Techniques to Ensure

Timely Payments to

Subcontractors

.__._--__

.-

-.

GAO

United States

General Accounting Ofiflce

Washington, D.C. 20648

National Security and

International Affairs Division

B-252095

May 28,1993

The Honorable Sam Nunn

Chairmsn, Committee on

Armed Services

United States Senate

The Honorable Dale Bumpers

Chairman, Committee on

Small Business

United States Senate

The Honorable Ronald V. Delhuns

Chairman, Committee on

Armed Services

U.S. House of Representatives

The Honorable John J. LaFalce

Chairman, Committee on

Small Business

US. House of Representatives

We identified existing statutory and regulatory provisions that help provide timely payments to

subcontractors working on federal contracts and evaluated the feasibility and desirability of

additional payment protections for subcontractors working on federal projects.

We are sending copies of this report to the Secretaries of Defense, Air Force, Army, and Navy;

the Director, Office of Management and Budget; and other interested parties. Upon request,

copies may also be made available to others.

This report was prepared under the direction of Paul F. Math, Director, Acquisition Policy,

Technology, and Competitiveness, who may be reached on (202) 512-4587 if you or your staff

have any questions concerning this report. Other major contributors are listed in appendix VI.

Prank C. Conahan

Assistant Comptroller General

Executive Summary

Purpose

Subcontractors depend on cash flow generated by progress or other

periodic payments from prime contractors to meet payrolls and pay other

bills. A long-standing congressional concern is whether federal prime

contractors are paying subcontractors in a timely manner. Payments to

subcontractors sometimes constitute well over 50 percent of prime

contract costs.

This report responds to section 806 of the National Defense Authorization

Act for F’iscal Years 1992 and 1993, which requires

GAO

to (1) identify

existing statutory and regulatory provisions that help provide timely

payments to subcontractors working on federal contracts and (2) evaluate

the feasibility and desirability of additional proposed payment protections

for subcontractors that are enumerated in the legislation.

Background

The federal government provides interim financing to

prime

contractors.

On fixed-price contracts, the government uses progress payments, which

can reimburse contractors for 75 to 100 percent of allowed incurred costs

each month. On cost-reimbursement contracts, the government can

reimburse contractors for all allowable incurred costs on a biweekly basis.

Under both types of contracts, the prime contractors’ payment requests to

the government will often include costs incurred to pay subcontractors.

Prime contractors have primary responsibility for managing payments to

subcontractors. Although the federal government has concerns about

payment protection for subcontractors, the government does not have a

contractual relationship with the subcontractors. As a result, the federal

government has been a reluctant participant in resolving payment

problems between its prime contractors and their subcontractors.

Results in Brie

for federal subcontractors. These provisions vary depending on the type of

contract and contractor. While the proposals listed for evaluation in

section 806 would provide additional payment protections, in most cases,

they would add varying amounts of cost and administrative burdens to the

government’s and contractors’ payment processes.

GAO

contacted the industrial associations that previously reported that

subcontractor payment problems were prevalent, as well as other

associations, to distribute a questionnaire, presuming that if problems

exist, firms would notify

GAO

in their responses.

GAO

received 151

Page 2

GALWNSIAD-93-136 DOD Contracting

.,,

Exseutive Summary

responses from subcontractors that complained about their payment

problems on work funded by federal projects in tlscal year 1991 (their

latest complete fiscal year). The identified payment problems were

noteworthy to the responding subcontractors because they adversely

affected the firms’ cash flow and financial health.

GAO

could not use

statistical sampling techniques because a complete data base on

subcontractors does not exist. Because of this and the fact that the

respondents were entirely self-selected,

GAO

could not determine whether

the responding subcontractors are representative of subcontractors

generally.

The proposals for consideration in section 806 would not necessarily

resolve all subcontractors’ payment problems. For example, the proposals

will not eliminate delayed payments to subcontractors that result from

disputes. When specifically needed, most of the items listed in section 806

could currently be used by contracting officers on an ad hoc basis.

However, federal policy and procedures do not describe the

circumstances under which contracting officers should take action to use

these techniques to ensure timely payments to subcontractors.

Principal Findings

Subcontractor Payment

Protection Provided

A number of existing statutes and regulations provide payment protection

to subcontractors. For example, large business prime contractors working

on non-construction projects are required to pay subcontractors before

billing the government. In contrast, prime contractors working on federal

construction projects are allowed to bill the government before paying

their subcontractors. However, they are required to pay their

subcontractors within 7 days after receiving payment from the government

l

and certify that they will make timely payment to their subcontractors.

These additional payment protections for subcontractors working on

federal construction projects were enacted in 1988 as amendments to the

Prompt Payment Act, partly because payment problems were reported to

be prevalent.

The payment protections enumerated in section 806 are generally feasible

and many are currently being used on a limited, ad hoc basis by

contracting officers. However, statutory and regulatory provisions

requiring the routine use of these payment protections would add to costs

Page 8

GAO/NSIAD-93-130 DOD Contracting

. .

,. ,

.,

,.,/ ,,‘, ;

/.

ExecutiveSummary

and administrative burdens by requiring additional data, procedures, and

controls.

Payment Problems

Identified by 151

Subcontractors

A

GAO

questionnaire to obtain information from subcontractors about their

payment problems was distributed through 33 contractor associations and

other means.

GAO

received 161 responses from subcontractors that

complained about their payment problems on work funded by federal

projects in fiscal year 1991 (their latest complete fiscal year>. Of the

161 subcontractors that complained about late payment, 118 reported the

amounts of delayed payments. The delayed payments were estimated at

$346 million, or about 23 percent of subcontract revenue, and the delays

averaged 146 days from the time the subcontractors submitted their

invoices to the prime contractors.

Contracting Officers Could

Contracting officers have occasionally used existing authority to make

Provide Added Payment

special arrangements to improve the timeliness of payments to

Protection

subcontractors, However, substantial evidence of a payment problem is

needed before they initiate additional payment protection for

subcontractors, which can be a time-consuming process. Contracting

officials expressed a reluctance to take actions even in cases where

contract performance had been significantly affected or the contractor had

repeatedly failed to make timely payments. Department of Defense (DOD)

officials stated that existing policy and procedures do not clearly state

when a contracting officer should act and what actions should be taken

when subcontractor payment problems are identified.

Recommendation

GAO

recommends that the Secretary of Defense issue policies and

procedures for (1) identifying the circumstances under which contracting

a

officers should take action to provide payment protection for

subcontractors and (2) implementing appropriate payment protection

techniques.

Comments and GAO’s

Evaluation

and partially concurred with its recommendation.

DOD

stated that it has a

significant interest in the timely payment of subcontractors because of the

potential negative impact on a prime contractor’s performance when

subcontractors are not paid promptly.

DOD

agreed to take action to ensure

that contracting officers are aware of the special techniques to use when

Page4

GAO/NSIAD-9%136DODContracting

,

ExecntiveSmmasy

“9

/

subcontractor payment problems arise.

GAO

believes that

DOD'S

proposed

actions are consistent with its recommendation.

DOD'S

comments are presented in their entirety in appendix I.

GAO

also received comments on a draft of this report from selected

industrial associations and has revised the report where appropriate.

While several industrial associations were supportive of

GAO'S

findings,

some were critical of several aspects of GAO’S draft report. One of the

criticisms indicated that

GAO

did not fulfill the requirements of section 806,

in part, because it did not include an analysis of the appropriateness of any

differential treatment needed in exploring the feasibility and desirability of

the payment protections described in section 806.

GAO

considered the

feasibility and desirability of providing additional payment protection for

subcontractors working for different categories of prime contractors, as

well as providing additional payment protection for all tiers of

subcontractors. However,

GAO

concluded that since the payment problems

identified were not specific to a particular group, there was not a need for

providing differential treatment.

Other criticisms centered around the distribution of the questionnaire

contained in appendix III, as well as the time provided to respond to the

questionnaire.

GAO

has modified its report to emphasize that it did not use

statistical sampling techniques and that the respondents were entirely

self-selected.

GAO

had originally requested that all responses be returned

by September l&1992. However, when

GAO

contacted each of the

associations to ensure that they had received the questionnaire for

distribution to their member fii, 10 of the 33 associations were given

additional time to distribute the questionnaire; as a result,

GAO

continued

to accept responses through November 1992.

Page6

GAOMSIAD-98-186 DOD

Contracting

_1,’

I,

.I 1’. ,b

,, _,”

, ’

“I

Contents

Executive Summary

2

Chapter 1

Introduction

Objectives, Scope, and Methodology

8

9

Chapter 2

Comparison of

Existing

Subcontractor

Payment Protection

Provisions With

Section 806

Provisions

Conclusion

Chapter 3

23

Better Use of Special

Payment Problems Identified by 161 Subcontractors

23

Proposals Do Not Address Some of the Causes of Payment

26

Payment Protection

Problems

Techniques Needed

Contracting Officers Can Provide Additional Payment Protection

27

Recommendation

27

Comments and Our Evaluation

28

Appendixes

Appendix I: Comments Prom the Department of Defense

Appendix II: Executive Branch Activities and Locations Visited

Appendix III: GAO Questionnaire on Subcontractor Payment

Problems

Appendix Iv: Trade Associations Distributing Questionnaire

Appendix V: Statutory and Regulatory Provisions to Help Ensure

Payments to Subcontractors

30

33

34

a

38

39

Tables

Appendix VI: Major Contributors to This Report

Table 2.1: Comparison of Existing Payment Protection Provisions

With Section 806 Proposed Provisions

Table 3.1: Sources of Fiscal Year 1991 Accrued Revenue for 118

Firms

41

14

24

Page 6

GAO/NSIAD-98-186 DOD Contracting

-.

Contenta

Figure

Figure 3.1: Prime Contractors Causing Worst Payment Problems

for Subcontractors That Complained to GAO

a

Abbreviations

DOD

Department of Defense

GAO

General Accounting Office

OMB

Office of Management and Budget

SBA

Small Business Administration

Page 7

GAWNSIAD-98-186 DOD Contracting

.‘;

/

Chapter 1

Introduction

In fiscal year 1991, the federal government reported contracting actions

for goods and services totaling about $210 billion, with payments to

subcontractors representing a large portion of these dollars.’ These

payments to subcontractors sometimes constitute well over 60 percent of

prime contract costs. Late payments can adversely affect prime

contractors’ and subcontractors’ financial health. In 1982, the Congress

enacted the Prompt Payment Act, which requires federal agencies to pay

their bills on time or pay interest on payments made to contractors after

the due date.

Prime contractors may receive progress or other payments from the

government for both fixed-price contracts and cost-reimbursement

contracts2 Prime contractors, in turn, may make progress or other

payments to their subcontractors. Progress payments are a method of

interim contract financing on fixed-price contracts in which the

government and the contractor share the financial burden of contract

performance. The government can reimburse the contractor through

progress payments of 76 to 100 percent of allowed incurred costs each

month. On cost-reimbursement contracts, the government can reimburse

the contractor for all allowable incurred costs on a biweekly basis. A

substantial portion of the prime contractor’s payment request to the

government will often include costs incurred to pay subcontractors.

Prime contractors have primary responsibility for managing payments to

subcontractors. Although the federal government has concerns about

payment protection for subcontractors, the government does not have a

contractual relationship with the subcontractors. As a result, the federal

government has been a reluctant participant in resolving payment

problems between its prime contractors and their subcontractors.

Large business prime contractors working on non-construction projects

receiving interim payments provide payment protection to their

subcontractors because they are required to make payment to

subcontractors before billing the government. In contrast, all small

business3 prime contractors, as well as large business primes working on a

l”Subcontractor” is used throughout this report to refer to any supplier, distributor, vendor, or firm

that furnishes supplies or services to or for a prime contractor or another subcontractor.

zA fixed-price contract provides for a firm pricing arrangement established by the parties at the time of

contract award. A co&reimbursement contract provides for payment to the contractor of allowable

incurred costa of performing the contract.

aA small business in federal contracting must conform to the government’s size standards for small in

its industry. The standards relate to the number of employees or dollar amounts in annual receipts.

Page 8

GAWNSIAD-93-136 DOD Contracting

Chapter 1

lntxodnctlon

federal construction project, are allowed to bill the government before

paying their subcontractors.

During congressional hearings in 1987 and 1988, evidence was presented

on substantial abuses involving construction contractors not paying

subcontractors on time, which was affecting the government’s ability to

obtain performance on these construction contracts. Subcontractors

depend on cash flow generated by progress or other payments to meet

payrolls and pay other bills. Subcontractors usually perform as much as

60 percent of work on federal construction projects. The Congress

responded to the payment problem by adding new provisions to the

Prompt Payment Act that apply to all subcontractors under federal

construction contracts. Under these provisions, certain contract clauses

must be included in all construction contracts and subcontracts. Members

of Congress have continued to express concern regarding the timeliness of

progress payments and other payments to subcontractors working for

federal prime contractors.

Objectives, Scope,

and Methodology

The National Defense Authorization Act for Fiscal Years 1992 and 1993,

section 806, required us to (1) identify existing statutory and regulatory

provisions which help provide timely payment of progress or other

periodic payments to subcontractors by prime contractors on federal

contracts and (2) evaluate the feasibility and desirability of requiring

additional protections to ensure the timely payment of progress or other

periodic payments, including the following protections:

l

F’ixed-payment terms and certification. A prime contractor (other than

construction prime contractor) would be required to (1) include in its

subcontracts a payment term requiring payment within 7 days (or some

other fixed term) after the prime receives payment from the government

a

and (2) submit with its payment request to the government a certification

that payments to subcontractors have been made from previous payments

received under contract, and timely payments will be made from the

proceeds of the payment covered by this certification.

l

Proof of payment. All prime contractors (other than construction prune

contractors subject to the provisions of sections 3903(b) and 3906 of title

31, United States Code) would be required to furnish with their payment

request to the government proof of payment of the amounts included in

such payment request for payments made to subcontractors.

l

Escrow accounts. A prime contractor would be required to establish an

escrow account at a federally insured financial institution that would

Page 9

GAO/NSIAD-93-136 DOD Contracting

Chapter 1

Introduction

make direct disbursements to subcontractors for the amounts certified by

the prime contractor in its payment request to the government as being

payable to such subcontractors in accordance with their subcontracts.

l

Direct disbursement when needed. If the contracting officer determines

that the prime contractor is failing to make timely payments to its

subcontractors, require direct disbursement of amounts certified by a

prime contractor as being payable to its subcontractors in accordance

with their subcontracts (using techniques such as joint payee checks,

escrow accounts, or direct payment by the government).

In addition, the act required us to consider the following protections:

l

Using payment bonds to ensure timely and ultimate payment. Prime

contractors would be required to obtain payment bonds, pursuant to the

Miller Act as a means of affording protection to construction

subcontractors, to help ensure (1) timely payment of progress payments

and (2) ultimate payment of such amounts due.

l

Increasing payment bonds to equal 100 percent of the contract value.

Payment bond amounts required under the Miller Act would be increased

from the current maximum amounts to an amount equal to 100 percent of

the amount of the contract.

l

Requiring payment bonds for supply and service contracts. Payment bonds

would be required for supply and service contracts (other than

construction) and, if feasible and desirable, the amounts of such bonds.

l

Using letters of credit as substitutes for payment bonds. Letters of credit

issued by federally insured financial institutions (or other alternatives)

would be used as substitutes for payment bonds in providing protection to

subcontractors on federal contracts.

The act also requested that we evaluate the effectiveness of the

modifications to federal regulations relating to the use of individual

sureties. However, we did not incorporate this as part of our evaluation

because we had recently issued a report stating that the changes to

regulations to curtail abuse by individual sureties were a step toward

strengthening management controls over individual sureties.4

To identify existing statutory and regulatory provisions that help provide

timely payment of progress or other periodic payments to subcontractors,

we reviewed the Federal Acquisition Regulation and regulations issued by

individual agencies. We discussed specific provisions that provide

4Construction Contracts Individual Sureties Had No Defaults on Fiscal Year 1991 Contracts

(GAO/GGD-9269, Apr. 1,1992).

Page 10

GAO/lUSlAD-93-136 DOD Contracting

Chapter 1

Introduction

payment protections with legal, policy, and contract management officials

and others. We conducted a computerized search of data bases containing

federal laws and regulations. In addition, we obtained and discussed

pertinent agency guidance.

We interviewed officials at numerous executive branch activities (see app.

II for a listing of the activities and locations we visited), subcontractors,

and prime contractors to (1) explore the feasibility and desirability of

additional payment protection provisions for subcontractors, (2) identify

examples where executive agencies have had experience using the type of

payment protection provisions listed in section 806, and (3) identify

whether alternative provisions for protecting subcontractors would be

more feasible and desirable. We interviewed officials at large banks,

sureties, and banking and surely associations to better evaluate the

feasibility and desirability of the suggested payment protection provisions.

As part of our effort to assess the desirability of additional payment

protection for subcontractors on federal projects, we developed a

questionnaire, reprinted in appendix III, to identify problems

subcontractors have experienced in receiving payments from work funded

by federal projects in fiscal year 1991 (their latest complete iiscal year at

the time the questionnaire was issued). The questionnaire was developed

during pretests with subcontractors.

A complete data base on subcontractors working on federal projects does

not exist; therefore, we could not specify the extent of payment problems

experienced by all subcontractors working on federal projects. We

contacted the industrial associations that previously have reported that

subcontractor payment problems were a common occurrence, as well as

other associations, to distribute the questionnaire presuming that if

l

problems exist, firms would notify us. Seventy-eight industrial associations

were asked to distribute our questionnaire to their member firms. The list

of associations was compiled, in part, by consulting with congressional

staff and those associations who had previously reported on subcontractor

payment problems. (See app. IV for a listing of the 33 trade associations

that agreed to distribute our questionnaire.) The trade associations either

sent a copy of the entire questionnaire to their members or provided their

members with the opportunity to request a copy. Many of the associations

sent cover letters to their member firms to encourage the firms to respond

to the questionnaire. We had originally requested that all responses be

returned by September X,1992. However, when we contacted each of the

associations to ensure that they had received our questionnaire for

Page 11

GMVNSIAD-98-186 DOD Contracting

chapter 1

Introduction

distribution to their member firms, 10 of the 33 associations were given

additional time to distribute the questionnaire. As a result, we continued to

accept responses through November 1992.

In addition, the questionnaire was published in its entirety in both the

Federal Register and the Government Contracts ReDorts. Five other

publications (Commerce Business Daily, Contract Management, Federal

Acquisition Report, Federal Computer Week, and the Federal Contracts

Report) printed notices about the questionnaire for subscribers. The

publications provided readers with a telephone number to obtain

additional information on the study. Ninety-two questionnaires were sent

directly to subcontractors.

Because we did not use statistical sampling techniques and the

respondents were entirely self-selected, we could not determine whether

these subcontractors are representative of subcontractors generally. In

addition, the information we gathered could not be used to determine the

relative magnitude or types of payment problems for subcontractors

generally or for any particular subgroup of contractors.

We interviewed selected subcontractors responding lo our questionnaire

as well as some of their prime contractors to obtain a more complete

perspective on the payment problems being experienced by

subcontractors. However, we did not verify the accuracy of the

information provided to us from subcontractors experiencing late

payments.

We performed our work from February 1992 to January 1993 in

accordance with generally accepted government auditing standards.

Page 12

GAO&MAD-99-186 DOD Contracting

Chapter 2

Comparison of Existing Subcontractor

Payment Protection Provisions With Section

806 Provisions

Statutory and regulatory provisions currently provide payment protections

for subcontractors working on federal projects. In most cases, the

proposals in section 806 would provide additional payment protections,

but would add varying amounts of cost and administrative burdens to the

government’s and contractors’ payment processes. Furthermore, most of

these provisions are being used by contracting officers on a limited basis if

contract performance is adversely affected by payment problems between

the prime contractor and its subcontractors.

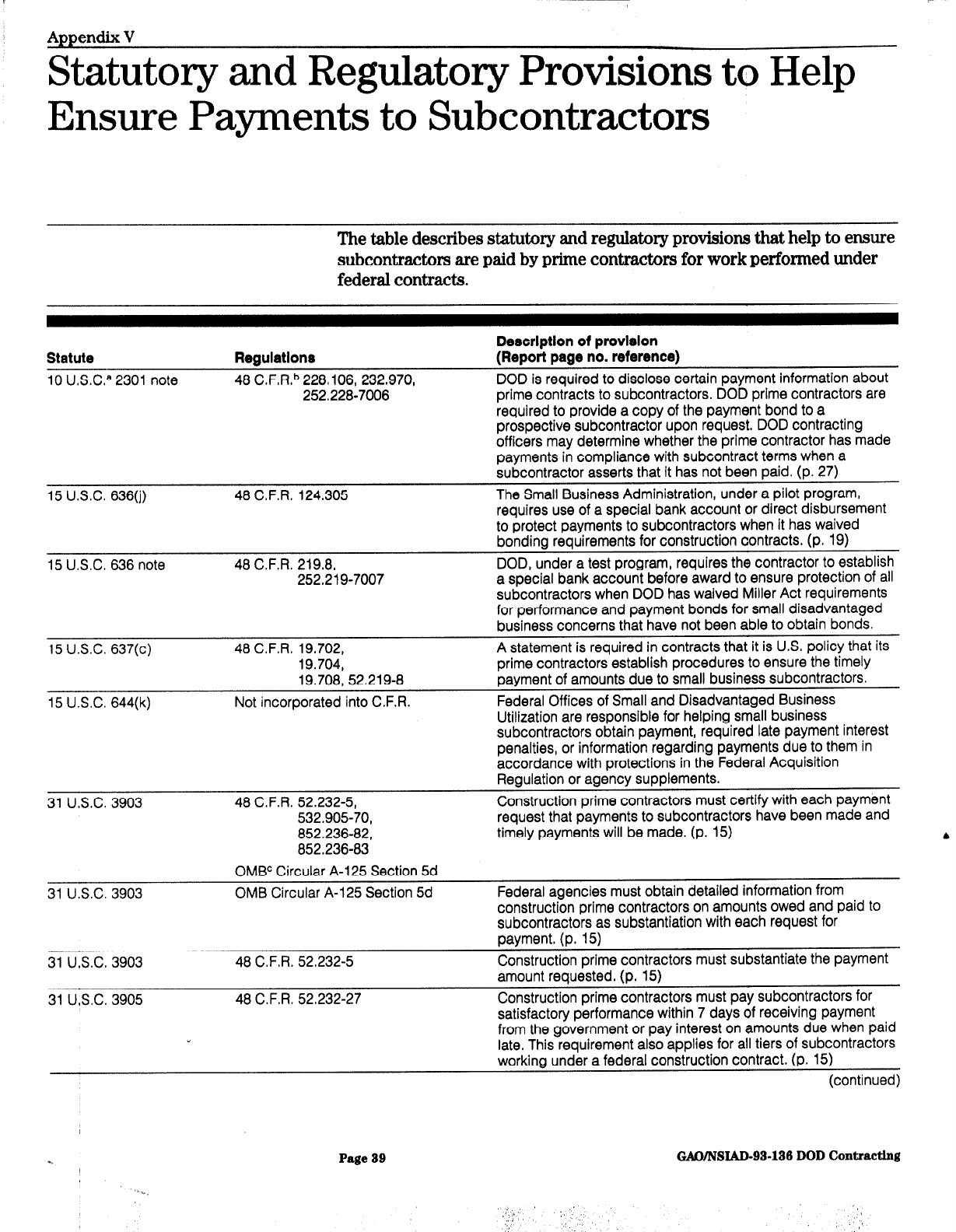

Table 2.1 compares payment protections that currently exist with the

proposed payment protections listed in section 806. The discussion that

follows the table highlights how the items listed in section 806 would

supplement existing payment protections provided by laws and

regulations. In addition to the payment protections described in table 2.1,

federal regulations require government officials to determine whether

prospective contractors are financially capable before awarding contracts

and regulations also require reviews or audits of prime contractors after

paying them, in part, to determine whether they pay their bills on time.

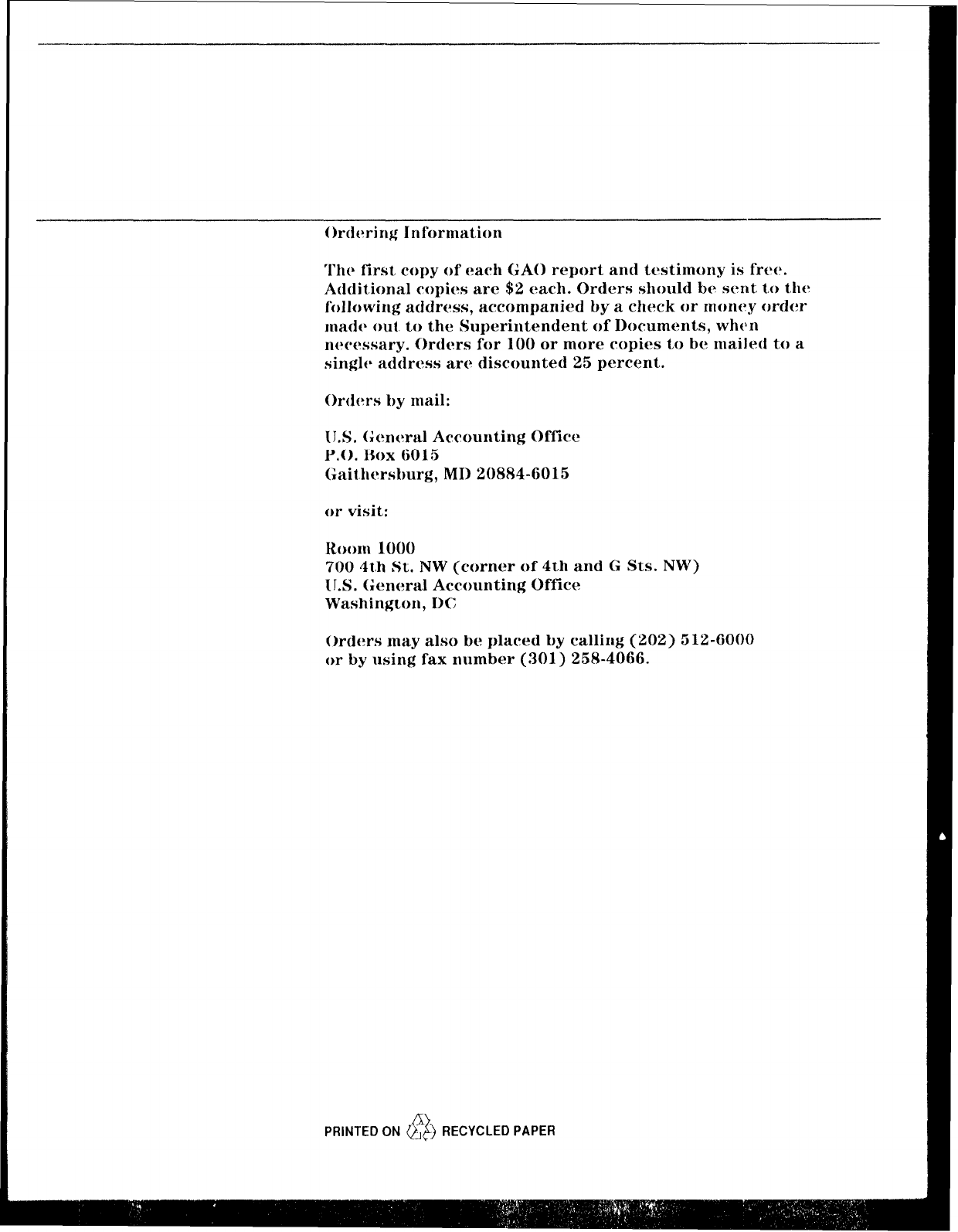

(See app. V for a listing of statutory and regulatory provisions to help

ensure payments to subcontractors.)

Page 18

GAO/NSIAD-99-136 DOD

Contracting

Chaptm 2

Comparieon of Existing Subcontractor

Payment Protection ProvisIons With Section

806 Provision0

Table 2.1: Comparlson of Exletlng Payment Protectton Provlslons Wlth Sectlon 806 Proposed Provlslons

Exlstlng requirement

Proposed provlslons

Section 806 proposed payment protection provlslons

Non-

Constructlon constructlon Constructlon

Non-

construction

Fixed-payment term and certlflcatlon: Prime contractor

must (1) include a clause in subcontracts requiring payment

within a fixed time period after receiving payment from the

government and (2) certify with each invoice that past

subcontractor payments have been made on time and that

payments covered by the certified invoice will be made on

time.

Y8S No

a

Yes

Proof of payment: Prime contractor must have paid and

submitted proof of payments to subcontractors when

invoicina the aovernment for those oavments.

No

No No Yes

” - . .

Escrow accounts: Prime contractor must establish an

escrow account and require disbursements by the escrow

agent of amounts certified by the prime contractor in

invoices to the government as being payable to

subcontractors.

No No Yes Yes

Direct disbursement when needed: If a government

contracting officer determines the prime is not making timely

payments, require direct disbursements to subcontractors of

amounts certified by the prime contractor in invoices to the

federal government as being payable to its subcontractors

(using techniques such as joint payee checks, escrow

accounts, or direct payment bv the aovernment).

Currently

permitted

Currently

permitted

Yes Yes

Payment bonds for ultlmate payment: Prime contractor

must furnish a payment bond to ensure ultimate payment.

Currently No

a Yes

required on

contracts

exceeding

$25,000

Payment bonds for timely payment: Prime contractor must

furnish a payment bond to ensure timely payment,

Payment bonds to equal contract value: For construction

contracts that require the prime contractor to furnish a

payment bond, the amount of the bond must be equal to

No

No

No

No

Yes

Yes

No

No

a

ioi,

percent of contract amount.

Payment bonds on supply and servlce contracts: Prime

contractors would be required to obtain payment bonds.

Letters of credit as substltutes for payment bonds: Prime

contractor is permitted to substitute letters of credit for

payment bonds,

No

Currently

pending

No

No

No

Yes

Yes

Yes

BThe proposed provision does not indicate that the existing requirement would be changed.

Fixed-Payment Term and

Certification

Section 806 lists as an option for consideration that a prime contractor

(other than a construction prime contractor) be required to include in its

Page 14

GAO/NSIAD-98-180 DOD Contracting

Chapter 2

Comparison of Exbting Snbeontcactor

Payment Protection Provieione With Section

806 Provbious

subcontracts a fmed-payment term after the prime receives payment from

the government and to certify that it will make timely payments to

subcontractors. Federal regulations, however, require large business

non-construction prime contractors to pay their subcontractors before

receiving payment from the government. Accordingly, to be an effective

mechanism for ensuring timely payment to subcontractors, this proposal,

if implemented, should be applicable only to prime contractors that pay

their subcontractors after receiving payment from the federal government.

In 1988, the Prompt Payment Act was amended to provide payment

protections for subcontractors working on federal construction projects.

The act as implemented requires prime contractors (1) to pay

subcontractors within 7 days of receiving payment or pay interest on late

payments and (2) to certify the following:

“Payments to subcontractors

. . . have been made from previous payments received under

the contract, and timely payments will be made from the proceeds of the payment covered

by this certification, in accordance with subcontract agreements and the requirements of

chapter 39 [Prompt Payment] of Title 31, United States Code . . .”

The act also requires that subcontractors working on federal construction

projects pay lower tier subcontractors within 7 days of receiving payment

or pay interest on late payments. Subcontractors are to use the same

fixed-payment term and interest penalty clauses in lower tier subcontracts

that prime contractors must use. Other Prompt Payment Act requirements

supplement the fixed payment term, interest penalty, and prime

contractor’s certification. Federal agencies are required to obtain detailed

information from prime contractors working on federal construction

projects on amounts owed and paid to individual subcontractors with each

request for payment and certifkation. This requirement is intended to

deter prime contractors on federal construction projects from

4

(1) certifying and submitting fraudulent payment requests or (2) diverting

government payments for other purposes besides paying subcontractors.

All large business non-construction prime contractors for both fixed-type

and cost-reimbursement contracts are required to pay their subcontractors

before receiving payment from the government. In addition, both large

business and small business, non-construction prime contractors with

fixed-price contracts and progress payments must certify on the form used

to bill the government that

Page 15

GAO/NSIAD-99-136 DOD Contracting

Chaptsr 2

Corn-n of ExMng Subcontractor

P4pWnt Protection Provbiona Wb.b Section

808 Provleionc

‘. . . sll the costs of contract performance . . . have been paid to the extent shown [on the

request for payment], or when not shown as paid have been paid or will be paid currently,

by the contractor, when due, in the ordinary coume of business. . .”

Prime contractors with cost-reimbursement contracts are not required to

certify or sign the form used to bill the government.

Proof of Payment

Section 806 lists as an option for consideration that prime contractors

(other than construction) would be required to furnish with their payment

request to the government proof of payments made to subcontractors.

Proof of payment, such as canceled checks, would document that prime

contractors had paid the costs of subcontracts in advance of billing the

government or shortly thereafter.

Under current regulations, small business primes can receive payment for

subcontractor costs that they have incurred but not yet paid. If proof of

payment was used on ail contracts, as stated in section 806, the current

differential treatment that provides a financial benefit to small businesses

receiving contract financing would be eliminated. Unless there is a desire

to eliminate this differential treatment, small business primes could be

excluded from this provision.

Proof of payment is not currently required for any government contract on

a routine basis but has been used on an ad hoc basis, The government has

required prime contractors (other than construction) to furnish proof of

payment when late payments to subcontractors have substantially

hindered the performance of government contracts, For example, the

Naval Sea Systems Command used a variation of proof of payment on a

shipbuilding contract because the contractor had repeatedly failed to pay

its subcontractors in the normal course of business, was financially

l

insolvent, and was not making progress on the contract. The process the

Navy used to administer proof of payment was as follows: (1) the

contractor submitted a list of the subcontractors it planned to pay; (2) the

Navy verified that the contractor planned to spend the material portion of

the progress payment making subcontractor payments and then paid the

prime contractor; (3) subcontractors signed certifications that they had

received payment; and (4) the prime contractor submitted the

certifications as proof of payment and verified that the listed

subcontractors received payment. Although this process resulted in

additional costs and administrative burden for the government and the

Page 16

GAOBJSIAD-98-136 DOD Contracting

chaptm 2

Comparison of Exbtlng Subcon-r

P8yment Protaciion ProvIdona With Section

606 Proviei0M

contractors, it was considered necessary to ensure completion of the

project.

Escrow Accounts

Section 806 lists as an option for consideration that prime contractors be

required to establish an escrow account that would be used to control

disbursements of contract ftmds and to prevent the prime contractor from

diverting funds for other uses. With an escrow account in place, a third

party, the escrow agent, would receive and disburse funds to

subcontractors. The escrow agent rather than the prime contractor would

receive payment from the government and be responsible for making

payments to subcontractors in amounts certified by the prime contractor.

Escrow accounts are not currently required for government contracts on a

routine basis; however, they have been used on an ad hoc basis. In one

case, agency officials were repeatedly notified over a 6month period that

the prime contractor had routinely failed to make timely payments to the

subcontractor. After realizing that contract performance could be in

jeopardy, the contracting officer assisted the subcontractor in negotiating

with the prime to obtain an escrow agreement. However, it took several

additional months from when the contracting officer agreed to get

involved until the escrow account became effective. When the escrow

account was finally in place and the correct payment office had the

paperwork, future payments were made to the escrow account as stated in

the contract modification.

In addition, escrow accounts would increase contract costs to the

government, with set-up fees alone ranging from $6,000 to $10,000

annually per contract, according to officials at a large bank. These officials

stated that the cost of escrow accounts could be even higher depending on

such factors as the frequency and volume of checks disbursed. For

example, in one auxihary ship contract, there were 186 fir&tier

b

subcontractors. Contracts for larger ships, such as an aircraft carrier,

would have many more subcontractors and provide for progress payments

as often as every 2 weeks

for many years. A senior Naval Sea Systems

Command official told us that requiring escrow accounts would be among

the most expensive section 806 provisions to implement on shipbuilding

contracts, and therefore, does not favor their routine use.

Direct Disbumement When

Section 806 lists as an option for consideration that direct disbursement be

Needed

required of amounts certified by a prime contractor as being payable to its

Page 17

GMVNSIAD-98-196 DOD Contr-

Chapter 2

Comparison of EdMing Subcontractor

Payment Protection Prov&3iont1 WMI Se&on

806 l’rovlsionr

subcontractors (using techniques such as joint payee checks, escrow

accounts, or direct payment by the government), if the contracting officer

determines that the prime contractor has failed to make timely payments

to its subcontractors. A principal advantage of this proposal is that it is

clearly intended for use on an ad hoc basis-when a problem has been

identified. The purpose of direct disbursement is to prevent the prime

contractor from diverting funds for other uses by placing controls on those

funds. With any method of direct disbursement, the prime contractor

would still be responsible for dete rmining what amounts are payable to

subcontractors.

A technique for disbursing payments for contract costs, the special bank

account, has been used in the past on an ad hoc basis to help ensure

contract performance. For example, when the Navy learned that a

shipbuilder was having difficulty performing, it negotiated with the

contractor to establish a special bank account. This allowed the

shipbuilder to continue receiving progress payments. A subcontractor told

us that its invoices were paid promptly once a special bank account was

instituted. While special bank accounts at-e a satisfactory method for

ensuring payment in extraordinary circumstances, officials familiar with

them said they are too administratively burdensome for routine use since a

government representative must review and sign each check.

In another case illustrating the use of a joint payee check arrangement, the

contracting officer requested the Defense Contract Audit Agency to verify

the amount of progress payments paid to subcontractors. The Defense

Contract Audit Agency reviewed the prime’s progress payments and

discovered that the contractor delayed payment of subcontract progress

billings for an unreasonable period despite having received government

payment for these subcontract billings, Even after the Defense Contract

Audit Agency review, the contractor continued to delay payment to

l

subcontractors. According to the contracting officer, a joint payee check

arrangement was established and was effective in ensuring subcontractors

were paid in a more timely manner-but nevertheless, it was a

time-consuming process.

Payment Bonds for

Ultimate Payment

Y

Section 806 lists as an option for consideration that payment bonds be

used to provide subcontractors with a remedy for seeking payment if the

prime contractor fails to make payment. A payment bond is a promise of a

surety to assure payment to subcontractors on a contract. A surety is the

individual or corporation that has agreed to be legally liable for the debt,

Page 18

GAWNSIAD-96-186 DOD Contracting

Chapter 2

Comparhon or Existing Subcontractor

Payment Protection Provisions With Section

806 Provieions

default, or failure to satis@ a contra&WI obligation. The surety is legally

liable for the dollar value of the payment bond. However, payment bonds

would not prevent payment problems from occurring because

subcontractors must demonstrate that the prime contractor has already

failed to make payment.

Payment bonds have generally been required for construction contracts

but not for other contract&’ The Miller Act, enacted in 1936, established

the bonding requirements for federal construction contracts. Prime

contractors on federal construction projects are required to furnish a

payment bond before starting work on any contract exceeding $26,000.

On commercial construction projects, subcontractors furnishing labor or

materials to a construction project have the right to file a lien to provide

the subcontractor protection against nonpayment. However,

subcontractors do not have lien rights with respect to federal construction

projects. Instead, the prime contractor must provide a payment bond. The

government will reimburse the contractor for the costs of bonding to the

extent that such costs are deemed reasonable.

The Small Business Administration

(SBA)

has, under a pilot program,

waived bonding requirements on construction contracts for small

disadvantaged businesses that have not been able to obtain bonds. A

special bank account is being used on a test basis as an alternative to the

Miller Act payment bond for construction contracts. Under the special

bank account, the government must approve all requests for disbursement,

and all checks must be signed jointly by the contractor and an

SBA

representative or an SBA-approved third party. Use of direct disbursement

instead of a special bank account is optional.

Under current regulations, the use of payment bonds is generally not

4

required for other than construction contracts, but bonds may be used

when it is deemed necessary to protect the government’s interest. Bonds

may be required when government property is provided to the contractor

for use in performing the contract. Also, bonds may be required in other

situations. The Navy experimented with the elimination of bonds on small

craft procurements but reissued a policy requiring performance and

‘Miller Act payment bonds cover subcontractors that have a contractual

relationship with

a prime

contractor or a relationship with a first-tier subcontractor that has a contractual relationship with a

prime contractor.

Page 19

GAMWAD-93-196 DOD Contracting

chrptar 2

Compadaon of Existing Subcontxaetor

Payment Protection Provisions With Section

806 Provisions

payment bonds after experiencing increased contractor defaults2 A

payment bond may be required only when the government also requires

the contractor to furnish a performance bond.

Payment Bonds for Timely

Section 806 lists as an option for consideration that payment bonds be

Payment

used to afford timely payment of progress payments to subcontractors

working on construction projects in addition to ultimate payment.

Payment bonds are not currently used to ensure timely payment of

progress payments. The Miller Act requires a subcontractor that has not

received ultimate payment to wait 90 days after completing the work

before filing suit To be an effective mechanism to ensure more timely

payment of progress payments to subcontractors, the Miller Act would

have to be amended to eliminate the requirement that subcontractors wait

90 days.

However, officials in the surety industry told us that if the waiting period

was reduced or eliminated, so that subcontractors could request payment

against payment bonds whenever a payment is overdue, the cost of

payment bonds could increase. Sureties may conduct an investigation

before making a payment under a payment bond. Officials in the surety

industry told us that these additional investigations could be costly, in

part, because they could require additional resources. In addition, any

investigations requiring more than minimal scrutiny would negate the

timeliness of payments under the payment bond.

Payment Bonds to Equal

Contract Value

Section 806 lists as an option for consideration that payment bond

amounts required under the Miller Act be increased from the current

maximum amounts to an amount equal to 100 percent of the contract

amount. This would provide additional payment protection to

CL

subcontractors when the current required maximum value is not sufficient

to cover subcontractor claims.

In accordance with the Miller Act, a payment bond is currently limited to

(1) 60 percent of the contract price if the price does not exceed $1 million,

(2) 40 percent of the contract price if the price is between $1 million and

$6 million, or (3) $2.6 million if the contract price is more than $5 million.

2A performance bond is a promise of a surety assuring the government that once the contract is

awarded, the prospective contractor will perform its obligations under the contract

Page 20

GAOINSIAD-99-196 DOD Contracting

clupmr 2

Comparieon of Erirting Snbcontmctor

Pqnle!M Protect4on Provbiono with section

606 ProvM0M

Eliminating the current cap on payment bond amounts could affect the

ability of prime contractors to obtain bonds. Some small disadvantaged

contractors already experience difficulty in obtaining bonds partially due

to their limited financial capability. The inability of these contractors to

obtain bonding may restrict their ability to compete in government

contracting.

Moreover, surety officials stated that existing bond coverage was

sufficient to pay all subcontractors except in infrequent circumstances.

Ordinarily, the prime contractor is required to perform a small percentage

of the total work with its own forces.

Payment Bonds on Supply

Section 806 lists as an option for consideration that payment bonds be

and Service Contracts

used for supply and service contracts. Federal regulations currently

specify that, in general, bonds shall not be required on supply and service

contracts. However, under certain circumstances, contracting officers can

require their use. Requiring the use of payment bonds on all supply and

service contracts would increase contract costs. Surety officials stated

that bonds typically cost about 1 percent or more of the contract value.

Government procurement and surety industry officials indicated that

certain contracts could be difficult to bond. As stated earlier, some small

disadvantaged contractors already experience difficulty in obtaining bonds

due to their limited financial capacity. The inability of these prime

contractors to obtain bonding may restrict their ability to compete in

government contracting. Further, sureties may not want to bond

experimental research and development contracts because these contracts

do not have a definitive value.

Letters of Credit as

Substitutes for Payment

Bonds

Section 806 lists as an option for consideration that letters of credit be

4

used as substitutes for payment bonds in providing protection to

subcontractors on federal contracts.

Construction

prime contractors will

have the option of substituting a letter of credit as security for the Miller

Act payment bond. By using a letter of credit, a prime contractor does not

have to qualify with a surety for bonding, while still protecting

subcontractors against nonpayment. Substituting letters of credit as

security for payment bonds is expected to improve access to federal

procurement for small businesses that may have difficulty obtaining bonds

from sureties.

Page 21

GAWNSIAD-93-126 DOD Contracting

Corn&on

of

Ed&&g Subcontractor

Payment Protecdon ~ovldona With Section

606 Provisions

As stated above, a payment bond is required only when a performance

bond is required. If a contractor defaults or subcontractor payment

problems arise, the government’s role could be substantially greater with

letters of credit than with bonds, according to an official at a large bank. A

surety obligates itself to ensure contract completion, as well as to pay

subcontractors, if the contractor it has bonded defaults. Conversely, a

bank that has issued a letter of credit is not responsible for ensuring

contract completion or confirming performance or payment problems, just

for paying the beneficiary the amount of the letter of credit when the

conditions of the letter are met. In this case, the government would be

responsible for completing the contract if the contractor defaulted.

Gonclusion

Various statutory and

regulatory provisions

provide payment protections

for subcontractors working on federal projects. The items listed in section

806 could provide some additional payment protection but would add

varying amounts of cost and admimstrative burdens to the payment

process.

Page 22

GAO/NSIAD-98486 DOD Contracting

Chapter 3

--

Better Use of Special Payment Protection

Techniques Needed

We received 161 responses from subcontractors who complained about

their payment problems on work funded by federal projects in i&al year

1991 (their latest complete fiscal year). The identified payment problems

were noteworthy to the responding subcontractors because they adversely

impacted the iirms’ cash flow and financial health. However, the section

806 proposals would not always address the causes of the payment

problems identified. Contracting officers currently have the authority to

take action when subcontractor payments are not timely and have used

most of the section 806 provisions on an ad hoc basis, However, federal

policy and procedures do not clearly describe the circumstances under

which contracting officers should take action to ensure timely payments to

subcontractors.

Payment Problems

Identified by 151

Subcontractors

payment problems was distributed through 33 contractor associations and

other means, We received 151 responses from subcontractors who

complained about their payment problems on work funded by federal

projects in fiscal year 1991 (their latest complete fiscal year). Of the 161

subcontractors who complained to us about late payment, 118 reported

the amotmts of delayed payments. The delayed payments were estimated

at $346 million, or about 23 percent of subcontract revenue, and the delays

averaged 146 days from the time the subcontractors submitted their

invoices to the prime contractors, In addition to identifying a payment

problem, the subcontractors provided other information, in response to

our questions, which is summarized below.

Financial Data on Delayed

Of the 161 firms identifying payment problems, 118 provided an estimate

Payments

of the amount of delayed payment. These f%ms earned revenue as prime

contractors and subcontractors in the federal sector as well as from

non-federal sources. As shown in table 3.1, the delayed payments were

l

estimated at $346 million-about 23 percent of the firms’ $1,619 million of

their federal subcontract revenue and about 6 percent of their total

revenue for fiscal year 1991.

Page 28

GMYNSIAD-92-186 DOD Contracting

,.

;,.

Chapter 8

Bettar Uee of SpeckI Payment Protection

Techniquer Needed

Table 3.1: Source6 of Flacal Year 1 Qgl

Accrued Revenue for 118 Firma

Dollars in millions

Revenue source In FY 1991

Prime on federal contract

Subcontractor on federal contract

Delayed payments

Non-delayed payments

Subtotal

Non-federal sources

Total

-

Amount

$2,915

345

1,174

1,519

2,145

$6,579

Type of Prime Contractor

The subcontractors provided us with information on the type of prime

contractor involved in their worst payment problem related to a federal

contract. Figure 3.1 shows that about 70 percent of the subcontractors

worked for prime contractors on their worst subcontractor payment

problem who pay their subcontractors after receipt of payment from the

government. These delayed payments were partially attributed to late

payment by the federal government. About 30 percent of the

subcontractors worked for primes that were expected to pay in advance of

receiving payment from the government. These delayed payments can be

due in part to the prime contractor challenging the subcontractor’s request

for payment.

A

Pa6e 24

GAO/NSIAD-99-196 DOD Contracting

Chapter 3

Better Use of SpccIal Payment Protection

Techniques Needed

Figure 3.1: Prime Contractore Cawing

Worst Payment Problems for

Subcontractors that Complained to

GAO

Small business, non-construction

Large business, construction

Small business, construction

A Large business, non-construction

Regulations provide subs with more protection

Actions Taken to Resolve

Problem

The firms provided information about the actions they took to address

their delayed payment problems. Almost all of the firms reported that they

formally notified their contractor in writing that the payment was overdue

(that is, sent past due notices), Forty percent reported that they requested

assistance from a federal agency officer, such as a contracting officer, and

27 percent stopped work. For those firms that classified themselves as

construction (less than 60 percent), 18 percent filed a notice under the

Miller Act. About 8 percent reported that they collected interest under the

terms of the subcontract.

a

Causes of Delayed

Payment

In identifying the causes of their worst delayed payment problem, 20 out

of 118 subcontractors that experienced a payment problem reported that

the prime challenged their request for payment. Fifty-two of the

118 subcontractors reporting payment problems said that they believed a

government delay in paying the prime contractor contributed to the

subcontractors’ payments being delayed.

Length of Payinent Delay

For their worst late payment, the subcontractors that complained about

payment problems provided the dates when they submitted their invoice

Page 26

GAWNSIAD-92-186 DOD Contracting

Chapter 8

Better Use of Special Payment Protection

Techniques Needed

to the prime and when they received payment. For those that had been

paid, payments were made an average of about 146 days after the firms

submitted their invoices to the prime contractor. However, about 41 of the

118 responding firms had not been paid on their most significant payment

problem as of late 1992. Delays of this magnitude will adversely affect a

subcontractor’s cash flow and ultimately reduce its profitability.

Proposals Do Not

Address Some of the

Causes of Payment

Problems

.

.

In examining the feasibility and desirability of the payment protections

listed in section 806, we attempted to identify some of the underlying

causes of payment problems. The items described in section 806 may help

prevent prime contractors from diverting funds for purposes other than

their intended use. However, the items listed in section 806 would not help

mitigate payment problems caused by

delayed payment by the government and/or

disputes between the prime and the subcontractor.

When the government has delayed payment to the prime contractor, some

of the payment protections listed in section 806 would not provide

additional payment protection to subcontractors. Procurement officials

stated that payment delays may result from the government not processing

the prime contractor’s payment request in a timely fashion. However, the

payment delays may also result from the government disapproving the

prime contractor’s payment request because of contract performance

problems.

In addition, many of the items listed in section 806 would provide

additional payment protection to subcontractors only if the prime

contractor has agreed to pay the subcontractor and certifies on its invoice

to the government that the subcontractor should be paid. Procurement

I,

officials we interviewed said that disputes were a cause of subcontractor

payment problems. When there is a dispute between the prime and the

subcontractor, the prime may delay payment to the subcontractor until the

dispute is resolved and the prime is expected to exclude these costs from

its invoice to the government. The items listed in section 806 are not

designed to address delayed payments to subcontractors that result from

disputes.

Page 20

GAO/NSIAD-93-186 DOD Contracting

Chapter 8

Better Use o? Special Payment Protection

Techniques Needed

Contracting Officers

Can Provide

Additional Payment

Protection

The National Defense Authorization Act for F’iscal Years 1992 and 1993

requires

DOD

to disclose payment information about prime contracts and

allows contracting officers to respond to subcontractor assertions of

nonpayment. The-act states that under procedures established in the

regulations, when the prime contractor has not complied with subcontract

payment terms, a contracting officer may encourage a prime contractor to

make timely payment to the subcontractor; or reduce or suspend progress

payments to the contractor if contract payment terms allow it. The act also

authorizes the contracting officer to pursue administrative or legal action

if the contractor’s certification that accompanies a payment request is

inaccurate.

In response to this act,

DOD

issued regulations that were effective in

September 1992. Portions of the regulations require contracting officers to

advise the subcontractor on whether the prime contractor has submitted

requests for payments. Contracting officers are also required to disclose

information about payment bonds to subcontractors. Subcontractors can

use this information to help resolve their payment problems.

DOD'S

new regulations state that contracting officers may “encourage the

contractor to

make

timely payment to the subcontractor, , .” As discussed

in chapter 2, contracting officers have occasionally used special payment

protection techniques to improve the timeliness of payments to

subcontractors, such as special bank accounts. However, contracting

officials expressed a reluctance to take actions even in cases where

contract performance had seriously been affected or the contractor had

repeatedly failed to make timely payment.

DOD

officials stated that its

policies and procedures do not identify the (1) circumstances under which

contracting officer should act and (2) special payment protection

mechanisms that could be used.

a

Recommendation

Payment protection mechanisms, such as many of those listed in section

806. are available and could be used to improve the timeliness of payments

to subcontractors. However, policy and procedures do not clearly state

when a contracting officer should act and what actions should be taken

when subcontractor payment problems are identified. We recommend that

the Secretary of Defense issue policies and procedures for (1) identifying

the circumstances under which contracting officers should take action to

provide payment protection for subcontractors and (2) implementing

appropriate payment protection techniques.

Page 27

GADAWXAD-92-126 DOD Contracting

Chapter 8

Better Wee of Spdd Payment Protection

Technique8 Needed

Comments and Our

Evaluation

In commenting on a draft of this report,

DOD

concurred with our findings

and partially concurred with our recommendation.

DOD

stated that it has a

significant interest in the timely payment of subcontractors because of the

potential negative impact on a prime contractor’s performance when

subcontractors are not paid promptly.

DOD

agreed to take action to ensure

that contracting officers are aware of the special techniques to use when

subcontractor payment problems arise. We believe that

DOD'S

proposed

actions are consistent with our recommendation.

WD'S

comments are

presented in their entirety in appendix I.

We also requested comments on a draft of this report from selected

industrial associations and have revised the report where appropriate.

However, one of the criticisms indicated that we did not fulfill the

requirements of section 806, in part, because we did not include an

analysis of the appropriateness of any differential treatment for

subcontractors needed in exploring the feasibility and desirability of the

payment protections described in section 806. We considered the

feasibility and desirability of providing additional payment protection for

subcontractors working for different categories of prime contractors, as

well as providing additional payment protection for all tiers of

subcontractors. However, we concluded that since the payment problems

identified were not specific to a particular group, there was not a need for

providing differential treatment.

Other criticisms centered around the distribution of the questionnaire

contained in appendix III, as well as the time provided to respond to the

questionnaire. We have modified the report to emphasize that we did not

use statistical sampling techniques and that the respondents were entirely

self-selected. We had originally requested that all responses be returned by

September l&1992. However, when we contacted each of the associations

to ensure that they had received the questionnaire for distribution to their

member firms, 10 of the 33 associations said they needed additional time

a

to distribute the questionnaire; as a result, we continued to accept

responses through November 1992.

Page 28

GAO/NSIAD.98-186 DOD Contracting

,

,.: 8 : ’

.I

.,I

’

‘,,

.‘I

I

4

.y ,,-

a

Page 29

GAOAWIAD-98-186 DOD Contracting

! ,.

Appendix I

Comments From the Department of Defense

OFFICE OF THE UNDER SECRETARY OF DEFENSE

WASHINGTON, DC 20301

~CaiJlllTlON

DP/CPF

MAR 2 3 1993

Mr. Frank C. Conahan

Assistant Comptroller General

National Security and

International Affairs Division

U.S. General Accounting Office

Washington, DC 20548

Dear Mr. Conahan:

This is the Department of Defense (DOD) response to the General

Accounting Office (GAO) draft report entitled--"SUBCONTRACTOR PAYMENT:

Need

for Statutory and Regulatory Changes Not Identified," dated

February 3, 1993 (GAO Code 396156/OSD Case 9314). The DOD concurs with the

findings

and

partially concurs with the recommendation included in the

report.

The DOD has a significant interest in the timely payment of

subcontractors because of the potential negative impact on contract

performance when subcontractors are not paid promptly. It is the DOD

policy that prime contractors promptly pay their subcontractors for work

performed on defense contracts.

However, because contracts between prime

contractors and subcontractors are private contracts, the DOD does not have

privity of contract with the subcontractors and must, therefore, induce

compliance through requirements placed on prime contractors.

For example,

a

DOD objective is to do business only with companies

having a satisfactory record of integrity and business ethics. For that

reason, a contracting officer is required to obtain information about a

potential prime contractor's responsibility before awarding a contract.

Responsibility includes the potential contractor's financial condition,

performance record,

and relations with vendors, trade creditors, and

bankers. Companies which

are

not paying their bills promptly are regarded

unfavorably during these reviews and may be prevented from receiving a

contract.

Construction contracts require prime contractors to have a third party

guarantee that subcontractors and suppliers on a DOD contract will be paid.

The prime contractor must also certify that payments to subcontractors will

be made within seven days of payment by the DOD, which ensures

subcontractors on construction contracts are paid promptly.

Additionally, if the prime contractor is a large business, the DOD

will not make progress payments or cost reimbursements on subcontracts

until payment is made to the supplier. If any prime contractor (whether a

a

Page 80

GAOiNSIAD-98-186 DOD Contracting

Commenti From the Dqmtment of Defame

large or small business) is delinquent in paying the costs of performing a

tifenae contract, the Progress Payments clause gives the contracting

officer the authority to suspend or reduce progress payments.

These

requirements

are a

strong incentive for timely payment to subcontractors.

In accordance with the requirements included in Section SO6 of the

National Defense Authorization Act for

Fiscal

Years

19% and 1993

(Public

Law 102-190), the DOD issued additional regulations that

became effective

in September 1992.

These regulations require the DOD to disclose

information about prime contract payments and payment bonds to

subcontractors, to encourage prime contractors to

make

timely payments to

subcontractors, and to consider reducing or suspending progress payments to

contractors if allowed by the contract payment terms.

The DOD agrees that despite these policies, there

are

some problems

with subcontractor payments, although the problems are not widespread.

Contracting officers are reluctant to

use

special techniques that would

encourage the prompt payment of subcontractors even when contract

performance

has been seriously affected.

The DOD agrees that special

techniques (such as special bank accounts, escrow aCCOWItS, and proofs of

subcontractor payment) should be considered when contract performance is

expected to be negatively impacted because of subcontractor payment

problems.

To ensure contracting officers are aware of these techniques and the

situations when they should be considered for use, the Director of Defense

Procurement will issue a memorandum within the next

60 days to

the

Military

Departments and the Defense Logistics Agency. The

memorandum will

address

(1) the importance of examining company payment of subcontractors before

issuing a responsibility determination for potential contractors; (2) the

importance of communications between administrative contracting officers,

procurement contracting officers

, and prime contractors when subcontractor

payment problems arise; and (3) the selective use of special techniques

when the contracting officer believes contract performance may be

jeopardized due to subcontractor payment problems. This policy memorandum

will be highlighted in a Defense Acquisition Circular.

The DOD will also

ensure the subject is adequately

covered

in training courses and the

Contract Administration Manual.

The detailed DOD comments on the report recommendation are provided in

the enclosure.

The DOD appreciates the opportunity to comment on this

&aft report.

Sincerely,

Eleanor R. Spector

Director, Defense Procurement

Enclosure

Page 81

CUDiNSIAD-98486

DOD Contracting

‘. ,.

I,

Commenta From the Deparbaent of Defeme

Nowonp.27.

OAODRAE'TREPORT-DATED- 3, 1993

(GAO CODE 396156) 050 CASE 9314

"SWC<YWTRACTOR PAYkaNT: NEED FOR STATDTORY AND

REGDLMQRY CHMGES NOT IDE#TIlpIED"

DEPARTMEN!l'OZ'DWENSE-SO)J

TSE GAO RE-TION

*a***

0

: The GAO recommended that the Secretary of Defense

issue policies and procedures (1) for identifying the circumstances

under which contracting officers should take action to provide payment

protection for subcontractors and (2) for implementing appropriate

payment protection techniques. (p. 33/GAO Draft Report)

DOD:

Partially concur.

The Director of Defense Procurement

will issue a policy memorandum within the next 60 days to the

Military Departments and the Defense Logistics Agency to ensure

contracting officers are aware of the payment techniques available

for use when the interests of the Government need protection due to

subcontractor payment problems.

The memorandum will address (1) the

importance of examining company payment of subcontractors before

issuing a responsibility determination for potential contractors;

(2) the importance of communications between administrative

contracting officers, procurement contracting officers, and prime

contractors when subcontractor payment problems arise;

(3) and the

selective use of special techniques when the contracting officers

believe contract performance may be jeopardized due to subcontractor

payment problems.

In addition, the Department will ensure that this

subject area is adequately covered in training courses, and that the

issuance of the policy memorandum is highlighted in a Defense

Acquisition Circular.

Since many of these problems arise on

contracts under the cognizance of the Defense Contract Management

Command, the substance of the policy memorandum will be included in

the Contact Administration Manual issued by the Defense Logistics

Agency.

The Department expects to implement the above actions in

FY 1993.

Enclosure

Page 22

GAANNSIAD-98-186 DOD Contrmting

,‘.: _

,,

..‘. ,,

‘,

,., 1’“’

,

,1,;

.’ ,

,’ /

,‘._I

.“.‘/l, .:I

.) : ...z.

Appendix II

Executive Branch Activities and Locations

Visited

Department of

Defense

Defense Contract Audit Agency

Headquarters

Branch offices (Atlanta, Orlando)

Defense Contract Management Command

Headquarters

Defense Contract Management Command District South

Defense Contract Management Area Operations (Atlanta, Birmingham,

Chicago, Orlando)

US. Air Force, Warner-Robins Air Logistics Center

US. Army Corp of Engineers

Headquarters

South Atlantic Division

Savannah District

Mobile District

US. Army Missile Command

Naval Facilities Engineering Command

Headquarters

Northern Division (Philadelphia)

Naval Sea Systems Command

Headquarters

Supervisor of Shipbuilding, Conversion, and Repair (New Orleans)

b

_

Office of Management

and Budget

Small Business

Administration

11

Offices of Advocacy, Minority Small Business and Capital

Ownership Development, Procurement Assistance, and Surety

Guarantees

Page 98

GAO/NSIAD-99-190 DOD Contracting

‘F,

:’ ;

0’

Appendix III

GAO Questionnaire on Subcontractor

Payment Problems

REQUEST FOR INFORMATION ABOUT DELAYED PAYMENT PROBLEMS

FOR SUBCONTRACTORS UNDER FEDERAL CONTRACTS IN 1991

The United States General Accounting Oflice (GAO), an

agency of the Congress. is studying subconuactor payment

prtwlures as part of a congressional assessment of federal

conmcting legislation. Part of our study concerns delays

which &contnxtors have experienced in receiving

paymems from contractors on work funded by federal

conmu. If you have had a deluyed payment, as defti

below, we encowage you to complete this questiomuure.

Infomution provided in the questionnaire will be trrated as

confidential by GAO. Study rcsulu will only be rqmrted in

stadsdcal summaries in which the information from

individual Btms can not be identifiad.

Completed questiconaims should be ntmned to:

Mr. Ralph Dawn

US General Accounting Office

Room 5015

44lGStmetNW

Washingmu. D.C. 20548

Any inquiries about the study should be directed to Mr.

Ralph Dawn or Ms. Edna Falk (202-275-8465).

DEFINITION OF DELAYED PAYMEhTS WHICH ARE

,o,

II

(I

federal contract?

b. Were you owed payments at any

0 Yes 0 No

time in FY-91 on such a conoect?

c. Was the payment on at least one

0 Yes 0 No

such subconuact delayed beyond a

period which was either specified

in your subcon~b identified as

your due date fx accepted as

normal for dtesa twes of contracts?

eligible for the Small Business Administration’s 8(a)