Chicago Public Schools

Health and Benets Handbook 2022

Chicago Public School Benets Handbook 2

The information in this handbook is effective January 1, 2022, except as otherwise noted.

Nothing in this handbook should be interpreted as creating an employment contract, binding agreement or

agreement to continue employment or as a guarantee of employment. The Board retains the right to

modify, amend, suspend or terminate the benet plans at any time.

The plans, benets and coverage described in this handbook are subject to change at the sole discretion of the

Board. The Health and Benets Team will provide notice of changes through email or other means; however,

such changes will have effect regardless of whether notice is given or received. If there is a conict or

inconsistency among the benets and requirements summarized in this handbook and the actual plan documents

and contracts, the documents and contracts will govern. This handbook is not intended to substitute, replace,

overrule or modify any existing federal and state laws, agency rules, regulations or terms of a collective bargaining

agreement (if applicable).

The Board currently intends to maintain the various plans that comprise the benets program. But the Board

retains the right to amend or terminate any plan or benet to the fullest extent allowed by law at any time, as it

deems advisable, as to any or all of the employees, retirees, former employees or other participants or beneciaries

who are or may become covered. The Board periodically reevaluates the benets program. Any changes to the

plans may be more or less advantageous to a given employee than the provisions of the current plans. The Board,

in its sole discretion, may establish the effective date for any changes that are formally adopted.

The nal interpretation of this handbook’s provisions is the exclusive responsibility of the Board of Education

of the City of Chicago. If you have additional questions, you may call the Health and Benets Team

at (773) 553-HR4U (4748) from 9:00 a.m. to 4:00 p.m. Monday through Friday. Additional information is

online at CPS.edu/Staff then click on the link for HR4U. Correspondence may be directed to:

Board of Education of the City of Chicago

Attention: Health and Benets

2651 W. Washington Blvd.

Chicago, IL 60612

Welcome to the Chicago Public Schools. As a vital part of our students’ futures, it is important to us that you

maintain your health, energy and peace of mind and are able to be your best each day. We are pleased to

offer employees a comprehensive health and wellness benets package with digitally enhanced tools and

mobile access customizable to the way you live. We encourage you to do more than skim this guide; read

it thoroughly and learn how to access perks such as discounts on gym memberships for the whole family;

wellness and stress management coaching; and nancial and legal services through the Employee Assistance

Program (EAP). In the guide, you’ll also nd out how to earn points for your healthy actions and redeem them

for prizes through the new Well on Target wellness program by Blue Cross Blue Shield of Illinois (BCBSIL).

We’re in this together! Our benets specialists are eager to assist, answer your questions and help you make

the most of your benets.

The Best Care at the Best Value

Chicago Public School Benets Handbook 3

Table of Contents

Eligibility 5

Enrollment 8

Enrolling Dependents 9

Enrolling a Domestic Partner/ Afdavit of Domestic Partnership 12

Enrolling a Civil Union Partner 14

Required Documents for Dependents 15

Wellness Program 17

Medical Plans at a Glance 19

BlueAccess for Members 20

BCBSIL BlueAdvantage Health Maintenance Organization (HMO) 21

BCBSIL Preferred Provider Organization (PPO) 22

BCBSIL PPO with Health Savings Account (HSA) 23

BlueCross BlueShield of Illinois Health Savings Account (HSA) 24

Clinical and Pre-Authorization for PPO and

PPO with HSA Plans 25

Prescriptions 28

Dental Plan Options 32

Vision Plan Options 33

Behavioral Health, Addiction and Employee

Assistance Program 34

Short-Term Disability 36

Long-Term Disability 45

Life Insurance, Accidental Death & Dismemberment Coverage 46

Flexible Spending Accounts (FSA) 49

Supplemental Retirement 55

Differences between 403(b) and 457 Plans 55

Bright Start College Savings 57

Maintaining Benets During a Leave of Absence 59

COBRA 62

What Happens to My Benets if I Terminate? 63

Family and Medical Leave Act 65

Employee Rights and Responsibilities 65

Subrogation 68

Glossary 70

Authenticating and Submitting Enrollment Documents 74

Sample of the Benet Documentation Cover Sheet 75

Vendor Contacts 76

Chicago Public School Benets Handbook 5

Eligibility

Timing is critical. If you do not enroll in benets coverage within 31 days

of your hire date or during open enrollment, you will have to wait

until the next Open Enrollment. Coverage would take effect January 1 the

following year.

Dependents

Employees of the Board/CPS

who are represented by the CTU

and who regularly work at least

15 hours each week.

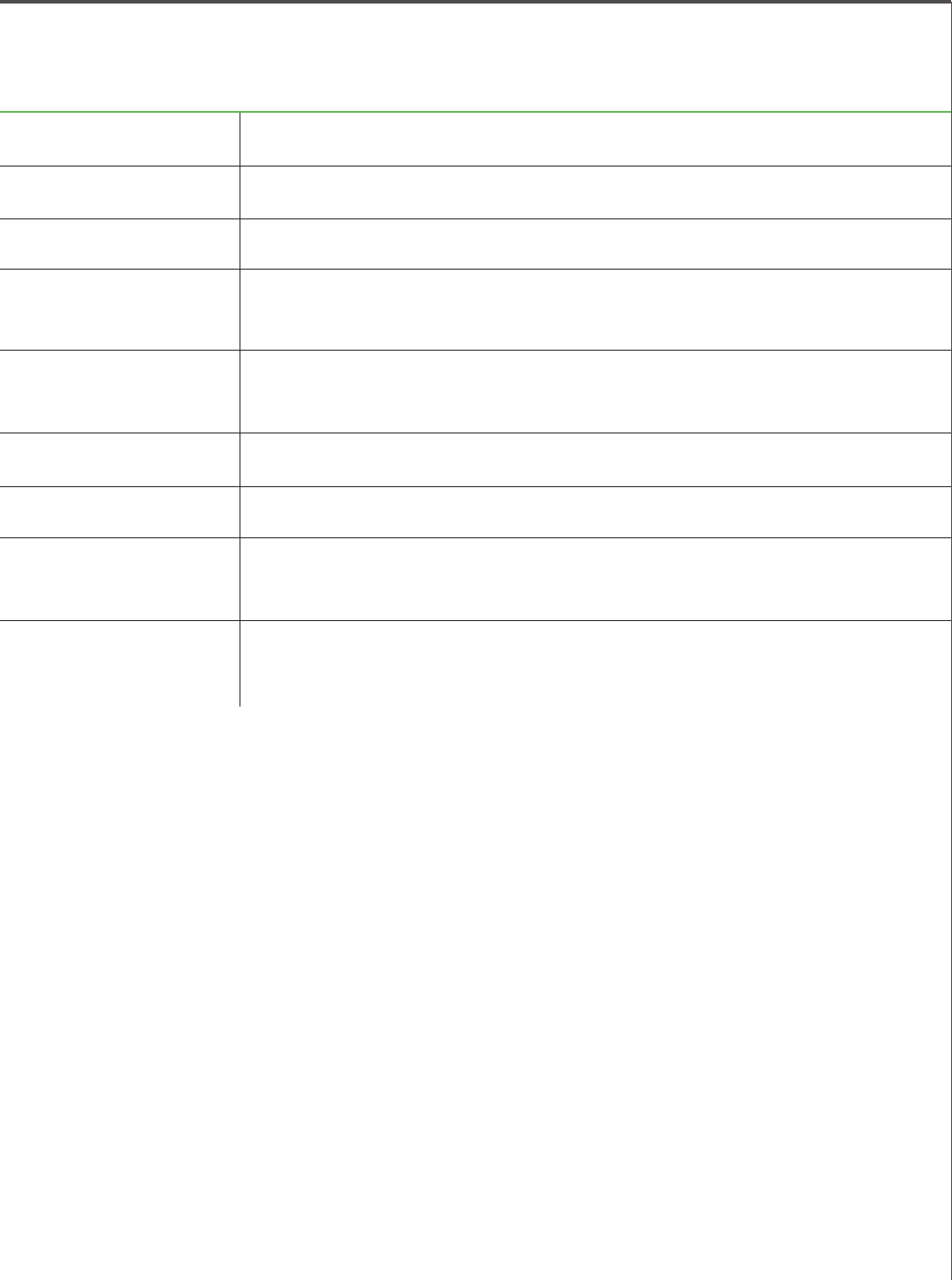

Group Benets: Who Qualies for Coverage

Employees of the Board/CPS who

work at least 30 hours each week,

have Full-Time status or are

a regularly assigned teacher, other

than temporary or seasonal.

Employees of the Board/CPS who

are represented by Local No. 1 or

Local No. 73 and who regularly

work at least 15 hours each week.

When dependent coverage is available, benets-eligible employees can

elect to cover their…

• Legal spouse or civil union partner.

• Dependent children under the age of 26, including natural children,

stepchildren, legally adopted children and/or children under the employee’s

legal guardianship.

• Dependent children ages 26 to 30 who were honorably discharged from

the military and reside in Illinois. For information relating to cost see page 11.

• Children of any age who depend on the employee because of physical

or mental handicap, if they were covered and adequate documentation

of disability was submitted to and approved by the Health and Benets

Team prior to the child’s 26th birthday.

New hires and employees electing coverage due to a family status change may

add disabled dependents age 26 and older when electing coverage for the rst

time, and the age limit for submitting documentation does not apply.

The employee must provide proof that the child was disabled prior to the child’s

26th birthday, and that the child was continuously covered by group health

coverage since the child’s 26th birthday.

Chicago Public School Benets Handbook 6

An eligible employee cannot be covered under any Board-sponsored plan as both

an employee and a dependent. If both you and your spouse are employed by the

Board, you choose one of two options:

• One employee enrolls as the other employee’s dependent.

• Each employee enrolls for individual coverage.

In either option you may also enroll your dependent children (but children may

not be enrolled by both parents in Board-sponsored plans).

Some leaves of absences (LOA) may allow an employee to continue receiving

benets. If you are planning an LOA, you should contact the Absence and

Disability Management Department before your leave or as soon as possible to

conrm your eligibility to continue any benet. When you return from your LOA

you must verify your benet status with the Health and Benets Team within 31

days of your return to avoid a possible lapse in your coverage. If your benets

were discontinued during your LOA, you may re-enroll for benets within 31

days of your return from your LOA, provided that you are eligible for coverage.

Coverage is not automatic. While on an LOA, you are still responsible for

payment of your benets. If you are not receiving a paycheck, you will be sent

a monthly invoice for payment.

You will have the opportunity to change coverage for yourself and/or your depen-

dents during Open Enrollment each year. The change will take effect the following

January 1. Dependents can be added within 31 days of a qualifying event, such as

a marriage or birth of a child, with coverage effective immediately. (For eligibility

see Family Status Change.)

Because of favorable tax treatment you receive by paying for certain benets on

a pre-tax basis, the IRS requires strict compliance with Section 125 of the Internal

Revenue Service Code, which governs when changes are allowed. If you think

you have a qualifying family status change, immediately contact the Health and

Benets Team for more information.

Coverage for you and your eligible dependents will cease:

• If the plan is discontinued

• If you fail to pay premiums for the plan

• If you no longer meet the eligibility requirements to participate in the plan

• When you are no longer part of an employee group covered by this plan

• On the last day of the month in which your employment terminates.

Changing Coverage

Leaves of Absence

(LOA) and Employee

Benets

Dual Eligibility

Chicago Public School Benets Handbook 7

If you have a qualifying Family Status Change during the year, you may change

coverage within 31 days of the event. Documentation is required. Do not wait

until you receive the document(s), however, to notify the Health and Benets Team.

Completion of your enrollment must occur within the 31-day period. Any change

in coverage must be consistent with the change in family status.

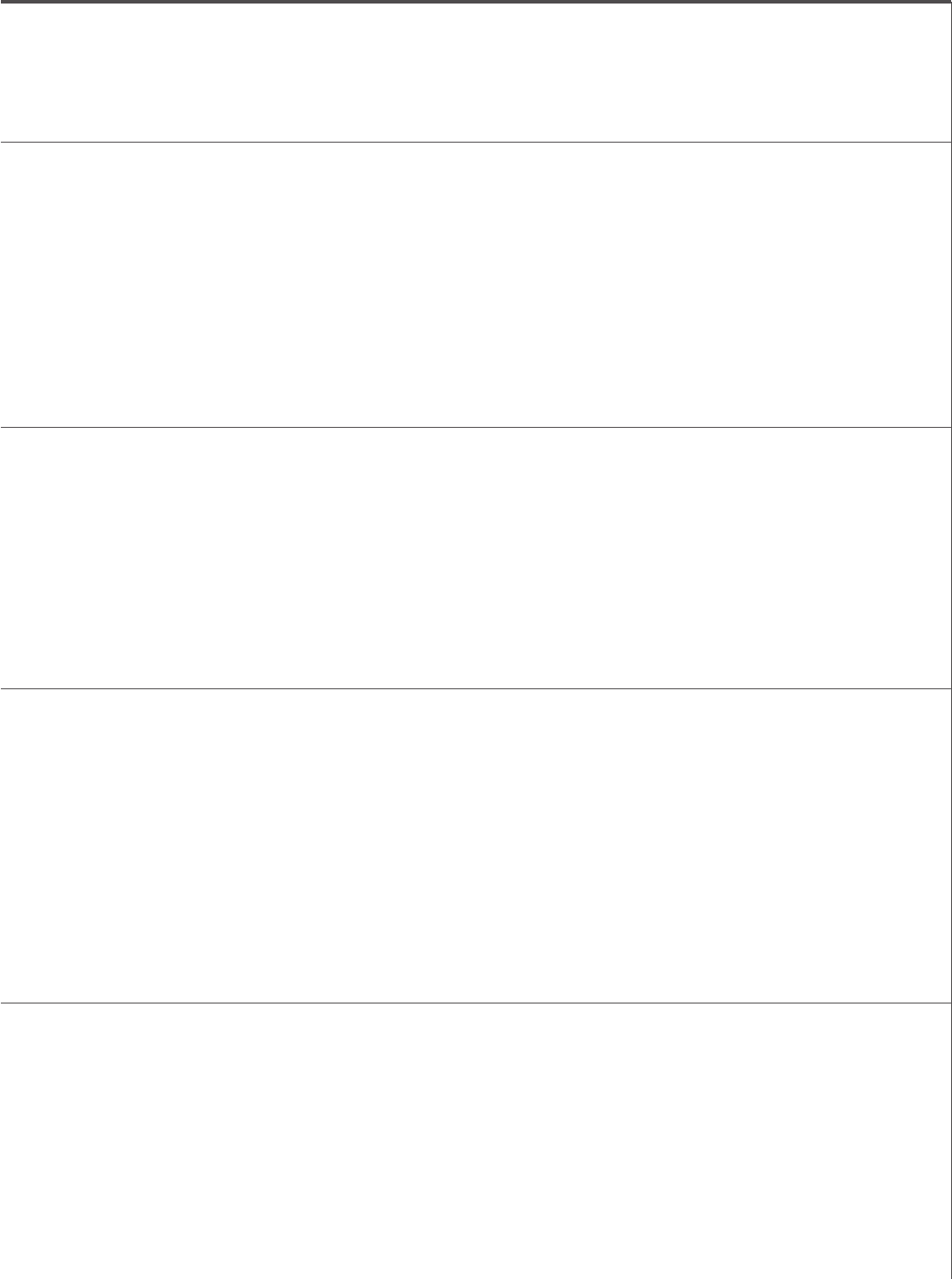

Below are some of the most common triggers.

Any enrollment changes will take effect as of the date the event occurred if you

properly notify the Health and Benets Team within 31 days of the event. Other-

wise, your next chance to change coverage will be during Open Enrollment, with

the change taking effect the following January 1.

The district considers submission of documents falsifying a person’s eligibility

to obtain healthcare coverage an act of fraud. Similarly, failing to notify the

Chicago Public Schools that a formerly eligible person (spouse, child, civil union

or domestic partner) is no longer eligible within 31 days of the date that person

became ineligible is an act of fraud. Suspicious acts will be reported to the Ofce

of the Inspector General and are grounds for termination. The employee will also

be held responsible for any PPO claims or HMO premiums paid on behalf of an

ineligible person.

Family Status

Change

Fraudulent Acts

Legal Marital

Status

Employment

Status

Number or Status

of Dependents

Domestic

Relations Orders

Work

Schedule

Medicare and

Medicaid

Marriage, divorce, establishment/

termination of a civil union, termi-

nation of an existing grandfathered

domestic partnership, death.

Birth, adoption, placement

for adoption or death of

a dependent; change in age

or other qualifying criterion

of dependent.

Your spouse/civil union partner/

dependent child(ren) gains or loses

coverage; or employment ends or

starts for the employee, spouse

or dependent that affects benets

eligibility.

A court order resulting from

a divorce, legal separation,

annulment, or change in legal

custody that requires health

plan coverage for the employee’s

child under the employee’s

health plan, or that requests the

employee’s former spouse

to provide the coverage.

A switch between part-time and

full-time work, a strike or lockout,

commencement of or return

from an unpaid leave of absence,

or an increase or decrease in hours

of employment by the employee,

spouse or dependent that affects

benets eligibility.

A corresponding change

is permitted under the

Children’s Health Insurance

Program Reauthorization

Act of 2009 (CHIPRA) due

to the employee’s, spouse’s,

or dependent’s gain or loss

of Medicare or Medicaid

eligibility.

Chicago Public School Benets Handbook 8

Enrollment

If you are eligible for benets, you may elect coverage for yourself, your

spouse, civil union partner and children, provided they all meet eligibility

criteria. Remember, you must submit any required proof of dependency within

31 days of your date of hire. Please log in to CPS.edu/Staff then click on the

link for HR4U for more information to complete your benets enrollment.

If You Don’t Enroll

Coverage Levels

Cost

If you do not enroll for coverage within 31 days after your hire date or during

Open Enrollment, while there are some very limited exceptions (e.g., if you lose

coverage due to a spouse’s loss of work), you will not be able to enroll until the

next Open Enrollment and your coverage will not take effect until the following

January 1. Also, if you decline coverage, you and your eligible dependents will

be ineligible to continue coverage under COBRA if you leave CPS employment

or experience any other qualifying event.

CPS pays a substantial portion of the cost of your medical care plan. Your share

of the cost is deducted from your paycheck, as a percentage of your salary, on

a pre-tax basis, according to Sections 105, 106 and 125 of the Internal Revenue

Service Code. As result, your taxable income will be reduced by the amount

of your premiums. You won’t pay any federal or state taxes (or Medicare taxes

if they apply) on your premiums. Contact the Health and Benets Team for

information about the current cost of coverage. Medical costs are subject to

change each year.

You and your legal spouse

or one child (employee + one)

You, your legal spouse and one

or more children (family)

Yourself

(employee

only)

Chicago Public School Benets Handbook 9

Enrolling Dependents

If you wish to enroll an eligible dependent in a Board-sponsored benet plan,

you must submit the documents specied below as proof of dependency. To ensure

proper identication of your documents, you must use your personalized cover

sheet along with all of the pertinent documentation. It can be downloaded from

CPS.edu/Staff then click on the link for HR4U. Your spouse or dependent

cannot be enrolled if identifying information is not included with your documents.

• Submit a county-certied copy of your marriage certicate. Keep in mind

the following: Marriage licenses are acceptable only if they also have a certi-

cation of the date that the county clerk recorded the marriage. A marriage

license that is signed by the ofcial who performed the marriage ceremony,

but does not have the date the marriage was recorded with the county clerk,

is not acceptable. Ceremonial or church certicates or certicates that are

issued by a justice of the peace are not acceptable.

• Your name and the name of your spouse on the marriage certicate must

match your name and your spouse’s name as they appear on the Board’s/

CPS’s records. Any name change must be documented by court-issued

change documents.

• A person you are divorced from is not eligible for coverage. If you provide

a county-certied copy of your marriage certicate, you are certifying that

you are currently married to the individual named on the certicate. If you

provide a marriage certicate to establish the eligibility of a person you are

divorced from or you fail to notify the Health and Benets Team of a divorce

from a formerly eligible spouse, you are committing fraud. You will be held

responsible for any claims or premiums paid on behalf of an ineligible person.

Spouse

Documentation Required:

Marriage Certicate

Chicago Public School Benets Handbook 10

To enroll a dependent child, submit a county-certied copy of the child’s birth

certicate; you also must establish your relationship to the child’s other parent

(or in the case of a stepchild, your spouse’s relationship). Keep in mind the

following:

• A county-certied copy of a birth certicate is issued by a municipality,

county or state. The certicate must contain parental information and the birth

registration number. Your name must appear on the birth certicate.

• If the child is your stepchild, your spouse’s name must appear on the birth

certicate.

• If you are the child’s legal guardian, you or your spouse must not be named as

one of the two parents.

• If the child is your adopted child and the birth certicate has not yet been

amended to name you as a parent of the child, the letter issued by the govern-

mental agency placing the child in your home will be accepted as documen-

tation until the amended birth certicate can be issued.

If the dependent is your stepchild and you are divorced from the other parent,

you must provide a copy of the divorce decree that is certied by the clerk of the

court in which the divorce was led. The divorce decree must name you only, or

both you and your former spouse, as responsible for providing the child’s health

insurance in order for the child to be covered under the plan. If the divorce decree

does not state who is responsible for providing health care coverage, and reserves

the issue of child support, you must provide a copy of any later child support or-

der. If there is no child support order, you must provide a notarized afdavit stat-

ing that although the issue of child support was reserved, no child support order

has ever been entered in the court. If both the divorce decree and child support

order do not say who is responsible for health insurance, the child can be covered

under a Board plan if the other parent is not named as the person who can claim

the child as a dependent on a federal income tax return. If the other parent is not

named, you must provide a notarized statement that the child is claimed as your

dependent for federal income tax purposes.

If your divorce decree states that your ex-spouse is responsible for providing

your child’s (or children’s) health insurance, you cannot provide coverage under

the Board health care plans unless you have the decree amended to name you

as the responsible party, either solely or jointly with your ex-spouse. You must

return to the court where your divorce was granted to have it amended. You will

receive a Notice of Motion indicating your new court date. Submit a copy of it

to the Health and Benets Team. When the amendment has been ordered by the

court, provide the Health and Benets Team with a certied copy to complete

your le.

Children

Documentation Required:

Birth Certicate

Chicago Public School Benets Handbook 11

If the dependent is your stepchild, your spouse must submit a copy of the original

certied birth certicate that veries the dependent’s parent is your spouse. Your

spouse’s name must be on the child’s birth certicate.

If you are the child’s parent, but are not named as the parent on the birth certicate,

the child cannot be covered as a dependent under a Board plan without a certied

copy of the child support order requiring the child to be placed on your health

insurance or an amended birth certicate naming you as the child’s parent.

Unmarried dependent military veteran children who reside in Illinois, between the

ages of 26 and 30, can be covered as dependents if they otherwise meet the criteria

of dependency established for children under the age of 26. Birth certicates and

proof of parental relationship must be established in the same manner as outlined

on the previous pages. To be eligible, a veteran must:

• Have served in the active or reserve components of the U.S. Armed Forces,

including the National Guard;

• Have received a release or discharge other than a dishonorable discharge; and

• Submit proof of service using a DD2-14 (Member 4 or 6) form, otherwise

known as a “Certicate of Release or Discharge from Active Duty.” To obtain

a copy of a DD2-14, the veteran can call the Illinois Department of Veterans

Affairs at (800) 437-9824 or the U.S. Department of Veterans Affairs at

(800) 827-1000.

• The cost to continue the military dependent’s coverage on the group plan is

100% of the cost of coverage (member portion plus the state/employer

contribution), regardless of the number of dependents enrolled on the member’s

coverage. The Illinois mandate validating the cost can be found here

https://www2.illinois.gov/cms/benets/StateEmployee/Pages/State-Dependent-

Enrollment.aspx.

Any children with disabilities who depend on you for support or maintenance

because of their physical or mental handicap will be covered, if you provide

proof of incapacitation, along with the birth certicate and proof of parental

relationship, prior to the child’s 26th birthday. You can request forms from the

Health and Benets Team. The determination of incapacitation will be made

by either the Health and Benets Team or a medical review rm. New hires and

employees electing coverage due to a family status change may add disabled

dependents age 26 and older when electing coverage for the rst time, and the

age limit for submitting documentation does not apply. However, the employee

must provide proof that the child was disabled prior to the child’s 26th birthday

and that the child was continuously covered by group health coverage since

the child’s 26th birthday.

Chicago Public School Benets Handbook 12

Domestic Partner

Afdavit of Domestic Partnership

A domestic partner is eligible for coverage as of the same date that your coverage

becomes effective if you are a new employee. An eligible domestic partner can

be either same or opposite sex. If you are an employee with existing coverage

who is adding a domestic partner, the partner’s coverage becomes effective as of

the date that domestic partner status is established, provided that you submit the

required documents to the Health and Benets Department promptly. In the

event that your domestic partner is conned to a hospital with an illness or

injury, coverage will begin when your domestic partner is no longer conned.

The following eligibility requirements must be met for a domestic partner to be

covered:

• You, the employee, must be enrolled in a Board-sponsored medical or dental

plan; and

• You must submit a completed Afdavit of Domestic Partnership and meet the

eligibility requirements for a Domestic Partner. Your afdavit needs to meet

the minimum requirements listed below:

a.You and your partner are at least 18 years of age

and reside at the same residence;

b. Neither you nor your partner is married (if you or your partner were

previously married, proof of dissolution of marriage is required);

c. You and your partner are not related by blood closer than

would bar marriage in the State of Illinois;

d. You and your partner are each other’s sole domestic partner,

responsible for each other’s common welfare;

e. You must submit certied birth certicates and copies of governmet-issued

ID cards for both you and your partner.

• Acknowledgment of Imputed Income (AII) Form.

AND

At least two of the following four conditions must apply and proof must

be submitted:

1. You and your partner have been residing together for at least twelve (12)

months prior to ling the Afdavit of Domestic Partnership.

2. You and your partner have common or joint ownership of a residence.

3. You and your partner have at least two of the following arrangements:

i. Joint ownership of a motor vehicle;

ii. Joint credit account;

iii. Joint checking account;

iv. Lease for residence identifying both you and your partner as tenants.

4. You declare your partner as a primary beneciary in your will.

The Health and Benets Department will review your afdavit to determine

whether you meet these requirements.

Eligibility Requirements

Chicago Public School Benets Handbook 13

If the Health and Benets Department approves your request, you must com-

plete enrollment for your Partner within 31 days of the date your request for

domestic partnership is approved. If you promptly submit all the required

documentation, coverage will be effective as of the date your Partner is granted

domestic partner status. If you do not enroll within 31 days, the next opportunity

to do so is during the annual Open Enrollment.

The premium contribution deduction for your domestic partner is taken after-tax.

The annual monetary value of the health benet for your domestic partner will

be reported as imputed income on your W-2. Please consult with your tax advi-

sor about the tax consequences. All other eligibility and plan provisions apply.

If at any time your domestic partner becomes ineligible for benets, it is your

responsibility to notify the Health and Benets Department in writing. Certain

limitations exist in regard to continuing coverage for a domestic partner. Contact

the Health and Benets Department for more information. Following the

termination of a domestic partnership, a minimum of 12 months must elapse

before a new domestic partner may be designated.

Coverage Termination

for Domestic Partner

Chicago Public School Benets Handbook 14

Civil union partners may be added during Open Enrollment or as a “Family

Status Change” at the time the civil union certicate is issued.

To add your civil union partner to health coverage you must submit the Civil

Union Partner Information Form and an original certied civil union certicate

and/or a birth certicate if you are adding a dependent of your civil union

partner within 31 days of the date of your civil union.

The premium deduction for your civil union partner is taken after-tax. The

annual monetary value of the health benet for your civil union partner will be

reported as imputed income on your W-2. Please consult with your tax advi-

sor about the tax consequences. All other eligibility and plan provisions apply.

If at any time your Partner becomes ineligible for benets due to a termination

of the partnership, it is your responsibility to notify the Health and Benets Team

in writing. Certain limitations exist in regard to continuing coverage for a civil

union partner. To terminate the partnership submit the Original County Certied

Dissolution of Civil Union certicate. Contact the Health and Benets Team

for details.

The names of both parents and the children’s names must match on the birth

certicates, the marriage certicate, divorce decrees, child support orders and

notarized statements, if any, and on the records of the Board/CPS. If names do

not match, certied court orders of name change must be provided to show the

change in identity.

All documents must be certied as having been led by the governmental unit

that has jurisdiction over issuing such documents. Certied copies of documents

generally have a raised or multi-colored seal, or are issued on multi-colored

paper. Foreign documents must be issued by a governmental unit. If these

documents are not in English, they must be accompanied by an English

translation that is issued by a certied translator; prepared by the consulate of the

foreign country that originally issued the document; or notarized by a notary who

can read and write the language in which the document is prepared and swears

that the translation is a faithful representation of the accompanying document.

Enrolling a Civil Union Partner

Civil Union Partner Certicate

Civil Union Partner

Documentation Required:

Civil Union Certicate

Coverage Termination

for Civil Union Partner

Name Changes

Acceptable

Documentation

Chicago Public School Benets Handbook 15

Required Documents for Dependents:

A Summary

To nalize your benets choices, you must submit the required documentation

within 31 days of the hire date or qualifying event date. Refer to the table below.

See page 68 for instructions on submitting your documentation.

Unmarried Military Dependent

Children Who Are Residents of

Illinois (ages 26 - 30)

(Benets terminate at the end

of the month in which the 30th

birthday occurs.)

Legal dependents

(Court appointed)

Dependent (0-26 yrs.)

Disabled dependent (0-26 yrs.)

Spouse

Benet participant being added Document(s) Needed

An original certied marriage certicate.

An original county certied Birth Certicate (with parental information)

Disabled dependent (0-26 yrs.)

Civil union partner

An original certied civil union certicate.

Acknowledgment of Imputed Income (AII) form.

An original certied birth certicate

and military discharge paperwork (DD2-14).

Adopted children

If the child is your adopted child and the birth certicate has not yet been amended to name you and other adoptive

parent as the child’s parents, then the letter issued by the governmental agency placing the child in your home will

sufce for documentation, until such reasonable time as the amended birth certicate can be issued.

You do not need to prove your relationship to the child’s parents if you are the child’s legal guardian. You must provide

an original of the guardianship appointment certied by the clerk of the court in which the appointment occurred.

Domestic partner

The following eligibility requirements must be met for a domestic partner to be covered:

• You, the employee, must be enrolled in a Board-sponsored medical or dental plan; and

• You must submit a completed Afdavit of Domestic Partnership and meet the eligibility requirements for a samesex

Domestic Partner. Your afdavit needs to meet the minimum requirements listed below:

a. You and your partner are at least 18 years of age and reside at the same residence;

b. Neither you nor your partner is married (if you or your partner were previously married, proof of dissolution

of marriage is required);

c. You and your partner are not related by blood closer than would bar marriage in the State of Illinois;

d. You and your partner are each other’s sole domestic partner, responsible for each other’s common welfare;

e. You must submit certied birth certicates and copies of government-issued ID cards for both you and

your partner.

• Acknowledgment of Imputed Income (AII) Form.

AND

At least two of the following four conditions must apply and proof must be submitted:

1. You and your partner have been residing together for at least twelve (12) months prior to ling the Afdavit of

Domestic Partnership.

2. You and your partner have common or joint ownership of a residence.

3. You and your partner have at least two of the following arrangements:

i. Joint ownership of a motor vehicle;

ii. Joint credit account;

iii. Joint checking account;

iv. Lease for residence identifying both you and your partner as tenants.

4. You declare your partner as a primary beneciary in your will.

The Health and Benets Department will review your afdavit to determine whether you meet these requirements.

Chicago Public School Benets Handbook 17

Wellness Program

BlueCross BlueShield of Illinois (BCBSIL) will administer the wellness

program. As the sole medical carrier, BCBSIL will provide CPS employees

with a fully integrated experience that can be customized to meet individual

wellness goals.

The program is called Well onTarget and it is designed to give you the support

you need to make healthy choices. With Well onTarget, you gain access to

a convenient, secure website with personalized tools and resources, right at

your ngertips.

To access Well onTarget, log in to Blue Access for Members (BAM) at

BCBSIL.com. Once you are logged in to BAM, simply click the link on

the right side of the page and it will take you to the Well onTarget portal.

Employees will no longer be penalized for not completing required wellness

activities, but participation is highly encouraged. Take stock of yourself and

your health. This program will help you do that.

Well onTarget Member Wellness Portal

At the heart of Well onTarget is the member portal. It links you to a suite of

innovative programs, including:

onmytime Self-directed Courses

Reach your health goals at your own pace with online, self-directed courses for

topics such as stress management and weight management.

Health and Wellness Content

The health library teaches and empowers through evidence-based,

interesting articles.

Tools and Tracker

Use these interactive tools to help keep you on track for your next 5K or to

monitor your blood pressure levels.

Fitness Program and Health Clubs

A exible membership program gives you unlimited access to a nationwide

network of gyms. Membership is month-to-month and there is no long-

term contract required. Fees are $25 per month per member with a one-time

enrollment fee of $25.

Blue Points

Earn Blue Points by completing activities such as tracking your calories

or connecting a tness tracking device. Blue Points can be redeemed for

items such as gift cards or electronics.

Medical Plans at a Glance 19

BlueAccess for Members 20

BCBSIL BlueAdvantage Health Maintenance Organization (HMO) 21

BCBSIL Preferred Provider Organization (PPO) 22

BCBSIL PPO with Health Savings Account (HSA) 23

BlueCross BlueShield of Illinois Health Savings Account (HSA) 24

Clinical and Pre-Authorization for PPO and

PPO with HSA Plans 25

Prescriptions 28

Dental Plan Options 32

Vision Plan Options 33

Behavioral Health, Addiction and Employee

Assistance Program 34

Revised 2022-01

Chicago Public School Benet Guide 19

HMOs

Lower premiums

No deductibles

Doctor must be selected from pre-

approved list of doctors.

BlueCross BlueShield HMO requires

referral from your primary care doctor

to see a specialist doctor. Your primary

care physician and their staff will

manage and coordinate your care.

Slightly higher premiums

Carry over deductible credit provision only when the

deductible is met during the last two months of the

calendar year.

Covers in-network and out-of-network doctors.

Offers nancial incentives for selecting doctors

from the pre-approved list.

See a specialist doctor without referral. Pre-

approval, however, is required for certain services

such as MRIs and CT scans. (See page 23 for more

information about pre-approval requirements.)

BCBSIL nurses may reach out to you via

a phone call to help coordinate or manage your

care or your medical condition. This is an

additional resource to answer your questions,

help you effectively communicate with your

doctor, and help you understand your benets.

Telemedicine (Virtual Visits) are available only

for PPO and PPO with HSA plans.

PPOs

You can select a PPO or HMO from a single carrier – BlueCross BlueShield

of Illinois. We offer plans that are employee only, employee + one, or family

coverage. CPS shares in the cost of coverage for this benet.

Deductions are based on the paycheck date in accordance with the annual payroll calendar.

HMO and PPO Plans

Key Differences

BlueCross

BlueShield

PPO

BlueCross

BlueShield

BlueAdvantage

HMO

BlueCross

BlueShield

PPO with HSA

Medical Plans At a Glance

Employees and dependents will not incur out-of-

pocket expenses when receiving physical and

occupational therapy at an Athletico clinic.

Deductibles and visit limits still apply.

Chicago Public School Benet Guide 20

BlueAccess for Members

Want to nd more information on your plan?

Log in to BAM, BlueAccess for Members, the BlueCross BlueShield member

website to nd information about your claims, request an ID card, and access

their library of information. Visit bcbsil.com/members.

Chicago Public School Benets Handbook 21

Benet Highlights for eligible expenses BlueCross BlueShield BlueAdvantage HMO

Annual deductible

N/A

Out-of-pocket maximum

Single $1,500

Employee+1 $3,000

Family $3,000

Care in doctor’s ofce

• General ofce visits (e.g., x-rays, allergy shots, chemotherapy)

• Wellness/preventive care (e.g., physical check-ups for adults and

children, well baby care, colonoscopies, mammograms, pap smears

and immunizations)

100%

$30 Regular co-pay

$45 Specialist co-pay

$30 Urgent co-pay

100% (no co-pay)

Inpatient hospital services

• Hospital (semi-private) room and board

• Doctor’s visits (including specialists), x-rays, drugs, surgeon fees

and anesthesiologists

100% after $275 co-pay per admission

100%, $0 (co-pay)

Outpatient hospital care (including surgery)

Covered in full after $225 co-pay per visit

Maternity

• $30 copay applies for 1st prenatal visit only

• Prenatal/postnatal

• Hospital coverage (mother and newborn)

100% after $45 co-pay

100% after $275 co-pay

Covered emergency care

• Emergency care (if deemed an emergency)

• Ambulance

100% after $200 co-pay per visit for In-network and Out of network providers

100% with $0 co-pay. Ground Transportation only.

Behavioral/Mental Health (unlimited visits)

• Inpatient

• Outpatient

100% after $275 co-pay

100% after $20 co-pay

Therapy

• Physical, occupational and speech therapy for restoration of function

approved by doctor

• Chiropractic care

100% for the number of visits which, if approved by a doctor, up to 60 visits

combined for all therapies, plus $30 co-pay per visit per calendar year

100% after $45 co-pay per visit up to 30 visits per calendar year

Care in skilled nursing facility 100%; 60 calendar day limit

Coordinated Home Care 100% (no co-pay)

Prosthetic devices and medical equipment

100%

Eligible full-time union employees

Eligible Full - time union employee

Employee Only: 2.0%

Employee + 1: 2.2%

Family: 2.5%

Eligible Half-time Teachers

Employee Only: 4.0%

Employee + 1: 4.4%

Family: 5.0%

Eligible Non-Union Employees

Employee Only: 3.5%

Employee +1: 3.7%

Family: 5.0%

BlueCross BlueShield of Illinois BlueAdvantage

Health Maintenance Organization (HMO)

Chicago Public School Benets Handbook 22

Benet highlights for eligible expenses BlueCross BlueShield PPO

In Network Out of Network

Annual deductible

Single $600

Employee+1 $1,800

Family $1,800

Single $1,200

Employee+1 $3,600

Family $3,600

Out-of-pocket maximum

Single $2,700

Employee+1 $5,200

Family $5,200

Single $5,400

Employee+1 $10,800

Family $10,800

Care in doctor’s ofce

• General ofce visits (e.g., x-rays, allergy

shots and chemotherapy)

• Wellness/preventive care (e.g., routine

physical check-ups for adults and children, well

baby care, colonoscopies, mammograms, pap

smears and immunizations)

80%

$25 Regular co-pay

$40 Specialist co-pay

$25 Urgent co-pay

100% (no co-pay)

50%

$25 Regular co-pay

$40 Specialist co-pay

$25 Urgent co-pay

100% (no co-pay)

Pre-authorization requirements

• Procedure, therapy and surgical

(See page 24 for more information.)

Pre-authorization required, failure can result in 50%

additional co-insurance charge up to $1,000 plus the co-

insurance that is applicable to the service. Benets can be

further reduced or denied completely if it is determined

that treatment or admission is not medically necessary.

Pre-authorization required, failure can result in 50%

additional co-insurance charge up to $1,000 plus the co-

insurance that is applicable to the service. Benets can be

further reduced or denied completely if it is determined

that treatment or admission is not medically necessary.

Telemedicine (Virtual Visits)

$25 co-pay N/A

In-patient hospital services

• Hospital (semi-private room and board)

• Doctor’s visits (including specialists), x-rays,

drugs, surgeon fees and anesthesiologists

$100 deductible per admission and 80% after deductible

Included in inpatient hospitalization

$100 deductible per admission and 50% after deductible

Included in inpatient hospitalization

Outpatient hospital care (including surgery)

80% after deductible 50% after deductible

Maternity

• Prenatal/postnatal

• Hospital coverage (mother and newborn)

100% after $40 co-pay

80% after deductible

50% after deductible

50% after deductible

Covered emergency care

• Emergency care (if deemed an emergency)

• Ambulance

100% after $200 co-pay

100% after deductible

100% after $200 co-pay

100% after deductible

Behavioral/Mental Health (unlimited visits)

• Inpatient

• Outpatient

80% after deductible

100% after $25 co-pay

50% after deductible

80% after $25 co-pay

Therapy

• Physical, occupational and speech therapy for

restoration of function approved by doctor –

up to 60 combined visits per calendar year

• Chiropractic care up to 30 visits per

calendar year

100% after deductible, then $30 co-pay

100% after deductible and $30 co-pay

80% after deductible

80% after deductible

Care in skilled nursing facility (up to 120

days/year if medically necessary)

80% after deductible 50% after deductible

Prosthetic devices and medical equipment

80% after deductible 50% after deductible

Eligible full-time union employees

Employee Only: 2.2% Employee + 1: 2.5% Family: 2.8%

Eligible half-time teachers

Employee Only: 4.4% Employee + 1: 5.0% Family: 5.6%

Eligibile non-union employees

Employee Only: 3.7% Employee +1: 4.0% Family: 5.0%

BlueCross BlueShield of Illinois Preferred

Provider Organization (PPO)

Chicago Public School Benets Handbook 23

In addition to HMO and PPO plans, CPS offers a PPO with Health SavingsAccount (HSA) plan.

An HSA is a tax-favored account used in conjunction with an HSA-compatible health plan. The

funds in the account are used to pay for IRS-qualied medical expenses such as services applied

to the deductible, dental, vision and more.

CPS will contribute up to $600 for single coverage, $1,500 for employee +1 or $2,000 for family

coverage to your individual HSA. Funds will be paid incrementally per pay period. Employer

contributionswill be pro-rated based on the beginning date of enrollment with the PPO with

HSA plan.

Employer and employee contributions will be deposited to the participant’s accounts after each

pay date in one lump sum.

• A CPS employer contribution (seed money) you can apply toward your

deductible and other medical expenses.

• Funds roll over year to year and are yours even if you leave CPS.

• Monthly premiums are lower and tax savings are higher.

Per IRS regulations, employees cannot be enrolled in both the HSA plan and the Health Care

FSA plans concurrently. It is against current IRS regulations to be covered under the PPO

with HSA and contribute to the Health Care FSA plan. More information can be found in IRS

Publication 969.

Per IRS, 2022 employee + employer contribution maximums are:

• Employee Only Coverage: $3,650

• Employee+1 and Family Coverage: $7,300

HSA funds roll over year-to-year; there are tax benets on contributions, earnings and

distributions; and long-term investment opportunities are available.

Per IRS, 2022 catch up for age 55 and up is $1,000

The HSA is the employee’s account, not CPS’. All transactions are handled between the employee

and HSA Bank. It is the employee’s responsibility to complete the process to open their account

within 60 days. If your account is not opened, contributions cannot be deposited.

Monthly maintenance fees may be charged depending on the balance in the

account. Contact HSA Bank for more information on monthly fees.

Use the savings from the lower premium to put into your HSA account and watch your savings

build up faster!

Your contribution amount will be divided among the pay periods in the year. If you do not receive

a paycheck during the summer, for example, a makeup contribution for the missed pay periods

during the summer months will be deposited into your HSA Bank account for the employer

portion at the beginning of the new school year.

BlueCross BlueShield of Illinois PPO

with Health Savings Account (HSA)

Chicago Public School Benets Handbook 24

Benet highlights for eligible expenses In Network Out Of Network

CPS employer contribution*

Single $600 Employee+1 $1,500 Family $2,000

Annual deductible

Single $2,000

Employee+1 $4,000

Family $4,000

Single $4,000

Employee+1 $8,000

Family $8,000

Out-of-pocket maximum

(established by IRS regulations)

Single $4,000

Employee+1 $8,000

Family $8,000

Single $8,000

Employee+1 $16,000

Family $16,000

Care in doctor’s ofce

• General ofce visits (e.g., x-rays, allergy

shots, and chemotherapy)

• Wellness/preventive care (e.g., routine

physical check-ups, well baby care,

colonoscopies, mammograms, pap smears,

and immunizations)

80% after deductible

100% (no co-pay, no deductible)

50% after deductible

100% (no co-pay, no deductible)

Pre-authorization requirements

• Procedure, therapy and surgical.

(See page 24 for more information.)

Pre-authorization required, failure can result in 50%

additional co-insurance charge up to $1,000 plus the

co-insurance that is applicable to the service. Benets

can be further reduced or denied completely if it is

determined that treatment or admission is not medically

necessary.

Pre-authorization required, failure can result in 50%

additional co-insurance charge up to $1,000 plus the co-

insurance that is applicable to the service. Benets can be

further reduced or denied completely if it is determined

that treatment or admission is not medically necessary.

Telemedicine (Virtual Visits)

80% after deductible N/A

Inpatient hospital services

• Hospital (semi-private) room and board

• Doctor’s visits (including specialists), x-rays,

drugs, surgeon fees and anesthesiologists

80% after deductible

Included in inpatient hospitalization

50% after deductible

Included in inpatient hospitalization

Outpatient hospital care (including surgery) 80% after deductible 50% after deductible

Maternity

• Prenatal/postnatal

• Hospital coverage (mother and newborn)

80% after deductible

80% after deductible

50% after deductible

50% after deductible

Covered emergency care

• Emergency care (if deemed an emergency)

• Ambulance

80% after deductible

100% after deductible

80% after deductible

100% after deductible

Behaviorial/Mental Health (unlimited visits)

• Inpatient

• Outpatient

100% after deductible

100% after deductible

80% after deductible

80% after deductible

Therapy

• Physical, occupational and speech therapy for

restoration of function approved by doctor

• Limited to 60 combined visits per calendar year

• Chiropractic care

• Limited to 30 visits per calendar year

100% after deductible, then $30 co-pay

100% after deductible, then $30 co-pay

80% after deductible

80% after deductible, then $30 co-pay

Care in skilled nursing facility (up to 120 days/year

if medically necessary)

80% after deductible 50% after deductible

Prosthetic devices and medical equipment

80% after deductible 50% after deductible

Pharmacy

80% after deductible 50% after deductible

Eligible full-time union employees

Employee Only: 0.0% Employee + 1: 1.0% Family: 1.9%

Eligible half-time teachers

Employee Only: 0.0% Employee + 1: 2.0% Family: 3.8%

Eligible non-union employees

Employee Only: 2.8% Employee +1: 3.0% Family: 3.8%

BlueCross BlueShield of Illinois

Health Savings Account (HSA)

* Health Savings Account (employer contributes this amount to the employee)

Funds will be deposited in the accounts on each pay period and will be calculated incrementally based on pay period.

Chicago Public School Benets Handbook 25

Clinical and Pre-Authorization for PPO

and PPO with HSA Plans

BlueCross BlueShield of Illinois manages the pre-authorization process for

CPS employees and dependents enrolled in the PPO and PPO with HSA health

plans. Pre-authorization is designed to ensure you receive quality medical care

while discouraging unnecessary treatment. To verify that certain treatments

and hospital stays are appropriate, you must obtain approval from the medical

professionals at BCBSIL. They are available from 8 a.m – 6 p.m. Monday

through Friday at (800) 572-3089 for Pre-authorization for medical and for

behavioral health services.

Pre-Authorization

Requirements

Pre-authorization is required for the following services and procedures:

• Inpatient hospital care, including acute rehabilitation hospitals

and surgeries.

• Inpatient skilled nursing facility care.

• Organ transplants.

• Air ambulance transportation.

• Certain outpatient surgeries and procedures such as:

○

Blepharoplasty (surgery to eyelids)

○

Breast surgeries (reduction, reconstruction except when related

to mastectomy, biopsy and lesions)

○

CAT scans

○

MRI

○

Nasal surgery (rhinoplasty and septoplasty)

○

PET scans

○

Sclerotherapy and ligation, vein-stripping

○

Sleep studies

• Hospice: inpatient and home.

• Home nursing visits.

• Private duty nursing.

Chicago Public School Benets Handbook 26

Pre-Authorization

Requirements

• Durable medical equipment and supplies such as:

○

Hospital beds

○

Ventilators

○

Prosthetics

• Other durable medical equipment that costs $1,000 or more.

• Enteral formula (life-sustaining tubal feeding).

• All pregnancy care (during the rst three months or as soon as the pregnancy

is conrmed and within two business days after admission for delivery, not

including weekends).

If you remain an employee after you reach age 65 and become eligible for

Medicare, the Board-sponsored plan will be the primary plan and Medicare will

be secondary. This plan will also be primary for your spouse, if he or she is age 65

or older, eligible for Medicare and is covered by a Board-sponsored plan.

Coordination with

Medicare

Chicago Public School Benets Handbook 27

What If I Don’t Call?

LaTanya, a 32-year-old longtime runner, is experiencing severe back pain during

her workouts. LaTanya’s doctor has diagnosed her with back problems and has

ordered an MRI. LaTanya, her doctor, a family member or a friend must notify

BCBSIL and receive approval prior to her receiving an MRI.

Caleb, age 7, has had numerous bouts of a sore throat and neck swelling over the

past couple of years. During a recent examination, Caleb’s doctor found a lump

in Caleb’s neck. The lump was not viewable with a normal X-ray so his doctor

has suggested that Caleb have an MRI. Because Caleb is a minor, his doctor, the

facility or a family member (parent or legal guardian) must notify BCBSIL prior

to the scheduled date of this outpatient procedure.

Maria, age 55, who has severe osteoarthritis, is scheduled to have a knee replace-

ment. This surgery will require Maria to be in the hospital for several days. Maria,

her doctor, the facility, a family member or friend must notify BCBSIL as soon

as the admission date is scheduled to pre-authorize this inpatient surgery and

hospital admission.

You must call at least seven (7) days in advance for most services requiring pre-

authorization. You must call within two (2) business days after emergency

treatment or inpatient admissions. All pregnancies must be pre-authorized twice,

during the rst three (3) months or when the pregnancy is conrmed (if later)

and again within two (2) business days after admission for delivery (not

including weekends).

When to Call

MRI

Outpatient

Procedures

Inpatient surgery and

hospital admission

If you do not call for pre-authorization and/or follow the program’s recom-

mendations, you will be responsible for 50% of eligible charges (capped at

$1,000 per individual per event per hospital stay). You will pay this penalty

plus the co-insurance that applies. Also, benets could be further reduced if it

is determined that the treatment or admission is not medically necessary.

Example 1

Example 2

Example 3

In cases of End Stage Renal Disease (ESRD), the Board-sponsored plan is

primary for the rst 30 months. It is important that you inform the Claims

Administrator if you have ESRD.

Chicago Public School Benets Handbook 28

CVS/Caremark pharmacy staff continually reviews medicines, products and prices

for your plan sponsor. This is done to make sure that medicines that work well and

are cost-effective to become part of your benet plan. As part of this effort, there

are changes to your drug benet plan that could affect certain specialty prescription

drugs. Call CVS Caremark Specialty Pharmacy toll-free at (800) 237-2767

if you have questions.

Prescriptions

We wanted to make it easy, so we offer three convenient ways for CPS employees

to purchase prescription drugs. The program covers eligible drugs purchased:

By mail-order

Specialty Drugs

At a non-partici-

pating pharmacy

At a participating

pharmacy

Chicago Public School Benets Handbook 29

When to

use which

benet

Retail Program Mail Service Program

For immediate or short-term medicine

needs up to a 30-day supply

For maintenance or long-term medicine

needs up to a 90-day supply

Where

You can use your prescription benet at

more than 62,000 Caremark participating

retail pharmacies nationwide, including

Target and over 20,000 independent

community pharmacies. You can ll 90

days of medicine at a retail CVS

or Target store.

To locate a Caremark participating

retail pharmacy in your area, login to

your account at www.caremark.com

and select the ‘Find a Pharmacy’ link

under the ‘My Prescriptions’ tab, or

call CVS Customer Care toll-free at

(866) 409-8523.

Simply mail your original prescription

along with the mail service order

form to CVS. Your medicines will be

sent directly to your home.

Standard delivery is free of charge for

mail orders.

$10 for each generic medicine after

deductible.

$40 for each brand-name medicine on

the drug list after deductible.

$55 for each brand-name medicine not

on the drug list after deductible.

$95 for specialty medicine after

deductible.

80% covered after medical deductible

is satised.

$20 for each generic medicine after

deductible.

$90 for each brand-name medicine on

the drug list after deductible.

$120 for each brand-name medicine not

on the drug list after deductible.

$200 for specialty medicine after

deductible.

80% covered after medical deductible

is satised.

Prescription Drug

Program Details

Cost to you HMO

and PPO

Cost to you PPO

with HSA

Chicago Public School Benets Handbook 30

Important Change

to Prescription

Drug Deductible

Non-Participating

Pharmacy Purchases

Web Services

Important Change

About Generic vs

Brand Name

Prescriptions

All CPS employees enrolled in the BlueAdvantage HMO or PPO plan will

have to pay a $75 prescription drug deductible per calendar year per household.

Employees who are enrolled in the HSA plan must satisfy the medical

deductible before prescription coinsurance applies.

All CPS employees enrolled in a medical plan will only have access to generic

drugs. Brand name drugs will only be covered if approved by Caremark Doctors

through an appeal process or the employee’s doctor completes the Caremark

prior authorization process.

Register at www.caremark.com to nd a local pharmacy and to access tools

that can help you save money and manage your prescription benet. To register,

have your benets ID card handy.

In most cases, you will not need to visit a non-participating pharmacy, because

the Caremark Retail Program includes more than 62,000 participating pharma-

cies. However, if you choose a non-participating pharmacy, you will pay 100%

of the prescription price. You will then need to submit a paper claim form, along

with the original prescription receipt(s), to Caremark for reimbursement of cov-

ered expenses. Covered prescriptions purchased at a non-participating pharmacy

will be reimbursed at 60% of the generic drug cost. The plan will also only pay

60% of the generic drug cost if a brand-name drug is issued when a generic drug

is available. Submit paper claim forms to:

CVS Caremark

P.O. Box 52136

Phoenix, Arizona 85072-2136

Chicago Public School Benets Handbook 31

Drugs that Qualify for

Coverage

Drugs that are Not

Covered

• Federal legend drugs (drugs requiring a prescription).

• Compound prescriptions (limits and exclusions apply).

• Insulin.

• Women’s contraceptives (limits and exclusions apply).

• Men’s Erectile Dysfunction medications (limits and exclusions apply)

• Specic supplements (i.e., folic acid, iron and uoride).

• Low-dosage aspirin.

• Tobacco cessation (generic only).

• Infertility medications.

• Disposable insulin syringes/needles and diabetic supplies.

• Acne medication (with prior certication from Caremark

for participants over age 35).

• Growth hormones (with prior certication from Caremark).

• Cosmetic drugs such as Rogaine.

• Drugs available without a prescription, except insulin.

• Prescription drugs with an over-the-counter equivalent.

• Drugs for the treatment of obesity, morbid obesity, or weight-loss.

• Appetite suppressants.

• Brand contraceptives (oral and injection) and contraceptive devices that

have a generic equivalent.

• Medical supplies and equipment.

• Drugs not prescribed by a provider acting within the scope

of his or her license.

• Experimental, investigational or unproven drugs or therapies.

• Drugs provided to you by the local, state or federal government and

any drug for which payment or benets are provided by the local, state

or federal government (for example, Medicare).

• Prescription vitamins.

• Topical nail-fungal medication (for oral, limits and exclusions apply).

• Replacement prescription drugs resulting from loss or theft.

Chicago Public School Benets Handbook 32

Dental care coverage is provided at no cost to you; CPS covers the full dental

contribution deduction for all coverage levels. And, you get to choose your

own dentist. Just use a facility ID from the provider network sponsored by

Delta Dental, which can be found at www.deltadentalil.com. (Note: Select the

DELTACARE Network when searching for an in-network dentist on Delta

Dental’s website.)

Delta Dental DHMO

If you choose the PPO, CPS will cover the cost of the employee-only contribu-

tion. Employees pay an additional cost for +1 or family coverage. Under the

PPO plan, you can select either an in-network or an out-of-network provider.

The plan will pay a certain percentage of the PPO rate whether or not you use

a network provider.

Delta Dental PPO

Services Delta Dental HMO Delta Dental PPO

In Network Out of Network

Preventive 100% 80% of PPO rate 80% of PPO rate

Basic 75–85% 80% of PPO rate 80% of PPO rate

Major 65–70% 50% of PPO rate 50% of PPO rate

Individual maximums

Deductible None None $100 annually

Benet Limit None $1,500 annually

Employee Contributions – 26 Pay Periods

Employee only None None

Employee +1 None $9.71 per pay period

Family None $20.56 per pay period

Employee Contributions – 20 Pay Periods

Employee only None None

Employee +1 None $12.62 per pay period

Family None $26.73 per pay period

Dental Plan Options

Chicago Public School Benets Handbook 33

Employees and eligible dependents enrolled in BCBSIL medical plans can

access basic vision coverage through EyeMed Vision Care at no cost to you.

The basic vision plan provides you one eye exam per year for a $15 co-pay.

In addition, you will receive discounts on eyewear.

Basic Vision

Enhanced Vision

For a monthly premium, you can upgrade to the Enhanced Vision plan, which

includes coverage for glasses and contacts, and discounts on laser vision correc-

tion. Choose from independent doctors and retail providers to nd the one that

best ts your needs and schedule.

Vision Plan Options

If you decide to upgrade to the Enhanced Vision Plan for a monthly premium, you will receive coverage for glasses and

contacts, and discounts on laser vision correction. Reimbursement is available for out-of-network benets, but the greatest

savings are with in-network providers. See details in the certicate of coverage.

Digital Retinal Exam covered in full w/ $0 co-pay once every calendar year

Standard lenses once every calendar year

• Cost: Single, bifocal, trifocal and lenticular: $25 co-pay.

• Lens Options: UV treatment $10, tint (solid and gradient) $10, standard plastic scratch coating $0, standard polycarbonate

(adults) $35, standard polycarbonate (kids under 19) $0, standard anti-reective coating $45, polarized 20% off retail.

Frames once every calendar year

• Any available frame at provider location – $0 copay, $150 allowance, 20% off balance over $150

Contact lenses once every calendar year

• Conventional – $0 co-pay, $175 allowance, 15% off balance over $175

• Disposable – $0 co-pay, $175 allowance, plus balance over $175

Exam options

• Standard contact lens t and follow-up – up to $55

• Premium contact lens t and follow-up – 10% off retail price

Additional discounts and features

• Receive a 40% discount off complete pair eyeglass purchase

• 20% discount on non-prescription sunglasses

• 20% discount on other lens options and services

• 15% discount on conventional contact lenses once the funded benet has been used.

• 15% off retail price or 5% off promotional price for Lasik or PRK from the US Laser Network,

owned and operated by LCA Vision.

Deductions Per Paycheck

20 Pay Periods

• Employee Only – $4.44

• Employee + 1 Dependent – $6.48

• Family – $11.63

26 Pay Periods

• Employee Only – $3.42

• Employee + 1 Dependent – $4.99

• Family – $8.95

Freedom Pass

• CPS employees and dependents enrolled in the Enhanced Vision Plan can get any pair of frames for free at Target

Optical stores. To redeem your frames, you must log into EyeMed.com and print off the “Freedom Pass” from the

special offers page and present it at the store.

Chicago Public School Benets Handbook 34

The help you need to manage life’s demands and addiction

We’re not here to judge; we’re here to help, maintaining the strictest condence.

As a CPS employee, you can access counseling and substance abuse recovery

services to help you effectively deal with stressful and challenging situations,

and feelings such as:

Stress

Anger management

Relationship problems

Domestic abuse

Work issues

Sadness

Alcohol abuse

Drug abuse

Grief

Problems with food

Gambling problems

CPS offers an Employee Assistance Program (EAP) that can help you and your

household members with a wide range of issues affecting your overall quality

of life. Offered through Magellan Healthcare, all employees are automatically

enrolled in the EAP, which is provided in strict condence and at no cost to you.

The benet includes up to 5 condential counseling sessions with a licensed

behavioral health professional, as well as comprehensive online information

and resources. The program can assist with everything from job stress, family

or relationship concerns, depression or anxiety, substance abuse or misuse, legal

and nancial issues and more. You may reach the EAP by phone, 24/7/365 for

a consultation, or to link to a counselor or crisis intervention at (800) 424-4776

(800-4CHIPSO) or online at www.magellanascend.com.

Employee Assistance

Program (EAP)

Behavioral Health, Addiction,

and Employee Assistance Program

If you are enrolled in the PPO or PPO with HSA, contact BCBSIL at

(800) 851-7498 to access services. If you are in the BlueAdvantage HMO

plan, contact your primary care physician to receive services.

Behavioral Health

Chicago Public School Benets Handbook 36

Short-Term Disability

CPS provides employer-paid Short-Term Disability benets for all eligible

employees. All CPS employees who are members of an eligible class are

covered under short-term disability. The policy in full legal detail can be obtained

on CPS.edu/Staff then click on the link for HR4U. Here are some highlights.

Summary

This benet is designed to replace income lost during periods of disability

resulting from a non-occupational injury, illness, or pregnancy. Employee

contributions and enrollment forms are not required. All CPS employees who are

members of an eligible class are covered under short-term disability.

Eligible Class is dened as:

1) Collectively Bargained Employees; or

2) Non-Union Employees (Employees who are not members of

a bargaining class)

a) Who are full-time benets eligible employees under Board rules or policies;

AND

b) Who are part-time teachers assigned to a position number and benets

eligible employee as a member of the Chicago Teachers Union; and

c) Who are actively employed in their position with CPS

Coverage begins on the rst calendar day of the month following 60 consecutive

days of employment. Employees who are rehired within 12 months from the date

of the employment termination with CPS will be eligible for coverage as of the

date of rehire as long as they worked 60 days in their prior employment with CPS.

Employees suspended without pay are ineligible for Short-Term Disability.

Effective Date of

Coverage

Chicago Public School Benets Handbook 37

Submitting a Request

Ten Sick Day/Seven

General Use Day

Exhaustion Rule

If you meet the eligibility requirements and you have a medical condition that ren-

ders you unable to work, you should initiate your claim within 10 calendar days

from your rst date of absence due to your disability by going to HR4U > Self

Service > Benets > Leave Life Events or by calling (773) 553-4748. After you

complete the Life Event you then have 15 days to submit your medical certica-

tion to the Absence and Disability Management Department. If you do not report

your claim within 10 calendar days from your rst date of absence, your disability

claim may be denied. In addition to ling for Short-Term Disability, your applica-

tion will be evaluated for a leave of absence under the Family Medical Leave Act

(FMLA). An approved Short-Term Disability claim runs concurrently with FMLA

if you are FMLA eligible. To be eligible for FMLA you must work for CPS for

one (1) year and 1250 hours.

For any Period of Disability, the Ten Sick Day/Seven General Use Days Exhaustion

Rule requires, prior to the beginning of your Period of Disability, that you use ten

sick days or seven general use days of your current year allotment.

Chicago Public School Benets Handbook 38

100% During the period beginning on the date of disability, and continuing up

to and including the 30th day, the amount you receive will be 100 percent of the

Daily Rate of Pay*, calculated by multiplying your hourly base pay x scheduled

hours. You will receive this percentage of that.

Calendar Days 1 – 30

Calendar Days 31 – 60

Calendar Days 61 – 90

Submitting a Request

Notify your supervisor

prior to your leave of

absence or within 10

days of your disability.

Follow the required

call off procedures

established by your

manager/principal.

1

Apply online: CPS.

edu/Staff then click

on the link for HR4U.

Download required

forms and submit within

15 calendar days.

2

Absence and Disability

Department will review

medical certication

upon receipt and send a

determination letter to

you and your supervisor

within 4 business days.

3

Ongoing

communication with

your supervisor and

/ or Absence and

Disability Department

may be required

throughout the

duration of your leave

of absence.

4

80% Beginning on the 31st calendar day from the date of disability and con-

tinuing up to and including the 60th day, you will receive 80 percent of the

Daily Rate of Pay.

60% From the 61st calendar day from the date of disability continuing up to and

including the 90th day, the percentage shall be 60 percent of the Daily Rate of Pay.

• Paid CPS Holidays will be paid by CPS and are counted toward the 90

calendar day maximum benet.

• Paid CPS Holidays will be paid at the rate of the disability period

(100%, 80%, and 60%)

• Intersession pay will be based on the formula as agreed to by the collective

bargaining agreement and are counted towards the 90 calendar day

maximum benet.

• Short-term disability benets you receive from the Plan are taxable income.

• Federal and applicable state and local taxes are withheld from benet

payments.

*If you have a change in your base pay while on disability, your base pay used to calculate your

short-term disability benet will be adjusted based on the new salary rate.

Chicago Public School Benets Handbook 39

An employee may supplement the STD payment in days 31 – 90 to reach 100%

income during such period(s) by usage of sick days from their sick day bank(s).

Employee must complete the authorization form and elect the specic banks for

deductions. Please note, usage of sick days is not an automatic process. Failure

to complete the authorization form within the time period will result in no sick

day usage during the eligible period(s), and no retroactive sick day usage will be

applied to past claim period(s).

Daily Benets shall be paid for each regular work day for which the employee

would have been scheduled had the employee not been disabled, but only for

days during the Period of disability and not in excess of the Maximum Benet

Period. Examples of days not paid by STD include: Holidays, Snow days, and

Intercessions. Short-Term Disability benets will not be paid during the summer

intersession. If the employee remains disabled beginning with the rst scheduled

work date following the end of the summer intercession, the employee will be

responsible for contacting the plan Absence and Disability Department to submit

a new claim.

Benets paid under the Plan are reduced by the total amount of certain other

income for which you may be eligible during any period of disability. These

sources of other income are:

• Any settlement, judgment, or other recovery from any person or entity,

including your own automobile or liability carrier which provides benets that

are intended to replace any portion of your pay

• Any amount of STD benets paid for days determined later that benets were

not due. In the case that there are future benets, overpayments will be

deducted from benets due.

When claim benets are payable: Benets are paid biweekly, for the prior period

for which you are owed, after CPS receives the required proof. If any amount is

unpaid when disability ends, it will be paid when required proof of disability is

in hand. Short-term disability benet payments begin on the rst day after you

have exhausted ten sick days or seven general use days from your current scal

year’s allotment. You must be under the care of a physician who veries, to

the satisfaction of the Absence and Disability Department, that because of your

disability you are unable to perform the essential duties of your employment

with CPS.

Short-term disability benet payments begin on the rst day after you have

exhausted ten sick days or seven general use days from your current scal

year’s allotment. You must be under the care of a physician who veries, to

the satisfaction of the Claims Administrator, that because of your disability

you are unable to perform the essential duties of your employment with CPS.

Supplemental Income

with Usage of Sick Days

Payment of

Daily Benet

Reduction of Benet

Payments

Chicago Public School Benets Handbook 40

Once you begin receiving short-term disability benets, your benets continue

until the earliest of the following events occurs:

• You no longer have a covered disability under the Plan. Either you are able to

resume the essential duties of your regular position or you take a position at

CPS that accommodates your medical restrictions.

• You are unable to provide satisfactory medical evidence of a covered disability.

• You do not follow the treatment plan ordered by your physician.

• You fail to cooperate with a scheduled independent medical examination (IME)

or functional capacity evaluation (FCE).

• You begin work similar to your work with CPS for wage or prot with another

employer or through self-employment.

• You have received benets for a 90-day period.

• You are incarcerated.

• Your employment ends for any reason, including retirement or death.

• The plan terminates.

• You become suspended from your employment at CPS.

Short-Term disability allows you to continue to receive a full or partial salary

for up to 90 days in a rolling 12-month period. A rolling 12-month period is

measured backward from the last date you used any Short-Term Disability.

For example, if a requested Short-Term Disability was to begin on July 1, the

12 months preceding that date would be reviewed to determine whether any

Short-Term Disability time had already been used. If so, that time would be

deducted from the remaining amount of Short-Term Disability time available.