Attention:

You may file Forms W-2 and W-3 electronically on the SSA’s Employer

W-2 Filing Instructions and Information web page, which is also accessible

at www.socialsecurity.gov/employer. You can create fill-in versions of

Forms W-2 and W-3 for filing with SSA. You may also print out copies for

filing with state or local governments, distribution to your employees, and

for your records.

Note: Copy A of this form is provided for informational purposes only. Copy A appears in

red, similar to the official IRS form. The official printed version of this IRS form is scannable,

but the online version of it, printed from this website, is not. Do not print and file Copy A

downloaded from this website with the SSA; a penalty may be imposed for filing forms that

can’t be scanned. See the penalties section in the current General Instructions for Forms

W-2 and W-3, available at www.irs.gov/w2, for more information.

Please note that Copy B and other copies of this form, which appear in black, may be

downloaded, filled in, and printed and used to satisfy the requirement to provide the

information to the recipient.

To order official IRS information returns such as Forms W-2 and W-3, which include a

scannable Copy A for filing, go to IRS’ Online Ordering for Information Returns and

Employer Returns page, or visit www.irs.gov/orderforms and click on Employer and

Information returns. We’ll mail you the scannable forms and any other products you order.

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax

forms.

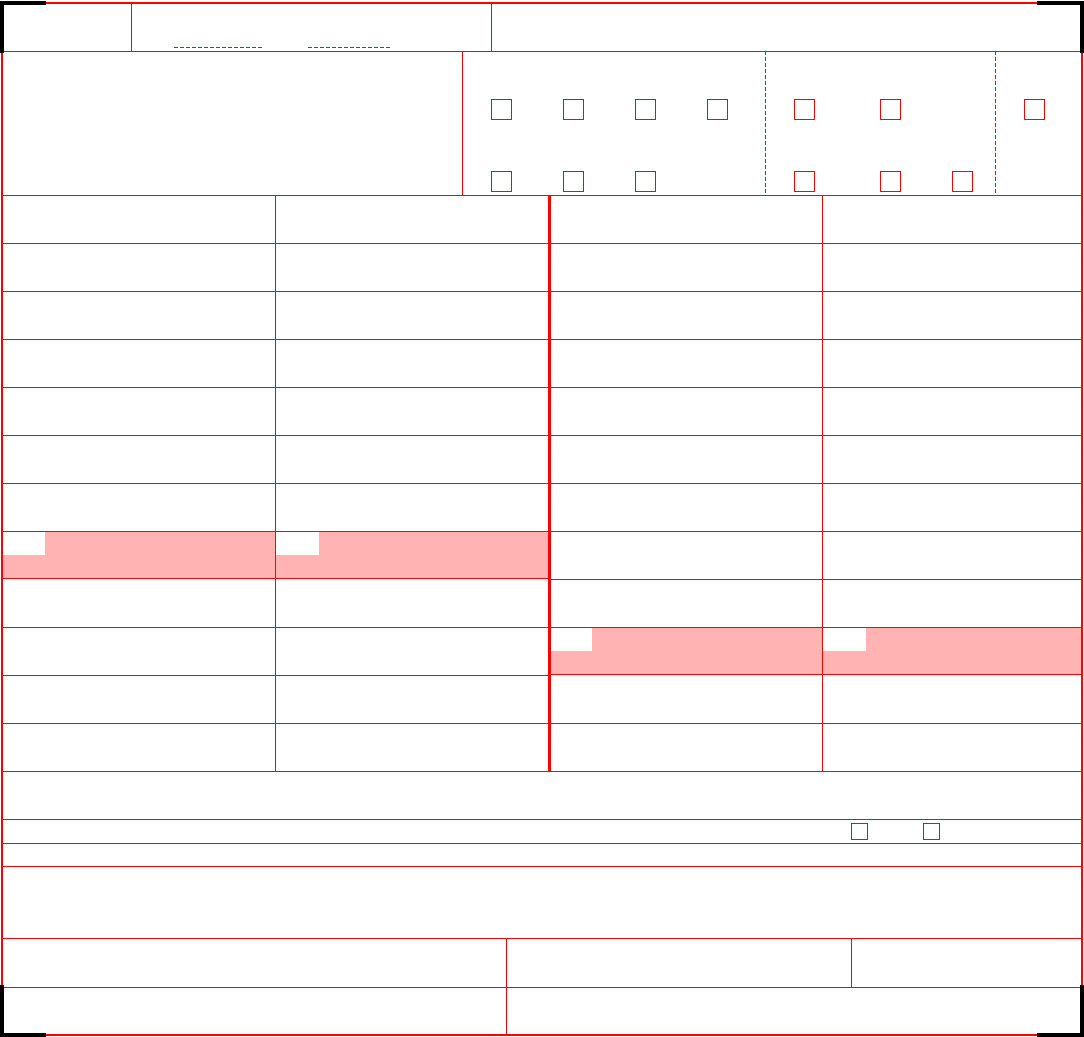

DO NOT CUT, FOLD, OR STAPLE

55555

a Tax year/Form corrected

/ W-

For Official Use Only:

OMB No. 1545-0029

b Employer’s name, address, and ZIP code c

Kind of Payer (Check one)

941/941-SS Military 943 944

CT-1

Hshld.

emp.

Medicare

govt. emp.

Kind of Employer (Check one)

None apply 501c non-govt.

State/local

non-501c

State/local

501c

Federal

govt.

Third-party

sick pay

(Check if

applicable)

d Total number of Forms W-2c e

Employer identification number (EIN)

f Establishment number g Employer’s state ID number

Complete boxes h, i, or j only if

incorrect on last form filed.

h Employer’s originally reported EIN i Incorrect establishment number j

Employer’s incorrect state ID number

Total of amounts previously reported

as shown on enclosed Forms W-2c.

1 Wages, tips, other compensation

Total of corrected amounts as

shown on enclosed Forms W-2c.

1 Wages, tips, other compensation

Total of amounts previously reported

as shown on enclosed Forms W-2c.

2 Federal income tax withheld

Total of corrected amounts as

shown on enclosed Forms W-2c.

2 Federal income tax withheld

3 Social security wages 3 Social security wages 4 Social security tax withheld 4 Social security tax withheld

5 Medicare wages and tips 5 Medicare wages and tips 6 Medicare tax withheld 6 Medicare tax withheld

7 Social security tips 7 Social security tips 8 Allocated tips 8 Allocated tips

9 9

10 Dependent care benefits 10 Dependent care benefits

11 Nonqualified plans 11 Nonqualified plans 12a Deferred compensation 12a Deferred compensation

12b 12b

14

Inc. tax w/h by third-party sick pay payer

14

Inc. tax w/h by third-party sick pay payer

16 State wages, tips, etc. 16 State wages, tips, etc. 17 State income tax 17 State income tax

18 Local wages, tips, etc. 18 Local wages, tips, etc. 19 Local income tax 19 Local income tax

Explain decreases here:

Has an adjustment been made on an employment tax return filed with the Internal Revenue Service? Yes No

If “Yes,” give date the return was filed:

Under penalties of perjury, I declare that I have examined this return, including accompanying documents, and, to the best of my knowledge and belief, it is true,

correct, and complete.

Signature: Title: Date:

Employer’s contact person Employer’s telephone number For Official Use Only

Employer’s fax number Employer’s email address

Form W-3c (Rev. 6-2024)

Transmittal of Corrected Wage and Tax Statements

Department of the Treasury

Internal Revenue Service

Purpose of Form

Complete a Form W-3c transmittal only when filing paper Copy A of the most

recent version of Form(s) W-2c, Corrected Wage and Tax Statement. Make a

copy of Form W-3c and keep it with Copy D (For Employer) of Forms W-2c for

your records. File Form W-3c even if only one Form W-2c is being filed or if those

Forms W-2c are being filed only to correct an employee’s name and social security

number (SSN) or the employer identification number (EIN). See the General

Instructions for Forms W-2 and W-3 for information on completing this form.

E-Filing

See the General Instructions for Forms W-2 and W-3 for e-filing requirements for

Forms W-2c and W-3c. The SSA provides two free e-filing options on its Business

Services Online (BSO) website:

• W-2c Online. Use fill-in forms to create, save, print, and submit up to 25 Forms

W-2c at a time to the SSA.

• File Upload. Upload wage files to the SSA you have created using payroll or tax

software that formats the files according to the SSA’s Specifications for Filing

Forms W-2c Electronically (EFW2C).

For more information, go to www.SSA.gov/employer.

When To File

File this form and Copy A of Form(s) W-2c with the Social Security Administration

as soon as possible after you discover an error on Forms W-2, W-2AS, W-2GU,

W-2CM, W-2VI, or W-2c. Provide Copies B, C, and 2 of Form W-2c to your

employees as soon as possible.

Where To File Paper Forms

If you use the U.S. Postal Service, send this entire page with Copy A of Form

W-2c to:

Social Security Administration

Direct Operations Center

P.O. Box 3333

Wilkes-Barre, PA 18767-3333

Note: If you use an IRS-approved private delivery service to file, replace “P.O. Box

3333” with “Attn: W-2c Process, 1150 E. Mountain Dr.” in the address and change

the ZIP code to “18702-7997.” Go to www.irs.gov/PDS for a list of IRS-approved

private delivery services.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 10164R