Withholding Tax

Guide

Effective for Withholding Periods

Beginning on or After January 1, 2022

Publication W-166 (6/24)

TABLE OF CONTENTS

Page

1.

FEDERAL EMPLOYER’S TAX GUIDE........................................................................................................................... 5

2.

REGISTRATION AND ACCOUNT INFORMATION ........................................................................................................ 6

A. Application Process ....................................................................................................................................................... 6

B. Wisconsin Withholding Tax Number ............................................................................................................................ 6

C. Filing Frequency ............................................................................................................................................................ 6

D. Reactivate Withholding Account .................................................................................................................................. 7

E. Change in Business Entity ............................................................................................................................................. 7

3.

GENERAL WITHHOLDING INFORMATION ................................................................................................................ 7

A. Employee’s Withholding Exemption Certificate ........................................................................................................... 7

B. Special Situations Regarding Form WT-4 and Form WT-4A .......................................................................................... 7

C. Employees Claiming Exemption from Withholding (Form WT-4) ................................................................................. 8

D. Withholding Calculator ................................................................................................................................................. 9

E. New Hire Reporting Requirements ............................................................................................................................... 9

F. Wages Paid to Residents Who Work Outside Wisconsin .............................................................................................. 9

G. Special Minnesota Withholding Arrangement ............................................................................................................. 9

H. Out-of-State Disaster Relief Responders ...................................................................................................................... 9

I. Wages Paid to Nonresidents Who Work in Wisconsin ............................................................................................... 10

J. Nonresident Employers .............................................................................................................................................. 10

K. Withholding on Nonresident Entertainers ................................................................................................................. 11

L. Withholding for Noncash Fringe Benefits ................................................................................................................... 12

M. Health Savings Accounts ............................................................................................................................................. 12

N. Third Party Sick Pay ..................................................................................................................................................... 12

O. Pensions ...................................................................................................................................................................... 13

P. Reporting of Wages for Agricultural, Domestic, or Other Employees Exempt from Withholding ............................. 13

Q. Willful Misclassification Penalty for Construction Contractors .................................................................................. 13

R. Payments Made to Decedent Estate or Beneficiary ................................................................................................... 13

4.

DEPOSITING WITHHELD TAXES ............................................................................................................................. 14

A. Reporting Requirements ............................................................................................................................................. 14

B. Deposit Report (Form WT-6) Filing Options ............................................................................................................... 14

C. Reporting Periods ....................................................................................................................................................... 14

D. Reporting Changes to Wisconsin Employer Account Information .............................................................................. 15

E. Filing Due Dates .......................................................................................................................................................... 15

F. Extensions ................................................................................................................................................................... 16

G. Failure to File or Pay by the Due Date ........................................................................................................................ 16

H. Failure to Report Amount of Taxes Withheld ............................................................................................................. 17

I. Refund/Credit for Overpayment(s) ............................................................................................................................. 17

J. Other ........................................................................................................................................................................... 17

5.

RECONCILIATION PROCESS ................................................................................................................................... 17

A. Preparing Employee W-2 ............................................................................................................................................ 17

B. Furnishing Employees with Wage and Tax Statements .............................................................................................. 18

C. Annual Reconciliation (WT-7) Filing Options .............................................................................................................. 18

D. Wage Statement and Information Return Reporting Requirements .......................................................................... 20

E. Filing Wage and Information Returns ......................................................................................................................... 21

F. Extensions ................................................................................................................................................................... 21

G. Discontinuing Withholding ......................................................................................................................................... 22

H. Wisconsin Information Return Form 9b ..................................................................................................................... 22

6.

OTHER TAXES TO BE AWARE OF ............................................................................................................................ 23

7.

KEEPING AWARE OF CHANGES IN WISCONSIN TAX LAWS ...................................................................................... 24

8.

ADDITIONAL INFORMATION AND FORMS ............................................................................................................. 24

WISCONSIN INCOME TAX WITHHOLDING METHODS ..................................................................................................... 25

ALTERNATE METHOD OF WITHHOLDING WISCONSIN INCOME TAX ............................................................................... 26

Withholding Tax Guide

Publication W-166

Back to Table of Contents

4

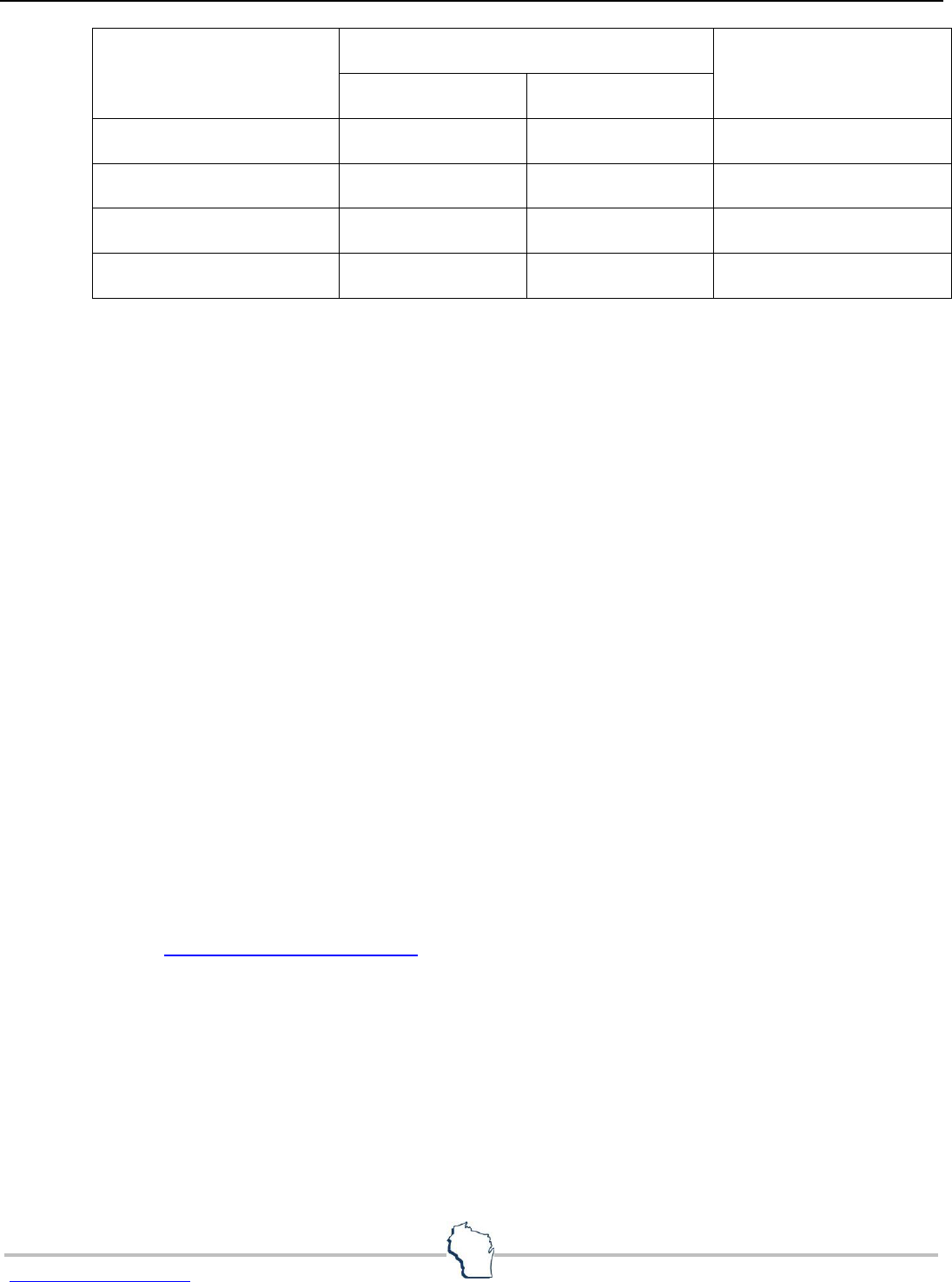

TABLE OF WISCONSIN WITHHOLDING FORMS AND FEDERAL COUNTERPART

WI FORM

NUMBER

FORM TITLE

FEDERAL

COUNTERPART

BTR-101

Application for Business Tax Registration

SS-4

WT-4

Employee’s Wisconsin Withholding Exemption Certificate & New Hire

Reporting

W-4

WT-4A

Wisconsin Employee Withholding Agreement

None

WT-6

Withholding Tax Deposit Report

Form 8109

WT-7

Employer’s Annual Reconciliation of Wisconsin Income Tax Withheld from

Wages

W-3

None

*

Wage and Tax Statement

W-2

Form 9b

Wisconsin Information Return

1099, W-2G

WT-11

Nonresident Entertainer’s Receipt for Withholding by Employer

None

WT-12

Nonresident Entertainer's Lower Rate Request

None

W-200

Certificate of Exemption from Wisconsin Income Tax Withholding

None

W-220

Nonresident Employee’s Withholding Reciprocity Declaration

None

*

Wisconsin uses federal Form W-2

IMPORTANT NEWS

Withholding tax rates. Current withholding rates continue for 2024.

Electronically File Forms W-2c. You can electronically file Forms W-2c through the data file transfer using EFW2C

format.

Printable wage and information returns. Effective December 1, 2024, for all tax years, format to print one taxpayer

per page. Use the following formats for printable forms:

• W-2

• W-2C

• W-2G

• 1099-DIV

• 1099-INT

• 1099-MISC

• 1099-NEC

• 1099-R

Withholding Tax Guide

Publication W-166

Back to Table of Contents

5

REMINDERS

Form 1099-NEC. For federal purposes, businesses use Form 1099-NEC instead of Form 1099-MISC to report to the IRS

amounts paid for services performed by someone who is not an employee of the business (nonemployee compensation).

For Wisconsin purposes, businesses must follow the reporting requirements in Publication 117, Guide to Wisconsin Wage

Statements and Information Returns.

Truncated taxpayer identification numbers on Forms W-2 and 1099. As a safeguard against identity theft, the IRS allows

payers to truncate a payee's taxpayer identification number (SSN, FEIN, or ITIN) on the copy of Form W-2 or 1099 that the

payer gives to the payee. The department follows the IRS treatment.

Caution: Payers may not truncate the payee's social security number on any forms filed with the department, IRS, or Social

Security Administration. Payers may not truncate their own identification number on any forms given to the payee or filed

with the department, IRS, or Social Security Administration.

Federal Form W-4 cannot be used for Wisconsin withholding tax purposes. For Wisconsin withholding tax purposes,

every newly-hired employee is required to provide a completed Form WT-4 to each of their employers.

Reporting requirement for employer withholding. Employers filing quarterly, monthly, or semi-monthly cannot submit

an annual reconciliation of Wisconsin tax withheld (Form WT-7) until all withholding deposit reports (Form WT-6) have

been filed. The filer will get a rejection or error message if:

1. The total withholding tax reported on the annual reconciliation is more than the total tax reported on the withholding

deposit reports or

2. One or more withholding deposits have not been filed. Withholding deposits can be in pending status with a future

payment date.

This requirement reduces the number of penalties imposed on the annual reconciliation and reduces appeals (see

Wisconsin Tax Bulletin #203).

Application to submit W-2 information. We created a My Tax Account (MTA) application that allows businesses to key in

and submit W-2 and 1099 information at any time during the year. The application makes it easy to submit information

returns omitted from previous submissions. It also provides a user-friendly option for those that don’t have an active

withholding account but have a need to submit W-2s or 1099s.

Nonresident entertainer reporting. The nonresident entertainer withholding report (Form WT-11) is tax-year specific and

allows you to report withholding for multiple nonresident entertainers. Nonresident entertainers may request a lower

withholding rate using Form WT-12. You may file these forms electronically through MTA.

W-2s and information returns required to be filed with the department are due January 31. See Publication 117, Guide

to Wisconsin Wage Statements and Information Returns, for more information.

We may not issue a refund to an employed individual before March 1, unless the individual and individual's employer

have filed all required returns and forms for the taxable year for which the individual claims a refund.

1.

FEDERAL EMPLOYER’S TAX GUIDE

Wisconsin individual income and withholding tax laws generally conform to the federal Internal Revenue Code. Most

definitions and instructions are identical to those used by the Internal Revenue Service (IRS) and published in the

Federal Employer’s Tax Guide Circular E (Publication 15) and the Employer’s Supplemental Tax Guide

(Publication 15-A). These publications may be obtained at your local IRS office, or by calling 1-800-829-3676.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

6

2.

REGISTRATION AND ACCOUNT INFORMATION

A. Application Process

Every employer who pays wages subject to Wisconsin withholding, or voluntarily withholds Wisconsin tax, must

register for a Wisconsin withholding tax number. Registration options include:

• Register online at tap.revenue.wi.gov/btr or

• Complete Form BTR-101, Application for Wisconsin Business Tax Registration, and mail or fax as provided

in the form's instructions. If you fax Form BTR-101, use black ink and include a cover sheet with the

contact's name, fax number, and telephone number. You may obtain Form BTR-101 by contacting any of

our local offices, or by calling (608) 266-2776.

If you register online, you will receive a Wisconsin withholding tax number within one to two business days. If

you mail or fax Form BTR-101, allow 15 business days for the department to process your application.

Fully complete your application. Failure to include information such as the first date of withholding, your federal

employer identification number, or an estimate of the amount of tax to be withheld could delay the processing

of your application.

Business Tax Registration Renewal Fee: The initial $20 registration fee covers a period of two years. At the end

of that period, a $10 renewal fee applies every two years to all persons holding permits or certificates subject

to Business Tax Registration provisions.

B. Wisconsin Withholding Tax Number

Employers should use the 15-digit Wisconsin withholding tax number assigned to your business for all state

withholding tax reporting.

The Wisconsin withholding tax number has 15 digits and appears as: 036-0000000000-00. You will retain your

number permanently, unless you no longer have a withholding requirement and close your account. If you have

more than one withholding tax number, notify us. We will let you know which number to use.

Each corporation (subsidiary) of an affiliated group, which has its own employees and its own federal employer

identification number, must apply for its own Wisconsin withholding tax number. Each corporation is considered

a separate employer. Unlike the Internal Revenue Service, Wisconsin does not permit the use of a common

paymaster. However, a corporation that has several divisions (not separate entities) must have a single

Wisconsin withholding tax number to report withholding for all divisions.

The Wisconsin withholding tax number is different from the federal employer identification number. Always use

the Wisconsin withholding tax number when corresponding with us.

C. Filing Frequency

The department assigns your filing frequency based on information provided in your application. If your

withholding liability changes, you may be notified in writing of a change to your filing frequency starting with

the period beginning January 1 of the next calendar year.

Filing more frequently than your required assigned frequency is acceptable if there is at least one return per

required period. You do not need to request permission to file more frequently than your assigned filing

frequency. For example: if an employer has a biweekly payroll but has a monthly filing requirement, the

employer may submit WT-6 payments for each biweekly payroll period.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

7

If you want to file less frequently than your assigned frequency, you must request permission from the

department. In general, the department will only approve these requests if the employer provides proof that

the employer will not have a tax liability during the required filing periods. For example: if an employer has a

monthly payroll but has a semi-monthly filing requirement, the employer may request permission to file

monthly instead of semi-monthly.

D. Reactivate Withholding Account

If you resume business or rehire employees, and previously held a Wisconsin withholding tax number, request

reinstatement of your prior number if ownership of your business is the same. Call (608) 266-2776 or email your

request to DORWithh[email protected]ov.

E. Change in Business Entity

If you change your business entity (e.g., sole proprietorship to partnership or corporation, or partnership to

corporation) you must obtain a new Wisconsin withholding tax account number. An employer who acquires the

business of another employer may NOT use the former employer's tax number. The new employer must apply

for their own number.

Note: The department has adopted a policy similar to the IRS regarding partner changes. Generally, if you are

required to obtain a new federal employer identification number, you are also required to register for a new

Wisconsin withholding tax number.

A continuing partnership with an ownership change of less than 50% may continue using the same Wisconsin

withholding tax account number. When the change in ownership is 50% or more, follow federal requirements.

If a new federal identification number is required, a new Wisconsin withholding number is required. Send the

names, addresses, and social security numbers of added or dropped partners to the department within 10 days

after a change takes place.

A separate annual reconciliation (WT-7) and wage and information returns must be filed for each legal entity.

Single-Member LLC

A disregarded entity is automatically considered an "employer" for purposes of federal withholding taxes.

Wisconsin follows this treatment. This means a single-owner entity that is disregarded as a separate entity under

Internal Revenue Code is an "employer" for Wisconsin withholding tax purposes.

As an "employer," a disregarded entity must obtain a Wisconsin withholding tax number.

3.

GENERAL WITHHOLDING INFORMATION

A. Employee’s Withholding Exemption Certificate

The Wisconsin Withholding Exemption Certificate (Form WT-4) is used to determine the amount of Wisconsin

income tax to be withheld from employee wages. Every newly-hired employee must give Form WT-4 to their

employer. Employers may also use this form to comply with new hire reporting requirements.

B. Special Situations Regarding Form WT-4 and Form WT-4A

Additional withholding: If the amount withheld is insufficient to meet an employee’s annual income tax liability,

the employee can avoid making estimated tax payments or paying a large amount with their income tax

return by reducing the number of withholding exemptions claimed. If no exemptions are claimed, and under

Withholding Tax Guide

Publication W-166

Back to Table of Contents

8

withholding still results, the employee may designate an additional amount to be withheld using Wisconsin

Form WT-4 or submit a written request to the employer to have an additional amount withheld each pay period.

Less withholding: If the maximum number of allowable exemptions is claimed and over withholding still occurs,

the employee may request the employer withhold a lesser amount. In such instances, the employee must

complete an Employee Withholding Agreement (Form WT-4A).

The employee must provide a copy of the agreement to the employer and the department. The department is

authorized to void an agreement by written notification to the employer and employee if it is determined that

the agreement is incorrect or incomplete.

No withholding: An employer is not required to deduct and withhold Wisconsin income tax from the employee’s

wages when the employee certifies to the employer on Form WT-4 that the employee had no income tax liability

for the prior year and anticipates no liability for the current year. Federal Form W-4 cannot be used by an

employee to claim complete exemption from Wisconsin withholding. See item C, for an explanation of the

employer’s responsibility to furnish a copy of the exemption certificate to this department.

Employers must retain copies of Forms WT-4 and WT-4A submitted by their employees.

Note: A claim for total exemption from withholding tax must be renewed annually. Employers should review

their records at the beginning of each year to ensure they have a current Form WT-4 on file for each employee

claiming total exemption from withholding tax.

Employees who prepay their Wisconsin income tax: An employee may prepay with the department

100 percent of their estimated tax for the next year before the last day of the current year.

We will issue a Certificate of Exemption from Wisconsin Income Tax Withholding (Form W-200) for the

employee to present to their employer. The employee is then entitled to a complete exemption from Wisconsin

withholding for the designated year. This is a voluntary action by the employee and may not be forced by the

employer. The employer should not ask the employee to complete, nor should the employer accept, a

Form WT-4 which claims total exemption for the year of the prepayment.

See our Prepayment of Tax common question for additional information.

C. Employees Claiming Exemption from Withholding (Form WT-4)

Wisconsin law requires that a copy of Form WT-4 be filed with the department whenever either of the following

conditions exists:

• The employee claims more than 10 exemptions.

• The employee claims complete exemption from Wisconsin withholding and earns over $200 a week.

Employers. Send Forms WT-4 claiming more than 10 exemptions or complete exemption from withholding to

Wisconsin Department of Revenue, Audit Bureau, PO Box 8906, Madison, WI 53708-8906.

Copies of employee exemption certificates filed during a quarter must be submitted at the end of the quarter.

No copy is required if the employee is no longer working for the employer at the end of the quarter.

We will review certificates filed by the employer upon receipt. Employers withhold taxes as requested by their

employee, unless the employer receives written instructions from the department to withhold on some other

basis.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

9

Employees. When an employee claims complete exemption from Wisconsin withholding tax, a new Form WT-4

must be filed annually. The employer must receive a completed Form WT-4 for the current income year on or

before April 30, of that year. If the employee fails to furnish an exemption form, the employee shall be

considered as claiming zero withholding exemptions.

D. Withholding Calculator

An employee with too much or too little withheld from their paycheck may find our withholding calculator

helpful. The calculator estimates the amount of Wisconsin income tax withheld by an employer based on the

number of withholding exemptions the employee claims, the employee's withholding status and pay

information.

E. New Hire Reporting Requirements

All employers with a federal employer identification number must report all newly-hired or rehired employees

to the New Hire Program within 20 days of hire or re-hire.

The easiest and most cost-effective way to report new hires is via the internet. For more information, visit

the Wisconsin New Hire Reporting Center or contact the New Hire Processing Center toll free at 1-888-300-4473.

F. Wages Paid to Residents Who Work Outside Wisconsin

Wages paid to Wisconsin residents are subject to Wisconsin withholding, whether paid for services performed

entirely in Wisconsin, partly in and partly outside Wisconsin, or entirely outside Wisconsin. The Secretary of

Revenue may authorize special withholding arrangements in hardship cases resulting from situations in which

persons domiciled in Wisconsin are subjected to withholding in some other state because they perform

substantial personal services in such other state.

G. Special Minnesota Withholding Arrangement

The Secretary of Revenue has authorized a special withholding arrangement for employers of Wisconsin

residents working in Minnesota. Wisconsin withholding will not be required under the following circumstances:

• The employee is a legal resident of Wisconsin (i.e., domiciled in Wisconsin) when the wages are earned in

Minnesota, and

• The wages earned in Minnesota by the Wisconsin resident are subject to Minnesota withholding and would

also be subject to Wisconsin withholding.

Employees who do not have Wisconsin income tax withheld from wages earned in Minnesota must make regular

estimated tax payments if they expect to owe $500 or more with their Wisconsin income tax return for the year.

For more information see the Withholding and Tax Filing webpage.

H. Out-of-State Disaster Relief Responders

Qualifying out-of-state employers and out-of-state employees are allowed an exemption from employer

withholding registration and income tax reporting requirements, if the qualifying employer or employee is in

Wisconsin solely to perform disaster relief work in connection with a state of emergency declared by the

Governor.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

10

"Disaster relief work" means work, including repairing, renovating, installing, building, or performing other

services or activities, relating to infrastructure in this state that has been damaged, impaired, or destroyed in

connection with a declared state of emergency.

"Infrastructure" includes property and equipment owned or used by a telecommunications provider or cable

operator or that is used for communications networks, including telecommunications, broadband, and

multichannel video networks; electric generation, transmission, and distribution systems; gas distribution

systems; water pipelines; and any related support facilities that service multiple customers or citizens, including

buildings, offices, lines, poles, pipes, structures, equipment, and other real or personal property.

In order to claim an exemption under the Act, the qualifying business or employee must contact the department

within 90 days of the last day of the disaster period. See Publication 411, Disaster Relief, for more information.

The above provisions first apply to taxable years beginning on January 1, 2015.

I. Wages Paid to Nonresidents Who Work in Wisconsin

All wages paid to nonresidents (persons domiciled outside Wisconsin), for services performed in Wisconsin

*

, are

subject to withholding unless an exception applies. Some exceptions are listed below:

(1) Employers are interstate rail or motor carriers, subject to the jurisdiction of the federal Interstate Commerce

Commission and the employee regularly performs duties in two or more states.

(2) Payment is for retirement, pension and profit sharing benefits received after retirement.

(3) Employees are residents of a state with which Wisconsin has a reciprocity agreement; refer to the

Reciprocity section.

(4) Employees are residents of a state with which Wisconsin does not have a reciprocity agreement and either:

(a) the employer is an interstate air carrier and the employee earns 50% or less of their compensation in

Wisconsin, or

(b) the employer can reasonably expect the annual Wisconsin earnings to be less than $1,500. If the

employee wage estimate exceeds $1,500, the employer must withhold from wages paid thereafter,

sufficient amounts to offset amounts not withheld from wages previously paid.

(5) Employee qualifies for the nonresident military spouse withholding exemption. See Form W-221,

Nonresident Military Spouse Withholding Exemption.

*

If a nonresident earns wages both in and outside of Wisconsin, only that part of the wages earned in Wisconsin in each payroll

period is subject to Wisconsin withholding. It may be necessary for the employer to make a reasonable division of wages for each

payroll period with regard to services performed in and outside of Wisconsin. The employer may also be required to withhold

income tax for the employee’s state of residence. Contact the department in that state for more information.

Reciprocity: Wisconsin has reciprocity agreements with Illinois, Indiana, Kentucky, and Michigan. Persons who

employ residents of those states are not required to withhold Wisconsin income taxes from wages paid to such

employees. Written verification is required to relieve the employer from withholding Wisconsin income taxes

from such employee’s wages. Form W-220, Nonresident Employee's Withholding Reciprocity Declaration, may

be used for this purpose.

J. Nonresident Employers

Employers engaged in business in Wisconsin (e.g., organized under Wisconsin law, licensed to do business in

Wisconsin, or transacting business in Wisconsin) have the same requirements to withhold as Wisconsin

employers.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

11

Employers who are not engaged in business in Wisconsin, but who employ Wisconsin residents outside of

Wisconsin, may voluntarily register to withhold Wisconsin tax. If the employer chooses not to withhold the tax,

the employee may be required to make estimated payments of Wisconsin income tax. Payments may be made

electronically through our Make a Payment webpage or by using Form 1-ES, Wisconsin Estimated Income Tax

Voucher.

K. Withholding on Nonresident Entertainers

All payments made to a nonresident entertainer for performing in Wisconsin, except those excluded from the

total contract price, are presumed subject to withholding if the total contract price for the performance is more

than $7,000. The "employer" must file Form WT-11 within five days of the conclusion of the nonresident

entertainer's performance and withhold 6% of the total contract price, unless a lower rate is approved.

Exceptions: There is no requirement to withhold from the nonresident entertainer's payment if:

• The total contract price is $7,000 or less,

• The nonresident entertainer provides the employer proof of filing a sufficient bond or deposit with the

department at least seven days prior to the performance in Wisconsin, or

• The nonresident entertainer provides the employer a copy of a waiver issued by the department.

Total contract price does not include travel expense payments made to, or on behalf of, an entertainer that are

1) made under an accountable plan and 2) for actual transportation, lodging, and meals that are directly related

to the entertainer's performance in Wisconsin.

A nonresident entertainer generally must file a surety bond or cash deposit in the amount of 6% of the total

contract price at least seven days prior to the Wisconsin performance. To make a cash deposit, please contact the

Pass-Through Entity Review Unit by telephone at (608) 264-1032 or by email: dorincomepte@wisconsin.gov for

assistance in making the cash deposit payment.

If the entertainer is required to file a surety bond or deposit and fails to do so, the "employer" must withhold.

This withholding is separate from regular employee withholding and applies only to nonresident entertainers.

Any tax withheld under this nonresident entertainer law must be submitted separately from regular withholding

taxes.

If the amount withheld and Form WT-11 are not sent electronically through My Tax Account:

• Mail Form WT-11 and the amount withheld to Wisconsin Department of Revenue, PO Box 8965, Madison

WI 53708-8965, or

• Deliver to the department’s Madison office at 2135 Rimrock Road.

One copy of Form WT-11 should be given to the nonresident entertainer and one copy should be retained by

the employer. If you need more information on Form WT-11, call (608) 264-1032.

A nonresident entertainer is:

• A nonresident person who furnishes amusement, entertainment, or public speaking services, or performs

in one or more sporting events in Wisconsin for consideration or,

Withholding Tax Guide

Publication W-166

Back to Table of Contents

12

• A foreign corporation, partnership, or other type of entity not regularly engaged in business in Wisconsin,

that derives income from amusement, entertainment, or sporting events in Wisconsin or from the services

of a nonresident person as defined above.

"Employer" is a resident person who contracts for the performance of a nonresident entertainer. If there is no

such person, "employer" is the person who has receipt, custody or control of the event proceeds.

For more information, see Publication 508, Nonresident Entertainers.

L. Withholding for Noncash Fringe Benefits

Taxable noncash fringe benefits provided to employees must be treated as additional wages that are subject

to withholding. Generally, the determination of whether a fringe benefit is taxable for Wisconsin is based on

federal income tax law. Noncash fringe benefits that are subject to federal withholding tax are also subject to

Wisconsin withholding, at the same value and for the same payroll period.

Examples of taxable noncash fringe benefits that are subject to withholding include: use of employer-provided

automobiles for commuting, an employer-provided vacation, free or discounted commercial airline flights, and

employer-provided tickets to entertainment events.

The amount of Wisconsin income tax to be withheld from an employee who receives taxable noncash fringe

benefits can be determined by:

(1) Combining the employee’s taxable noncash fringe benefits and regular wages and determining the

withholding as though the total constituted a single wage payment.

(2) Treating the taxable noncash fringe benefit as a supplemental wage payment and determining the amount

to be withheld by following the instructions for supplemental wage payments found on page 24 of this

guide.

Note: Federal law permits an employer to elect not to withhold federal income tax for taxable noncash fringe

benefits which employees realize from the use of an employer-provided vehicle. Employers who make this

election for federal purposes will not be required to withhold Wisconsin income tax for the same vehicle

fringe benefits.

M. Health Savings Accounts

Effective for taxable years beginning in 2011 and thereafter, Wisconsin follows federal provisions relating to

HSAs. The only difference is the imposition of penalties. For details, see Fact Sheet 1105, Health Savings

Accounts.

N. Third Party Sick Pay

Wisconsin does not follow the federal provisions relating to payments of sick pay made by third parties (e.g., an

insurance company). Wisconsin statutes provide that when a third-party payer of sick pay makes payments

directly to the employee and the employee has provided a written request to withhold Wisconsin income tax

from those payments, the third-party payer must report and remit the income tax withheld from sick pay, not

the employer.

For Wisconsin purposes, the payer of third-party sick pay plans who withhold Wisconsin income tax must issue

a Form W-2 directly to the individual who received the sick pay. The Form W-2 must report the amount of

taxable sick pay and the total amount of Wisconsin income tax withheld. Note: The department will not accept

a consolidated Form W-2, so the payer must file a separate Form W-2 for each individual.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

13

O. Pensions

If a pension recipient requests in writing that Wisconsin income tax be withheld from their pension, the payer,

if engaged in business in Wisconsin, must withhold tax in accordance with Wisconsin withholding tables in this

booklet or in the amount that the pension recipient designates to the payer. However, the amount withheld

from each pension payment may not be less than $5.

P. Reporting of Wages for Agricultural, Domestic, or Other Employees Exempt from Withholding

"Wages" means all remuneration for services performed by an employee for an employer. Wages are subject

to Wisconsin withholding tax with the exception of agricultural, domestic or other employee wages exempt

from withholding as provided in sec. 71.63, Wis. Stats.

All entities with activities in Wisconsin whether paying taxable wages or not, are required to provide their

payees a federal Form W-2, 1099-MISC, 1099-NEC, or 1099-R and should follow these reporting guidelines:

• Wages, regardless of the amount, are to be reported on federal Form W-2.

• All payments which are not wages but from which Wisconsin income tax has been withheld are to be

reported on federal Form W-2, 1099-MISC, 1099-NEC, or 1099-R as appropriate.

• Payments of $600 or more that are not wages and from which no Wisconsin income tax has been withheld

are to be reported on federal Form W-2, 1099-MISC, 1099-NEC, or 1099-R as appropriate. Note: If these

payments are not required to be reported to the Internal Revenue Service, they may be reported to the

department on Wisconsin Form 9b instead of the federal form.

If you do not hold a Wisconsin withholding tax number because you are not required to withhold from

employees' wages (agriculture, domestic, etc.), did not withhold, and never held a Wisconsin withholding tax

number, enter 036888888888801 on the W-2 in the box titled "Employer's State ID Number."

Forms W-2, W-2G, 1099-MISC, and 1099-R must be filed with the department as outlined in Publication 117,

Guide to Wisconsin Wage Statements and Information Returns. If the forms include Wisconsin withholding, you

must also file the annual reconciliation (WT-7) by January 31. If the due date falls on a weekend or legal holiday,

the due date becomes the business day immediately following the weekend or legal holiday.

Q. Willful Misclassification Penalty for Construction Contractors

Any employer engaged in the construction of roads, bridges, highways, sewers, water mains, utilities, public

buildings, factories, housing, or similar construction projects who willfully provides false information to the

department, or who willfully and with intent to evade any withholding requirement, misclassifies or attempts

to misclassify an individual who is an employee of the employer as a nonemployee shall be fined $25,000 for

each violation.

R. Payments Made to Decedent Estate or Beneficiary

Various types of payments are made to the estate or to beneficiaries of a deceased employee which result from

the deceased person's employment. The department follows IRS policy in determining whether withholding of

income tax is required from these payments.

SUBJECT TO WITHHOLDING: An uncashed check originally received by a decedent prior to the date of death

and reissued to the decedent's personal representative shall be subject to withholding of Wisconsin income tax.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

14

NOT SUBJECT TO WITHHOLDING: The following types of payments to a decedent's personal representative or

heir shall not be subject to withholding of Wisconsin income tax:

• Payments representing wages accrued to the date of death but not paid until after death.

• Accrued vacation and sick pay.

• Termination and severance pay.

• Death benefits such as pensions, annuities and distributions from a decedent's interest in an employer's

qualified stock bonus plan or profit sharing plan, as provided in sec. 71.63(6)(j), Wis. Stats.

4.

DEPOSITING WITHHELD TAXES

A. Reporting Requirements

Wisconsin income taxes are to be withheld from employees in accordance with the instructions in this guide.

Withholding liability is incurred when wages are paid to employees, not when wages are earned. The tax

withheld is to be held in trust for the state by the employer and remitted via the withholding deposit report

(Form WT-6) or annual reconciliation (Form WT-7), according to each employer’s assigned filing frequency.

Withholding deposit reports and the annual withholding reconciliation must be submitted electronically unless

you've been granted a department waiver from electronic filing. Annual filers are not required to file deposit

reports.

B. Deposit Report (Form WT-6) Filing Options

Form WT-6 filing and payment options include:

• My Tax Account

• Telefile – call (608) 261-5340 or (414) 227-3895

• E-File Transmission

• ACH Credit – through your financial institution

WAGE ATTACHMENTS: Amounts collected from certification (garnishment) of employee wages should NOT be

remitted with Wisconsin income tax withheld from employees. All employers must submit wage attachment

payments electronically unless they have been granted an exception. We offer two electronic payment

methods:

• My Tax Account

• ACH Credit

For more information about Wage Attachment Payments, visit our website.

C. Reporting Periods

The filing frequency assigned to you by the department has a set number of reporting periods per calendar year.

When determining the appropriate reporting period, it is helpful to remember that withholding liability is

incurred when wages are paid to the employee, not when wages are earned.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

15

Filing Frequency

# of Reporting Periods Per Calendar Year

Tax Period End Date

WT-7

WT-6

Annual

1

*

12/31

Quarterly

1

4

3/31, 6/30, etc.

Monthly

1

12

1/31, 2/28, etc.

Semi-monthly

1

24

1/15, 1/31, etc.

*

No WT-6 deposit report required

Example: A semi-monthly filer must file a report for the 1st through the 15th of the month and a report for

the 16th through the end of month. An employer filing on a semi-monthly basis pays employees on January

11. As a result, the income tax withheld is reported in the period ending January 15 (tax period end date).

This report is due to the department by January 31 (tax period due date).

Example: An employer filing on a monthly basis pays employees on December 26. As a result, the income

tax withheld is reported for period ending December 31 (tax period end date). This report is due to the

department by January 31 (tax period due date).

A withholding deposit report must be submitted regardless of whether taxes are withheld during the

period.

ACH debit payments made via the My Tax Account program must be initiated by 4:00 p.m. central standard

time of the due date to be considered timely paid. The electronic withholding deposit report must be made

by the due date to be considered timely filed.

All withholding filers with an active withholding tax account are required to file an annual reconciliation

(WT-7).

D. Reporting Changes to Wisconsin Employer Account Information

Employers are obligated to keep the department current of any changes of name or address. You can notify the

department by one of the methods below:

• Submit address change through My Tax Account

• Email: DORRegistration@wisconsin.gov

• Write: Wisconsin Department of Revenue, PO Box 8902, Madison, WI 53708-8902

• Fax: (608) 327-0232, Attn: Registration Unit

E. Filing Due Dates

Note: If the original due date falls on a weekend or holiday, the return and/or payment is due the business day

following the weekend or holiday.

Deposit Reports (WT-6)

Withholding Tax Guide

Publication W-166

Back to Table of Contents

16

Annual filers – No deposit report required. Withholding is reported on the annual reconciliation (WT-7).

Monthly or quarterly filers – Deposit report is due on or before the last day of the month following the monthly

or quarterly withholding period.

Semi-monthly filers – When the employee pay date is on or between the 1st and the 15th of the month, the

amount deducted and withheld for the period ending the 15th of the month is due on or before the last day of

the month.

When the employee pay date is on or between the 16th and the end of the month, the amount deducted and

withheld for the period ending the last day of the month is due on or before the 15th of the following month.

Example: An employee is paid December 16. The employer reports withholding on the deposit report for period

ending December 31. This deposit report is due January 15.

Annual Reconciliation (WT-7)

All filers – The annual reconciliation, wage statements, and information returns are due to the department by

January 31, the last day of the month following the calendar year. When the withholding account is closed

before December 31, the annual reconciliation is due within 30 days of the account cease date.

File wage statements (Forms W-2) and information returns (Forms 1099) reflected on the reconciliation by

January 31. Note: My Tax Account is generally available for filing Forms W2 and 1099 for the current tax year

before published forms and other software are available.

F. Extensions

The department may grant a one-month extension to file the deposit report (WT-6) if you are able to

demonstrate good cause and reason for the requested delay. Extension requests must be received by the

original due date of the deposit report.

Note: Interest will be imposed during the one-month extension period at the rate of one percent. To request

an extension, do one of the following:

• Complete the Request Extension to File in My Tax Account

• Email: WIWithholdin[email protected]

• Write: Mail Stop 3-80, Wisconsin Department of Revenue, Tax Operations Business, PO Box 8902,

Madison, WI 53708-8902

• Fax: (608) 327-0232

We may not issue a refund to an employed individual before March 1, unless the individual and individual's

employer have filed all required returns and forms for the taxable year for which the individual claims a

refund.

Caution: Bulk extension requests will not be accepted. Requests must be submitted separately for each

account. Good cause must be shown for each request regarding why the filing deadline cannot be met in

order for your request to be considered.

G. Failure to File or Pay by the Due Date

Failure to receive a Wisconsin withholding tax account number does not relieve the employer from timely

Withholding Tax Guide

Publication W-166

Back to Table of Contents

17

reporting and depositing the tax withheld.

Late filing fee: Any person who is required to file a withholding report and deposit withholding taxes that fails

to do so timely and the department shows that the taxpayer's action or inaction was due to the taxpayer's willful

neglect and not to reasonable cause, shall be subject to a $50 late fee, except for corporations taxed under

subch. IV or insurance companies taxed under subch. VII of ch. 71, Wis. Stats., the late fee is $150.

Penalties: Any employer who fails or refuses to file a report or statement or remit taxes withheld from employee

wages on or by the due date may be subject to penalties upon a showing by the department that the taxpayer's

action or inaction was due to the taxpayer's willful neglect and not to reasonable cause.

A negligence penalty of 5% of the tax due for each month the report is filed after the due date may be imposed.

The maximum negligence penalty for late filing is 25% of the tax due. The negligence penalty may be waived on

appeal if a return is filed late due to reasonable cause.

A penalty of 25% of the amount not withheld or properly reported, deposited or paid over may also be imposed.

Interest: Interest accrues at the rate of 18% per year on any taxes that are not deposited in a timely manner.

During a period in which an extension is granted, interest accrues at the rate of 1% per month.

H. Failure to Report Amount of Taxes Withheld

An estimated tax amount may be assessed to an employer who fails to timely report the amount of tax withheld

for a period. This estimated amount, if left unanswered, may become final and due. An estimated tax amount,

once delinquent, may only be adjusted by the filing of an actual deposit report and/or annual reconciliation and

accompanying employee wage and tax statements.

I. Refund/Credit for Overpayment(s)

A claim for refund of an overpayment must be filed within four years from the due date of the income or

franchise return. A written request for a refund must be submitted to the department within the four-year

period and the request must be accompanied by an amended annual reconciliation and employee wage and tax

statements (if changed).

Mail claims for refund to Wisconsin Department of Revenue, Mail Stop 3-14, PO Box 8920, Madison,

WI 53708-8920.

Exception: When an overpayment occurs on a prior period, the withholding liability and payment may be

reduced on a later period within the same calendar year, provided the annual reconciliation for that year has

not been filed.

J. Other

A person required to collect, account for, or pay withholding taxes, who willfully fails to collect, account for, or

pay those taxes to the department, may be held personally liable for such taxes, including interest and penalties.

5.

RECONCILIATION PROCESS

A. Preparing Employee W-2

The following must be reported as Wisconsin wages in Box 16 of Form W-2:

Withholding Tax Guide

Publication W-166

Back to Table of Contents

18

• All wages earned by Wisconsin residents, regardless of where services were performed.

• All wages earned by nonresidents for services performed in Wisconsin, unless the individual is a resident of

Illinois, Indiana, Kentucky or Michigan and has properly completed Form W-220, Nonresident Employee's

Withholding Reciprocity Declaration.

For additional W-2 preparation guidance see examples in Section 6 of Publication 172.

B. Furnishing Employees with Wage and Tax Statements

A wage and tax statement (federal Form W-2) must be prepared for each employee to whom wages were paid

during the previous calendar year, regardless of the amount of wages paid, and even though no tax was

withheld.

Give the proper copies of this statement to the employee by the following January 31, or at the time

employment is terminated. See "Discontinuing Withholding" for more information. The copy designated for

the department must be sent to the department along with the annual reconciliation. Filing options are

provided in this publication.

If it is necessary to correct a wage and tax statement after it has been given to an employee, a W-2c must be

issued to the employee. If the error affects a reconciliation already filed, file an amended reconciliation.

File corrected wage statements with the department. Options include:

• Electronic filing options:

o Use My Tax Account

o Submit a corrected EFW2 file

• If you file fewer than 10 wage statements or obtained an electronic filing waiver, you may send a W-2c

with no more than one statement or return per page to:

Wisconsin Department of Revenue

PO Box 8920

Madison WI 53708-8920

If a wage statement is lost or destroyed, furnish a copy marked "Reissued by Employer" to the employee.

Any "employee" copies of wage statements which, after reasonable effort, cannot be delivered to employees

should be retained by the employer for four years.

Note: Any employer who furnishes a false or fraudulent wage statement or who intentionally fails to furnish a

wage statement is subject to a penalty under Wisconsin law.

C. Annual Reconciliation (WT-7) Filing Options

If your Wisconsin withholding tax account was active for any part of the calendar year, you must file an annual

reconciliation. Filing and payment options include:

• My Tax Account

• Telefile – call (608) 261-5340 or (414) 227-3895

• E-File Transmission

Withholding Tax Guide

Publication W-166

Back to Table of Contents

19

• ACH Credit – through your financial institution

The WT-7 reconciles the amount withheld from wages paid to employees with the amount deposited

throughout the calendar year on the WT-6 deposit reports. In addition to filing the WT-7, submit supporting

wage statements and information returns.

Failure to file a completed annual reconciliation or its equivalent can result in the disallowance of the wage

deduction on your individual income tax return or corporation franchise or income tax return.

If an electronic filing waiver has been granted, you may mail Form WT-7 along with supporting wage and

information returns.

Note: Amounts collected from the certification (garnishment) of wages should NOT be included as Wisconsin

tax withheld on the W-2 form or annual reconciliation.

Late filing fees: Any person who is required to file a withholding report and deposit withholding taxes that fails

to do so timely, and the department shows that the taxpayer's action or inaction was due to the taxpayer's

willful neglect and not to reasonable cause, shall be subject to a $50 late fee, except for corporations taxed

under subch. IV or insurance companies taxed under subch. VII of Ch. 71, Wis. Stats., the late fee is $150.

Penalties: A penalty of 25% of the amount not withheld, properly deposited or paid over may be imposed, upon

a showing by the department that the taxpayer's action or inaction was due to the taxpayer's willful neglect and

not to reasonable cause.

Appeals: If you are appealing an amount due, you must submit your appeal through My Tax Account, or send a

letter to Wisconsin Department of Revenue, PO Box 8981, Madison, WI 53708-8981. If sending a letter, be sure

to include your Wisconsin withholding number. We do not accept appeal requests made by email or telephone.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

20

D. Wage Statement and Information Return Reporting Requirements

Wage Statement and Information Return Reporting Requirements

Required information

Send information

Required format

for paper filers

Do not send

•

15-digit Wisconsin

withholding tax number.

Those who did not

withhold, are not

required to withhold and

never held a Wisconsin

withholding tax number,

must use

036888888888801.

•

Nine-digit federal

employer ientification

number (FEIN)

•

Legal name must match

numbers above

•

Nine-digit payee tax

identification number

1

•

Wisconsin as top state (if

possible)

Before Filing

•

Register, if required, or

make any name changes

•

Verify the first three

items above using the

look-up in My Tax

Account

•

Preparers can use our

withholding data

exchange to verify client

information

Electronic

•

If you file 10 or more

wage statements or

information returns, you

must file them

electronically. See

Publication 117 for "How

to File."

Paper

•

If you file fewer than 10,

we encourage you to file

electronically. Otherwise,

mail them to the

following address:

Wisconsin Department

of Revenue

PO Box 8920

Madison, WI 53708-8920

Do not send to any other

address

•

Data must be in similar

location of federal form

on IRS website

•

Must be in form format.

We will not accept text

lists.

• No more than one

statement or return per

page

•

Use the following

formats for printable

forms:

• W-2

• W-2C

• W-2G

• 1099-DIV

• 1099-INT

• 1099-MISC

• 1099-NEC

• 1099-R

•

Page no larger than

8.5"x11"

•

Page no smaller than

2.75" high or 4.25" wide

•

Send only one statement

or return per

employee/payee (no

duplicates)

•

Use blue or black ink

•

1096-federal transmittal

form

•

1099-DIV or 1099-INT if

no Wisconsin

withholding (do not

include on WT-7)

•

CDs, magnetic tapes or

PDF files

•

Carbon copies

•

Correspondence

•

Duplicate W-2s with no

change (if change made,

file W-2c only)

•

Duplicate WT-7

•

Old version WT-7 if

paper filing

•

W-2s or 1099s with no

Wisconsin connection

•

WT2

1

As a safeguard against identity theft, the Internal Revenue Service (IRS) allows payers to truncate a payee's taxpayer

identification number (SSN, FEIN, or ITIN) on the copy of Form W-2 or 1099 that the payer gives to the payee. The

department follows the IRS treatment. Caution: Payers may not truncate the payee's social security number on any

forms filed with the department, IRS, or Social Security Administration.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

21

E. Filing Wage and Information Returns

If you file 10 or more wage statements or 10 or more of any one type of information return, you must file

electronically.

Electronic filing options include:

• Use approved payroll software.

• Key Forms W-2, 1099-MISC, 1099-NEC, and 1099-R in My Tax Account when filing the annual

reconciliation (WT-7).

• Key Forms W-2, 1099-MISC, 1099-NEC, and 1099-R in My Tax Account at any time during the year. Log

into My Tax Account and select "Enter W-2/1099 Information."

This application makes it easy to submit information returns omitted from previous submissions. It also

provides a user-friendly option for those that don’t have active withholding accounts but have a need to

submit W-2s or 1099s.

• Submit an EFW2 file (for Form W-2) through the department's website.

• Submit an IRS formatted file (for Forms 1099-MISC, 1099-NEC, 1099-R, 1099-K, W-2G, etc.) through the

department's website.

Note: The only electronic filing options for Form 1099-K with Wisconsin withholding are (1) approved payroll

software and (2) an IRS formatted file that is in the format provided in IRS Publication 1220.

If you file fewer than 10 wage statements or fewer than 10 information returns, we encourage you to file

electronically using one of the methods above. The department will send you a confirmation number upon

receipt. Otherwise mail to the address shown in Chart 2 in Publication 117.

F. Extensions

You may request an extension of 30 days for filing the annual reconciliation (Form WT-7) if you are able to

demonstrate good cause and reason for the requested delay. If an extension is granted for the Form WT-7, it

also applies to the corresponding wage statements and information returns. You may request a 30-day

extension for filing W-2s and/or 1099s with the department, if no Form WT-7 extension is needed. There is no

extension of time for filing W-2Gs.

Due dates for the following cannot be extended:

• Furnishing wage statements to employees

• Furnishing information returns to recipients

Extension requests must be received by the original due date using one of the following:

• Complete the Request Extension to File in My Tax Account

• Email WIWithholding@wisconsin.gov

• Write to Mail Stop 3-80, Wisconsin Department of Revenue, Tax Operations Business, PO Box

8902, Madison, WI 53708-8902

Withholding Tax Guide

Publication W-166

Back to Table of Contents

22

We may not issue a refund to an employed individual before March 1, unless the individual and individual's

employer have filed all required returns and forms for the taxable year for which the individual claims a

refund.

Caution: Bulk extension requests will not be accepted. Requests must be submitted separately for each

account. Good cause must be shown for each request regarding why the filing deadline cannot be met in

order for your request to be considered.

G. Discontinuing Withholding

When an employer goes out of business, the employer must notify the department of the last date of

withholding. We will send a letter confirming the account closure. The annual reconciliation must be filed

within 30 days of discontinuing withholding.

If the employer ceases to pay taxable wages, or all of the employees are exempt from withholding based on

the Employees Wisconsin Withholding Exemption Certificate (Form WT-4), the employer should request to

have its Wisconsin withholding account inactivated.

If taxes are again withheld, the employer can request that the account be reactivated by calling (608) 266-

2776 or emailing DORRegistration@wisconsin.gov.

H. Wisconsin Information Return Form 9b

Note: Federal Form 1099-MISC, 1099-NEC, 1099-R, or W-2, as appropriate, is required instead of Wisconsin

Form 9b if you are required to file the federal Form with the Internal Revenue Service (IRS). The due date

below also applies to these forms.

Who Must File? – Any person including individuals, fiduciaries, partnerships, limited liability companies, and

corporations doing business in Wisconsin and making payments to individuals of rents, royalties, or certain

nonwage compensation, as provided in Chart 1 of Publication 117.

Notes:

• If an employee receives wages subject to withholding and additional amounts not subject to

withholding, the total compensation must be reported on a wage statement instead of Form 9b.

• Payers other than corporations must report rents and royalties only if the payer deducts the payments

in computing Wisconsin net income.

• If Wisconsin withholding is reported on the federal form (1099-MISC, 1099-NEC, 1099-R, or W-2), the

federal form must be included on the annual reconciliation (Form WT-7).

What is the Due Date for Filing Form 9b? – The due date for filing Form 9b with the department and

furnishing a copy to the recipient is January 31. For information about requesting a 30-day extension for filing

Form 9b with the department, see Publication 117. Note: The due date for furnishing a copy of Form 9b to

the recipient cannot be extended.

Where to file? – For the most current information, see Publication 117.

Combined Federal/State Filing Program – Payers who participate in the Combined Federal/State Filing

Program are not required to file Forms 1099 with the Wisconsin Department of Revenue unless there is

Wisconsin withholding. Any Form 1099 with Wisconsin withholding must be filed along with the annual

Withholding Tax Guide

Publication W-166

Back to Table of Contents

23

reconciliation, Form WT-7.

6.

OTHER TAXES TO BE AWARE OF

If you have business activities or earn income in Wisconsin, you may be subject to other Wisconsin taxes. Although

the information below is not intended to be all inclusive, it may help you in obtaining information about other

Wisconsin taxes. More information is available on our website.

Sales and use tax: A state sales and use tax is imposed in Wisconsin. In addition, some counties and the city of

Milwaukee in the state impose a sales/use tax. See this chart which shows the state, county, and city tax rates.

The sales tax is imposed on the sales price from the retail sale, lease, or rental of all tangible personal property,

unless specifically exempt, and taxable services. If you make retail sales of items subject to the Wisconsin sales

and use tax, you must register for a Wisconsin seller’s permit.

Wisconsin also imposes a use tax on the purchase of tangible personal property or taxable services that are

stored, used, or consumed in this state on which sales tax was not charged. This most commonly occurs when

tangible personal property is purchased from out-of-state retailers and no sales tax is charged.

Individuals, partnerships, corporations, and other organizations registered for sales or use tax with the

department should report any use tax on their Wisconsin state and county sales and use tax return.

Individuals who are not registered for sales or use tax with the department may report the tax from out-of-state

purchases on their income tax return. A line is provided on individual income tax returns called "Sales and use tax

due on internet, mail order, or other out-of-state purchases."

Individual income tax: Every person who is a resident of Wisconsin and who has gross income exceeding a certain

amount is subject to Wisconsin income taxes, regardless of where the income is earned.

A person who is a nonresident of Wisconsin is subject to Wisconsin income taxes if they have gross income of $2,000

or more from Wisconsin sources, such as personal services performed in Wisconsin or income from a business or

property in Wisconsin.

Corporation income or franchise tax: Every corporation organized under the laws of Wisconsin or licensed to do

business in Wisconsin (except certain organizations exempt under sec. 71.26(1)(a) or 71.45(1), Wis. Stats.) is

required to file a Wisconsin corporate franchise or income tax return, regardless of whether or not business was

transacted. Unlicensed corporations are also required to file returns for each year they do business or have certain

business activities in Wisconsin.

Estimated tax for individuals: Estimated income tax payments are generally required if you expect to owe $500 or

more of income tax with your income tax return. The estimated tax requirement applies to full-year residents, part-

year residents, and nonresidents. Interest may be imposed if you fail to make these payments.

Estimated tax for corporations: Corporations must generally make estimated income or franchise tax payments if

their current year tax liability will be $500 or more.

Pass-through withholding: Pass-through entities (partnerships and tax-option (S) corporations) with nonresident

partners or shareholders are generally required to withhold for their nonresident partners or shareholders who

have $2,000 or more of Wisconsin source income, unless an exemption applies. This requirement is separate from

payroll withholding and usually applies whether or not the partner or shareholder has physical presence in

Wisconsin. For more information see the department's FAQ page.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

24

Unemployment insurance: For more information contact the Wisconsin Department of Workforce Development.

Worker's compensation: For more information contact the Wisconsin Department of Workforce Development.

Remittances for unemployment tax should be made according to Wisconsin Department of Workforce Development

instructions. Funds are separate from employee withholding.

7.

KEEPING AWARE OF CHANGES IN WISCONSIN TAX LAWS

If you are required to file Wisconsin tax returns, you should be aware of changes in the tax laws, court cases, and

other published guidance which may affect how you file returns and compute tax. Information available from our

website includes:

Withholding Tax Update: The Withholding Tax Update is an annual publication that provides updated material on

general withholding tax laws and supplements the Wisconsin Employer’s Withholding Tax Guide.

Wisconsin Tax Bulletin: The Wisconsin Tax Bulletin is a quarterly publication prepared by the department. The

bulletin includes information on most taxes administered by the department, including sales and use, income,

franchise, and excise taxes. It includes up-to-date information on new tax laws, interpretations of existing laws,

information on filing various types of returns, and on current tax topics. It also gives a brief excerpt of major

Wisconsin tax cases decided by the courts and the Wisconsin Tax Appeals Commission.

Rules – Wisconsin Administrative Code: The Wisconsin Administrative Code includes administrative rules that

interpret the Wisconsin Statutes. Rules have the force and effect of law. The department has adopted a number of

rules concerning interpretations of the various Wisconsin tax laws.

Topical and Court Case Index: The Topical and Court Case Index will help you find a particular Wisconsin Statute,

Administrative Rule, Wisconsin Tax Bulletin article or tax release, publication, Attorney General opinion, or court

decision that deals with your particular Wisconsin tax question.

8.

ADDITIONAL INFORMATION AND FORMS

If, after reading this publication, you have any questions about withholding, you may:

• Email: DORWithholdingTax@wisconsin.gov

• Call: (608) 266-2776

Telephone help is also available using TTY equipment. Call the Wisconsin Telecommunications

Relay System at 711 or, if no answer, (800) 947-3529. These numbers are to be used only when

calling with TTY equipment.

• Write: Mail Stop 5-77

Wisconsin Department of Revenue

PO Box 8949

Madison, WI 53708-8949

Call or visit any Wisconsin Department of Revenue office. Office locations and hours are listed on the department's

website: Office Locations.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

25

WISCONSIN INCOME TAX WITHHOLDING METHODS

INTRODUCTION

Use the wage-bracket tables to determine the amount of income tax to be withheld on the following pages in the same way

as those appearing in federal Publication 15 (Circular E) and Publication 15-T. There is one alternate method of determining

the amount of tax to be withheld that is approved by the department. The instructions for this method appear on pages 25

and 26. Employers who desire to use a method other than the wage-bracket tables or the approved alternate method must

receive permission from the department before the beginning of the payroll period for which the employer desires to

withhold the tax by such other method.

An employer has the discretion of withholding an entire month’s taxes in one pay period when payroll periods are more than

once a month.

SUPPLEMENTAL WAGE PAYMENTS

If supplemental wages - such as bonuses, commissions, or overtime pay - are paid at the same time as regular wages, the

income tax to be withheld should be determined as if the total of the supplemental and regular wages were a single wage

payment for the regular payroll period.

If supplemental wages are paid between regular payroll periods, the employer may determine the tax to be withheld by

adding the supplemental wages either to the regular wages for the current payroll period or to the regular wages for the last

preceding payroll period within the same calendar year.

As an alternative to the above methods, the withholding on supplemental wage payments may be determined by estimating

the employee’s annual gross salary and applying flat percentages to the supplemental payments. (These flat percentages

may be used only where supplemental payments are involved; they cannot be used for determining the withholding liability

for regular wages and salaries.)

Approved Flat Percentages

Annual Gross Salary

At Least

But Less Than

Percent (%)

0

12,760

3.54

12,760

25,520

4.65

25,520

280,950

5.30

280,950 and over

7.65

USE OF DAILY OR MISCELLANEOUS TABLES

If an employee has no payroll period, determine the tax to be withheld as if the wages were paid on a "daily or

miscellaneous" payroll period. This method requires a determination of the number of days (including Sundays and holidays)

in the period covered by the wage payment. If the wages are unrelated to a specific length of time (for example,

commissions paid on completion of a sale), then the number of days must be counted from the date of payment back to the

latest of these three events: (a) the last payment of wages made during the same calendar year, (b) the date employment

commenced if during the same calendar year, or (c) January 1 of the same year.

In cases where an employee is paid for a period of less than 1 week and signs a written statement (under penalties of

perjury) that the employee does not work for wages subject to withholding for any other employer during the same calendar

week, then the employer is permitted to compute the withholding on the basis of a weekly, instead of a daily or

miscellaneous payroll period.

See the "daily or miscellaneous" tables on page 27.

Withholding Tax Guide

Publication W-166

Back to Table of Contents

26

If the annual net wage is:

Not over $12,760

Over $12,760 but not over $25,520

Over $25,520 but not over $280,950

Over $280,950

Schedule of Tax Rates for Withholding

The amount of tax is:

3.54% of this amount

$451.70 + 4.65% of excess over $12,760

$1,045.04 + 5.30% of excess over $25,520

$14,582.83 + 7.65% of excess over $280,950

ALTERNATE METHOD OF WITHHOLDING WISCONSIN INCOME TAX

Employers are authorized to use the following alternate method of withholding income tax without receiving any further approval

from the department.

1. Procedure

(a) Multiply the total wage for the payroll period by the number of payroll periods in a year to determine the annual gross earnings.

(b) Decrease the annual gross earnings by the deduction amount determined from the formula below.

For single persons:

— If annual gross earnings are less than $17,780, deduction amount = $6,702.

— If annual gross earnings are $73,630 or more, deduction amount = $0.

— If annual gross earnings are at least $17,780 but less than $73,630, deduction amount is obtained by subtracting from

$6,702, 12% of annual gross earnings in excess of $17,780, i.e. deduction amount = $6,702 – 0.12 (Annual gross earnings –

$17,780).

For married persons:

— If annual gross earnings are less than $25,727, deduction amount = $9,461.

— If annual gross earnings are $73,032 or more, deduction amount = $0.

— If annual gross earnings are at least $25,727 but less than $73,032, deduction amount is obtained by subtracting from

$9,461, 20% of annual gross earnings in excess of $25,727, i.e. deduction amount = $9,461 – 0.20 (Annual gross earnings –

$25,727).

(c) Multiply the number of exemptions claimed by $400 and subtract the result from the amount determined in (b) above. The result

is the annual net wage.