DISTRIBUTOR SETTLEMENT

AGREEMENT

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

i

Table of Contents

Page

I. Definitions............................................................................................................................1

II. Participation by States and Condition to Preliminary Agreement .....................................13

III. Injunctive Relief .................................................................................................................13

IV. Settlement Payments ..........................................................................................................13

V. Allocation and Use of Settlement Payments ......................................................................28

VI. Enforcement .......................................................................................................................34

VII. Participation by Subdivisions ............................................................................................40

VIII. Condition to Effectiveness of Agreement and Filing of Consent Judgment .....................42

IX. Additional Restitution ........................................................................................................44

X. Plaintiffs’ Attorneys’ Fees and Costs ................................................................................44

XI. Release ...............................................................................................................................44

XII. Later Litigating Subdivisions .............................................................................................49

XIII. Reductions/Offsets .............................................................................................................53

XIV. Miscellaneous ....................................................................................................................54

EXHIBIT A Alleged Harms ....................................................................................................... A-1

EXHIBIT B Enforcement Committee Organizational Bylaws ................................................... B-1

EXHIBIT C Litigating Subdivisions List ................................................................................... C-1

EXHIBIT D Later Litigating Subdivision Suspension and Offset Determinations .................... D-1

EXHIBIT E List of Opioid Remediation Uses ........................................................................... E-1

EXHIBIT F List of States and Overall Allocation Percentages .................................................. F-1

EXHIBIT G Subdivisions Eligible to Receive Direct Allocations from the Subdivision

Fund and Default Subdivision Fund Allocation Percentages ................................ G-1

EXHIBIT H Participation Tier Determination

1

.......................................................................... H-1

EXHIBIT I Primary Subdivisions ................................................................................................. I-1

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

ii

EXHIBIT J Settling Distributors’ Subsidiaries, Joint Ventures, and Predecessor Entities ......... J-1

EXHIBIT K Subdivision Settlement Participation Form ........................................................... K-1

EXHIBIT L Settlement Fund Administrator .............................................................................. L-1

EXHIBIT M Settlement Payment Schedule .............................................................................. M-1

EXHIBIT N Additional Restitution Amount Allocation ............................................................ N-1

EXHIBIT O Adoption of a State-Subdivision Agreement ......................................................... O-1

EXHIBIT P Injunctive Relief ...................................................................................................... P-1

EXHIBIT Q Illustrative Examples of Prepayments .................................................................... Q-1

EXHIBIT R Agreement on Attorneys’ Fees, Expenses and Costs ............................................. R-1

EXHIBIT S Agreement on the State Outside Counsel Fee Fund ................................................ S-1

EXHIBIT T Agreement on the State Cost Fund Administration ................................................ T-1

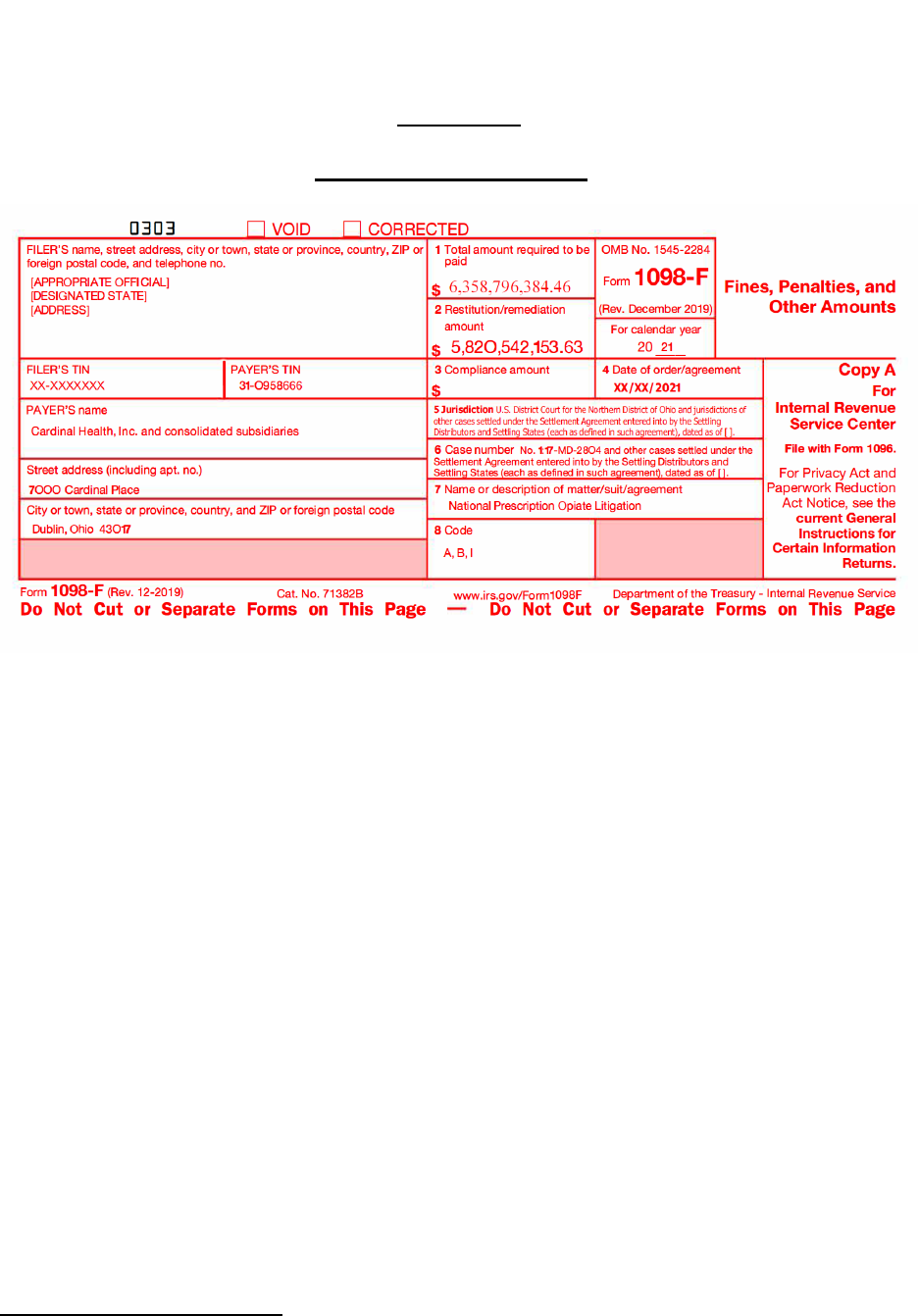

EXHIBIT U ABC IRS Form 1098-F .......................................................................................... U-1

EXHIBIT V Cardinal IRS Form 1098-F .................................................................................... V-1

EXHIBIT W McKesson IRS Form 1098-F ............................................................................... W-1

EXHIBIT X Severity Factors ...................................................................................................... X-1

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

1

DISTRIBUTOR SETTLEMENT AGREEMENT

This Settlement Agreement, dated as of July 21, 2021 (the “Agreement”), sets forth the terms of

settlement between and among the Settling States, the Settling Distributors, and the Participating

Subdivisions (as those terms are defined below). Upon satisfaction of the conditions set forth in

Section II and Section VIII, this Agreement will be binding on all Settling States, Settling

Distributors, and Participating Subdivisions. This Agreement will then be filed as part of

Consent Judgments in the respective courts of each of the Settling States, pursuant to the terms

set forth in Section VIII.

I. Definitions

For all sections of this Agreement except Exhibit E and Exhibit P, the following

definitions apply:

A. “Abatement Accounts Fund.” The component of the Settlement Fund

described in Section V.E.

B. “Additional Restitution Amount.” The amount available to Settling States

listed on Exhibit N totaling $282,692,307.70.

C. “Agreement.” This agreement, as set forth above. For the avoidance of doubt,

this Agreement is inclusive of all exhibits.

D. “Alleged Harms.” The alleged past, present, and future financial, societal, and

public nuisance harms and related expenditures arising out of the alleged misuse and abuse of

Products, non-exclusive examples of which are described in the documents listed on Exhibit A,

that have allegedly arisen as a result of the physical and bodily injuries sustained by individuals

suffering from opioid-related addiction, abuse, death, and other related diseases and disorders,

and that have allegedly been caused by the Settling Distributors.

E. “Allocation Statute.” A state law that governs allocation, distribution, and/or

use of some or all of the Settlement Fund amounts allocated to that State and/or its Subdivisions.

In addition to modifying the allocation set forth in Section V.D.2, an Allocation Statute may,

without limitation, contain a Statutory Trust, further restrict expenditures of funds, form an

advisory committee, establish oversight and reporting requirements, or address other default

provisions and other matters related to the funds. An Allocation Statute is not required to

address all three (3) types of funds comprising the Settlement Fund or all default provisions.

F. “Annual Payment.” The total amount payable to the Settlement Fund

Administrator by the Settling Distributors on the Payment Date each year, as calculated by the

Settlement Fund Administrator pursuant to Section IV.B.1.e. For the avoidance of doubt, this

term does not include the Additional Restitution Amount or amounts paid pursuant to Section X.

G. “Appropriate Official.” As defined in Section XIV.F.3.

H. “Bankruptcy Code.” Title 11 of the United States Code, 11 U.S.C. § 101, et

seq.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

2

I. “Bar.” Either: (1) a law barring Subdivisions in a State from maintaining

Released Claims against Released Entities (either through a direct bar or through a grant of

authority to release claims and the exercise of such authority in full) or (2) a ruling by the highest

court of the State (or, in a State with a single intermediate court of appeals, the intermediate

court of appeals when not subject to further review by the highest court of the State) setting forth

the general principle that Subdivisions in the State may not maintain any Released Claims

against Released Entities, whether on the ground of this Agreement (or the release in it) or

otherwise. For the avoidance of doubt, a law or ruling that is conditioned or predicated upon

payment by a Released Entity (apart from the Annual Payments by Settling Distributors under

this Agreement) shall not constitute a Bar.

J. “Case-Specific Resolution.” Either: (1) a law barring the Subdivision at issue

from maintaining any Released Claims against any Released Entities (either through a direct bar

or through a grant of authority to release claims and the exercise of such authority in full); or (2)

a ruling by a court of competent jurisdiction over the Subdivision at issue that the Subdivision

may not maintain any Released Claims at issue against any Released Entities, whether on the

ground of this Agreement (or the release in it) or otherwise. For the avoidance of doubt, a law or

ruling that is conditioned or predicated upon payment by a Released Entity (apart from the

Annual Payments by Settling Distributors under this Agreement) shall not constitute a Case-

Specific Resolution.

K. “Claim.” Any past, present or future cause of action, claim for relief, cross-

claim or counterclaim, theory of liability, demand, derivative claim, request, assessment, charge,

covenant, damage, debt, lien, loss, penalty, judgment, right, obligation, dispute, suit, contract,

controversy, agreement, parens patriae claim, promise, performance, warranty, omission, or

grievance of any nature whatsoever, whether legal, equitable, statutory, regulatory or

administrative, whether arising under federal, state or local common law, statute, regulation,

guidance, ordinance or principles of equity, whether filed or unfiled, whether asserted or

unasserted, whether known or unknown, whether accrued or unaccrued, whether foreseen,

unforeseen or unforeseeable, whether discovered or undiscovered, whether suspected or

unsuspected, whether fixed or contingent, and whether existing or hereafter arising, in all such

cases, including, but not limited to, any request for declaratory, injunctive, or equitable relief,

compensatory, punitive, or statutory damages, absolute liability, strict liability, restitution,

abatement, subrogation, contribution, indemnity, apportionment, disgorgement, reimbursement,

attorney fees, expert fees, consultant fees, fines, penalties, expenses, costs or any other legal,

equitable, civil, administrative, or regulatory remedy whatsoever.

L. “Claim-Over.” A Claim asserted by a Non-Released Entity against a Released

Entity on the basis of contribution, indemnity, or other claim-over on any theory relating to a

Non-Party Covered Conduct Claim asserted by a Releasor.

M. “Compensatory Restitution Amount.” The aggregate amount paid or incurred

by the Settling Distributors hereunder other than amounts paid as attorneys’ fees and costs or

identified pursuant to Section V.B.2 as being used to pay attorneys’ fees, investigation costs or

litigation costs.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

3

N. “Consent Judgment.” A state-specific consent judgment in a form to be

agreed by the Settling States and the Settling Distributors prior to the Initial Participation Date

that, among other things, (1) approves this Agreement and (2) provides for the release set forth in

Section XI.A, including the dismissal with prejudice of any Released Claims that the Settling

State has brought against Released Entities.

O. “Covered Conduct.” Any actual or alleged act, failure to act, negligence,

statement, error, omission, breach of any duty, conduct, event, transaction, agreement,

misstatement, misleading statement or other activity of any kind whatsoever from the beginning

of time through the Reference Date (and any past, present, or future consequence of any such act,

failure to act, negligence, statement, error, omission, breach of duty, conduct, event, transaction,

agreement, misstatement, misleading statement or other activity) relating in any way to (1) the

discovery, development, manufacture, packaging, repackaging, marketing, promotion,

advertising, labeling, recall, withdrawal, distribution, delivery, monitoring, reporting, supply,

sale, prescribing, dispensing, physical security, warehousing, use or abuse of, or operating

procedures relating to, any Product, or any system, plan, policy or advocacy relating to any

Product or class of Products, including, but not limited to, any unbranded promotion, marketing,

programs, or campaigns relating to any Product or class of Products; (2) the characteristics,

properties, risks, or benefits of any Product; (3) the reporting, disclosure, non-reporting or non-

disclosure to federal, state or other regulators of orders placed with any Released Entity; or (4)

diversion control programs or suspicious order monitoring; provided, however, that as to any

Claim that a Releasor has brought or could bring, Covered Conduct does not include non-

compliance with statutory or administrative supply security standards concerning cleanliness of

facilities or stopping counterfeit products, so long as such standards apply to the storage and

distribution of both controlled and non-controlled pharmaceuticals.

P. “Designated State.” New York.

Q. “Effective Date.” The date sixty (60) calendar days after the Reference Date.

R. “Enforcement Committee.” A committee consisting of representatives of the

Settling States and of the Participating Subdivisions. Exhibit B contains the organizational

bylaws of the Enforcement Committee. Notice pursuant to Section XIV.Q shall be provided

when there are changes in membership or contact information.

S. “Final Order.” An order or judgment of a court of competent jurisdiction

with respect to the applicable subject matter (1) which has not been reversed or superseded by a

modified or amended order, is not currently stayed, and as to which any right to appeal or seek

certiorari, review, reargument, stay, or rehearing has expired, and as to which no appeal or

petition for certiorari, review, reargument, stay, or rehearing is pending, or (2) as to which an

appeal has been taken or petition for certiorari, review, reargument, stay, or rehearing has been

filed and (a) such appeal or petition for certiorari, review, reargument, stay, or rehearing has

been resolved by the highest court to which the order or judgment was appealed or from which

certiorari, review, reargument, stay, or rehearing was sought, or (b) the time to appeal further or

seek certiorari, review, reargument, stay, or rehearing has expired and no such further appeal or

petition for certiorari, review, reargument, stay, or rehearing is pending.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

4

T. “Global Settlement Abatement Amount.” The abatement amount of

$19,045,384,616.

U. “Global Settlement Amount.” The Global Settlement Amount is $21 billion,

which shall be divided into the Global Settlement Abatement Amount, the Additional Restitution

Amount, and the Global Settlement Attorney Fee Amount.

V. “Global Settlement Attorney Fee Amount.” The attorney fee amount of

$1,671,923,077.

W. “Incentive Payment A.” The incentive payment described in Section IV.F.1.

X. “Incentive Payment B.” The incentive payment described in Section IV.F.2.

Y. “Incentive Payment C.” The incentive payment described in Section IV.F.3.

Z. “Incentive Payment D.” The incentive payment described in Section IV.F.4.

AA. “Incentive Payment Final Eligibility Date.” With respect to a Settling State,

the date that is the earlier of (1) the fifth Payment Date, (2) the date of completion of opening

statements in a trial of any action brought by a Subdivision in that State that includes a Released

Claim against a Released Entity when such date is more than two (2) years after the Effective

Date, or (3) two (2) years after the Effective Date in the event a trial of an action brought by a

Subdivision in that State that includes a Released Claim against a Released Entity began after the

Initial Participation Date but before two (2) years after the Effective Date.

BB. “Initial Participating Subdivision.” A Subdivision that meets the

requirements set forth in Section VII.D.

CC. “Initial Participation Date.” January 26, 2022, as extended by written

agreement of the Settling Distributors and the Enforcement Committee on December 22, 2021.

DD. “Injunctive Relief Terms.” The terms described in Section III and set forth in

Exhibit P.

EE. “Later Litigating Subdivision.” A Subdivision (or Subdivision official

asserting the right of or for the Subdivision to recover for alleged harms to the Subdivision

and/or the people thereof) that: (1) first files a lawsuit bringing a Released Claim against a

Released Entity after the Trigger Date; or (2) adds a Released Claim against a Released Entity

after the Trigger Date to a lawsuit brought before the Trigger Date that, prior to the Trigger Date,

did not include any Released Claims against a Released Entity; or (3) (a) was a Litigating

Subdivision whose Released Claims against Released Entities were resolved by a legislative Bar

or legislative Case-Specific Resolution as of the Trigger Date, (b) such legislative Bar or

legislative Case-Specific Resolution is subject to a Revocation Event after the Trigger Date, and

(c) the earlier of the date of completion of opening statements in a trial in an action brought by a

Subdivision in that State that includes a Released Claim against a Released Entity or one

hundred eighty (180) days from the Revocation Event passes without a Bar or Case-Specific

Resolution being implemented as to that Litigating Subdivision or the Litigating Subdivision’s

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

5

Released Claims being dismissed; or (4) (a) was a Litigating Subdivision whose Released Claims

against Released Entities were resolved by a judicial Bar or judicial Case-Specific Resolution as

of the Trigger Date, (b) such judicial Bar or judicial Case-Specific Resolution is subject to a

Revocation Event after the Trigger Date, and (c) such Litigating Subdivision takes any action in

its lawsuit asserting a Released Claim against a Released Entity other than seeking a stay or

dismissal.

FF. “Later Participating Subdivision.” A Participating Subdivision that is not an

Initial Participating Subdivision, but meets the requirements set forth in Section VII.E.

GG. “Litigating Subdivision.” A Subdivision (or Subdivision official) that brought

any Released Claim against any Released Entity prior to the Trigger Date; provided, however,

that a Subdivision (or Subdivision official) that is a Prior Litigating Subdivision shall not be

considered a Litigating Subdivision. Exhibit C is an agreed list of all Litigating Subdivisions.

Exhibit C will be updated (including with any corrections) periodically, and a final version of

Exhibit C will be attached hereto as of the Reference Date.

HH. “National Arbitration Panel.” The panel comprised as described in Section

VI.F.2.b.

II. “National Disputes.” As defined in Section VI.F.2.a.

JJ. “Net Abatement Amount.” The Global Settlement Abatement Amount as

reduced by the Tribal/W. Va. Subdivision Credit.

KK. “Net Settlement Prepayment Amount.” As defined in Section IV.J.1.

LL. “Non-Litigating Subdivision.” Any Subdivision that is neither a Litigating

Subdivision nor a Later Litigating Subdivision.

MM. “Non-Participating Subdivision.” Any Subdivision that is not a Participating

Subdivision.

NN. “Non-Party Covered Conduct Claim.” A Claim against any Non-Released

Entity involving, arising out of, or related to Covered Conduct (or conduct that would be

Covered Conduct if engaged in by a Released Entity).

OO. “Non-Party Settlement.” A settlement by any Releasor that settles any Non-

Party Covered Conduct Claim and includes a release of any Non-Released Entity.

PP. “Non-Released Entity.” An entity that is not a Released Entity.

QQ. “Non-Settling State.” Any State that is not a Settling State.

RR. “Offset Cap.” The per-State dollar amount which the dollar-for-dollar offset

described in Section XII.A cannot exceed in a Payment Year, to be calculated by multiplying the

amount of the relevant Annual Payment apportioned to the State and to its Subdivisions for that

Payment Year by the percentage for the applicable Participation Tier as set forth in Exhibit D.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

6

SS. “Opioid Remediation.” Care, treatment, and other programs and expenditures

(including reimbursement for past such programs or expenditures

1

except where this Agreement

restricts the use of funds solely to future Opioid Remediation) designed to (1) address the misuse

and abuse of opioid products, (2) treat or mitigate opioid use or related disorders, or (3) mitigate

other alleged effects of, including on those injured as a result of, the opioid epidemic. Exhibit E

provides a non-exhaustive list of expenditures that qualify as being paid for Opioid Remediation.

Qualifying expenditures may include reasonable related administrative expenses.

TT. “Opioid Tax.” Any tax, assessment, license fee, surcharge or any other fee (other

than a fixed prospective excise tax or similar tax or fee that has no restriction on pass-through)

imposed by a State on a Settling Distributor on the sale, transfer or distribution of opioid

products; provided, however, that neither the Excise Tax on sale of Opioids, Article 20-D of New

York’s Tax Law nor the Opioid Stewardship Act, Article 33, Title 2-A of New York’s Public

Health Law shall be considered an Opioid Tax for purposes of this Agreement.

UU. “Overall Allocation Percentage.” A Settling State’s percentage as set forth in

Exhibit F. The aggregate Overall Allocation Percentages of all States (including Settling States

and Non-Settling States) shall equal one hundred percent (100%).

VV. “Participating Subdivision.” Any Subdivision that meets the requirements for

becoming a Participating Subdivision under Section VII.B and Section VII.C. Participating

Subdivisions include both Initial Participating Subdivisions and Later Participating Subdivisions.

WW. “Participation Tier.” The level of participation in this Agreement as

determined pursuant to Section VIII.C using the criteria set forth in Exhibit H.

XX. “Parties.” The Settling Distributors and the Settling States (each, a “Party”).

YY. “Payment Date.” The date on which the Settling Distributors make the

Annual Payment pursuant to Section IV.B.

ZZ. “Payment Year.” The calendar year during which the applicable Annual

Payment is due pursuant to Section IV.B. Payment Year 1 is 2021, Payment Year 2 is 2022 and

so forth. References to payment “for a Payment Year” mean the Annual Payment due during

that year. References to eligibility “for a Payment Year” mean eligibility in connection with the

Annual Payment due during that year.

AAA. “Preliminary Agreement Date.” The date on which the Settling Distributors

are to inform the Settling States of their determination whether the condition in Section II.B has

been satisfied. The Preliminary Agreement Date shall be no more than fourteen (14) calendar

days after the end of the notice period to States, unless it is extended by written agreement of the

Settling Distributors and the Enforcement Committee.

BBB. “Prepayment Notice.” As defined in Section IV.J.1.

1

Reimbursement includes amounts paid to any governmental entities for past expenditures or programs.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

7

CCC. “Primary Subdivision.” A Subdivision that is a General Purpose Government

(including, but not limited to, a municipality, county, county subdivision, city, town, township,

parish, village, borough, gore, or any other entities that provide municipal-type government) with

population over 10,000; provided, however, that as used in connection with Incentive Payment

C, the population threshold is 30,000. Attached as Exhibit I is an agreed list of the Primary

Subdivisions in each State.

DDD. “Prior Litigating Subdivision” A Subdivision (or Subdivision official) that

brought any Released Claim against any Released Entity prior to the Trigger Date and all such

Released Claims were separately settled or finally adjudicated prior to the Trigger Date;

provided, however, that if the final adjudication was pursuant to a Bar, such Subdivision shall not

be considered a Prior Litigating Subdivision. Notwithstanding the prior sentence, the Settling

Distributors and the Settling State of the relevant Subdivision may agree in writing that the

Subdivision shall not be considered a Prior Litigating Subdivision.

EEE. “Product.” Any chemical substance, whether used for medicinal or non-

medicinal purposes, and whether natural, synthetic, or semi-synthetic, or any finished

pharmaceutical product made from or with such substance, that is: (1) an opioid or opiate, as

well as any product containing any such substance; or (2) benzodiazepine, carisoprodol, or

gabapentin; or (3) a combination or “cocktail” of chemical substances prescribed, sold, bought,

or dispensed to be used together that includes opioids or opiates. “Product” shall include, but is

not limited to, any substance consisting of or containing buprenorphine, codeine, fentanyl,

hydrocodone, hydromorphone, meperidine, methadone, morphine, oxycodone, oxymorphone,

tapentadol, tramadol, opium, heroin, carfentanil, diazepam, estazolam, quazepam, alprazolam,

clonazepam, oxazepam, flurazepam, triozolam, temazepam, midazolam, carisoprodol,

gabapentin, or any variant of these substances or any similar substance. Notwithstanding the

foregoing, nothing in this section prohibits a Settling State from taking administrative or

regulatory action related to benzodiazepine (including, but not limited to, diazepam, estazolam,

quazepam, alprazolam, clonazepam, oxazepam, flurazepam, triozolam, temazepam, and

midazolam), carisoprodol, or gabapentin that is wholly independent from the use of such drugs in

combination with opioids, provided such action does not seek money (including abatement

and/or remediation) for conduct prior to the Effective Date.

FFF. “Reference Date.” The date on which the Settling Distributors are to inform

the Settling States of their determination whether the condition in Section VIII has been satisfied.

The Reference Date shall be no later than thirty (30) calendar days after the Initial Participation

Date, unless it is extended by written agreement of the Settling Distributors and the Enforcement

Committee.

GGG. “Released Claims.” Any and all Claims that directly or indirectly are based

on, arise out of, or in any way relate to or concern the Covered Conduct occurring prior to the

Reference Date. Without limiting the foregoing, Released Claims include any Claims that have

been asserted against a Settling Distributor by any Settling State or Litigating Subdivision in any

federal, state, or local action or proceeding (whether judicial, arbitral, or administrative) based

on, arising out of, or relating to, in whole or in part, the Covered Conduct, or any such Claims

that could be or could have been asserted now or in the future in those actions or in any

comparable action or proceeding brought by a State, Subdivision, or Releasor (whether or not

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

8

such State, Subdivision, or Releasor has brought such action or proceeding). Released Claims

also include all Claims asserted in any proceeding to be dismissed pursuant to this Agreement,

whether or not such claims relate to Covered Conduct. The Parties intend that this term,

“Released Claims,” be interpreted broadly. This Agreement does not release Claims by private

individuals. It is the intent of the Parties that Claims by private individuals be treated in

accordance with applicable law. Released Claims is also used herein to describe claims brought

by a Later Litigating Subdivision or other non-party Subdivision that would have been Released

Claims if they had been brought by a Releasor against a Released Entity.

HHH. “Released Entities.” With respect to Released Claims, the Settling

Distributors and (1) all past and present subsidiaries, divisions, predecessors, successors, and

assigns (in each case, whether direct or indirect) of each Settling Distributor; (2) all past and

present subsidiaries and divisions (in each case, whether direct or indirect) of any entity

described in subsection (1); (3) the respective past and present officers, directors, members,

trustees, and employees of any of the foregoing (each for actions that occurred during and related

to their work for, or employment with, any of the Settling Distributors or the foregoing entities);

(4) all past and present joint ventures (whether direct or indirect) of each Settling Distributor or

its subsidiaries, including in any Settling Distributor or subsidiary’s capacity as a participating

member in such joint venture; (5) all direct or indirect parents and shareholders of the Settling

Distributors (solely in their capacity as parents or shareholders of the applicable Settling

Distributor with respect to Covered Conduct); and (6) any insurer of any Settling Distributor or

any person or entity otherwise described in subsections (1)-(5) (solely in its role as insurer of

such person or entity and subject to the last sentence of Section XI.C). Any person or entity

described in subsections (3)-(6) shall be a Released Entity solely in the capacity described in

such clause and shall not be a Released Entity with respect to its conduct in any other capacity.

For the avoidance of doubt, CVS Health Corp., Walgreens Boots Alliance, Inc., and Walmart

Inc. (collectively, the “Pharmacies”) are not Released Entities, nor are their direct or indirect

past or present subsidiaries, divisions, predecessors, successors, assigns, joint ventures,

shareholders, officers, directors, members, trustees, or employees (shareholders, officers,

directors, members, trustees, and employees for actions related to their work for, employment

with, or involvement with the Pharmacies) Released Entities. Notwithstanding the prior

sentence, any joint venture or past or present subsidiary of a Settling Distributor is a Released

Entity, including any joint venture between a Settling Distributor or any Settling Distributor’s

subsidiary and a Pharmacy (or any subsidiary of a Pharmacy); provided, however, that any joint

venture partner of a Settling Distributor or a Settling Distributor’s subsidiary is not a Released

Entity unless it falls within subsections (1)-(6) above. Lists of Settling Distributors’ subsidiaries,

joint ventures, and predecessor entities are appended to this Agreement as Exhibit J. With

respect to joint ventures (including predecessor entities), only entities listed on Exhibit J are

Released Entities. With respect to wholly-owned subsidiaries (including predecessor entities),

Exhibit J represents a good faith effort by the Settling Distributors to list all such entities, but any

and all wholly-owned subsidiaries (including predecessor entities) of any Settling Distributor are

Released Entities, whether or not they are listed on Exhibit J. For the avoidance of doubt, any

entity acquired, or joint venture entered into, by a Settling Distributor after the Reference Date is

not a Released Entity.

III. “Releasors.” With respect to Released Claims, (1) each Settling State;

(2) each Participating Subdivision; and (3) without limitation and to the maximum extent of the

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

9

power of each Settling State’s Attorney General and/or Participating Subdivision to release

Claims, (a) the Settling State’s and Participating Subdivision’s departments, agencies, divisions,

boards, commissions, Subdivisions, districts, instrumentalities of any kind and attorneys,

including its Attorney General, and any person in his or her official capacity whether elected or

appointed to serve any of the foregoing and any agency, person, or other entity claiming by or

through any of the foregoing, (b) any public entities, public instrumentalities, public educational

institutions, unincorporated districts, fire districts, irrigation districts, and other Special Districts

in a Settling State, and (c) any person or entity acting in a parens patriae, sovereign, quasi-

sovereign, private attorney general, qui tam, taxpayer, or other capacity seeking relief on behalf

of or generally applicable to the general public with respect to a Settling State or Subdivision in a

Settling State, whether or not any of them participate in this Agreement. The inclusion of a

specific reference to a type of entity in this definition shall not be construed as meaning that the

entity is not a Subdivision. Each Settling State’s Attorney General represents that he or she has

or has obtained (or will obtain no later than the Initial Participation Date) the authority set forth

in Section XI.G. In addition to being a Releasor as provided herein, a Participating Subdivision

shall also provide the Subdivision Settlement Participation Form referenced in Section VII

providing for a release to the fullest extent of the Participating Subdivision’s authority.

JJJ. “Revocation Event.” With respect to a Bar, Settlement Class Resolution, or

Case-Specific Resolution, a revocation, rescission, reversal, overruling, or interpretation that in

any way limits the effect of such Bar, Settlement Class Resolution, or Case-Specific Resolution

on Released Claims, or any other action or event that otherwise deprives the Bar, Settlement

Class Resolution, or Case-Specific Resolution of force or effect in any material respect.

KKK. “Settlement Class Resolution.” A class action resolution in a court of

competent jurisdiction in a Settling State (that is not successfully removed to federal court) with

respect to a class of Subdivisions in that State that (1) conforms with that Settling State’s

statutes, case law, and rules of procedure regarding class actions; (2) is approved and entered as

an order of a court of competent jurisdiction in that State and such order has become a Final

Order; (3) is binding on all Non-Participating Subdivisions in that State (other than opt outs as

permitted under the next sentence); (4) provides that all such Non-Participating Subdivisions

may not bring any Released Claims against any Released Entities, whether on the ground of this

Agreement (or the releases herein) or otherwise; and (5) does not impose any costs or obligations

on Settling Distributors other than those provided for in this Agreement, or contain any provision

inconsistent with any provision of this Agreement. If applicable state law requires that opt-out

rights be afforded to members of the class, a class action resolution otherwise meeting the

foregoing requirements shall qualify as a Settlement Class Resolution unless Subdivisions

collectively representing more than one percent (1%) of the total population of that State opt out.

In seeking certification of any Settlement Class, the applicable State and Participating

Subdivisions shall make clear that certification is sought solely for settlement purposes and shall

have no applicability beyond approval of the settlement for which certification is sought.

Nothing in this Agreement constitutes an admission by any Party that class certification would be

appropriate for litigation purposes in any case or for purposes unrelated to this Agreement.

LLL. “Settlement Fund.” The interest-bearing fund established pursuant to this

Agreement into which the Annual Payments are made under Section IV.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

10

MMM. “Settlement Fund Administrator.” The entity that annually determines the

Annual Payment (including calculating Incentive Payments pursuant to Section IV and any

amounts subject to suspension, offset, or reduction pursuant to Section XII and Section XIII),

annually determines the Participation Tier pursuant to Section VIII.C, administers the Settlement

Fund, and distributes amounts into the Abatement Accounts Fund, State Fund, and Subdivision

Fund pursuant to this Agreement. The duties of the Settlement Fund Administrator shall be

governed by this Agreement. Prior to the Initial Participation Date, the Settling Distributors and

the Enforcement Committee shall agree to selection and removal processes for and the identity of

the Settlement Fund Administrator, and a detailed description of the Settlement Fund

Administrator’s duties and responsibilities, including a detailed mechanism for paying the

Settlement Fund Administrator’s fees and costs, all of which shall be appended to the Agreement

as Exhibit L.

NNN. “Settlement Fund Escrow.” The interest-bearing escrow fund established

pursuant to this Agreement to hold disputed or suspended payments made under this Agreement,

and to hold the first Annual Payment until the Effective Date.

OOO. “Settlement Payment Schedule.” The schedule attached to this Agreement as

Exhibit M.

PPP. “Settlement Prepayment.” As defined in Section IV.J.1.

QQQ. “Settlement Prepayment Reduction Schedule.” As defined in Section IV.J.1.

RRR. “Settling Distributors.” McKesson Corporation, Cardinal Health, Inc., and

AmerisourceBergen Corporation (each, a “Settling Distributor”).

SSS. “Settling State.” A State that has entered into this Agreement with all Settling

Distributors and delivers executed releases in accordance with Section VIII.A.

TTT. “State.” With the exception of West Virginia, which has addressed its claims

separately and is excluded from participation in this Agreement, the states, commonwealths, and

territories of the United States of America, as well as the District of Columbia. The 55 States are

listed in Exhibit F. Additionally, the use of non-capitalized “state” to describe something (e.g.,

“state court”) shall also be read to include parallel entities in commonwealths, territories, and the

District of Columbia (e.g., “territorial court”).

UUU. “State Fund.” The component of the Settlement Fund described in

Section V.C.

VVV. “State-Subdivision Agreement.” An agreement that a Settling State reaches

with the Subdivisions in that State regarding the allocation, distribution, and/or use of funds

allocated to that State and to its Subdivisions. A State-Subdivision Agreement shall be effective

if approved pursuant to the provisions of Exhibit O or if adopted by statute. Preexisting

agreements addressing funds other than those allocated pursuant to this Agreement shall qualify

if the approval requirements of Exhibit O are met. A State and its Subdivisions may revise a

State-Subdivision Agreement if approved pursuant to the provisions of Exhibit O, or if such

revision is adopted by statute.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

11

WWW. “Statutory Trust.” A trust fund established by state law to receive funds

allocated to a Settling State’s Abatement Accounts Fund and restrict any expenditures made

using funds from such Settling State’s Abatement Accounts Fund to Opioid Remediation, subject

to reasonable administrative expenses. A State may give a Statutory Trust authority to allocate

one (1) or more of the three (3) types of funds comprising such State’s Settlement Fund, but this

is not required.

XXX. “Subdivision.” Any (1) General Purpose Government (including, but not

limited to, a municipality, county, county subdivision, city, town, township, parish, village,

borough, gore, or any other entities that provide municipal-type government), School District, or

Special District within a State, and (2) any other subdivision or subdivision official or sub-entity

of or located within a State (whether political, geographical or otherwise, whether functioning or

non-functioning, regardless of population overlap, and including, but not limited to,

Nonfunctioning Governmental Units and public institutions) that has filed a lawsuit that includes

a Released Claim against a Released Entity in a direct, parens patriae, or any other capacity.

“General Purpose Government,” “School District,” and “Special District” shall correspond to the

“five basic types of local governments” recognized by the U.S. Census Bureau and match the

2017 list of Governmental Units.

2

The three (3) General Purpose Governments are county,

municipal, and township governments; the two (2) special purpose governments are School

Districts and Special Districts.

3

“Fire District,” “Health District,” “Hospital District,” and

“Library District” shall correspond to categories of Special Districts recognized by the U.S.

Census Bureau.

4

References to a State’s Subdivisions or to a Subdivision “in,” “of,” or “within”

a State include Subdivisions located within the State even if they are not formally or legally a

sub-entity of the State; provided, however, that a “Health District” that includes any of the

following words or phrases in its name shall not be considered a Subdivision: mosquito, pest,

insect, spray, vector, animal, air quality, air pollution, clean air, coastal water, tuberculosis, and

sanitary.

YYY. “Subdivision Allocation Percentage.” The portion of a Settling State’s

Subdivision Fund set forth in Exhibit G that a Subdivision will receive pursuant to Section V.C

or Section V.D if it becomes a Participating Subdivision. The aggregate Subdivision Allocation

Percentage of all Subdivisions receiving a Subdivision Allocation Percentage in each State shall

equal one hundred percent (100%). Immediately upon the effectiveness of any State-Subdivision

Agreement, Allocation Statute, Statutory Trust, or voluntary redistribution allowed by Section

V.D.3 (or upon the effectiveness of an amendment to any State-Subdivision Agreement,

2

https://www.census.gov/data/datasets/2017/econ/gus/public-use-files.html

3

E.g., U.S. Census Bureau, “Technical Documentation: 2017 Public Use Files for State and Local Government

Organization” at 7 (noting that “the Census Bureau recognizes five basic types of local governments,” that three of

those are “general purpose governments” (county governments, municipal governments, and township

governments), and that the other two are “school district and special district governments”),

https://www2.census.gov/programs-surveys/gus/datasets/2017/2017_gov_org_meth_tech_doc.pdf.

4

A list of 2017 Government Units provided by the Census Bureau identifies 38,542 Special Districts and

categorizes them by “FUNCTION_NAME.” “Govt_Units_2017_Final” spreadsheet, “Special District” sheet,

included in “Independent Governments - list of governments with reference information,”

https://www.census.gov/data/datasets/2017/econ/gus/public-use-files.html. As used herein, “Fire District”

corresponds to Special District function name “24 – Local Fire Protection,” “Health District” corresponds to Special

District function name “32 – Health,” “Hospital District” corresponds to Special District function name “40 –

Hospitals,” and “Library District” corresponds to Special District function name “52 – Libraries.” See id.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

12

Allocation Statute, Statutory Trust, or voluntary redistribution allowed by Section V.D.3) that

addresses allocation from the Subdivision Fund, or upon any, whether before or after the Initial

Participation Date, Exhibit G will automatically be amended to reflect the allocation from the

Subdivision Fund pursuant to the State-Subdivision Agreement, Allocation Statute, Statutory

Trust, or voluntary redistribution allowed by Section V.D.3. The Subdivision Allocation

Percentages contained in Exhibit G may not change once notice is distributed pursuant to Section

VII.A, except upon the effectiveness of any State-Subdivision Agreement, Allocation Statute,

Statutory Trust, or voluntary redistribution allowed by Section V.D.3 (or upon the effectiveness

of an amendment to any State-Subdivision Agreement, Allocation Statute, Statutory Trust, or

voluntary redistribution allowed by Section V.D.3) that addresses allocation from the

Subdivision Fund. For the avoidance of doubt, no Subdivision not listed on Exhibit G shall

receive an allocation from the Subdivision Fund and no provision of this Agreement shall be

interpreted to create such an entitlement.

ZZZ. “Subdivision Fund.” The component of the Settlement Fund described in

Section V.C.

AAAA. “Subdivision Settlement Participation Form.” The form attached as Exhibit K

that Participating Subdivisions must execute and return to the Settlement Fund Administrator.

BBBB. “Suspension Amount.” The amount calculated as follows: the per capita

amount corresponding to the applicable Participation Tier as set forth in Exhibit D multiplied by

the population of the Later Litigating Subdivision.

CCCC. “Suspension Cap.” The amount calculated as follows: the suspension

percentage corresponding to the applicable Participation Tier as set forth in Exhibit D multiplied

by the amount of the relevant Annual Payment apportioned to the State of the Later Litigating

Subdivision and to Subdivisions in that State in each year of the suspension.

DDDD. “Suspension Deadline.” With respect to a lawsuit filed by a Later Litigating

Subdivision asserting a Released Claim, the deadline set forth in Exhibit D corresponding to the

applicable Participation Tier.

EEEE. “Threshold Motion.” A motion to dismiss or equivalent dispositive motion

made at the outset of litigation under applicable procedure. A Threshold Motion must include as

potential grounds for dismissal any applicable Bar or the relevant release by a Settling State or

Participating Subdivision provided under this Agreement and, where appropriate under

applicable law, any applicable limitations defense.

FFFF. “Tribal/W. Va. Subdivision Credit.” The Tribal/W. Va. Subdivision Credit

shall equal 2.58% of the Global Settlement Abatement Amount.

GGGG. “Trigger Date.” In the case of a Primary Subdivision, the Reference Date. In

the case of all other Subdivisions, the Preliminary Agreement Date.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

13

II. Participation by States and Condition to Preliminary Agreement

A. Notice to States. On July 22, 2021 this Agreement shall be distributed to all

States. The States’ Attorneys General shall then have a period of thirty (30) calendar days to

decide whether to become Settling States. States that determine to become Settling States shall

so notify the National Association of Attorneys General and Settling Distributors and shall

further commit to obtaining any necessary additional State releases prior to the Reference Date.

This notice period may be extended by written agreement of the Settling Distributors and the

Enforcement Committee.

B. Condition to Preliminary Agreement. Following the notice period set forth in

Section II.A above, the Settling Distributors shall determine on or before the Preliminary

Agreement Date whether, in their sole discretion, enough States have agreed to become Settling

States to proceed with notice to Subdivisions as set forth in Section VII below. If the Settling

Distributors determine that this condition has been satisfied, and that notice to the Litigating

Subdivisions should proceed, they will so notify the Settling States by providing notice to the

Enforcement Committee and Settlement Fund Administrator on the Preliminary Agreement

Date. If the Settling Distributors determine that this condition has not been satisfied, they will so

notify the Settling States by providing notice to the Enforcement Committee and Settlement

Fund Administrator, and this Agreement will have no further effect and all releases and other

commitments or obligations contained herein will be void.

C. Later Joinder by States. After the Preliminary Agreement Date, a State may only

become a Settling State with the consent of the Settling Distributors, in their sole discretion. If a

State becomes a Settling State more than sixty (60) calendar days after the Preliminary

Agreement Date, but on or before January 1, 2022, the Subdivisions in that State that become

Participating Subdivisions within ninety (90) calendar days of the State becoming a Settling

State shall be considered Initial Participating Subdvisions. A State may not become a Settling

State after January 1, 2022.

D. Litigation Activity. Following the Preliminary Agreement Date, States that

determine to become Settling States shall make best efforts to cease litigation activity against

Settling Distributors, including by jointly seeking stays or severance of claim against the Settling

Distributors, where feasible, and otherwise to minimize such activity by means of agreed

deadline extensions and agreed postponement of depositions, document productions, and motion

practice if a motion to stay or sever is not feasible or is denied.

III. Injunctive Relief

A. Injunctive Relief. As part of the Consent Judgment, the Parties agree to the entry

of the injunctive relief terms attached in Exhibit P.

IV. Settlement Payments

A. Settlement Fund. All payments under this Section IV shall be made into the

Settlement Fund, except that, where specified, they shall be made into the Settlement Fund

Escrow. The Settlement Fund shall be allocated and used only as specified in Section V.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

14

B. Annual Payments. The Settling Distributors shall make eighteen (18) Annual

Payments, each comprised of base and incentive payments as provided in this Section IV, as well

as fifty percent (50%) of the amount of any Settlement Fund Administrator costs and fees that

exceed the available interest accrued in the Settlement Fund as provided in Section V.C.5, and as

determined by the Settlement Fund Administrator as set forth in this Agreement.

1. All data relevant to the determination of the Annual Payment and

allocations to Settling States and their Participating Subdivisions listed on Exhibit G shall

be submitted to the Settlement Fund Administrator no later than sixty (60) calendar days

prior to the Payment Date for each Annual Payment. The Settlement Fund Administrator

shall then determine the Annual Payment, the amount to be paid to each Settling State

and its Participating Subdivisions included on Exhibit G, and the amount of any

Settlement Fund Administrator costs and fees, all consistent with the provisions in

Exhibit L, by:

a. determining, for each Settling State, the amount of base and

incentive payments to which the State is entitled by applying the criteria under

Section IV.D, Section IV.E, and Section IV.F;

b. applying any suspensions, offsets, or reductions as specified under

Section IV, Section XII, and Section XIII;

c. applying any adjustment required as a result of prepayment or

significant financial constraint, as specified under Section IV.J and Section IV.K;

d. determining the amount of any Settlement Fund Administrator

costs and fees that exceed the available interest accrued in the Settlement Fund, as

well as the amounts, if any, of such costs and fees owed by Settling Distributors

and out of the Settlement Fund pursuant to Section V.C.5;

e. determining the total amount owed by Settling Distributors

(including any amounts to be held in the Settlement Fund Escrow pending

resolution of a case by a Later Litigating Subdivision as described in Section XII)

to all Settling States and the Participating Subdivisions listed on Exhibit G; and

f. the Settlement Fund Administrator shall then allocate, after

subtracting the portion of any Settlement Fund Administrator costs and fees owed

out of funds from the Settlement Fund pursuant to Section V.C.5, the Annual

Payment pursuant to Section V.C and Section V.D among the Settling States,

among the separate types of funds for each Settling State (if applicable), and

among the Participating Subdivisions listed on Exhibit G.

2. The Settlement Fund Administrator shall also apply the allocation

percentages set forth in Section IV.I and determine for each Settling Distributor the

amount of its allocable share of the Annual Payment. For the avoidance of doubt, each

Settling Distributor’s liability for its share of the Annual Payment is several, and not

joint.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

15

3. As soon as possible, but no later than fifty (50) calendar days prior to the

Payment Date for each Annual Payment and following the determination described in

Section IV.B.1 and Section IV.B.2, the Settlement Fund Administrator shall give notice

to the Settling Distributors, the Settling States, and the Enforcement Committee of the

amount of the Annual Payment (including the amount of the Settlement Fund to be

allocated to the Settlement Fund Administrator in costs and fees pursuant to Section

V.C.5), the amount to be received by each Settling State, the amount to be received by

the separate types of funds for each Settling State (if applicable), and the amount to be

received by each Settling State’s Participating Subdivisions listed on Exhibit G. The

Settlement Fund Administrator shall also give notice to each Settling Distributor of the

amount of its allocable share of the Annual Payment, including its allocable share of the

amount of any Settlement Fund Administrator costs and fees that exceed the available

interest accrued in the Settlement Fund pursuant to Section V.C.5.

4. Within twenty-one (21) calendar days of the notice provided by the

Settlement Fund Administrator, any party may dispute, in writing, the calculation of the

Annual Payment (including the amount allocated for Settlement Fund Administrator costs

and fees), or the amount to be received by a Settling State and/or its Participating

Subdivisions listed on Exhibit G. Such disputing party must provide a written notice of

dispute to the Settlement Fund Administrator, the Enforcement Committee, any affected

Settling State, and the Settling Distributors identifying the nature of the dispute, the

amount of money that is disputed, and the Settling State(s) affected.

5. Within twenty-one (21) calendar days of the sending of a written notice of

dispute, any affected party may submit a response, in writing, to the Settlement Fund

Administrator, the Enforcement Committee, any affected Settling State, and the Settling

Distributors identifying the basis for disagreement with the notice of dispute.

6. If no response is filed, the Settlement Fund Administrator shall adjust the

amount calculated consistent with the written notice of dispute, and each Settling

Distributor shall pay its allocable share of the adjusted amount, collectively totaling that

year’s Annual Payment, on the Payment Date. If a written response to the written notice

of dispute is timely sent to the Settlement Fund Administrator, the Settlement Fund

Administrator shall notify the Settling Distributors of the preliminary amount to be paid,

which shall be the greater of the amount originally calculated by the Settling

Administrator or the amount that would be consistent with the notice of dispute,

provided, however, that in no circumstances shall the preliminary amount to be paid be

higher than the maximum amount of Base and Incentive Payments A and D for that

Payment Year as set forth on Exhibit M. For the avoidance of doubt, a transfer of

suspended payments from the Settlement Fund Escrow pursuant to Section XII.A.2 does

not count toward determining whether the amount to be paid is higher than the maximum

amount of Base and Incentive Payments A and D for that Payment Year as set forth on

Exhibit M.

7. The Settlement Fund Administrator shall place any disputed amount of the

preliminary amount paid by the Settling Distributors into the Settlement Fund Escrow

and shall disburse any undisputed amount to each Settling State and its Participating

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

16

Subdivisions listed on Exhibit G within fifteen (15) calendar days of the Payment Date or

at such later time as directed by each Settling State.

8. Disputes described in this subsection shall be resolved in accordance with

the terms of Section VI.F.

9. For the avoidance of doubt, no Subdivision not listed on Exhibit G shall

receive an allocation from the Subdivision Fund and no provision of this Agreement shall

be interpreted to create such an entitlement.

C. Procedure for Annual Payment in Payment Years 1 and 2. The process described

in Section IV.B shall not apply to Payment Years 1 and 2. The procedure in lieu of Section

IV.B.1 for Payment Years 1 and 2 is as set forth below:

1. The Payment Date for Payment Year 1 is September 30, 2021. Provided

that the condition set forth in Section II.B has been satisfied, on or before such date, the

Settling Distributors shall pay into the Settlement Fund Escrow the total amount of the

base payment, Incentive Payment A for the Settling States (the amount specified in

Exhibit M for Payment Year 1 reduced by the allocable share of any Non-Settling States),

and the Settling Distributors’ allocable share of the amount of any Settlement Fund

Administrator costs and fees that exceed the available interest accrued in the Settlement

Fund pursuant to Section V.C.5. In the event that, in accordance with the terms of

Section VIII.A, the Settling Distributors determine not to proceed with the Settlement, or

the Settlement does not become effective for any other reason, the funds held in the

Settlement Fund Escrow shall immediately revert to the Settling Distributors. If the

condition set forth in Section VIII.A is met, the Settlement Fund Administrator shall

allocate the Annual Payment, after subtracting the portion of Settlement Fund

Administrator costs and fees owed out of funds from the Settlement Fund pursuant to

Section V.C.5, pursuant to Section V.C and Section V.D among the Settling States and

their Participating Subdivisions listed on Exhibit G. The portion of any Settlement Fund

Administrator costs and fees owed out of funds from the Settlement Fund pursuant to

Section V.C.5 shall be available to the Settlement Fund Administrator for the payment of

such costs and fees immediately. The remainder of the Annual Payment for Payment

Year 1 shall be transferred by the Settlement Fund Administrator on the Effective Date

from the Settlement Fund Escrow to the Settlement Fund and then to each Settling State

and to its Initial Participating Subdivisions included on Exhibit G; provided, however,

that for any Settling State where the Consent Judgment has not been entered as of the

Effective Date, the funds allocable to that Settling State and its Participating Subdivisions

included on Exhibit G shall not be transferred from the Settlement Fund Escrow or

disbursed until ten (10) calendar days after the entry of the Consent Judgment in that

State; and, provided, further, the Settlement Fund Administrator shall leave in the

Settlement Fund Escrow funds allocated to Subdivisions included on Exhibit G that are

not Initial Participating Subdivisions. Should such a Subdivision become a Participating

Subdivision between the Initial Participation Date and the Effective Date, the allocation

for such Participating Subdivision shall be transferred to the Settlement Fund and paid to

the Participating Subdivision at the same time as Initial Participating Subdivisions in that

State are paid.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

17

2. The Payment Date for Payment Year 2 is July 15, 2022. On or before

such date, the Settling Distributors shall pay into the Settlement Fund the total amount of

the base payment, Incentive Payment A for the Settling States (the amount specified in

Exhibit M for Payment Year 2 reduced by the allocable share of any Non-Settling States),

and the Settling Distributors’ allocable share of the amount of any Settlement Fund

Administrator costs and fees that exceed the available interest accrued in the Settlement

Fund pursuant to Section V.C.5. The portion of any Settlement Fund Administrator costs

and fees owed out of funds from the Settlement Fund pursuant to Section V.C.5 shall be

available to the Settlement Fund Administrator for the payment of such costs and fees

immediately. The Settlement Fund Administrator shall disburse the remaining amounts

to each Settling State and to its Participating Subdivisions included on Exhibit G within

fifteen (15) calendar days of the Payment Date or at such later time as directed by each

Settling State. If a Settling State enacts a legislative Bar after the Initial Participation

Date, but before July 15, 2022, a Subdivision that meets the requirements for becoming a

Participating Subdivision under Section VII prior to July 15, 2022 (but was not an Initial

Participating Subdivision) shall be eligible to receive its allocated share (if any) for

Payment Year 2, and it shall also receive any amounts allocated to it for Payment Year 1

from the Settlement Fund Escrow.

3. Any amounts remaining in the Settlement Fund Escrow for allocations to

Subdivisions listed on Exhibit G that have not become Participating Subdivisions after all

payments for Payment Year 2 are disbursed shall be transferred to the Settlement Fund

and disbursed to the appropriate sub-funds in each Settling State pursuant to Section

V.D.5.

4. Any disputes as to the allocation of the Annual Payments in Payment

Years 1 and 2 shall be resolved pursuant to the process set forth in Section IV.B.3

through Section IV.B.8, except that in Payment Year 1, the Settlement Fund

Administrator shall have until ten (10) calendar days after the Initial Participation Date to

give notice of the amount to be received by each Settling State, the amount to be received

by the separate types of funds for each Settling State (if applicable), and the amount to be

received by each Initial Participating Subdivision in the Settling States that is listed on

Exhibit G.

D. Payment Date for Subsequent Payment Years. The Payment Date for Payment

Year 3 and successive Payment Years is July 15 of the third and successive years and the Annual

Payment shall be made pursuant to the process set forth in Section IV.B, except that, with respect

to Payment Year 3, Settling States shall have up to the Payment Date to become eligible for

Incentive Payment A and thus avoid the reductions set forth in Section XIII. If a Settling State

enacts a Bar less than sixty (60) calendar days before the Payment Date for Payment Year 3,

each Settling Distributor shall pay, within thirty (30) calendar days of the Payment Year 3

Payment Date, its allocable share, pursuant to Section IV.I, of the difference between the Annual

Payment as calculated by the Settlement Fund Administrator and the amount that would have

been owed had the Settlement Fund Administrator taken the Bar into account.

E. Base Payments. Subject to the suspension, reduction, and offset provisions set

forth in Section XII and Section XIII, the Settling Distributors shall collectively make base

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

18

payments equal to fifty-five percent (55%) of the Net Abatement Amount multiplied by the

aggregate Overall Allocation Percentage of the Settling States. These payments will be due in

installments consistent with Exhibit M over the eighteen (18) Payment Years and as adjusted by

the Settlement Fund Administrator pursuant to the provisions in Section IV, Section XII, and

Section XIII.

F. Incentive Payments. Subject to the suspension, offset, and reduction provisions

set forth in Section XII and Section XIII, the Settling Distributors shall collectively make

potential additional incentive payments totaling up to a maximum of forty-five percent (45%) of

the Net Abatement Amount multiplied by the aggregate Overall Allocation Percentage of the

Settling States, with the actual amount depending on whether and the extent to which the criteria

set forth below are met in each Settling State. The incentive payments shall be divided among

four (4) categories, referred to as Incentive Payments A-D. Incentive Payments A-C will be due

in installments over the eighteen (18) Payment Years, and Incentive Payment D will be due in

installments over thirteen (13) years beginning with Payment Year 6. The total amount of

incentive payments in an Annual Payment shall be the sum of the incentive payments for which

individual Settling States are eligible for that Payment Year under the criteria set forth below.

The incentive payments shall be made with respect to a specific Settling State based on its

eligibility for that year under the criteria set forth below.

1. Incentive Payment A. Incentive Payment A shall be equal to forty percent

(40%) of the Net Abatement Amount multiplied by the aggregate Overall Allocation

Percentage of the Settling States, provided all Settling States satisfy the requirements of

Incentive Payment A. Incentive Payment A will be due to a Settling State as part of the

Annual Payment in each of the eighteen (18) Payment Years that a Settling State is

eligible for Incentive Payment A and shall equal a total potential maximum of

$7,421,605,477 if all States are eligible for all eighteen (18) Payment Years. Each

Settling State’s share of Incentive Payment A in a given year, provided that Settling State

is eligible, shall equal the total maximum amount available for Incentive Payment A for

that year as reflected in Exhibit M times the Settling State’s Overall Allocation

Percentage. Eligibility for Incentive Payment A is as follows:

a. For the Payment Years 1 and 2, all Settling States are deemed

eligible for Incentive Payment A.

b. For each Payment Year other than Payment Years 1 and 2, a

Settling State is eligible for Incentive Payment A if, as of sixty (60) calendar days

prior to the Payment Date (except that in Payment Year 3, this date is as of the

Payment Date), (i) there is a Bar in that State in full force and effect, (ii) there is a

Settlement Class Resolution in that State in full force and effect, (iii) the Released

Claims of all of the following entities are released through the execution of

Subdivision Settlement Participation Forms, or there is a Case-Specific

Resolution against such entities: all Primary Subdivisions, Litigating

Subdivisions, School Districts with a K-12 student enrollment of at least 25,000

or .10% of a State’s population, whichever is greater, and Health Districts and

Hospital Districts that have at least one hundred twenty-five (125) hospital beds in

one or more hospitals rendering services in that district; or (iv) a combination of

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

19

the actions in clauses (i)-(iii) has achieved the same level of resolution of Claims

by Subdivisions (e.g., a Bar against future litigation combined with full joinder by

Litigating Subdivisions). For the avoidance of doubt, subsection (iv) cannot be

satisfied unless all Litigating Subdivisions are Participating Subdivisions or there

is a Case-Specific Resolution against any such Subdivisions that are not

Participating Subdivisions. The Settling Distributors and the Enforcement

Committee shall meet and confer in order to agree on data sources for purposes of

this Section prior to the Preliminary Agreement Date.

c. Notwithstanding Section IV.F.1.b, for each Payment Year other

than Payment Years 1 and 2, a Settling State that is not eligible for Incentive

Payment A as of the Incentive Payment Final Eligibility Date shall not be eligible

for Incentive Payment A for that Payment Year or any subsequent Payment

Years.

d. If the Settling Distributors made a payment under Incentive

Payment A solely on the basis of a Bar or Settlement Class Resolution in a

Settling State and that Bar or Settlement Class Resolution is subsequently

removed, revoked, rescinded, reversed, overruled, interpreted in a manner to limit

the scope of the release, or otherwise deprived of force or effect in any material

respect, that Settling State shall not be eligible for Incentive Payment A thereafter,

unless the State requalifies for Incentive Payment A through any method pursuant

to Section IV.F.1.b, in which case the Settling State shall be eligible for Incentive

Payment A less any litigation fees and costs incurred by Settling Distributor in the

interim, except that, if the re-imposition occurs after the completion of opening

statements in a trial involving a Released Claim, the Settling State shall not be

eligible for Incentive Payment A (unless this exception is waived by the Settling

Distributors).

e. In determining the amount of Incentive Payment A that Settling

Distributors will pay in a Payment Year and each Settling State’s share, if any, of

Incentive Payment A for that Payment Year, the Settlement Fund Administrator

shall: (i) identify all Settling States that are eligible for Incentive Payment A; (ii)

multiply the Overall Allocation Percentage for each such eligible Settling State by

the maximum amount that Settling Distributors could owe with respect to

Incentive Payment A for that Payment Year as listed on Exhibit M. The amount

calculated in (ii) shall be the amount allocated to a Settling State eligible for

Incentive Payment A for that Payment Year and the aggregate of each such

amount for Settling States eligible for Incentive Payment A shall be the amount of

Incentive Payment A Settling Distributors are obligated to pay in that Payment

Year, all such amounts subject to the suspension, offset, and reduction provisions

in Section XII and Section XIII.

2. Incentive Payment B. Incentive Payment B shall be available to Settling

States that are not eligible for Incentive Payment A for the applicable Payment Year.

Incentive Payment B shall be equal to up to twenty-five percent (25%) of the Net

Abatement Amount multiplied by the aggregate Overall Allocation Percentage of the

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

20

Settling States. Incentive Payment B will be due to a Settling State as part of the Annual

Payment in each of the eighteen (18) Payment Years that a Settling State is eligible for

Incentive Payment B and equal a total potential maximum of $4,638,503,423 if all States

are eligible for all eighteen (18) Payment Years. Each Settling State’s maximum share of

Incentive Payment B in a given year shall equal the total maximum amount available for

Incentive Payment B for that year as reflected in Exhibit M times the Settling State’s

Overall Allocation Percentage. Eligibility for Incentive Payment B is as follows:

a. A Settling State is not eligible for Incentive Payment B for a

Payment Year for which it is eligible for Incentive Payment A.

b. Subject to Section IV.F.2.a, the amount of Incentive Payment B for

which a Settling State is eligible in a Payment Year shall be a percentage of that

State’s maximum share of Incentive Payment B based on the extent to which

(A) Litigating Subdivisions in the State are Participating Subdivisions or (B) there

is a Case-Specific Resolution against Litigating Subdivisions in the State,

collectively, “Incentive B Eligible Subdivisions.” The percentage of the State’s

maximum share of Incentive Payment B that the State is eligible for in a Payment

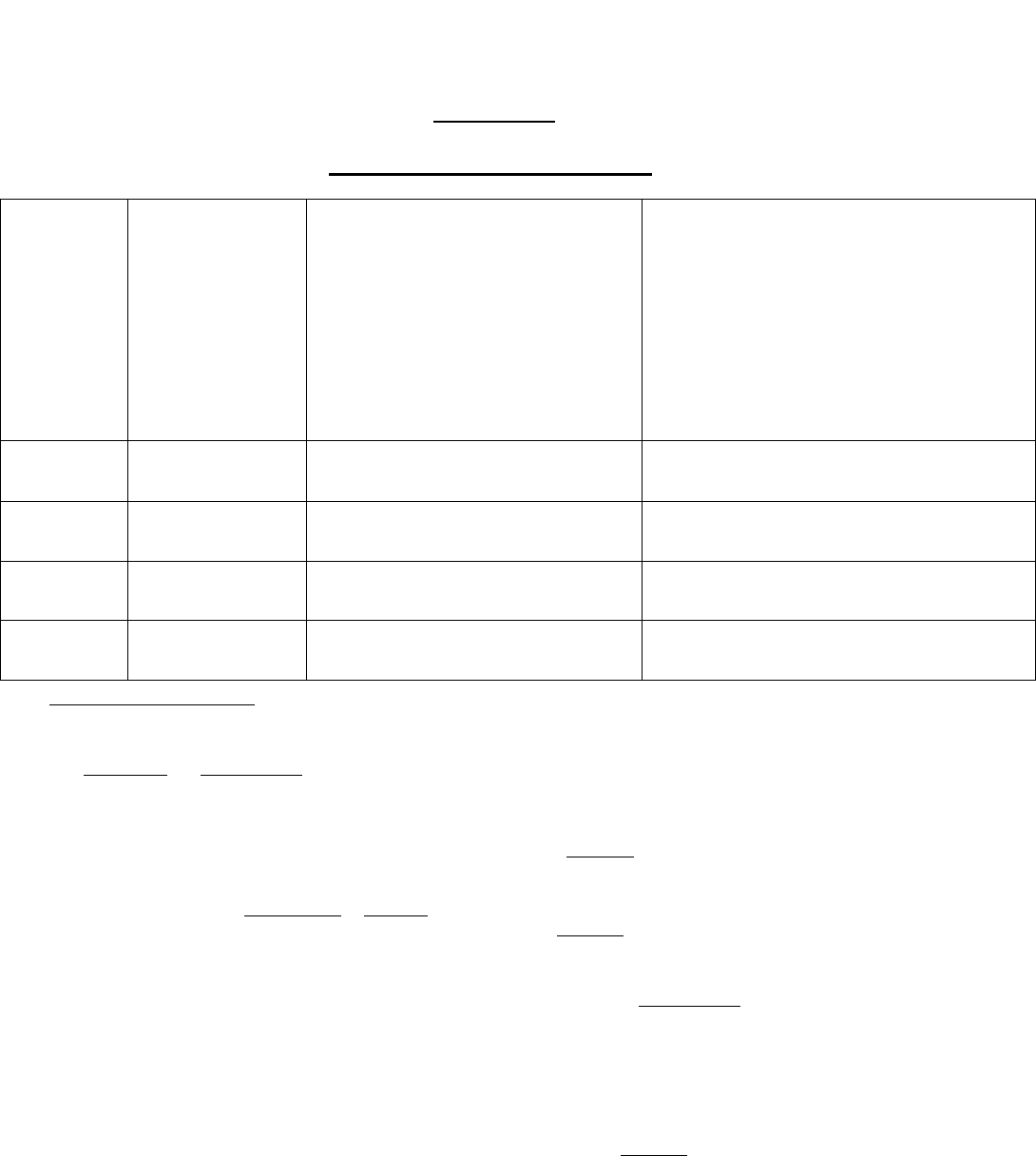

Year shall be determined according to the table below:

Percentage of Litigating

Subdivision Population

that is Incentive B

Eligible Subdivision

Population

5

Incentive Payment B

Eligibility Percentage

Up to 85%

0%

85%+

30%

86+

40%

91+

50%

95+

60%

99%+

95%

100%

100%

5

The “Percentage of Litigating Subdivision Population that is Incentive B Eligible Subdivision Population” shall be

determined by the aggregate population of the Settling State’s Litigating Subdivisions that are Incentive B Eligible

Subdivisions divided by the aggregate population of the Settling State’s Litigating Subdivisions. In calculating the

Settling State’s population that resides in Litigating Subdivisions, (a) the population of the Settling State’s Litigating

Subdivisions shall be the sum of the population of all Litigating Subdivisions in the Settling State, notwithstanding

that persons may be included within the population of more than one Litigating Subdivision, and (b) the population

that resides in Incentive B Eligible Subdivisions shall be the sum of the population of the Incentive B Eligible

Subdivisions, notwithstanding that persons may be included within the population of more than one Incentive B

Eligible Subdivision. An individual Litigating Subdivision shall not be included more than once in the numerator,

and shall not be included more than once in the denominator, of the calculation regardless if it (or any of its

officials) is named as multiple plaintiffs in the same lawsuit; provided, however, that for the avoidance of doubt, no

Litigating Subdivision will be excluded from the numerator or denominator under this sentence unless a Litigating

Subdivision otherwise counted in the denominator has the authority to release the Claims (consistent with Section

XI) of the Litigating Subdivision to be excluded. For the avoidance of doubt, a Settling State in which the

population that resides in Incentive B Eligible Subdivisions is less than eighty-five percent (85%) of the population

of Litigating Subdivisions shall not be eligible for any portion of Incentive Payment B.

FINAL AGREEMENT 3.25.22

EXHIBIT C AS OF 5.27.22;

EXHIBITS G AND I AS OF 02.22.23

21

c. In determining the amount that Settling Distributors will pay in a