United States General Accounting Office

GAO

Briefing Report to the Honorable

Hank Brown, U.S. Senate

October 1994

NEW DENVER

AIRPORT

Impact of the Delayed

Baggage System

GAO/RCED-95-35BR

GAO

United States

General Accounting Office

Washington, D.C. 20548

Resources, Community, and

Economic Development Division

B-258641

October 14, 1994

The Honorable Hank Brown

United States Senate

Dear Senator Brown:

This briefing report responds to certain issues in your May 5, 1994, letter

concerning delays in the opening of the new Denver International Airport.

It documents the briefing we provided to your office on September 22,

1994, and specifically addresses three areas regarding the new airport:

(1) problems with the baggage handling system that delayed the airport’s

opening, (2) the added costs resulting from the delay, and (3) the adequacy

of expected revenues at the new airport to cover the cost of operating the

facility and to service its debt. This report addresses issues you identified

as requiring an immediate response. We will meet with your staff to

discuss the other, longer-term, issues raised in your letter.

Background

The new Denver International Airport was built to replace Stapleton

International Airport, a facility that has experienced serious air traffic

congestion and noise problems.

1

The new airport is the first major airport

to be built in the United States since 1974. Spread out over 50 square miles,

it has the capacity to expand eventually to 12 runways. On opening, the

airport will have a terminal building and three concourses, the farthest of

which will be about 1 mile from the terminal. Concourse A will serve

Continental Airlines, Continental Express, GP Express, and a variety of

international carriers. Concourse B will serve United Airlines and United

Express. American, Delta, Frontier, Markair, Northwest, TWA, and USAir

will use Concourse C.

On the basis of cost estimates as of September 1, 1994, the total cost to

build the new airport will be about $4.9 billion, of which the Federal

Aviation Administration (

FAA) has committed $685 million from the Airport

and Airway Trust Fund. Most of the money needed to build the airport has

come from revenue bonds issued by the Denver Airport System.

2

(See sec.

1 for details on the total cost of the airport and sec. 2 for a breakdown of

federal funds.)

1

We addressed other issues relating to the new airport in two prior reports: New Denver Airport:

Safety, Construction, Capacity, and Financing Considerations (GAO/RCED-91-240, Sept. 17, 1991) and

New Denver Airport Followup (GAO/RCED-92-285R, Sept. 14, 1992).

2

Denver Airport System is headed by the Manager of the Department of Aviation, who reports directly

to the Mayor of the City of Denver.

GAO/RCED-95-35BR New Denver AirportPage 1

B-258641

Because the airport is so large, airport planners decided that a

state-of-the-art automated baggage handling system, capable of moving

bags much more quickly than conventional tug-and-cart/conveyor belt

systems, would be needed. BAE Automated Systems Incorporated was

awarded a $193 million contract to design, build, and test an automated

baggage handling system. This system was designed to move baggage from

the check-in areas to the aircraft within 20 minutes. However, the baggage

handling system installed at the new airport has had many problems and

does not yet work satisfactorily. Originally, the airport was scheduled to

open in October 1993, but problems with the baggage handling system

have caused several postponements.

Results in Brief

The automated baggage handling system has had serious mechanical and

software problems and has yet to successfully pass the tests necessary for

it to be certified operational. In previous tests of the system, bags were

misloaded, were misrouted, or fell out of telecarts, causing the system to

jam. BAE is modifying the automated system to correct these problems.

However, the airport is installing an alternative, conventional baggage

handling system using conveyor belts, tugs, and carts that will be used at

the airport at least until the automated system is operating. The alternative

system is estimated to cost about $51 million.

Although Denver airport officials believe that this alternative system can

be completed in time to allow the airport to open by February 28, 1995, the

airport cannot open until an operating baggage system has been

successfully tested. In addition, the contractor responsible for the

conventional system has only recently started to make the structural

modifications necessary to operate the system. Airport officials hope that

Concourse B, serving United, will have the automated system operating at

the targeted opening date. If the automated system is not yet operational,

United will also be served by the conventional system. Whether the

automated system will eventually serve all areas of the airport or whether

some parts will continue to be served by the conventional system is yet to

be resolved.

The airport was originally scheduled to open in October 1993; however,

debt service did not begin until January 1, 1994. Up to that date, revenues

from Stapleton were sufficient to cover the operating costs at Stapleton as

well as the costs associated with the new airport. After January 1, 1994,

the costs of operating both airports, combined with the debt service

requirements, exceeded the revenues generated by Stapleton. The deficit

GAO/RCED-95-35BR New Denver AirportPage 2

B-258641

currently is between $18 million and $19 million each month. If all the

costs of delay are counted, including foregone net income, the total cost of

the delay will be about $360 million if the airport opens at the end of

February 1995.

The airport should be able to meet its financial obligations once it opens if

current traffic forecasts are realized and if cost estimates are correct.

Traffic projections are based on current levels at Stapleton, which has

about 16 million enplanements annually, and are expected to increase to

18.3 million in 2000. The agreement between the airport and the airlines

limits the amount that the airlines pay in user fees to $20 per enplaned

passenger (in 1990 dollars). These user fees are calculated after all other

revenues are applied to cover operating costs and debt service. If current

traffic, revenue, and cost projections are accurate, the airlines’ user fees

should be several dollars under the cap.

The accuracy of the Denver Airport System’s forecasts depends on several

assumptions: (1) savings from bond refinancing, (2) Continental Airlines’

revenues at projected levels, (3)

FAA discretionary funds’ being awarded,

and (4) an operational baggage system in place.

Problems With the

Baggage Handling

System Have Delayed

the Opening of the

New Airport

Significant mechanical and software problems have plagued the

automated baggage handling system. Denver airport officials are still

uncertain of how long it will take to correct all the problems. In a recent

report, BAE listed 72 tasks that must be completed before the system is

ready for testing. Then, the baggage system will be put through a series of

tests before it is certified as operational. It is possible that these tests

could reveal additional problems.

To open the airport by the end of February 1995, Denver has decided to

install a conventional baggage system to serve as an alternative to the

automated system. The alternative system, using conveyors, tugs, and

carts, will handle baggage between the terminal and all three concourses

until the automated system is operating properly. The automated system

will be operating first at Concourse B, which will serve United, and within

6 months at Concourse A, which will serve Continental and international

carriers. When the system for Concourse A becomes operational, airport

system officials will decide whether Concourse C will receive the

automated system or whether airlines on that concourse will continue to

use the conventional system. The alternative system is scheduled to be

ready by January 1995.

GAO/RCED-95-35BR New Denver AirportPage 3

B-258641

In addition to developing the alternative system, Denver has negotiated

with BAE to make substantial modifications to the automated system.

These modifications include changing the routing of the telecarts so that

more of them serve United at Concourse B. As part of this agreement,

United will contract directly with BAE for these modifications. On

September 29, 1994, BAE, United, and the City reached agreement on the

modifications to be made to the automated system. The estimated cost to

Denver for the modifications is about $35 million.

Excessive time to move baggage can affect the efficiency of an airline’s

operations by creating scheduling problems and disrupting the efficient

use of its aircraft fleet. The original automated baggage system was

designed to deliver bags from the terminal to the aircraft within 20

minutes. Recent Denver Airport System studies indicate that transit times

will only be moderately longer with the alternative system—up to 5

minutes longer. The airlines have challenged this estimate as being overly

optimistic. United believes it could take up to 50 minutes for baggage to

reach the most remote gates on Concourse B. Airlines on Concourse C

claim that transit times to and from Concourse C will be 27 to 31 minutes.

Transit times for the modified automated system are not yet available.

(See sec. 3 for more detailed information on the automated and alternative

baggage systems.)

The Delayed Opening

Has Caused Sizeable

Increases in Total

Costs of the New

Airport

The Denver Airport System began to experience operating deficits after

January 1, 1994, when debt payments began. By the end of February 1995,

the operating deficit will total about $230 million. The Denver Airport

System has used the 1993 operating surplus from Stapleton, contributions

from the airlines, bond proceeds, and other moneys set aside in various

reserve accounts to cover the deficit. As of September 1, 1994, the Denver

Airport System had about $467 million available—including proceeds from

its recent bond issue—to cover the airport system’s future deficits.

However, according to bond analysts to whom we spoke, not all of these

funds, especially those in the bond reserve fund, could be committed to

debt coverage without compromising the new airport’s credit rating.

Precisely how much could be spent from these funds before the credit

rating could be affected is not known.

Operating deficits are only part of the cost of the delayed opening. The

total cost of the delays to the airport and the airlines might reach

$360 million by February 1995. In addition to the deficit, other costs are

$37 million in lost income that the new airport would have generated if it

GAO/RCED-95-35BR New Denver AirportPage 4

B-258641

opened on January 1, 1994, $86 million for the alternative baggage system

and the modifications to the automated system, and $8 million in fees

associated with issuing the additional bonds. (See sec. 4 for additional

details on the costs of the delay and available revenues.)

The New Airport’s

Ability to Meet

Operating and Debt

Service Costs Is

Linked to Current

Traffic Projections

To evaluate whether the current delays and added costs would materially

affect the airport’s ability to meet operating and debt service costs when it

opens, we reviewed current projections of the airport’s traffic, revenues,

and costs. A simulation model, developed by Hickling Corporation,

3

was

employed to identify how different traffic forecasts affected the airport’s

financial situation. The model included recent information on the traffic

forecasts, project costs, financing plan, and financial statements for the

airport.

Air traffic at Denver has recovered from the depressed level of 13.7 million

enplanements in 1989. Traffic at Stapleton has grown to 16.3 million

enplanements in 1993. The 1993 traffic level was used as a base for

projecting future airport revenues in the most recent bond prospectus, and

traffic was projected to increase to 18.3 million in 2000. If these forecasts

materialize, the new airport should produce sufficient revenues to cover

expenses and service the debt. Projected traffic would have to be

20-25 percent lower than what is now forecast for the airport to

experience a high probability of sustained revenue shortfalls.

The new airport will be a relatively expensive facility, as airline user fees

will be about 3 times higher than those at Stapleton. The agreement

between the airport and the airlines limits the amount that the airlines will

pay in user fees to $20 per enplaned passenger (in 1990 dollars). These

user fees are calculated after all other revenues are applied to cover

operating costs and debt service. If traffic, revenue, and cost estimates are

accurate, airlines’ user fees should be below the cap—about $14.50 in 1990

dollars.

4

(See sec. 5 for more information on the financial outlook of the

new airport.)

3

Hickling Corporation, a consulting firm that specializes in risk assessment for airport investment

projects, assisted us in our evaluation. Hickling also provided assistance during our 1991 review of the

Denver airport project. Hickling has developed a risk analysis model applicable to a wide range of

subjects; the model has been used for airport infrastructure projects in Minneapolis/St. Paul, Minn.,

and in Vancouver and Toronto, Canada.

4

Because the cap is in 1990 dollars it rises over time. The cap in current 1994 dollars is about $22.50

and actual fees per enplanement are estimated to be $17-$18.

GAO/RCED-95-35BR New Denver AirportPage 5

B-258641

The accuracy of the Denver Airport System’s revenue and cost projections

is dependent on several important assumptions: (1) that $121 million will

be saved from 1995 through 1999 by restructuring and refinancing 1984/85

bonds, (2) that Continental Airlines will provide $273 million from 1995

through 1999 for use of the airport, (3) that the airport will receive

$95 million from 1995 through 1998 in discretionary funds from

FAA’s letter

of intent, and (4) that the airport will achieve an operational baggage

system.

We performed our review between May 1994 and September 1994 in

accordance with generally accepted government auditing standards.

Because the analyses presented in this report are based on traffic,

revenue, and cost forecasts that depend on key assumptions, caution must

be used in arriving at conclusions regarding the experience of the airport

in the first few years of operation. The extent to which these assumptions

materialize will be important ingredients in the near-term financial

experience of the new airport. The details of our scope and methodology

are contained in appendix I.

At the end of our field work, we discussed the facts contained in this

briefing report with senior officials from the Department of

Transportation, including the Department’s General Counsel, and the City

of Denver, including the City’s Director of Public Works and the Denver

Airport System Finance Director. They generally agreed with the

information presented, and we have incorporated their comments as

appropriate.

Unless you publicly release its contents earlier, we plan no further

distribution of this briefing report until 3 days from the date of this letter.

At that time, we will send copies of this briefing report to the Secretary of

Transportation; the Director, Office of Management and Budget; the City

of Denver; and interested congressional committees. We will also make

copies available to others on request.

GAO/RCED-95-35BR New Denver AirportPage 6

B-258641

Please contact me at (202) 512-2834 if you or your staff have any questions

concerning this briefing report. Major contributors to this briefing report

are listed in appendix II.

Sincerely yours,

Kenneth M. Mead

Director, Transportation Issues

GAO/RCED-95-35BR New Denver AirportPage 7

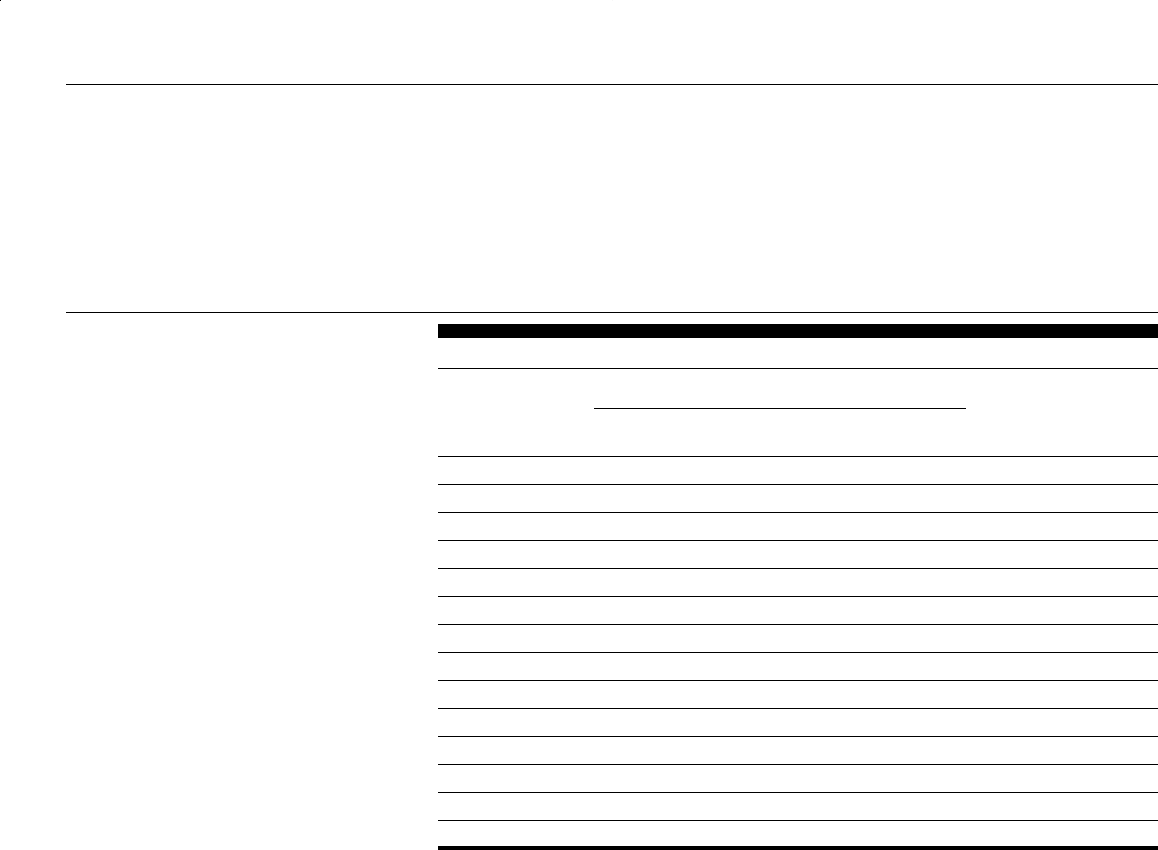

Contents

Letter

1

Section 1

Total Cost of Denver

International Airport

10

Section 2

Federal Funds for DIA

12

Section 3

DIA’s Automated

Baggage Handling

System

14

Problems With DIA’s Automated Baggage Handling System 17

Modifications to DIA’s Baggage Handling System 18

Remaining Uncertainties 21

Section 4

Cost of DIA’s Delayed

Opening

22

Cumulative Deficit Through February 28, 1995 23

Actual Deficit of the Denver Airport System—January 1, 1994,

Through June 30, 1994

25

Sources of Funds Used to Cover $80.08 Million Deficit—

January 1, 1994, Through June 30, 1994

27

Projected Deficit of the Denver Airport System—July 1, 1994,

Through February 28, 1995

29

Funds Available to Finance Future Delay Costs 30

Application of Proceeds of the Series 1994A Bonds 33

Forecast of Cumulative Operating Deficits 35

Summary of Total Delay Costs 37

Section 5

Impact of Delayed

Opening on DIA’s

Ability to Meet

Operating and Debt

Service Costs

38

Passenger Traffic Volume 39

Annual Enplanements at DIA Between 1994 and 2000 Under Low,

Median, and High Traffic Forecasts

41

Mean Cost per Enplaned Passenger for Two Opening Dates 43

Reduced DIA Enplanement Estimates to Levels Where There

Would Be a Significant Risk of Costs Exceeding Revenues

47

GAO/RCED-95-35BR New Denver AirportPage 8

Contents

Appendixes

Appendix I: Objectives, Scope, and Methodology 48

Appendix II: Major Contributors to This Briefing Report 51

Tables

Table 1.1: Cost of Denver International Airport 10

Table 2.1: Summary of Federal Funds for DIA 12

Table 4.1: Actual Deficit of the Denver Airport

System—January 1, 1994, Through June 30, 1994

24

Table 4.2: Projected Deficit of the Denver Airport System—July 1,

1994, Through February 28, 1995

28

Table 4.3: Reserve Funds in the Denver Airport System and

Amounts Available to Cover Future Delay Costs

31

Table 4.4: Application of Proceeds of the Series 1994A Bonds 32

Table 4.5: Comparison of Budgets for the January 1, 1994, to

February 28, 1995, Period for Two DIA Opening Dates

37

Table 5.1: Annual Enplanements at DIA Between 1994 and 2000

Under Low, Median, and High Traffic Forecasts

40

Table 5.2: Mean Cost per Enplaned Passenger if DIA Opens by

March 1, 1995

42

Table 5.3: Mean Cost per Enplaned Passenger if DIA Opens by

July 1, 1996

42

Table 5.4: Reduced DIA Enplanement Estimates to Levels Where

There Would Be a Significant Risk of Costs Exceeding Revenues

46

Abbreviations

AIP Airport Improvement Program

DIA Denver International Airport

FAA Federal Aviation Administration

F&E facilities and equipment

O&M operations and maintenance

PFC passenger facility charge

RAP risk analysis process

SIA Stapleton International Airport

GAO/RCED-95-35BR New Denver AirportPage 9

Section 1

Total Cost of Denver International Airport

Table 1.1: Cost of Denver International

Airport

Dollars in millions

Cost category Cost

Costs to Denver Airport System

Airport planning, land, and construction $3,214

Capitalized interest 919

Bond discounts and issuance expense 136

Total costs to Denver Airport System 4,269

Costs to others

FAA facilities 224

United Airline’s special facilities 261

Continental Airline’s special facilities 73

Rental car facilities 66

Total costs to others 624

Grand total costs of Denver International Airport $4,893

Legend

FAA = Federal Aviation Administration.

GAO/RCED-95-35BR New Denver AirportPage 10

Section 1

Total Cost of Denver International Airport

If Denver International Airport (DIA) opens by February 28, 1995, we

estimate that the costs of the airport, including facilities funded by

airlines, rental car companies, and

FAA will be about $4.9 billion. Of this

amount, the Denver Airport System (airport system) has funded $4.269

billion, including capitalized interest and Airport Improvement Program

(

AIP) grants. Details on AIP grants and FAA facilities and equipment funds

are in table 2.1, page 12.

FAA, the airlines, and rental car companies have

contributed another $624 million for their facilities.

The total cost encompasses all projects approved as of September 1, 1994.

It excludes costs for a sixth runway, which has not yet been authorized,

and other potential costs or recoveries arising from future legal

settlements between the airport system and its contractors. Since

September 1, 1994, Denver has agreed to build an alternative baggage

system estimated to cost $51 million and has agreed to further

modifications to the automated baggage system, which will cost an

estimated $35 million.

GAO/RCED-95-35BR New Denver AirportPage 11

Section 2

Federal Funds for DIA

Table 2.1: Summary of Federal Funds

for DIA

Airport Improvement Program funds

Dollars in millions

Fiscal

year

Entitlement

funds

Discretionary

funds Total

Facilities

and

equipment

funds Total

1988 $ 0.2 $ 0 $ 0.2 $ 0 $ 0.2

1989 34.2 25.8 60.0 4.2 64.2

1990 31.0 59.0 90.0 39.2 129.2

1991 0 25.0 25.0 60.0 85.0

1992 2.2 42.3 44.5 41.7 86.2

1993 5.9 42.0 47.9 24.0 71.9

1994 2.9 32.0 34.9 1.2 36.1

1995 6.0 31.0 37.0 0 37.0

1996 6.0 25.0 31.0 12.4 43.4

1997 6.0 25.0 31.0 19.2 50.2

1998 6.0 25.0 31.0 18.0 49.0

1999 6.0 22.9 28.9 1.3 30.2

2000 0 0 0 2.4 2.4

Total $106.4 $355.0 $461.4 $223.6 $685.0

In 1988, the federal government began funding DIA through the Airport and

Airway Trust Fund. As of September 1, 1994,

FAA planned to spend

$685 million from the Trust Fund; $472.8 million has already been

transferred to

DIA. Moneys for DIA have come from two major Trust Fund

accounts—the Airport Improvement Program (

AIP) and Facilities and

Equipment (

F&E).

GAO/RCED-95-35BR New Denver AirportPage 12

Section 2

Federal Funds for DIA

The majority of the federal funding, $461.4 million, for DIA comes from the

AIP. Not all of this amount has been transferred to DIA. As of September 1,

1994, about $302.5 million had been transferred—$132.1 million under a

letter of intent and $170.4 million in other

AIP grants.

1

The remainder will

be distributed by the end of 1999. The

AIP moneys have been used at DIA for

such things as land acquisition, the construction of runways, taxiways, and

aprons, and installation of a rail passenger transportation system. Federal

funds will not be used to fund the automated baggage system. In 1990,

FAA

gave DIA a letter of intent for $351 million;

2

however, this was significantly

reduced because the airport system imposed a passenger facility charge in

January 1992. By law, a portion of certain

AIP moneys must be turned back

if airports impose a passenger facility charge.

In addition to the

AIP moneys received under the letter of intent, DIA

received $170.4 million in other AIP moneys. Most of this

amount—$150.2 million—was granted prior to the 1990 letter of intent. In

fiscal years 1992 and 1993,

DIA also received separate AIP grants (not under

the letter of intent) totaling $20.2 million to procure incursion lighting,

conduct a light rail study, and begin work on a sixth runway.

DIA expects

to receive an additional $50 million in

AIP funds to complete the sixth

runway. An

FAA official told us, however, that FAA has not yet formally

committed this amount. On September 22, 1994, congressional

appropriators approved an amendment to the 1995 Department of

Transportation Appropriations bill to prohibit the planning, engineering,

design, and construction of a sixth runway at

DIA unless the runway is

needed to improve safety or performance.

DIA will receive about $223.6 million of F&E moneys through 2000. Since

1989, the Congress has appropriated $170.3 million in

F&E funds for DIA.

3

This money has been used for new air traffic control facilities; equipment

such as an airport surveillance radar system, instrument landing systems,

approach lights, weather sensors, and navigational aids; and transition

operations from Stapleton International Airport (

SIA) to DIA.

1

A letter of intent is a mechanism used to support projects at primary and reliever airports that will

significantly enhance systemwide airport capacity. Typically, letters of intent allow airports to begin

project development sooner and receive multiyear funding.

2

These funds are not guaranteed. They must be appropriated each year.

3

The congressional appropriation was $170.3 million; however, FAA has reprogrammed about

$2 million to other projects.

GAO/RCED-95-35BR New Denver AirportPage 13

Section 3

DIA’s Automated Baggage Handling System

GAO/RCED-95-35BR New Denver AirportPage 14

Section 3

DIA’s Automated Baggage Handling System

The automated baggage handling system, with a contract price of

$193 million, will be one of the largest and most sophisticated systems of

its type in the world. It was designed to provide the high-speed transfer of

baggage to and from aircraft, thereby facilitating quick turnaround times

for aircraft and improved services to passengers. Baggage will travel

between the terminal and concourses through interconnecting tunnels.

The most distant concourse is located about a mile from the terminal.

Even after modifications are complete, the automated baggage handling

system will have two main components: (1) high-speed, bag-carrying

telecarts mounted on tracks and (2) connecting conveyor belts to load and

off-load baggage. The tracks are suspended from the basement ceilings of

the terminal and concourses. Electric motors and synchronous drives

move the telecarts along the tracks at varying speeds. Photocells and radio

frequency reading devices direct each telecart to the right location. In

total, the original system included over 17 miles of track; 5.5 miles of

conveyors; 4,000 telecarts; 5,000 electric motors; 2,700 photocells; 59 laser

bar code reader arrays; 311 radio frequency readers; and over 150

computers, workstations, and communication servers. The automated

system was originally designed to carry up to 70 bags per minute to and

from the baggage check-in and baggage claim areas at speeds of up to 24

miles per hour. This would allow the airlines to receive checked baggage

at their aircraft within 20 minutes.

GAO/RCED-95-35BR New Denver AirportPage 15

Section 3

DIA’s Automated Baggage Handling System

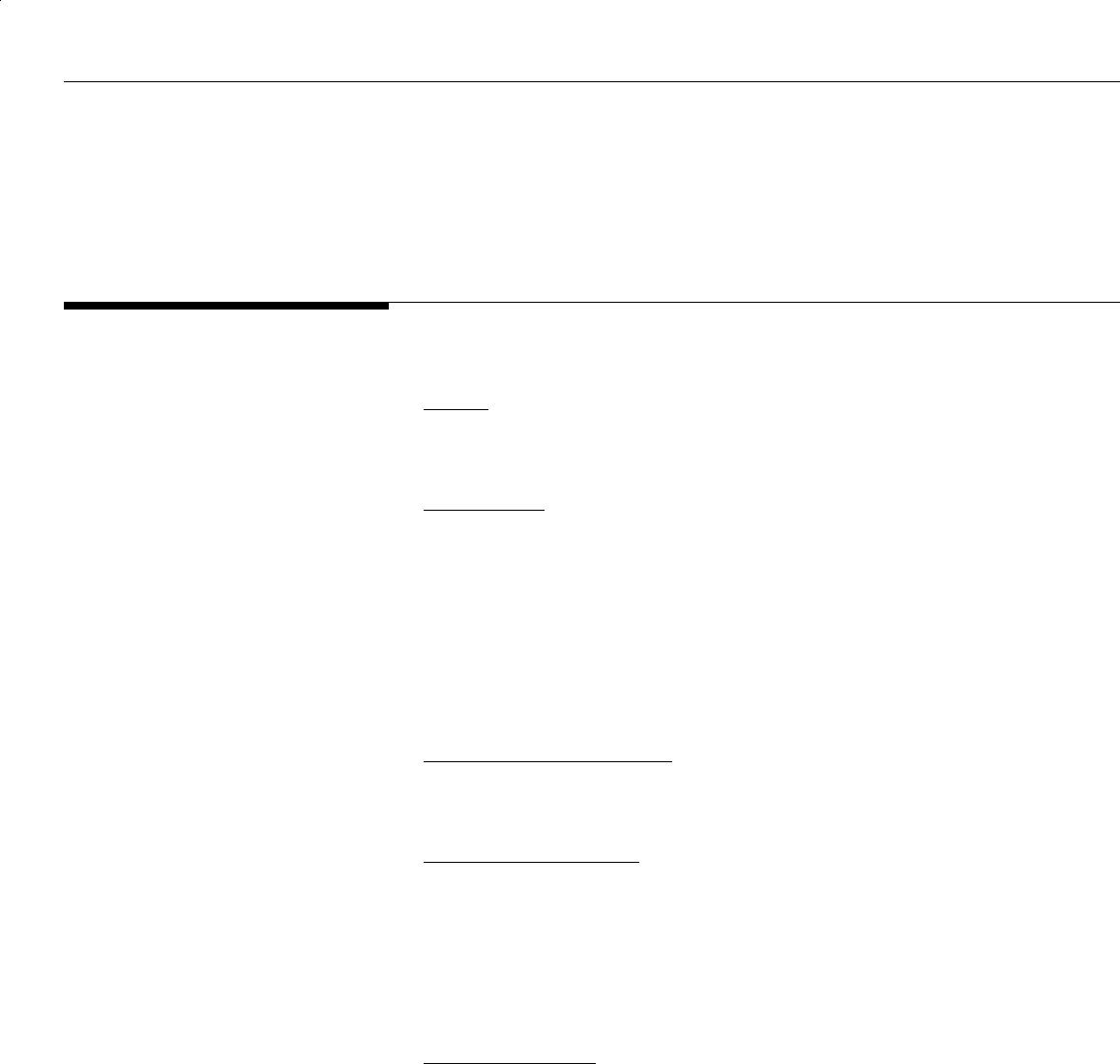

Problems with DIA’s Automated

Baggage Handling System

• Baggage jams undetected

• Double loading of telecarts

• Conveyor belts not synchronized

with telecarts

• Telecarts lock together when they

collide

• Empty car management

GAO/RCED-95-35BR New Denver AirportPage 16

Section 3

DIA’s Automated Baggage Handling System

Problems With DIA’s

Automated Baggage

Handling System

Significant mechanical and software problems have plagued the

automated baggage handling system. In tests of the system, bags were

misloaded, were misrouted, or fell out of telecarts, causing the system to

jam. Video cameras were installed at several known trouble spots to

document problems, such as the following:

• The baggage system continued to unload bags even though they were

jammed on the conveyor belt. This problem occurred because the photo

eye at this location could not detect the pile of bags on the belt and hence

could not signal the system to stop.

• The baggage system loaded bags into telecarts that were already full.

Hence, some bags fell onto the tracks, again causing the telecarts to jam.

This problem occurred because the system had lost track of which

telecarts were loaded or unloaded during a previous jam. When the system

came back on-line, it failed to show that the telecarts were loaded.

• The timing between the conveyor belts and the moving telecarts was not

properly synchronized, causing bags to fall between the conveyor belt and

the telecarts. The bags became wedged under the telecarts. This occurred

because telecarts were bumping into each other near the load point.

Although the contractor—BAE Automated Systems

Incorporated—believes that these problems have been resolved, other

problems remain. To resolve these problems and make the system

operational, a number of critical tasks must be completed. A recent BAE

system status report listed 72 hardware, software, and testing activities

that must be completed, such as the following:

• The telecarts’ front bumpers have to be replaced so that they will not slip

under the back bumpers when telecarts collide. These collisions have

caused telecarts to lock together.

• Additional track, synchronous drives, and related software changes must

be installed to improve “empty car management,” that is, allocating the

correct number of telecarts to specific locations at appropriate times.

BAE and City of Denver officials recognize that the system’s testing might

uncover additional problems.

GAO/RCED-95-35BR New Denver AirportPage 17

Section 3

DIA’s Automated Baggage Handling System

Modifications to DIA’s Baggage

Handling System

• Build an Alternative System

•Conventional system

•Could serve all concourses

•Estimated costs—$51 million

• Changes to Automated System

•United Airlines may oversee

•Phased in service to concourses

•Estimated costs—$35 million

Modifications to DIA’s

Baggage Handling

System

Because of continuing problems with the automated system, the City

decided to build an alternative (i.e., conventional) baggage handling

system and make substantial modifications to the automated system. The

alternative system will use conveyor belts, tugs, and carts to move bags to

and from the terminal and concourses. The alternative system will be the

primary system until the automated system comes on-line. Once the

automated system is operational, the alternative system will serve as a

backup system if the automated system malfunctions.

GAO/RCED-95-35BR New Denver AirportPage 18

Section 3

DIA’s Automated Baggage Handling System

With facility modifications and equipment, the alternative system is

currently projected to cost over $51 million, which includes the cost to

procure tugs and carts. The system is scheduled to be completed by

January 15, 1995, and testing completed about February 15, 1995.

To build the alternative system, major modifications to the physical

structures must be made. Five areas of the third floor parking garage will

be enclosed and converted into staging areas for airlines’ baggage. The

terminal building will be modified by the cutting of holes in walls at the

third level to allow conveyor belts to enter from ticket counters and from

curbside check-in to the staging areas.

Extensive use of tugs and carts to transport bags will be necessary. Tugs

and carts will move bags from the terminal through existing tunnels to the

concourses. To do this, the ventilation systems in tunnels will have to be

modified to keep the level of exhaust fumes from the tugs at acceptable

levels. The City plans to purchase tugs powered by natural gas to minimize

exhaust emissions. Inbound baggage will be transported from the aircraft

on carts to the terminal basement, where they will be loaded onto

conveyors leading up to the baggage claim area. Bags for passengers on

connecting flights will be transferred between aircraft on carts operating

via the tarmac.

The automated system also will undergo substantial modifications. The

City and United entered into an agreement that allows United to contract

directly with BAE to modify portions of the automated system to provide a

separate outbound automated baggage system for United by February 28,

1995. These modifications include changing the routing of the telecarts so

that more of them serve United at Concourse B. The inbound portions will

not be completed until later. The agreement also includes a requirement

for BAE to complete an automated baggage system for Concourse A by

August 31, 1995. The City will evaluate the need for an automated system

for Concourse C carriers within 6 months after the airport opens.

On September 29, 1994, BAE, United, and the City reached agreement on

the modifications to be made to the automated baggage handling system.

These modifications are estimated to cost the City about $35 million. BAE

will be paid $17.5 million on February 28, 1995, assuming that the system is

operational, and the remainder after the system is substantially completed.

If the automated system is not operational by opening day, United will be

served by the conventional baggage system.

GAO/RCED-95-35BR New Denver AirportPage 19

Section 3

DIA’s Automated Baggage Handling System

Remaining Uncertainties

• Timing

• Performance

• Final System Configuration

• Resource Requirements

• Unresolved Claims

GAO/RCED-95-35BR New Denver AirportPage 20

Section 3

DIA’s Automated Baggage Handling System

Remaining

Uncertainties

A number of outstanding, unanswered questions surround the baggage

handling system. Among the remaining uncertainties are the following:

• Timing. The automated system is undergoing modifications, and

construction of the alternative system is just getting under way. Both

systems must still be tested before the airport can open. Prior tests have

not gone well.

• Performance. The original automated system was designed to transport

outbound baggage from the terminal to the aircraft within 20 minutes. It is

not yet known whether the modified automated system will meet design

standards. The City estimates that bags can be delivered using the

alternative system in 20 to 25 minutes. United and carriers on Concourse C

have expressed concern about whether the conventional system can

deliver bags in the times estimated by the airport system. United believes

that using the alternative system may take up to 50 minutes to deliver bags

to aircraft at

DIA’s most remote gates. Airlines at Concourse C believe that

it will take 27 to 31 minutes to deliver bags using this system.

• Final system configuration. It has not been decided whether Concourse C

will eventually be reconnected to the automated system. This could result

in lower levels of baggage service to airlines and their passengers on

Concourse C.

• Resource requirements. The conventional system is much more

labor-intensive than the automated system. United told us that it currently

has about 1,100 employees working the baggage system at

SIA; an

additional 600 people would be needed to handle baggage using

DIA’s

alternative system. The usefulness of the conventional tug-and-cart

operation as a backup system after the automated system becomes

operational is also in question because of the additional standby

employees required.

• Unresolved claims. The final cost of the baggage system is uncertain

because of the potential for litigation after the baggage system is

completed. The City has not paid BAE $22 million of the $193 million

contract for the automated baggage system. On September 29, 1994, BAE,

United, and the City reached an agreement for modifying the automated

baggage system. The agreement calls for the City to pay BAE

$17.75 million of the unpaid $22 million but reserves the rights of both

parties to assert claims for alleged damages. They agreed to attempt to

resolve their claims through mediation, but if unsuccessful, they agreed to

file any unresolved claims in court.

GAO/RCED-95-35BR New Denver AirportPage 21

Section 4

Cost of DIA’s Delayed Opening

Cumulative Deficit Through

February 28, 1995

Total Deficit $230

(in Millions)

•Actual 80

(1/94-6/94)

•Projected 150

(7/94-2/95)

GAO/RCED-95-35BR New Denver AirportPage 22

Section 4

Cost of DIA’s Delayed Opening

Cumulative Deficit

Through February 28,

1995

On the basis of current monthly deficits, the total operating deficit

incurred by the airport system from January 1, 1994, through February 28,

1995, will be $230 million. Financial data are available through June 30,

1994. For the period after July 1, 1994, the deficits must be estimated. Our

projection of the total deficit included the $80 million through June 30,

1994, and the projected deficit of $150 million for the period July 1, 1994,

through February 28, 1995.

GAO/RCED-95-35BR New Denver AirportPage 23

Section 4

Cost of DIA’s Delayed Opening

Table 4.1: Actual Deficit of the Denver

Airport System—January 1, 1994,

Through June 30, 1994

Dollars in millions

Deficit

Revenue and cost

breakdown

Revenue

and cost

Operating revenues generated at SIA

Landing fees $ 23.64

Terminal complex rentals 22.33

Concessions 24.24

Aviation fuel taxes 6.06

Other 2.66

Total SIA operating revenues 78.93

Less: SIA’s operating costs

Personnel & professional svcs. 16.28

Cleaning & utilities 9.62

Maintenance, supplies, materials 6.70

Other 3.42

Total SIA operating costs 36.02

SIA’s operating surplus 42.91

Less: SIA’s net debt service 17.19

Surplus produced by SIA 25.72

DIA’s costs

Operating costs

Personnel & professional svcs. 10.86

Cleaning & utilites 6.41

Maintenance, supplies, materials 4.47

Baggage system maintenance 1.83

Other 2.28

Total DIA operating costs 25.85

Debt service requirements on bonds 122.35

Less: passenger facility charges (20.89)

Interest income (16.51)

Continental’s payments (5.00)

Net debt service costs 79.95

Total DIA costs 105.80

Net deficit 80.08

Average monthly deficit, Jan. through June 1994 $ 13.35

GAO/RCED-95-35BR New Denver AirportPage 24

Section 4

Cost of DIA’s Delayed Opening

Actual Deficit of the

Denver Airport

System—January 1,

1994, Through June

30, 1994

The airport system incurred a net operating deficit of $80.08 million from

January 1, 1994, through June 30, 1994—an average of $13.35 million each

month. This deficit occurred because the revenues generated by

SIA did

not cover the debt servicing requirements and operations and maintenance

(

O&M) costs at both airports. For this same period, DIA officials had earlier

estimated a net monthly deficit of $16.4 million; however, they took a

conservative approach that led to the understating of

SIA revenues and the

overstating of operations costs at the two airports. Our calculations were

based on actual monthly deficits. There was no deficit prior to January 1,

1994.

The following were key elements of our calculations:

• Operating costs at SIA and DIA are based on total obligations recorded in

the airport system’s accounting records for January 1 through June 30,

1994. The airport system’s accountants allocated costs between the two

airports according to which airport benefitted from the expenditure of

those funds.

• Passenger facility charges (PFC) are generated from a special $3 fee that

was added to the price of a ticket for each enplaned passenger at Denver

airport starting in July 1, 1992. The airport system’s bond ordinance

requires that

PFCs be used to pay debt service requirements.

• Interest income is generated from several investment pools managed by

the airport system, principally the bond reserve fund.

• Depreciation was excluded as a cost category because SIA will not be an

airport after

DIA opens, and depreciation is an expense requiring no cash

outlay.

GAO/RCED-95-35BR New Denver AirportPage 25

Section 4

Cost of DIA’s Delayed Opening

Sources of Funds Used to

Cover $80.08 Million Deficit

39% •

Airlines

$31.0 Million

32%

•

Aviation Fuel Tax

$25.92 Million

•

8%

Surplus Bond Reserves

$6.45 Million

•

6%

1993 Operating Surplus

$4.75 Million

15%•

Capitalized Interest

$11.96 Million

GAO/RCED-95-35BR New Denver AirportPage 26

Section 4

Cost of DIA’s Delayed Opening

Sources of Funds

Used to Cover $80.08

Million Deficit—

January 1, 1994,

Through June 30, 1994

The airport system used funds from five sources to cover the

$80.08 million operating deficit for the first 6 months of 1994, as follows:

Payments from airlines

. During the 6-month period, United and

Continental airlines paid $36.53 million to the airport system to cover

delay costs. The airport system applied $31 million of this amount against

the $80.08 million deficit. United’s $23.9 million contribution came from

special facility bond funds that remained from a construction project for

its maintenance hangar at

DIA. The airport system’s agreement with United

stipulated that these funds would be used to offset facility upgrades to

Concourse B requested by United.

In April and May 1994, both United and Continental paid $6.63 million and

$6 million, respectively, to help offset delay costs from March 9 to May 15,

1994. United also agreed to pay an additional $9.9 million and Continental

an additional $1.4 million before December 31, 1994. The airport system

does not plan to compensate the airlines for these payments.

Aviation fuel tax fund

. On January 1, 1994, the airport system had about

$36.6 million in the aviation fuel tax fund, a special purpose fund

established to retire

SIA’s portion of 1984 and 1985 revenue bonds. The

airport system used $25.92 million from this fund to cover the net

operating deficit; $10.8 million from the proceeds of the 1994A bond issue

has been transferred back into this fund.

Capitalized interest

. Capitalized interest is money from the original bond

proceeds set aside to pay debt service payments during the airport’s

construction period; $11.96 million was used to cover part of the deficit.

Surplus in bond reserve fund

. Under the bond ordinance, the airport

system is required to set aside enough money in a bond reserve fund to

pay debt service requirements for a full year. The funding requirement for

Denver’s bond reserve fund was $304.63 million, excluding the 1994A

bonds. On January 1, 1994, the airport system had $315.11 million in the

fund, leaving a surplus of about $10.5 million; $6.45 million of this surplus

was used to cover the deficit.

Operating surplus from 1993

SIA operations. Net revenues from operations

at

SIA are held in an operating fund, which had a balance of $7.65 million

on January 1, 1994. During the first 6 months of 1994, $4.75 million was

used to cover the deficit.

GAO/RCED-95-35BR New Denver AirportPage 27

Section 4

Cost of DIA’s Delayed Opening

Table 4.2: Projected Deficit of the

Denver Airport System—July 1, 1994,

Through February 28, 1995

Dollars in millions

Deficit

Revenue and cost

breakdown

Revenue

and cost

Operating revenues generated at SIA

Landing fees $31.0

Terminal complex rentals 29.0

Concessions 32.0

Aviation fuel taxes 8.0

Other 4.0

Total operating revenues 104.0

Less: SIA’s operating costs

Personnel & professional svcs. 26.2

Cleaning & utilities 15.5

Maintenance, supplies, materials 10.8

Other 5.5

Total operating costs 58.0

SIA’s operating surplus 46.0

Less: SIA’s debt service 23.0

Surplus produced by SIA 23.0

DIA’s costs

Operating costs

Personnel & professional svcs. 17.6

Cleaning & utilities 10.4

Maintenance, supplies, materials 7.3

Other 3.7

Total operating costs 39.0

Debt service requirements on bonds 182.0

Less

Passenger facility charges (27.0)

Interest income (17.0)

Continental’s payments (4.0)

Net debt service costs 134.0

Total DIA costs 173.0

Net deficit 150.0

Average monthly deficit, July 1994 through Feb. 1995 18.75

GAO/RCED-95-35BR New Denver AirportPage 28

Section 4

Cost of DIA’s Delayed Opening

Projected Deficit of

the Denver Airport

System—July 1, 1994,

Through February 28,

1995

We estimate that the net deficit projected from July 1, 1994, through

February 28, 1995, will be about $150 million—an average of $18.75 million

each month. The monthly deficit increased from $13.35 million for the first

6 months of 1994 because of increased

O&M costs and debt service

requirements from the $257 million 1994A bond issue.

The following were key elements of our calculations:

• We assumed that the pattern of revenues for 1994 will follow the pattern of

revenues experienced in 1993, when the revenues were split evenly

between the first and second halves of the year. Total revenues at

SIA for

the first half of 1994 were $78.9 million, or just over $13 million a month.

• Operating costs at SIA and DIA are based on recently completed budgets for

the airport system, which estimated monthly operating costs of

$12.1 million at both airports for the last half of 1994.

• The debt service requirement on the 1994A bond issue has increased by

about $2 million a month.

GAO/RCED-95-35BR New Denver AirportPage 29

Section 4

Cost of DIA’s Delayed Opening

Funds Available to Finance

Future Delay Costs

45% •

Bond Reserve Fund

$209 Million

26%

•

New 1994A Bond Issue

$119.6 Million

27%•

Capital Fund

$128.2 Million

•

2%

United’s Delay Cost

$9.9 Million

Funds Available to

Finance Future Delay

Costs

The airport system has $467.2 million available to cover further delay costs

to

DIA.

GAO/RCED-95-35BR New Denver AirportPage 30

Section 4

Cost of DIA’s Delayed Opening

Table 4.3: Reserve Funds in the

Denver Airport System and Amounts

Available to Cover Future Delay Costs

Dollars in millions

Source Total amount Available

Bond reserve fund $308.6 $209.5

New 1994A bond issue 192.6

a

119.6

Capital fund 167.7 128.2

United’s delay cost payments 9.9 9.9

Total $678.8 $467.2

a

The total amount shown for the new bond issue excludes $64.4 million transferred to the capital

fund.

Bond Reserve Fund

The bond reserve requirement for DIA is now $308.6 million. Under the

terms of the bond ordinance, funds can be withdrawn from this account

only if they are needed to meet debt service requirements. Funds

withdrawn must be paid back at the rate of 1/60th of the amounts owed

each month. Given this requirement, $209.5 million of the $308.6 million

could be used before outside sources would have to be tapped. However,

according to bond analysts to whom we spoke, drawing on these

resources before

DIA opens could affect the airport’s credit standing.

Capital Fund

All of the airport system’s surpluses are paid into a capital fund after O&M

costs, debt service requirements, and O&M reserve account requirements

are made. The capital fund can be used to pay capital costs, extraordinary

costs, or bond requirements. The projected balance in the capital fund as

of December 31, 1994, was $167.7 million, of which $128.2 million is

available.

Monthly Payments on

Delay Costs by United

Airlines

In accordance with an earlier agreement with the airport system, United

will make monthly payments of $1.7 million during the last half of 1994,

which cumulatively totals $9.9 million. This amount will cover United’s

share of the airport system’s delay costs for the period March 9 through

May 15, 1994.

GAO/RCED-95-35BR New Denver AirportPage 31

Section 4

Cost of DIA’s Delayed Opening

Table 4.4: Application of Proceeds of

the Series 1994A Bonds

Dollars in millions

Application Proceeds

Available for funding delay costs $119.6

Fund costs of alternative baggage system 50.6

Transfer to capital and project funds 64.4

Transfer to aviation fuel tax fund 10.8

Transfer to bond reserve fund 3.3

Underwriters’ discount and cost of issuance 4.4

Original issue discount 3.9

Total proceeds $257.0

GAO/RCED-95-35BR New Denver AirportPage 32

Section 4

Cost of DIA’s Delayed Opening

Application of

Proceeds of the Series

1994A Bonds

The airport system sold $257 million in airport system revenue

bonds—Series 1994A—with an effective date of August 30, 1994. The

airport system plans to apply these proceeds as follows:

• $50.6 million to install an alternative baggage handling system.

• $64.4 million for other capital projects, including funds to cover the costs

for modifications to the automated baggage system.

• $10.8 million to partially replenish funds used to cover earlier deficits.

Airport officials told us that the $10.8 million will bring the total in this

fund to the amount needed to retire

SIA’s 1984 and 1985 revenue bonds.

• $3.3 million to increase the bond reserve fund to its new minimum

requirement.

• $4.4 million for costs associated with selling the bonds.

• $3.9 million for the original issue discount on the bonds.

After satisfying these requirements, $119.6 million of the $257 million in

bond revenues will remain for future delay costs. The airport system

classifies this money as capitalized interest, which is money set aside to

pay debt service requirements before

DIA opens.

GAO/RCED-95-35BR New Denver AirportPage 33

Section 4

Cost of DIA’s Delayed Opening

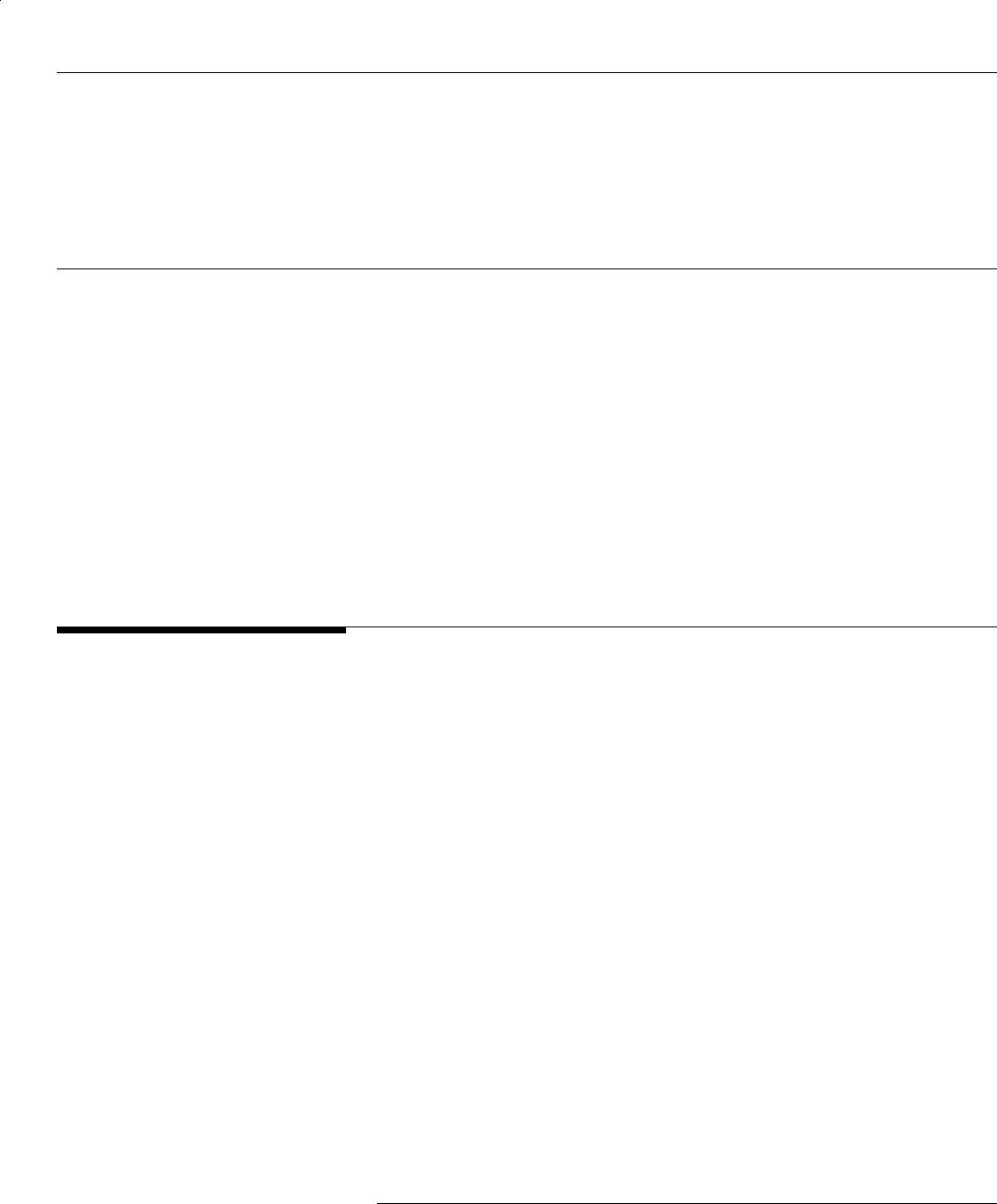

Forecast of Cumulative Operating

Deficits

Dollars in Millions

0

50

100

150

200

250

300

350

400

2/28/95 7/1/95 9/30/95 12/31/95

Date of DIA Opening

230

305

360

415

2/28/95 is the latest announced DIA opening date.

GAO/RCED-95-35BR New Denver AirportPage 34

Section 4

Cost of DIA’s Delayed Opening

Forecast of

Cumulative Operating

Deficits

The deficit likely will continue to accumulate by $18 million to $19 million

each month if the opening of

DIA is delayed beyond February 1995. If DIA

does not open in 1995, the total deficit will grow to $415 million by

December 31, 1995. However, if the airport is not open by October 1995,

the City will need to tap the bond reserve fund to pay for the operating

deficit.

GAO/RCED-95-35BR New Denver AirportPage 35

Section 4

Cost of DIA’s Delayed Opening

Summary of Total Delay Costs

(in Millions)

Net Deficit $230

Opportunity Costs 37

Changes to Baggage

Systems 86

Fees From Bond

Issue 8

——

Total $361

GAO/RCED-95-35BR New Denver AirportPage 36

Section 4

Cost of DIA’s Delayed Opening

Summary of Total

Delay Costs

If DIA had opened by January 1, 1994, and operated in accordance with its

final 1994 budget, the airport system would have incurred a $37 million

surplus instead of a $230 million deficit through February 1995. (See table

4.5.) This means that the real costs from the delayed opening of

DIA will

total about $267 million by February 1995. In addition, the airport system

would not have had to incur $8.3 million for underwriting costs and issue

discounts from the 1994A bond issue. Furthermore, about $86 million for

modifications to the baggage handling systems would have been avoided.

Therefore, the true delay costs are about $361 million.

Table 4.5: Comparison of Budgets for

the January 1, 1994, to February 28,

1995, Period for Two DIA Opening

Dates

Dollars in millions

Revenues and costs to Denver Airport

System

Jan. 1, 1994,

opening date

Feb. 28, 1995,

opening date

Revenue from airlines

a

(landing fees and

terminal rent)

$ 313.2 $ 106.0

Other operating revenues (mostly

concessions)

92.8 62.9

Nonoperating revenues (PFCs, interest,

aviation fuel tax)

91.9 104.5

Total revenues 497.9 273.4

O&M cost

b

(171.3) (158.9)

Debt service cost (289.8) (344.5)

Net surplus (deficit)

c

$ 36.8 $(230.0)

a

Revenue from airlines, mainly through landing fees and rents, would increase substantially at DIA

compared with revenue from airlines at SIA.

b

O&M costs in DIA’s budget included about $6 million for the 14 months for residual operations at

SIA. Until disposal of SIA occurs, it will remain part of the airport system. The airport system’s

funds will be used to pay any costs at SIA, but those costs will not be included in airlines’ rates

and charges. Instead, SIA costs will be paid from DIA’s net revenues. After SIA closes, airport

system officials expect to spend about $25 million on capital projects through 1998 for

environmental cleanup, demolition of structures, and structural repairs. Airport system officials are

currently developing a master plan for the disposition of SIA and have begun a 5-year leasing

program for SIA facilities. Ultimately, airport system officials expect that the disposition of SIA will

produce $75 million in net proceeds.

c

Airlines receive 75 percent of net revenues produced from operations at DIA.

GAO/RCED-95-35BR New Denver AirportPage 37

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

Impact of Delayed Opening on DIA’s

Operating and Debt Costs

• Traffic and Revenue Forecasts

•Key Assumptions

•Sensitivity Analysis

• Airline Situation

• Results From Risk Analysis

GAO/RCED-95-35BR New Denver AirportPage 38

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

In September 1991, we reported on the likelihood that DIA would earn

sufficient revenues to cover its operating costs and meet obligations to

bondholders. We estimated the probabilities of various factors, such as

alternative traffic levels, and then calculated whether revenues would be

adequate to cover all costs.

1

The 1991 risk analysis found that the

probability that the airport would experience a shortfall in revenues was

low. We updated our analysis to take into account a number of recent

events that could affect the airport’s ability to meet its operating and debt

service costs.

The new analysis is based on the models developed for the 1991 report.

Modeling risk assessment is highly sensitive to the assumptions made

governing key variables. We paid particular attention to traffic estimates,

as they are critical to predicting airport revenues. The details of the

approach are discussed in appendix I.

Passenger Traffic

Volume

Passenger traffic is a direct source of revenue to DIA via the $3.00 PFC per

enplanement. More importantly, in accordance with the agreements

between the City of Denver and the airlines, all costs not covered through

other means such as

PFCs and rents from airport concessionaires must be

paid by airlines’ user fees. The agreements between Denver and the

airlines specify that these charges are not to exceed $20 per passenger

enplaned at

DIA in 1990 dollars. The cap is allowed to rise with inflation, so

that today, the maximum charge to the airlines per enplaned passenger is

$22.50 in current dollars. If airline payments combined with revenues from

other sources are not sufficient to cover an airport’s operating costs and

repay debt, the airport has a shortfall.

Airlines’ passenger traffic in Denver rose steadily after 1970, peaking in

1986 at slightly over 16 million enplaned passengers. Traffic declined to

below 14 million enplanements in 1989 and 1990 and our September 1991

study used this lower base in developing traffic forecasts and revenue

projections. However, traffic grew by 2.8 percent in 1991 and recovered

strongly in 1992 and 1993, when enplanements grew by 8.9 percent and 5.7

percent, respectively. In 1993, there were 16.32 million enplanements at

SIA.

1

We contracted with Hickling Corporation, a consulting firm that specializes in risk assessment for

airport investment projects, to assist us in this evaluation.

GAO/RCED-95-35BR New Denver AirportPage 39

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

Table 5.1: Annual Enplanements at DIA

Between 1994 and 2000 Under Low,

Median, and High Traffic Forecasts

Enplaned passengers in millions

Year

Lower bound

estimate

Median

estimate

Upper bound

estimate

1994 14.573 16.192 17.002

1995 14.719 15.962 17.451

1996 14.866 16.422 17.900

1997 15.014 16.882 18.349

1998 15.165 17.343 18.798

1999 15.316 17.803 19.247

2000 15.469 18.263 19.697

Note: Actual enplanements in 1993 were 16.32 million.

GAO/RCED-95-35BR New Denver AirportPage 40

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

Annual Enplanements

at DIA Between 1994

and 2000 Under Low,

Median, and High

Traffic Forecasts

To forecast traffic for 1994 and beyond, the current analysis took, as a

starting point, recent projections made by the consultant to the airport

system prior to the latest bond prospectus. Those projections indicated no

growth in 1994 and a decline to 16 million enplanements in 1995. Traffic is

then expected to increase and reach 18.3 million annual enplanements in

2000.

FAA also projected traffic at Denver, but while it also assumed no

growth in 1994,

FAA estimates that enplanements will increase to 17 million

in 1995 and to 21.9 million in 2000. The present analysis is based on the

more conservative estimates developed for the bond prospectus as a

median forecast.

Upper and lower bound estimates of enplanements were then developed.

The lower bound projection assumed that traffic in 1994 would be 10

percent lower than the current forecast, or about 14.6 million

enplanements annually. Traffic, thereafter, is assumed to grow by only 1

percent per year, yielding 15.5 million enplanements in 2000, nearly

1 million fewer than in 1993. It is assumed that there is a 90-percent

probability that this lower bound forecast will be exceeded. The upper

bound forecast assumes that traffic in 1994 is 5 percent higher than

projected in the prospectus and grows linearly, so that it reaches

90 percent of

FAA’s forecast for 2000. It is assumed that there is only a

10-percent chance that traffic growth will exceed this forecast.

GAO/RCED-95-35BR New Denver AirportPage 41

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

Table 5.2: Mean Cost per Enplaned

Passenger If DIA Opens by March 1,

1995

Year Current dollars 1990 dollars

1995 $17.35 $14.46

1996 19.50 15.57

1997 18.08 13.83

1998 18.47 13.54

1999 17.64 12.41

2000 19.32 13.01

Table 5.3: Mean Cost per Enplaned

Passenger If DIA Opens by July 1,

1996

Year Current dollars 1990 dollars

1996 $20.62 $16.47

1997 19.43 14.89

1998 19.60 14.37

1999 18.96 13.30

2000 20.68 13.89

Note: The calculations for these tables are based on assumed enplaned levels of 14.6 million to

17 million enplaned passengers in 1994 and subsequent years as shown earlier in this section.

These levels are associated with the median of the forecast. The airport recently announced its

intention to accelerate principal repayment on the 1994A bonds, and this could increase the cost

per enplaned passenger by about $1 between 1995 and 2000.

GAO/RCED-95-35BR New Denver AirportPage 42

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

Mean Cost per

Enplaned Passenger

for Two Opening

Dates

The Mayor of Denver has announced a new opening date of February 28,

1995, but there is no guarantee that

DIA will, in fact, open then. Therefore,

we examined the impact on operating revenues and debt service costs if

the airport is not open until July 1, 1996. On the basis of information

provided by the airport system, we assumed that any further delays in

opening

DIA will cost at least $18 million per month and would be debt

financed.

2

If current traffic forecasts materialize and if the current projections of the

airport’s operating costs are accurate, then regardless of whether

DIA

opens by March 1, 1995, or by July 1, 1996, expected revenues appear to be

sufficient to allow the airport to meet scheduled debt payments. Despite

the fact that airlines’ user fees will be almost 10 percent higher than they

would have been had the airport opened on time, the cost per enplaned

passenger will be several dollars below the $20 cap in 1990 dollars. With a

1995 opening, the cost per enplaned passenger will peak at about $15.57 in

1996 (in 1990 dollars) and then decline. With a 1996 opening, the peak

again occurs in 1996 at $16.47 in 1990 dollars.

Our analysis depends on cost and revenue forecasts that were developed

for the recent bond prospectus. Those projections, in turn, depend on

several key assumptions made by the Denver Airport System. First, the

airport assumes that it will be able to refinance the 1984 and 1985 bonds in

1995 and to restructure debt service. Doing so will reduce the airport’s

debt service by $121 million over the 1995-99 period. If the airport does not

refinance and restructure this debt, debt service costs will be higher and

the airport will need to find alternative revenue sources or to raise the fees

paid by the airlines.

2

The debt service figures used in our analysis were provided by the Denver Airport System in

August 1994.

GAO/RCED-95-35BR New Denver AirportPage 43

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

Second, the revenue projections to the year 2000 are based on Continental

Airlines’ agreement to lease 20 gates over that period at a cost of

$273 million. However, Continental is reducing its presence at Denver. The

airport’s projections account for a reduced presence by Continental after

the year 2000, when it will have a commitment for only four gates, but

assume that Continental will either pay for the space or will sublet the

space to another airline. Third, the airport’s projections assume that

$95 million committed by

FAA in its letter of intent from the discretionary

account of the

AIP will be funded as planned. Finally, airport financial

forecasts were based on an assumption that a baggage system with

sufficient operational reliability would permit the airport to open.

Another key element of the airport’s cost is its debt service, and there are

differences in various reports on debt service requirements. An analysis of

1996 debt service requirements can illustrate the problem. The audited

financial statements for the Denver Airport System prepared by Deloitte &

Touche as of December 31, 1993, reported a 1996 debt service requirement

of $302.5 million. The latest Denver Airport System plan of finance shows

a 1996 debt service requirement of $289.6 million. The bond prospectus

financial analysis prepared by Leigh Fisher Associates, the airport’s

consultant, reported a 1996 debt service requirement of $243.7 million.

Denver Airport System officials and their consultants provided the

following rationale to reconcile these differences.

• The audited financial statements did not include debt service on the 1994A

bonds, amounting to $24.4 million in 1996, because these bonds were

issued after the last audit which was done as of December 31, 1993.

• Denver’s plan of finance assumes a $30.5 million debt service reduction in

1996 based on the refinancing in 1995 of the 1984 and 1985 airport system

revenue bonds.

• The bond prospectus debt service requirement was inconsistent with

those in the other two reports largely because it excluded $40.5 million of

passenger facility charges (

PFC) in 1996. It assumed that PFCs would be a

revenue source that should be offset against total debt service.

GAO/RCED-95-35BR New Denver AirportPage 44

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

• DIA, in its plan of finance and in its bond prospectus, reduced debt service

requirements from the audited amount by $10.7 million in 1996 to account

for estimated market rates of interest on variable rate bonds. The audited

financial statements were prepared assuming maximum rates of interest

on variable rate bonds.

• Several other variables that involve smaller dollar amounts were included

in the reconciliation.

GAO/RCED-95-35BR New Denver AirportPage 45

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

Table 5.4: Reduced DIA Enplanement

Estimates to Levels Where There

Would Be a Significant Risk of Costs

Exceeding Revenues

Enplanements in millions

Year

Lower bound

estimate

Median

estimate

Upper bound

estimate

1994 11.075 12.306 12.921

1995 11.186 12.131 13.263

1996 11.298 12.481 13.604

1997 11.411 12.831 13.945

1998 11.525 13.180 14.287

1999 11.640 13.530 14.628

2000 11.757 13.880 14.969

Note: Actual enplanements in 1993 were 16.32 million.

GAO/RCED-95-35BR New Denver AirportPage 46

Section 5

Impact of Delayed Opening on DIA’s Ability

to Meet Operating and Debt Service Costs

Reduced DIA

Enplanement

Estimates to Levels

Where There Would

Be a Significant Risk

of Costs Exceeding

Revenues

The financial risk model was run by using different assumptions of

depressed levels of traffic in order to determine the sensitivity of

DIA’s

financial situation to the traffic forecast. We undertook this analysis partly

because Continental, one of the principal airlines expected to operate a

hub at

DIA, is scaling back its scheduled operations substantially. Today,

Continental handles about 24.2 percent of the traffic at

SIA and United

handles about 57.4 percent. No other airline handles as much as 5 percent,

although Delta and American handle 4.1 percent and 3.7 percent,

respectively. Continental plans to reduce the number of daily flights out of

Denver from 94 to 23 by the end of October 1994.

3

United plans to increase

its daily departures from 277 to 300 by the end of 1994.

Projected traffic levels would need to be nearly 20-25 percent lower before

the model found that there would be significant risk that

DIA’s estimated

costs might exceed revenues. We are not making an independent analysis

of traffic at

DIA; however, several points are relevant to Denver’s air traffic.

First, United will be handling almost 60 percent of the enplanements, and

that airline is committed to

DIA. Second, approximately 46 percent of the

traffic is originating or ending in Denver, and that traffic is dependent on

factors such as Denver’s economy, rather than on airlines’ user fees. Third,

in Continental’s 100 largest markets connecting through Denver, United

offers competing service in 77. In Continental’s top 1,000 markets that

connect through Denver (which account for more than three-fourths of all

Continental’s traffic over Denver), United offers competing service in 547.

4

Finally, while airlines’ user fees at Denver will be high, the costs of using

alternative hub airports can lead to higher airline operating costs, which in

many cases offset the higher fees at

DIA.

3

Although Continental is scaling back its operations, other airlines may increase their operations at

DIA to compensate for Continental’s reduction in flights. DIA’s revenue flow assumes revenues from

the reduced level of Continental’s operations; however, any additional change would affect the

airport’s revenues.

4

These data are for the first quarter of 1994, the most recent for which data are available. We define

United as “competing” if it has at least a 10-percent share of the market.

GAO/RCED-95-35BR New Denver AirportPage 47

Appendix I

Objectives, Scope, and Methodology

To determine the problems with the baggage handling system, we

interviewed officials of the

DIA management team, including contractors,

the airlines, an airline baggage consultant, and the consultant hired by the

City of Denver to evaluate the system. We reviewed the system’s

completion schedules including lists of tasks remaining to be completed,

specifications for the system, and other contract documents such as

agreements between the City, United, and BAE; and we observed tests of

the automated system.

To determine the cost of the delayed opening of

DIA, we reviewed cost

estimates and the resources available to pay these costs. In addition, we

performed an analysis of projected revenues and operating costs to

determine the reasonableness of those projections and to identify the

financial effects of continued delays. For our analysis, we (1) interviewed

appropriate officials of the Denver Airport System and the City Treasurer’s

Office, consultants responsible for projecting airport revenues and debt

service, and airline representatives; (2) reviewed and analyzed

DIA’s

accounting records, documents, and procedures, including the audited

1993 financial statement; and (3) reviewed relevant financial information

contained in official statements for issued bonds. We did not audit, and do

not express an opinion on, the data provided by

DIA that are used in our

analysis. We identified the underlying assumptions included in

DIA’s

revenue and cost projections. We note the key assumptions used in the

analysis where appropriate.

Certain information such as the airport system’s 1993 financial statement

was independently audited by Deloitte & Touche. The auditor issued an

unqualified opinion on the airport system’s financial position as of

December 31, 1993.

To address the financial outlook of the

DIA project, we discussed the costs,

including delay costs and available funding sources to finance those costs,

with

DIA officials, officials from the City’s Revenue Department, the

airport’s financial adviser at First Albany Corp., bond analysts, and

officials from credit-rating agencies. We also contacted United and

Continental—the two principal airlines serving the airport—for their views

on the proposed fees and charges. As part of these discussions, we

collected relevant information on the airport’s costs, revenues, debt, user

fees, and traffic levels.

To determine whether expected revenues would be sufficient to cover

operating costs and service the debt, we contracted with Hickling

GAO/RCED-95-35BR New Denver AirportPage 48

Appendix I

Objectives, Scope, and Methodology

Corporation, an airport consulting firm, to perform a risk analysis.

Hickling developed a risk assessment model to assist us in our 1991 study.

That model included six submodels: traffic,

O&M costs, project costs,

nonairline revenues, project finance, and airline revenues. We updated the

analysis using the most recent information on traffic projections, the

project’s cost, the financing plan, and the airport’s financial statements.

The model uses this information to simulate possible outcomes and

develops an estimate of the probability that net revenues will be sufficient

to service the debt.

Modeling risk assessment is highly sensitive to the assumptions made

governing key variables. The approach that was taken was to construct a

range of possible values for the key factors such that there is only a

10-percent chance that the actual value will be higher than the top of the

range and a 10-percent chance that the actual value will be lower than the

bottom of the range.

In addition to the assumptions surrounding traffic levels and traffic growth

discussed in section 5, several other assumptions were key to the analysis.

According to the information we developed from the airport system’s

provided data, the cost of further delays is assumed to be about

$18 million per month. If

DIA does not open by February 28, 1995, it is

assumed at a 90-percent certainty level that subsequent delay costs will be

at least $17 million per month and it is assumed that there is a 10-percent

chance that they will exceed $20 million per month. It is further assumed

that all costs associated with delays after February 28, 1995, will require

additional debt financing. The analysis assumes that the terms of the new

debt would be 30-year bonds with equal annual payments. The interest

rate on the new debt issue is assumed to have a median value of

7.8 percent. The 80-percent confidence interval for interest rates has an

upper bound of 9.5 percent and a lower bound of 7.2 percent.

Originally, the goal was to estimate the probabilities that

DIA would open