators regarding potential risks for retail

investors amidst market volatility. A notable proportion of individual traders incurred losses prompting the SEBI to

contemplate measures aimed at limiting retail investors' exposure to derivatives based on their wealth.

In like manner, the corporate debt market experienced expansion as companies sought funds through bonds

and debentures. In 2024, India's debt market is anticipated to remain an attractive investment avenue with

wealth managers expressing optimism about the country's economic prospects despite macroeconomic

challenges. Positive sentiments surround fixed income investments anticipating capital gains from expected

rate cuts in both India and the U.S. Additionally, there is considerable interest in alternative investments like

private credit and real estate funds. This outlook reflects a general sentiment that although specific sectors may

exhibit some overvaluation, the overall valuation landscape in India is somewhat stretched but not overly

concerning.

Additionally, mutual funds continued to be a favoured investment choice among retail investors offering a

variety of schemes and options. India's mutual fund industry has witnessed significant growth driven by factors

such as increased retail participation, growing recognition of mutual funds as viable investment vehicles and

technological advancements facilitating easier access to mutual fund investments. Key trends observed in

recent years expected to persist into 2024 include a surge in systematic investment plan (SIP) contributions,

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

10

investors seeking portfolio diversification or exposure to new markets. SEBI has been proactively engaged in

fostering retail investment by streamlining the IPO application process and promoting investor education. The

proliferation of demat accounts in India, a key metric reflecting retail involvement, has witnessed substantial

growth, surpassing notable benchmarks.

India's equity market has not evolved in isolation but as part of a global financial ecosystem increasingly

interconnected and influenced by technological advancements. The introduction of electronic trading systems

in the 1990s marked a pivotal moment, enhancing market accessibility and efficiency. Similarly, the global trend

towards dematerialization facilitated smoother, more secure transactions, aligning India with international

standards.

Moreover, the liberalization of the Indian economy in the early 1990s played a crucial role in attracting foreign

investments, leading to a more integrated market. The gradual relaxation of foreign direct investment (FDI)

norms has further bolstered this integration, making India an attractive destination for global investors.

Key Market Segments: Challenges and Recommendations

Equities: A Global Context

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

11

heightened interest in debt and hybrid funds amid market volatility, and a rise in investments in sector-specific

and thematic funds.

The notable expansion in Assets under Management (AUM) within India's mutual fund sector reflects increased

investor confidence. Asset Management Companies (AMCs) have widened their portfolio offerings to

encompass a diverse array of mutual fund landscape into a robust and vibrant segment including thematic,

sector-focused, ESG (Environmental, Social and Governance) funds and funds with specific maturity targets.

There has been a significant rise in the utilization of digital channels for mutual fund investments facilitated by

web platforms and mobile applications thereby extending reach to a broader investor base.

While platforms like the SME exchange are steps in the right direction, more innovative policies could further

boost SME participation. For instance, offering tax incentives for investments in SMEs or creating a dedicated fund

to provide financial support could encourage more listings and investment in this segment.

Policy Innovations for SMEs

Debt Markets

The potential of India's debt market, particularly the corporate bond segment, is immense, yet unlocking this

potential requires overcoming significant hurdles. The G-Sec (Government Securities) market in India is

comparatively more developed, serving as a benchmark for risk-free rates and playing a crucial role in the

financial system. However, the corporate bond market lags in development, facing challenges such as limited

liquidity, a narrow investor base, and regulatory constraints. Addressing these issues can catalyze the market's

growth, providing a vital financing avenue for businesses and contributing to economic development.

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Innovations such as algorithmic trading and artificial intelligence (AI) can enhance market efficiency and

transparency. However, to fully leverage these technologies, there needs to be a regulatory framework that

ensures fair practices and minimizes systemic risks. Furthermore, blockchain technology could revolutionize

trade clearing and settlement processes, making them more secure and efficient.

Fostering Innovation and Technology in Trading

Path Forward

The use of big data analytics in market surveillance can be a game-changer in identifying and mitigating risks

associated with market manipulation and fraud. By analyzing trading patterns in real-time, regulators can

detect anomalies that may indicate manipulative practices, thereby enhancing market integrity.

Leveraging Big Data for Market Surveillance

Efforts to educate investors should go beyond traditional methods and leverage digital platforms to reach a

wider audience. Initiatives like gamified learning experiences and mobile applications that offer simplified

investment advice could bridge the financial literacy gap. Furthermore, promoting financial inclusion by easing

access to investment opportunities for underrepresented sections of the population could contribute to more

balanced market growth.

Inclusive Growth and Financial Inclusion

While market volatility and corporate governance issues are well-acknowledged challenges, deeper structural

issues also merit attention. For instance, the skewed market capitalization, where a few large-cap stocks

dominate trading volumes, reflects underlying issues in market breadth. This concentration risk can exacerbate

market volatility and limit the market's ability to function as a barometer for the broader economy.

Another nuanced challenge is the digital divide and financial literacy gap, which affects the equitable

participation of the investor base. While urban areas have seen a surge in investor participation, rural areas

remain underrepresented, partly due to limited access to digital platforms and financial education.

Challenges: Beyond the Surface

12

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Overcoming Challenges

The Indian financial system's heavy reliance on bank financing, especially for infrastructure projects, points to a

deeper issue of risk aversion and a lack of market mechanisms to effectively price and manage credit risk.

Developing a more vibrant corporate bond market could provide an alternative financing route, potentially

lowering the cost of capital and spreading risk more broadly across the economy.

Bridging the Gap Between Bank Financing and Bond Financing

While simplifying issuance norms and reducing compliance costs are critical steps, regulatory reforms could

also include creating a more favorable tax regime for bond investments and introducing more flexible credit

rating criteria for issuers. This could help smaller and medium-sized enterprises (SMEs) access the bond market,

diversifying the issuer base.

Regulatory Reforms: Beyond Simplification

Enhancing liquidity in the secondary market is vital for the growth of the corporate bond market. Beyond

traditional measures like market-making schemes, leveraging financial technology (FinTech) can play a

transformative role. For instance, blockchain technology could streamline the issuance and settlement process,

reduce costs, and increase transparency. Similarly, AI and machine learning could enhance credit risk

assessment, making it easier for investors to evaluate bond investments.

Market Infrastructure Development: Leveraging Technology

Allowing greater participation from foreign and institutional investors is crucial. However, this should be coupled

with strategies to broaden the domestic investor base. Innovative financial instruments such as bond ETFs

(Exchange-Traded Funds) and infrastructure investment trusts (InvITs) can make bond investments more

accessible to retail investors. Moreover, developing a credit default swap (CDS) market could mitigate credit risk

concerns, making corporate bonds more attractive to a wider array of investors.

Expanding the Investor Base: Strategic Approaches

13

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Widening the Derivatives Market

India's derivatives market, a crucial component of the financial ecosystem, has seen remarkable growth,

especially in the equity derivatives segment. This growth reflects an increasing appetite among investors for

sophisticated financial instruments that can hedge against market volatility. However, the journey ahead

involves navigating through complexities to unlock further growth. This includes expanding product diversity,

simplifying regulatory frameworks, and enhancing investor education to ensure a deeper understanding of

these complex instruments.

The introduction of a broader array of derivative products such as commodity derivatives, credit derivatives, and

even weather derivatives could significantly enhance the market's utility and attractiveness. For instance,

commodity derivatives can provide a critical hedging tool for stakeholders in India's vast agricultural sector,

offering protection against price volatility. Credit derivatives, on the other hand, can offer new ways to manage

credit risk, especially valuable in a growing economy with diverse credit profiles.

Innovations such as structured derivatives, which cater to specific investor needs by combining various

underlying assets, could also add depth to the market. These products can meet the sophisticated hedging and

investment strategies of institutional investors while potentially opening new avenues for retail investor

engagement through simplified structures.

Product Innovation: Beyond Equity Derivatives

Pathways to Growth

Promoting the issuance of green bonds and bonds financing sustainable projects could tap into the growing

global demand for ESG (Environmental, Social, and Governance) investments. This not only provides a new

avenue for issuers but also aligns India's debt market development with global sustainability goals.

Encouraging Green Bonds and Sustainable Financing

A corporate bond guarantee mechanism, possibly backed by the government or a consortium of banks, could

mitigate the perceived risk of corporate bond investments. This would encourage more conservative investors,

such as pension funds and insurance companies, to allocate a portion of their portfolios to corporate bonds.

Developing a Corporate Bond Guarantee Mechanism

Fostering an ecosystem that encourages financial innovation can lead to the development of new financial

products and platforms that enhance market efficiency and accessibility. Regulatory sandboxes, where new

financial products and technologies can be tested under relaxed regulatory conditions, could encourage

innovation in the debt market space.

Creating an Ecosystem for Financial Innovation

A corporate bond guarantee mechanism, possibly backed by the government or a consortium of banks, could

mitigate the perceived risk of corporate bond investments. This would encourage more conservative investors,

such as pension funds and insurance companies, to allocate a portion of their portfolios to corporate bonds.

Developing a Corporate Bond Guarantee Mechanism

14

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Simplification and Education: Demystifying Derivatives

The complexity of derivatives often acts as a barrier to entry for a significant portion of potential market

participants. Streamlining regulatory processes to make it easier for both issuers and investors to engage with

derivative products is crucial. This simplification must be accompanied by robust educational initiatives aimed

at demystifying derivatives for retail investors. Such initiatives could include interactive webinars, virtual trading

simulations, and comprehensive guides that cover the basics of derivatives trading, risk management, and

strategic applications.

Strengthening risk management frameworks is essential to safeguard against systemic risks, particularly as the

derivatives market grows and diversifies. This involves not only the implementation of robust regulatory

measures and oversight mechanisms but also encouraging the adoption of advanced risk management

practices among market participants. For instance, the use of AI and machine learning in monitoring market

patterns and risks can offer more nuanced insights into potential vulnerabilities, enabling preemptive actions to

mitigate risks.

Risk Management: A Foundation for Innovation

An integrated approach that considers the interdependencies between the equity, debt, and derivatives

markets is essential for a cohesive financial market development strategy. This involves:

• Coordinated Regulatory Reforms: Regulatory harmonization across different segments of the financial

market is crucial. A unified approach by SEBI (Securities and Exchange Board of India), RBI (Reserve Bank of India),

and the Ministry of Finance can ensure that reforms are aligned and mutually reinforcing, promoting a balanced

market development.

• Infrastructure and Technological Advancements: The role of technology in enhancing market

infrastructure cannot be overstated. Advanced trading platforms, real-time settlement systems, and state-of-

the-art cybersecurity measures can significantly improve efficiency, accessibility, and confidence in the

financial markets.

Integrating Strategies for Financial Market Development

15

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

The theme of Environmental, Social, and Governance (ESG) has not only cemented its relevance across the

globe's capital markets but has also started sprouting within India, indicating a shift towards more sustainable

investment practices. The projection for global ESG Assets Under Management (AUM) is set for a robust increase

moving from approximately USD 20 trillion in 2021 to an estimated USD 34 trillion by 2026 which would represent

about 22% of the total AUM. This growth is not just numerical; it's reflective of a deeper trend where companies

prioritizing ESG are delivering superior margins and returns. This edge is largely due to more favourable capital

costs with ESG indices worldwide also outperforming traditional market benchmarks underscoring the financial

viability of sustainable investing.

Meanwhile challenges in China, including issues with reporting standards, labour law compliance, the impacts of

its zero-Covid policy and various socio-economic concerns have somewhat stifled its ESG performance. This

situation opens the door wider for India to step in as a more attractive destination for ESG-focused investments

from around the globe. Looking ahead ESG is poised to become a cornerstone in the decision-making process

within Indian capital markets and is projected to account for approximately 34% of the country's total domestic

AUM by 2047. This anticipated growth is likely to be fueled not only by the advent of new ESG assets emerging from

sectors like Renewable Energy, Electric Vehicles (EV), Green Hydrogen, and Climate Tech but also through the

reclassification of existing assets not previously identified under the ESG umbrella, marking a significant evolution

in how investments are viewed and valued in India's financial landscape.

The role of ESG factors in the Indian capital market has been gaining significant momentum with a strong focus on

non-financial reporting and sustainability practices. The evolving ESG landscape in India highlights the increased

demand for transparency and accountability from companies regarding their ESG initiatives. This shift is largely

driven by stakeholders’ expectations and the understanding that addressing ESG issues is crucial for long-term

sustainability and resilience in the face of challenges like the COVID-19 pandemic.

A key development in this area is the SEBI initiative to enhance ESG disclosures and practices among Indian

companies. This model includes Key Performance Indicators (KPIs) under environmental, social and governance

attributes for reasonable assurance focusing on aspects such as water footprint, gender diversity, greenhouse

gas footprint and employee well-being and safety.

The push towards ESG reporting in India reflects a broader trend of integrating ESG factors into corporate

decision-making and reporting processes. Companies are now expected to align their sustainability

interventions with leading ESG reporting standards and integrate ESG analytics to provide a comprehensive

picture of the organization's value creation. This integration is crucial for attracting and retaining investors who are

increasingly considering ESG factors in their investment decisions. The Task Force on Climate-related Financial

Disclosures (TCFD) recommendations have also been highlighted as a comprehensive framework for companies

to report climate risks and opportunities aiding investors in analysing potential financial impacts due to climate

change.

The effect of the new ESG framework extends beyond the listed companies impacting supply chains and smaller

enterprises. It emphasizes the importance of ESG footprints across a company's supply chain urging listed

companies to support their partners in developing processes for ESG disclosures. This approach aims to provide a

Role of Environmental, Social and Governance (ESG) in Indian Capital Market

16

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

The Indian capital markets are undergoing transformative changes, driven by data and technology trends that

are reshaping the landscape for investors, corporations, and regulators. The confluence of rising interest rates,

increased ESG reporting and investing, a booming insurance sector, and significant investments in technology to

harness data, points to a rapidly evolving market environment.

One of the notable trends is the shift towards digitalization, prompted by the growing competitiveness in the

financial industry. Financial institutions are increasingly partnering with fintech firms to digitize their operations

to boost operational agility and remain competitive. This evolution is essential for staying relevant in the modern

era, with more banks and financial institutions digitizing their operating models to stay ahead of the competition.

India needs to focus on the interplay of data and technology, considering the unique dynamics of the Indian

economy, regulatory environment, and technological adoption trends.

The integration of blockchain, cybersecurity enhancements, Regulatory Technologies (RegTech), cloud

computing, and fintech collaborations within India's capital markets marks significant progress. However,

substantial efforts are still required to fully leverage these technologies for market advancement:

Data and technology for new age market challenges

While blockchain's potential to transform clearing and settlement processes is recognized, its widespread

adoption across India's capital markets remains in its infancy. More initiatives and pilot projects are needed to

test blockchain's efficacy in real-world scenarios, ensuring that the technology can significantly reduce

settlement times and enhance security and transparency while addressing counterparty risks effectively.

Blockchain for Enhanced Security and Transparency

17

complete picture of ESG risks and impacts thereby enhancing transparency and mitigating green washing risks.

India's evolving ESG landscape represents a significant shift towards sustainable and responsible business

practices driven by regulatory changes, investor demand and a broader societal recognition of the importance of

ESG factors. Companies that adapt to these changes and effectively integrate ESG principles into their operations

are likely to benefit from increased investor interest, better risk management, and a more sustainable growth

trajectory.

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

RegTech's potential to streamline compliance with complex regulatory requirements is clear, yet the full

deployment of automated compliance tools remains to be achieved. The capital markets ecosystem needs to

embrace these technologies more broadly, ensuring that AI-powered tools are effectively monitoring

transactions and identifying non-compliant activities.

Regulatory Technologies (RegTech) for Compliance

The benefits of cloud computing for scalability, flexibility, and cost efficiency are well acknowledged. However,

deeper integration of cloud solutions into the capital markets infrastructure is required to unlock these benefits

fully. This involves not just adopting cloud technologies but also optimizing cloud-based platforms for data

analysis and investment strategy development across the market spectrum.

Cloud Computing for Scalability and Efficiency

Fintech collaborations have indeed played a crucial role in making financial products more accessible. Yet, to

truly democratize access to capital markets, there needs to be a concerted effort to expand these collaborations,

reaching underserved and rural populations. This requires innovative approaches and solutions that cater to the

unique needs of these segments, further simplifying investment processes and enhancing financial literacy.

Fintech Collaborations for Financial Inclusion

18

Despite the Securities and Exchange Board of India (SEBI) issuing guidelines to strengthen cybersecurity

practices, the constantly evolving nature of cyber threats necessitates ongoing vigilance and continuous

improvement of cybersecurity measures. Market participants and regulators must stay ahead of emerging

threats by adopting cutting-edge security technologies and practices.

Increased Focus on Cybersecurity

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Government Initiatives and Regulatory Environment

The regulatory framework and government initiatives in the Indian capital markets have evolved significantly to

promote transparency, efficiency, and investor protection. The Securities and Exchange Board of India (SEBI),

along with other regulatory bodies like the Reserve Bank of India (RBI), Insurance Regulatory and Development

Authority (IRDA), and Pension Fund Regulatory and Development Authority (PFRDA), play pivotal roles in

overseeing various aspects of the financial sector. SEBI, in particular, regulates investment products and has

been instrumental in implementing policies to deepen the securities markets and foster innovations in financial

instruments.

A noteworthy regulatory aspect is the multiple regulatory architecture, which encompasses product-wise

regulators for different financial products, including credit, investment, insurance, and pension products. The

Forward Markets Commission (FMC), which was merged with SEBI in late 2015, exemplifies efforts to consolidate

regulatory oversight for enhanced market efficiency.

Quasi-regulatory agencies like the National Bank for Agriculture and Rural Development (NABARD), Small

Industries Development Bank of India (SIDBI), and National Housing Bank (NHB) also contribute to the regulatory

landscape by supervising and regulating specific financial institutions and activities. Central ministries,

especially the Ministry of Finance (MoF), and state governments through the Registrar of Cooperatives play a

significant role in policy-making and regulation.

The establishment of the Financial Sector Development Council (FSDC) marked an important development in

India's regulatory architecture. The FSDC, which replaced the High-Level Committee on Capital Markets, acts as

a council of regulators with the Finance Minister as chairman. It aims to resolve inter-agency disputes, oversee

the regulation of financial conglomerates, and perform wealth management functions dealing with multiple

products.

Recent developments by SEBI have focused on enhancing market activities and investor protection. For instance,

SEBI's amendments to the SEBI (Delisting of Equity Shares) Regulations, 2021, and the introduction of a standard

operating procedure for the delisting of a listed subsidiary company through a scheme of arrangement highlight

the regulator's commitment to clarity and transparency in market operations. These amendments aim to

provide greater flexibility to issuers, ensure transparency in the issuance of non-convertible securities, and

clarify the criteria for companies in the same line of business seeking delisting.

Key initiatives include the implementation of more detailed disclosure requirements for market participants. This

move is designed to empower investors with crucial information necessary for making informed decisions, thus

strengthening investor protection and enhancing risk assessment. By requiring comprehensive disclosures

about risks specific to businesses, operations, and financial positions, SEBI aims to equip investors with the tools

needed for thorough risk assessments. This initiative not only improves corporate governance by mandating

transparency in related-party transactions, board composition, and remuneration policies but also ensures

market integrity by preventing the dissemination of false or misleading data. Moreover, these disclosure norms

CHAPTER 3

19

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

contribute to efficient price discovery, attracting both domestic and foreign investments and fostering market

development and innovation.

These regulatory advancements are a testament to SEBI's dedication to refining the operational efficiency of the

Indian Capital Markets ensuring they remain robust, transparent and investor-friendly amidst the evolving

global economic landscape.

The EY IPO Trends Report places Indian stock exchanges at the forefront of the global IPO arena in 2023

showcasing India's leadership in terms of the number of IPOs and its commendable 8th place ranking in terms of

funds raised. A diverse array of IPO activities has been noted in the mainboard including noteworthy fundraising

efforts by an infrastructure investment trust. Additionally the SME sector has demonstrated significant growth

signalling a buoyant trend in India's IPO activities. Key sectors leading this surge include Hospitality &

Construction, Automotive & Transportation, Diversified Industrial Products, and Real Estate, reflecting a broad-

based interest across various industries.

These positive movements are indicative of the concerted efforts by Indian Capital Markets to refine and

strengthen regulatory mechanisms, bolster corporate governance standards and enhance investor knowledge

and engagement. SEBI's regulatory updates aim to heighten market transparency and operational practices.

Innovations such as adjustments in issue pricing, the introduction of Key Performance Indicators (KPIs) for clearer

disclosures and the pioneering establishment of the Social Stock Exchange mark significant strides towards this

goal.

To address the evolving landscape of the Indian capital markets, the regulators needs to undertake several

targeted actions, particularly in the areas of sustainability, technological innovation, and financial literacy.

We need to harness AI and machine learning technologies to enhance its regulatory oversight capabilities.

Utilizing these technologies for real-time market surveillance can help in detecting unusual market activities

more efficiently, thereby preventing fraud and ensuring market integrity.

Implementing AI and Machine Learning in Regulatory Processes

The adoption of blockchain technology in the settlement and clearing process is another area the regulator

needs to explore. Blockchain can offer an immutable record of transactions, significantly reducing the risk of

fraud and errors, and streamlining the entire process for greater efficiency.

Leveraging Blockchain for Increased Transparency

20

While focusing on ESG reporting for larger corporations, SEBI also needs to develop specific ESG guidelines

tailored for Micro, Small, and Medium Enterprises (MSMEs). These guidelines should recognize the unique

challenges and resource constraints faced by MSMEs, providing them with a feasible roadmap for sustainable

business practices that can enhance their attractiveness to socially conscious investors.

Developing a Comprehensive ESG Framework for MSMEs

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Given the burgeoning interest in cryptocurrency and digital assets, India needs to introduce regulatory

sandboxes specific to this domain. This would allow for the experimentation with crypto-related products in a

controlled environment, helping SEBI to formulate appropriate regulations that ensure investor protection while

fostering innovation.

Introducing Sandbox Regulations for Cryptocurrency

21

To boost financial literacy, SEBI may consider creating a unified digital platform offering curated educational

content tailored to different investor segments. This platform could leverage interactive tools, simulations, and

gamification to make learning about capital markets engaging and accessible to all, especially targeting

younger investors to cultivate a culture of informed investing from an early age.

Creating a Unified Digital Platform for Investor Education

The regulators needs to encourage the development and issuance of green bonds by offering regulatory

incentives and creating a supportive ecosystem. This would not only align with global sustainability goals but

also provide a boost to projects focused on renewable energy, waste management, and biodiversity

conservation within India.

Encouraging Development of Green Bonds

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Capital Markets for Indian SMEs

CHAPTER 4

SMEs have traditionally found it challenging to utilize traditional capital markets for financing largely due to an

ecosystem that has not been fully accommodating. Their unique financing needs especially for operational

liquidity and a scarcity of resources for managing regulatory compliance and navigating market intricacies

have been significant obstacles. Enhancing and simplifying the access mechanisms to make them both cost-

efficient and user-friendly is vital. Such improvements would significantly empower SMEs offering them an

effective pathway to harness capital markets for their funding requirements thereby fostering their growth and

development in a positive and formal manner.

SME IPOs

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024*

43

67

135

144

54

27

59

109

182

19

260.21

536.68

1,752.88

2,396.82

657

168

787

1,980

4,967

557

Year

No. of IPOs

Amount Raised

(in Rs. Crore)

3

Initially, the number of IPOs and the capital raised showed variability, with a notable increase peaking in 2018.

Following a downturn in 2019 and 2020, influenced by market volatility, there was a significant recovery, reaching

an all-time high in 2023 in terms of both the number of IPOs and the amount raised. The early data for 2024

suggests a decrease, indicating a potential normalization of market activities or the preliminary nature of the

year's data. This trend analysis reflects the increasing utilization and success of IPOs as a financing mechanism,

highlighting the growing confidence in the market.

22

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

BSE and the NSE have established specialized platforms for Small and Medium Enterprises (SMEs) designated as

BSE SME and NSE EMERGE respectively. These platforms have been specifically designed to furnish SMEs with a

more accessible channel for securing capital via the public market. They permit listings under more lenient

criteria in comparison to those required for the main board, thus catering to the distinctive requirements of SMEs.

Though there is a noticeable shift towards these markets, a significant number of SMEs lack knowledge about the

listing requirements and procedures on stock exchanges. The costs associated with listing even on the Bombay

Stock Exchange and National Stock Exchange remain prohibitive for many.

From the time of SME establishments the platforms BSE SME and NSE Emerge have witnessed a consistent rise in

SME listings. A substantial number of SMEs that have pursued listings on these platforms have experienced

notable growth following their public offering. This growth is evidenced by an increase in their stock prices, along

with enhanced visibility and credibility within the investor community.

In an effort to bolster SME participation in capital markets the Indian government along with regulatory entities

such as the Securities and Exchange Board of India (SEBI) have introduced a suite of initiatives and policies. These

include the simplification of compliance norms to lower the regulatory and compliance hurdles for SMEs aiming

to list on specialized SME platforms the establishment of a Fund of Funds by the Small Industries Development

Bank of India (SIDBI) to provide indirect financial support to SMEs thereby aiding their growth and ensuring they

meet the prerequisites for listing.

Despite these initiatives, SMEs in India face significant barriers to accessing capital markets. These challenges

stem from a lack of awareness and prevalent misconceptions about the complexity and cost of listing on SME

exchanges. Additionally the extensive preparation required for a public listing including financial restructuring

and meeting corporate governance standards can be overwhelming for SMEs. However, the considerable

benefits of accessing capital markets for Indian SMEs are evident. Entering public markets can supply the

essential capital needed for growth, enhance corporate governance, and boost visibility and credibility among

both customers and investors.

Key areas for the growth and development of SMEs

To stimulate growth in SME capital markets, it's essential to develop a robust investor base that is keen on

investing in SMEs. This involves not just attracting institutional investors but also individual investors who see

value in SME growth. Policy measures could include tax incentives for investments in SME sectors, creation of

dedicated SME investment funds, and facilitating platforms that connect SMEs with potential investors.

Encouraging venture capital and private equity investments into SMEs by providing regulatory ease and

financial incentives can also play a significant role.

Building Investor Bases for SME Markets

Market literacy is critical for both SMEs and investors. For SMEs, understanding the nuances of accessing capital

markets, the requirements for listing, and how to manage investor relations is crucial. For investors,

understanding the unique value proposition of SMEs, the risk profile, and the potential for growth within the SME

Enhancing Market Literacy Among SMEs and Investors

23

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Reducing the time it takes for SMEs to raise funds is vital for their growth and operational efficiency. Simplifying

regulatory requirements, creating fast-track listing processes for SMEs, and enabling technology-driven

platforms for quicker fundraising can significantly help. For example, digital crowdfunding platforms and peer-

to-peer lending can offer SMEs quicker access to capital. Regulatory sandbox environments can also be created

to test innovative financing models without the normal regulatory constraints

Speeding Up Fund-Raising for SMEs

Streamlining the listing process on stock exchanges for SMEs is crucial. This can involve reducing the paperwork,

lowering the costs associated with listing, and providing a simplified regulatory framework that balances

investor protection with the need for SMEs to access public markets. The development of dedicated SME trading

platforms or boards within existing exchanges can also provide tailored listing options that are more suited to the

needs and capabilities of SMEs.

Simplifying Listing Procedures

Transparency and the flow of information are fundamental to a thriving SME capital market. Regularly publishing

data on SME performance, market trends, and investment opportunities can boost investor confidence and SME

visibility. Creating online portals and databases where such information is readily accessible will help in making

informed decisions for both SMEs and investors.

Ensuring Effective Information Dissemination

24

sector are essential. Workshops, seminars, and digital platforms offering resources and training can significantly

enhance market literacy. Regulatory bodies and industry associations could collaborate to create educational

content and certification programs for SMEs and investors.

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

A Comparative Analysis

CHAPTER 5

Recent data reveals that India has reached an unprecedented peak in its share of global market capitalization,

around 3.4%, which surpasses its long-term average of 2.5%. This achievement places India at the forefront of

global market valuation contributors, highlighting its growing influence and resilience in the face of a general

decline in global market capitalization.

With China's economic growth rate decelerating, there is a marked shift towards India as an alternative

epicentre for growth, cementing its role as a critical driver in both emerging and global markets. Furthermore the

combination of possessing the largest general and youthful populations globally which presents a

demographic advantage along with a government that is both market-friendly and democratically elected

provides a solid basis for stock selection and the potential for outstanding performance.

Comparatively, when looking at the Indian and US stock markets, there are notable differences in performance,

volatility, sector dominance, and valuations. Over the past ten years, the Dow Jones Index has generally offered

better returns than the BSE Sensex, with a more stable performance. The correlation between the two markets

suggests a semi-strong relationship, indicating the importance of cautious diversification strategies. Indian

markets have been riskier, with higher volatility compared to the US markets. In terms of sector weightage,

financials dominate the Indian indices, whereas tech firms have more weight in the US markets. Valuation-wise,

the Sensex has a higher PE ratio, suggesting market expectations of faster earnings growth for Indian companies

compared to US companies.

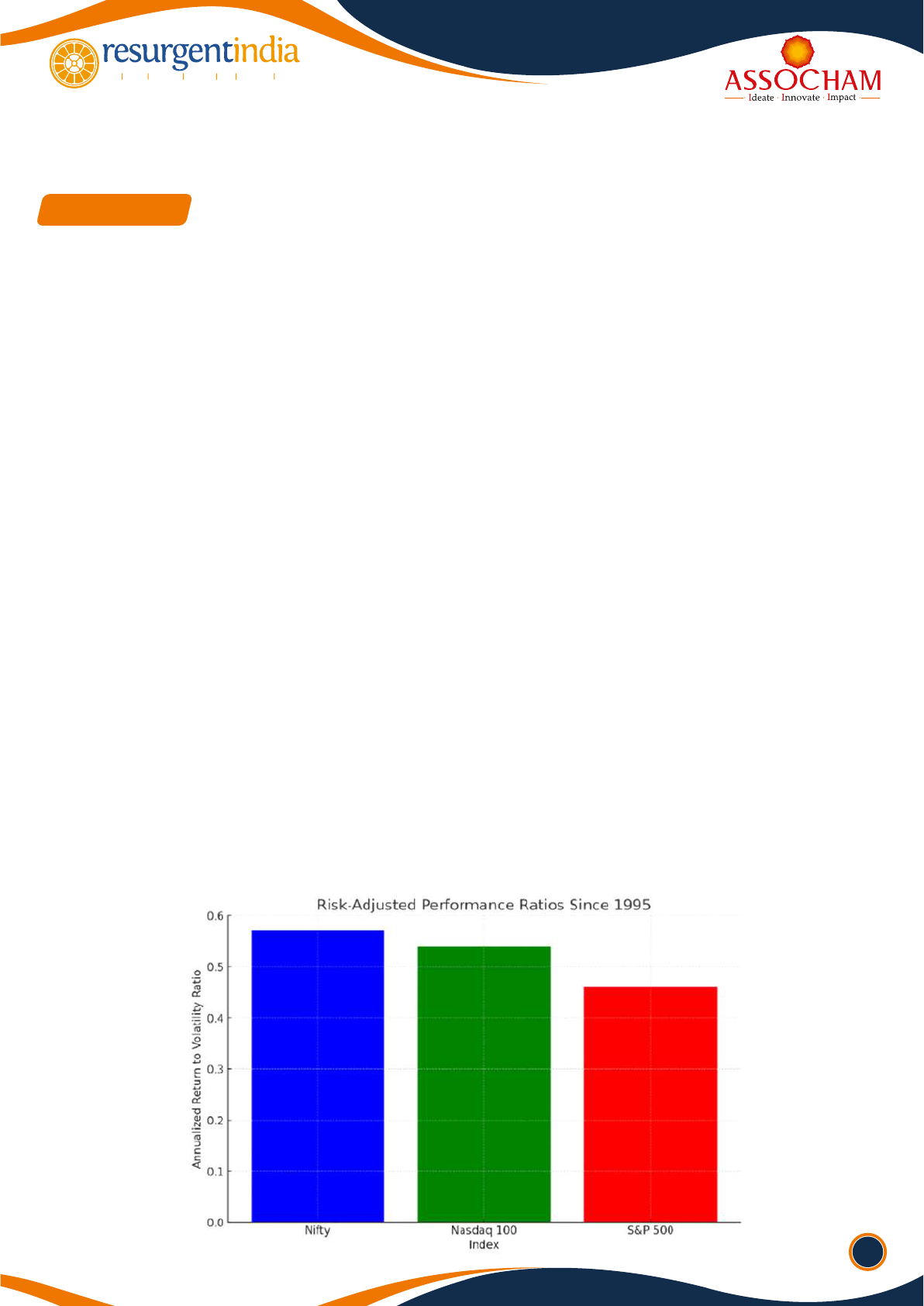

Since its inception in 1995, the Nifty, India's benchmark equity index, has demonstrated a notable annualized

return to volatility ratio of 0.57. This outperforms the ratios of the Nasdaq 100 (0.54) and the S&P 500 (0.46),

indicating that the Indian market has historically provided strong returns for lower volatility.

25

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

The bar chart above illustrates the Risk-Adjusted Performance Ratios since 1995 for the Nifty, Nasdaq 100, and S&P

500 indices. It highlights that the Nifty has outperformed both the Nasdaq 100 and S&P 500 in terms of the

annualized return to volatility ratio, showcasing the Indian market's capacity to provide strong returns with lower

volatility historically.

The bar chart above conceptually illustrates the comparison of market size and activity, highlighting the market

capitalization of the Indian stock market in relation to the combined markets of Korea and Taiwan, as well as

trading volumes in comparison to Hong Kong. India's significant position in the global financial landscape is

conspicuous, with its market capitalization surpassing that of Korea and Taiwan combined, and a thriving capital

market evinced by the number of IPOs exceeding those issued by the United States.

India is set to join the JPMorgan Government Bond Index-Emerging Markets (GBI-EM) on June 28, 2024, with a

potential weight of up to 10%. This inclusion is expected to enhance the bond market's depth, diminish risk

premiums, lower capital costs, and fortify debt sustainability.

Furthermore, the low correlation of Indian equities with global markets, as highlighted by the MSCI India Index's

beta of approximately 0.6 to the MSCI Emerging Markets Index, underscores India's improved economic.

Additionally, India's recognition as a low geopolitical risk nation within the emerging market spectrum, along with

its status as an oil importer, positions it to potentially benefit from stable or decreasing oil.

26

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Key Findings

CHAPTER 6

India's capital markets have undergone a transformative journey over the past two decades, emerging as a

formidable force on the global financial stage. With market capitalization reaching an impressive $4.379 trillion

by December 2023, India now ranks among the top five highest-valued countries worldwide, a testament to its

burgeoning financial sector and the increasing confidence of both domestic and international investors. This

growth trajectory has been significantly bolstered by the advent of digital trading platforms and a progressive

regulatory landscape, aimed at enhancing market transparency and stability. However, challenges such as

India's exclusion from major global government bond debt indexes highlight the need for strategic interventions

to harness its economic size and market potential fully.

Against this backdrop, India's Vision 2047 articulates an ambitious blueprint for transforming the nation into a

developed economy, emphasizing the pivotal role of capital markets in mobilizing resources for infrastructure,

technological innovation, and economic growth. The following points outline strategic recommendations to

navigate the complexities of an evolving financial ecosystem.

1. Market Cap and Global Influence: India's impressive market capitalization not only showcases its

economic strength but also its potential to shape global finance. To capitalize on this, India could spearhead

international finance forums and alliances, advocating for more inclusive global finance policies and creating

bilateral investment treaties to ease cross-border investments.

2. Capital Formation and Infrastructure: Directing savings into national development through

infrastructure bonds offers a dual benefit: ensuring robust returns for investors and funding critical projects. India

could incentivize these bonds through tax benefits and guarantees, making them a cornerstone for funding

ambitious infrastructure projects aligned with smart city initiatives and rural development.

3. Sector-Specific Funds for Vision 2047: To materially support Vision 2047, India could focus on creating

27

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

sector specific funds. These funds, supported by both government and private sector expertise, would not only

provide capital but also mentorship, fostering innovation that aligns with India's developmental goals.

4. Attracting Foreign Investment: Beyond easing regulatory barriers, India could implement a

comprehensive strategy for global outreach, involving diplomatic engagement, investment roadshows, and

targeted marketing campaigns highlighting its robust legal and economic reforms. Establishing India-centric

investment funds in key foreign markets could also act as a conduit for funneling investments into Indian

enterprises.

5. Financing Innovation and Entrepreneurship: Introducing innovation-focused investment vehicles could

channelize funds into high-growth sectors. Additionally, tax incentives for corporate investments in innovation

hubs would encourage more private sector involvement in nurturing entrepreneurship.

6. Promoting Green Finance: Introducing a green bond market framework that includes standardized

metrics for environmental impact and benefits could help in the promotion of green finance.

7. Technology-Driven Financial Inclusion: Leveraging India's strong IT sector to develop user-friendly

platforms for underserved populations could accelerate financial inclusion, integrating more citizens into the

financial growth narrative. Partnering with fintech companies to develop localized financial education apps

would ensure that the benefits of financial inclusion are widely understood and embraced.

8. Diversifying the IPO Market: To encourage a broader range of companies to go public, India could begin

with simplifying the IPO process for tech and green energy firms and introduce fast-track approval lanes. This,

combined with public awareness campaigns highlighting the benefits of investing in these sectors, could help

diversify investment options.

9. Corporate Debt Market: The establishment of a partial credit guarantee fund could de-risk investments

in corporate bonds, particularly for infrastructure projects. This would make corporate bonds more attractive to

pension funds and insurance companies, diversifying their investment portfolios.

10. Enhancing SME Access to Capital Markets: Simplifying the listing process on SME platforms and reducing

associated costs could encourage more SMEs to access public markets. Launching a nationwide mentorship

program that pairs upcoming SMEs with experienced market players could demystify the process of going

public, enhancing SME participation in capital markets.

These suggestions aim to harness the current strengths of India's capital markets while addressing areas for

growth and innovation, laying a foundation for sustained economic development aligned with India's strategic

goals.

28

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Report Sources:

• Unlocking India’s Capital Markets Potential _ S&P Global.pdf

• https://mospi.gov.in/105-capital-markets

• https://nasscom.in/knowledge-center/publications/technology-sector-india-2023-

strategic-review

• https://www2.deloitte.com/in/en/pages/technology/articles/tech-trends-2023.html

• https://investorsarchive.ltimindtree.com/insights/resources/tech-trends-global-capital-

markets-fy-2023

• https://www.globalxetfs.com/india-outlook-2024-the-secular-growth-story/

• https://www.spglobal.com/en/research-insights/featured/special-editorial/look-

forward/unlocking-india-s-capital-markets-potential

• https://www.businesstoday.in/markets/stocks/story/india-share-global-market-

capitalisation-all-time-high-what-lies-ahead-346625-2022-09-07

29

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

Disclaimer

The information contained in the document is of a general nature and is not intended

to address the objectives, financial situations, or needs of any particular individual or

entity. It is provided for informational purposes only and does not constitute, nor should

it be regarded in any manner whatsoever, as advice and is not intended to influence a

person in making a decision, including, if applicable, in relation to a financial product or

an interest in a financial product. Although we endeavor to provide accurate and

timely information, there can be no guarantee that such information is accurate or

that it will continue to be accurate in the future. No one should act on such information

without appropriate professional advice and without a thorough examination of the

particular situation.

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

About ASSOCHAM

The Associated Chambers of Commerce & Industry of India (ASSOCHAM) is the country’s oldest apex chamber. It

brings in actionable insights to strengthen the Indian ecosystem, leveraging its network of more than 4,50,000

members, of which MSMEs represent a large segment. With a strong presence in states, and key cities globally,

ASSOCHAM also has more than 400 associations, federations, and regional chambers in its fold.

Aligned with the vision of creating a New India, ASSOCHAM works as a conduit between the industry and the

Government. The Chamber is an agile and forward-looking institution, leading various initiatives to enhance the

global competitiveness of the Indian industry, while strengthening the domestic ecosystem.

With more than 100 national and regional sector councils, ASSOCHAM is an impactful representative of the Indian

industry. These Councils are led by well-known industry leaders, academicians, economists and independent

professionals. The Chamber focuses on aligning critical needs and interests of the industry with the growth

aspirations of the nation.

ASSOCHAM is driving four strategic priorities – Sustainability, Empowerment, Entrepreneurship and Digitisation.

The Chamber believes that affirmative action in these areas would help drive an inclusive and sustainable

socio-economic growth for the country.

ASSOCHAM is working hand in hand with the government, regulators, and national and international think tanks

to contribute to the policy making process and share vital feedback on implementation of decisions of far-

reaching consequences. In line with its focus on being future-ready, the Chamber is building a strong network of

knowledge architects. Thus, ASSOCHAM is all set to redefine the dynamics of growth and development in the

technology-driven ‘Knowledge-Based Economy. The Chamber aims to empower stakeholders in the Indian

economy by inculcating knowledge that will be the catalyst of growth in the dynamic global environment.

The Chamber also supports civil society through citizenship programmes, to drive inclusive development.

ASSOCHAM’s member network leads initiatives in various segments such as empowerment, healthcare,

education and skilling, hygiene, affirmative action, road safety, livelihood, life skills, sustainability, to name a few.

The Knowledge Architect of Corporate India

RESURGENT INDIA LTD.

SEBI - Registered CAT - I Merchant Bank

Regn. No. INM000012144 / ISO 9001 : 2015 Certified

Mob. : +91 7840 000 667

www.resurgentindia.com

PAN INDIA PRESENCE

AHMEDABAD

MUMBAI

PUNE

GURGAON

LUDHIANA

JAIPUR

UDAIPUR

SURAT

BANGALORE

LUCKNOW

VARANASI

KOLKATA

BHOPAL

INDORE

BHUBANESWAR

HYDERABAD

CHENNAI

LEADING INVESTMENT BANKING FIRM

LEADING INVESTMENT BANKING FIRMLEADING INVESTMENT BANKING FIRM

TEV STUDY & DPR

VALUATION & TRANSACTION

ADVISORY

RESTRUCTURING

DEBT SYNDICATION

EQUITY FUNDRAISING

MERGERS & ACQUISITIONS

LEGAL SERVICES

ASM / LIE REPORT

SERVICES OFFERING

Debt

Equity

Valuaon

Advisory

TEV

Insolvency

Training

The Associated Chambers of Commerce and Industry of India

4th Floor, YMCA Cultural Centre and Library Building,

01, Jai Singh Road, New Delhi - 110001

Tel : 011-46550500 (Hunting Line) Fax: 011-23017008, 23017009

www.assocham.org