Associated Student Body

2015

Accounting Manual, Fraud Prevention Guide and Desk Reference

Internal Controls

Fraud Prevention

Procedures

Policies

Governance

Organization

Laws

F o r C a l i F o r n i a K - 1 2 P u b l i C S C h o o l S a n d C o m m u n i t y C o l l e g e S

Associated

Student

Body

Accounting Manual, Fraud Prevention Guide

and Desk Reference

2015

Fiscal Crisis & Management Assistance Team

ii

Publishing Information

e Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference was

published by the Fiscal Crisis and Management Assistance Team (FCMAT)

(mailing address: 1300 17th Street, Bakerseld, CA 93301).

© 2015 by FCMAT

All rights reserved

is manual may be reproduced with permission from FCMAT.

Ordering Information

Bound copies of this publication are available for $40.00 each, including tax and shipping charges.

Please send check or purchase order to the mailing address listed above, or pay via credit card using the link

on FCMAT’s website at www.fcmat.org.

A complete, printable version of this publication may be downloaded at no charge at www.fcmat.org.

iii

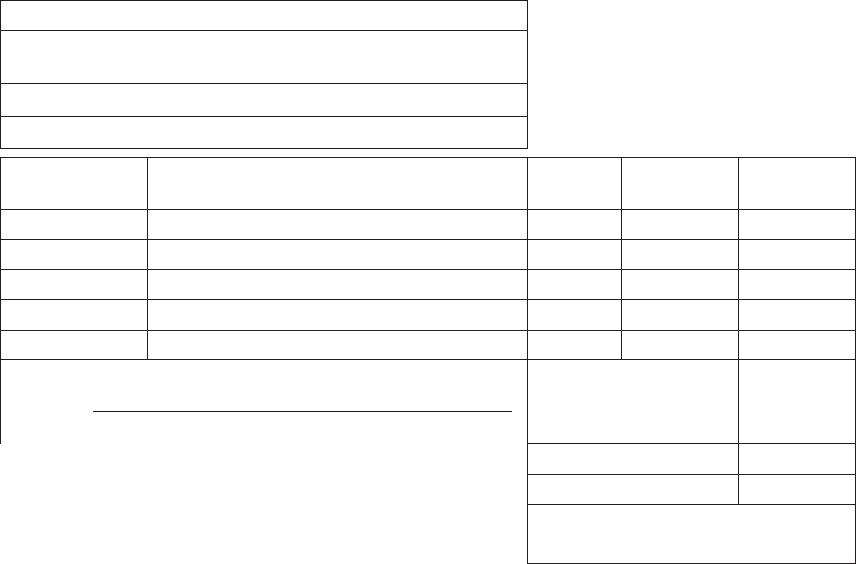

Contents

Contents

Foreword ...................................................................................................................................................ix

Chapter 1 – Introduction .......................................................................................................................1

Intent of the ASB Manual ................................................................................................................................... 1

ASB Issues ................................................................................................................................................................ 2

Chapter 2 – Roles and Responsibilities – Administration of an ASB .............................................5

The State of California .......................................................................................................................................... 5

The Governing Board ............................................................................................................................................. 5

The Superintendent (K-12) or President (Community Colleges) ................................................................ 5

The Business Ofce Staff ..................................................................................................................................... 6

The Principal/School Administrator .................................................................................................................... 6

The ASB Advisor ...................................................................................................................... ............................... 8

The ASB Bookkeeper ........................................................... ................................................................................. 9

The Student Council ........................................................... ................................................................................. 10

The Independent Auditors ................................................................................................................................. 11

The Food Service/Cafeteria Program ............................................................................................................... 11

Groups That Should Not Administer or Supervise Activities of Student Organizations .................. 12

Chapter 3 – Laws and Regulations ....................................................................................................13

Laws and Regulations Overview ....................................................................................................................... 13

Importance of Good Business Practices ........................................................................................................ 14

Governing Board Policy and Administration Regulations .......................................................................... 14

Recommended Legal Background Knowledge ............................................................................................ 15

Laws Governing K-12 Food Sales ...................................................................................................................... 19

Chapter 4 – Forming an ASB ................................................................................................................21

ASB Types: Organized vs. Unorganized ........................................................................................................ 21

Elementary/Unorganized ASB Schools ............................................................................................................ 21

Secondary/Organized ASB Schools .................................................................................................................. 21

Student Organization and Club Trust Accounts .......................................................................................... 24

Minutes of Meetings ...........................................................................................................................................25

Forms ...................................................................................................................... ..................................................29

Chapter 5 – General Business Practices and Internal Controls...................................................37

The Business Operating Cycle .......................................................................................................................... 37

Establishing the Bank Account ........................................................................................................................ 37

Internal Controls ..................................................................................................................................................38

Internal Controls Checklists ..............................................................................................................................40

Maintaining ASB Records ..................................................................................................................................50

Temporary Loans ..................................................................................................................................................50

iv

Insurance ................................................................................................................................................................. 51

Whistleblower Hotlines and Fraud Reporting Websites ............................................................................ 51

Information Summary, Document Checklist and Questions ....................................................................53

Forms ...................................................................................................................... ..................................................53

Chapter 6 – Budgets and Budget Management ...............................................................................57

What Budgets Represent ...................................................................................................................................57

Budget Development ............................................................................................................................................58

Budget Monitoring ........................................................... ....................................................................................60

Carryover of Unexpended Balances ............................................................................................................... 61

What Happens when a Class Graduates? .................................................................................................... 61

Forms ...................................................................................................................... ..................................................63

Chapter 7 – Accounting and Financial Management ......................................................................69

Accounting Systems .............................................................................................................................................69

Centralized versus Decentralized Accounting...............................................................................................70

Chart of Accounts ................................................................................................................................................ 71

Sound Business Practices for Accounting System Management ............................................................72

Financial Reporting and Closing the Books ...................................................................................................72

Types of Financial Reports ................................................................................................................................ 73

Closing the Books ................................................................................................................................................ 75

District Business Ofce Support ..................................................................................................................... 75

Annual Audit ...........................................................................................................................................................75

Bank Reconciliations ...........................................................................................................................................77

Good Business Practices for Bank Account Management and Reconciliation ...................................78

Forms ...................................................................................................................... ..................................................87

Chapter 8 – Fundraising Events ..........................................................................................................89

Approval of Fundraisers.......................................................................................................................................89

Revenue Projections for Individual Fundraiser Events .................................................................................89

Typically Allowed Fundraising Events and Revenues ................................................................................... 91

Fundraisers That May Not be Allowed ..........................................................................................................94

Procedures for Reporting Revenue Sources Other than Fundraisers .....................................................96

Nonstudent Group Fundraising .........................................................................................................................96

ASB Accounts are not Pass-Through Accounts ............................................................................................. 97

Fundraising Websites ...........................................................................................................................................97

Forms ...................................................................................................................... .................................................. 99

Chapter 9 – Class Fees, Deposits and Other

Charges – Grades K-12 ...................................................................................................................... 111

Allowable Fees ...................................................................................................................................................... 112

Prohibited Fees ..................................................................................................................................................... 116

v

Charter Schools ................................................................................................................................................... 119

Chapter 10 – Vending Machines ....................................................................................................... 121

Purpose of Vending Machines ........................................................................................................................121

Products Sold in Vending Machines .............................................................................................................. 121

Issues for Vending Machines ..........................................................................................................................122

Good Business Practices Related to Vending Machine Operations ..................................................... 123

Vending Machine Operations ...................................................................................................................... ... 124

Advantages and Disadvantages of Various Vending Machine Operations ........................................125

Procedures for Managing Vending Machine Stock ..................................................................................125

Procedures for Emptying Vending Machines .............................................................................................126

Forms ...................................................................................................................... ................................................ 129

Chapter 11 – The Student Store ..................................................................................................... 133

ASB Store Operations ...................................................................................................................... ................. 133

Sound Business Practices for Student Stores .............................................................................................134

Sales and Use Tax .............................................................................................................................................136

Forms ...................................................................................................................... ................................................ 137

Chapter 12 – Gifts and Donations ................................................................................................... 145

Donations of Cash to a District for a Specic School or Program ......................................................145

Cash Donations to an ASB Organization ....................................................................................................146

Donations of Material or Equipment to an ASB Organization .............................................................146

Donations of Scholarships to an ASB Organization ................................................................................147

Donations to ASBs from Booster Clubs, Foundations, Auxiliary Organizations and Other Parent-Teacher

Organizations .................................................................................................................................................... 147

Good Business Practices for ASB Donation Management ..................................................................... 147

Tax-Exempt Status ............................................................................................................................................. 147

Forms ...................................................................................................................... ................................................ 149

Chapter 13 – Cash Receipt Management and Procedures ....................................................... 155

Good Business Practices for Cash Procedures ...........................................................................................155

Audit Findings and Preventive Action ...........................................................................................................155

Cash Control Procedures for Fundraising Events ...................................................................................... 155

Cash Control Procedures for the ASB Bookkeeper ..................................................................................160

Internal Controls for Cash After Receipt .....................................................................................................161

Petty Cash and Change Accounts ..................................................................................................................163

Clearing Account .................................................................................................................................................164

Taxes.......................................................................................................................................................................164

Forms ...................................................................................................................... ................................................ 165

Chapter 14 – Allowable and Questionable Expenses .................................................................. 179

Examples of Allowable Purchases ..................................................................................................................179

vi

Examples of Prohibited Purchases ............................................................................................................... 180

Good Business Practices ........................................................... ......................................................................... 184

Chapter 15 – Contracts .................................................................................................................... 185

Contract Situations ............................................................................................................................................185

Potential Problem Situations ........................................................................................................................... 185

Role of the Business Ofce .............................................................................................................................186

Uncompensated Service Agreements ............................................................................................................ 186

Booster Clubs, Foundations, Auxiliary Organizations and other Parent-Teacher Organizations ..187

Good Business Practices ..................................................................................................................................187

Chapter 16 – Equipment Purchases and Management ............................................................... 189

Equipment Ownership Options .....................................................................................................................189

Risk Management and Insurance Options .................................................................................................189

Inventory Practices ............................................................................................................................................189

Forms ...................................................................................................................... ................................................191

Chapter 17 – Employees and Consultants ..................................................................................... 193

ASB Employees ....................................................................................................................................................193

Good Business Practices for ASB Employee Payroll Management ........................................................193

The ABC Test .......................................................................................................................................................195

Consultants ...........................................................................................................................................................195

Chapter 18 – Cash Disbursement Management and Procedures............................................. 197

Sales and Use Tax ..............................................................................................................................................197

Internal Controls ..................................................................................................................................................197

Associated Student Body Sales and Use Tax Applicability ..................................................................... 203

Forms ...................................................................................................................... ............................................... 207

Chapter 19 – Cash Controls and Fraud ......................................................................................... 213

Fundraising and Deposits .................................................................................................................................213

Checks, Reimbursements and Advances ......................................................................................................215

ASB Financial Reports ........................................................................................................................................ 217

Club Advisors’ Copies of Financial Documents ...........................................................................................218

Chapter 20 – Charter Schools and ASBs ....................................................................................... 221

Chapter 21 – Booster Clubs, Foundations, Auxiliary Organizations

and Other Parent-Teacher Associations ......................................................................................... 223

Auxiliary Organization versus Student Organization at Community Colleges .................................. 225

Regulations Governing Booster Auxiliary Organizations ......................................................................... 226

Booster Auxiliary Organizations as Nonprot Organizations with Their Own Tax Identication Number

229

Financial Guidelines ........................................................................................................................................... 230

Solicitations on School Premises .....................................................................................................................231

vii

School District Employees ............................................................................................................................... 232

Donations for Supplies, Equipment and Transportation ........................................................................ 232

Paying Stipends, Salaries and Consultants ................................................................................................. 233

Forms ...................................................................................................................... ............................................... 235

Chapter 22 – Where to Go for Help ............................................................................................. 239

Organizations and Online Resources .......................................................................................................... 239

State Agencies ................................................................................................................................................... 240

National Associations ...................................................................................................................................... 240

Chapter 23 – Glossary ...................................................................................................................... 241

Terminology ......................................................................................................................................................... 241

Acronyms ..............................................................................................................................................................251

Chapter 24 – Appendices .................................................................................................................. 255

Sample Associated Student Body (ASB) Constitutions and Bylaws ..................................................... 255

Sample Budgets ................................................................................................................................................... 277

Legal References ............................................................................................................................................... 289

California Education Codes Specic to K-12 Education.......................................................................... 289

California Education Codes Specic to Community Colleges ................................................................ 307

Public Contract Code ........................................................................................................................................ 313

California Administrative Code, Title 5, Education ...................................................................................321

Code of Federal Regulations, Title 7 ............................................................................................................ 325

California Penal Code ........................................................................................................................................331

Revenue and Taxation Code ............................................................................................................................341

Board of Equalization, Sales and Use Tax Regulations .......................................................................... 343

California Constitution, Article XVI, Public Finance ................................................................................. 365

Sample Internal Control Reference Checklist ............................................................................................ 367

California School Boards Association Samples .......................................................................................... 377

Sample Administrative Regulations ............................................................................................................. 397

Chapter 25 – FCMAT Online Frequently Asked Questions Archive and Help Desk ........... 409

viii

ix

Foreword

e Fiscal Crisis and Management Assistance Team (FCMAT) is proud to present the fourth revision of the

Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference. Initially published in

2002, the manual continues to be a widely used resource in education. In this revision, FCMAT has added

information in response to suggestions from users in the eld, ASB workshop attendees, and many questions

received and answered via FCMAT’s online help desk. New information is also included based on updated

laws and clarication related to food service and allowable fees.

Established in 1992 by the Legislature as an independent and external state-funded entity, FCMAT helps

California’s local educational agencies fulll their nancial and managerial responsibilities by providing scal

advice, management assistance, professional development, software and products, resources, and other related

school business services. FCMAT’s work ranges from the state policy level to the operational level at schools.

is manual is an example of FCMAT’s direct support, assistance and leadership to educational agencies

statewide, including K-12 schools, community colleges, county oces of education, and charter schools.

e Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference is designed for

school administrators, associated student body (ASB) and activity directors, scal services administrators,

oce managers and accountants, ASB bookkeepers, secretaries, teachers, students and others who are

responsible for student body activities. is manual responds to the increased demands on today’s school

leaders to augment funding for students and schools while maintaining scal accountability, transparency

and accuracy.

e goal of the manual is to answer questions in many areas concerning ASBs, including laws, accounting,

purchasing, student stores, vending machines, food sales, clubs, internal controls and overall roles and

responsibilities. It will be especially helpful to new employees and those who have recently been assigned

ASB responsibilities. Readers are guided systematically through the major steps to initiate and maintain an

eective student body program for elementary, middle, junior and senior high school students, as well as

community colleges.

is manual is a concise guide to successful student body business management in a complex environment.

It focuses on the wide range of decision-making authority of student councils, suggests useful tools and

procedures, provides practical advice, and indicates legal constraints in specic areas. Most important, the

Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference suggests the right

questions to ask and how to assess the answers.

FCMAT will continue to publish periodic revisions to this manual. Suggestions about how to improve this

document and make it more useful are always welcome.

FCMAT acknowledges the many people who have taken part in producing this manual and keeping

it updated so that it remains useful in the eld. eir time, dedication and shared expertise have been

invaluable.

Joel D. Montero, Chief Executive Ocer

Fiscal Crisis and Management Assistance Team

x

Chapter 1

–

Introduction 1

Chapter 1

Chapter 1 – Introduction

California law allows students in California’s public schools to raise money and make decisions about how

they will spend this money. Student organizations established to raise and spend money on behalf of students

are called Associated Student Body organizations, or ASBs. ASBs must be made up of current students and be

located at the school where the funds are maintained. e funds raised and spent by student organizations are

called associated student body funds or ASB funds. In the minds of public school ocials, parents and the

general public, ASB funds may be thought of as small proceeds from a few bake sales, magazine sales, dances

or car washes a year. However, in many cases ASB funds have become big business for student organizations

and fund much more than people realize. An ASB at a large high school or a community college may raise

millions of dollars a year.

ASB organizations and the management of ASB funds present students with opportunities not only to

raise and spend money, but also to learn the principles of operating a small business and acquire leadership

skills while making a contribution to their school and fellow students and improving their own educational

experience. As students and sta work together to plan projects and activities, students also learn project

planning.

It takes work and management by many individuals to ensure that an ASB is operated correctly. is

manual provides information on how to run a successful ASB organization in a user-friendly format to

guide district business oce support sta, principals/school administrators, ASB and activity directors, scal

administrators, oce managers and accountants, ASB bookkeepers, secretaries, students and others who are

responsible for student body activities.

Intent of the ASB Manual

Each of this manual’s 25 chapters covers one or more critical areas in the administration of ASB. e manual

is intended to be a comprehensive guide to student organization operations and was written for those involved

in ASB operations. It includes sample forms and procedures that may be copied directly from the manual

or modied for an entity’s own use. e manual can be used by K-12 school districts, charter schools and

community colleges because all of these public entities can have ASBs in their schools. Although the manual

may seem oriented to K-12 districts, all guidance related to internal controls and best business practices can

also be used by charter schools and community colleges.

Because current laws do not cover everything that occurs in ASB operations, the guidance in this manual

goes beyond the law and ocial regulations to include information based on good business practices, sound

internal controls, and the practices of successful ASB operations in many districts throughout California.

Educational entities with successful ASB operations have the following:

• Comprehensive board policies and administrative regulations regarding ASB operations and funds

that provide guidance beyond what is in the law, including district procedures, best practices and

internal controls.

• A comprehensive and user-friendly ASB manual that provides guidance for all individuals involved

in day-to-day ASB activities.

• A signicant level of oversight and support from the district’s business oce.

• Annual training for all sta members and students who work with ASB operations.

• Standardized processes and procedures at all sites.

2 Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

is manual can be used by educational entities to achieve successful ASB operations because:

• e manual covers the policies, procedures and internal controls that should exist when handling

ASB funds and operations, and includes sample forms and procedures.

• e manual can be used as the basis for a district’s comprehensive board policy and administrative

regulations, or the governing board can adopt a policy that requires the sta to adhere to the

guidance in the manual.

• e manual is suciently comprehensive to provide guidance for both district oce and school

sta if the district has not produced its own manual for ASB operations.

• e manual includes information on eective oversight and support from the district’s business

oce sta.

• e manual can be used as the basis for annual training either by a district’s business oce sta or

by a trainer from outside the district.

• e manual includes sample forms in most chapters to help districts as they develop their own

standard forms and procedures for communication and audit purposes.

is FCMAT Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference may

also be adopted to supplement a district’s board policy or procedures regarding student organizations and

booster auxiliary organizations. Sample board policy language for this is as follows:

e Governing Board adopts on an ongoing basis the most recent Fiscal

Crisis and Management Assistance Team (FCMAT) Associated Student Body

Accounting Manual, Fraud Prevention Guide and Desk Reference as the

District’s ASB Manual as part of district ASB board

policy. In the event of any conict between the most recent FCMAT Associated

Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

and the District ASB processes or procedures, the policies

and procedures established in the District will prevail.

is type of language gives a district clarity and the exibility to follow its own policies and procedures when

they dier from those in the FCMAT Associated Student Body Accounting Manual, Fraud Prevention Guide

and Desk Reference.

ASB Issues

Many issues can occur with ASB funds and operations if not managed appropriately. First, in sharp contrast

to other funds that the district usually receives in the form of checks or wire transfers, most ASB funds

are received in cash. It is always easier for fraud, abuse or human error to occur when dealing with cash, so

internal controls are extremely important. However, internal controls over ASB funds are often overlooked or

found to be inadequate.

Other issues arise as a result of decentralized student fundraising and operations by many individuals and

groups throughout the district, without adequate communication, guidance and standardization. In addition,

sta and students involved in ASB are often asked to use proper accounting procedures and internal controls

even though they are not accountants and have probably received little or no guidance or training regarding

the importance of correct procedures and controls and what could occur if they are not followed. Appropriate

communication, standardization, training and oversight are critical to ensure that the correct processes and

procedures are followed.

Chapter 1

–

Introduction 3

Local communities, parents and other members of the public often pay close attention to ASB issues and are

typically sensitive when they occur. e media are also often quick to report on ASB issues because the funds

are raised by students and for students.

e district is ultimately responsible for how ASB funds are handled and spent. us, board policy,

procedures and internal controls must start with the district, and proper oversight and follow-up must take

place to ensure that issues do not occur.

4 Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

Chapter 2

–

Roles and Responsibilities—Administration of an ASB 5

Chapter 2

Chapter 2 – Roles and Responsibilities – Administration of an ASB

Many individuals and entities are involved in administering and supervising the activities of student

organizations.

The State of California

e State of California is responsible for establishing the laws and regulations that govern the activities of

local educational agencies (LEAs), including student organizations. e Legislature writes the laws, and state

agencies enact regulations based on those laws.

e California Department of Education (CDE) develops policies regarding any legislation or regulations

enacted as a result of the law; these are codied in Title 5 of the California Code of Regulations for K-12

school districts. For community colleges, the California Community Colleges Chancellor’s Oce (CCCCO)

functions as the oversight agency.

No one state agency monitors the operations of ASB organizations. Rather, the state relies on districts’

governing boards to ensure that ASB activities are carried out within the law, based on a district’s internal

policies and procedures. is is reviewed during a district’s annual independent audit performed by an

external certied public accountant (CPA) rm.

The Governing Board

e governing board of the school district, charter school or community college is ultimately responsible for

everything that happens in the district, including the activities of student organizations. Under Education

Code section 48930 for K-12, and section 76060 for community colleges, the governing board has the

authority to approve the formation of a student body organization within the district. is means that

governing boards are not required to allow student body organizations to exist. Many districts have chosen

to stop student fundraising and organizations as a last resort because of continual and severe noncompliance

issues, including fraud.

In assuming the authority the Education Code gives them, governing boards establishes parameters for

district operations through board policies and regulations. ese policies and regulations must specify how

the student body organization will be established, how the organization’s activities will be supervised, and

how the organization’s nances will be operated and managed. e district’s administration is responsible

for establishing and monitoring the procedures to carry out the policies and regulations adopted by the

governing board.

Students are raising funds for their own benet and are able to make decisions about the funds (with

co-approval from an administrator); however, when there is a conict, governing board policies and

regulations override ASB decisions because ultimately the funds are under the governing board’s authority.

A comprehensive board policy is the cornerstone of sound practices in student organizations. is is most

eectively achieved by establishing a comprehensive district ASB manual for all student organizations to

follow, and referencing it in board policy that requires all sta to follow the manual’s guidance. Sample board

policies are provided in the appendices of this manual (Chapter 23).

The Superintendent (K-12) or President (Community Colleges)

e superintendent or president of a district is responsible for ensuring that board policies are implemented

and that sta follow those policies. In addition, the superintendent or president is responsible for establishing

the procedures by which sta remain in compliance with board policy. is is normally done by establishing

administrative regulations.

6 Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

e superintendent or president should communicate and make certain that:

• ey act as the supervisor of the student body organization’s activities.

• All district sta are familiar with and understand the importance of following all policies

established by the governing board, including those regarding ASB.

• All district sta understand the importance of problems noted in the annual audit.

• Immediate action is taken to investigate any allegations of impropriety regarding ASB funds.

Appropriate action is taken if the allegations are conrmed.

The Business Ofce Staff

District business oce sta are responsible for general oversight of student body activities. In this capacity,

the business oce sta should:

• Serve as a resource and answer questions from the school sta.

• Develop and update the district’s ASB manual based on input from the school sta, student

organizations and district auditors. Questions asked throughout the year and the ndings noted by

the auditors should also be taken into consideration when updating the manual.

• Provide training at least annually on the district’s ASB manual or procedures. is includes

providing new sta members and student council members with copies of the district’s ASB

manual and training during the year.

• Make periodic visits to schools to review the procedures in operation and answer questions. It is a

good practice to visit each school at least once a year and more often if the school appears to have

problems or continues to have audit ndings year after year.

• Obtain and review nancial reports from the schools at least quarterly.

• Review the reconciled bank statements for all ASB accounts at school schools regularly, preferably

monthly.

• Work with the schools’ sta to respond to problems and audit ndings noted by the auditors in the

annual audit and develop corrective actions to resolve the issues.

• Follow up on all issues related to administration of student organizations.

• Develop accounting procedures for recording and controlling the student body organization’s

nancial transactions.

• Periodically review procedures to make sure they conform to prescribed accounting procedures;

take into consideration any input from school sta, student organizations and district auditors

when updating policies and procedures.

The Principal/School Administrator

e principal/school administrator is the most important person when it comes to managing a school.

Regardless of the school level or size of the school, the principal/school administrator is directly responsible

for student body organization nancial activities and must make sure that they conform to established laws,

policies and procedures that aect the student body, including those specic to the district.

Although the principal/school administrator has ultimate responsibility for all activities at the school,

including ASB, many ASB management functions may be delegated to other sta members depending on the

grade level and size of the school, unless board policy or law does not allow such delegation. At elementary

schools, this designee is often a teacher or secretary. In secondary schools, the designee is usually an assistant

Chapter 2

–

Roles and Responsibilities—Administration of an ASB 7

principal or ASB advisor. e principal/school administrator must maintain nal approval authority for ASB

projects and activities because of the school’s educational and legal obligations to its students.

Unorganized ASBs

Under the supervision of the superintendent, the principal/school administrator is responsible for the

activities at the school (see Chapter 4 for full denitions of unorganized and organized ASBs). In elementary,

adult education, continuation, special education, regional occupational programs (ROPs) and K-8 schools

(unorganized ASB) the students do not govern themselves, so the principal/school administrator is primarily

responsible for all ASB activities, including the following:

• Communicating the student organization policies and procedures to the sta and students, and

enforcing the policies and procedures.

• Assigning and supervising a school sta member (often the school secretary or the attendance clerk)

to perform school nancial tasks related to ASB and maintain adequate records of ASB activities,

including the deposit of funds.

• Receiving and reviewing the monthly bank reconciliation prepared for the ASB bank account and

any other nancial information and statements for the ASB funds, including budgets and nancial

reports.

• Deciding how many fundraising events will be held each year and, before approving them,

ensuring that they are appropriate for the students and the community.

• Scheduling and receiving proper approval for fundraising events.

• Making decisions about how the funds raised will be spent, and approving the use of the funds

before they are spent.

• Delegating responsibility for operating the fundraising event to a responsible adult.

• Monitoring the results of the fundraising activities.

• Ensuring that all ASB funds are raised and spent in accordance with applicable laws and the

district’s policies and procedures.

• Working with the district’s business oce to provide training, implement good business practices,

ensure internal controls, and resolve audit ndings.

• Working with the student organization to develop methods for securing cash collected after hours

and on non-school days.

• Ensuring that proper cash control procedures are established and followed at all times.

• Reporting any suspected fraud or abuse to the district’s business oce.

e principal/school administrator may delegate some or all of these activities to a school employee such as

a vice principal, teacher, or classied school support sta member. Because cash is involved, the principal/

school administrator should ensure proper internal controls by requiring that a second school employee be

involved in the following:

• Decisions about the use of ASB funds.

• Handling all cash.

• Signing checks to spend the student funds.

Organized ASBs

For middle, junior and high schools (organized ASB), the responsibilities of the principal/school adminis-

trator are dierent because the students are much more active in governing the ASB activities, with oversight

8 Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

from the principal/school administrator and other school employees. e principal/school administrator is

responsible for the following major duties, many of which are delegated to an ASB advisor:

• Communicating the student organization policies and procedures to the sta and students, and

enforcing the policies and procedures.

• Ensuring that a student council is established, that it approves all new clubs, and that every club

and the student council has a certicated advisor.

• Providing supervision to the ASB advisors.

• Reviewing and approving constitutions for each club on campus.

• Making certain that minutes are kept of all ASB and club meetings.

• Supervising the ASB bookkeeper or similar position. is position will perform school nancial

tasks related to ASB, maintain adequate records of ASB activities, deposit funds into the bank, pay

invoices, reconcile monthly bank statements, and prepare monthly nancial statements.

• Receiving and reviewing the monthly bank reconciliation prepared for the ASB bank account and

any other nancial information and statements for the ASB funds, including budgets and nancial

reports.

• Ensuring that all ASB funds are raised and spent in accordance with applicable laws and the

district’s policies and procedures, and approving the use of the funds before they are spent (the

assigned ASB advisor and the student representative of the club spending the funds must also

approve use of the funds).

• Deciding how many fundraising events will be held each year and, before approving them,

ensuring that they are appropriate for the students and the community.

• Scheduling and receiving proper approval for fundraising events.

• Working with the district’s business oce to provide training, implement of good business

practices, ensure internal controls and resolve audit ndings.

• Working with each student organization to develop methods for securing cash collected after hours

and on non-school days.

• Ensuring that proper cash control procedures are established and followed at all times.

• Reporting any suspected fraud or abuse to the district’s business oce.

e principal/school administrator may delegate some or all of these activities to a school employee such as a

vice principal or teacher.

The ASB Advisor

In secondary schools and community colleges, each student club will have an

advisor; this is in addition to the advisor who is responsible for the general

student council (also called the leadership class in many high schools). Every

ASB advisor, whether for a specic student club or the general student council,

must be a certicated employee of the district and must be aware of all laws,

policies and procedures that aect the student body, including those specic

to the district, to ensure they are followed. e advisor will act as a liaison to

the faculty, administration, student body and community in matters relating

to ASB, and keep the principal/school administrator and sta apprised of the

organization’s activities.

Fraud Alert

When the ASB advisor

relinquishes their

responsibilities and has

the ASB bookkeeper

perform the ASB

advisor functions,

separation of duties

diminishes and the

opportunity for fraud

increases.

Chapter 2

–

Roles and Responsibilities—Administration of an ASB 9

For organized ASBs, an advisor’s responsibilities will include:

• Providing guidance and direction, and being knowledge about how ASBs operate so legal

responsibilities are understood.

• Overseeing the election/selection of ocers and committee chairs, as well as ensuring that they

understand and carry out their duties.

• Approving expenditures along with the student representative and the board designee.

• Ensuring that the clubs are meeting and keeping minutes.

• Reviewing with the students all budgets, nancial reports and transactions.

• Working with the students when preparing the annual budget and revenue projection estimates.

• Ensuring that only valid expenditures are made and authorized from the dierent clubs’ funds.

• Ensuring that every organized club has a constitution in place and follows it.

• Providing supervision to ensure student safety and compliance during ASB activities.

• Ensuring that student organizations secure in a school safe any cash collected after hours and on

non-school days.

• Ensuring that proper cash control procedures are established and followed at all times.

• Reporting any suspected fraud or abuse to the district’s business oce.

As the principal/school administrator’s designee, the ASB advisor frequently is directly responsible for all of

the functions listed above and ensures that all required procedures are followed. e ASB advisor(s) works

directly with students in clubs and the student council on a day-to-day basis, supervising the activities of

the student council and the clubs and serving as a link from the student council and the clubs to the ASB

bookkeeper and the principal/school administrator.

When any ASB organization or club holds fundraising events, the ASB advisor is responsible for ensuring

that adequate planning and internal controls are established and that all of the funds are properly accounted

for and given to the ASB bookkeeper with all the necessary paperwork at the end of the event. Because of the

age of the students, the ASB advisor in an unorganized student body organization will do many more of the

tasks, while the advisor in an organized ASB or at a community college will mainly oversee students doing

the tasks. Regardless of the age of the students in the organization, it is important that they be involved as

much as possible in the various responsibilities so that student body activities serve not only as fundraisers but

also as learning opportunities.

Additional duties of the ASB advisor include the following:

• Helping students prepare the annual budget and revenue projection estimates for fundraisers.

• Ensuring that adequate internal controls are in place.

• Approving expenditures (in organized ASBs, student representative(s) and a board designee will

also need to approve).

• Ensuring that all laws, policies and procedures are followed.

The ASB Bookkeeper

At each school, a sta member is responsible for maintaining the accounting records for the ASB funds and

safeguarding the funds at the school until they are received at the bank. In elementary schools, the school

secretary or an attendance clerk may serve as an ASB bookkeeper. Middle, junior and high schools, and

community colleges, will usually have a sta person whose only responsibility is to maintain the accounting

records for student organizations.

10 Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

Regardless of which employee is assigned to be ASB bookkeeper, or the exact title that employee might hold,

the employee responsible for ASB bookkeeping (referred to as ASB bookkeeper in this manual) is responsible

for ensuring that:

• When receipted funds are properly counted, conrmed, documented and then turned over to the

ASB bookkeeper, all ASB funds are safeguarded while at the school until deposited in the ASB

bank account in a timely manner (within a few days of receipt).

• Adequate nancial records are prepared and maintained for all ASB nancial transactions in

accordance with established policies and procedures.

• Expenditures are approved in advance of any spending and paid only after receiving appropriate

documentation of expenditures, which should include but not be limited to preapproved purchase

orders, invoices, packing slips, and student council minutes.

• e bank reconciliation is completed each month.

• Materials are provided to ASB advisors for fundraisers, and stock is kept on hand (change box,

receipt books, tickets, etc.).

• Purchase orders, payments, and invoices are processed.

• Laws and the district’s policies and procedures related to ASB funds are followed.

• Business policies, procedures and internal controls related to ASB, such as those for accounting,

purchasing, budget, and payroll, are known and followed.

• Any suspected fraud or abuse is reported to the principal/school administrator or the district’s

business oce.

e ASB bookkeeper position is often perceived as a simple bookkeeping position but it is more than that.

e ASB bookkeeper also acts as a controller and is the gatekeeper for student funds. e ASB bookkeeper

must be strong-willed enough to refuse and disallow deposits, reimbursements or other transactions when

policies and procedures are not followed.

Both the ASB advisor and bookkeeper must work together and support each other in keeping their duties

separate and when policies and procedures are not followed.

The Student Council

In middle, junior high and high schools, as well as community colleges, a student council (often called a

general student council or leadership class) must oversee all of the student clubs in the school. e student

council represents the students and has primary authority over student funds, with guidance from, and

adherence to, district policy.

A successful student council will understand and respect the value of faculty and student participation;

everyone needs to participate and work together for success to occur.

e main responsibilities of the student council include the following:

• Developing and adopting the annual budget for the student council/leadership class.

• Authorizing the budgets for all student clubs.

• Authorizing fundraising events for all student clubs, with additional authorization from the

principal/school administrator if required in that district. In some districts, the student council

is not given this authority; rather, it is notied of what the principal/school administrator has

approved.

Chapter 2

–

Roles and Responsibilities—Administration of an ASB 11

• Approving expenditures, in addition to approval from a board designee and the ASB advisor. In

some districts the student council will approve expenditures from all student funds before the

spending occurs; in others the general student council approves after the fact; and in others it does

not approve any expenditures (for student clubs) but is informed of them. e student council must

approve its own expenditures before spending occurs.

• Reviewing nancial reports and bank reconciliations from all student clubs.

• Approving new clubs (in addition to approval from the principal/school administrator).

• Approving who will be student council auxiliary members for other functions, such as head of

lighting and head of sound.

• Approving the student council’s policies and procedures and determining how student council

members will perform their duties, as well as the consequences for nonperformance of duties.

e student council in an unorganized ASB is not usually as active and does not normally adopt the annual

budget, authorize fundraising events, approve expenditures, review nancial reports or approve new clubs.

e principal/school administrator or designee normally has full responsibility for these functions, even

though the students may give input.

The Independent Auditors

e district’s independent auditors, who perform the annual nancial audit of the school entity, also have

responsibility to audit ASB funds and student activities as part of the annual audit. e auditors scrutinize

the ASB funds and, if they identify a problem or signicant weakness in how ASB funds were managed

during the school year, they will report the weakness to the district’s chief business ocial. Any material

ndings will be included in the nal annual independent nancial report as an audit nding. Each nding

will be accompanied by the auditor’s recommendation for how to correct the weakness. e district must

provide a written response to the audit nding and the auditor’s recommendation, and develop an action plan

to ensure that the nding does not occur again.

Audit ndings should be taken seriously and the action plan followed so that the nding is not repeated

in subsequent years. If a nding occurs at one school but not another, it is important that all individuals

involved with ASB at all schools know what the ndings were so that their own operations can be reviewed

and adjusted if necessary. is helps prevent the audit nding from being repeated in future years at any

school. Audit ndings should be used as a tool to strengthen operations throughout the district with

follow-up to ensure that issues do not recur.

e auditors can also be used as a resource throughout the year when questions, internal control concerns

or unique issues arise. Because the auditors are familiar with the district’s operations and with student body

operations in other districts, they can provide valuable advice and insight.

If there is a suspicion that fraud may be occurring, the district can contract with the auditors or other

agencies to investigate the possible fraud and provide a written report.

The Food Service/Cafeteria Program

e relationship of the ASB to a district’s food service/cafeteria program is often thought of as competitive,

but in reality the two programs should work together because both benet the same students. Food

regulations are numerous and often confusing to student groups. Because the food service/cafeteria program

must follow most of the same regulations, its sta should be considered experts and partners who can help

ensure that any food or beverage sold by students meets nutritional requirements and complies with local,

state and federal laws.

Because student groups must follow specic rules, including those regarding noncompetitive sales and

whether items can be prepared on site at the K-12 level, the food service/cafeteria program sta can help

12 Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

ensure that all sales are in compliance and that students are being served safely and correctly. ese

regulations were not developed by the food service/cafeteria program but are the result of legislation. If

the laws are not followed, the district can be penalized with reduced funding to the food service/cafeteria

program, which aects all of the district’s students.

Groups That Should Not Administer or Supervise Activities of Student

Organizations

Booster Clubs, Foundations, Auxiliary Organizations and other Parent-Teacher Associations

e relationship between booster clubs, foundations, parent-teacher associations, auxiliary organizations

and student organizations is often confusing. Student organizations are legally considered part of the

school district and/or community college, but booster clubs, foundations, auxiliary organizations and other

parent organizations are not. ese nonstudent organizations are established to support the school district

or community college and its students, and they may raise funds and donate these funds to the district or

purchase items with their funds for donation or assistance to the district; however, they are separate legal

entities. Funds raised by booster clubs, foundations, auxiliary organizations or parent-teacher groups should

not be deposited into or commingled with the funds or bank accounts of the student organization or the

district; rather, they should be deposited into the organization’s own bank account. ese organizations

can donate funds to the ASB, but once they have done so, the ASB decides how to use the funds, following

district policy, procedures and applicable laws. It is critical that student groups and parent groups keep their

activities and funds separate even though they are supporting the same students.

More information on this subject is contained in Chapter 21.

Chapter 3

–

Laws and Regulations 13

Chapter 3

Chapter 3 – Laws and Regulations

is chapter provides a brief overview of the sections of the California Education Code, Title 5 of the

California Administrative Code, California Constitution, Internal Revenue Code and the Penal Code that

aect ASB operations at all levels (K through community college). Full citations of the relevant code sections

cited are included in the appendices of this manual.

In addition to state laws and regulations that must be followed, there should be local school district board

policies, administrative regulations and procedures that have the eect of law in that specic school district

relative to how ASBs are managed and operated. To run a successful ASB, it is important that all of the

people involved with the ASB be familiar with the laws and the local district rules that govern ASBs.

State and federal laws and local district policies, procedures and administrative regulations are subject

to continual review and change. is manual includes the full text of all major California state laws

and regulations that directly aect ASB operations as of December 31, 2014. is list is included in the

appendices. e reader may also wish to check the Internet for changes to state law. Many websites, including

http://leginfo.legislature.ca.gov/faces/codes.xhtml, www.calregs.com and www.oal.ca.gov, have references or

lists of California laws and regulations.

Laws and Regulations Overview

Education Code

e California Education Code is one of 29 sets of code in the state and is the primary body of law for

kindergarten through community college governance. ASB management is referenced in many of the code’s

sections. Laws in the Education Code must go through a formal process before being chaptered or signed into

law by the governor. ese laws are also known as statutes.

California Code of Regulations – Title 5

A regulation is a rule adopted by a state regulatory agency to implement, interpret, or make specic the law

enforced or administered by it, or to govern its procedure. e California Code of Regulations (CCR), also

known as the California Administrative Code, has the force of law.

Regulations in the CCR are adopted by a state regulatory agency, approved by the California Oce of

Administrative Law, led with the secretary of state and then signed by the governor. e CCR is separated

into 28 sections called titles. e education section is known as Title 5.

Penal Code

e Penal Code is the primary body of law for issues related to crimes and criminal activity. e portions of

the Penal Code relating to games of chance, such as lottery and bingo, are important to ASB operations.

Revenue and Taxation Code

e state Revenue and Taxation Code (RTC) identies what constitutes a sale and what is subject to state

sales tax. Based on this code, ASBs must pay sales tax on what they buy and sell, with few exceptions.

Publication 18 of the California State Board of Equalization (BOE) provides guidance on the taxability of

sales by nonprot organizations, including ASBs. Publication 18 can be found on the BOE website at http://

www.boe.ca.gov/pdf/pub18.pdf.

Internal Revenue Code

Although ASB operations are not guided by the Internal Revenue Code (IRC), if teachers or other adults

are conducting fundraising independent of the ASB or an approved booster/auxiliary organization to make

14 Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

donations to the ASB or to increase class budgets, that income is considered taxable. e United States Tax

Law can be found online at http://www.fourmilab.ch/ustax/.

California Constitution

In the absence of a statute granting public local educational agencies (LEAs) the legal authority to make a

special expenditure (i.e., for food, clothing, awards, etc.), the legality of any expenditure is determined by

the “gift of public funds” provision in the California Constitution, Article 16, section 6. is constitutional

provision prohibits making any gift of public money to any individual (including public employees),

corporation, or other government agency. It states, “ . . . the Legislature shall have no . . . power to make

any gift, or authorize the making of any gift, of any public money or thing of value to any individual . . .

whatever . . .”

Expenditures of school funds must be for a direct and primary public purpose to avoid being a gift. An

approved public purpose must be within the scope of a school district’s jurisdiction and purpose, which does

not extend to purposes such as aid to the indigent or the promotion of social welfare, though these may be

lawful public purposes for other agencies.

On the other hand, it is also well established that expenditures of public funds that involve a benet to

private persons (including public employees) are not gifts within the meaning of the California Constitution

if those funds are expended for a public purpose. is means that public funds may be expended only if

a direct and substantial public purpose is served by the expenditure and private individuals are beneted

only incidentally to the promotion of the public purpose. To justify the expenditure of public funds, an

LEA’s governing board must determine that the expenditure will benet the education of students within its

schools. Expenditures that most directly and tangibly benet students’ education are more likely justied.

Expenditures driven by personal motives are not justied even if they have been a longstanding local custom

or are based on benevolent feelings.

If the LEA’s governing board has determined that a particular type of expenditure serves a public purpose,

courts will almost always defer to that nding. us, if the district has a board policy stating that specic

items are allowable (e.g. scholarships or donations), there is more certainty that the expenditure might be

considered allowable. Unless such a policy exists, examples of items that would be usually considered a gift of

public funds include owers, candy, advertisements for private award ceremonies, and donations to charity.

Importance of Good Business Practices

e laws and regulations that govern ASB activities and funds are not suciently comprehensive to provide

guidance for all areas in which questions arise. us, while this manual conforms to the laws and regulations,

it also provides guidance in areas where formal legal guidance is inadequate or nonexistent. is supple-

mentary guidance is based on sound business practices, internal controls and eective procedures used by

successful LEAs throughout California. Because the additional guidance is not based on laws or regulations,

local school administrations may change these recommended practices to better suit the operating

environment of each individual LEA.

Governing Board Policy and Administration Regulations

Because only a limited number of laws and regulations in the Education Code, Penal Code, California

Constitution and California Code of Regulations identify parameters for ASB operations, a signicant

amount of local exibility is needed. e governing board has nal authority over everything that occurs

in the district, including ASB operations. is includes authority to decide whether ASB organizations will

exist in the district, and if so, how all ASB operations and activities will be supervised, and ensuring that

clear guidelines and processes are developed to enable ASB organizations to operate eciently and eectively

for the benet of students. e recommended procedure for providing these guidelines and processes is

Chapter 3

–

Laws and Regulations 15

for the governing board to develop and adopt clear and understandable board policies and administrative

regulations, as well as an ASB manual, for district sta, students and other stakeholders to follow.

Because most ASB operations relate directly to business management functions, the district’s chief business

ocial should take a lead role in ensuring that the district has appropriate board policies and administrative

regulations regarding the operation and management of the organization’s nances. In addition, all

individuals involved with the ASB should receive training at least every two years on ASB laws, policies,

regulations, internal controls and good business practices. e district’s business oce should take the lead

in ensuring that this training is provided. ASBs must be made aware that district policy applies to them, and

people involved in ASB must understand that district board policies and regulations are an additional set of

laws that ASB organizations must follow. All district board policies that apply to general district operations

apply to ASB as well, unless there is a policy stating otherwise.

Local school leaders should be encouraged to suggest innovative ASB practices, ASB fundraisers, and ASB

management operations that will promote the general welfare, morale, and educational experiences of

students. Successful ASB management is a collaborative eort between and among students, student leaders,

teachers, activity directors, advisors, school site leaders, school sta, and the district’s central oce.

Recommended Legal Background Knowledge

LEAs must ensure that ASBs are in compliance with the areas of ASB operations specically addressed in

the law. For this reason, it is important that principals/school administrators, ASB advisors, and district

administrators understand the provisions of the law, which are listed in their entirety in the appendices of this

manual.

ese laws and regulations cover three major areas related to ASB operations:

• General Guidance

• Fundraising Activities

• Food Sales in Schools

e following summary gives a brief overview of the sections of the California Education Code applicable to

grades K-12:

General Guidance Provisions of Law – K 12

Education Code § 48930 Grants the governing board the authority to allow groups of students

to organize a student body organization. Also discusses the purpose and

privileges of student body activities.

Education Code § 48933 Gives guidance on where the ASB organization may deposit or invest its

funds.

Requires that ASB funds be spent with the preapproval of three people:

an employee or ofcial of the school district designated by the governing

board, the ASB advisor (must be a certicated employee), and a student

representative of the ASB organization.

Education Code § 48934 Allows ASB funds to be used to nance activities for noninstructional

periods or to augment or enrich the district’s programs for K–6

students.

Education Code § 48936 Provides guidance on uses of student funds, such as loans to other ASB

organizations in the district or loans for permanent improvements to

school district property.

16 Associated Student Body Accounting Manual, Fraud Prevention Guide and Desk Reference

Education Code § 48937 Requires the governing board to provide for the supervision and auditing

of the ASB funds.

Allows the governing board to use the school district staff for ongoing

audits of ASB funds.

Education Code § 48938 Authorizes the governing board to appoint an employee to act as trustee

for unorganized ASB funds in elementary and continuation schools,

special education or regional occupational programs, or in adult classes.

Education Code § 35564 Applies only when a school district is reorganized, i.e., when two school

districts are legally combined or boundaries are changed. The section

provides guidance on how the ASB funds are split.

Fundraising Activities Provisions of Law – K-12

Education Code § 48931 Grants the governing board the authority to authorize the sale of food

by student organizations.