Record Keeping 101

Small and Beginning Farmers Workshop

Milledgeville, GA

February 2014

Ag & Applied Economics

Ag & Applied Economics

Overview of Today

• Why keep records

• Production records

• Financial records

–Five easy steps to record keeping

• Schedule F

• Essentials of good records

Ag & Applied Economics

Why Keep Records?

• Record keeping is an important activity for ag

enterprises of any type or size

• Business records may be required for tax

purposes, to qualify for government assistance

programs, loans or leases

• A good set of records can help you make better

business decisions by providing real data about

past performance that helps you to more

accurately predict future trends

Ag & Applied Economics

Top 3 Reasons for Not Keeping

Records

Are these thoughts that you’ve had?

1) I don’t have time

2) I’m not that organized

3) I consume everything I grow/raise

Ag & Applied Economics

Using Your Records

• Taxes: records provide the documentation

needed to deduct the production costs

• Government Programs: records are required for

participation

• Loans/credit: financial records are required to obtain

loans or other forms of credit

• Leasing agreements: production and financial records

required in order to lease or buy additional land

• Farm management and planning: records help you

make informed management decisions and future plans

Ag & Applied Economics

Business activities that require

business records

– Crop insurance claims

– Product marketing strategy

– Commercial bank loan

– Enterprise feasibility decisions

– Federal income tax filing

– Farm revenue insurance claims

– Production technique comparisons

– Strategic Planning

Ag & Applied Economics

How Much is Enough?

You want to end up with a set of records that:

• Fits your operation

• Is easy to maintain

• Provides the information you need

to make good decisions for your

operation

“Everything that can be counted doesn’t

necessarily count; everything that counts

cannot necessarily be counted.” - Einstein

Ag & Applied Economics

Getting Started

Make record keeping a habit that is part of your

daily, weekly, and monthly activities:

– Write down events when they happen

– Keep receipts

– Organized on schedule; weekly or monthly

Ag & Applied Economics

Beyond Receipts:

Keeping Production Records

More than keeping your receipts in labeled envelopes or

files, using additional forms to organize and track the

information is where the real value of records is found

Ag & Applied Economics

Keeping Production Records

• Track details of day-to-day production such as

inventories, inputs consumed and products sold

• Track the number of animals in a herd,

acres planted of a specific crop, crop

yields or amount of product produced

• Track amount of inputs used to raise your crops

or animals to help track input consumption and

expenses, and anticipate future input needs

Ag & Applied Economics

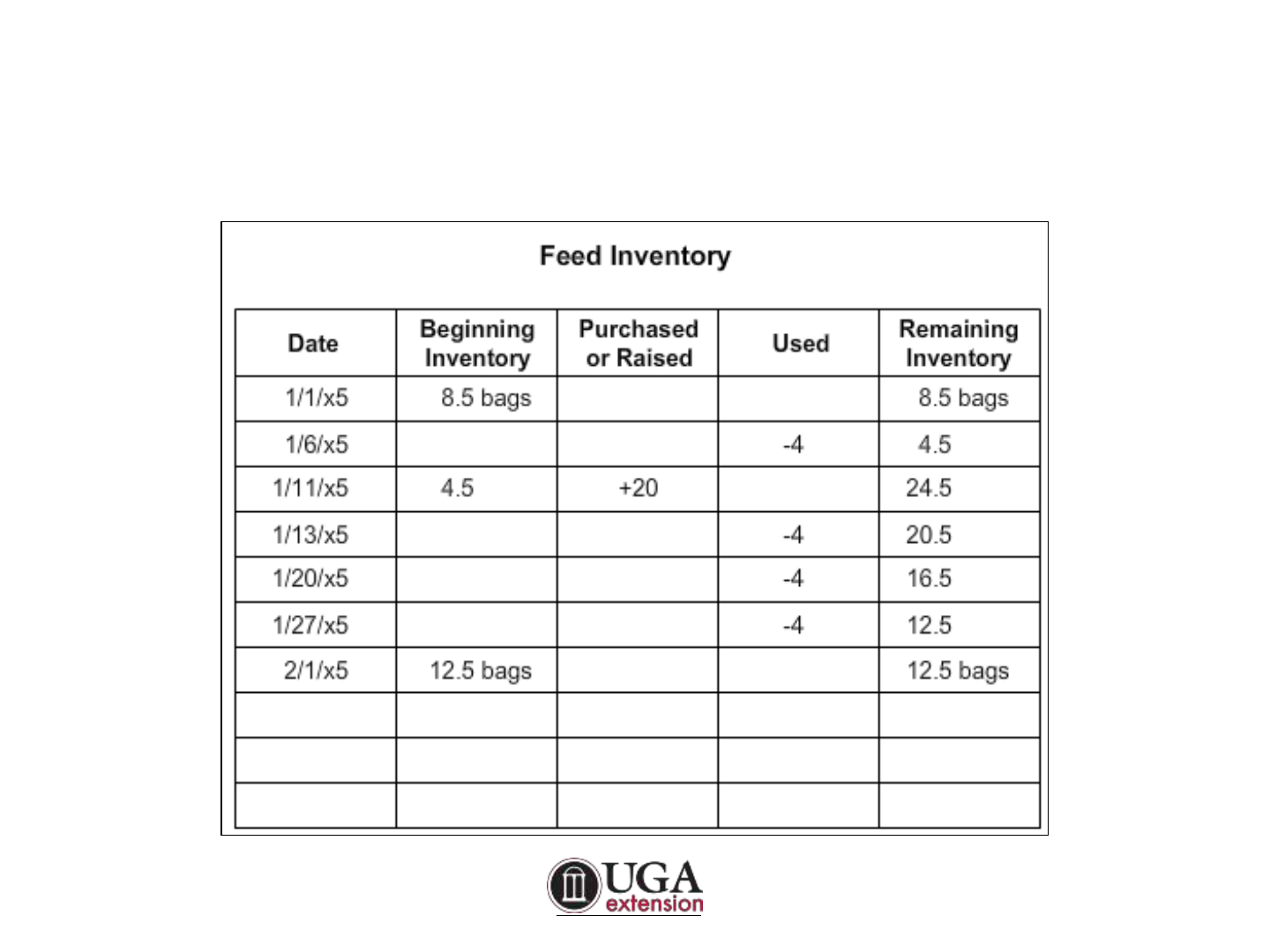

Recording Inventories

Ag & Applied Economics

Another Type of Inventory

Ag & Applied Economics

Another Type of Inventory (cont.)

Ag & Applied Economics

Input Records

Ag & Applied Economics

Benefits of Production Records

• A good set of production records can help you

make more informed management decisions

for your operation

• These records can help you to decide:

– How many acres of a crop to plant

– Which animals to keep for breeding stock

– How many breeding animals are needed

– The amount of inputs to have on hand

Ag & Applied Economics

Financial Records

Financial records help answer questions like:

– Am I making money?

– Where is the money going?

– Do I have money right now?

– What is my income tax liability?

– Will I have to borrow money?

Ag & Applied Economics

Three Related Forms

There are three key financial forms that every

operation should complete:

1) Expense and Income Statement

2) Monthly Financial Record

3) Annual Financial Summary

Ag & Applied Economics

Basic Record Keeping: 5 Easy Steps

Step 1: Keep all income and expense receipts

Step 2: Record business transactions

Step 3: Transfer entries into Monthly Ledger

Step 4: Estimate farm profit or loss

Step 5: Enterprise analysis

Ag & Applied Economics

Step 1: Keep All Income and Expense Receipts

• Save documentation of income and expenses

– Ex: sales receipts, cash register tapes, check records,

credit card receipts and statements

• Sort the income and expense documents by:

– Crop or livestock enterprise, income or expense type

• This will provide valuable information for:

– Estimating the profitability of each enterprise

– Comparing competing enterprises

– Calculating breakeven market prices or yields

– Comparing different production techniques

Ag & Applied Economics

Save Your Receipts

• Use envelopes or folders labeled for your key

income and expense categories

– Crop sales

– Livestock sales

– Seed

– Fertilizer

– Fuel

– Feed

– Veterinarian

– Etc.

Ag & Applied Economics

Step 2: Record Business Transactions

• Not all journals separate transactions by

enterprise

• Doing this can provide information to you in a

way that will help you make better

management decisions

• For transactions associated with two or more

enterprises, do your best to allocate the

income or cost to the appropriate enterprises

Ag & Applied Economics

Mixed Receipts

When sorting by enterprise, you may encounter

mixed receipts

• There are three types of mixed

receipts

1) No specific enterprise

2) Multiple enterprise

3) Farm and household

Ag & Applied Economics

Transfer Data From Production

Records

$600

Steer Sales

1007

$1.20/lb

Ag & Applied Economics

Step 3: Transfer Entries into Monthly

Ledger

The monthly ledger sums all the income and

expenses by account for each month:

– List your income and expense categories

– Add up the journal entries by account

each month

– Record the totals in the monthly ledger

Ag & Applied Economics

Transfer Expenses and Income to

Monthly Records

$3,064

Ag & Applied Economics

Step 4: Estimate Farm Profit or Loss

• The income statement:

– All income is summed on the left

– Expenses are totaled on the right

• Provides an estimate of the profitability of the

farming business over the last year

• Obtaining the largest net farm income possible is the

primary goal of most farmers

• To achieve this goal, you must select profitable crop

and livestock enterprises

Ag & Applied Economics

Annual Financial Summary

500

3,064

3,064

$3,564

$1,500

$2,064

Ag & Applied Economics

Step 5: Enterprise Analysis

• Estimate profitability of each individual crop or

livestock enterprise through an enterprise analysis

• Use only those income and expenses associated with

the specific crop or livestock enterprise

• Total income minus total expenses equals an estimate

of the enterprise's profit or loss

• Performed on a yearly basis so you can keep track of

which enterprises are profitable and which are not

Ag & Applied Economics

More Financial Analysis

Start with these steps, but work to advance to

preparing financial statements including:

– Cash flow statement

– Balance sheet

– Income statement

– Statement of owner equity

Ag & Applied Economics

Using Financial Reports

• You will begin to identify financial trends as

you develop financial records over a few years

• The trends may answer key questions about

the management of your operation

Ag & Applied Economics

An Alternative System

$385.00

$200.00

$200.00

$1,464.00

& sows

8

Ag & Applied Economics

Advantages of the Two-Sided System

• Receipts for transactions involving more than

one of your sorting categories can be easily

handled

• Accounts can be doubled-checked for

accuracy by ensuring the total from the left

side agrees with the total of all the entries

made on the right side of the form

Ag & Applied Economics

Schedule F

What is a Schedule F?

• Schedule F is the IRS form for farmers to report

income and deductible expenses for their farming

operation

• The IRS defines a farmer as “A person who

cultivates, operates or manages a farm for profit.”

• A farm includes stock, dairy, poultry, bee, fruit, or

truck farms and plantations, ranches, nurseries,

ranges, orchards and oyster beds

Ag & Applied Economics

Transferring Income to the Schedule F?

You may need to refer to the prior year’s income

statement for some information, such as the

price of items purchased for resale

Ag & Applied Economics

Reporting Farm Expenses

• Each type of expense has a specific line on the

form where you report it

• Expenses from all categories are totaled at the

bottom of the expenses portion of the form

Ag & Applied Economics

Schedule SE

• Farm profits and other self-employment income are

multiplied by 92.35% to determine net earnings

• Net earnings are multiplied by the current SE tax rate to

determine the taxes owed

• When a farm operates at a loss, has expenses that

exceed income, or has net earnings amounting to less

than $400, no self-employment tax is owed for that year

• The IRS allows the self-employed to record SE taxes as

an adjustment to total income on the Form 1040

Ag & Applied Economics

Schedule F: Non-Tax Advantages

A Schedule F may

− Enhance one’s ability to prove land is used for ag, which

generally has lower property tax rates

− Enable participation in some gov’t programs through

NRCS and FSA

− Be required to purchase certain crop insurance products

− Be required to obtain payments when gov’t declares a

disaster area caused by drought or other weather event

− Strengthen an application for a farm-related loan

Ag & Applied Economics

• A good set of detailed records:

– Is worth the effort, time and cost

– Enables you to make better management decisions

– Separates personal and business finances

– Makes tax preparation easier and more accurate

• Essential aspects of good record keeping systems

– Accuracy, completeness, arrangement, permanency,

neatness, legibility, simplicity, and consistency

Essentials of Good Records

Ag & Applied Economics

Hand vs Computerized System

• To establish a good set of usable records, you

will need to determine whether to keep them

by hand or use a computerized system

• There are advantages and disadvantages to

both

Ag & Applied Economics

Evaluating Computer Software

Before deciding which software to purchase, ask

yourself these questions

– How easy is the program to use?

– Who will input the data?

– What support is available?

– What output and output formats can be

generated?

– Will the output meet the needs of all users?

Ag & Applied Economics

The foundation of good record keeping

is putting information together in a way

that supports sound management

decisions.

This will improve not only your business

but also help you achieve your personal

goals as well.

Thank you

Ag & Applied Economics