Working Paper Series

Identification of systematic monetary

policy

Lukas Hack, Klodiana Istrefi, Matthias Meier

Disclaimer: This paper should not be reported as representing the views of the European Central Bank

(ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

No 2851

Abstract

We propose a novel identification design to estimate the causal effects of systematic

monetary policy on the propagation of macroeconomic shocks. The design combines (i) a

time-varying measure of systematic monetary policy based on the historical composition of

hawks and doves in the Federal Open Market Committee (FOMC) with (ii) an instrument

that leverages the mechanical FOMC rotation of voting rights. We apply our design to

study the effects of government spending shocks. We find fiscal multipliers between two and

three when the FOMC is dovish and below zero when it is hawkish. Narrative evidence from

historical FOMC records corroborates our findings.

Keywords: monetary policy, FOMC, rotation, government spending.

JEL Codes: E32, E52, E62, E63, H56.

ECB Working Paper Series No 2851

1

Non-technical summary

Monetary policy decisions made by central banks are intentional responses to macroeconomic

conditions. These responses are known as systematic monetary policy. In theory, system-

atic monetary policy plays a crucial role in influencing the impact of macroeconomic shocks.

However, there is a lack of reduced-form empirical evidence that identifies and quantifies this

causal relationship. In this study, we first introduce an identification design to assess the causal

effects of systematic monetary policy on the propagation of macroeconomic shocks. We then

use this design to study the interaction between government spending and the response of

systematic monetary policy. Our findings show that systematic monetary policy is a crucial

determinant of the effectiveness of fiscal policy.

Our identification design combines a measure of systematic monetary policy based on the histor-

ical composition of hawks and doves in the Federal Reserve’s Federal Open Market Committee

(FOMC) since the 1960s, along with an instrument that levers the mechanical rotation of voting

rights in the FOMC. The classification of FOMC members as hawks or doves is based on narra-

tives from news archives, portraying them as either more concerned about inflation (hawks) or

more concerned about supporting employment and growth (doves), as in Istrefi (2019).

To account for changes in the composition of hawks and doves in the FOMC that are influenced

by economic and political developments, we construct an instrumental variable that takes advan-

tage of the mechanical rotation of voting rights in the FOMC. This rotation is a yearly process

that redistributes voting rights among the Federal Reserve Bank presidents. The mechanical

nature of the rotation renders it exogenous to economic or political factors, allowing us to iden-

tify the causal effects of systematic monetary policy. To the best of our knowledge, our FOMC

rotation instrument is the first instrument of systematic monetary policy.

To estimate the causal effects of systematic monetary policy on the propagation of fiscal shocks

in the economy, we use a local projection model where macroeconomic variables such as GDP

or government consumption respond to the fiscal shock, the interaction between the fiscal shock

and the Hawk-Dove balance in the FOMC, the level of the Hawk-Dove balance, and potentially

other factors as well. The instrument vector is given by the vector of regressors when replacing

the Hawk-Dove balance with the FOMC rotation instrument. For the fiscal shock, we examine

military spending shocks as studied in previous works by Ramey (2011) and Ramey and Zubairy

(2018), for the period from 1960 to 2014.

Our findings show that the response of GDP to government spending shocks depends crucially

on the number of dovish and hawkish FOMC members. An increase in discretionary govern-

ment spending leads to a GDP expansion which is more pronounced when more dovish FOMC

members vote in the FOMC. Conversely, more hawks dampen the expansionary effect of govern-

ment spending. Quantitatively, we find that the peak GDP increase roughly doubles when there

are two more doves in the FOMC relative to the long-run sample average. In contrast, we find

that GDP does not expand in response to additional government spending when there are two

more hawks in the FOMC.

A common metric to evaluate the effectiveness of fiscal spending is the fiscal multiplier: the

increase in GDP per additional government spending. We find a strong and highly significant

dependence of the fiscal multiplier on systematic monetary policy. Under a hawkish FOMC,

ECB Working Paper Series No 2851

2

the multiplier is insignificant, with point estimates at or below 0. Under a dovish FOMC,

the multiplier is highly statistically significant and ranges between 2 and 3. An additional

important result is that when we consider systematic monetary policy in our analysis, the

average multipliers are larger and more precisely estimated compared to a linear model that

ignores this relationship.

Upon examining the mechanism underlying the state-dependent effects of government spending

shocks, we observe distinct patterns in nominal interest rates depending on the hawkishness

of the FOMC. Under a hawkish FOMC, nominal interest rates tend to rise substantially. On

the other hand, under a dovish FOMC, nominal interest rates initially decline and experience a

delayed increase. This suggests that a hawkish FOMC hikes rates in response to fiscal expansion

to contain inflationary pressures. Indeed, we find that a hawkish FOMC is more successful in

containing inflation expectations and inflation.

It is important to note that drawing the conclusion that the government should increase spending

when central banks have committees with dovish members in the majority could be misleading.

This is because such changes in government spending would not be random shocks (what we

studied) but predictable policy decisions. The Lucas critique applies if there are structural

changes in the conduct of fiscal policy. To avoid misleading conclusions, a promising direction

for future research is to utilize our findings to inform micro-founded models that study optimal

fiscal stabilization policies.

Finally, while our identification design is specific to U.S. monetary policy, a promising avenue

for future research is to study other countries or currency areas in which committees decide

monetary policy. In fact, since 2015 the European Central Bank’s Governing Council allocates

voting rights to its members through a rotation mechanism. Investigating these contexts can

provide valuable insights into the interaction between systematic monetary policy and fiscal

shocks in different settings.

ECB Working Paper Series No 2851

3

1 Introduction

Monetary policy is not random but a purposeful response to macroeconomic conditions. This

response represents systematic monetary policy. Fundamentally, the systematic response reflects

the preferences of the policymakers, e.g., concerning price stability and employment, which

change over time as the policymakers change. As a consequence, the effects of macroeconomic

shocks differ across time, depending on systematic monetary policy. In theory, systematic

monetary policy is well-known to be important for the propagation of macroeconomic shocks.

However, there is no direct evidence on the causal effects of the Fed’s systematic monetary

policy.

1

The main contribution of this paper is an identification design to estimate the causal effects

of systematic monetary policy on the propagation of macroeconomic shocks. We use historical

fluctuations in the composition of hawks and doves in the Federal Open Market Committee

(FOMC) to measure time variation in systematic monetary policy. To address the concern

that these fluctuations are endogenous to economic and political developments, we propose an

instrument that exploits the mechanical rotation of voting rights in the FOMC. To the best of

our knowledge, our FOMC rotation instrument is the first instrument for systematic monetary

policy. We then apply the identification design to government spending shocks and find that

fiscal multipliers significantly depend on systematic monetary policy. When the FOMC is

dovish, it delays tightening in response to an expansionary fiscal spending shock, and fiscal

multipliers are between two and three. Conversely, multipliers can be negative under a hawkish

FOMC that tightens faster and more aggressively.

We measure time variation in systematic U.S. monetary policy building on the narrative clas-

sification of FOMC members by Istrefi (2019) which uses news archives to classify members of

the FOMC as hawks and doves, for the period 1960 to 2023. Hawks are more concerned about

inflation, while doves are more concerned about supporting employment and growth. Following

Istrefi (2019) and Bordo and Istrefi (2023), we aggregate individual FOMC member preferences

into an aggregate Hawk-Dove balance for each FOMC meeting.

2

The Hawk-Dove balance is an

appealing measure of systematic monetary policy because it reflects the aggressiveness of the

FOMC towards fulfilling one or the other leg of the dual mandate without having to specify a

policy reaction function or the policy tools.

Identifying the causal effects of systematic monetary policy, independent of how it is measured,

is challenging because of endogeneity. For example, systematic monetary policy may change in

response to unemployment or inflation (Davig and Leeper, 2008). Similarly, the appointment

of central bankers can depend on economic and political circumstances, e.g., as documented

1

A vast empirical literature estimates the effects of monetary policy shocks (e.g., the pioneering work by

Romer and Romer, 1989; Bernanke and Blinder, 1992; Cochrane and Piazzesi, 2002). These shocks are commonly

understood as deviations from a policy rule, whereas most policy variation is due to systematic monetary policy,

i.e., the rule itself. While evidence on monetary policy shocks may (indirectly) be informative about the effects

of systematic monetary policy under certain assumptions (e.g., McKay and Wolf, 2022), we propose to directly

estimate the causal effects of systematic monetary policy.

2

Istrefi (2019) constructs the FOMC Hawk-Dove balance and shows that these preferences match with narra-

tives on monetary policy, preferred interest rates, dissents, and forecasts of FOMC members. Bordo and Istrefi

(2023) study what forms these preferences and how the FOMC composition affects decision making by estimating

a Taylor rule augmented by the Hawk-Dove balance. We go beyond their analysis by estimating the dynamic

causal effects of systematic monetary policy on the propagation of macroeconomic shocks.

ECB Working Paper Series No 2851

4

for the Nixon administration (Abrams, 2006; Abrams and Butkiewicz, 2012). We discuss this

identification challenge through the lens of a New Keynesian model in which the coefficients of

the monetary policy rule fluctuate in response to macroeconomic shocks. The model dynamics

can be represented as a state-dependent local projection. The OLS estimates of the local

projection will fail to identify the causal effects of systematic monetary policy because they are

contaminated by unobserved shocks that change the monetary policy rule. Instead, we show

that an instrument that captures exogenous variation in systematic monetary policy achieves

identification.

We propose an instrument that levers exogenous variation in the Hawk-Dove balance arising

from the FOMC rotation. The rotation is an annual mechanical scheme that shuffles four voting

rights among eleven Federal Reserve Bank presidents.

3

Specifically, our FOMC rotation instru-

ment is the Hawk-Dove balance of the subset of FOMC members with temporary voting rights

through the rotation. Importantly, the mechanic nature of the rotation renders it orthogonal

to economic and political developments.

Our identification design combines the measure of systematic monetary policy and the instru-

ment in a state-dependent local projection for a macroeconomic shock of interest. Specifically,

we regress an outcome of interest on the shock, the shock interacted with the Hawk-Dove

balance, the Hawk-Dove balance in levels, and possibly further controls. The instrument vector

is given by the vector of regressors when replacing the Hawk-Dove balance with the FOMC

rotation instrument. This local projection is in line with the dynamics of a New Keynesian

model with time-varying systematic monetary policy. However, different from a New Keynesian

model, our design identifies the effects of systematic monetary policy without imposing strong

structural assumptions.

We apply our identification design to study the effects of government spending shocks. The

response of monetary policy to fiscal policy is widely considered to be crucial for the effectiveness

of fiscal policy, both in the policy debate (e.g., Blinder, 2022) and in New Keynesian theory

(e.g., Woodford, 2011; Farhi and Werning, 2016). Notwithstanding the perceived importance of

this type of fiscal-monetary interaction, there is no direct evidence on the causal effects of the

Fed’s systematic monetary policy for the propagation of government spending shocks.

We focus on the military spending shocks in Ramey (2011) and Ramey and Zubairy (2018) for

the period 1960-2014.

4

We find that the real GDP response significantly depends on systematic

monetary policy. The GDP response increases in the share of dovish FOMC members, and

decreases in the share of hawks. When the Hawk-Dove balance exceeds the sample average

by two doves, quarterly GDP increases by up to 0.7% in response to a military shock, which

is expected to raise cumulative military spending by 1% of GDP over the next five years.

Conversely, quarterly GDP falls by up to 0.3% when the Hawk-Dove balance exceeds the sample

average by two hawks.

5

3

The rotation is considered important by Fed watchers in the media. Each year before the rotation, they

discuss its implications for the direction of monetary policy. Relatedly, Ehrmann et al. (2022) study how voting

rights affect the communication of Federal Reserve Bank presidents and market reaction to this communication.

4

In the post-Korean War sample that we study, Ramey (2011) shows that these shocks are poor instruments

and the average spending multiplier is imprecisely estimated. In contrast, we show that accounting for time-

varying systematic monetary policy strongly improves the precision of the estimated multiplier.

5

For comparison, an increase of the Hawk-Dove balance by two doves or two hawks roughly corresponds to

ECB Working Paper Series No 2851

5

The negative (and significant) dependence of the GDP response on the FOMC’s Hawk-Dove

balance is in line with commonly used New Keynesian models in which a more aggressive central

bank response to fiscal shocks leads to smaller GDP effects. We see this evidence as supporting

the usefulness of our identification design. In contrast, the OLS estimate substantially under-

estimates the role of systematic monetary policy on the GDP response to spending shocks.

A common metric to assess the effectiveness of fiscal spending is the spending multiplier, the

dollar increase of real GDP per additional dollar of real government spending. We estimate the

two- and four-year cumulative spending multipliers and find strong dependence on systematic

monetary policy. While multipliers under a hawkish FOMC are typically insignificant with point

estimates at or below 0, we find that dovish multipliers are between 2 and 3 and statistically

significant. Moreover, the average multipliers are larger and much more precisely estimated

when accounting for systematic monetary policy compared to a linear model that omits this

state dependency. These results are robust to various modeling choices, as we show in an

extensive sensitivity analysis.

We further inspect the mechanism behind the state-dependent effects of government spending

shocks. We show that nominal interest rates rise under a hawkish FOMC, while they initially

fall and rise only with substantial delay under a dovish FOMC. When the Hawk-Dove balance

exceeds the sample average by two hawks, the federal funds rate (FFR) starts to increase within

one year and rises up to 50 basis points beyond the pre-shock level around two years after the

shock. Conversely, the FFR falls below the pre-shock level for more than two years after the

shock, and then sharply rises toward a 50 basis point increase three years after the shock, when

there are two more doves in the FOMC. The different interest rate responses are consistent

with the fiscal multiplier estimates across hawkish and dovish FOMCs. Moreover, we find that

hawkish policy is more successful in containing inflation and that the monetary policy response

primarily transmits to real GDP through private consumption.

Finally, we complement our quantitative analysis with narrative evidence from the historical

records of the FOMC meetings. These records reveal that FOMC members and staff frequently

discuss changes in (military) government spending, their potential impact on the economy

and inflation, and the FOMC’s policy response. We further provide detailed case studies of

two important military spending buildup events in the 1960s, associated with the U.S. Space

Program and the Vietnam War. We show that a hawkish FOMC indeed tightens faster after

military buildups, whereas a dovish FOMC delays action.

Relation to literature. This paper contributes to a literature that aims to identify the effects

of systematic monetary policy on the propagation of macroeconomic shocks. Closely related

are McKay and Wolf (2022) and Barnichon and Mesters (2022) which differ in the required

structural assumptions and observational requirements from our identification design.

6

Their

approach assumes a linear (structural) model to identify the effects of monetary policy rules

using multiple monetary policy (news) shocks. In contrast, our approach exploits the historical

one standard deviation in the change of the Hawk-Dove balance.

6

McKay and Wolf (2022) focus on constructing policy counterfactuals, whereas Barnichon and Mesters (2022)

uses a similar approach to study optimal policy. Relatedly, Wolf (2023) uses the approach of McKay and Wolf

(2022) to provide fiscal policy shock counterfactuals for a strict inflation targeting central bank.

ECB Working Paper Series No 2851

6

variation in systematic monetary policy in a non-linear model to directly estimate its causal

effects. In fact, our evidence shows that the non-linearity with respect to systematic mone-

tary policy is statistically significant and economically large. This suggests that avoiding the

linearity assumption is important, underscoring the importance of our identification design. A

more traditional approach constructs monetary policy counterfactuals via a sequence of mone-

tary policy shocks (e.g., Bernanke et al., 1997; Kilian and Lewis, 2011; Benati, 2021).

7

Yet,

this approach is subject to the Lucas critique (Sargent, 1979), except for the special case of

modest shocks (Leeper and Zha, 2003). Our identification design is not subject to this Lucas

critique because we explicitly model and estimate how the dynamics depend on systematic

monetary policy. Another closely related paper is Cloyne et al. (2021), which estimates the

role of systematic monetary policy for the propagation of fiscal consolidation shocks. Whereas

Cloyne et al. (2021) leverages time-invariant cross-country differences in systematic monetary

policy estimated from Taylor rule regressions, we leverage exogenous variation in systematic

monetary policy in the U.S. over time.

Another approach of estimating the effects of time-varying systematic monetary policy uses

non-linear VAR models (e.g., Primiceri, 2005; Sims and Zha, 2006). A key advantage of our

approach is that it requires weaker identifying assumption and addresses the potential endo-

geneity of systematic monetary policy. Our paper also relates to a literature studying macroe-

conomic models with exogenous changes in systematic monetary policy (e.g., Davig and Leeper,

2007; Bianchi, 2013; Leeper et al., 2017) or endogenous changes (e.g., Davig and Leeper, 2008;

Barthélemy and Marx, 2017). Our time-series approach requires fewer structural assumptions

and provides moments to discipline such models.

Finally, our paper relates to a large empirical literature that estimates the government spending

multiplier. Most empirical estimates find an average fiscal spending multiplier between 0.5 and

1.5 (e.g., Blanchard and Perotti, 2002; Mountford and Uhlig, 2009; Barro and Redlick, 2011;

Ramey, 2011). Closely related are recent papers which study how the effects of government

spending shocks differ at the zero lower bound (e.g., Ramey and Zubairy, 2018; Miyamoto

et al., 2018). While the zero lower bound reflects a specific monetary policy regime, this regime

is endogenous to the business cycle which means the estimates may reflect both the regime and

the shocks leading to it. Instead, we isolate the causal effects of monetary policy. Another

related paper is Nakamura and Steinsson (2014), which estimates relative regional multipliers

that difference out the response of monetary policy. Our paper also relates to many recent

papers that have estimated state-dependencies of the multiplier (other than systematic monetary

policy), e.g., depending on the economy being in recession (Auerbach and Gorodnichenko, 2012;

Jordà and Taylor, 2016; Ramey and Zubairy, 2018; Ghassibe and Zanetti, 2022); sign of the

shock (Barnichon et al., 2022; Ben Zeev et al., 2023); exchange-rate regime, trade openness,

and public debt (Ilzetzki et al., 2013); foreign holdings of debt (Broner et al., 2022); and tax

progressivity (Ferrière and Navarro, 2018).

The paper is organized as follows: Section 2 provides a simple New Keynesian model to

discuss the identification challenge. Section 3 introduces the identification design for system-

7

A further related paper on the intersection of shocks and systematic policy is Arias et al. (2019) which

identifies monetary policy shocks via sign restrictions on systematic monetary policy.

ECB Working Paper Series No 2851

7

atic U.S. monetary policy. Section 4 contains the main empirical results on the effects of fiscal

spending shocks. Section 5 provides evidence for understanding the mechanism. Section 6

provides a narrative of the FOMC records in the 1960s. Section 7 concludes.

2 Identification challenge

In this section, we present a stylized non-linear New Keynesian model in which systematic

monetary policy may fluctuate endogenously. We use the model to expound the challenge of

empirically identifying the effects of systematic monetary policy on the propagation of macroe-

conomic shocks.

A New Keynesian model. The model is a textbook New Keynesian model (e.g., Galí,

2015) except for a monetary policy rule with time-varying coefficients. Households choose

consumption, labor and bond holdings to maximize E

0

P

∞

t=0

β

t

log C

t

− N

1+φ

t

subject to

budget constraints. Intermediate good firms produce variety goods using Y

it

= x

a

t

N

it

where

x

a

t

is exogenous productivity. The price of the variety good can be reset with a constant

probability 1 − θ. Final good firms produce the final good Y

t

=

R

1

0

Y

(ϵ−1)/ϵ

it

di

ϵ/(ϵ−1)

. A

fiscal policy authority finances government spending G

t

= γY x

s

t

with lump-sum taxes where

γ ∈ [0, 1), Y is steady-state output, and x

s

t

denotes exogenous changes in fiscal spending. Goods

market clearing requires Y

t

= C

t

+ G

t

. The exogenous variables follow stable AR(1) processes

log x

k

t

= ρ

k

log x

k

t−1

+ ε

k

t

with ε

k

t

∼ (0, σ

2

k

) for k = a, s respectively. A monetary policy rule

closes the model. Letting lower case letters denote (log) deviations from the steady state, the

monetary authority sets nominal interest rates i

t

according to

i

t

=

e

ϕ

t

π

t

, (2.1)

where

e

ϕ

t

∈ (1, ∞) is systematic monetary policy, which varies over time according to a stable

AR(1) process

ϕ

t

= ρ

ϕ

ϕ

t−1

+ ζ

s

ε

s

t

+ ζ

a

ε

a

t

+ η

t

, (2.2)

where

e

ϕ

t

= ϕ+ϕ

t

and ϕ denotes the unconditional mean of

e

ϕ

t

. Importantly, we allow systematic

monetary policy to be endogenous, as ϕ

t

may respond to macroeconomic shocks (ε

s

t

, ε

a

t

).

8

Such

endogeneity creates an empirical identification challenge as we discuss toward the end of this

section. In addition, we allow for exogenous changes in systematic monetary policy, captured

by the exogenous policy shifter η

t

. We assume that ε

s

t

, ε

a

t

, and η

t

are mutually independent

and identically distributed over time.

Accounting for the non-linear effects of systematic monetary policy ϕ

t

, the approximate equi-

librium dynamics of GDP are given by

y

t

= a + b

s

x

s

t

+ b

a

x

a

t

+ c

s

x

s

t

ϕ

t

+ c

a

x

a

t

ϕ

t

+ dϕ

t

, (2.3)

8

For DSGE models with exogenous changes in the Taylor rule coefficients, see, e.g., Davig and Leeper (2007)

and Bianchi (2013). For endogenous changes in the Taylor rule coefficients, see, e.g., Davig and Leeper (2008)

and Barthélemy and Marx (2017).

ECB Working Paper Series No 2851

8

where a, b

s

, b

a

, c

s

, c

a

, d are coefficients that depend on the deep structural parameters of the

model. Appendix A.1 provides details on the derivation.

Identification challenge. We next discuss the challenge of identifying the effects of system-

atic monetary policy from a regression when y

t

is generated by (2.3). Without loss of generality,

and in anticipation of our main empirical question, we focus our discussion on the fiscal spending

shock. Consider an econometrician who observes y

t

, ε

s

t

, ϕ

t

, and estimates the state-dependent

local projection

y

t+h

= α

h

+ β

h

ε

s

t

+ γ

h

ε

s

t

ϕ

t

+ δ

h

ϕ

t

+ v

h

t+h

, (2.4)

for h = 0, . . . , H forecast horizons. For h = 0, the residual v

h

t+h

contains lagged spending shocks,

contemporaneous and lagged technology shocks, and the interaction of these shocks with ϕ

t

.

For h > 0, the residual further contains shocks (ε

s

t

, ε

a

t

) and policy shifter (η

t

) occuring between

t and t + h. The estimands in (2.4) are

β

h

= b

s

(ρ

s

)

h

, γ

h

= c

s

(ρ

s

ρ

ϕ

)

h

, δ

h

= d(ρ

ϕ

)

h

. (2.5)

Both β

h

, the average effect of the spending shock, and γ

h

, the differential effect associated with

ϕ

t

, diminish in the forecast horizon h.

We next ask whether the OLS estimates of (β

h

, γ

h

, δ

h

) are consistent, i.e., whether they asymp-

totically recover the estimands in (2.5).

9

In general, consistency holds under the strong exogeneity

assumption ζ

s

= ζ

a

= 0, that is if ϕ

t

is independent of the macroeconomic shocks. In contrast,

if ϕ

t

correlates with at least one of the shocks, the OLS estimates do not consistently esti-

mate (β

h

, γ

h

, δ

h

). If, for example, ϕ

t

responds to a technology shock, the OLS estimator will

be contaminated by the response of GDP to the technology shock.

10

For further details, see

Appendix A.2.

Now suppose the econometrician observes an instrument ϕ

IV

t

that is correlated with ϕ

t

(rele-

vance), but uncorrelated with all past, present, and future macroeconomic shocks ε

s

t

and ε

a

t

and that is uncorrelated with all past and future policy shifters η

t

(exogeneity). Consider the

IV estimates of (β

h

, γ

h

, δ

h

) when using (ε

s

t

, ε

s

t

ϕ

IV

t

, ϕ

IV

t

) as instrument vector for the regres-

sors (ε

s

t

, ε

s

t

ϕ

t

, ϕ

t

). The IV estimator consistently estimates (β

h

, γ

h

, δ

h

), even when ϕ

t

fluctu-

ates endogenously in response to macroeconomic shocks (ζ

a

, ζ

m

̸= 0). For further details, see

Appendix A.2. This result guides the remainder of our paper in which we propose an instrument

for systematic monetary policy and use it to estimate the causal effects of systematic monetary

policy.

Illustration. To illustrate the effects of systematic monetary policy and the identification

challenge, we focus on a special case of our economy in which ρ

s

= ρ

a

= ρ

ϕ

= 0. To understand

9

We explicitly include δ

h

in the vector of coefficients because including the (endogenous) control variable ϕ

t

in the regression is important for identification, as ϕ

t

is correlated with ε

s

t

and ε

s

t

ϕ

t

in general.

10

If the econometrician observes and includes all shocks and corresponding interaction terms in the regression

according to equation (2.3), then the OLS estimates will be consistent without the exogeneity assumption. In

practice, this is infeasible as many shocks are (partially) unobserved.

ECB Working Paper Series No 2851

9

Figure 1: GDP response and systematic monetary policy

Notes: The solid line shows the model solution for the GDP response to a spending shock as a function of systematic

monetary policy (ϕ

t

), i.e., b

s

+ c

s

ϕ

t

, with b

s

and c

s

given by (2.6) and the parametrization: β = 0.99, θ = 0.75, ϵ = 9,

φ = 2, γ = 0.2,

¯

ϕ = 1.5, ζ

s

= 1, ζ

a

= 0.25, σ

s

= σ

a

= 1. The dashed line shows the OLS estimate

ˆ

β

OLS

s

+ ˆγ

OLS

s

ϕ

t

based

on a regression of (2.3) when the terms in u

t

are unobserved. The implied coefficients are β

s

= 0.164 and γ

s

= −0.017,

and the large-sample OLS estimates are

ˆ

β

OLS

s

= 0.164 and ˆγ

OLS

s

= −0.002.

how ϕ

t

affects the GDP response to fiscal spending shock ε

s

t

, we need to know

b

s

= γ (1 + λϕ) ω

−1

, c

s

= −γ(1 − γ)λφω

−2

, (2.6)

where ω = 1 + λ (φ(1 − γ) + 1) ϕ, λ = (1 − θ)(1 − βθ)/θ. Since β

s

> 0 and γ

s

< 0 (under

standard parameter restrictions), the GDP response falls in the strength of the monetary policy

reaction to inflation. This is the monetary offset (e.g., Woodford, 2011; Christiano et al., 2011).

The solid line in Figure 1 illustrates the monetary offset. The dashed line illustrates the OLS

bias in the estimated GDP response to the spending shock. In our example, the OLS estimate

understates the role of systematic monetary policy.

3 Identification design

In this section, we propose an identification design to study how systematic monetary policy

in the U.S. shapes the propagation of macroeconomic shocks. Our identification design relies

on three crucial elements: (i) a measure of systematic monetary policy, (ii) an instrument for

systematic monetary policy, and (iii) a state-dependent local projection regression that combines

(i) and (ii) to tackle the identification challenge discussed in the preceding section.

3.1 Hawk-Dove balance in the FOMC

In the following, we build on the classification of Federal Open Market Committee (FOMC)

members into hawks and doves by Istrefi (2019) and argue that the Hawk-Dove balance captures

ECB Working Paper Series No 2851

10

well variation in systematic monetary policy over time.

The FOMC. The FOMC is the committee of the Federal Reserve that sets U.S. monetary

policy. The FOMC consists of 12 members: the seven members of the Board of Governors of

the Federal Reserve System, including the Federal Reserve Chair, the president of the Federal

Reserve Bank (FRB) of New York, and four of the remaining 11 FRB presidents, who serve

one-year terms on a rotating basis. The seven FRB presidents temporarily without FOMC

membership participate in the FOMC meetings as non-voters.

Individual policy preferences. To measure the policy preferences of FOMC members we

use the Istrefi (2019) classification of FOMC members as hawks and doves, for the period 1960-

2023.

11

Underlying this classification are more than 20,000 real-time media articles from over

30 newspapers and business reports of Fed watchers (available in news archives like ProQuest

Historical Newspapers and Factiva) mentioning individual FOMC members. Istrefi (2019) uses

these articles to categorize individual FOMC members as hawks or doves for each FOMC

meeting based on the news information available up until the meeting. So, the Hawk-Dove

classification is a panel that tracks FOMC members over time, at FOMC meeting frequency.

Hawks are perceived to be more concerned with inflation, while doves are more concerned with

employment and growth.

12

Through the lens of our model in Section 2, we can think about

hawks as preferring a larger inflation coefficient ϕ

t

than doves. However, the Hawk-Dove clas-

sification we use is not tied to assuming a specific policy rule.

Overall, 129 of the 147 FOMC members between 1960 and 2023 are classified as hawk or dove.

The news coverage for the remaining 18 members does not allow classification (as hawk or dove)

for any meeting, as some served in the early 1960s with sparse media coverage and others are

very recent appointments in the FOMC. The majority (95) of the classified FOMC members

are consistently hawks or doves over time while the rest switches camps at least once. Swings

are equally split in either direction and quite uniformly distributed over time. On average, the

34 swinging FOMC members switch camps at only 1.8% of the member-meeting pairs.

While true policy preferences are unobserved, Istrefi (2019) shows that perceived preferences

match well with policy tendencies that are unknown in real-time to the public, as expressed

by preferred interest rates, with forecasting patterns of individual FOMC members, and with

dissents. In addition, Bordo and Istrefi (2023) show that the FOMC members’ educational

background, e.g., whether they graduated from a university related to the Chicago school of

economics, and early life experience, i.e., whether they grew up during the Great Depression,

predicts the Hawk-Dove classification. The long lasting effect of the early life experience in the

formation of policy preferences is consistent with the very few swings in our sample.

11

The data in Istrefi (2019) covers 1960 through 2014. The data is currently extended up to the first meeting

of 2023. Thus, our sample covers all 634 (scheduled) FOMC meetings between 1960 and 2023.

12

A typical example of a newspaper quote used to categorize a hawk reads: “Volcker leans toward tight-money

policies and high interest rates to retard inflation”, New York Times, 2 May 1975. For a dove: “The weakness

of Treasury prices and higher yields was seen reflecting the view that Bernanke will be ‘pro-growth’ and perhaps

less hawkish on inflation, said John Roberts, managing director at Barclays Capital in New York”, Dow Jones

Capital Markets Report, 24 October 2005.

ECB Working Paper Series No 2851

11

Aggregate Hawk-Dove balance. To measure variation in systematic monetary policy over

time, we aggregate the cross-section of individual FOMC member preferences into an aggregate

Hawk-Dove balance for each meeting (cf. Istrefi, 2019). We do so because the nature of monetary

policy-making by committee involves the aggregation of diverse individual policy preferences in

a collective decision.

13

We adopt a symmetric numerical scale for the qualitative Hawk-Dove

classification in order to aggregate the preferences. We define Hawk

iτ

as the policy preference

of FOMC member i at FOMC meeting τ :

Hawk

iτ

=

+1 Consistent hawk

+

1

2

Swinging hawk

±0 Preference unknown

−

1

2

Swinging dove

−1 Consistent dove

(3.1)

A consistent hawk is an FOMC member that has not been categorized as a dove in the past.

In contrast, a swinging hawk has been a dove at some point in the past. The definition of a

consistent dove and a swinging dove is analogous. We assign a lower weight to swingers as they

are often perceived as ‘middle-of-the-roaders’ with more moderate leanings to the hawkish or

dovish side (Istrefi, 2019).

14

Finally, we assign Hawk

iτ

= 0 when the policy preference of the

FOMC member is (yet) unknown.

We next aggregate the individual policy preferences in (3.1). We compute the aggregate Hawk-

Dove balance by

Hawk

τ

=

1

|M

τ

|

X

i∈M

τ

Hawk

iτ

(3.2)

where M

τ

denotes the set of FOMC members at meeting τ. A full FOMC consists of |M

τ

| = 12

members but |M

τ

| is occasionally below 12 because of absent members or vacant positions.

15

The Hawk-Dove balance in (3.2) is the arithmetic average across individual preferences. This

is our baseline aggregation of the Hawk-Dove balance in the FOMC and conforms well with the

consensual mode in which the FOMC typically operates.

1617

In Section 4.5, we show that our

13

Relatedly, Blinder (1999) writes: While serving on the FOMC, I was vividly reminded of a few things all of

us probably know about committees: that they laboriously aggregate individual preferences; that they need to be led;

that they tend to adopt compromise positions on difficult questions; and–perhaps because of all of the above–that

they tend to be inertial.

14

Our empirical findings are robust to not distinguishing between consistent and swinging preferences, see

Section 4.5.

15

When a substitute temporarily replaces an absent FOMC member, we assume the substitute acts in the

interest of the original FOMC member and assign the same policy preference, see Appendix B for details. This

assumption affects less than one percent of all observations and is not important for our results.

16

Riboni and Ruge-Murcia (2010) argue that a consensus model fits actual policy decisions of the Federal

Reserve. In addition, Riboni and Ruge-Murcia (2022) provide evidence suggesting that policy proposals of the

Fed Chair are the result of a compromise, reflecting a balance of power within the FOMC.

17

Cieslak et al. (2022) construct a Hawk-Dove score based on the language in FOMC meeting transcripts.

In contrast to our measure which captures FOMC members preferences about monetary policy, their measure

captures (a hawkish or dovish) sentiment on current direction of policy changes. Furthermore, Ferguson et al.

(2023) classify central bank governors in 80 countries as hawks and doves, with respect to financial sector support,

for the periods preceding banking crises.

ECB Working Paper Series No 2851

12

Figure 2: Hawk-Dove balance in the FOMC

Notes: The solid red line shows the quarterly time series of the aggregate Hawk-Dove balance of the FOMC

(Hawk

t

) from 1960 until 2023. The dashed red line shows the aggregate Hawk-Dove balance of the subgroup

of rotating FRB presidents with voting right in period t, the FOMC rotation instrument (Hawk

IV

t

). Grey

bars indicate NBER dated recessions.

empirical findings are robust to alternatively using the median of preferences or putting a higher

weight on the Fed Chair’s preference. Finally, we aggregate Hawk

τ

from meeting frequency to

quarterly frequency. We compute the Hawk-Dove balance Hawk

t

for quarter t as the average

balance in the first month of the quarter. If the first month is without a meeting, we use the

first preceding month with a meeting.

We present the evolution of the Hawk-Dove balance from 1960 to 2023 as the solid line in

Figure 2. There is considerable variation in this balance, featuring both hawkish and dovish

majorities. The variation reflects the turnover of rotating FOMC members, the turnover of non-

rotating FOMC members, and changes in policy preferences of incumbent FOMC members. We

discuss the importance of these components for Hawk

t

fluctuations in Subsection 3.2.

Systematic monetary policy. The aggregate Hawk-Dove balance Hawk

t

represents our

measure of systematic U.S. monetary policy. It accounts for the diversity of views within

the FOMC on how policy should be adjusted to promote both, price stability and maximum

employment. This diversity is usually expressed in FOMC meetings through different forecasts

of individual members, through dissents, and in public through speeches. While the Fed’s

response to macroeconomic shocks is more sophisticated and depends on various economic

factors, we argue that our Hawk-Dove balance matches well with narratives of monetary policy

in the U.S. (Istrefi, 2019). For example, the dovish leaning of Hawk

t

in the mid-1960s coincides

with a period of delays and hesitation from the FOMC to take anti-inflationary action (Meltzer,

2005). The hawkish majorities in the 1970s might be surprising given the high inflation rates

in this period. Yet it is consistent with monetary policy being misguided by an underestimated

ECB Working Paper Series No 2851

13

natural rate of unemployment (DeLong, 1997; Romer and Romer, 2002) and persistence of

inflation (Primiceri, 2006). In particular, Orphanides (2004) argues that for the periods before

and after Paul Volcker’s appointment in 1979, policy was broadly similar and consistent with

a strong reaction to Greenbook inflation forecasts.

18

During the 1980s, the perception of a

less hawkish FOMC reflects nominations of dovish Board members by President Reagan. In

addition, it is consistent with the imperfect credibility of hawkish policy during the Volcker

disinflation, as observed in persistently elevated long-term interest rates (indicative of inflation

expectations) in this period (Goodfriend and King, 2005). Overall, this suggests that the Hawk-

Dove balance captures important aspects of the Fed’s systematic policy-making.

Our approach of measuring systematic policy via Hawk

t

has several advantages to alternative

approaches such as calibrating or estimating policy rules (e.g., Clarida et al., 2000; Bauer et al.,

2022). Importantly, we do not have to specify a particular reaction function, nor do we need to

restrict the analysis to specific policy instruments or communication strategies.

19

We further

avoid the well-known identification issues that plague the estimation of monetary policy rules

(Cochrane, 2011; Carvalho et al., 2021). Independently of the policy tool or policy rule, our

measure reflects the aggressiveness of the FOMC towards fulfilling one or the other leg of

the dual mandate. In addition, the Hawk-Dove balance reflects public beliefs, in real-time,

about monetary policymakers. In contrast, ex-post estimates of systematic monetary policy

may inadvertently use ex-post information not available at the time of the policy decision,

potentially giving rise to misleading conclusions (Orphanides, 2003).

Comparability over time. A potential concern with the classification of FOMC members

into hawks and doves is that the meaning of being a hawk or dove might have changed over

time. We argue this is likely no major concern. First, Istrefi (2019) has classified each member

as a hawk or dove based on a common and time-invariant definition, that is the policy leaning

with regard to the dual mandate of the Fed: maximum employment and stable prices. Second,

given that preferences tend to be stable, we would expect many swings whenever the meaning of

hawks or doves changes. However, swings in measured preferences are rare suggesting that the

meaning of being a hawk or dove is relatively stable over time. Third, the fact that we observe

large and persistent fluctuations in Hawk

t

is incompatible with the Hawk-Dove classification

being a relative ranking, according to which hawks are those FOMC members which are more

hawkish than the contemporaneous average policy preference among FOMC members, and

analogously for doves. Finally, in a robustness exercise in Section 4, we show that our results

are robust to using an alternative Hawk-Dove balance which accounts for potential trends in

the meaning of hawks and doves.

Relation to monetary policy shocks. Empirically identified monetary policy shocks are

often considered to reflect changes in central bank preferences (Christiano et al., 1999; Ramey,

18

Moreover, Orphanides (2003) shows that a dovish Taylor rule with a sufficiently large weight on the output

gap would have resulted in substantially higher inflation.

19

For a summary of alternative policy rules that the FOMC consults, see here:

https://www.federalreserve.gov/monetarypolicy/policy-rules-and-how-policymakers-use-them.htm. Policy

instruments have been changing over our sample, from targeting monetary aggregates to targeting the Fed Funds

rate, conducting balance sheets policy, and through forward guidance communication.

ECB Working Paper Series No 2851

14

2016). Hence, they may be related to the Hawk-Dove balance, our measure of systematic mone-

tary policy. In Appendix D, we characterize this relationship based on the Romer and Romer

(2004) identification strategy of monetary policy shocks. Because their identification strategy

assumes a time-invariant policy rule, the identified monetary policy shocks may indeed capture

time variation in systematic monetary policy. However, the relationship between identified

monetary policy shocks and systematic monetary policy is non-linear and also depends on the

state of the economy (e.g., the inflation rate). Instead, our Hawk-Dove balance provides a

cleaner measure of systematic monetary policy.

3.2 FOMC Rotation Instrument

We next propose and discuss a novel FOMC rotation instrument that allows us to identify the

effects of systematic monetary policy, even if monetary policy is endogenous to the state of the

economy (cf. Section 2).

Potential endogeneity. Systematic monetary policy may change depending on the state of

the economy. For example, the Federal Reserve may become more dovish in response to high

unemployment, or more hawkish in response to high inflation (cf. Davig and Leeper, 2007).

More fundamentally, some FOMC members may become hawkish or new appointments may

increase the number of hawks in the FOMC. Changes in individual policy preferences could be

intrinsic responses to changes in the macroeconomic environment. They could also be driven by

external pressure from lobbies or the government. Relatedly, Abrams (2006) and Abrams and

Butkiewicz (2012) document the influence of the Nixon administration on the FOMC in the

period leading up to the 1972 election. In addition, which type of central banker gets appointed

may depend on the state of the economy. In this context, note that members of the Board of

Governors and the Fed Chair require a nomination from the U.S. President for their first and

any subsequent term. This may render both extensive margin and intensive margin changes in

the Hawk-Dove balance endogenous.

FOMC rotation instrument. To address the endogeneity of the Hawk-Dove balance we

propose an instrument which leverages exogenous variation in Hawk

t

that arises from the

annual FOMC rotation. Each year, four FOMC memberships rotate among eleven FRB pres-

idents following a mechanical scheme that has been in place since the early 1940s. According

to the scheme, some FRB presidents become FOMC members every second year (Cleveland

and Chicago) and others every third year (Philadelphia, Richmond, Boston, Dallas, Atlanta,

St. Louis, Minneapolis, San Francisco and Kansas City). As the rotation of voting rights is

independent of the state of the economy, it induces exogenous variation in Hawk

t

. To leverage

the variation from the FOMC rotation we propose a novel instrument, which we refer to as

FOMC rotation instrument. Formally, the instrument is given by

Hawk

IV

τ

=

1

|R

τ

|

X

i∈R

τ

Hawk

iτ

, (3.3)

ECB Working Paper Series No 2851

15

where R

τ

denotes the set of rotating FOMC members at FOMC meeting τ. A full set of rotating

members consists of |R

τ

| = 4 members.

20

We aggregate the FOMC rotation instrument to

quarterly frequency analogously to the Hawk-Dove balance.

In Figure 2, the dashed line presents the FOMC rotation instrument over time. On average, the

rotating presidents are more hawkish than the overall FOMC Hawk-Dove balance, reflecting the

fact that FRB presidents tend to be more hawkish than governors (Chappell et al., 2005; Istrefi,

2019; Bordo and Istrefi, 2023). Both series display sizable variation over time, but fluctuations

in the instrument Hawk

IV

t

are more short-lived, with a year-over-year autocorrelation of 0.20

compared to 0.66 for Hawk

t

, see Table 1.

Table 1: Summary statistics

Mean Median SD Autocorr Corr Min Max T

Hawk

t

0.04 0.09 0.35 0.66 - -0.80 0.67 253

Hawk

IV

t

0.28 0.33 0.45 0.20 0.64 -0.75 1.00 253

Notes: Summary statistics for the quarterly time series from 1960 until 2023. Hawk

t

is the average Hawk-

Dove balance of the FOMC. Hawk

IV

t

is the FOMC rotation instrument. Autocorr refers to the year-over-year

first-order autocorrelation. Corr refers to the correlation with Hawk

t

.

Relevance of instrument. Our instrument Hawk

IV

t

aggregates the policy preferences of one-

third of the FOMC members, capturing a significant part of the variation in the overall Hawk-

Dove balance Hawk

t

. In fact, the correlation between Hawk

t

and Hawk

IV

t

is 0.64. Formal

weak instrument tests require a fully specified regression model and are therefore delegated to

Section 4. However, we can estimate a stylized first-stage regression to study the explanatory

power of the FOMC rotation instrument. We regress Hawk

t

on Hawk

IV

t

and a constant. This

regression has an R

2

of 0.41 and an effective F-statistic (Montiel Olea and Pflueger, 2013)

for joint significance of 46.13, well above the common threshold of 10 for weak instruments

(Andrews et al., 2019).

We further provide a decomposition of Hawk

t

into intensive margin changes of incumbent

FOMC members’ policy preferences and extensive margin changes in the composition of the

FOMC due to entry and exit, see Appendix C for details. We find that extensive margin

changes in the FOMC composition due to the rotation account for 53% of the variance in yearly

changes of Hawk

t

. The turnover of non-rotating FOMC members accounts for another quarter

of the variance, and the remainder is due to preference changes of incumbent FOMC members

and various covariance terms. Both the first-stage regression and the variance decomposition

strongly suggest that our instrument is relevant for Hawk

t

.

Finally, the rotation is considered important by Fed watchers in the media. Each year before

the rotation, they discuss its implications for monetary policy. A typical media discussion, here

an article in The New York Times from January 1, 2011, reads as follows:

20

In our sample, |R

τ

| = 4 for 625 out of 634 FOMC meetings and |R

τ

| = 3 for the remaining nine meetings

because of an absent member.

ECB Working Paper Series No 2851

16

As the Federal Reserve debates whether to scale back, continue or expand its $600

billion effort to nurse the economic recovery, four men will have a newly prominent

role in influencing the central bank’s path. The four men are presidents of regional

Fed banks, and under an arcane system that dates to the Depression, they will become

voting members in 2011 on the Federal Open Market Committee, [...] the change

in voting composition is likely to give the committee a somewhat more hawkish cast.

This could amplify anxieties about unforeseen effects of Bernanke’s policies [...]. Two

of the four new voters are viewed as hawkish on inflation, meaning that they tend

to be more worried about unleashing future inflation than they are about reducing

unemployment in the short run.

Exogeneity of instrument. We next argue that variation in Hawk

IV

t

is quasi-exogenous.

First, the rotation scheme is mechanical and time-invariant and therefore unrelated to the state

of the economy. Second, new appointments of FRB presidents are relatively infrequent and

unlikely to be influenced by the federal government. FRB presidents are appointed by the

Board of Directors of the respective Federal Reserve district. The directors are to represent

the broader public and financial institutions located in the district. In contrast, members of

the Board of Governors (including the Fed Chair) are nominated by the U.S. president and

confirmed by the Senate. Furthermore, the average tenure of an FRB president is eleven years

but only seven years for a governor in our sample. Relatedly, Bordo and Istrefi (2023) show that

different from governors, there is no correlation between the preferences of the FRB presidents

and the U.S. president’s party at the time of their appointment. In addition, some regional

FRBs have persistent leanings toward either the dovish or the hawkish camp. For example, the

Cleveland FRB president is typically a hawk whereas the president of the San Francisco FRB

is typically a dove.

Third, swings of preferences are likely a negligible threat to the exogeneity of our instrument.

For rotating FOMC members, swings occur only in 1.3% of member-meetings pairs, and not all

swings are endogenous to the state of the economy.

21

In addition, we find that swings account

for a negligible fraction of the variance of the rotation instrument. In particular, we decompose

Hawk

IV

t

into intensive margin changes of preferences (swings) and extensive margin changes

of the composition of rotating FOMC members due to either the rotation or appointments,

see Appendix C for details. The rotation accounts for 93% of the variance in yearly changes

of Hawk

IV

t

, appointments for 8% and swings for 1%.

22

Fourth, Hawk

IV

t

displays relatively

short-lived time series fluctuations that are unlikely to be correlated with slow-moving macroe-

conomic trends, such as increasing market power, female labor force participation, and various

technological innovations. Similarly, Hawk

IV

t

is uncorrelated with business cycle fluctuations.

For example, the correlation between Hawk

IV

t

and yearly real GDP growth is -0.02 and statis-

tically insignificant. In contrast, the correlation between Hawk

t

and GDP growth is 0.15 and

21

Bordo and Istrefi (2023) discuss three major swing waves in the FOMC during 1960-2014. The first wave is

a hawkish wave influenced by inflation dynamics in the late 1960s to early 1970s. The second wave is a hawkish

swing in the early 1990s, related to the discussion on inflation targeting inspired by the announcements of the

Reserve Bank of New Zealand and Bank of Canada. Finally, the third swing wave is a dovish one in the late

1990s, following a new understanding of the economy.

22

Our empirical results are robust to excluding swingers from our instrumental variable, see Section 4.5.

ECB Working Paper Series No 2851

17

significant at the 5% level.

Overall, the above arguments support the validity of our FOMC rotation instrument for iden-

tifying the causal effects of systematic monetary policy. To the best of our knowledge, this

paper is the first to propose an instrument for systematic monetary policy. We believe this is a

substantial contribution to the literature which opens up myriad research questions.

A validation exercise for Hawk

t

and Hawk

IV

t

. Given our definition of hawkish policy

makers and conventional wisdom about hawkish monetary policy, we should expect a hawkish

FOMC to respond more aggressively to inflation. As validation exercise, we empirically test

this correlation via a dynamic Taylor rule regression. We use Hawk

IV

t

as instrument in a

local projection of the federal funds rate on the Greenbook inflation forecast interacted with

Hawk

t

. We find that a hawkish FOMC indeed raises the federal funds rate significantly more

aggressively in the presence of higher inflation forecasts. For more details on the exercise, the

results, and a weak instrument test, see Appendix E. Overall, this exercise suggests that Hawk

t

and Hawk

IV

t

capture important variation in systematic monetary policy.

3.3 Local projection framework

Finally, we propose to combine Hawk

t

and Hawk

IV

t

in a state-dependent local projection

framework that permits causal identification of how systematic monetary policy shapes the

propagation of various macroeconomic shocks. The setup of the local projection is consistent

with the New Keynesian model discussed in Section 2.

We regress an outcome variable of interest, x

t+h

, on a macroeconomic shock of interest, ε

s

t

, the

interaction of the shock with the Hawk-Dove balance Hawk

t

, as well as Hawk

t

in levels and a

vector of additional control variables Z

t

. Formally,

x

t+h

= α

h

+ β

h

ε

s

t

+ γ

h

ε

s

t

(Hawk

t

− Hawk) + δ

h

(Hawk

t

− Hawk) + ζ

h

Z

t

+ v

h

t+h

, (3.4)

for h = 0, . . . , H forecast horizons. Hawk denotes the arithmetic sample mean of Hawk

t

. To

address the potential endogeneity of Hawk

t

, we use the instrument vector

q

t

=

h

1, ε

s

t

, ε

s

t

Hawk

IV

t

− Hawk

IV

,

Hawk

IV

t

− Hawk

IV

, Z

t

i

(3.5)

for the regressors in (3.4). The two key coefficients in (3.4) are β

h

and γ

h

, which capture the

average response, when the Hawk-Dove balance of the FOMC is at its sample average, and

the differential response, when the FOMC is more or less hawkish than the sample average.

Based on Section 2, the IV estimator is consistent if the instrument Hawk

IV

t

is orthogonal to

all macroeconomic shocks (both observed shocks ε

s

t

and other unobserved shocks) at all lags

and leads. In the next section, we discuss whether the identifying assumptions are satisfied in

the context of a government spending shock.

In general, this framework can be used to study the propagation of any shock through systematic

U.S. monetary policy. Our framework permits revisiting a range of important empirical ques-

tions, such as the role of systematic monetary policy for the effects of oil-related shocks (e.g.,

Bernanke et al., 1997; Kilian and Lewis, 2011), technology shocks (e.g., Galí et al., 2003), news

ECB Working Paper Series No 2851

18

shocks (e.g., Barsky and Sims, 2011), fiscal spending shocks (e.g., Ramey and Zubairy, 2018),

and tax shocks (e.g., Romer and Romer, 2010). Moreover, our framework allows the estimation

of a new set of moments that can be used to discipline structural models with time variation

in systematic monetary policy, such as regime-switching models (e.g., Davig and Leeper, 2007;

Bianchi, 2013; Bianchi and Ilut, 2017).

4 Government spending and monetary policy

In this section, we use our identification design to estimate how the effects of U.S. government

spending shocks depend on systematic monetary policy. We find that a hawkish FOMC signif-

icantly dampens the expansionary effects of increased government spending on GDP, while

a dovish FOMC supports it. Relatedly, we find sizeable differences in the fiscal multiplier

depending on the hawkishness or dovishness of the FOMC. We further provide evidence on the

strength of our instrument, and perform an extensive sensitivity analysis considering alternative

Hawk-Dove balances, an alternative spending shock, varying sample periods, and the inclusion

of additional control variables.

4.1 Data and identifying assumptions

We next discuss the data (in addition to Hawk

t

and Hawk

IV

t

) and the identifying assumptions

for our analysis of government spending shocks.

Variables. We first specify the local projection framework (3.4)-(3.5). Our baseline shock of

interest, ε

s

t

in (3.4), is the military spending shock constructed by Ramey (2011) and Ramey

and Zubairy (2018), based on a narrative approach to identify surprise build-ups (or build-

downs) in U.S. military spending. The shock is constructed as the present value of expected

changes in real defense spending over the next years, typically up to a horizon of five years,

and expressed relative to real potential GDP. The two outcome variables of interest, x

t+h

in

(3.4), are real GDP and real government spending, both expressed relative to real potential

GDP.

23

Finally, the vector of control variables, Z

t

in (3.4), includes four lags of real GDP and

real government spending, both relative to potential output and four lags of the fiscal spending

shock. If we restrict γ

h

= δ

h

= 0, our specification of (3.4) corresponds to equation (1) of

Ramey and Zubairy (2018). This facilitates the comparability of our results with the literature.

Sample. Our baseline sample covers the period from 1960Q1 to 2014Q4, which is the longest

possible sample for which the Hawk-Dove balance and the fiscal spending shocks are available.

Our sample includes important military spending shocks, e.g., the Vietnam War, the Carter-

Reagan military buildup, and 9/11. On the other hand, our sample excludes WWII and the

Korean War which are important events in Ramey (2011) and Ramey and Zubairy (2018).

24

In

23

Detrending by potential GDP is the so-called Gordon and Krenn (2010) transformation. Compared to using

log variables, this avoids using an ex-post multiplication with the GDP/G ratio, which substantially varies over

time, to obtain the fiscal spending multiplier.

24

Ramey (2011) shows that excluding the Korean War renders military spending shocks a weak instrument

for contemporaneous government spending. In general, it is not surprising that military spending shocks are a

ECB Working Paper Series No 2851

19

the context of studying the response of monetary policy to fiscal spending shocks, however, it

may be desirable to exclude these events because monetary policy was less autonomous from

fiscal policy prior to the Treasury-Fed Accord in 1951. Between 1942 and 1951, the Fed was

constrained to support government bond prices by pegging short-term interest rates.

Identifying assumptions. Two key identifying assumptions are necessary for the causal

interpretation of the estimates of β

h

and γ

h

in (3.4).

The first assumption is that military spending shocks are random shocks. In particular,

the distribution of military spending shocks does not depend on systematic monetary policy.

According to Ramey and Shapiro (1998) and Ramey and Zubairy (2018), military spending

shocks are unanticipated changes in spending plans triggered by geopolitical events and are

therefore exogenous to the economy. This argument similarly applies when conditioning on

systematic monetary policy. We provide three additional arguments as to why the military

spending shocks are independent of systematic monetary policy: (i) the response of military

spending to the shock does not depend on systematic monetary policy, see Section 5.2; (ii)

the news quotes used to construct military spending shocks as described in the supplementary

appendix to Ramey and Zubairy (2018) do not mention monetary policy, the Federal Reserve,

or the FOMC for our sample; and (iii) the Hawk-Dove balance does not predict future spending

shocks. The specific concern the last point addresses is that military spending shocks might be

timed to episodes with a more dovish FOMC. To test this concern we regress future military

spending shocks on Hawk

t

and use Hawk

IV

t

as an instrument. We find no significant effects of

the Hawk-Dove balance on contemporaneous or future military spending shocks, see Figure G.1

in Appendix H. If anything, we find expansionary shocks when the FOMC is hawkish, inconsis-

tent with the timing hypothesis above.

The second assumption is that the FOMC rotation instrument is orthogonal to other macroe-

conomic shocks at all leads and lags. This is plausible for various reasons as discussed in

Section 3.2. More specifically, given that fluctuations in Hawk

IV

t

are relatively short-lived and

uncorrelated with real GDP growth, it is unlikely that our estimates capture differences in the

response across booms and busts (e.g., Auerbach and Gorodnichenko, 2012; Ramey and Zubairy,

2018). It is similarly unlikely that Hawk

IV

t

correlates with changes in systematic fiscal policy,

which tends to be persistent.

4.2 GDP and government spending

We next present our empirical estimates of the causal effects of systematic monetary policy on

the responses of real GDP and real government spending to fiscal spending shocks. We find

that expansionary spending shocks raise GDP significantly more strongly when the FOMC is

more dovish.

Baseline IV estimates. Figure 3 shows the responses of real GDP and real government

spending (G) to a military spending shock conditional on systematic monetary policy (Hawk

t

).

weak instrument for contemporaneous government spending because the shocks largely pertain to future spending.

Therefore, we do not use military spending shocks as an instrument but as shocks in our local projection framework

(3.4) and find a significant dynamic government spending response, see Section 4.2.

ECB Working Paper Series No 2851

20

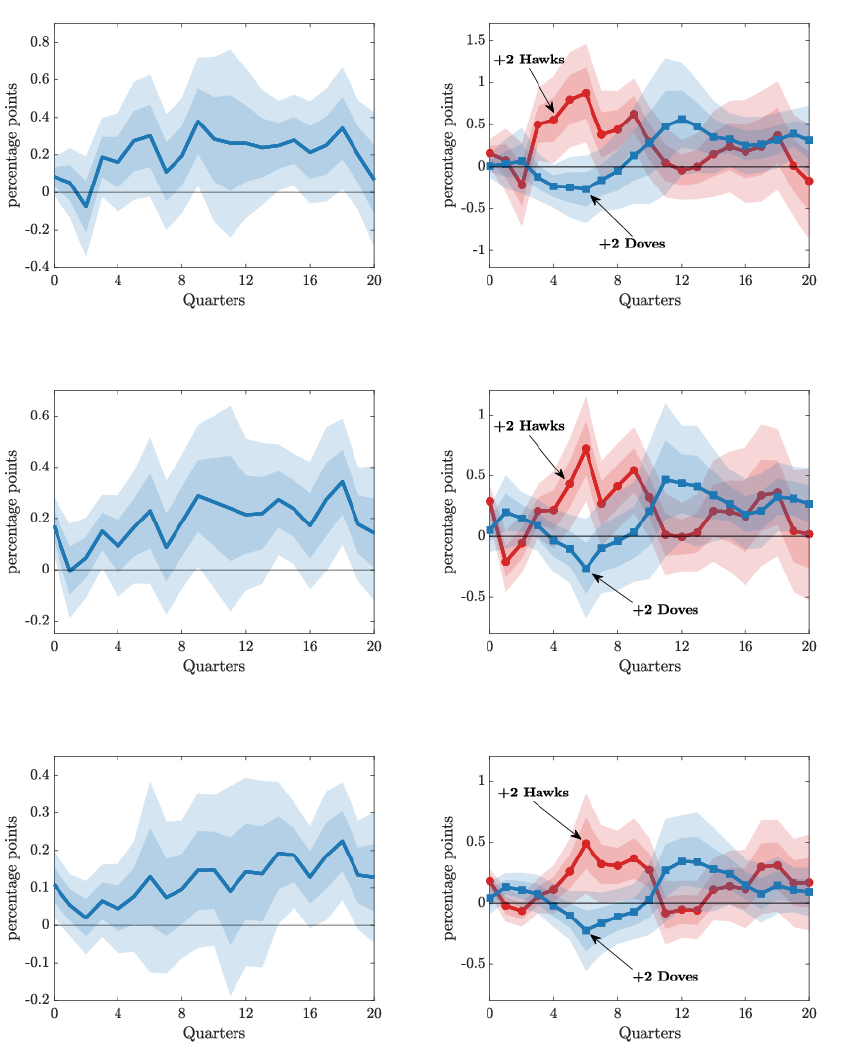

Figure 3: Responses to spending shocks conditional on monetary policy

(a) Average GDP (β

h

) (b) Average G (β

h

)

(c) Differential GDP (γ

h

) (d) Differential G (γ

h

)

(e) State-dependent GDP (β

h

± γ

h

) (f) State-dependent G (β

h

± γ

h

)

Notes: The figure shows responses of real GDP and real government spending (G) to an expansionary military spending

shock, corresponding to one percent of GDP, conditional on systematic monetary policy (Hawk

t

). We show IV estimates

based on the local projection framework (3.4)-(3.5) as specified in Section 4.1. The β

h

captures the responses when Hawk

t

equals its sample average. The γ

h

captures the differential responses when Hawk

t

exceeds the sample average by two

hawks. The β

h

± γ

h

shows the state-dependent responses when Hawk

t

exceeds the sample average either by two hawks

(+2 Hawks) or by two doves (+2 Doves). The shaded areas indicate 68% and 95% confidence bands using Newey-West

standard errors.

The estimates are based on the local projection framework (3.4)-(3.5) as specified in Section 4.1.

The solid lines show the point estimates and the shaded areas indicate 68% and 95% confidence

ECB Working Paper Series No 2851

21

bands using Newey-West standard errors.

25

All estimates of β

h

and γ

h

are normalized to

correspond to an expansionary shock that raises the expected present discounted value of future

military spending by one percent of GDP.

26

Panels (a) and (b) show the IV estimates of β

h

for GDP and G, which capture the responses

when Hawk

t

equals its sample average. The average responses of both GDP and G are positive

and significantly different from zero at most horizons beyond the first year. Both responses

build up gradually and exceed 0.15% for GDP and 0.11% for G after one year.

Panels (c) and (d) show the estimates of γ

h

, which capture the differential responses of GDP

and G when the FOMC exceeds the average Hawk-Dove balance by two hawks. Specifically, γ

h

is scaled to capture an increase in (Hawk

t

− Hawk) of 2/12. This means, for example, that

two FOMC members with unknown preferences are replaced by two consistent hawks, or that

two FOMC members swing from dovish to hawkish. An increase in Hawk

t

by 2/12 exceeds

one standard deviation of the change in Hawk

t

which is 0.15. Importantly, the GDP response

is lower after a fiscal expansion when the FOMC is more hawkish. This effect is statistically

significant at the 5% level until three years after the shock. The estimated magnitudes are

sizeable. Between two and three years after the shock the GDP response is more than 0.4%

lower under a more hawkish FOMC. Conversely, the GDP response is 0.4% higher when there

are two more doves in the FOMC. The differential response of government spending (G) is also

negative at horizons until three years after the shock, albeit smaller in absolute terms and less

significant. In Section 5.2, we show that the differential G response is driven by non-military

spending, whereas we find no meaningful differential effect for military spending.

Panels (e) and (f) of Figure 3 show β

h

± γ

h

, the state-dependent responses when Hawk

t

exceeds the sample average either by two hawks (+2 Hawks) or by two doves (+2 Doves). The

GDP response strongly varies between the dovish and the hawkish FOMC. The dovish FOMC

supports the GDP expansion while the hawkish FOMC undoes the GDP expansion. Quantita-

tively, GDP increases by up to 0.68% under the dovish FOMC, but falls by up to 0.35% under

the hawkish FOMC. The former response is highly statistically significant, whereas the latter

response is less precisely estimated.

Overall, our evidence suggests that monetary offset of fiscal spending shocks is not a constant

feature of monetary policy but varies strongly with the Hawk-Dove balance in the FOMC.

In contrast to the GDP response, government spending displays smaller and less significant

differences in the state-dependent responses.

Comparison with OLS. We compare our IV estimates presented above with the OLS coun-

terparts. Figure 4 shows the OLS and IV estimates of cumulative GDP responses to a military

shock as a function of the FOMC’s Hawk-Dove balance. At horizons of around one year, the

OLS estimates substantially understate the dependence of the GDP response on the Hawk-Dove

balance. In contrast, at long horizons of around four years, the OLS bias seems negligible.

27

25

For the Newey-West standard errors, we set the bandwidth to h + 1, where h is the horizon in (3.4). A

truncation parameter rule (Lazarus et al., 2018) or automatic bandwidth selection leads to similar results.

26

Normalizing the responses to a shock size of 1% of GDP approximately normalizes to one standard deviation

of the shock series, which is 1.17% of GDP.

27

Figure G.3 in the Appendix presents the cumulated responses at intermediate horizons of two and three

years. Figure G.2 presents the OLS estimates of β

h

and γ

h

.

ECB Working Paper Series No 2851

22

Figure 4: Cumulative GDP responses for OLS and IV

(a) 1-year response (b) 4-year response

Notes: The figure shows the cumulative real GDP response to an expansionary military spending shock, corresponding to

one percent of GDP, conditional on systematic monetary policy (Hawk

t

). We show IV and OLS estimates based on the

local projection framework (3.4)-(3.5) as specified in Section 4.1. The displayed estimates are computed as

P

H

h=0

[β

h

+

γ

h

(Hawk

t

− Hawk

t

)] for H = 4 quarters (Panel a) and H = 16 quarters (Panel b).