A Renewable Energy Roadmap

RENEWABLE

ENERGY

OUTLOOK FOR

ASEAN

A Renewable Energy Roadmap

ASEAN Centre for Energy

One Community for Sustainable Energy

A Renewable Energy Roadmap

A REMAP ANALYSIS

OUTLOOK FOR ASEAN 2016 EDITION

ASEAN Centre for Energy

One Community for Sustainable Energy

ABOUT IRENA

The International Renewable Energy Agency (IRENA) is an intergovernmental organisation that supports countries in their transition to a sustainable energy future, and serves as the principal platform for international co-

operation, a centre of excellence, and a repository of policy, technology, resource and financial knowledge on renewable energy. IRENA promotes the widespread adoption and sustainable use of all forms of renewable energy,

including bioenergy, geothermal, hydropower, ocean, solar and wind energy, in the pursuit of sustainable development, energy access, energy security and low-carbon economic growth and prosperity.

About ACE

Established on 1 January 1999, the ASEAN Centre for Energy (ACE) is an intergovernmental organisation that independently represents the 10 ASEAN Member States’ (AMS) interests in the energy sector. The Centre serves as

a catalyst for the economic growth and integration of the ASEAN region by initiating and facilitating multilateral collaborations as well as joint and collective activities on energy. It is guided by a Governing Council composed of

Senior Officials on Energy from each AMS and a representative from the ASEAN Secretariat as an ex-officio member. Hosted by the Ministry of Energy and Mineral Resources of Indonesia, ACE’s headquarter is located in Jakarta.

The Renewable Energy Support Programme for ASEAN (ASEAN-RESP) is a joint project by ACE and GIZ, on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ), and it enables regional

exchange on renewable energy between ASEAN Member States. IRENA and ACE are grateful to ASEAN-RESP for its financial support for the two REmap ASEAN regional workshops.

Acknowledgements

This report was prepared by the International Renewable Energy Agency (IRENA) and the ASEAN Centre for Energy (ACE). It was prepared under the overall guidance of Dolf Gielen, IRENA Director for Innovation and Technology,

and Ir. Dr. Sanjayan K.V. Velautham, Executive Director of ACE.

The main authors of the report were Nicholas Wagner (IRENA), Deger Saygin (IRENA), Yong Chen (IRENA) and Beni Suryadi (ACE).

Valuable review and feedback was provided by IRENA colleagues Rabia Ferroukhi, Laura Gutierrez and Jasper Rigter as well as ACE colleagues Badariah Yosiyana, Yudha Irmansyah Siregar, Nanda Febriani Moenandar and Dr.

Atit Tippichai. Additional valuable review was provided by Kohji Iwakami (UN ESCAP), Rizky Fauzianto (GIZ), Putu Marsya Sabrina (GIZ), and Cecilia Tam (APERC). The authors would like to extend a special thanks to Maria-José

Poddey (GIZ). The editor of this report was Ellen Thalman.

The report has benefited from input by numerous ASEAN Regional Energy Policy Sub-Sector Network (REPP-SSN) and Renewable Energy Sub-Sector Network (RE-SSN) Focal Points and Working Group experts, who provided

information, reviewed country analysis, and participated in two working meeting and three webinars during the period March to October 2016. Their comments and suggestions were of great value and have shaped the final

report.

AMS Working Group experts include: Brunei Darussalam: Dr. Andi Tabrani, Muhammad Rifdi; Cambodia: Kin Sothea, Ngin Yav, Munyphakdey Koet; Indonesia: Kartika Dewi Widiastut, Siti Suddatul Aisyah Novianty; Lao People’s

Democratic Republic: Litthanoulok Laspho, Phaysone Phouthonesy, Khonetavanh Douangchanh; Malaysia: Wong Tin Song, Law Yen Yang, Azah Ahmad, Nor Azaliza Damiri, Ahmad Syafiq Rosli; Myanmar: Hla Myo Aung, Swe

Swe Than, Dr. Thi Thi Soe; Singapore: Poh Wei Chian, Erica Liu, Lindy Tan, Derek Wu; Philippines: Lilibeth Morales, Diana Christine Gabito, Jane Peralta, Cynthia Mañalac, Gaspar Escobar, Jr., Michael John Velasco; Thailand: Supit

Padprem, Bubpha Kunathai, Sukanlaya Treewitthayanurak, Kulwaree Sajjawaporaporn, Lumyai Mungpanklang; Vietnam: Quach Quang Dong.

Special thanks to all the participating ASEAN Energy Ministers, Senior Officials and other Participants for their constructive feedback and discussions during the Ministers-CEO Dialogue on 23 September 2016 in Nay Pyi Taw,

Myanmar, in the occasion of the 34th ASEAN Ministers on Energy Meeting (AMEM). In a Joint Ministerial Statement released at the event the Ministers commended ACE’s productive collaboration with IRENA and GIZ towards

the publication of the ASEAN Renewable Energy Outlook. The statement noted that the Ministers were encouraged by the findings of the Outlook and called for additional effort and robust framework from all AMS towards the

timely achievement of the ASEAN renewable energy target.

IRENA is grateful to the German and Japanese governments, whose support of the REmap Programme make the publication of reports like this one a reality.

Report citation

IRENA & ACE (2016). Renewable Energy Outlook for ASEAN: a REmap Analysis. International Renewable Energy Agency (IRENA), Abu Dhabi and ASEAN Centre for

Energy (ACE), Jakarta.

This report is available for download from www.irena.org/publications, the REmap website www.irena.org/remap and www.aseanenergy.org/publications

For further information or to provide feedback, please contact the IRENA REmap team at remap@irena.org and ACE team at secretariat@aseanenergy.org

© IRENA & ACE 2016

Unless otherwise stated, this publication and

material featured herein are the joint property of the

International Renewable Energy Agency (IRENA)

and the ASEAN Centre for Energy (ACE), subject to

copyright by IRENA & ACE.

Material in this publication may be freely used, shared,

copied, reproduced, printed and/or stored, provided

that all such material is clearly attributed to IRENA &

ACE.

Material contained in this publication attributed to

third parties may be subject to third-party copyright

and separate terms of use and restrictions, including

restrictions in relation to any commercial use.

ISBN 978-92-95111-27-1 (print)

ISBN 978-92-95111-28-8 (PDF)

DISCLAIMER

This publication and the material featured herein are provided “as is”.

All reasonable precautions have been taken by IRENA and ACE to verify the reliability of the material featured in this publication. Neither IRENA, ACE nor any of its

officials, agents, data or other third-party content providers or licensors provides any warranty, including as to the accuracy, completeness, or fitness for a particular

purpose or use of such material, or regarding the non-infringement of third-party rights, and they accept no responsibility or liability with regard to the use of this

publication and the material featured therein. The ASEAN Member States or the individuals and institutions that contributed to this report are not responsible for any

opinions or judgements the report contains.

The information contained herein does not necessarily represent the views, opinions or judgements of the Members of IRENA and ASEAN Member States or of the

individuals and institutions that contributed to this report, nor is it an endorsement of any project, product or service provider. The designations employed and the

presentation of material herein do not imply the expression of any opinion on the part of IRENA and ACE concerning the legal status of any region, country, territory,

city or area or of its authorities, or concerning the delimitation of frontiers or boundaries.

3

ABOUT IRENA

The International Renewable Energy Agency (IRENA) is an intergovernmental organisation that supports countries in their transition to a sustainable energy future, and serves as the principal platform for international co-

operation, a centre of excellence, and a repository of policy, technology, resource and financial knowledge on renewable energy. IRENA promotes the widespread adoption and sustainable use of all forms of renewable energy,

including bioenergy, geothermal, hydropower, ocean, solar and wind energy, in the pursuit of sustainable development, energy access, energy security and low-carbon economic growth and prosperity.

About ACE

Established on 1 January 1999, the ASEAN Centre for Energy (ACE) is an intergovernmental organisation that independently represents the 10 ASEAN Member States’ (AMS) interests in the energy sector. The Centre serves as

a catalyst for the economic growth and integration of the ASEAN region by initiating and facilitating multilateral collaborations as well as joint and collective activities on energy. It is guided by a Governing Council composed of

Senior Officials on Energy from each AMS and a representative from the ASEAN Secretariat as an ex-officio member. Hosted by the Ministry of Energy and Mineral Resources of Indonesia, ACE’s headquarter is located in Jakarta.

The Renewable Energy Support Programme for ASEAN (ASEAN-RESP) is a joint project by ACE and GIZ, on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ), and it enables regional

exchange on renewable energy between ASEAN Member States. IRENA and ACE are grateful to ASEAN-RESP for its financial support for the two REmap ASEAN regional workshops.

Acknowledgements

This report was prepared by the International Renewable Energy Agency (IRENA) and the ASEAN Centre for Energy (ACE). It was prepared under the overall guidance of Dolf Gielen, IRENA Director for Innovation and Technology,

and Ir. Dr. Sanjayan K.V. Velautham, Executive Director of ACE.

The main authors of the report were Nicholas Wagner (IRENA), Deger Saygin (IRENA), Yong Chen (IRENA) and Beni Suryadi (ACE).

Valuable review and feedback was provided by IRENA colleagues Rabia Ferroukhi, Laura Gutierrez and Jasper Rigter as well as ACE colleagues Badariah Yosiyana, Yudha Irmansyah Siregar, Nanda Febriani Moenandar and Dr.

Atit Tippichai. Additional valuable review was provided by Kohji Iwakami (UN ESCAP), Rizky Fauzianto (GIZ), Putu Marsya Sabrina (GIZ), and Cecilia Tam (APERC). The authors would like to extend a special thanks to Maria-José

Poddey (GIZ). The editor of this report was Ellen Thalman.

The report has benefited from input by numerous ASEAN Regional Energy Policy Sub-Sector Network (REPP-SSN) and Renewable Energy Sub-Sector Network (RE-SSN) Focal Points and Working Group experts, who provided

information, reviewed country analysis, and participated in two working meeting and three webinars during the period March to October 2016. Their comments and suggestions were of great value and have shaped the final

report.

AMS Working Group experts include: Brunei Darussalam: Dr. Andi Tabrani, Muhammad Rifdi; Cambodia: Kin Sothea, Ngin Yav, Munyphakdey Koet; Indonesia: Kartika Dewi Widiastut, Siti Suddatul Aisyah Novianty; Lao People’s

Democratic Republic: Litthanoulok Laspho, Phaysone Phouthonesy, Khonetavanh Douangchanh; Malaysia: Wong Tin Song, Law Yen Yang, Azah Ahmad, Nor Azaliza Damiri, Ahmad Syafiq Rosli; Myanmar: Hla Myo Aung, Swe

Swe Than, Dr. Thi Thi Soe; Singapore: Poh Wei Chian, Erica Liu, Lindy Tan, Derek Wu; Philippines: Lilibeth Morales, Diana Christine Gabito, Jane Peralta, Cynthia Mañalac, Gaspar Escobar, Jr., Michael John Velasco; Thailand: Supit

Padprem, Bubpha Kunathai, Sukanlaya Treewitthayanurak, Kulwaree Sajjawaporaporn, Lumyai Mungpanklang; Vietnam: Quach Quang Dong.

Special thanks to all the participating ASEAN Energy Ministers, Senior Officials and other Participants for their constructive feedback and discussions during the Ministers-CEO Dialogue on 23 September 2016 in Nay Pyi Taw,

Myanmar, in the occasion of the 34th ASEAN Ministers on Energy Meeting (AMEM). In a Joint Ministerial Statement released at the event the Ministers commended ACE’s productive collaboration with IRENA and GIZ towards

the publication of the ASEAN Renewable Energy Outlook. The statement noted that the Ministers were encouraged by the findings of the Outlook and called for additional effort and robust framework from all AMS towards the

timely achievement of the ASEAN renewable energy target.

IRENA is grateful to the German and Japanese governments, whose support of the REmap Programme make the publication of reports like this one a reality.

Report citation

IRENA & ACE (2016). Renewable Energy Outlook for ASEAN: a REmap Analysis. International Renewable Energy Agency (IRENA), Abu Dhabi and ASEAN Centre for

Energy (ACE), Jakarta.

This report is available for download from www.irena.org/publications, the REmap website www.irena.org/remap and www.aseanenergy.org/publications

For further information or to provide feedback, please contact the IRENA REmap team at remap@irena.org and ACE team at secretariat@aseanenergy.org

© IRENA & ACE 2016

Unless otherwise stated, this publication and

material featured herein are the joint property of the

International Renewable Energy Agency (IRENA)

and the ASEAN Centre for Energy (ACE), subject to

copyright by IRENA & ACE.

Material in this publication may be freely used, shared,

copied, reproduced, printed and/or stored, provided

that all such material is clearly attributed to IRENA &

ACE.

Material contained in this publication attributed to

third parties may be subject to third-party copyright

and separate terms of use and restrictions, including

restrictions in relation to any commercial use.

ISBN 978-92-95111-27-1 (print)

ISBN 978-92-95111-28-8 (PDF)

DISCLAIMER

This publication and the material featured herein are provided “as is”.

All reasonable precautions have been taken by IRENA and ACE to verify the reliability of the material featured in this publication. Neither IRENA, ACE nor any of its

officials, agents, data or other third-party content providers or licensors provides any warranty, including as to the accuracy, completeness, or fitness for a particular

purpose or use of such material, or regarding the non-infringement of third-party rights, and they accept no responsibility or liability with regard to the use of this

publication and the material featured therein. The ASEAN Member States or the individuals and institutions that contributed to this report are not responsible for any

opinions or judgements the report contains.

The information contained herein does not necessarily represent the views, opinions or judgements of the Members of IRENA and ASEAN Member States or of the

individuals and institutions that contributed to this report, nor is it an endorsement of any project, product or service provider. The designations employed and the

presentation of material herein do not imply the expression of any opinion on the part of IRENA and ACE concerning the legal status of any region, country, territory,

city or area or of its authorities, or concerning the delimitation of frontiers or boundaries.

FOREWORD IRENA

The nations of Southeast Asia stand at a crossroads in terms of their collective energy future. Over the next decade, the region will experience

rapid economic growth and a 50% rise in energy demand. With this growth comes challenges, as the region strives to supply energy affordably,

sustainably and securely.

The Association of Southeast Asian Nations (ASEAN), recognising this challenge, has decided to chart a course towards a sustainable, secure and

prosperous future based more heavily on renewable energy. Accordingly, the region has set out to make 23% of its primary energy renewable – more

than double the current share.

This aspirational target, although ambitious to reach by 2025, is grounded in a firm awareness of the region’s wealth of renewable energy resources.

It also recognises a compelling business case, as tumbling technology costs for renewables make access to modern energy services increasingly

feasible and affordable for all while bringing the region closer to a trajectory in line with the objectives of the Paris Agreement and the Sustainable

Development Goals.

The International Renewable Energy Agency (IRENA) has worked intensively with the ASEAN Centre for Energy and ASEAN’s ten member states to

find ways to accelerate renewable energy deployment across the region. As this report indicates, renewable energy can bring lower overall costs,

cleaner cities, and a more secure and robust energy supply.

But this future depends on action now – not only to scale up significantly the amount of renewable power, but also to switch to more renewable-

based heating, cooking and transport. All ASEAN countries must act, at a national and regional level.

IRENA stands ready to support ASEAN Member States in charting out this exciting journey as they work together to build a secure, accessible,

affordable and sustainable energy future.

Adnan Z. Amin

Director-General

International Renewable

Energy Agency

A Renewable Energy Roadmap

4

FOREWORD ACE

At the beginning of this year, the ASEAN Centre for Energy (ACE) published the 4th ASEAN Energy Outlook (AEO4). Against the backdrop

of various developments effecting the energy sectors, AEO4 presents two scenarios of the region’s energy demand and supply to 2035: a

Business as Usual Scenario which reflects the continuous trend of the energy sector’s development from the past; and and Advancing Policy

Scenario that incorporates progressive policy and action plans from each ASEAN Member States to achieve their official national targets for

renewable energy and energy efficiency. The findings raised concerns in terms of energy security as the region will continue to depend on

fossil fuels, with coal as the main energy source to meet the rapid growth of electricity demand. However, AEO4 also outlines the potentials

to reduce energy intensity while highlighting the potentials to increase the contribution from renewable energy.

Seeing the importance to analyse these findings further ACE started a collaboration with the IRENA with the support of ASEAN Member

States to identify the path for the region to achieve its aspirational target of 23% of RE in the energy mix by 2025. This regional target was set

by the AMS at the 33rd ASEAN Ministers on Energy Meeting in 2015. This study not only indicates the status of renewables in Member States,

but also available options for ASEAN to achieve its aspirational renewable energy target. Beyond that, it supports the main objectives of the

ASEAN Plan of Action for Energy Cooperation 2016-2025 towards ‘energy security, accessibility, affordability and sustainability for all’.

This publication is part of ACE's efforts to fulfil its function as a regional centre of excellence that builds a coherent, coordinated, focused

and robust energy policy agenda and strategy for ASEAN. In its development process, it also received support from the Renewable Energy

Support Programme for ASEAN, a project jointly implemented by ACE and Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ)

GmbH on behalf of the Federal Ministry for Economic Cooperation and Development (BMZ). We are glad that the findings of this study have

provided key discussion points during the Ministers-CEO Dialogue on the occasion of the 34th AMEM on 23 September 2016 in Nay Pyi Taw,

Myanmar, and received positive feedback. We hope this publication will motivate all stakeholders in enhancing cooperation for renewables

promotion and deployment in the region.

Ir. Dr. Sanjayan Velautham

Executive Director

ASEAN Centre for Energy

A Renewable Energy Roadmap

ASEAN Centre for Energy

One Community for Sustainable Energy

5

CONTENTS

C

CONTENTS

FOREWORD IRENA ���������������������������������������������������������������������3

FOREWORD ACE

�������������������������������������������������������������������������4

LIST OF FIGURES

������������������������������������������������������������������������� 7

TABLES

����������������������������������������������������������������������������������������������8

BOXES

����������������������������������������������������������������������������������������������8

EXECUTIVE SUMMARY

��������������������������������������������������������������9

ASEAN TO 2025

������������������������������������������������������������������������ 27

Growing population and prosperity ������������������������������������������������� 28

Rapidly growing energy demand

�������������������������������������������������������31

Issues related to growing energy demand ������������������������������������35

●● Energy security

������������������������������������������������������������������35

●● Air pollution

������������������������������������������������������������������������35

●● CO

2

emissions ���������������������������������������������������������������������36

Drivers for renewables

��������������������������������������������������������������������������38

●● Increasing cost-competitiveness

���������������������������������38

●● Abundant renewable resource availability

�������������� 38

●● Socio-economic benefits

���������������������������������������������� 40

RENEWABLE ENERGY PROSPECTS IN ASEAN ��������������42

Role of renewables to 2025 �����������������������������������������������������������������43

●● Developments for renewables

in the Reference and REmap cases

����������������������������43

●● Renewable energy shares by sector

��������������������������48

●● The renewable technology mix

������������������������������������ 49

Accelerating renewables – the REmap Options ��������������������������� 52

●● Overview

������������������������������������������������������������������������������52

●● Power

������������������������������������������������������������������������������������� 54

●● Transport

������������������������������������������������������������������������������59

●● Buildings

�������������������������������������������������������������������������������� 61

●● Industry

���������������������������������������������������������������������������������64

●● Bioenergy

�����������������������������������������������������������������������������65

CONTENTS

1. 2. 3.

INTRODUCTION ������������������������������������������������������������������������20

The International Renewable Energy Agency

and REmap programme ������������������������������������������������������������������������� 21

ASEAN Centre for Energy

�������������������������������������������������������������������� 22

Approach and country stakeholder engagement �����������������������23

●● REmap programme

����������������������������������������������������������23

●● Country engagement

�������������������������������������������������������24

●● The baseline to 2025 – the Reference Case

������������ 24

●● Objective of this study: identifying renewable

energy technology options to close the gap

���������25

RENEWABLE ENERGY OUTLOOK FOR ASEAN

6

COSTS, BENEFITS AND INVESTMENT NEEDS

OF RENEWABLES

�����������������������������������������������������������������������68

Substitution costs �����������������������������������������������������������������������������������69

Benefits relating to air pollution and CO

2

���������������������������������������71

CHANGES IN CO

2

EMISSIONS ������������������������������������������������������������� 73

Investment needs to close the gap

���������������������������������������������������75

ACTION AREAS FOR ENABLING ASEAN’S

RENEWABLES POTENTIAL

������������������������������������������������������ 78

REFERENCES

..........................................................................81

LIST OF ABBREVIATIONS

�������������������������������������������������������83

4. 5. A

ANNEX A: COUNTRY OVERVIEW TABLES ................ 84

ASEAN ��������������������������������������������������������������������������������������������������������� 85

Brunei Darussalam

����������������������������������������������������������������������������������86

Cambodia ���������������������������������������������������������������������������������������������������87

Indonesia

����������������������������������������������������������������������������������������������������88

Lao PDR ������������������������������������������������������������������������������������������������������89

Malaysia

������������������������������������������������������������������������������������������������������ 90

Myanmar

������������������������������������������������������������������������������������������������������91

Philippines ��������������������������������������������������������������������������������������������������92

Singapore

���������������������������������������������������������������������������������������������������93

Thailand

������������������������������������������������������������������������������������������������������94

Vietnam ������������������������������������������������������������������������������������������������������� 95

ANNEX B: WORKSHOP PROCEEDINGS ����������������������������96

ANNEX C: DATA SOURCES FOR COUNTRIES

���������������� 97

ANNEX D:

ASEAN COMMODITY PRICE AND

TECHNOLOGY COST ASSUMPTIONS

�����������98

ANNEX E:

REMAP METHODOLOGY, METRICS AND

TERMINOLOGY DESCRIPTIONS

�������������������� 101

PHOTO CREDITS

����������������������������������������������������������������������106

C

7

FIGURES AND TABLES

LIST OF FIGURES

Figure 6: Primary energy demand by fuel or source,

2014 and Reference Case in 2025 ������������������������������������������������������34

Figure 7: External costs associated with air pollution

by energy carrier in ASEAN �����������������������������������������������������������������36

Figure 8: ASEAN's energy-related CO

2

emissions by

sector and fuel, 2014 and Reference Case��������������������������������������� 37

Figure 9: Levelised cost of electricity or heat, by

technology, ASEAN, in 2025 ���������������������������������������������������������������� 39

Figure 10: Solar and wind resource map from

IRENA’s Global Atlas, ASEAN region������������������������������������������������ 40

Figure 11: Expected change in GDP due to climate

change by 2060 ����������������������������������������������������������������������������������������41

Figure 12: TPES growth and renewable energy share �������������46

Figure 13: Renewable energy share in ASEAN

Member States by sector, 2025 �����������������������������������������������������������49

Figure 14: TPES by fuel in 2014, and 2025 for the

Reference Case and REmap �����������������������������������������������������������������50

Figure 15: Renewable energy consumption in TFEC

in 2014, and in 2025 for the Reference Case and REmap ������������51

Figure 16: Breakdown of REmap Options by technology

and by country ������������������������������������������������������������������������������������������ 52

Figure 17: Breakdown of power generation in ASEAN,

2014 and 2025 for the Reference Case and REmap ��������������������� 55

Figure 18: Power capacity in ASEAN region, 2014,

Reference Case and REmap �����������������������������������������������������������������56

Figure 19: Power sector renewable energy share,

renewable energy additions and total, 2014-2025 �����������������������56

Figure 20: Annual installation rate for various

renewable power technologies per year, by country,

to 2025 �������������������������������������������������������������������������������������������������������� 57

Figure 21: Variable renewable energy shares of

ASEAN Member States in power generation, 2014-2025

�����������58

Figure 22: Transport sector renewable energy

share, renewable additions and total, 2014-2025

�������������������������60

Figure 23: Building sector modern renewable energy

share, renewable additions and total, 2014-2025

��������������������������61

Figure 24: Development of the modern renewable

energy share in buildings of the ASEAN Member States,

2014-2015

����������������������������������������������������������������������������������������������������62

Figure 25: Industry sector renewable energy share,

renewable additions and total, 2014-2025

��������������������������������������64

Figure 26: Total demand for primary biomass in

ASEAN, 2025

��������������������������������������������������������������������������������������������� 65

Figure 27: Demand vs supply ratio of biomass in

select ASEAN Member States, 2025

�������������������������������������������������66

Figure 28: REmap Options substitution cost by

country from the government perspective

������������������������������������� 70

Figure 29: Energy system costs and reduced

externalities relating to REmap Options, by sector

���������������������72

Figure 30: Cost and savings of REmap Options,

share of GDP in 2025

������������������������������������������������������������������������������ 73

Figure 31: CO

2

emissions from energy, increases

in Reference Case and REmap in 2025 ��������������������������������������������� 74

Figure 32: Annual renewable energy investment needs

to 2025

��������������������������������������������������������������������������������������������������������76

Figure ES1: Renewable energy share in the ASEAN

region in total primary energy supply to 2025

�������������������������������������������10

Figure ES2: Air pollution external costs (left figure)

and energy-related CO

2

emissions (right figure) in the

ASEAN region, 2014 and Reference Case in 2025 �������������������������� 11

Figure ES3: Renewable energy additions in the Reference

Case and REmap Options, by electricity and direct-use

������������� 12

Figure ES4: Breakdown of REmap Options by sector and

renewable energy source

����������������������������������������������������������������������� 13

Figure ES5: Renewable energy shares in the ASEAN

region by sector to 2025

������������������������������������������������������������������������14

Figure ES6: Physical capacity growth of select

renewable technologies in the Reference Case and

REmap Options to 2025

��������������������������������������������������������������������������15

Figure ES7: Costs and savings of REmap Options

in 2025

���������������������������������������������������������������������������������������������������������� 17

Figure ES8: Annual investment needs in renewable

energy capacity between 2014 and 2025 in the ASEAN

region for Reference Case and REmap Options

�����������������������������18

Figure 1: Map of countries participating in IRENA’s

REmap programme and ASEAN regional report

���������������������������21

Figure 2: Renewable energy share in ASEAN

Member States to 2025 and 2030

������������������������������������������������������25

Figure 3: Relation between urbanisation rate and

electricity consumption, 1990-2013

��������������������������������������������������� 30

Figure 4: Total final energy consumption by sector,

2014 and Reference Case 2025

����������������������������������������������������������� 32

Figure 5: Increase in energy demand by 2025 over

2014 levels

�������������������������������������������������������������������������������������������������� 33

RENEWABLE ENERGY OUTLOOK FOR ASEAN

8

LIST OF TABLES

LIST OF BOXES

Box 1: Case and terminology overview �������������������������������������������������������������������������������������������������������������������������������������������������������23

Box 2: Overview of terminology: RE share, TPES, TFEC, and sectors grouping

�������������������������������������������������������������������������26

Box 3: Closing the gap by country and a differentiated approach

��������������������������������������������������������������������������������������������������47

Box 4: Electrifying the rural population in ASEAN

������������������������������������������������������������������������������������������������������������������������������� 63

Box 5: A view to 2030 for renewable energy

�������������������������������������������������������������������������������������������������������������������������������������������67

Box 6: Energy efficiency and energy intensity Improvement

������������������������������������������������������������������������������������������������������������74

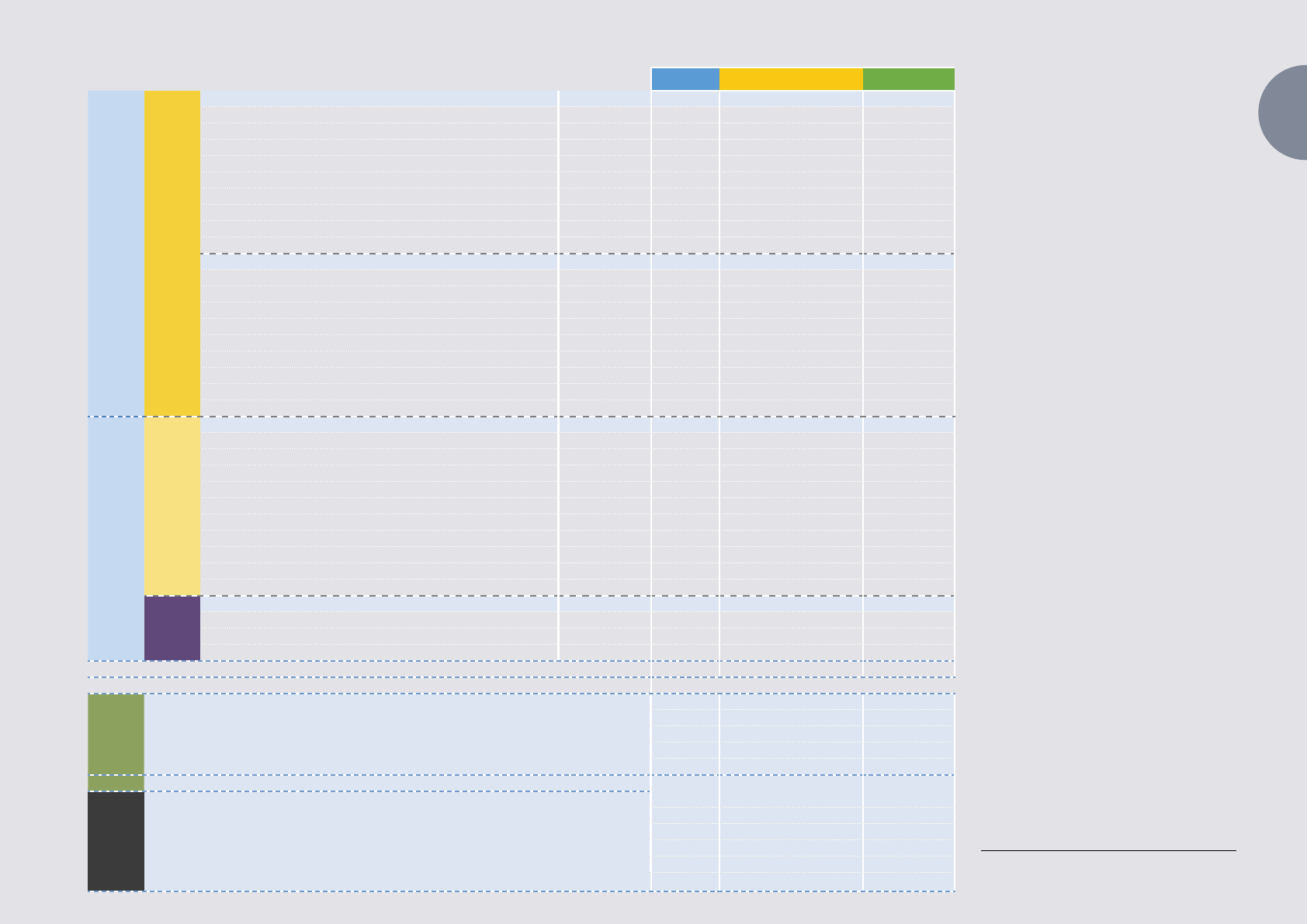

Table 5: REmap Options importance by

technology and sector

������������������������������������������������������������� 53

Table 6: Flexibility mechanisms in the

ASEAN power system, in 2025

���������������������������������������������59

Table 7: Electrification rates in select

ASEAN Member States

������������������������������������������������������������ 63

Table 8: Key indicators and shares in ASEAN,

2025 and 2030

���������������������������������������������������������������������������67

Table 9: Renewable energy shares in TPES in

ASEAN Member States, 2025 and 2030

���������������������������67

Table 10: Change in fuel cost expenditures

by 2025 due to REmap Options

��������������������������������������������71

Table 11: Technology investment in ASEAN,

average between 2014 and 2025

����������������������������������������� 77

Table 1: Population and GDP growth in

ASEAN Member States, 2014 and 2025

����������������������������29

Table 2: Total primary energy supply by

country, 2014 and Reference Case 2025

����������������������������31

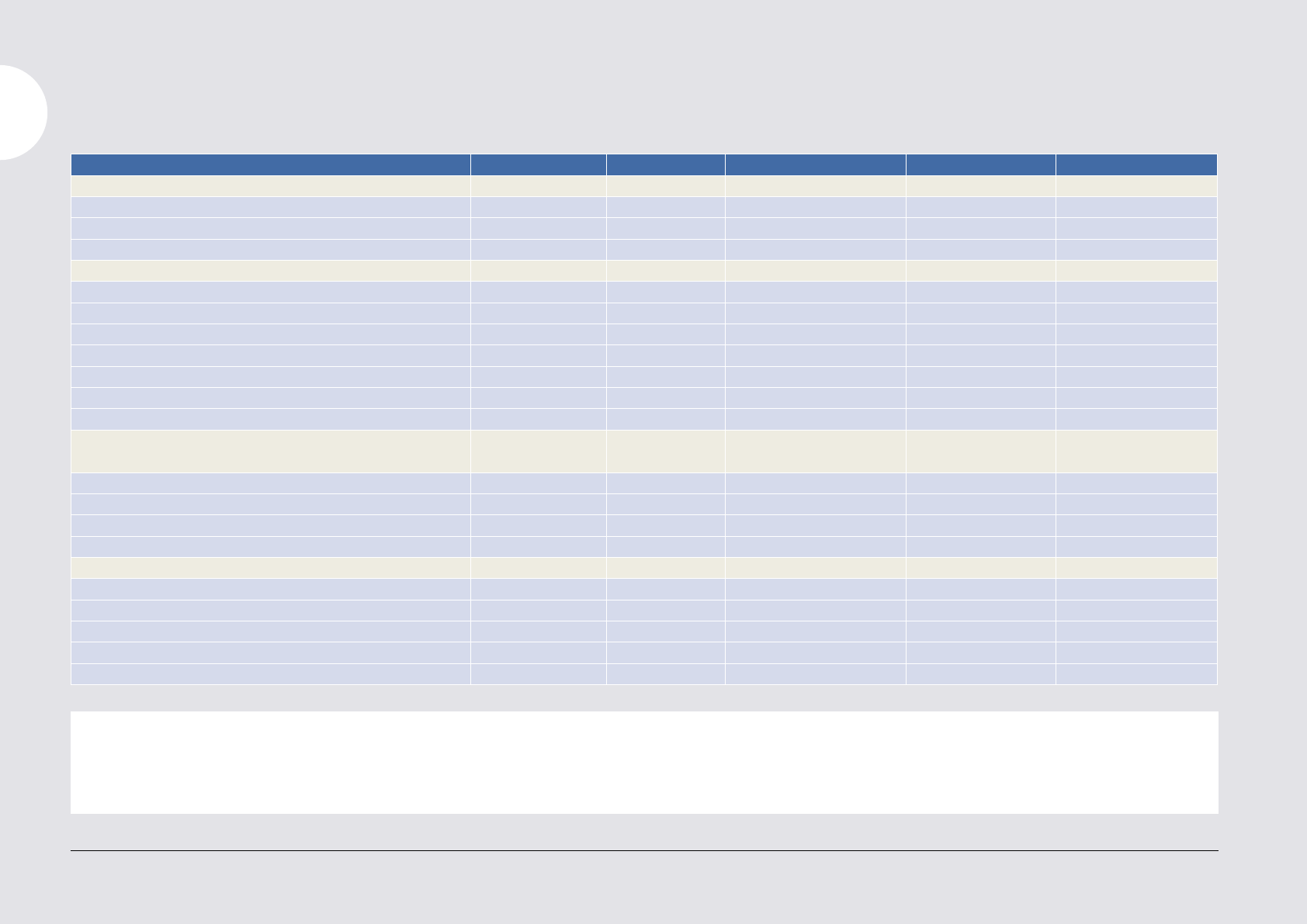

Table 3: REmap ASEAN roadmap table

�������������������������� 44

Table 4: Country contribution towards

increasing ASEAN’s renewable energy

share to 23%

��������������������������������������������������������������������������������47

EXECUTIVE SUMMARY

ES

9

EXECUTIVE SUMMARY

RENEWABLE ENERGY OUTLOOK FOR ASEAN

10

The renewable energy share will need to increase two-and-a-half fold by 2025

with a six percentage-point gap between the Reference Case and 23% target

0%

5%

10%

15%

20%

25%

30%

2014 2020 2025

2030

Renewable energy share in TPES

ASEAN Target:

2014 Share

17%

23%

The "Gap"

9.4%

The Association of Southeast Asian Nations (ASEAN) has set the

aspirational target of securing 23% of its primary energy from

modern, sustainable renewable sources by 2025. This objective

implies a two-and-a-half-fold increase in the modern renewable energy

share compared to 2014� At the same time, power generation will

double by 2025, and overall energy demand will grow by almost 50%�

A TARGET FOR A CLEAN, SUSTAINABLE AND PROSPEROUS FUTURE

Figure ES1: Renewable energy share in the ASEAN region in total primary energy supply to 2025

This target is well in line with the global thinking and ambition

levels for renewables, but it will require a significant acceleration

of renewable energy deployment over the coming decade. In 2014,

the ASEAN region's renewables share in total primary energy supply

(TPES) was 9�4%� By 2025 it is expected to increase to just under 17%

if current policies and those under consideration are followed� Thus,

the region must overcome a six percentage-point gap to reach its goal�

The challenge is how to implement this 23% renewable energy

target. Doing so will require an understanding of what can individual

countries contribute, what can different sectors contribute, and what

are the costs and benefits of different technologies� This study explores

the potential for deploying renewable energy technologies across the

entire energy system of ASEAN Member States� It also quantifies costs

and investments, environmental benefits, and identifies key challenges

to ramping up renewables in the region�

GROWING ECONOMIES, POPULATION

AND ENERGY DEMAND

The population of the ASEAN region will increase from around

615 million in 2014 to 715 million by 2025. The economy will grow

more than 5% per year, resulting in a rapid rise in energy demand.

The region will see 4% annual growth in energy demand until 2025,

amounting to a rise of 50% over 2014 levels� Electricity demand will

double between 2014 and 2025�

The region has insufficient indigenous fossil fuel resources to

meet its growing energy demand, and the share of imported fossil

fuel will increase, which has important energy security implications�

EXECUTIVE SUMMARY

ES

11

Energy demand for electricity production will rise at the fastest

pace, but fuel demand in industry and transport will also increase

rapidly. According to developments likely to occur based on current

or planned policies or expected market developments (known in this

report as the Reference Case), most demand will be met with fossil

fuels, but it also foresees significant growth in hydropower, geothermal

power, and some forms of modern bioenergy for heating and cooking�

Rising fossil fuel demand will boost carbon dioxide (CO

2

)

emissions and exacerbate local air pollution. This has global

implications� The share of global energy consumed in the region will

increase from 5�7% today to 7�5% by 2025� In the Reference Case,

energy-related CO

2

emissions will increase by 61% and total energy-

related CO

2

emissions will amount to over 2�2gigatonnes (Gt) annually

in 2025�

External costs related to air pollution from the combustion of

fossil fuels will increase by 35%, from USD 167 billion annually in

2014 to USD 225 billion in 2025. This would equal around 5% of the

ASEAN region’s gross domestic product (GDP) in 2025� Therefore, the

region will see rising costs for energy supply, as well as rising costs

from the negative effects of greater fossil fuel use in increasingly urban

societies�

Figure ES2: Air pollution external costs (left figure) and energy-related CO

2

emissions (right figure) in the ASEAN region, 2014 and Reference Case in 2025

Air pollution external costs (USD bln/yr)

0 20 40 60 80 100 120 140 160

2014

22%

64%

82%

Reference Case

0

200

400

600

800

1000

1200

84%

54%

91%

32%

66%

73%

35%

Energy-related CO

2

emissions (Mt/yr)

Power

Industry Buildings

Coal

Oil

Gas

2014

Reference

Case 2025

Transport

Energy-related CO

2

emissions will increase

by over 60% by 2025

External costs associated with air pollution could

reach USD 225 billion annually by 2025

RENEWABLE ENERGY OUTLOOK FOR ASEAN

12

THE CASE

FOR RENEWABLES

Renewable energy has emerged as the single largest source of

new power capacity additions in recent years. The year 2016 has

seen record low prices for utility-scale solar photovoltaics (PV) and

onshore wind, as low as USD 0�03 per kilowatt-hour (kWh) for the

lowest-cost project proposals� More and more countries are showing

how significant shares of variable renewables can be integrated into

existing grids, while maintaining or even improving power reliability

and quality� This shifting energy landscape also comes at an important

time for the climate, with the Paris Agreement entering into force�

The shared objective to keep climate change below 2 degrees Celsius

implies a global decarbonised energy system between 2050 and 2070�

Renewable energy has a key role to play on the supply side to realise

this objective�

ASEAN Member States can benefit from these global trends. This

roadmap shows that by 2025 across most of the ASEAN region,

renewable power technologies will be able to supply electricity

at or below the cost of generation from non-renewable energy

sources. Additionally, the region’s ample renewable energy resources

can provide opportunities for the cost-effective deployment of

renewable technologies for heating and cooking, with large potential

for solar thermal and modern bioenergy�

THE RENEWABLE

TECHNOLOGY MIX

The REmap approach covers energy supply and demand – it looks at

power, heating, transport and cooking, and at all renewable sources�

Given the short time horizon and ambitious ASEAN target for 2025 –

which is under a decade away – this broad, multi-sector scope is the

best way to find a viable pathway�

Renewable

energy share

23%

9.4%

17%

REmap Option

Renewable electricity

Renewable direct-uses

additions

Reference Case

additions

51%

49%

70%

30%

Figure ES3: Renewable energy additions in the Reference Case and REmap Options, by electricity and direct-use

Renewable electricity

plays an important

role in increasing the

region’s renewable

share, but much of the

additional potential

identified in REmap

comes from direct-

uses of renewables for

heating, cooking and

transport

EXECUTIVE SUMMARY

ES

13

Note: Geo. stands for geothermal.

Around half of the modern renewables potential for 2025 is in

the power sector. The other half is in end-use sectors, i.e. renewable

fuels or direct-uses of renewables for heat, cooking, and transport�

However, renewables deployment under government plans, knows as

the Reference Case, and the additional potential identified in REmap

differ significantly�

The Reference Case sees significant increases in hydropower, and

more modest growth in geothermal power, liquid biofuels, and a

reduction of around one-third in the traditional uses of bioenergy�

The REmap Options, which are the additional potential of

renewables on top of the Reference Case, and which close the six

percentage-point gap to reach the region’s aspirational target,

are made up of about one-third renewable power and about two-

thirds renewables in heating, cooking and transport. Around 15%

come from solar PV, with another 15% from wind, geothermal and

bioenergy-based power� The remainder of the additions are made

up of 25% from solar thermal, 35% from mainly biogas and modern

bioenergy cookstoves in buildings (residential and commercial), as

well as bioenergy used in industry and transport, and 10% from other

renewable sources�

The distribution of renewable energy use varies significantly by

country and sector, with renewable shares in countries ranging from

4% to 59% in REmap – a wide variation from the regional objective

of 23%� The wide range can be attributed to a different resource

endowment, different levels and growth rates of energy demand, and

different starting points based on today’s levels� Across the ASEAN

region, the power sector has the highest share, followed by buildings,

industry and transport� Additional potential for deploying renewables

on top of the Reference Case exists in all sectors, but REmap shows

that the largest increase can take place in buildings and industry by

2025�

Bioenergy

Solar thermal

Liquid biofuels

Solid

biofuels

Gaseous

biofuels

Solar thermal

Small hydro

Solid biofuels

Gaseous biofuels

Solar PV

Wind

Geo.

P

o

w

e

r

:

3

0

%

I

n

d

u

s

t

r

y

:

2

6

%

B

u

i

l

d

i

n

g

s

:

4

0

%

Transport:

4%

Figure ES4: Breakdown of REmap Options by sector and renewable energy source

Seventy percent of the

potential to increase

renewable energy beyond

the Reference Case lies in the

end-use sectors of buildings,

industry and transport

RENEWABLE ENERGY OUTLOOK FOR ASEAN

14

Note: End-use sectors include the consumption of electricity sourced from renewables. Shares presented in figure exclude traditional

uses of bioenergy.

POWER

● The renewable energy share of total power generation will

increase from 20% in 2014 to 27% in the Reference Case,

and further to 34% in REmap by 2025� This would amount

to 410 terawatt-hours (TWh) of renewable power growth

from 2014 to 2025, 280 TWh of which occurs in the

Reference Case and an additional 130 TWh in the REmap

Options� Installed renewable capacity would increase from

51 gigawatts (GW) in 2014 to 184 GW by 2025, amounting

to 43% of total power generation capacity in 2025�

● The findings indicate that additional renewable energy

opportunities remain in power generation beyond what

countries plan to deploy in their Reference Cases� More

can be done especially with solar PV, both in distributed

and in utility scale, which will increase from just 2 GW in

2014 to almost 60 GW in 2025 in REmap� Also bioenergy-

based power and wind can grow faster than anticipated�

● The share of variable renewable power (VRE) across the

ASEAN region will generally be low, but shares in individual

countries and within individual power systems will vary� In

some countries, the share of VRE in generation will exceed

10% if all REmap Options are implemented� Experience

from other countries shows that such shares can be

Figure ES5: Renewable energy shares in the ASEAN region by sector to 2025

0%

5%

10%

15%

20%

25%

30%

35%

Power Buildings Industry Transport

Renewable energy share

End-use sectors

2014 Reference Case REmap

The highest renewable

energy share will be in

power, but high shares

will also be seen in

buildings and industry

EXECUTIVE SUMMARY

ES

15

Hydropower, geothermal and liquid biofuels see significant growth in the

Reference Case; most other technologies see the majority of growth take place in the

REmap Options

● In REmap, the renewable energy share is double that of

the Reference Case, reaching 26%� Half of this increase

is driven by greater use of modern bioenergy, such as

in modern solid and biogas cookstoves, which replace

accommodated with

limited grid investments and

operational adjustments�

TRANSPORT

● The transport sector will see energy demand grow by

45% between 2014 and 2025� The sector has the lowest

share of renewables of any sector, but some of the highest

renewable growth potential� The share of renewable

energy in the sector could triple from just 3% in 2014 to

9% in REmap�

● The technologies that would enable this growth include

both biofuels and electric mobility� Most of the increase in

the Reference Case will be from biofuels, with around 20

billion litres of total demand� The REmap Options show

the significant additional potential of electric vehicles�

There would be around 59 million electric two- and

three-wheelers, and around 5�9 million electric four-wheel

vehicles� Additionally, electrified public transport would

grow rapidly within cities and for transit travel� The sector

will become more electrified, with the share of transport

energy coming from electricity rising from 0�2% in 2014 to

1�6% 2025� However the role of biofuels will still be evident�

BUILDINGS

● In buildings, the share of renewable energy from modern

renewable energy sources, which excludes traditional uses

of bioenergy, increases from 6% to 13% by 2025 in the

Reference Case�

Figure ES6: Physical capacity growth of select renewable technologies in the Reference Case and REmap Options to

2025

Note: The numbers in figure refer to the total end value in 2014, Reference Case 2025, or REmap 2025. They do not refer to additions

taking place in each case.

Hydropower Solar PV Geothermal Liquid

biofuels

Electric

two/three

wheelers

Electric

vehicles

Solar thermalModern

cookstoves

(solid)

Power Transport Heating/Cooking

79

GW

82 GW

2014

Reference

Case

REmap

2 GW

14

GW

57 GW

3 GW

10

GW

11 GW

4 bln.

litres

19 bln.

litres

20 bln.

litres

0.01

mln.

0.6

mln.

8.9

mln.

1

mln.

5

mln.

59

mln.

2.0

mln.

12.5

mln.

0.4

mln.

2.5

mln.

13

mln. m

2

0.5

mln. m

2

150

mln. m

2

39

GW

Modern

cookstoves

(biogas)

RENEWABLE ENERGY OUTLOOK FOR ASEAN

16

much of traditional use of bioenergy� By 2025 there could

be 12�5 million modern cookstoves, 2�5 million biogas

cooking installations, and 0�4 million biofuel cookers in

operation� The other large source of renewable energy is

solar thermal� Total collector area would expand by around

150 million square metres, bringing the region average to

0�2 square metres per capita�

INDUSTRY

● Demand for energy will grow by more

in the industry sector than in any

other end-use sector, rising by

more than 60% by 2025� The

share of renewables will

only increase marginally, by 15%-18% in the Reference

Case�

● REmap shows that additional potential lies in increased

use of bioenergy to provide process heat generation

and in co-generation of power and heat, as well as in

solar thermal for lower-temperature industrial processes�

The industry sector also provides opportunities for self-

generation of power, e.g. from solar PV or bioenergy� The

share of renewables in the sector could increase to as

much as 23% in REmap�

It is important to note that there are multiple routes through which

countries can increase renewables in their energy system� More em-

phasis could be given to one sector over another, for instance the rapid

development of renewable power generation capacity and electri-

fication of transport, cooking and heating� Or more emphasis could

be put on deploying higher levels of modern, sustainable bioenergy�

Also, regional energy trade for bioenergy fuels or electricity could be

expanded and result in a shifting landscape of renewable energy de-

ployment� Therefore, there is no single “true” distribution� The REmap

insights can inform a discussion about an economically viable pathway,

but variations on this pathway are possible�

EXECUTIVE SUMMARY

ES

17

Reduced externalities resulting from higher

deployment of renewables can amount to between

0.2-1.0% of GDP – at a minimum at least 10 times

higher than costs

Figure ES7: Costs and savings of REmap Options in 2025

-10

-8

-6

-4

-2

0

2

4

Transport Power Industry Buildings Total

CO

2

Air pollution

(outdoor)

Energy

system cost

Change in costs

resulting from

REmap Options

Costs

Savings

USD billion/yr

THE COSTS, BENEFITS AND INVESTMENTS NEEDED FOR RENEWABLE ENERGY

The portfolio of renewable options to increase the renewable

energy share from the Reference Case level of 17% to ASEAN’s

23% target would cost only USD 1.9 per megawatt-hour (MWh)

of final renewable energy in 2025 (equal to around USD 0�7 billion in

incremental energy system costs, or just 0�02% of annual GDP in 2025)�

Of all the REmap Options identified, around 60% are cost-effective,

and around 40% result in additional costs�

However, benefits significantly exceed costs if reduced

externalities are considered. Reduced externalities from lower levels

of outdoor air pollution and CO

2

emissions result in savings at least

10 times higher than the incremental cost of the REmap Options�

If indoor air pollution is included, savings increase significantly, to

as much as 50 times more than costs� These savings are equal to

between 0�2% and 1�0% of ASEAN’s GDP in 2025, depending on

whether indoor air pollution is considered (included in the higher level)�

These assessments are also only based on the low-end calculations

for external cost reductions� If the high end is assumed, savings as a

share of GDP could be over 2�0%� The power sector plays the key role in

realising these reductions, as do the savings from air pollution and CO

2

emission reductions� The transport sector is also an important source

of savings, resulting from lower levels of air pollution in cities�

Note: Assumes low-end estimates for externalities for outdoor air pollution and CO

2

, indoor air pollution excluded from figure.

RENEWABLE ENERGY OUTLOOK FOR ASEAN

18

The region will need to invest USD 290 billion in renewable energy capacity

over the next decade

CO

2

emissions from energy will rise by 61% in the Reference Case.

The REmap Options and closing the gap to ASEAN’s renewable

energy target will limit this rise to 47%. Additionally, the energy

intensity of the region’s economy will decline by around 30% by 2025

in REmap over 2005 levels, broadly in line with the region’s targets for

energy intensity improvement�

The ASEAN region will need to invest USD 27 billion annually, a

total of USD 290 billion by 2025, in renewable energy capacity in

order to meet the 23% renewable energy goal. Just under half of

this will be investment that takes place in the Reference Case, and the

remainder will come from the REmap Options� To close the gap, an

additional USD 14 billion annually will be required on top of existing

government plans� Of this, USD 5 billion annually can be redirected

from investments in fossil fuels, but additional mobilisation of USD 9

billion annually will be needed�

The power sector will account for 75% of the average annual

investment need of USD 27 billion.

USD 7�5 billion per year will need

to be invested in solar PV, and USD 6�3 billion in hydropower� The

building and industry sectors will require around USD 7 billion annually

in investment, focused largely on bioenergy and solar thermal�

Figure ES8: Annual investment needs in renewable energy capacity between 2014 and 2025 in the ASEAN region for

Reference Case and REmap Options

Investment in

renewable energy

capacity to reach

23% share

USD 27 billion/yr

Reference Case

USD 13 billion/yr

REmap Options:

New investment

USD 9 billion/yr

REmap Options: redirected fossil fuel investment

into renewable energy capacity USD 5 billion/yr

EXECUTIVE SUMMARY

ES

19

Action area 1:

increase power

system flexibili-

ty in the ASEAN

region while using renew-

ables to provide modern

energy access for all

Action area 2:

expand efforts

for renewable

energy uptake

for the power sector and

for heating, cooking and

transport sectors

Action area 3:

create a sustain-

able, affordable

and reliable re-

gional bioenergy market

Action area 4:

address the infor-

mation challenge

by increasing the

availability of up-to-date

renewable energy data

and the sharing of best

practice for renewable

energy technologies

ACTION AREAS FOR ENABLING ASEAN’S RENEWABLE ENERGY

POTENTIAL

Accelerating the deployment of renewable energy technologies must take national circumstances into account.

There is therefore no single set of solutions suited to the needs of the entire ASEAN region. Suggestions can,

however, be grouped broadly into four areas:

The full report Renewable Energy Outlook for ASEAN provides in-depth findings on technology and country-level deployment

potential for renewables� It also sheds some insights into the main drivers, costs and benefits, and investments needs for

renewable energy� Please visit www.irena.org/remap to download the report�

01

INTRODUCTION

ES

21

01

In October 2015, the Association of Southeast Asian Nations (ASEAN)

announced a region-wide aspirational target to achieve 23% renewable

energy in total primary energy supply by 2025, a significant increase

from just under 10% in 2014� The goal is part of ASEAN’s Plan of Action

for Energy Cooperation (APAEC) 2016-2025, adopted by its Member

States at the 33

rd

ASEAN Ministers on Energy Meeting (AMEM) in

September 2015 in Kuala Lumpur, Malaysia�

The International Renewable Energy Agency (IRENA) and the ASEAN

Centre for Energy (ACE) agreed to conduct a study using IRENA's

REmap analytical tools, to develop a Renewable Energy Outlook that

would build on the 4th ASEAN Energy Outlook (AEO4, released in

January 2016) (ACE, 2015)� This study is in part supported by the

Renewable Energy Support Programme for ASEAN (ASEAN-RESP),

a joint project of ACE and the Deutsche Gesellschaft für Internationale

Zusammenarbeit (GIZ) GmbH, on behalf of the German Federal

Ministry for Economic Cooperation and Development (BMZ)�

ASEAN Member States must make an immediate and concerted

effort if they are to realise the 23% aspirational target by 2025� The

AEO4 study shows that, without additional efforts, the region will

only reach a 15�4% renewable energy share� Thus, there is a significant

gap to close if the region wants to achieve 23%� This study explores

the potential for deploying renewable energy technologies across the

entire energy system of ASEAN Member States in pursuit of the 23%

renewables share� It also quantifies costs, associated benefits, and

some key challenges to ramping up renewables in the region�

This report was previewed in September 2016 during the 34

th

ASEAN AMEM meeting held in Nay Pyi Taw, Myanmar� The ASEAN

Member States in their Joint Ministerial Statement indicated their

encouragement of the findings of the report and called for additional

efforts and robust frameworks from all ASEAN Member States towards

a timely achievement of the renewable energy target�

Figure 1: Map of countries participating in IRENA’s REmap programme and ASEAN regional report

THE INTERNATIONAL

RENEWABLE ENERGY AGENCY

AND REMAP PROGRAMME

The IRENA REmap programme shows how it is possible to significantly

accelerate the global share of renewable energy by 2030� Such

accelerated growth helps fulfil the United Nations (UN) Sustainable

Development Goal 7 (SDG on energy), set in its 2030 Agenda for

Sustainable Development, to ensure access to affordable, reliable,

Note: 40 countries participated as of early 2016 (green) including Indonesia and Malaysia, and the 8 remaining ASEAN Member States

were added in mid-2016 as part of this study (all ASEAN Member States are marked in red).

RENEWABLE ENERGY OUTLOOK FOR ASEAN

22

01

sustainable, and modern energy for all� IRENA is also the hub for the

renewable energy objective of the Sustainable Energy for All initiative

(SEforALL), which aims to double the share of renewables globally by

2030�

REmap is a global study of renewable energy potential built from the

bottom up� As of March 2016, it analyses 40 countries

6

that represent

over 80% of global energy use, working closely with them to determine

the potential of renewables (Figure 1)� In addition to the power sector,

the report looks at the end-use sectors of agriculture, buildings

(residential, commercial, public, and services), industry and transport�

The study shows that when renewables are combined with

accelerated improvements in energy efficiency, the world can set itself

on a path towards a limited global temperature rise of two degrees

Celsius or lower compared to the pre-industrial level� REmap also

shows that higher levels of renewables would result in savings up to 15

times higher than costs�

REmap is developed in close cooperation and consultation with

government-nominated experts (energy statisticians, energy modellers

and energy policy experts)� It is an analysis of the potential, costs and

savings of renewable energy technology options� REmap provides a

perspective on the options available at the sector level that represent

the realistic potential of renewables beyond national energy targets

and plans up to 2030�

6 These are Argentina, Australia, Belgium, Brazil, Canada, China, Colombia,

Cyprus, Denmark, the Dominican Republic, Ecuador, Egypt, Ethiopia, France,

Germany, India, Indonesia, Iran, Italy, Japan, Kazakhstan, Kenya, Kuwait,

Malaysia, Mexico, Morocco, Nigeria, Poland, the Republic of Korea, the Russian

Federation, Saudi Arabia, South Africa, Sweden, Tonga, Turkey, Ukraine, the

United Arab Emirates, the United Kingdom, the United States, and Uruguay�

IRENA’s approach in REmap follows two parallel tracks: (i) country-

based analysis to identify actions on technology deployment,

investment and policies in collaboration with REmap countries and

regional associations, such as in the case of this study; and (ii) series of

technology roadmaps to identify cross-country insights on the actions

required to significantly increase the share of renewables in the global

energy mix� For regions with rapidly growing energy demand, but

which REmap does not yet fully cover with country analyses, REmap

also develops regional outlooks, including for Africa (IRENA, 2015a), in

addition to the present publication for Southeast Asia�

For more information about the REmap programme, to view a wide

and expanding body of studies and reports, learn more about the

methodology or assumptions, or view and download data, please visit

www.irena.org/remap.

ASEAN CENTRE

FOR ENERGY

Established on 1 January 1999, the ASEAN Centre for Energy (ACE) is

an intergovernmental organisation that independently represents the

10 ASEAN Member States' (AMS) interests in the energy sector� The

Centre serves as a catalyst for the economic growth and integration

of the ASEAN region by initiating and facilitating multilateral

collaborations as well as joint and collective activities on energy� It is

guided by a Governing Council composed of Senior Officials on Energy

from each AMS and a representative from the ASEAN Secretariat as

an ex-officio

member� Hosted by the Ministry of Energy and Mineral

Resources of Indonesia, ACE’s headquarter is located in Jakarta� For

more information, please visit www.aseanenergy.org

ASEAN Centre for Energy

One Community for Sustainable Energy

INTRODUCTION

ES

23

01

APPROACH AND COUNTRY

STAKEHOLDER ENGAGEMENT

REMAP PROGRAMME

REmap explores renewable energy options for decision makers for

consideration in their energy planning and policy making� It uses

information from countries’ national plans, goals or outlooks to produce

a baseline picture of a country’s energy system to 2025 for this report,

or 2030 and longer for others� This baseline is called the Reference

Case�

In addition, it identifies pathways to harness the potential of

renewable energy technologies beyond the Reference Case� These

are the REmap Options� These options are customised for specific

countries and sectors, and aim to close an important knowledge

gap by giving policy makers a clearer understanding of the available

opportunities for accelerating renewable energy deployment� The

REmap Options consider resource availability, access to finance,

local expertise and technical human resource needs, manufacturing

capacity, policy environment, the age of existing capital stock and the

costs of technologies by 2025�

The REmap programme does not set renewable energy targets�

The political feasibility and challenges to implementing each option

varies in different sectors and countries, depending on their particular

circumstances and on the level of commercialisation technologies have

reached� Targets are effective starting points, but policy makers need

to know more: what is the renewable deployment potential, in which

sectors and countries can this be found, and what barriers inhibit

realisation of this potential?

REmap’s methodology is different from other scenario studies and

modelling exercises, as it is based on cooperation and consultation with

countries to develop both the Reference Case and the REmap Options�

The REmap spreadsheet tool allows the country experts to evaluate

and create their own REmap analyses� Using this clear and dynamic

accounting framework, they can evaluate and verify Reference Case

developments and REmap Options� All results are displayed in a

REmap-specific energy balance and an overview of these results on

country level are provided in Annex A of this report�

There are multiple routes through which countries can increase

renewables in their energy system� For instance, more emphasis

BOX 1: CASE AND TERMINOLOGY OVERVIEW

In this report, the two main energy pathways countries could pursue to 2025 and the gap between these are

referred to as:

2014 “base year” – 2014 is the start year because it is the latest for which complete statistical data is available

for all countries� ASEAN Member States completed a questionnaire to provide the data� This could mean that it

may differ slightly from other sources due to differences in collection methodologies or technology grouping

approaches, or if the data was subsequently revised�

The Reference Case – The most likely case based on planned policies and expected market developments

for each country’s energy sector� This Reference Case is based on energy demand forecasts submitted by

ASEAN Member States for this report, or taken from the Advancing Policies Scenario (APS) of the 4

th

ASEAN

Annual Energy Outlook (AEO4)� It does not necessarily reflect business as usual, but includes some accelerated

commitments relating to renewables and energy efficiency improvement that countries had already made as of

early 2016� The Reference Case in this report results in a slightly higher renewable energy share than in the AEO4

APS scenario, because some countries updated their renewable outlooks and other related market conditions�

The REmap Options – The renewable energy technology options for closing the gap between Reference Case

developments and the ASEAN aspirational target of a 23% renewable energy share in primary energy supply by

2025� The REmap Options are also often referred to as “the gap” in this report�

REmap – The case in which the REmap Options are assumed to be fully deployed, on top of developments in

the Reference Case� The “REmap” case is thus in line with ASEAN’s 23% goal�

RENEWABLE ENERGY OUTLOOK FOR ASEAN

24

01

can be given to increasing renewables in one sector over another,

i.e. countries can focus on more rapid development of renewable

electricity generation capacity and electrification of transport, cooking

and heating� Alternatively, more emphasis can be put on deploying

higher levels of modern, sustainable bioenergy� Regional energy trade

can also be expanded and result in a shifting landscape of renewable

energy deployment� Therefore, there is no single “true” distribution of

renewables deployment� The REmap insights presented in this report

are one possible pathway, developed in collaboration with experts from

countries, and they can inform a discussion on meeting the region’s

renewable energy target� But just how to meet the joint objective is a

political decision�

COUNTRY ENGAGEMENT

This study is a collaborative effort, built on IRENA’s REmap analytical

framework, and done in close collaboration with experts from ASEAN

Member States and ACE� ASEAN’s Member States include ten countries:

Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar,

the Philippines, Singapore, Thailand, and Vietnam�

Each country identified experts for a working group to help IRENA

develop its REmap analyses over a six month period� The experts

shared data, reviewed results and took part in three webinars and two

workshops, one in Manila in March 2016 and one in Bangkok in June

2016 (see Annex B)� During the workshops, findings were discussed

and improved upon, and key drivers and needs for renewables were

outlined� Two countries, Indonesia and Malaysia, had already been

participating in REmap since 2014, and the remaining eight countries

joined in early 2016� The final results of this report were presented

during the 34

th

AMEM meeting in Myanmar in September 2016� Member

States indicated their encouragement of the findings of the report and

called for additional efforts and robust frameworks from all ASEAN

Member States towards a timely achievement of the ASEAN renewable

energy target�

This study is based largely on information, data and analysis ASEAN

Member States provided during this period� These include government

plans and studies, as well as other studies on how the region’s energy

use is expected to develop� Another important source of information

is the AEO4, prepared by ACE and released in 2015 (ACE, 2015)� The

AEO4 focuses in detail on the energy sector and identifies renewable

energy potential, but does not explore the detail a pathway to reaching

the regions 23% renewable share target� Therefore, this roadmap

serves as an important complement to the AEO4 from a renewable

energy perspective� It also updates some data with the most recent

information provided by the ASEAN Member States�

THE BASELINE TO 2025 – THE REFERENCE CASE

The starting point for a REmap analysis is the national energy plan or

outlook of a country� Each country provides information on expected

developments in the energy sector between today and 2025 or

expected developments are taken from AEO4� The data provides a

breakdown of demand among different energy carriers by sector, i.e.

electricity generation, residential, commercial, services, transport and

industry� In REmap, these sectors are then grouped into four main

sectors: electricity generation (also called power sector), industry

(including agriculture), transport and buildings (including residential,

commercial, services, and public)�

In the ASEAN region, the renewable energy share in primary energy

supply was 9�4% in 2014 (excluding traditional uses of bioenergy

7

)�

According to the AEO4 business as usual case (which is a conservative

7 Traditional uses of bioenergy are generally not considered a modern renewable

energy source for the purpose of this assessment and the ASEAN aspirational

target�

INTRODUCTION

ES

25

01

outlook for renewable energy deployment), the share would remain

at this level until 2025, estimated to rise to only around 10%� However,

according to the outlooks and plans submitted for this report, many

of which are in line with the Advancing Policy Scenario (APS) of the

AEO4, the Reference Case

8

of this report shows the share could rise

to 16�9% by 2025� This increase would result from the inclusion and

successful implementation of stronger policies ASEAN Member States

have defined in their official targets for increasing renewable energy

and reducing energy intensity� It is also slightly higher than the 15�4%

share envisioned in the APS� This difference is due in part to rapid

developments in the renewable energy sector since the release of

the AEO4� For instance, Indonesia, the Philippines and Thailand, all

large energy consumers in the region, have set renewable energy

targets that are reflected in this analysis� Despite these advances, there

remains a gap of six percentage points to reach the 23% renewable

energy share by 2025 as depicted in Figure 2�

OBJECTIVE OF THIS STUDY: IDENTIFYING

RENEWABLE ENERGY TECHNOLOGY OPTIONS

TO CLOSE THE GAP

This study identifies renewable energy technology options to reach

ASEAN’s target of 23% renewables by 2025, above the Reference

Case share of just below 17%� These REmap Options aim to close this

six-percentage-point gap� They were identified in consultation with

country experts, and using literature on accelerated renewable energy

deployment scenarios, sectoral or technology-focused IRENA studies

and other sources (see Annex C)�

8 For the REmap Reference Case national projections were used for most

countries� If a projection was not available, then the AEO4 APS scenario was

used (see Annex C for an overview of sources)�

Each REmap Option is characterised by its cost and benefits�

The purpose of the cost-benefit analysis is to assess the cost-

competitiveness of renewable energy technologies in several ways�

The main method is to look at substitution costs, i.e. the attractiveness

of renewable energy technologies compared to conventional variants�

Benefits are estimated related to emissions of carbon dioxide (CO

2

)

from fossil fuels as well as indoor and outdoor air pollutants (see

section 4 for more information)� Investments required to deploy

renewable energy capacity are estimated as a separate indicator�

IRENA has developed its own methodology to assess these costs

(IRENA, 2014a) and benefits (IRENA, 2016f) and more information

about these indicators is available in Annex E�

0%

5%

10%

15%

20%

25%

30%

2014 2020 2025

2030

Renewable energy share in TPES

ASEAN Target:

2014 Share

17%

23%

The "Gap"

9.4%

Figure 2: Renewable energy share in ASEAN Member States to 2025 and 2030

RENEWABLE ENERGY OUTLOOK FOR ASEAN

26

01

BOX 2: OVERVIEW OF TERMINOLOGY: RE SHARE, TPES, TFEC, AND SECTORS GROUPING

This report uses terminology to describe energy demand, and assesses renewable energy shares as defined by the ASEAN target� Different countries use different accounting methods

to estimate the renewable energy share in their total energy mix� For example, the UN’s Sustainable Energy for All Initiative (SEforALL) uses Total Final Energy Consumption (TFEC)� In

comparison, other countries and regions, but most importantly ASEAN, use Total Primary Energy Supply (TPES)�

Primary energy is, for instance, crude oil and coal before conversion into gasoline and electricity – the “final energy” – that reaches consumers� As useful as this distinction is in revealing