FOCUS

TRANSFORM

DELIVER

Rolls-Royce Holdings plc

Annual Report 2016

Front cover

A Trent 1000 engine being

assembled at our Seletar

plant in Singapore.

This page

A Trent XWB, the world’s

most efficient large

aero engine.

Rolls-Royce is a pre-eminent

engineering company focused

on world-class power and

propulsion systems.

Rolls-Royce Holdings plc Annual Report 2016 FINANCIAL HIGHLIGHTS AND CONTENTS

Financial highlights

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements. Any statements that express forecasts,

expectations and projections are not guarantees of future performance and guidance may be

updated from time to time. This report is intended toprovide information to shareholders,

and is not designed to be relied upon by any other party or for any other purpose, and the Company

and its Directors accept no liability to any other person other than that required under English law.

Latest information will be made available on the Group’s website. Bytheir nature, these statements

involve risk and uncertainty, and a number of factors could cause material differences to the

actual results or developments.

* All figures in the narrative of the Strategic Report are underlying unless otherwise stated.

Underlying explanation is in note 2 onpage131.

ORDER BOOK

£79,810m

2015: £76,399m

FREE CASH FLOW

£100m

2015: £179m

UNDERLYING* PROFIT BEFORE TAX

£813m

2015: £1,432m

REPORTED (LOSS)/PROFIT BEFORE TAX

£(4,636)m

2015: £160m

UNDERLYING* REVENUE

£13,783m

2015: £13,354m

REPORTED REVENUE

£14,955m

2015: £13,725m

UNDERLYING* EARNINGS PER SHARE

30.1p

2015: 58.7p

REPORTED EARNINGS PER SHARE

(220.1)p

2015: 4.5p

FULL YEAR PAYMENT TO SHAREHOLDERS

11.70p

2015: 16.37p

NET DEBT

£(225)m

2015: £(111)m

Contents

STRATEGIC REPORT

Group at a glance 2

Chairman’s statement 4

Chief Executive’s review 6

Introduction 6

Review of 2016 7

Priorities for 2017 13

Business model 14

Financial summary 16

Business review 18

Financial review 36

Sustainable business 40

Key performance indicators 46

Principal risks 48

Going concern and viability statements 53

DIRECTORS’ REPORT

Board of Directors 54

Chairman’s introduction 58

Corporate governance 59

Committee reports 67

Nominations & Governance Committee 67

Remuneration introduction 72

Remuneration policy 76

Directors’ remuneration report 83

Audit Committee 96

Safety & Ethics Committee 103

Science & Technology Committee 110

Responsibility statements 113

Other statutory information 186

FINANCIAL STATEMENTS

Financial statements contents 114

Group nancial statements 115

Company nancial statements 167

OTHER INFORMATION

Subsidiaries, joint ventures and associates 170

Independent auditor’s report 176

Sustainability assurance statement 183

Additional nancial information 184

Other statutory information 186

Shareholder information 190

Glossary 192

STRATEGIC REPORT

Rolls-Royce Holdings plc Annual Report 2016 STRATEGIC REPORT GROUP AT A GLANCE

Group at

a glance

ENGINEERS (YEAR END)

16,526

GROSS R&D EXPENDITURE

£1.3bn

ORDER BOOK

£79.8bn

PATENTS APPLIED FOR

672

EMPLOYEES (YEARAVERAGE)

49,900

COUNTRIES

50

The Group is organised into five

customer-facing businesses:

CivilAerospace, Defence

Aerospace, PowerSystems,

Marine and Nuclear.

UNDERLYING REVENUE

£13,783m

UNDERLYING PROFIT BEFORE FINANCING

£915m

UNDERLYING REVENUE MIX

GROUP

Civil Aerospace 51%

Defence Aerospace 16%

Power Systems 19%

Marine 8%

Nuclear 6%

Our award-winning Unied Bridge is the

result of detailed studies of how crews

use the equipment on the bridge, making

the vessel safer and easier to operate.

GROUP AT A GLANCE Rolls-Royce Holdings plc Annual Report 2016 GROUP AT A GLANCE

CIVIL AEROSPACE

UNDERLYING REVENUE

£7,067m

UNDERLYING PROFIT BEFORE FINANCING

£367m

UNDERLYING REVENUE MIX

PAGES TO FOR MORE INFORMATION

DEFENCE AEROSPACE

UNDERLYING REVENUE

£2,209m

UNDERLYING PROFIT BEFORE FINANCING

£384m

UNDERLYING REVENUE MIX

PAGES TO FOR MORE INFORMATION

UNDERLYING REVENUE

£777m

UNDERLYING PROFIT BEFORE FINANCING

£45m

UNDERLYING REVENUE MIX

PAGES TO FOR MORE INFORMATION

MARINE NUCLEAR

POWER SYSTEMS

UNDERLYING REVENUE

£2,655m

UNDERLYING PROFIT BEFORE FINANCING

£191m

UNDERLYING REVENUE MIX

PAGES TO FOR MORE INFORMATION

UNDERLYING REVENUE

£1,114m

UNDERLYING LOSS BEFORE FINANCING

£(27)m

UNDERLYING REVENUE MIX

PAGES TO FOR MORE INFORMATION

OE revenue 48%

Services revenue 52%

OE revenue 57%

Services revenue 43%

OE revenue 46%

Services revenue 54%

OE revenue 40%

Services revenue 60%

OE revenue 68%

Services revenue 32%

STRATEGIC REPORT

Rolls-Royce Holdings plc Annual Report 2016STRATEGIC REPORT CHAIRMAN’S STATEMENT

Progress in 2016 can be

judged by how we have

overcome our challenges;

we have delivered on our

commitments in a difficult

year while at the same time

embarking on a significant

transformation.”

UNDERLYING EPS

30.1p

PAYMENT TO SHAREHOLDERS

11.7p

conduct we have agreed to pay financial

penalties and costs of around £671m. These

dishonest acts, some as recent as 2013, are a

major blemish on the reputation of the

business and we have apologised unreservedly.

Importantly, the Board has taken extensive

action to strengthen ethics and compliance

procedures across the Group over recent

years,so that high standards of conduct are

embedded as an essential part of the way we

do business. We share a determination to see

that Rolls-Royce comes out of this episode as a

more trusted, resilient and better managed

business that wins right every time. Every

employee, from the bottom to the top of the

Group, is fully aware of the importance of

doing the right thing.

As described in the Nominations &

Governance Committee report (see page 70)

our governance framework was rolled out in

the summer and provides clarity and

accountability, providing additional integrity

to our business.

OTHER STATUTORY INFORMATION P

Ian Davis

Chairman

Chairman’s

statement

Last year I talked about how Rolls-Royce

is a business in transition and how

important the next few years were

going to be, laying the groundwork for

future success. In 2016, we have made

a good start to the transformation

programme, designed to bring

significant and sustainable benefits

over the coming years.

Our core strengths lie in our product portfolio,

admired by our customers and respected by

our competitors. This underpins our

exceptional order book which will drive future

shareholder value. To unlock these benefits, we

need to sustain our investment in our key

competitive advantages, including our

world-leading research & development

capability, as we introduce new products,

ramp up production and expand our service

capability to support our growing aftermarket.

By necessity, the transformation programme

targeted simplifying the way we manage the

business and reducing our fixed cost base.

Ihave been very encouraged by the

engagement across the Group on what is,

understandably, a difficult exercise for

many and which has seen around 20% of

management roles being removed.

There is much more to do in terms of

efficiency and behavioural change to achieve

greater cost competitiveness. Key to this will

be embedding the thinking around pace and

simplicity that Warren East, your Chief

Executive, has brought to the business. He

will talk more about how we are doing

this in the Strategic report.

Corporate governance

The recent settlements, with the UK Serious

Fraud Office and other authorities, are a

salient reminder of how critical it is to

'winright'. As a result of past, unacceptable

Rolls-Royce Holdings plc Annual Report 2016 CHAIRMAN’S STATEMENT

communication programme in 2016 to

outline the changes, culminating in the capital

markets' event in November. You can read

more about this on pages 66 and 130.

We have noted with interest the

Government’s green paper on UK Corporate

Governance: The Options for Change and we

are actively taking steps to strengthen our

interaction with stakeholders, particularly

employees. Further detail is included in my

introduction to the Directors’ report on

page 58. I look forward to reporting our

progress in our Annual Report next year.

Since taking over as chairman of the

Remuneration Committee in May, Ruth

Cairnie has undertaken a comprehensive

consultation on our proposed new incentive

schemes, ahead of this year’s AGM. You can

read more about our proposed remuneration

policy in the Directors’ remuneration report

on pages 72 to 82.

Feedback from investors suggests that we

have improved the level of engagement,

transparency and openness in many of our

communications. While we can always do

better, I believe the team has made a strong

start in rebuilding trust.

I know Warren looks forward to introducing

Stephen Daintith and Simon Kirby, our new

Chief Operating Officer, to the market in the

coming months to present their combined

views on the strategic priorities for the

business, which will define our future path.

Looking forward

2017 will be another transformative year

for Rolls-Royce. We continue to operate in

uncertain markets and will need to respond

to shifting market dynamics, while at the

same time make progress on our core

priorities both in terms of customer deliveries

and internal organisation changes.

Warren has been building a strong and

experienced management team to help him

achieve his strategic and operational goals.

The Board will continue to both challenge

andsupport their actions as they work to

ensure we transition successfully over the

next few years to a more profitable and

cash-generative future.

Ian Davis

Chairman

13 February 2017

Shareholder payments

Our stated objective in the long term is

to progressively rebuild our payment to

shareholders to an appropriate level, subject

to the short-term cash needs of the business.

This reflects the Board’s long-standing

confidence in the strong future cash

generation of Rolls-Royce.

At this stage, the investment needs of the

business remain high, reflected in the low

level of free cash flow in 2016 and this is

expected again in 2017. In addition, the Board

sees the need to retain a degree of balance

sheet flexibility.

As a result, it is proposed that the final

payment for 2016 is unchanged from 2015

at 7.1 pence per share. Taken together with

the interim payment, this brings the full year

payment to 11.7 pence per share. As with past

payments, the distribution will be in the form

of C Shares.

Board developments

During the year, there have been a number of

important changes to the Board. In March, we

appointed Brad Singer, a partner of ValueAct

Capital, to the Board, at which time he also

joined the Science & Technology Committee.

Sir Kevin Smith took over the role of Senior

Independent Director from Lewis Booth, who

continues as chairman of the Audit

Committee, animportant role for us at the

present time. In May, following the 2016 AGM,

Dame Helen Alexander stepped down from

the Board. In November 2016, Alan Davies

stepped down from the Board.

In addition, we announced in September

thatStephen Daintith will join the Board in

2017 as Chief Financial Officer. His record of

achievement in change management is

particularly relevant to the Group. He will

succeed David Smith.

Colin Smith will be leaving the Company after

43 years of service and will be stepping down

from the Board after this year’s AGM. Colin has

made a major contribution to the success

of the business over many years, including

12 years on the Board. I would like to thank

both David and Colin for their valuable

support during their time with Rolls-Royce.

More detail on the changes to the Board are

set out in the Nominations & Governance

Committee report on page 68.

Overall I believe we have a strong and

experienced Board, fully engaged with the

business and well able to provide both

support and scrutiny in equal measure.

Rebuilding trust and confidence

We made significant efforts in 2016 to

improve our communication with

stakeholders. The foundations laid in the

second half of 2015 were enhanced by a

broad range of engagement, including

formal events such as the corporate

governance seminar in April, which I hosted,

and the capital markets' event in November,

led by Warren and his team. This latter event

brought together senior management from

all of our business units with analysts and

investors. The event gave our guests the

chance to ask questions and improve their

understanding of the business.

Despite the challenges we face as a business,

we know how important it is to sustain our

investment in our people and communities.

This has included maintaining active

graduate and apprenticeship schemes, as well

as investing in our research partnerships

and STEM (science, technology, engineering

and mathematics) programmes. Internally, we

are working hard on employee engagement,

including initiatives around diversity and

wellbeing (see Sustainable business on

page 42 and the Safety & Ethics Committee

report on page 109).

During the year, we have also done significant

work on the new revenue reporting standard,

IFRS 15 Revenue from Contracts with

Customers. Due to be adopted at the start of

2018, this will go a long way to better align the

recognition of profit and cash for our original

equipment business in particular, and will

help make our performance improvements

more transparent. Ibelieve this will be

welcomed by many stakeholders, but may take

time to be properly understood. As a result,

we have undertaken a progressive

These dishonest acts…

are a major blemish

on the reputation of the

business and we have

apologised unreservedly.”

STRATEGIC REPORT

Rolls-Royce Holdings plc Annual Report 2016STRATEGIC REPORT CHIEF EXECUTIVE’S REVIEW

Chief Executive’s review

2016 has been an

important year as

we accelerated the

transformation of

Rolls-Royce.”

Overall, we have performed ahead of our expectations for the year as a whole

while delivering significant changes to our management and processes.

We increased our large aero-engine production output by 25%, supported the

needs of our customers, and made good technical progress in the final stages

of the development of the three new large engines, due to enter service over the

next twelve months. At the same time we have improved manufacturing lead

times for our key Civil Aerospace programmes, an important goal as we ramp

up production over the next few years. Progress with our transformation

programme was also better than expected, delivering over £60m of in-year

benefits compared to our initial target of between £30-50m. Overall, the

performance improvements have helped offset a number of changing trading

conditions and higher research & development (R&D) spend.

Introduction

Warren East

Chief Executive

Rolls-Royce Holdings plc Annual Report 2016 REVIEW OF 2016

13

Priorities for 2017

Our clear focus and priorities for

developing thebusiness.

14

Business model

How we deliver value from our

products andservices.

36

Financial review

Explaining our 2016 nancial

performance inmore detail.

48

Principal risks

Outlining our main risks

together with our risk

management process.

7

Review of 2016

How the Group performed in a

year ofsignicant change.

16

Financial summary

Summary of our 2016

nancial performance.

40

Sustainable business

Setting out the approach

we take to ensure we are

a sustainable business.

18

Business review

Reviewing each of our ve

customer-facing businesses;

with analysis of their markets.

46

Key performance indicators

How nancial and

non-nancialindicators are

usedto measure the Group.

This Strategic report describes thebusiness in depth and provides

further information on our nancial position and business performance.

Review of 2016

Performance in 2016

In 2015, we identified a number of significant

headwinds that would hold back performance

in 2016, including mixed market conditions

and the revenue and cost impacts of some key

product transitions.

Looking first at our markets, demand for our

large Civil Aerospace products and services

remained robust, despite some specific

weaknesses for service demand in respect

of older engines. At the same time, demand

for new corporate jets softened, as did the

aftermarket for the regional jets powered

by our AE 3007 engines. Defence Aerospace

markets held up well with a steady demand

for our aftermarket services in particular.

Offshore oil & gas markets for our

Marine business continued to suffer from

the consequences of low oil prices.

Alongside weaker industrial demand, this

also impacted Power Systems.

Other known headwinds transpired broadly

as expected, led by lower Trent 700 volumes

and prices, legacy civil large engine

aftermarket reductions and weakness in

marine markets. At thesame time, we have

continued to invest in products and services

to support our customers and reinforce the

long-term strength of our order book, valued

at the end of the year at around £80bn.

Against this backdrop, Group underlying

revenue reduced by 2% on a constant

currency basis with reductions in both

original equipment and aftermarket

revenues, led by the Marine business where

revenues were down 24%. More details are

included in the Financial summary on page 16

and the Business reviews on pages 18 to 35.

Compared to 2015, underlying profit before

finance charges and tax was 45% lower at

£915m. On this basis, Civil Aerospace

delivered £367m (2015:£812m); Defence

Aerospace delivered £384m (2015: £393m);

Power Systems delivered £191m

(2015: £194m); Marine generated a loss

of £27m (2015: £15m profit) and Nuclear

delivered £45m (2015:£51m excluding the

£19m R&D credit benefits highlighted in

2015). More detail on eachbusiness is

included in the Business review.

After underlying financing costs of £102m

(2015: £60m including a £34m gain from

hedging overseas dividends), underlying

profit before tax was £813m (2015: £1,432m).

Since the EU referendum at the end

of June, the value of sterling relative to the

US dollar has fallen significantly. As a result,

we have recognised a £4.4bn in-year

non-cash mark-to-market valuation

adjustment forour currency hedge book as

part of our reported financing costs of

£(4,677)m (2015:£(1,341)m). While reported

revenue of £14,955m (2015: £13,725m) was

unaffected by this adjustment, it impacted

reported profit. In addition, our reported

results also included a £671m charge for

financial penalties from agreements with

investigating authorities in connection with

historic bribery and corruption involving

STRATEGIC REPORT

Rolls-Royce Holdings plc Annual Report 2016 STRATEGIC REPORT REVIEW OF 2016

ORDER BOOK (£BN)

2015

2016

0 10 20 30 40 50 60 70 80

0 3 6 9 12

2015

2016

UNDERLYING REVENUE (£BN)

UNDERLYING PROFIT BEFORE FINANCING (£M)

2015

2016

0 300 600 900 1,200 1,500

FREE CASH FLOW (£M)

2015

2016

0 300 600 900 1,200 1,500

intermediaries in a number of overseas

markets. Our reported loss before tax was

£(4,636)m (2015: £160m profit).

After an underlying tax charge of £261m

(2015: £351m), underlying profit after tax

for the year was £552m (2015:£1,081m).

With an average 1,832m shares in issue,

underlying earnings per share were 30.1p

(2015: 58.7p).

After a reported tax credit of £604m

(2015: £76m charge), the reported loss for

the year was £(4,032)m (2015: £84m profit).

Reported earnings per share were (220.1)p

(2015: +4.5p).

A full reconciliation of underlying to

reported profit can be found in note 2

on page 134.

Free cash inflow in the year was £100m

(2015: inflow of £179m), better than

expected, reflecting strong cash collections

from a number of key customers at the very

end of the period and an improvement in

underlying working capital performance.

While some of this positive variance is a

timing impact and likely to reverse early

in 2017, improved efficiencies should drive

a level of sustainable benefit.

A more detailed review of financial

performance is included in the Financial

summary on page 16 and the Financial review

on page 36.

Our focus on clear priorities for 2016

has helped deliver positive outcomes

Our 2016 priorities were threefold: to

strengthen our focus on engineering,

operational and aftermarket excellence

to drive long-term profitable growth; to

deliver a strong start to our transformation

programme; and to start rebuilding

trust and confidence in our long-term

growth prospects.

Payment schedule SFO DoJ MPF Total

2017 £119m* + £13m US$170m US$26m £293m*

2019 £100m* £100m*

2020 £130m* £130m*

2021 £148m* £148m*

* Plus interest.

Agreement reached with various

investigating authorities

In mid-January 2017, we announced that we

had entered into Deferred Prosecution

Agreements (DPAs) with the UK’s Serious

Fraud Office (SFO) and the US Department

of Justice (DoJ) and completed a Leniency

Agreement with Brazil’s Ministério Público

Federal (MPF). These agreements relate to

bribery and corruption involving

intermediaries in a number of overseas

markets, concerns about which we passed

to the SFO from 2012 onwards following

a request from the SFO.

The agreements are voluntary and result in

the suspension of prosecution provided that

the Company fulfils certain requirements,

including the payment of financial penalties.

The agreements will result in the total

payment of around £671m. This is recognised

within our 2016 accounts.

Under the terms of the DPA with the SFO,

we agreed to pay £497m plus interest under

a schedule lasting up to five years, plus a

£13m payment in respect of the SFO’s costs.

We also agreed to make payments to the DoJ

totalling around US$170m and to the MPF

totalling around US$26m. As a result, the

total payment in 2017 is expected to be

£293m (at prevailing exchange rates) with

some elements having already been paid.

It is our intention that these financial

penalties will be paid from existing facilities

and an improved underlying cash flow

performance in the longer term.

Rolls-Royce Holdings plc Annual Report 2016 REVIEW OF 2016

In Civil Aerospace, these investments in

state-of-the-art manufacturing facilities will

enable us to meet the significant growth in

engine deliveries required to match customer

demand for our new Trent engines,

particularly the Trent 1000, Trent XWB and

Trent 7000. At the same time, the

investments lower unit costs and reduce the

net cash outflows related to engine

production. In Defence Aerospace, the

investments have focused on modernisation

of facilities such as in Indianapolis to reduce

costs and improve delivery performance of

both original equipment and spares to

support higher standards of customer

service. In Marine, new facilities will

contribute to a more efficient and scalable

manufacturing capability that will address

the demands of our customers today, while

markets are weak, and tomorrow, when they

have recovered.

The benefits of these investments are

starting to be seen in improved delivery

performance, lower assembly lead times,

lower unit costs and increased capacity.

For example, in Civil Aerospace, large engine

deliveries increased by over 15% to over 355

and capacity is now in place to deliver around

500 engines in 2017; an increase of over

a third.

The focus on improving aftermarket

excellence has been driven business-by-

Increased our focus on engineering,

operational and aftermarket

excellence

Over the last few years, we have invested

significantly in new product development

and manufacturing capabilities. In

engineering, in 2016 we invested over

£1.3bn in gross R&D. The net investment

of £937m was higher than 2015 and our

expectations for 2016. A large proportion

of this was focused on Civil Aerospace

to support delivery of three new engine

programmes which will enter service over

the next 12 months: the Trent 1000 TEN

(Thrust, Efficiency, and New technology)

the Trent XWB-97 and the Trent 7000.

Supporting these investments was a

Group-wide engineering efficiency

programme, known internally as E

3

,

which has formed part of our overarching

transformation programme. Within the

engineering team, this change programme

has focused on delivering a lean, resilient,

lower-cost engineering function

through reducing complexity, improving

work prioritisation and simplifying

management structures.

In operations, over £1.4bn has been

invested in new capital equipment since

2011 (£225m in 2016) in transforming our

manufacturing footprint across the business.

business, by customer needs as well as

through the broader transformation

activities. In Civil Aerospace for example,

this has resulted in a progressive change

to the structure of our engine overhaul

services, our commercial TotalCare® and

time and materials product offerings, and

management structures. These have

enabled us to respond to a changing market

and maturing installed engine portfolio by

adapting our resources to focus on areas of

greatest value to the Group and our

customers – such as supporting airframe

transitions and rolling out SelectCare™ and

TotalCare Flex® offerings and preparing for

the launch of LessorCare™. In Defence

Aerospace, the focus has been driven by the

customer need for more embedded support.

This has included increasing our service

presence at key customer facilities in the

UK and overseas, improving response time

and resolving a greater proportion of

issues on-wing.

PRIORITY

Strengthen focus to drive long-term profitable growth

STRATEGIC REPORT

Engineering

excellence

Operational

excellence

Capturing

aftermarket value

Invested to support delivery of three

new engine programmes to enter

service in the next 12 months.

New powered gearbox design

successfully tested at new

German facility.

Launched a Group-wide engineering

efficiency programme, known as E

3

– part of our Group-wide

transformation programme.

£225m invested in 2016 in

transforming our manufacturing

footprint across the business.

Increased large aero-engine

production output by 25%.

Started modernisation of Defence

Aerospace facility in Indianapolis to

reduce costs and improve delivery

performance.

Invested to support delivery of the UK’s

new Astute and Dreadnought class

nuclear-powered submarines.

Investment driven business-by-

business, by customer needs.

Restructured our engine overhaul

services including an increased equity

investment in our MRO JVs.

Launched new commercial TotalCare

product offerings to support maturing

installed base.

Embedded aftermarket support for key

Defence Aerospace customers at key

customer facilities in the UK and

overseas.

Rolls-Royce Holdings plc Annual Report 2016 STRATEGIC REPORT REVIEW OF 2016

Transformation programme ahead

of expectations

In November 2015, we announced a major

transformation programme focused on

simplifying the organisation, streamlining

senior management, reducing fixed costs

and adding greater pace and accountability

to decision making. The initial target was to

deliver incremental gross cost savings of

between £150m-£200m per annum, with

the full benefits accruing from the end of

2017 onwards.

Against these initial objectives, which

included a target of delivering in-year

savings of £30m-50m in 2016, we have made

a better than expected start. In-year savings

in 2016 were above target, at over £60m.

During the year, we also identified

significant opportunities to drive

sustainable cost savings from the business.

As a result, we expect the in-year savings

that can be delivered in 2017 to be between

£80m-£110m and we are on track to achieve

the top end of the target for the programme

as a whole, targeting a run rate of over

£200m by the end 2017.

At the same time, other restructuring

initiatives have delivered their expected

benefits. These included programmes

to improve operational efficiency in

Civil Aerospace and Defence Aerospace

(announced in 2014) and Marine

(announced in May 2015), as well as a back

office cost saving programme in Marine

(announced in October 2015).

In December 2016, an additional

reorganisation of the Marine business was

announced to further rationalise

manufacturing activities in Scandinavia,

targeting incremental annualised savings

of £50m from mid-2017. Reflecting our

cautious near-term outlook for the Marine

business, we have also taken an exceptional

charge of around £200m for the impairment

of goodwill, principally associated with the

acquisition of Vickers in 1999.

In summary, expected ongoing benefits

of all current restructuring programmes

initiated since 2014 will reduce costs by

around £400m by the end of 2018,

compared to a 2014 baseline.

In aggregate, ongoing divisional

restructuring programmes together

with the new programme announced in

November 2015 are expected to reduce

costs by around £400m by the end of 2018,

including the full benefit of the Marine

restructuring announced in December 2016.

The cost reduction breaks down into

incremental legacy Civil Aerospace and

Defence Aerospace restructuring savings of

£80m, Marine savings of now around

£110m and the transformation programme

savings of around £200m.

2016 progress on our US transformation

In January 2016, construction began on a five-year, US$600m

modernisation programme for our manufacturing and technology

research plant in Indianapolis, Indiana, US. This is the largest

investment by the Group in the US since we purchased

the Allison Engine Company in 1995.

In September 2016, we achieved a major milestone by opening a new,

dedicated pre-production facility. This enables us to digitally design,

develop, test and perfect new manufacturing methods for the entire

site as modern production comes online over the next four years.

When complete, the 1.5 million square feet manufacturing facility will

leverage the latest technologies and production methods which,

alongside a highly-skilled workforce, will establish our Indianapolis plant

as one of the most competitive manufacturing facilities in the world.

The site will also house new technology development capabilities which

we will apply to our next-generation engines in the US.

We currently employ about 4,000 people in Indianapolis, where

engines are designed, assembled and tested for US defence aircraft,

civil helicopters, regional and business jets and power systems for

US naval vessels.

PRIORITY

Deliver a strong start to our transformation programme

21

3

1. Turbines manufacturing

and pre-production method

development.

2. Production assembly

and test, and customer

delivery centre.

3. Experimental assembly

and test labs,

and LibertyWorks®.

Rolls-Royce Holdings plc Annual Report 2016 REVIEW OF 2016

Making transformation happen

Power

Systems

Civil

Aerospace

Defence

Aerospace

Marine GroupNuclear

Right behaviours

and culture

Simpler

processes

Simpler

organisation

Competitiveness:

improved productivity and cost

Pace and simplicity:

the right tools to stay ahead of our competitors

Continuous improvement:

embedded change for ongoing results

Accountability:

clear ownership and responsibility to deliver

£200m

cost savings

On track to deliver £200m

of annual cost savings by the

end of 2017.

25%

growth in large engines

Signicant improvement in

Trent 1000 and Trent XWB

lead times enabling a 25%

year-on-year increase in

production output of large

aero engines.

20%

reduction in senior

management positions

Five market-facing businesses

have replaced a divisional

structure with signicant

reduction in management

layers and central bureaucracy.

20%

fewer engine variants

Power Systems has met its

customers’ needs while cutting

engine variants by 20% as a

result of its simplied portfolio

of reciprocating engines.

Increased P&L

accountability

Full accountability for legacy

spares business has allowed

service teams in Defence

Aerospace to react faster to

customer needs and

increase revenues.

Efficiencies in

Marine

Restructuring of the Marine

business has placed full

accountability under four

market-facing businesses,

while right-sizing the

organisation to meet

the challenges of the

offshore marine market.

30%

performance improvement

30% improvement in the lead

time and cost of instrumentation

and control products for civil

nuclear reactors.

42,000

employees involved in

improvement activities

42,000 employees involved in

2016 continuous improvement

activities, supported by a

network of over 700 facilitators

and champions.

STRATEGIC REPORT

Rolls-Royce Holdings plc Annual Report 2016 STRATEGIC REPORT REVIEW OF 2016

the next few months, the senior leadership

team will be concluding the review of our

strengths and investment opportunities to

define an appropriate vision for the business

and the best way we can deliver sustainable

shareholder value. Conclusions from this

work will be shared during 2017.

Rebuilding trust and confidence in the

Group and its long-term prospects remains

a key priority for the management team.

The focus remains on progressive, effective

communication combined with strong

operational delivery. While we have made a

steady start, more remains to be done. The

addition of new management and a

renewed focus within the business

leadership teams, with clear goals and

stronger accountabilities, should provide a

strong platform for further progress in 2017.

Acquisition of outstanding 53.1%

stake in Industria de Turbo

Propulsores SA (ITP)

We were notified in early July that SENER

Grupo de Ingeniería SA (SENER) had decided

to exercise the put option in respect of its

53.1% stake in ITP. This decision provides us

with the opportunity to effectively

consolidate several key large engine risk and

revenue sharing arrangements (RRSAs) into

the business, strengthen our position on a

number of important defence aero engine

platforms and will enable us to enjoy greater

benefits from future aftermarket growth.

Under the shareholder agreement, the

consideration of €720m will be settled over

a two-year period following completion in

eight equal, evenly-spaced instalments. The

agreement allows flexibility to settle up to

100% of the consideration in the form of

Rolls-Royce shares. Final consideration as to

whether the payments will be settled in

cash, shares or cash and shares will be

determined by Rolls-Royce during the

payment period. Completion remains

subject to regulatory clearances and is

expected in mid-2017.

The acquisition of ITP strengthens our

position on Civil Aerospace large engine

growth programmes by capturing

significant additional value from its

long-term aftermarket revenues, including

the high volume Trent 1000 and Trent XWB

engines, where ITP has played a key role as

a participant in RRSAs. It also enhances the

Group’s own manufacturing and services

capabilities and adds value to the Defence

Aerospace business, particularly on the

TP400 and EJ200 programmes.

Further details of its impact on the Group

will be made available on completion of

the acquisition.

Rebuilding trust and confidence;

steady year with few major surprises

2016 out-turned ahead of expectations with

only a few unexpected developments from

an operational perspective, despite the

challenges presented by a changing

macro-environment and some known

weaknesses in the business. The expected

headwinds in Civil Aerospace and Marine

transpired largely as forecast. In addition,

the benefits of outperformance on

transformation savings and foreign

exchange hedging more than offset some

additional programme costs in Civil

Aerospace and a range of other smaller

one-off items. As a result, external

expectations remained largely unchanged

throughout the year.

The introduction of the new revenue

reporting standard, IFRS 15 Revenue from

Contracts with Customers, will have a

significant impact on how we present our

revenues and profits, particularly for Civil

Aerospace. As a result, a combination of

significant in-house analysis and

appropriate progressive communication

was undertaken, culminating in a capital

markets’ event in November. This set out in

some detail how we now expect the new

standard to change the presentation of

our financial results, illustrated through a

re-presentation of 2015 performance. All

the materials from this investor event were

shared at the time and are available on the

Company’s website at www.rolls-royce.com.

Priorities for 2017 broadly

unchanged; additional focus on

developing our long-term vision

and strategy

Overall, the priorities for 2017 are largely

unchanged from those set out in 2016.

We will continue to invest in strengthening

our focus on engineering, operational and

aftermarket excellence to drive long-term

profitable growth. At the same time,

2017 will be an important year to drive

incremental savings from our

transformation programme.

At our capital markets’ event in November

2016 we set out how our focus is turning

towards the Group’s long-term goals. Over

PRIORITY

Rebuild trust and confidence in our long-term growth prospects

New Trents to

enter service

2017 will be a milestone year for our

Civil Aerospace business and its Trent

engine programmes, with three new

engines approaching entry into service.

The Trent 1000 TEN will power all

variants of the Boeing 787 Dreamliner

family and draws on technologies

from the Trent XWB and Advance

engine programmes.

The Trent XWB-97 will be the sole

powerplant for the Airbus A350-1000.

Delivering an increased 97,000lbs

of thrust, the new engine will allow

Airbus to increase the aircraft’s payload,

range and maximum take-off weight.

The Trent 7000 builds on the success of

its predecessor, the Trent 700, delivering

a 10% improvement in specific fuel

consumption while halving noise

output. It will be the sole powerplant

for the Airbus A330neo.

Taken together, these developments

underline the scale of our

commitment to research and

technology and delivering on the

needs of our customers.

Rolls-Royce Holdings plc Annual Report 2016 PRIORITIES FOR

The successful roll-out of new engines,

led in particular by the Trent XWB, Trent

1000 and Trent 7000, together with

agrowing aftermarket, is expected to drive

significant revenue growth over the coming

ten years as we build towards a 50% plus

share of the installed widebody passenger

market. As a result, we remain confident

that the important investments we are

making to modernise our production will

create a strong platform to drive customer

service and strong cash flows, together with

the current investments in new products

and the streamlining of our existing product

portfolios to ensure we are providing

high-value, cost-competitive products into

our target end markets.

Outlook for 2017

After a better than expected 2016,

year-on-year incremental progress will be

modest. Our medium-term trajectory for

revenue, profit and free cash flow remains

unchanged. On a constant currency basis,

Group revenue for 2017 should be

marginally higher than that achieved in

2016, despite expected further weakening

in offshore oil & gas markets in Marine.

Underlying improvements in performance

should be driven largely by transformation

savings and free cash flow should benefit

from increased aftermarket cash revenues

in Civil Aerospace, further improvements

in working capital efficiency and cost

savings. As a result, we expect a modest

performance improvement overall and we

are targeting free cash flow to be similar to

that achieved in 2016. Individual outlooks

are provided in the Business review starting

on page 18.

Looking further ahead: long-term

outlook remains strong

We continue to see value in the underlying

strengths of our business: the underlying

growth of our long-term markets; the

quality of our mission-critical technology

and services; and the strength of customer

demand for these which is reflected in our

strong order book. While we have near-term

challenges and some core execution

priorities, these constants provide us with

confidence in a strong, profitable and

cash-generative future.

1 Strengthen our focus to drive long-term protable growth

Engineering

excellence

Investing in and developing the

excellence of our engineering

toproduce high-performance

powersystems.

Operational

excellence

Transforming our manufacturing

andsupply chain to embed a lean

approach across our facilities

and processes.

Capturing

aftermarket value

Leveraging our installed base,

product knowledge and capabilities

to provide outstanding services to

customers.

2 Sustain the strong start to our transformation programme.

3 Continue to rebuild trust and condence in our long-term growth prospects.

4 Develop our long-term vision and strategy.

Underpinned by a commitment to developing our people and our culture in a safe

and ethical environment.

Priorities For 2017

STRATEGIC REPORT

Rolls-Royce Holdings plc Annual Report 2016 STRATEGIC REPORT BUSINESS MODEL

Our business model seeks to

capture value from markets for

high-performance power. We do this

by developing advanced, integrated

power and propulsion systems and

providing long-term aftermarket

support and delivery of outstanding

customer services. We seek to recoup

our investment through developing

superior products, many of which

are selected for use on major

multi-year programmes.

Value creation

Our highly-skilled people create value

through a combination of a deep research

and product development capability,

world-class technology and engineering

expertise, and a substantial and experienced

supply chain with many relationships and

collaborations going back over 25 years.

We make significant investments in

advanced technology and engineering

programmes to deliver market-leading

products together with the manufacturing

capability to produce them.

Outputs

The outputs from the operation of this

business model are: long-term value

creation for our customers; a sustainable

and competitive market position; and the

generation of returns for our shareholders.

Our long-life products typically operate

in challenging environments where they

are expected to deliver sustained levels

of performance, such as fuel efficiency

and reliability. For our customers, they

deliver value through enhancing the

competitiveness of their own product or

service, whether airframe or other transport

or industrial application.

The product offering is often combined with

flexible service options to best suit each

customer’s operating needs. In certain

markets we further strengthen our

customer relationships through long-term

service agreements where we commit to

deliver exceptional standards of service,

including high levels of product operational

availability. This provides significant value

to customers and, in return, we achieve

long-term predictable revenues.

Our long-term competitive position also relies

on having a full lifecycle design, sourcing

and manufacturing platform which is capable

of developing products which incorporate

advanced materials often operating close to

the limits of their capabilities. Our operational

focus is on ensuring we can deliver these

on-time and in increasing scale. As production

levels rise, we will benefit from increasingly

cost-efficient manufacturing and lower

unit costs.

By growing our installed base of power

systems and leveraging our aftermarket

service activities, we enhance our revenue,

profit and cash flow. Cash flow is then

invested to support future product

development and technology programmes,

driving growth while providing

shareholder returns.

Our business model

How we create value

Value creation

Customers:

Differentiated products

aligned to their

operating requirements

Corporate:

Strong market position

World-class development

and production facilities

Shareholders:

Long-term

cash flow generation

Engineering

excellence

Operational

excellence

Capturing

aftermarket value

Inputs

• People and expertise

• R&D capability

• Supply chain collaboration

• Advanced manufacturing

• Customer relationships

• Financial investment

Rolls-Royce Holdings plc Annual Report 2016 BUSINESS MODEL

Develop technology

that anticipates

customer needs

Our deep understanding

ofcustomer needs drives

thedevelopment of new

technologies and products.

Disciplined capital

allocation

We allocate our capital

toachieve abalance of

financial strength

andliquidity to deliver

commercial advantage and

sustainable long-term

shareholder returns.

Grow market share

andinstalled base

Our substantial order

book for both original

equipment and services

provides good visibility

of future revenues and

provides a firm foundation

to invest withconfidence.

Secure and maximise

aftermarket opportunity

Our equipment is in

service for decades.

Our deep design

knowledge and in-service

experience ensures that

weare best placed

to optimise product

performance

and availability.

Invest in R&D

and skilled people

Developing and protecting

leading-edge technology

and deploying it across our

businesses allows us

to compete on a global

basis and creates high

barriers toentry.

Manufacturing capability

We manufacture

cost-efficiently through

a combination

ofeconomies of scale,

developing alean

enterprise and integrated

management of our

supply chain.

Investment in future

programmedevelopment

We make significant investment

indevelopment programmes

which we believe will deliver

cost-efficient and competitive

next-generation products

and services.

Engineering excellence

Industry-leading R&D

Proven product reliability

Exceptional long-life products

Differentiated products and services

Operational excellence

Strong supply chain partnerships

Sustained cost reduction

Transforming to world-class production

capability

Cost-focused lean enterprise

High performance culture

Capturing aftermarket value

Long-term relationships with civiland

defence customers

Decades of in-service experience

Flexible range of service offerings

Growing installed base and global

aftermarket footprint

Design, make and service

world-class products

Wewin and retain customers by

developing and delivering products

and services that provide more capability

and offer better through-life value than

those ofour competitors.

STRATEGIC REPORT

Rolls-Royce Holdings plc Annual Report 2016 STRATEGIC REPORT FINANCIAL SUMMARY

Order book and order intake

During the year, our order book increased

by £3.3bn to £79.8bn, led by Civil Aerospace,

which, alongside strong order intake, also

benefited from a £2.1bn uplift from a

five cent decrease to our long-term US dollar

planning rate. Order intake in our Marine

business was poor, largely as a result of the

continuing weak offshore market. Overall,

orders were also lower in Defence Aerospace,

Power Systems and Nuclear, although we

view the prospects for these businesses as

unchanged, reflecting long-term orders won

in previous years.

Underlying trading

Underlying Group revenue declined 2%

in 2016 compared to 2015 on a constant

currency basis, reflecting declines in both

original equipment revenue (down 2%)

and services (down 3%) and driven almost

entirely by Marine. By business on a

constant currency basis, Civil Aerospace

revenue was unchanged, Defence Aerospace

revenue increased 1%, Power Systems

revenue decreased 1%, Marine revenue

Financial summary

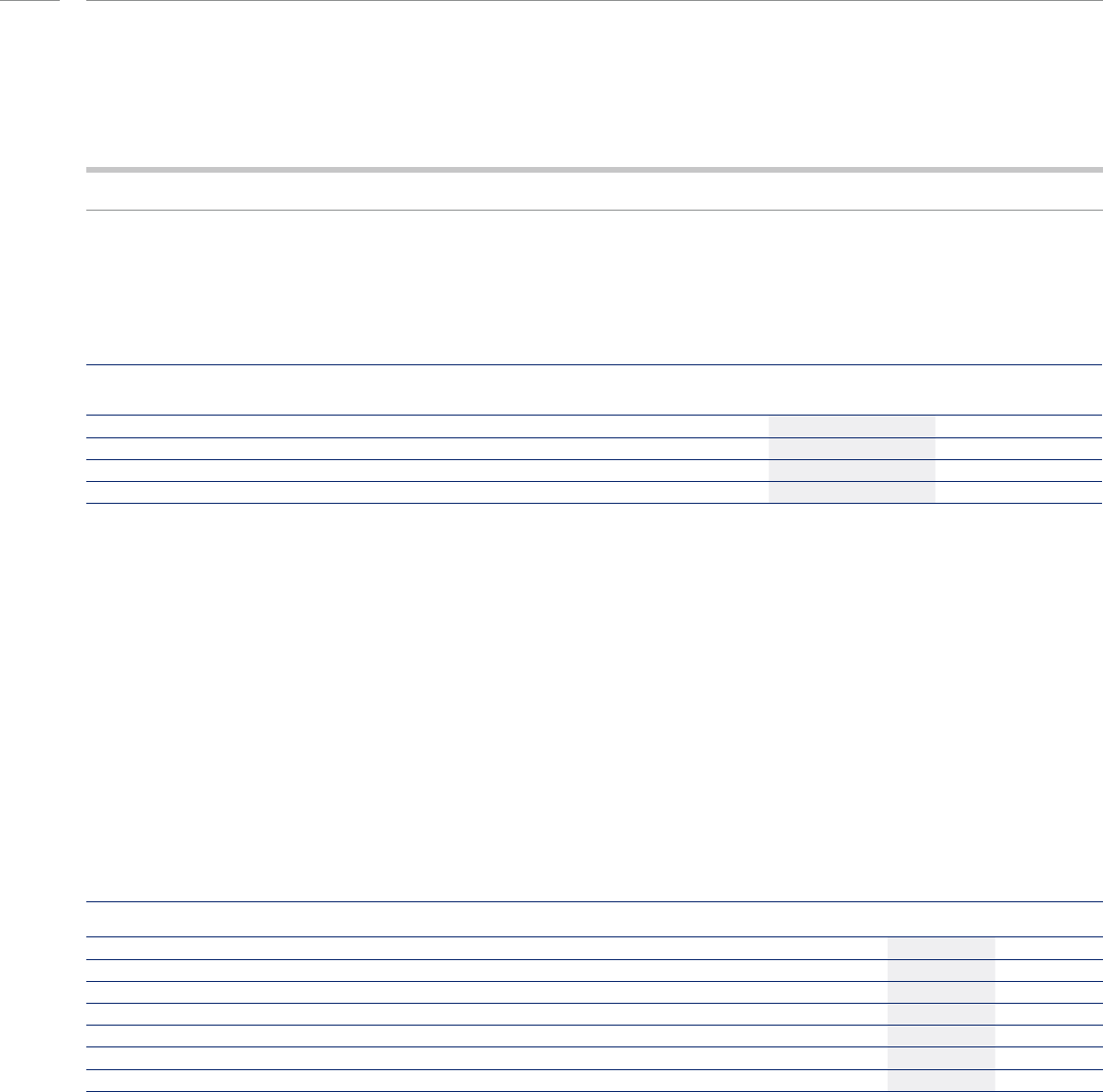

GROUP TRADING SUMMARY

£m 2015*

Underlying

change**

Foreign

exchange*** 2016

Order book 76,399 3,329 82 79,810

Underlying revenue 13,354 (296) 725 13,783

Change -2% +5% +3%

Underlying OE revenue 6,724 (112) 415 7,027

Change -2% +6% +5%

Underlying services revenue 6,630 (184) 310 6,756

Change -3% +5% +2%

Underlying gross margin 3,203 (577) 197 2,823

Gross margin % 24.0% -390bps 20.5%

Commercial and administrative costs (1,025) (71) (67) (1,163)

Restructuring costs (39) 41 (2) –

Research and development costs (765) (47) (50) (862)

Joint ventures and associates 118 (11) 10 117

Underlying profit before financing 1,492 (665) 88 915

Change -45% +6% -39%

Underlying operating margin

11.2% -480bps 6.6%

* 2015 figures have been restated as a result of £21m of costs previously reported in ‘cost of sales’, being reclassified

as ‘other commercial and administrative costs’ to ensure consistent treatment with 2016.

** Order book underlying change includes £2.1bn increase from a change to our long-term US dollar planning rate.

*** Translational foreign exchange impact.

decreased 24% and Nuclear revenue

increased 11%.

Underlying profit before financing of £915m

(2015: £1,492m) was 45% lower on a

constant currency basis, led by a significant

reduction in Civil Aerospace profit. This

reflected the previously communicated

volume and margin reductions on

link-accounted Trent 700 engines, reduced

business jet original equipment volumes,

reduced large engine utilisation and

increased technical costs for large engines.

In addition, reported 2015 numbers

included one-off benefits from a

methodology change in respect of risk

assessment and reversal of impairments

and provisions in respect of a Trent 1000

launch customer, totalling £189m and £65m

respectively. These were partially offset by

strong lifecycle cost improvements on

installed engines and some provision

releases. Profit in Defence Aerospace at

£384m was 8% lower on a constant currency

basis largely reflecting additional costs

related to the TP400 programme. Power

Systems was down 14% year-on-year

principally due to volume reduction and

adverse changes to product mix.

Marine profit was sharply lower led by

continuing weakness in the offshore

markets. Nuclear profit was 37% lower than

2015 due to a lower margin mix in

submarine projects.

Underlying gross margin was £2,823m,

down 390 basis points to 20.5% largely

reflecting the lower margins in Civil

Aerospace, Defence Aerospace and Marine.

Commercial and administrative costs

include accruals for employee incentive

schemes in line with our current policies.

Given the good performance relative to

original plan, these are higher than in the

prior year. This contributed to commercial

and administrative costs being £71m higher

on a constant currency basis year-on-year.

The R&D charge increased by 6% over 2015

on a constant currency basis, reflecting

increased charges in Civil Aerospace and

the adverse year-on-year effect of the

favourable R&D credit adjustment taken

in 2015 in Nuclear.

Underlying restructuring charges reduced by

£41m reflecting the lower level of underlying

restructuring as most costs in 2016 were

taken as exceptional due to the nature of the

restructuring activities within the Group.

The exceptional charge in relation to these

programmes was £129m in 2016. This

included £92m for the transformation

programme launched in November 2015,

which delivered in-year benefits of over £60m

in 2016. The underlying tax rate for 2016

increased to 32.1% (2015: 24.5%). The primary

reasons for the increase are the

non-recognition of deferred tax assets on

losses in Norway, which reflects the current

uncertainty in the oil & gas markets, and

a different profit mix with more profits

arising in countries with higher tax rates.

Reported results

Reported results are impacted by the

mark-to-market adjustments driven by

movements in USD:GBP and EUR:GBP

exchange rates over the year. In addition, we

recognised the £671m charge related to the

agreements reached in respect of regulatory

David Smith

Chief Financial

Officer

Rolls-Royce Holdings plc Annual Report 2016 FINANCIAL SUMMARY

20162015201420132012

2016

2015201420132012

201620152014201420132012

inc Energy

exc Energy

£14,955m

REPORTED REVENUE

£(4,636)m

REPORTED (LOSS)/PROFIT BEFORE TAX

6.8%

NET R&D AS A PROPORTION OF UNDERLYING REVENUE

2015 £13,725m

2014 £13,736m

2013 £15,513m

2012 £12,161m

2015 £160m

2014 £67m

2013 £1,759m

2012 £2,766m

2015 6.2%

2014 exc 5.9%

2014 inc 5.8%

2013 4.8%

2012 4.7%

201620152014201420132012

inc Energy

exc Energy

201620152014201420132012

inc Energy

exc Energy

Net debt and foreign currency

The Group is committed to maintaining

a robust balance sheet with a healthy,

investment-grade credit rating.

We believe this is important when selling

high-performance products and support

packages which will be in operation for

decades. Standard & Poor’s updated its

rating in January 2017 to BBB+ from

A-/negative outlook and Moody’s

maintained a rating of A3/stable.

During 2016, the Group’s net debt position

increased from £111m to £225m, reflecting

the £100m free cash inflow, shareholder

payments of £301m and £154m for the

increased investment in our approved

maintenance centre joint ventures following

receipt of regulatory approval for the

changes to the joint venture agreements

in June 2016. In April, we increased our

revolving credit facilities by £500m to

£2bn to provide additional liquidity.

The Group hedges the transactional foreign

exchange exposures to reduce volatility to

revenues, costs and resulting margins.

The hedging policy sets maximum and

minimum cover ratios of hedging for net

investigations, a goodwill impairment

charge of £219m largely reflecting a more

cautious outlook for our Marine business

and £129m of exceptional restructuring

cost. As a result, the reported loss before tax

was £(4,636)m (2015: a profit of £160m).

Free cash flow

Free cash inflow in the year was £100m

(2015: £179m), better than expected,

reflecting strong cash collections from a

number of key customers at the very end of

the period and an improvement in underlying

working capital performance. This helped

offset the lower profit before tax and higher

expenditure on property, plant and

equipment and intangibles. The latter reflects

the increased capital investment in new

manufacturing capacity, higher capitalised

R&D, mainly related to the Trent 1000 TEN

and higher certification costs on the Trent

XWB-97. More details on the movement in

trading and free cash are included in the

Funds flow section of the Financial review.

While some of this positive variance is a

timing impact and likely to reverse early in

2017, improved efficiencies should drive a

level of sustainable benefit.

transactional foreign exchange exposure.

It allows us to take advantage of attractive

foreign exchange rates, whilst remaining

within the cover ratios. A level of flexibility

is built into the hedging instruments to

manage changes in exposure from one

period to the next and to reduce volatility

by smoothing the achieved rates over time.

The most significant exposure is the net

US dollar income which is converted into GBP

(currently approximately $5bn per year and

forecast to increase significantly by 2021).

Following the fall in the value of sterling,

which resulted from the outcome of the EU

referendum, additional cover has been taken

out to benefit from the favourable rates.

This has resulted in an increase in the nominal

value of the hedge book to approximately

$38bn at the end of 2016 (end2015: $29bn)

together with a reduction in the average rate

in the hedge book to £/$1.55 (end

2015:£/$1.59). The movement in the average

achieved rate year-on-year was around two

and a half cents, providing a net underlying

Group benefit, after balance sheet effects

(the movement in achieved rate also affects

creditor and debtor balances of hedged

cash flows), of around £20m.

STRATEGIC REPORT

£13,783m

UNDERLYING REVENUE

2015 £13,354m

2014 exc £13,864m

2014 inc £14,588m

2013 £15,505m

2012 £12,209m

£813m

UNDERLYING PROFIT BEFORE TAX

2015 £1,432m

2014 exc £1,617m

2014 inc £1,618m

2013 £1,759m

2012 £1,434m

201620152014201420132012

inc Energy

exc Energy

6.6%

UNDERLYING OPERATING MARGIN

2015 11.2%

2014 exc 12.1%

2014 inc 11.5%

2013 11.8%

2012 12.0%

Rolls-Royce Holdings plc Annual Report 2016STRATEGIC REPORT BUSINESS REVIEW

In 2016, the Trent 1000 was selected to

power the rst test ight of the Boeing

787-10 Dreamliner. It has already powered

the rst ights of the 787-8 and 787-9.

Key highlights

Underlying revenue unchanged; gross

margins lower:

• Original equipment (OE): increased

deliveries of newer Trent engines but

lower link-accounted Trent 700 and

business aviation sales reduced

achieved margins.

• Services: growth from in-production

large engine fleet, but declining regional

and older large engine fleet aftermarket

revenues; increase in technical costs for

large engines, including the Trent 700

and Trent 900, largely mitigated by

foreign exchange benefits.

£4.4bn order book growth; includes

£2.1bn benefit from long-term US dollar

planning rate change.

New programmes: Trent 1000 TEN

received EASA certification in July; first

test run of new UltraFan® gearbox; first

flight of the Airbus A350-1000 powered

by the Trent XWB-97.

Supply chain modernisation reducing

costs and increasing capacity for Trent

XWB ramp up.

2017 outlook: modest growth in revenue

and profit; cost improvements offsetting

OE and aftermarket mix effects.

CIVIL

AEROSPACE

Operational review

Financial overview

Overall, underlying revenue for

Civil Aerospace was unchanged (up 2%

at actual exchange rates). OE revenue

was unchanged, with increases from

higher volumes of large engines being

offset by the decline in business jet

engines and V2500 modules. Aftermarket

revenue was down 1% despite strong

growth from our in-production engines.

OE revenue from Large engine: linked

and other* was up 2% reflecting increased

volumes of Trent 900s and a higher

number of spare Trent XWB engines,

partly offset by Trent 700 volume and

price reductions, ahead of the introduction

of the Trent 7000 for the Airbus A330neo.

Sales of spare engines to joint ventures,

included in Large engine: linked and

other*, generated revenue of £288m

(2015: £189m).

OE revenue from Large engine: unlinked

installed* increased 47%, led by higher

volumes of Trent XWBs.

* See table on page 20.

UNDERLYING REVENUE MIX

OE revenue 48%

Services revenue 52%

UNDERLYING REVENUE BY SECTOR

Large engine 66%

Business aviation 17%

Regional 5%

V2500 12%

Business review

Summary

The Civil Aerospace business is a major manufacturer of aero engines for the large

commercial aircraft and corporate jet markets. We power 35 types of commercial

aircraft and have more than 13,000 engines in service around the world.

Rolls-Royce Holdings plc Annual Report 2016 BUSINESS REVIEW

Large engine service revenue reflected

double digit growth from our in-production

engines which more than offset the

reduction from older engines, including

the expected lower year-on-year utilisation

of Trent 500 and Trent800 engines. Time

and material revenue reduced, as a result

of fewer overhauls of engines across the

out-of-production fleet.Contract

accounting effects within service revenue

in 2016 were significantly lower than prior

year. As a result, while there was a small

foreign exchange improvement in 2016,

underlying service revenue from large

engines was down 4%. Adjusting for

contract accounting effects, service revenue

from large engines would have been up 2%.

Revenue from business aviation* OE engine

sales was, as expected, lower, particularly

for the BR710 engines, reflecting general

market weakness and a transition to newer

non Rolls-Royce powered platforms. Volumes

of our newer BR725 engine, which powers

the Gulfstream G650 and G650ER, were

stable. Overall, business aviation* OE

revenues declined 25% while aftermarket

revenue was slightly down. Service revenue

from our regional *jet engines declined 14%,

reflecting retirements and reduced

utilisation of relevant fleets by North

American operators in particular.

On the V2500* programme, which powers

aircraft including the Airbus A320, revenue

from OE modules declined 10% reflecting

the production slow-down as Airbus

transitions to the A320neo, powered by

another engine provider. However, V2500*

service revenues were 21% higher, reflecting

price escalation on flying hour payments

together with increased overhaul activity.

Overall gross margins for Civil Aerospace

were 16.8% (2015: 22.0%), declining £397m

from 2015 on a constant currency basis.

The main headwinds were as forecast at the

start of the year: OE reductions to the Trent

700 programme; business aviation engines

and V2500 modules; reduced utilisation and

fewer overhauls of our out-of-production

Trent 500 and Trent 800 and RB211 engines;

and the declining regional aftermarket.

In addition, we also incurred programme

charges of around £30m for engines still

in development. These were partially offset

by the release, after accounting and legal

review, of accruals related to the

termination in prior years of intermediary

services, totalling £53m (2015: £nil). Gross

margin from spare engine sales to joint

ventures contributed £97m (2015: £67m).

The in-year net benefit from long-term

contract accounting adjustments totalled

£90m (2015: total benefit of £222m, which

included a £189m one-off benefit associated

with the refinement of our methodology for

risk assessment of future revenue). The

£90m included a £217m benefit from

lifecycle cost improvements (2015: benefit of

£140m). We also recognised in this period a

£35m benefit from a five cent change (2015:

£nil) to our estimated long-term US dollar

to sterling exchange rate to bring our own

planning rate within updated external

benchmark long-term forecast data. These

benefits were offset by technical costs of

£98m (2015: £24m) for large engines,

including the Trent 900, relating to the need

for increased shop visits in the short term,

and the Trent 700, where we are upgrading

the engine management system, together

with a charge of £64m (2015: £83m),

reflecting other operational changes.

The year-on-year change was also impacted

by a one-off £65m write-back in 2015

of a previously recognised impairment of

contractual aftermarket rights (CARs) for

sales to a launch customer and the release

of a related provision; in 2016 these sales

were capitalised as CARs.

Costs below gross margin were £89m higher

than the previous year at £818m on an

underlying basis. Within this, R&D charges

of £568m were £34m higher, reflecting

higher spend on key programmes,

particularly in respect of the Trent 7000

which are being expensed ahead of

capitalisation and lower development cost

contributions from risk and revenue sharing

partners, partly offset by increased R&D

capitalisation on the Trent 1000 TEN.

Underlying commercial and administrative

costs were £43m higher than 2015 reflecting

increased employee incentive charges.

Underlying restructuring costs of £11m were

£4m higher than 2015 and profits from joint

ventures and associates were down £8m.

As a result, profit before financing and tax

was 55% down, reflecting a combination

of lower overall gross margins, higher

commercial and administrative, R&D and

restructuring costs and reduced joint venture

and associate profits. Taking account of

foreign exchange effects, underlying profit

before financing and tax was £367m

(2015: £812m).

CIVIL AEROSPACE | KEY FINANCIAL DATA

£m 2015

Underlying

change*

Foreign

exchange ** 2016

Order book 67,029 4,395 2 71,426

Engine deliveries 712 (63) 649

Underlying revenue 6,933 (27) 161 7,067

Change – +2% +2%

Underlying OE revenue 3,258 14 85 3,357

Change – +3% +3%

Underlying services revenue 3,675 (41) 76 3,710

Change -1% +2% +1%

Underlying gross margin 1,526 (397) 56 1,185

Gross margin % 22.0% -570bps 16.8%

Commercial and administrative costs (296) (43) (3) (342)

Restructuring costs (7) (4) – (11)

Research and development costs (515) (34) (19) (568)

Joint ventures and associates 104 (8) 7 103

Underlying profit before financing 812 (486) 41 367

Change -60% +5% -55%

Underlying operating margin 11.7% -700bps 5.2%

* Order book underlying change includes £2.1bn increase from a change to our long-term US dollar planning rate.

** Translational foreign exchange impact.

ORDER BOOK

£71.4bn

STRATEGIC REPORT

Rolls-Royce Holdings plc Annual Report 2016STRATEGIC REPORT BUSINESS REVIEW

Trading cash flow

Trading cash flow before working capital

movements of £22m declined year-on-year

by £462m, driven by a reduction in

underlying profit before financing of

£445m and increased property, plant and

equipment additions. There were also

increased certification costs driven by the

Trent XWB-97 and higher R&D capitalisation

of the Trent 1000 TEN development costs,

offset in part by other timing differences

including provision movements.

The overall trading cash flow improvement

of £43m resulted largely from a significant

year-on-year improvement in working

capital, due mainly to differences in the

timing of payments to suppliers and

increased deposits, offset in part by an

increase in inventory. In addition, reflecting

the lower profits recorded on our linked

engines such as the Trent 700, net long-term

contract debtor additions were also lower.

TotalCare net assets and contractual

aftermarket rights

TotalCare net assets increased in 2016 by

£230m (2015: £406m) to £2.44bn reflecting

accounting for new linked engines of £432m

(2015: £521m), contract accounting

adjustments taken in the year of £90m

(2015: £222m) offset by the cash inflows and

net other items of £(292)m (2015: £(337)m).

It should be noted that the £230m net asset

increase is different from the £246m used in

the trading cash flow above because of

foreign exchange effects on evaluating

TotalCare net debtor balance movements.

The CARs balance increased by £169m (2015:

increase of £156m) to £574m reflecting

higher sales of unlinked Trent XWB engines

partly offset by engine cost improvements.

Investment and business

development

Order intake of £14.1bn in 2016 for Civil

Aerospace was £1.3bn higher than the

previous year. The order book closed at

£71.4bn, up £4.4bn or 7% from 2015, which

included a £2.1bn benefit from the change

in the long-term planning foreign exchange

rate discussed previously. Excluding this, the

order book was up 3%.

Significant orders in 2016 included a US$2.7bn

order from Norwegian for Trent 1000 engines,

an order from Garuda Indonesia worth $1.2bn

for Trent 7000 engines and a $900m order

from Virgin Atlantic for Trent XWB. All of these

include the provision of long-term TotalCare

engine services.

Foundations for future growth are built from

our investment in engineering excellence

During the year, we committed resources

in order to ensure we made significant

CIVIL AEROSPACE | REVENUE SEGMENTATION

2015

Underlying

change

Underlying

change %

Foreign

exchange

£m

2016

£m % of total % of total £m

Original equipment 3,258 48% 14 – 85 48% 3,357

Large engine: linked and other 1,570 23% 32 +2% 2 23% 1,604

Large engine: unlinked installed 504 7% 237 +47% 1 10% 742

Business aviation 903 14% (228) -25% 82 11% 757

V2500 281 4% (27) -10% – 4% 254

Service 3,675 52% (41) -1% 76 52% 3,710

Large engine 2,371 34% (84) -4% 2 32% 2,289

Business aviation 425 6% (13) -3% 40 6% 452

Regional 360 5% (52) -14% 34 5% 342

V2500 519 7% 108 +21% – 9% 627

CIVIL AEROSPACE | TRADING CASH FLOW

£m 2016 2015 Change

Underlying profit before financing 367 812 (445)

Depreciation and amortisation 491 410 81

Sub-total 858 1,222 (364)

CARs additions (208) (161) (47)

Property, plant, equipment and other intangibles (739) (502) (237)

Other timing differences

*

111 (75) 186

Trading cash flow pre-working capital movements 22 484 (462)

Net long-term contract debtor movements (246) (406) 160

Other working capital movements 267 (78) 345

Trading cash flow

**

43 – 43

* Includes timing differences between underlying profit before financing and cash associated with: joint venture profits less dividends received; provision charges higher /(lower) than

cash payments; non-underlying cash and profit timing differences (including restructuring); and financial assets and liabilities movements including the effect of foreign exchange

movements on non-cash balances.

** Trading cash flow is cash flow before: deficit contributions to the pension fund; taxes; payments to shareholders; foreign exchange on cash balances; and acquisitions and disposals.

Rolls-Royce Holdings plc Annual Report 2016 BUSINESS REVIEW

progress across all key engineering