Pareto Securities’ 28

th

Annual Energy Conference

Noble Corporation

15 September 2021

Forward Looking Statement

This presentation contains “forward-looking statements” about Noble’s business, financial performance and position, contracts and prospects. Words such as "anticipate,"

"believe," "could," "estimate," "expect," "intend," "may," "might," "plan," "project," "should," "shall," and "will" and similar expressions are intended to be among the statements

that identify forward-looking statements. Statements regarding the effect, impact, the global novel strain of coronavirus ("COVID-19") pandemic, and agreements regarding

production levels among members of the Organization of Petroleum Exporting Countries and other oil and gas producing nations ("OPEC+"), and any expectations we may have with

respect thereto, and those regarding contract backlog, costs, benefits, opportunities, financial performance, financial position, capital structure, debt, fleet strategy, bidding activity,

rig demand, contract commencements, dayrates, impact of future regulations, contract duration, fleet condition, capabilities or performance, industry fundamentals, shareholder

value, as well as any other statements that are not historical facts in this release, are forward-looking statements that involve certain risks, uncertainties and assumptions. These

include but are not limited to actions by regulatory authorities or other third parties, market conditions, factors affecting the level of activity in the oil and gas industry, supply and

demand of drilling rigs, factors affecting the duration of contracts, the actual amount of downtime, factors that reduce applicable dayrates, violations of anti-corruption laws,

hurricanes and other weather conditions, the future price of oil and gas and other factors detailed in the Company’s most recent Form 10-K, Form 10-Q’s and other filings with the

Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary

materially from those indicated. The Company disclaims any duty to update the information presented here.

3

“Since 1921 Noble has been the trusted partner of our

customers, our communities, and our employees.

Our relationship-centered approach, unwavering

commitment to our values, and passionate pursuit of

operational excellence consistently delivers safe and

efficient results.”

Noble – At a Glance

100-year history

Committed to core values

High-spec & rationalized fleet

Conservative balance sheet

Strong backlog

Capacity for growth

Trusted Partner

Highlights

(1) As of June 30

th

, 2021; Pro Forma for jackup divestment to ADES International Holding PLC.

(2) As of September 7

th

, 2021 closing price of $27.46/share for 66.6 million shares including penny warrants but excluding other warrants and management incentive plan.

Total Fleet Size

20 (12 Floaters / 8 Jackups)

Net Cash

$40 million

Financial

Operational

Total Liquidity

$900+ million

Backlog

$1.3 billion

Market Cap

~$1.8 billion

Average Fleet Age

8 Years

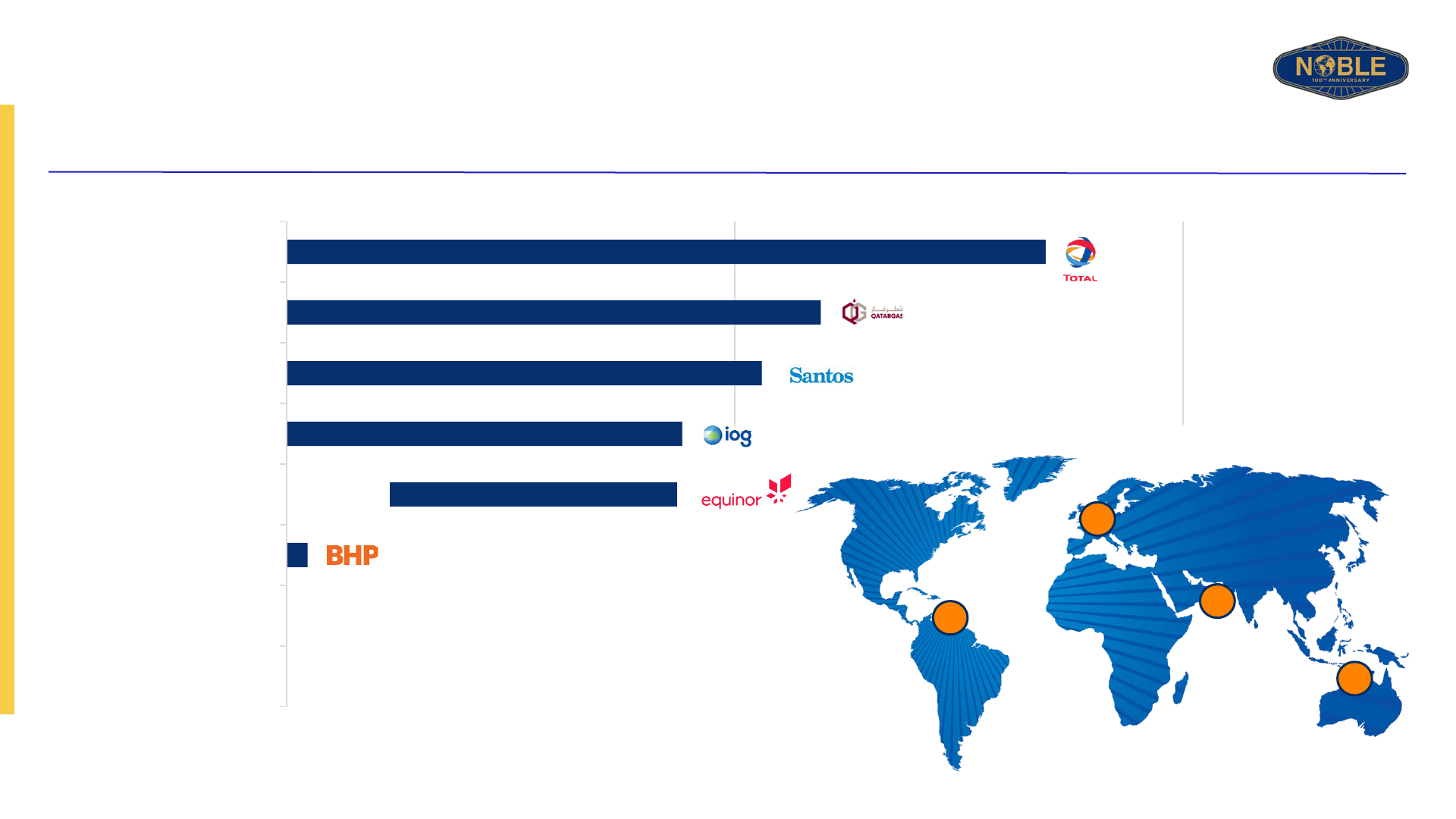

Select Customer

Relationships

(2)

(1)

4

The Noble Value Proposition

Ability to get paid in current market environment (“Yield”) with exposure to improving market (“Growth”)

Growth

Free Cash Flow in

Current Market

Environment

Yield

Improving

Market

+

Ability to

Return

Capital

=

Cash Flow

Growth

=

5

Recently Announced Divestment of Jackups in Saudi Arabia

Compelling economic return that accelerates ability to return capital to shareholders

Key Transaction Terms

Significant Increase in

Financial Flexibility

Net cash position anticipated in 2022

Significantly enhanced liquidity position

Improved position to prioritize:

Debt repayment

Returning cash to shareholders

through share buybacks and

dividends

Announced:

Estimated Closing:

Buyer:

Price:

Rigs:

August 26

th

, 2021

October 2021

ADES International Holding PLC

US $292 million

Noble Roger Lewis

Noble Scott Marks

Noble Joe Knight

Noble Johnny Whitstine

(1) Anticipated cash proceeds from transaction are $285 million, net of fees, expenses, and settlement of working capital.

(1)

6

APA Corp – Suriname – Noble Gerry de Souza

Murphy Oil – US GoM – Noble Faye Kozack

EnVen – US GoM – Noble Faye Kozack

Noble Platform and Brand to Drive Consolidation

Noble has the proven ability to drive industry consolidation

Noble Gerry de Souza (formerly Pacific Santa Ana)

Noble Faye Kozack (formerly Pacific Khamsin)

Noble Stanley Lafosse (formerly Pacific Sharav)

Rig Renaming

Rigs Scrapped

Pacific Mistral

Pacific Bora

Rig Contracts Awarded

(1)

(1) Noble Gerry de Souza completed rename change on September 1, 2021. Pacific Khamsin and Pacific Sharav will complete name changes during the next available window in contract drilling schedules

PACD Acquisition

Scorecard

Grew high-spec UDW fleet

Won contracts & added backlog

Expanded customer base

Realized $30 million of synergies

Strengthened balance sheet

Exercised capital discipline

Key Actions with PACD Fleet

7

Noble’s Key Value Drivers

8

Fleet Quality and Utilization Drive Cash Flow Generation

7G Drillships

6G Drillships

Semisubmersible

7

4

1

Floaters comprise 60% of Noble’s rig fleet

Floater Fleet

83%

12

Contracted

Average Age

~8 years

(1) Current fleet presented as pro forma divestment of 4 jackups to ADES International Holding PLC.

(1)

9

Fleet Quality and Utilization Drive Cash Flow Generation

Ultra High-Spec CJ70

High-Spec

1

7

Jackup Fleet

75%

8

Contracted

Average Age

~8 years

(1)

(1) Current fleet presented as pro forma divestment of 4 jackups to ADES International Holding PLC.

(1)

Jackups comprise 40% of Noble’s rig fleet

10

Fleet Quality and Utilization Drive Cash Flow Generation

Source: Rystad Energy UCube; Rystad Energy research and analysis, IHS Markit Petrodata

(1) Average Utilization 2015 – 2020.

(2) Competitive fleet includes all jackups and 6th and 7th generation drillships; excludes owner-operated and rigs working in China and Iran. Contract term fixed includes only new, mutually agreed contracts for competitive fleet

Noble owns ~4% of the global rig fleet – but won

7% of all rig years awarded over the last 6 years

Noble Premium

Noble’s fleet utilization is consistently high

In 2020, the Noble fleet captured 3x its share of

contracted rig years

(1)

(2)(1),

11

Note: Excludes cold stacked rigs

Jun-21 Jun-22 Jun-23 Jun-24

Pacific Scirocco

Pacific Meltem

Noble Gerry De Souza (Santa Ana)

Noble Clyde Boudreaux

Noble Faye Kozack (Khamsin)

Noble Stanley Lafosse (Sharav)

Noble Globetrotter I

Noble Sam Croft

Noble Bob Douglas

Noble Don Taylor

Noble Globetrotter II

Noble Tom Madden

4

4

1

2

1

(1) Per Fleet Status Report as of June 23, 2021 plus updates for contracts announced on 2Q21 earnings call for Noble Gerry de Souza (Santa Ana), and Noble Faye Kozack (Khamsin)

Jan-27

Floater Fleet Status

Strong Backlog Across a Diverse Customer Base

12

Jun-21 Jun-22 Jun-23

Noble Houston Colbert

Noble Sam Hartley

Noble Regina Allen

Noble Lloyd Noble

Noble Hans Deul

Noble Tom Prosser

Noble Mick O'Brien

Noble Sam Turner

Strong Backlog Across a Diverse Customer Base

Jackup Fleet Status

1

5

1

1

(1) Per Fleet Status Report as of June 23, 2021 plus updates for contract announced on 2Q21 earnings call for Noble Tom Prosser

(2) Pro forma for sale of four jackups in Saudi Arabia

13

Exposure to Improving Ultra-Deepwater Market

UDW floater supply and demand forecast

Source: Rystad Energy Research, September 2021

83

65

63

72

60

65

81

84

90

98

104

114

108

110

111

104

92

96

102

107

111

115

127

131

133

134

129

121

118

123

125

126

128

0

50

100

150

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

Demand Marketed supply Total supply

Rig years

ForecastHistorical

+0 +5 +4 +8 +2 +6

Increase in

Rystad’s demand

forecast since

June 2021

14

Financial Focus

Capital Structure Highlights

Committed to capital discipline, which

includes exercising a balanced economic

approach to capital related decisions

Dedicated to running a highly efficient cost

structure, both offshore and onshore

Focused on free cash flow generation –

expect to be free cash flow positive in

2022

(1) As of June 30

th

, 2021 and pro forma for divestment of four jackups to ADES International Holding PLC

(2) The Company expects to generate approximately $285 million in cash from the transaction net of fees, expenses, and the settlement of working capital.

Financially Disciplined and Cash Flow Focused

(1)

($ in millions)

(2)

Unadjusted

Cash and Cash Equivalents $161 $446

Debt

Maturity

Revolving Credit Facility 2025 $190 $190

2L Notes 2028 $216 $216

Total Debt $406 $406

Liquidity $636 $921

Net Debt / (Cash) $245 ($40)

Pro forma for

Saudi Asset Sale

As of June 30, 2021

15

Updated

2021 Guidance

(1,2)

Preliminary

2022 Guidance

(1)

Adjusted Revenue

(3)

$860 - $890 $975 - $1,050

Adjusted EBITDA

(3), (4)

$95 - $115 $265 - $300

Capital Expenditures $175 - $195 $105 - $120

(1) Noble provides guidance based on guidance basis, which is a non-GAAP financial measure. Management evaluates Noble’s financial performance in part based on guidance basis, which management

believes enhances investors’ understanding of Noble’s overall financial performance by providing them with an additional meaningful and relevant comparison of current and anticipated future results

across periods. The adjustments to arrive at guidance basis are described below. Due to the forward-looking nature of Adjusted EBITDA, management cannot reliably predict certain of the necessary

components of the most directly comparable forward-looking GAAP measure. Accordingly, the company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial

measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort.

(2) The Company has combined the 2021 results for the Predecessor and Successor periods as non-GAAP measures when giving full-year 2021 guidance since we believe it provides the most meaningful

basis to analyze our 2021 results.

(3) Adjusted to exclude recognition of the non-cash intangible contract asset amortization of ~$51 million and ~$44 million in 2021 and 2022, respectively. Without these adjustments, Revenue guidance

ranges for 2021 and 2022 would be $809 million - $839 million and $931 million - $1,006 million, respectively.

(4) The Company discloses Adjusted EBITDA (Operating Profit/loss excluding Depreciation and Amortization and, when applicable, Other Items). Other Items include amortization of intangible contract

assets, restructuring related items, merger and integration costs, and non-cash stock-based compensation expense related to the Company’s management incentive plan.

(5) Of the total calendar days available for our fleet in 2022, Noble assumes 86% of the days are operating days (excluding cold stacked rigs). Of the operating days, 61% are currently under firm contract,

and 22% are assumed exercised options. 22% of the available days are under the CEA agreement where the market rate has yet to be determined.

($ in millions)

As of September 9

th

, 2021

Financial Guidance

(5)

(5)

16

(1) The dayrates, utilizations, and business results shown here are hypothetical. The information is provided with the sole intention of highlighting how Noble’s business profitability might vary

across various market scenarios and should not be misconstrued as guidance.

(2) Highly Illustrative annual EBITDA calculation is representative of 10 active floaters and 8 jackups (pro forma divestment of 4 jackup rigs) operating under Noble’s current cost structure. Noble

Lloyd Noble dayrate is illustratively assumed at $275k for all cases. Calculations do not adjust for Noble’s current contract profile.

Highly Illustrative EBITDA sensitivity to Dayrates and Utilization for Noble’s fleet

(1) (2)

Noble has significant earnings power with its current fleet

Floater dayrates $250k $275k $300k

Jack-up dayrates $80k $100k $120k

Fleet Utilization 85% 88% 90%

Highly Illustrative EBITDA ~$275mm ~$460mm ~$650mm

17

Noble is the

platform for

investment in

offshore drilling

Noble represents a Yield + Growth opportunity for investors

Why Noble?

www.noblecorp.com

1919

Additional

Information

20

Reconciliation of Adjusted EBITDA

Income (loss) before income taxes $ 18,576 $ (25,271) $ 253,651 $ (2,844,179) $ (25,597)

Interest expense, net of amounts capitalized 7,863 6,895 229 67 23,427

Interest income and other, net (6,509) (8) (399) (466) (7,872)

Depreciation and amortization 25,339 14,244 20,622 90,477 90,606

Loss on impairment - - - 2,795,891 -

Intangible contract amortization 14,256 8,459 - - -

Professional services - tax refund success fee 4,679 - - - -

Professional services - corporate projects 3,414 - - - -

Merger and integration costs 6,740 2,013 - - -

Gain on bargain purchase (64,479) - - - -

(Gain)/Loss on extinguishment of debt - - - - (17,847)

Pre-petition charges - - - - 3,894

Reorganization items, net - - (252,051) 14,916 9,014

Adjusted EBITDA $ 9,879 $ 6,332 $ 22,052 $ 56,706 $ 75,625

Successor

Period from

Period from

Predecessor

Three Months Ended

Three Months Ended

31-Dec-20

30-Sep-20

30-Jun-21

31-Mar-21

5-Feb-21

6-Feb-21

1-Jan-21

Three Months Ended

through

through

Non-GAAP Reconciliation

(1) Certain non-GAAP performance measures and corresponding reconciliations to GAAP financial measures for the Company have been provided for meaningful comparisons between current results

and prior operating periods. Generally, a non-GAAP financial measure is a numerical measure of a company's performance, financial position, or cash flows that excludes or includes amounts that

are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles. In order to fully assess the

financial operating results, management believes that the use of EBITDA, or earnings before interest, taxes, depreciation and amortization, adjusted for the items listed above, is an appropriate

measure of the continuing and normal operations of the Company. These non-GAAP adjusted measures should be considered in addition to, and not as a substitute for, or superior to, contract

drilling revenue, contract drilling cost, contract drilling margin, average daily revenue, operating income, cash flows from operations, or other measures of financial performance prepared in

accordance with GAAP. Please see the following Non-GAAP Financial Measures and Reconciliations for a complete description of the adjustments.

(2) Upon emergence, Noble adopted fresh-start accounting which resulted in Noble becoming a new reporting entity for accounting and financial reporting purposes. Accordingly, our financial

statements and notes after February 5, 2021 are not comparable to our financial statements and notes prior to that date. As required by GAAP, results must be presented separately for the

predecessor period from all prior dates through February 5, 2021 (the “Predecessor” period) and the successor period from February 6, 2021 through all dates after (the “Successor” period).

($ in thousands)

21

Overview of Common Shares

Total Shares

Common Shares Issued at Emergence

50.0

Shares Issued to PACD 16.6

Total Common Shares Outstanding 66.6

Overview of Warrants

Strike Price

Expiration

Total Shares

Tranche 1 Warrants $19.27 02/08/28 8.3

Tranche 2 Warrants 23.13 02/08/28 8.3

Tranche 3 Warrants 124.40 02/08/26 2.8

Total Warrants 19.4

Total Shares + Warrants (excl MIP shares) 86.0

Common Shares and Warrant Overview

(1) Shares shown herein reflect shares prior to MIP shares.

(2) Includes 6.5mm shares converted to Penny Warrants after emergence. Penny Warrants are economically equivalent to ordinary shares.

(3) Sensitivity based on Treasury Stock Method and does not include any impact of Black-Scholes Protection as described in warrant agreements.

(1)(2)

(3)

(shares in millions)

Noble Share Price $20.00 $22.50 $25.00 $27.50 $30.00 $32.50 $35.00

Common Shares Outstanding 66.6 66.6 66.6 66.6 66.6 66.6 66.6

(+) Net Dilution from In-The-Money Warrants

0.3 1.1 2.1 3.2 4.2 5.0 5.7

Fully Diluted Noble Shares 66.9 67.7 68.7 69.8 70.8 71.6 72.3

Common Ownership 99.6% 98.4% 97.0% 95.4% 94.1% 93.0% 92.1%

Warrant Ownership 0.4% 1.6% 3.0% 4.6% 5.9% 7.0% 7.9%

Noble Share Summary

Illustrative Warrant Dilution Summary