TECHNICAL NOTES AND MANUALS

Implementing Accrual Accounting

inthePublic Sector

Prepared by Joe Cavanagh, Suzanne Flynn, and Delphine Moretti

Fiscal Affairs Department

INTERNATIONAL MONETARY FUND

INTERNATIONAL MONETARY FUND

Fiscal Affairs Department

Implementing Accrual Accounting in the Public Sector

Prepared by Joe Cavanagh, Suzanne Flynn, and Delphine Moretti

Authorized for distribution by Sanjeev Gupta

September 2016

DISCLAIMER: This Technical Guidance Note should not be reported as representing

the views of the IMF. The views expressed in this Note are those of the authors

and do not necessarily represent those of the IMF or IMF policy.

JEL Classication Numbers: H61, H83

Keywords: government accounting, accrual accounting, cash

accounting,GFSM, government nancial reporting,

IPSAS,accounting standards

Authors’ E-Mail Addresses: [email protected]; [email protected];

Technical Notes and Manuals 16/06 | 2016 1

Implementing Accrual Accounting in the

PublicSector

1

TECHNICAL NOTES AND MANUALS

This note addresses the following issues:

• What is accrual accounting in the public sector?

• How should governments prepare to move from cash to accrual accounting?

• How to sequence the move from cash to accrual accounting in the public sector?

• What does the transition to accrual accounting imply for the:

– Recognition of stocks and flows in government financial statements;

– Government accounting policies and adoption of international standards;

– Government accounting systems and practices; and

– Institutional coverage of government financial statements?

• What can be learned from countries that have successfully made the transition?

I. INTRODUCTION

1

Over the past two decades, a growing number of governments have begun moving away from

pure cash accounting toward accrual accounting. While accrual accounting has been the norm

among private corporations for over a century, the vast majority of governments prepared their

budgets and accounts on a cash basis up until the end of the last century. The recent spread of

accrual accounting to the public sector can be attributed to a number of related factors, including:

(i) a growing recognition of the limits of pure cash accounting (ii) the development of accrual-

based international standards for government fiscal and financial reporting including Government

Finance Statistics Manual (GFSM) and International Public Sector Accounting Standards (IPSAS);

2

(iii) the professionalization of the government accounting cadre and resulting introduction of private

sector techniques into the public sector; and (iv) the advent of computerized financial management

information systems (FMISs) which greatly reduce the transaction costs of collecting and consolidating

1

The authors would also like to thank Richard Allen, Marco Cangiano, Ian Carruthers (IPSASB), James L. Chan, Kaitlyn

Douglass, Manal Fouad, Torben Hansen, Richard Hughes, Tim Irwin, Mario Pessoa, Sandeep Saxena, Johann Seiwald, Holger

Van Eden, and Ken Warren for their comments and advice. The appendix on Accrual Basis for Fiscal Statistics was produced

with the assistance of Miguel Alves, Senior Economist in the Statistics Department and Fiscal Affairs Department. Delphine

Moretti is a former IMF staff and now works at the OECD and Joe Cavanagh is a member of the IMF’s roster of scal experts.

2

International Monetary Fund (2014b), International Federation of Accountants (2014); a list of the IPSAS standards

is in Appendix I.

2 Technical Notes and Manuals 16/06 | 2016

accrual-based information. In 2015, 41 governments (21 percent) have completed the transition, 16

governments account on a modified accrual basis (8 percent), 28 governments (17 percent) are on a

modified cash basis, and 114 governments (57 percent) remain on pure cash accounting (Figure 1).

Figure 1. Map of Countries Accounting Bases for Annual Financial Statements in 2015

Source: OECD and IMF staff estimates, based on public information, including Blöndal and Moretti (2016) and Eurostat (2014).

Pure cash accounting has a number of weaknesses from the point of view of government

financial transparency, integrity, and accountability. Under cash accounting, transactions

are recognized only when the associated cash is received or paid and economic events are not

reported if there is no immediate exchange of cash. Governments have been tempted to exploit

this weakness by deferring cash disbursements or bringing forward cash receipts as a means of

artificially inflating their financial balance. Moreover, governments that follow cash accounting

tend to not maintain comprehensive and up-to-date records of the value of their assets and

liabilities. This enables them to transfer assets (such as land or mineral rights) or incur liabilities

(such as pensions or public-private partnership contracts) to third-parties without disclosing their

financial implications for the government and taxpayer.

3

The term accrual accounting has come to be associated with four related innovations in government

accounting over the last several decades. These innovations are:

• The recognition of economic events in flow reports at the time at which they occur, as well as

when the related cash receipts and payments change hands. For this purposes an “economic

event” is an event which results in the creation, transfer, or destruction of economic value.

Economic events can include the delivery of a taxable service by a private company (for which

3

International Monetary Fund (2012 and 2014a).

Technical Notes and Manuals 16/06 | 2016 3

the government accrues tax revenue), performance of a public service by a government employee

(for which the government accrues a salary and perhaps a pension expense), or the loss or theft of

a government asset such as a vehicle or equipment (for which a reduction in the asset stock will

be recognized). These economic events may directly generate a corresponding or simultaneous

cash flow, but in many cases—such as depreciation, revaluations, or impairment—they do

not. This is an important difference between cash and accrual bases. Note however these other

economic events are real, and can be connected to previous or subsequent cash impacts: for

example, depreciation usually represents the allocation of the cost of an asset over its useful life;

and revaluation or impairment may reflect a changed view of the (cash) amount that can be

recovered from the asset when sold.

• The recording of all stocks of assets and liabilities, in balance sheets. Governments

that follow pure cash accounting typically account only for their cash holdings on the assets

side and, possibly, debt on the liability side of their balance sheets. These are often valued

at “book value” or the value at which they were initially acquired or issued. Under accrual

accounting, governments recognize all assets and liabilities including financial assets (such

as equities), non-financial assets (such as land and buildings), and liabilities other than debt

securities and bonds (such as payment arrears and pension obligations). These stocks are

usually recorded at their current market value, their value in use, or some approximation,

and regularly revalued to ensure the balance sheet reflects the government’s true financial

position at a given point in time.

• Enhanced monitoring of liabilities and contingent liabilities. Liabilities such as employee

entitlements, environmental obligations, insurance claim obligations, expected losses under

guarantee schemes which are not typically recognized in a cash accounting environment

receive much more attention once recognized under accruals.

• The consolidation of all entities under government control. Cash accounts typically only

cover budgetary central government (central government ministries and agencies). Accrual-

based international accounting standards call for financial statements which consolidate all

entities under government control

4

(such as extra-budgetary funds, arms-length agencies,

and public corporations).

5

Accrual accounting therefore offers a number of benefits over traditional cash accounting

from the point of view of government transparency, accountability, and financial manage-

ment. First, by capturing both cash transactions and non-cash flows in financial statements,

accrual-based fiscal reports provide a more comprehensive view of the government’s financial per-

formance and the cost of government activities. Second, accrual accounting can help focus greater

attention on the part of policymakers and the public on the acquisition, disposal, and manage-

ment of government assets, liabilities, and contingent liabilities. Third, by consolidating not only

4

The denition of control will vary depending on the accounting framework considered, but can be summarized as

the ability to determine or govern the nancial and operational policies of an entity. In addition, consolidation of entities

under government control is not stricto sensu an innovation to be associated with accrual accounting, as consolidation is

an important feature of scal statistics. It is to be noted that statistical standards have different consolidation concepts.

5

IPSAS uses the term “government business enterprise” rather than “public corporation”, although the denitions

are broadly similar. Under IPSAS, government business enterprises should follow commercial accounting standards,

although their nancial results may need to be restated in IPSAS terms so as to permit their consolidation in a Whole

ofGovernment account.

4 Technical Notes and Manuals 16/06 | 2016

central government ministries and agencies but all institutional units under government control,

accrual accounts provide a more complete picture of the financial position of the public sector as

a whole. Fourth, by reporting stocks and flows within an integrated accounting framework based

on internationally-accepted standards such as GFSM2014 and IPSAS, accrual accounting can

improve the reliability and integrity of government financial data.

At the same time, as discussed later this note, governments need to establish a well-func-

tioning cash accounting system before contemplating a move to accrual accounting. Com-

prehensive and timely monitoring of cash reserves and flows is vital to evaluating a government

financing needs at any point in time. Accounting for uses of cash is also important to ensuring the

integrity of the government finances and ensuring that all cash receipts and payments are autho-

rized by law. Finally, most government budgets are on a cash or modified cash basis, therefore ef-

fective monitoring of cash receipts and outlays is needed to report on the execution of the budget

even after moving to full accrual accounting.

This note provides those governments contemplating a move toward accrual accounting

with guidance on the preparation, sequencing, and implementation of the reforms. The note

builds on the conceptual guidance provided by Khan and Mayes’ Transition to Accrual Accounting

by providing practical advice on preparing for the transition to accrual accounting, as well as the

necessary changes to the format of financial statements, content of accounting policies, and design

of accounting systems at each phase of the transition.

6

It also identifies which IPSAS standards

and elements of the GFSM2014 framework to adopt at each phase of the transition with the aim

of achieving full compliance with both by the end of the transition.

7

The remainder of the note is organized as follows:

• Section II describes the key tasks in preparing for transition to accrual accounting;

• Section III discusses the issues in sequencing the transition to accrual accounting;

• Section IV describes the content of government financial statements, accounting policies,

and management systems under a system of Cash Accounting (Phase Zero);

• Section V describes the reforms, to government financial statements, accounting policies,

and operations required to introduce Elementary Accrual Accounting (Phase One);

• Section VI describes the further reforms to the government’s accounting framework required

to move to Advanced Accrual Accounting (Phase Two);

• Section VII describes the final set of reforms to the government’s accounting framework

require to complete the transition to Full Accrual Accounting (Phase Three);

• Section VIII concludes with some reflections on the lessons from experience from coun-

tries that have successfully made the transition from cash to accrual accounting;

6

Khan A. and S. Mayes (2007).

7

A generalized description of the relationship between the government nance statistics reporting guidelines and the

International Public Sector Accounting Standards can be found in Appendix 6 of the IMF’s GFS Manual 2014.

Technical Notes and Manuals 16/06 | 2016 5

• Appendix I provides a full list of International Public Sector Accounting Standards; and

• Appendix II maps the above phasing onto GFSM2014 standards for fiscal statistics.

II. PREPARING FOR TRANSITION TO ACCRUAL ACCOUNTING

Political support and technical leadership are important prerequisites for the reform.

Countries considering implementing accrual accounting in the public sector will come to the task

from a range of different starting points, objectives, capacities, systems, and traditions. High- level

leadership within the executive and support from the legislature and supreme audit institution

are essential to ensuring that the accrual information is produced, understood, and used for fiscal

decision-making, management, and accountability. In addition, the support of senior officials is

critical to drive the change, ensure that momentum is maintained and that technical obstacles

are overcome during the transition. This must include commitment of the necessary resources

to implement the reform. Where such a prerequisite is not met, countries should start by

implementing reforms with a limited scope (see phase 0 and 1 of the phasing discussed below).

Preparation for transition will typically involve the following preliminary tasks:

• Clarify the objectives of the reform: Having a common understanding of what the move to

accrual accounting is expected to achieve is essential in order to shape the transition and gain the

necessary commitment and ownership. Objectives may include: greater external transparency,

more reliable internal management information, stricter controls over expenditure arrears and

other liabilities, improved working capital management, more efficient management of govern-

ment assets, stricter financial oversight of extra-budgetary entities, or a better understanding and

management of fiscal risks. The relative importance attached to each of these objectives will, in

turn, inform the sequencing of the different reforms involved in the transition.

• Establish a representative reform team: This should comprise all key stakeholders, includ-

ing the: Ministry of Finance (MoF), government accountants, line ministries, local govern-

ment, public enterprises, statistics compilers, Parliament, Supreme Audit Institution and

accounting standard setters, and may need to be split into a steering committee and task

forces to deal with specific technical issues. A core of full-time staff in the MoF with a strong

understanding of accounting will be essential to drive the reform, deliver training, ensure

preparations are made for each phase, and address technical problems as they arise.

• Survey existing accounting policies, systems, skills and practices: This survey should

cover the entire public sector including central government ministries, extra-budgetary funds

and agencies, local governments, and public corporations and assess each sector’s current

degree of compliance with the requirements of accrual accounting based on international

standards. The results should inform both the costing of the reform and phasing of the

transition. For example, it may be the case that some classes of public entities (such as local

governments or public corporations) already apply accrual accounting in part or in full, and

can therefore be brought into the reform effort sooner rather than later (see Box 1).

6 Technical Notes and Manuals 16/06 | 2016

Box 1. Preparing for Adoption of Accrual Accounting in Chile

In 2010, the General Controller of Chile (Contraloría General de la República, CGR)

announced its intention to adopt accrual accounting in the public sector based on

IPSAS by 2019. One of the key preparatory tasks in the process was to conduct a gap

analysis comparing existing government accounting practices with the requirements of

IPSAS. The gap analysis categorized the 32 IPSAS into four categories that allowed the

ofcials to create a framework for studying and applying the new standards:

• high priority, which comprised xed assets, transfers, property investments, taxes,

nancial instruments and nancial liabilities;

• medium priority, which included revenue from exchange transactions, associates

and joint ventures, provisions, intangible assets, contingent assets and liabilities,

leases and concession arrangements;

• low priority, which comprised nancial statements, inventories, segment reporting,

employee benets, related party disclosures, effects of changes in foreign exchange

rate, agriculture and accounting policies, changes in estimates and errors; and

• not applicable standards, such as nancial reporting in hyperinationary economies

and construction contracts.

Source: Cavanagh and Fernandez Benito (2015).

• Estimate the costs of reform: Once the above gap analysis has been completed, the govern-

ment should estimate the costs of the reform to determine whether the prospective benefits

outweigh the costs, and secure budgetary resources to implement the reform—which may be

phased or involve partial adoption. Recent experience indicates that financial and other costs

of reforms can vary significantly depending on the state of accounting practices, degree of

ambition, and links with other financial management reforms (Box 2).

• Establish a mechanism for setting accounting standards: Historically in many jurisdic-

tions, accounting standards in the public sector have been set by the MoF. This is at odds

with the need for objectivity, independence, and integrity in government financial reporting.

Many countries introducing accrual accounting based on international accounting standards

have taken the opportunity to externalize the setting of accounting standards for the public

sector by:

– Establishing independent boards designed to advise the government on the adoption or

adaptation of international accounting standards (France, UK);

– Vesting responsibility for determination of public sector accounting standards in an inde-

pendent national body (New Zealand, Australia, Canada, South Africa);

– Adopting standards developed by an international standard setter (Chile-see Box 1); and

– Consulting the supreme audit institutions before enacting new accounting standards in

the public sector (Austria-see Box 3).

Technical Notes and Manuals 16/06 | 2016 7

Box 2. Estimating the Costs of Moving to Accrual Accounting

The cost of moving from cash to accrual accounting depends on the starting point,

scope, ambition, and speed of the transition and relationship to other public financial

management reforms. Based on experience in various countries, reform costs are likely

to include: (i) investment in new IT systems; (ii) training of finance and operational staff,

politicians, auditors; and (iii) in many cases, consultancy fees. Few countries have pub-

lished a full ex post assessment of the cost of adopting accrual accounting.

However, a recent study published by EUROSTAT based on a survey of EU Member

States estimates the cost of such reforms for the EU as a whole at between €1.2 and

€6.9 billion, which represents 0.009 to 0.053 percent of the EU GDP.

1/

The Austrian

Federal Government, who made the transition between 2009 and 2013, estimated the

cost of transition at €30 million (0.007 percent of GDP). Outside the EU, Switzerland

has estimated the cost of implementing accrual accounting and accrual budgeting at

the Federal Government level to be around €40 million (0.005 percent of GDP) with

approximately 80 percent of this cost being for the new IT system. However, these

estimations focus on advanced economies. Costs are likely to be higher in developing

and low-income countries where the “gap” to be closed in terms of capacity and IT

systems will likely be larger.

A number of factors need to be taken into account when considering these cost

estimates. First, implementation of accrual accounting is seldom the only reform being

implemented at the time, so part of the cost is associated with other reforms such

adoption of new fiscal rules, introduction of program and performance budgeting, or

improvements in internal or external audit practices. Second, the counterfactual of

not introducing accrual accounting does not entail zero cost. The largest single cost

associated with most moves to accrual accounting is the upgrading or replacement

of IT systems - both hardware and software. However, like all IT systems, government

systems become obsolete and need to be replaced or upgraded regardless of the

government’s reform intentions. Third, adoption of accrual accounting is likely to bring

benefits in terms of incentives for better maintenance of assets, avoidance of costly ex-

penditure arrears, and enhanced surveillance of fiscal risks, which need to be weighed

against the costs but are difficult to measure.

Source: Price Waterhouse Coopers (2014).

1

This estimated cost is indicative only. The study notes that to estimate reliably the cost of accrual ac-

counting implementation (and more specically the implementation of European Public Sector Accounting

Standards – EPSAS) for the EU as a wholeor for a specic government, an in-depth assessment should

be carried out at the level of each government within eachMemberState.

8 Technical Notes and Manuals 16/06 | 2016

Box 3. Setting Public Sector Accounting Standards in Austria

In Austria, the introduction of accrual accounting reform primarily driven by the desire

for better information for budget decision-making. The Ministry of Finance therefore

sought to balance the desire for greater comprehensiveness and accuracy in financial

reporting against the relevance of the additional information and the cost of obtaining it.

Hence, while IPSASs were considered as a reference point, full compliance with all stan-

dards was not the ultimate goal of the reform. Deviations from specific standards were

sanctioned on the grounds of cost or relevance, and those perceived to have a limited

impact on public finances or thought too complex were not considered for transposition.

Currently Austria fully applies 20 IPSAS, partially applies 5 (including those on consolida-

tion, employee benefits, and tax revenue) and does not apply 7 of 32

1

IPSAS standards

(including joint ventures, hyperinflation, and construction contracts). For those IPSASs

which are fully or partially adopted, national standards were prepared directly by the

Ministry of Finance based on concept notes setting out guiding principles, draft state-

ments, valuation rules, and recognition and disclosure principles of the different elements.

The legal drafts of the standards are finalized in cooperation with the Court of Audit and

following a formal consultation process with ministries and local governments.

1

There were 38 IPSAS standards at end-2015, of which one is superseded. The six most recent

standards come into force at the start of 2017. A full list is at Appendix 1.

• Training and change management: The introduction of accrual elements into government

accounts will require significant training of preparers of the financial statements in new

concepts, systems, and accounting methods. This training also needs to extend to the users

of financial statements including ministers and senior officials in the MoF, parliamentarians,

civil society, and the supreme audit institution (SAI).

8

To reach this diverse range of stake-

holders, training needs to make use of a variety of modalities including lectures, hands-on or

online tutorials, guidance notes, and a dedicated helpdesk facility.

• Develop an action plan for the transition: The transition to accrual accounting is seldom,

if ever, made in a single step. In most cases a transition plan needs to be defined, which sets

out the key stages of the reform, including the responsibilities and timing for the prepara-

tory tasks, reforms to the relevant systems and processes, and format and content of financial

statements at each stage. The plan should also consider whether pilot exercises or parallel

running of cash and accrual systems are required. IPSAS 33 provides further guidance for

when an entity first adopts accrual basis IPSASs., including voluntary exemptions (or “re-

liefs”) during the transition period. The following section discusses a stylized phasing for the

transition and the policy and operational reforms involved at each stage.

8

In most countries, the SAI will be responsible for certifying the nal accounts prepared on an accrual basis. In this

context, most SAI will have to broaden the scope of their audit, from “compliance audit” (based largely on the legality of

transactions) to “nancial audit” (which extends to whether the accounts give a true and fair view). This will require the

SAI to adopt international audit standards (the International Standards of Supreme Audit Institutions, ISSAI, are issued

by the International Organization of Supreme Audit Institutions, (INTOSAI); for more information: www.issai.org.), and

train the auditors in new auditing techniques (such as the risk-based audit approach).

Technical Notes and Manuals 16/06 | 2016 9

III. SEQUENCING THE TRANSITION TO ACCRUAL ACCOUNTING

The sequencing of reforms and the length of time needed to implement accrual accounting

can vary greatly. Some countries progressively add accrual elements or disclosures to their

financial statements without setting a specific date for a full implementation of accrual accounting

(e.g., Philippines, South Africa, and Sri Lanka – see Box 4). Countries that have looked to

implement accrual accounting at the budgetary central government or central government level

have undertaken the transition in three (e.g., New Zealand) to five years (e.g., France, Austria).

Other countries have started the implementation at sub-national level to address specific concerns

around accumulation of liabilities at that level (e.g., China). Countries which sought to implement

accrual accounting for the whole of the public sector, such as Peru and the United Kingdom, took

more than ten years to complete the transition (see Box 5).

Box 4. Sequencing the Introduction of Accrual Accounting in Sri Lanka

Sri Lanka has been moving towards accrual accounting based on IPSAS since 2004.

Beginning in 2005 the government adopted a revised format for its financial statements, which

closely mirrors the four financial statements required by IPSAS 1 (Statements of Financial

Performance, Financial Position, Cash Flows, and Changes in Net Assets). A Statement of

Budgetary Performance is also provided in the notes to the accounts to maintain alignment

between budget and outturn data. All of these statements are presented on a modified cash

basis with valuation at historic cost. The Statement of Financial Position includes financial

assets and liabilities other than cash, including on-lending and the capital contribution in SOEs,

as well as external borrowing.

The government plans to expand incrementally the coverage of the financial statements to

apoint where the move to full accruals is possible. Currently, the notes to the financial state-

ments include a schedule of movable assets acquired since 2004. For land and buildings,

there is a current process of valuation or revaluation which, once completed and together

with the data on movable assets, should permit a switch to accruals-based disclosure

offixedassets.

Source: Authors.

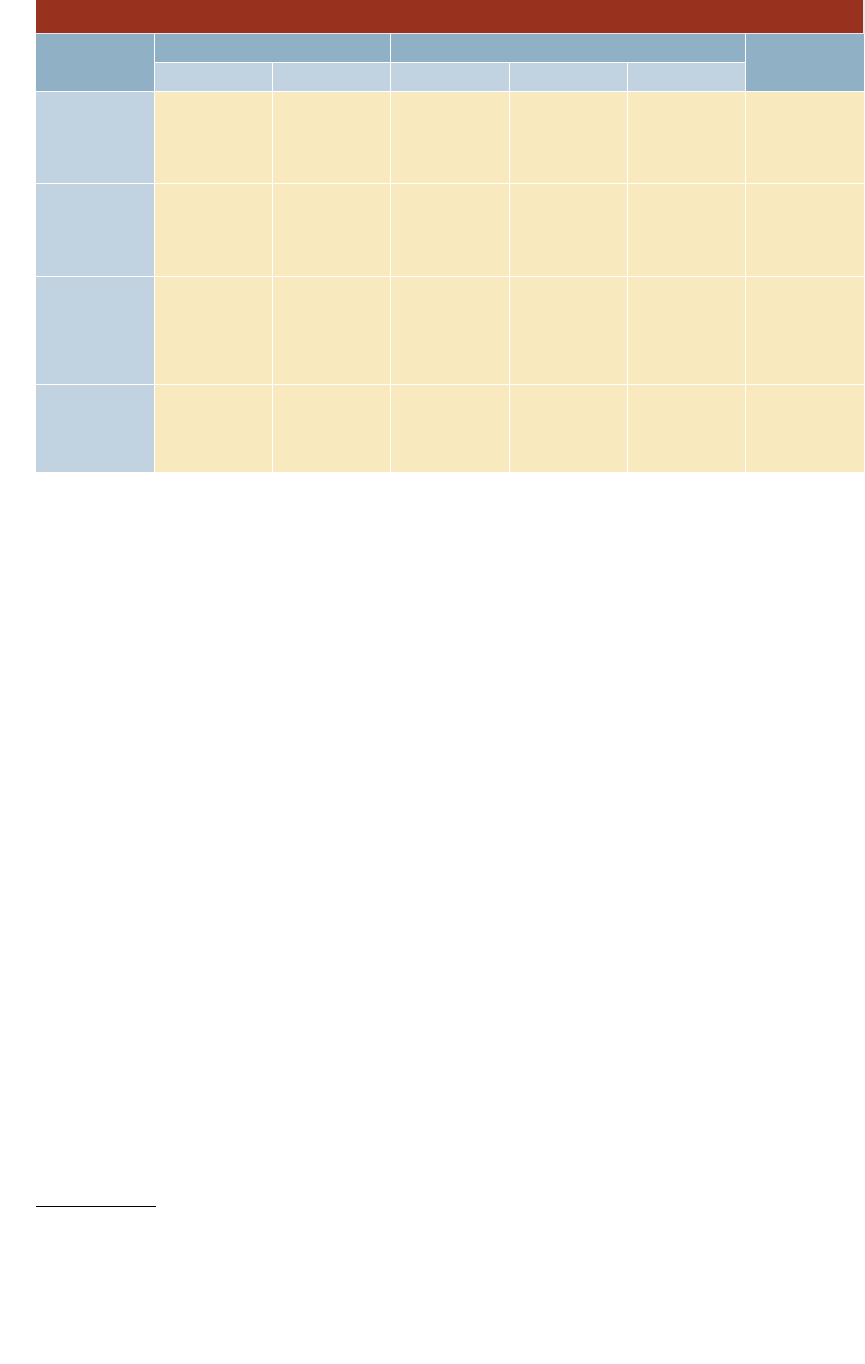

Building on international experience, this section provides an indicative phasing for the

transition from cash to accrual accounting in the public sector. In this phasing, the transition

to accrual accounting entails reforms in three parallel dimensions of fiscal reporting, which are

summarized in Table 1. These are:

• Recording of stocks in the balance sheet, beginning with a financial balance sheet and with the

ultimate goal of publishing a comprehensive balance sheet of the government’s financial and non-

financial assets and liabilities valued in accordance with international standards;

• Recognition of flows in the operating statement with the ultimate goal of recording all

transactions at the time economic value is transferred (rather that at the point cash payments

10 Technical Notes and Manuals 16/06 | 2016

are made) and as well as other economic flows that affect the government’s net worth (such

as changes in the value of government asset holdings); and

• Consolidation of institutions with the ultimate goal of including all institutional units

under the effective control of government in fiscal reports, regardless of their constitutional

status or legal form.

Box 5. Adopting Accrual Accounting in the United Kingdom Public Sector

In the UK, most areas of the public sector outside central government had operated

variations of the accrual basis for many years. In 1995, HM Treasury announced its

intention to move central government to an accrual basis for both budgeting and ac-

counting for individual government departments under the term “resource accounting

and budgeting” or RAB. RAB’s first full year of operation was originally intended to be

2001–02. Although the introduction of accrual accounting as a precursor to accrual

budgeting proceeded according to plan, concerns over data quality meant that the

introduction of accrual budgeting occurred in two phases, with depreciation and provi-

sions included in accrual budgets two years later than originally planned.

In 1998, HM Treasury and the National Audit Office initiated a joint study to examine

the merits and feasibility of producing a set of consolidated accrual-based accounts,

not just for central government but for the whole public sector, termed “whole of

government accounts” (or WGA). The production of accrual-based WGA was adopted

as the revised objective of the reform in the Government Resources and Accounts Act

passed in 2000.

Due to the more ambitious scope of the reform, HM Treasury planned a three-stage

implementation approach.

• Stage one involved the production of an unaudited whole of government accounts

based on statistical rather than accounting data.

• Stage two involved preparing unaudited consolidated Central Government Accounts

(CGA), incorporating the accounts of all central government departments but

excluding local government, trading funds, and some other non-departmental bodies.

• Stage three involved the publication of full accrual-based audited WGA.

As a result of delays in taking the final publication decision, the first full set of audited

WGA was finally published on 29 November 2011, more than a decade after the pas-

sage of the originating legislation. Since then, an action plan has been defined to raise

the quality of the data and address issues leading to audit qualifications. Improvements

in 2013-2014 included: consolidation of the assets and liabilities of the national rail net-

work, improvements to schools’ valuation of fixed assets, and faster WGA publication.

Source: 2007, Danny S.L. Chow et al. (2007), European Commission (2014), authors.

Technical Notes and Manuals 16/06 | 2016 11

TABLE 1. TRANSITION TO ACCRUAL ACCOUNTING: MAIN ELEMENTS ADDED AT EACH PHASE

1

BALANCE SHEET OPERATING STATEMENT

INSTITUTIONS

ASSETS LIABILITIES REVENUES EXPENSES OTHER FLOWS

Phase 0:

Cash Accounting

Cash balances Bank overdrafts

Debt

Cash receipts Cash payments None Budgetary

Central

Government

Phase 1:

Elementary

Accrual

Accounting

Trade

receivables

Prepayments

Trade payables Accrued trade

revenue

Accrued

expenses

excluding

depreciation

None Central

Government

Phase 2:

Advanced

Accrual

Accounting

Equity

Investments

Other nancial

liabilities Long-

term liabilities

(e.g., pensions)

Accrued non-tax

receivables

None Valuation

changes in

nancial assets

and liabilities

Provisions

General

Government

Phase 3:

Full Accrual

Accounting

Fixed and

intangible assets

Inventories

Tax receivables

Monetary

nancial

instruments

Accrued

receivables

Depreciation Valuation

changes in non-

nancial assets

Public Sector

Source: Authors.

1

For the purpose of this note, the terms operating statement and balance sheet are used. International accounting standards use the terms

statement of nancial performance and statement of nancial position respectively.

The actual sequencing of reforms followed by a particular government will therefore

depend upon a number of considerations. These include:

• The government’s starting point in terms of both the completeness of cash-based reporting and

the extent to which accrual stocks and flows are already being recorded or recognized. Many

countries already record some accrual flows or balance sheet items for internal management

purposes, which can be easily recognized in published accounts. In some countries, local govern-

ments have already advanced in applying accruals. Moreover, if a country is already using modi-

fied cash accounting, it may make more sense to complete the transition to accrual accounting

than to adopt the Cash IPSAS standard.

9

• The government’s objectives of moving to accrual accounting which, as discussed in SectionI,

can include strengthening monitoring and control of expenditure arrears, getting a clearer pic-

ture of the fiscal position of public entities outside the central government budget, or gaining a

better understanding of the long-term sustainability of the public finances.

• The materiality of stocks, flows, and entities outside government accounts, with attention

focused on the largest and most readily recognizable. For example, countries with large

public corporations which already follow accrual-based International Financial Reporting

Standards (IFRS) may find is easier to incorporate these into summary financial statements

before bringing in local governments.

9

The IPSAS Board is proposing to make amendments to the Cash Basis IPSAS to overcome obstacles to its adoption

that result from the current requirements for the preparation of consolidated nancial statements and disclosures of

information about external assistance and third party payments.

12 Technical Notes and Manuals 16/06 | 2016

• The duration of each phase which will depend on the level commitment to reform imple-

mentation, the resources available, the maturity of systems, and the accounting and financial

capacities across the public sector.

The phasing proposed in the next four sections, and summarize in Table 1, provides an

indicative road map to accrual accounting for a country starting with incomplete cash ac-

counting. It is designed to recognize the simplest and most important stocks and transactions

first, and then to gradually recognize more complex stocks and transactions in subsequent phases.

It also progressively extends the coverage of the financial statements from the budgetary central

government to the whole of the public sector. The proposed phasing is also designed such that,

at each phase of the transition, an integrated and internally consistent set of balance sheets and

operating statements are produced. This will allow for regular reconciliation of stocks and flows

and maintains the overall integrity of financial reporting at each stage. In the following sections,

each stylized phase of the transition from cash to accrual accounting is discussed in terms of ele-

ments reported in the balance sheet and the operating statement, and the institutions included in

the consolidated financial statements.

Whilst the sequencing of reform in this Note is based on the parallel extension of accruals in two

dimensions—balance sheet coverage and institutional coverage—it should be noted that these

two dimensions do not have to develop in parallel. Much will depend on the state of readiness,

and capacity (both human and systems) in each part of the public sector. So all sub-sectors may

advance together, for example, or some balance sheet items be included at earlier phases if reliable

data is available. Nor does the phasing imply that important preparatory work cannot or should

not be started earlier: data collection for later phases may need to start in preceding stages, for

example the preparation of inventories of non-financial assets will need to start early in prepara-

tion for reaching that stage.

IV. PHASE ZERO: CASH ACCOUNTING

This section discusses the accounting policies, operations, and financial statements

required for a well-functioning cash accounting system. Operating in a cash accounting

environment mainly involves producing reliable and complete information on the cash

transactions, cash holdings, and the short-term debt position of budgetary central government.

TABLE 2. ELEMENTS REPORTED IN PHASE 0: CASH ACCOUNTING

BALANCE SHEET OPERATING STATEMENT

INSTITUTIONS

ASSETS LIABILITIES REVENUES EXPENSES OTHER FLOWS

Phase 0

Cash Accounting

Cash balances Bank overdrafts

Debt

Cash receipts Cash payments None Budgetary

Central

Government

Source: Authors.

Technical Notes and Manuals 16/06 | 2016 13

Cash accounting has the benefit of being relatively simple and easy to administer. It is

therefore appropriate for countries that need to build capacities and improve the reliability and

integrity of their systems before moving to accrual accounting. For such countries, it is usually

consistent with the government budget, which will also be prepared on a cash or modified cash

basis, and allows the government, parliament, and citizens to assess how the voted budget has

been executed. Lastly, although it does not provide a sufficiently detailed picture of government’s

financial position, by comparing cash balances with outstanding debt, markets and stakeholders

can use cash-based accounts to assess the government’s immediate solvency and liquidity.

A. Financial Statements

At this stage the financial statements will comprise a cash flow statement, and ideally an

elementary balance sheet,

10

with accompanying notes to enhance the understanding and

interpretation of the statements. Where no balance sheet is produced, information on debt

should be disclosed in notes to the cash flow statement.

Cash flow statement

The cash flow statement, which is required for both cash and accrual accounting, should

present the government’s cash receipts and payments. The cash flow statement should

distinguish between operating, investing, and financing activities

11

to enable reconciliation with

incurrence and repayment of debt in the balance sheet. As shown in Figure 2, the cash flow

statement in Phase 0 should show:

• Cash receipts and payments relating to governments operating activities classified in accordance

with the government’s national economic or line-item classification. These include such items as

taxes collected and invoices paid;

• Cash flows relating to the government’s investing activities. These include cash flows derived

from purchases or sales of physical assets such as property, plant, and equipment as well as

financial assets such as loans to individuals and private sector companies, or equity and debt

instruments of other government owned entities;

• Cash flows from financing activities including payments and receipts related to government’s

stock of borrowing; and

• Reconciliation between the opening cash balance brought forward from the previous year;

movements in cash due to operating, investment and financing activities during the year;

and the closing cash balance at the end of the year.

10

Such a balance sheet is not required under Cash basis IPSAS.

11

IPSAS 2, which stipulates the format of the cash ow statement, leaves room for interpretation as to the classication

of “current” receipts and payments relating to investing and nancing, such as dividends or interest received, or interest

paid and other nance charges. In this Note, we follow the preferred treatment under IPSAS 2 and treat these current

ows as part of operating activities, leaving investing and nancing ows as those which change the stock of investment

or nancing. The logic is that the operating section of the cash ow statement thus more closely resembles the eventual

operating statement under accruals, whilst the items under investing and nancing affect only the balance sheet position.

14 Technical Notes and Manuals 16/06 | 2016

Figure 2. Cash Flow Statement in Phase Zero

YEAR N YEAR N-1

Cash Flow from Operating Activities

Taxation 441 411

Sales of goods and services 32 27

Grants Received 23 27

Dividends and interest received 10 7

Other receipts 11 12

Salaries and wages -288 -265

Purchase of goods and services -105 -89

Grants and subsidies -52 -43

Interest and debt charges -37 -31

Other payments -25 -19

Net Cash Flows from Operating Activities 10 37

Cash Flow from Investing Activities

Purchase of property, plant and equipment -49 -50

Purchase of new investments -30 -28

Proceeds from sale of property, plant and equipment 45 37

Proceeds from sale of investments 15 5

Net Cash Flows from Investing Activities -19 -36

Cash Flow from Financing Activities

New borrowing 27 10

Repayment of borrowing -11 -7

Net Cash Flows from Financing Activities 16 3

Net increase/decrease in cash 7 4

Cash at the beginning of the period 25 21

Cash at the end of the period 32 25

Source: IPSAS1 Presentation of financial statements; Authors.

Balance sheet

Even under cash accounting, it should be possible to prepare an elementary balance sheet.

Most purely cash-based financial statements do not have separate balance sheets, just opening

and closing cash balances, with some countries including information on public debt as a

memorandum item. However, as a step towards accruals accounting, these assets and liabilities

could be reported in an elementary form of balance sheet, which will be expanded over the next

phases. In this elementary form of balance sheet, as shown in Figure 3, the only asset recognized

is the government’s holdings of cash, and the only liabilities reported are government debt:

• Cash includes cash on hand, such as bank balances, cash awaiting banking, petty cash, and cash

in transit; and cash equivalents such as short-term deposits and deposits on call; and

Technical Notes and Manuals 16/06 | 2016 15

• Debt can take the form of bank overdrafts and other short-term credit, loans from com-

mercial banks or bilateral or multilateral creditors, and securities such as treasury bills or

sovereign bonds.

12

Figure 3. Balance Sheet in Phase Zero

YEAR N YEAR N-1

Current Assets 32 25

Cash and cash equivalents 32 25

Total Assets 32 25

Non-current Liabilities 767 741

Borrowing and financing 767 741

Current Liabilities 214 224

Borrowing and financing 214 224

Total Liabilities 981 965

Net Assets -949 -940

Source: IPSAS1 Presentation of nancial statements; Authors.

Note: The Balance Sheet distinguishes “current” from “non-current” assets and liabilities. “Current” are those which assets and liabilities

which “crystallize” (fall due or are convertible to cash) within 12 months of the Balance Sheet date. Many classes of asset and liability will fall

entirelywithin either current or non-current but in other cases, especially debt, the asset or liability will need to split out to differentiate current

and non-current.

B. Accounting Policies

Presentation of the cash flow statement

There are two main options for presentation of the cash flow statement:

• IPSAS 2: Cash Flow Statement requires that cash flows be reported by operating, investing and

financing activities, as presented in Figure 2. This has the advantage of presenting the cash flows

in the same format as the cash flow statement within the eventual set of accrual-based financial

statements. However, such a presentation is unlikely to be consistent with the traditional presen-

tation of the annual budget;

13

and

• Cash basis IPSAS therefore allows presentation of cash flows using a classification basis appro-

priate to the entity’s operations. For government, this is usually the same presentation as the

budget, which facilitates comparison between budgeted and actual amounts.

12

Note that the change in the stock of debt is not explained only by cash transactions (for example, they include

holding gains and losses due to currency uctuations, and debt renegotiation and forgiveness). Therefore, including debt

in the balance sheet under phase 0 implies that the balance sheet and cash ow statement will not reconcile directly:

consequently, a reconciliation table needs to be disclosed in the notes to the nancial statement. Countries that do not

establish a balance sheet under phase 0 should at least report debt as a memorandum item until it is properly integrated

into the accounts, at Phase 1.

13

A traditional budget presentation is to classify revenues by economic category, but expenditures by organic (i.e.,

organizational) category. This traditional presentation does not directly align with IPSAS 2 differentiation of operating,

investing and nancing ows; hence the need for a separate statement of budget performance.

16 Technical Notes and Manuals 16/06 | 2016

In practice, governments may present the information in both formats to enable comparison with

both the national budget and financial statements of other governments that apply international

accounting standards.

14

Box 6. Cash Basis IPSAS

Cash basis IPSAS covers the required and recommended disclosures for entities

accounting in pure cash terms but also recommends additional accruals-type

disclosures to accompany the accounts, such as a statement of outstanding invoices,

statement of contingent liabilities, and statement of cash assets and fund balances.

Therefore, Cash basis IPSAS can be viewed as a goal in its own right, but is more often

seen as a rst step on the transition to accruals.

However, few countries have successfully achieved full compliance with cash

basis IPSAS for two main reasons: (i) the mandatory requirement to consolidate all

government controlled entities (including public corporations); and (ii) the requirement

to include external assistance payments made by third parties directly to suppliers.

Signicant work may be required to attain full compliance with cash basis IPSAS in

countries where there is a weak reporting framework for public corporations, or which is

not compliant with IFRS, and this may take several years.

Since most countries may already use some form of modied cash or accrual and

report on their public debt, adoption of cash based nancial statements is sometimes

perceived as a backward step, and instead countries may wish to build on their

modied cash data and nancial statements to continue the transition to accruals.

IPSASB has recently published proposals to revise the cash basis IPSAS in order to

address these issues. Countries should therefore assess during the preparation stage

whether full compliance with the cash basis IPSAS is achievable in the short term, or

whether an incremental approach to adoption of accrual basis IPSASs would provide

more useful and comprehensible information to stakeholders during the transition.

Source: IPSAS1 Presentation of nancial statements; Authors.

Recognition and measurement of cash and financing operations

Accounting policies should prescribe that all government’s transactions be recorded as soon

as cash is received or disbursed. These transactions are usually reported at their cash value and

stocks at face value.

15

Foreign currency transactions should be recorded in the national currency

using the exchange rate at the date of the receipt or payment. The gains and losses between when

the currency was acquired and the end of the year should be reported in a note to the statement in

14

Most governments operating under a cash accounting environment will also establish a statistical reporting consis-

tent with GFSM: cash receipts are classied by nature; cash payments are classied using a functional and

economicclassication.

15

The Face value of a debt instrument is the undiscounted amount of principal to be repaid at (or before) maturity. Its

nominal value at any moment in time is the amount that the debtor owes to the creditor.

Technical Notes and Manuals 16/06 | 2016 17

order to reconcile cash at the beginning and end of the period.

16

Debt operations are also typically

recognized at nominal value in a cash accounting environment and subsequently adjusted to

reflect repayments of the principal or debt forgiveness operations. Disclosures should show

total domestic debt and total debt denominated in foreign currencies. Arrears

17

related to debt

repayments, suppliers or other third parties should be disclosed in a note to the accounts.

C. Operational Implications

Governments operating a Treasury Single Account (TSA), or a limited number of

commercial bank accounts, will find it easier to capture all cash balances and transactions

in their financial information system and statements.

18

Some government cash balances

and transactions may, however, continue to operate outside the TSA in the case of, for example,

donor-funded project accounts, overseas and locally-operated accounts of government, or

accounts operated by extra-budgetary agencies or state-owned enterprises. Where there is no TSA,

establishing the cash flow statements and determining the cash balances at year-end will require

the collation of reconciled bank statements for all government bank accounts.

Preparation of an integrated set of cash accounts will be greatly facilitated if governments

operate a double-entry book keeping system, in which every accounting entry requires a

corresponding and opposite entry to a different account within a “General Ledger.”

19

Under

a cash basis environment, operating with a double-entry book keeping system means that, for a

given financial transaction, an entry will reflect the cash receipt or payment, and another one will

reflect the corresponding change in the entity’s cash or debt balance.

20

This ensures that the cash

flow statement and the balance sheet, even if in elementary form, are integrated and that each

financial operation is captured in both statements.

21

To record the outstanding stock of debt on the balance sheet, a comprehensive register of debt is

also required. The register should record the outstanding stock and composition of its debt liabilities,

16

Cash basis IPSAS provides more detailed guidance on how to measure and report currency effects in a cash account-

ing environment.

17

Expenditure arrears are a subset of payables that have remained unpaid beyond a specied due date for payment. In

cases where no due date is specied, arrears are dened as payables that have remained unpaid after a specied number

of days after the date on the invoice or contract, in accordance with a law, regulation, government payment policy, or lo-

cal practice. Source: Prevention and Management of Government Expenditure Arrears, Suzanne Flynn and Mario Pessoa,

Fiscal Affairs Department, IMF.

18

This may be difcult to achieve for countries that benet from external assistance, for example expenses related to

a project nanced by a donors’ grant may be managed in separate systems, which are not monitored by the Treasury. In

some cases, revenue may be recorded in a separate IT system, also. Where this is the case, procedures should be in place

for ensuring that these separate IT systems are either integrated or interfaced with the main accounting system. In all

cases, complete information should be communicated to the Treasury in a regular and timely manner.

19

The General Ledger is a central repository or database of accounting transactions which will be needed for nancial

reporting, and represents the backbone of an accounting system.

20

The double-entry book keeping system is also an error detection tool. The sum of debits and the sum of the credits

must be equal in value: if the sum of debits and credits in “Cash balances” does not equal the corresponding sum of

credits and debit on “Cash receipts” and “Cash payments” for all accounts, an error has occurred.

21

Double-entry book-keeping is a worthwhile reform from a nancial integrity perspective regardless of whether a

country decides to move to accruals.

18 Technical Notes and Manuals 16/06 | 2016

including their currency denomination, maturity, and interest rate structure. Governments will often

have a standalone debt management system, which can provide such data; although in time this may

need to be integrated with the main accounting system, to ensure consistency and data integrity.

D. Institutional Coverage

During this phase, the financial statements’ coverage should be the same as the annual

budget—generally termed budgetary central government. This ensures that taxes and other

revenues collected and cash appropriations approved by the legislature are fully accounted for and

financial statements are directly comparable to the budget.

Consolidation policies

Accounting policies should require that entities whose activities are financed primarily

through the budget are consolidated in the financial statements. These entities typically

include central government ministries, departments, and agencies. Specialized boards,

commissions, and agencies with significant own-source revenues are often outside the boundary

of the budgetary central government, and only the transfer from the budget to those agencies,

or budget income remitted by them, is included in the government’s budget and accounts. For

the purpose of transparency, notes to the financial statements should disclose the institutions

consolidated in the accounts at each phase of the transition.

Accounting policies should clarify the treatment of third party assets. A common feature of

public accounting is that governments will be responsible for the administration or custodian-

ship of third party funds (for example, funds deposited with courts, trust funds based on public

subscription, or a guarantee or mutual funds based on industry contributions). Where the public

body is acting purely as agent, has no discretion over the use of these funds, and has no financial

interest in them, these should be treated as third party assets, outside of the control of the entity,

and excluded from the principal financial statements. However, the government’s holdings and

administration of these funds should be disclosed in the notes to the accounts. There should be

separate published accounts for these funds.

22

Consolidation processes

The ease with which consolidated financial statements for the budgetary central

government can be prepared depends on the degree of automation and integration of

government accounting systems. In some countries, all ministries process their financial

transactions through an integrated financial management information system (IFMIS) managed

by the ministry of finance, enabling a set of financial statements to be produced directly from

the system at year-end. In other countries, ministries operate separate information systems

and a manual consolidation of individual ministry accounts is needed at year-end. To achieve

22

From the statistical viewpoint, these transactions may be recorded differently. For example, mandatory industry

contributions may be reported as taxes.

Technical Notes and Manuals 16/06 | 2016 19

this, standard reporting templates should be developed by the MoF which identify any intra-

governmental transactions and balances. The MoF will need to develop its own database to

capture the information and perform the consolidation, eliminating any intra-governmental

transactions and balances. Cash basis IPSAS sets out broad principles for undertaking this

consolidation, the main one being that cash balances and cash transactions between consolidated

entities should be fully eliminated. At this stage, eliminations should be more limited in number,

as cash transfers and transactions between ministries are usually few, compared with the number

of transactions between entities in the wider public sector.

V. PHASE ONE: ELEMENTARY ACCRUAL ACCOUNTING

This section discusses the reforms to government accounting policies, operations, and

financial statements involved in moving from Phase 0: Cash Accounting to Phase 1: Elementary

Accrual Accounting. This first phase in the transition to accrual accounting involves developing

a system for recording some “in transit” receipts and expenses in the operating statement, and

recognizing the related stocks of unpaid invoices from suppliers as liabilities and unpaid bills issued

to customers for services rendered as assets on the government’s balance sheet. Note that once

accrual elements are introduced into the accounts, the terminology changes from the terms “receipts”

and “payments” (or expenditures) used in a cash accounting environment to the terms “revenue” (or

“income”) and “expenses” used in an accrual accounting environment. Note too that at this stage the

accounts begin to capture “other flows” for which there is no corresponding cash movement.

TABLE 3. ADDITIONAL ELEMENTS REPORTED IN PHASE 1: ELEMENTARY ACCRUAL ACCOUNTING

BALANCE SHEET OPERATING STATEMENT

INSTITUTIONS

ASSETS LIABILITIES REVENUES EXPENSES OTHER FLOWS

Phase 1

Elementary

Accrual

Accounting

Trade

receivables

Prepayments

Trade payables Accrued trade

revenue

Accrued

expenses

excluding

depreciation

None Central

Government

Source: Authors.

This elementary form of accrual accounting enables governments to monitor the accumula-

tion of expenditure obligations, ensure they are liquidated in timely manner, and prevent

expenditure arrears. It also provides internal and external stakeholders with a more complete

picture of the costs of the public services and the deficit/surplus in a given year, as these costs can-

not be hidden by delaying cash payments and generating arrears.

A. Financial Statements

The financial statements at this stage will include the cash flow statement as described in

the previous phase, a more developed balance sheet, and, for the first time, an operating

statement and accompanying notes. These statements should make up an integrated set of

accounts—in the sense that they are internally reconcilable.

20 Technical Notes and Manuals 16/06 | 2016

Balance sheet

Trade receivables should be recognized as assets in elementary accrual accounting. Trade

receivables are a subset of accounts receivable and are unpaid amounts owed to government by

the commercial sector or individuals arising from the rendering of services, the sale of goods, or

accrual of interest, royalties or dividends.

Accounts payable should be recognized as liabilities in this phase of the transition. Accounts

payable are unpaid invoices owed by government to the commercial sector and other pending

payments to third parties such as international institutions or citizens (e.g., tax refunds).

Thus, in addition to the cash holdings and debt shown in the phase zero balance sheet, the

balance sheet will include the additional items highlighted in blue in Figure 4. These are:

• on the asset side - trade receivables and prepayments;

• on the liabilities side - amounts payable to suppliers, and

• on the bottom line - the corresponding impact on net assets.

Figure 4. Development of the Balance Sheet in Phase One

YEAR N YEAR N-1

Current Assets 40 31

Cash and cash equivalents 32 25

Grants receivable 3 3

Trade receivables 5 3

Total Assets 40 31

Non-current Liabilities 767 741

Borrowing and financing 767 741

Current Liabilities 241 247

Borrowing and financing 214 224

Salaries and wages payables 12 11

Grants and subsidies payables 4 3

Trade payables 11 9

Total Liabilities 1,008 988

Net Assets -968 -957

Elements added on accruals basis in phase 1

Source: IPSAS1 Presentation of financial statements; Authors.

Note: this illustrative example assumes no contributed capital and no minority interest, which would change the equity section of the statement.

Operating statement

In addition to the Cash Flow Statement shown in Phase Zero, Phase One sees the

publication of the first operating statement incorporating some accrual flows. Amounts

recorded as payables and receivables in the balance sheet will generate corresponding flows in the

operating statement, which will develop as presented in the Figure 5 below:

Technical Notes and Manuals 16/06 | 2016 21

• On the revenue side, tax revenues (non-exchange revenues) are shown on a cash basis, while

non-tax revenues (exchange revenues), including receipts from sales of goods, fees and charges

for provision of services, and capital receipts or investment revenues (e.g., sale of government’s

shareholding), are shown on an accrual basis;

23

• On the expenditure side, wages and salaries, grants and subsidies, purchase of goods (in-

cluding fixed assets), and purchase of services are accounted for on an accrual basis. How-

ever, amortization or depreciation of assets will not be accounted for at this stage; and

• The use of “net change in cash” as the summary aggregate in a cash account (Phase 0) be-

comes the more familiar and useful “Surplus or deficit” under accrual accounting.

Figure 5. Development of the Operating Statement in Phase One

1

YEAR N YEAR N-1 ACCOUNTING BASIS

Tax revenue from direct taxes 235 218 Cash

Tax revenue from indirect taxes 159 151 Cash

Tax revenue from local taxes 47 41 Cash

Grants received 24 26 Accrual

Revenue from sales of goods and services 37 32 Accrual

Dividends and interest received 11 8 Accrual

Proceeds from sale of investments 15 5 Cash

Proceeds from sale of property, plant and equipment 45 37 Cash

Other revenue 8 9 Accrual

Total Revenue 581 527

Salaries 289 271 Accrual

Purchase of goods and services 100 87 Accrual

Grants and subsidies 56 45 Accrual

Purchase of investments 30 28 Cash

Purchase of property, plant and equipment 49 50 Partial Accrual

Finance costs 37 31 Cash

Other expenses 32 35 Accrual

Total Expenses 593 547

Gain on foreign exchange transactions 1 2 Cash

Other gain (or losses) 1 2

Surplus or Decit -11 -18

Elements recorded on an accrual basis in phase 1

Source: IPSAS1 Presentation of financial statements, Authors.

1

The presentation of the operating statement used by countries that have transitioned to accrual accounting may vary—international standards

do not specify an exact or detailed format to be followed. For example, the United Kingdom’s operating statement is presented as follows: (i) total

revenue, (ii) total expenditure, (iii) net expenditure before financing costs, (iv) net financing costs, and (v) net expenditure for the year. The net

expenditure before financing cost is not disclosed. However, independently from the presentation adopted, operating statements should include

similar type of flows and aggregates.

23

Transactions where the government receives a revenue without providing any service or good in exchange are called

“non-exchange transactions” (typically, tax revenue); transactions where the government receives a revenue in exchange

for a service or a good are called “exchange transactions” (for example, sale of a government’s building).

1/ The presentation of the operating statement used by countries that have transitioned to accrual accounting may vary—international standards do not specify an

exact or detailed format to be followed. For example, the United Kingdom’s operating statement is presented as follows: (i) total revenue, (ii) total expenditure, (iii) net

expenditure before financing costs, (iv) net financing costs, and (v) net expenditure for the year. The net expenditure before financing cost is not disclosed. However,

independently from the presentation adopted, operating statements should include similar type of flows and aggregates.

22 Technical Notes and Manuals 16/06 | 2016

B. Accounting Policies

Payables

Payables should be recognized in the balance sheet at the time an obligation to pay an

amount to a third party was created for the government. Accounting policies need to define

triggering events consistent with this principle. They are usually as follows:

• For goods and services, the delivery of goods, the provision of a service, or the fulfilment

ofacontract;

• For grants and subsidies, the existence of a valid claim, that is when all requirements and

conditions for receiving a subsidy or benefit are satisfied by the third party;

24

• For wages and salaries, when an employee earns an entitlement to receive a cash remunera-

tion or similar benefit, as specified in the law or employment contract; and

• For trade receivables, when the government is entitled to receive a payment from a third

party according to the contract.

However, where information systems or business processes do not allow tracking of these

triggering events as they occur, transitional accounting policies may be needed, which will

rely upon delayed or indirect recognition of trade payables. In Francophone and Latin countries,

which record expenditures in seven administrative stages, the payment order may be used as a delayed

triggering event for recognizing the trade payables (see Box 7 below). Another common delayed

triggering event will be the receipt of the invoice for goods or services delivered to government.

Policies for the valuation of trade receivables and accounts payable should be clearly stated.

These assets and liabilities will usually be recorded in the accounts at nominal value. If it is likely

that the full amount due from a third party will not be recovered, an adjustment for doubtful debt

should be made and an entry recorded in the balance sheet for the amount unlikely to be recov-

ered, or the receivable should be written-off.

25

24

Independently from the fact that this third party has made the claim.

25

Statistical standards record write-offs as other economic ows.

Technical Notes and Manuals 16/06 | 2016 23

Box 7. Expenditure Chain and Accrual Accounting

In Francophone and Latin countries, expenses are recognized in the budget following

a clearly dened process, which is usually referred to as the expenditure chain. It

consists of seven keys stages: authorization, apportionment, reservation, commitment,

verication, payment order and payment. If these stages are recorded in a reliable and

timely fashion, establishing a relationship between the steps in the process and the

triggering event for recognizing accrued expenses will help countries in transitioning

to accrual accounting. The verication stage (or Liquidation), when the administration

acknowledges that services or goods have been received and that a third-party is

entitled to receive a payment is similar to the triggering event for recognizing expenses

under accrual accounting (i.e., the occurrence of an economic event creating an

obligation). The verication stage could therefore be considered a proxy for accruing an

expense in the rst phase of the transition to accrual accounting.

Budget

Balance

Sheet

Account

Payable

Expense

Cash

Operating

Statement

Disclosures

Authorization Apportionment Reservation Commitment

Contingent

liability*

Verication

Payment

order

Payment

Source: Authors.

C. Operational Implications

The transition to accrual accounting usually requires a new Chart of Accounts. A Chart of

Accounts is the universal system of codes which are used to classify transactions and ultimately

their presentation in the financial statements. Additional categories or segments of the Chart

will be needed to accommodate the accrual equivalents of traditional cash transactions; to

accommodate new classes for assets and liabilities; and to incorporate non-cash transactions such

as depreciation or provisions. For example, in the Philippines, a first step in their current financial

reform has been to produce a “Unified Accounts Code Structure” (UACS) which meets the needs

of accrual accounting and statistics by linking financial accounts codes to GFS codes. There is an

automatic mapping from accounts codes to the relevant GFS codes, and thus both financial and

fiscal reports can be generated from the same data. Users need only enter the accounting code,

with the cross-coding to GFS being done in the background by way of reference or linking tables

within the system.

To determine the opening balances for trade payables, an inventory of all known accounts

payable related to goods and services should be compiled. This should be done for all services

and goods received and contracts let up to the balance sheet date. Such an inventory should also

24 Technical Notes and Manuals 16/06 | 2016

be compiled at year-end to determine the closing balance for accounts payable. It is also advis-

able to survey major suppliers or third parties (e.g., large local governments or public corpora-

tions receiving transfers) to confirm the accuracy of the amounts outstanding, and to review the

invoices received post period-end to identify accounts payable that should have been recognized

in the balance sheet at the closing date. A switch to accruals makes it even more important that

the source documentation, such as delivery notes, invoices, contracts, confirmation letters from

suppliers, should be systematically filed and available for audit.

A better approach to a year-end inventory of receivables and payables is to record goods de-

livered and services received in the accounts as transactions occur. To achieve this, account-

ing procedures and information systems should be set up to ensure that expenses are recorded

systematically, from the purchase order through receipt of goods to payment of the invoice,

including the dates at each stage, with capture of equivalent data on the trade receivables cycle.

When expenditure can be incurred without a purchase order, or receivables registered without an

invoice being issued - i.e., outside of the ledger system – there is a risk that the accounts payable

or receivable may not be recorded in a comprehensive or timely manner.

This systematic tracking of the processing of revenues and expenses often requires a

reconfiguration of the existing information system or the purchase of an IFMIS to record

the date, value, and status of each invoice for goods and services. Without an IFMIS, manual

records should be maintained, with regular internal audit to ensure that all invoices presented

for payment have been recorded in a timely manner. Compliance with these accounting rules is

critical to the accurate recording of accounting information, and an effective sanction regime for

officials who fail to record all invoices should be instituted.

For wages and salaries and grants and subsidies similar procedures need to be performed

for establishing the opening and closing balances of payables. Wage and salary-related accru-

als present special challenges which need to be reflected in the interface between human resource,

payroll, and accounting systems to ensure that triggering events can be effectively monitored. At

this stage it may only be possible to accrue simpler elements such as salaries, short-term benefits

and accumulated leave if these data are readily available. Long-term benefits such as pensions

will need to be included at a later stage.

26

For grants and subsidies, these non-exchange items are

partly covered by IPSAS 23

27

and should obey the general rules for recognition – they become an

asset (or liability, for the grantor) when a legally enforceable claim arises (i.e., when it is reason-

ably certain that the transfer of resources will occur, and its value can be reliably measured). The

ability to accrue for such items at this stage will depend on government’s systems for recording

them. Each type of grant or subsidy may merit different treatment.

26

Long term employee benets such as pensions represent specic challenges which will be dealt with in Phase two.

27

IPSAS 23 deals with the receipt of such revenues, but the accounting treatment for such expenses can be imputed.

AJuly 2015 IPSASB consultation paper “Recognition and Measurement of Social Benets” has proposed possible ac-

counting treatments for social benets.

Technical Notes and Manuals 16/06 | 2016 25

Box 8. Meeting the Requirements of Cash Budget Reports and Accrual

Accounting in Brazil

Brazil is part way through the transition to accrual accounting, based on IPSAS,

across all government bodies. These accruals accounts are to be produced alongside

traditional budgetary statements which are cash-based. Brazil started out with the

advantage of a unied IT system for accounting (SIAFI) in all bodies at the federal

level; and similar (but not identical) systems at state and local level. At federal level,

where the transition is most advanced, it was recognized that this IT system needed

to be adapted to serve the purposes of budgetary and accrual accounting. The key to

meeting this dual requirement has been to develop a system which in effect maintains

two sets of accounting ledgers—one for budgetary cash-based accounting and another