Working Paper Series

Navigating the housing channel of

monetary policy across euro area

regions

Niccolò Battistini, Matteo Falagiarda,

Angelina Hackmann, Moreno Roma

Disclaimer: This paper should not be reported as representing the views of the European Central Bank

(ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

No 2752 / November 2022

Abstract

This paper assesses the role of the housing market in the transmission of conventional and

unconventional monetary policy across euro area regions. By exploiting a novel regional

dataset on housing-related variables, a structural panel VAR analysis shows that monetary

policy propagates effectively to economic activity and house prices, albeit in a heterogeneous

fashion across regions. Although the housing channel plays a minor role in the transmis-

sion of monetary policy to the economy on average, its importance increases in the case of

unconventional monetary policy. We also explore the determinants of the diverse transmis-

sion of monetary policy to economic activity across regions, finding a larger impact in areas

with lower labour income and more widespread homeownership. An expansionary monetary

policy can thus be effective in mitigating regional inequality via its stimulus to the economy.

JEL Classification: D31, E32, E44, E52, R31

Keywords: housing market, conventional and unconventional monetary policy, regional in-

equality, business cycles

ECB Working Paper Series No 2752 / November 2022

1

Non-technical summary

Profound economic and institutional differences across regions have long challenged the effective-

ness of monetary policy in the euro area. The unequal geography of the transmission of monetary

policy has also stoked concerns about its possible side effects on regional inequality, especially

owing to the unconventional measures conducted by the European Central Bank (ECB) over the

last decade. In this context, the housing market—in light of its role in the propagation of shocks,

its distributional implications and its local dimension—has often come to the front of the media

and policy debate on the intended and unintended effects of monetary policy across euro area

regions.

Our paper contributes to the literature on this debate by assessing empirically the role

of the housing market in the conventional and unconventional transmission of monetary policy

across regions in the first two decades of the euro area. We first construct a large dataset with

a panel of 106 regions in eight euro area countries (Belgium, Germany, Spain, France, Ireland,

Italy, the Netherlands and Portugal) covering the period 1999-2018. We compile novel indicators

for regional house prices and loan-to-value (LTV) ratios based on loan-level data. We also collect

regional indicators for aggregate and sectoral activity, labour market developments and housing

market features.

We then consider monetary policy through its conventional and unconventional transmis-

sion mechanisms by constructing a measure of monetary policy shocks. To isolate the impact of

“genuine” monetary policy shocks, we adopt a high-frequency identification and impose sign and

zero restrictions on high-frequency changes in risk-free interest rates and stock prices around the

ECB’s monetary policy announcements. We assume that the conventional transmission mecha-

nism of monetary policy has mainly operated through short-term rates, whereas long-term rates

were primarily related to the unconventional transmission mechanism of monetary policy enacted

in the aftermath of the Global Financial Crisis.

Making use of our regional dataset and our measure of conventional and unconventional

monetary policy shocks, we design a methodology to assess the role of the housing market

in the transmission of monetary policy to the real economy. Using a structural panel vector

autoregression (SPVAR) model with regional GDP, employment and house prices as endogenous

variables, and euro area monetary policy shocks as exogenous variable, we first assess the average

impact of a monetary accommodation on GDP, employment and house prices across regions.

ECB Working Paper Series No 2752 / November 2022

2

Accounting for the endogenous reaction of GDP to employment and house prices, we further

quantify the role of the employment and the housing channels in conveying monetary stimulus.

We finally provide an anatomy of the long-term drivers of the diverse impact of monetary policy

across euro area regions.

Our results point to an effective, yet widely heterogeneous transmission of monetary policy

across the euro area, with monetary policy stimulating economic activity mainly through labour

income, compared with housing wealth. Nevertheless, the housing channel becomes more relevant

in the unconventional transmission of monetary policy. Moreover, as monetary policy is found to

impact poorer regions the most, policy makers should carefully monitor the risks of an increase

in cross-regional inequality as monetary policy normalises, especially in the case of resurgent

fragmentation risks. Our findings suggest that a proper assessment of the monetary policy

transmission should not neglect the housing market, with its multiple sources of propagation

and its pronounced local dimension.

ECB Working Paper Series No 2752 / November 2022

3

1 Introduction

Profound economic and institutional differences across regions have long challenged the effective-

ness of monetary policy in the euro area.

1

The unequal geography of the transmission of monetary

policy has also stoked concerns about its possible side effects on regional inequality, especially

owing to the unconventional measures conducted by the European Central Bank (ECB) over the

last decade.

2

The ECB’s large-scale asset purchases—critics maintain—have inflated the prices

of assets, such as stocks and houses, unfairly favouring rich, wealthy households.

3

To the extent

that similar households cluster geographically, monetary policy has, according to critics, further

exacerbated regional inequality. In the transition of the ECB out of crisis-era stimulus, a crucial

issue on the policy agenda has thus become the calibration of an appropriate monetary policy

stance that can support the recovery while minimising economic divergence across regions. In

this context, the housing market—in light of its role in the propagation of aggregate shocks, its

distributional implications and its local dimension—

4

has often come to the front of the media

and policy debate on the intended and unintended effects of monetary policy.

5

Our paper contributes to the literature on this debate by assessing empirically the role

of the housing market in the conventional and unconventional transmission of monetary policy

across regions in the first two decades of the euro area. Our contribution is threefold. First,

we construct a large dataset with a panel of 106 (mostly) NUTS2-level regions in eight euro

area countries (Belgium, Germany, Spain, France, Ireland, Italy, the Netherlands and Portugal)

covering the period 1999-2018. Most notably, we compile novel indicators for regional house prices

and loan-to-value (LTV) ratios based on loan-level data from the European DataWarehouse. We

also collect regional indicators for aggregate and sectoral activity, labour market developments

and housing market features from the ARDECO database and Eurostat. Our dataset features

a high degree of within-country, besides cross-country, diversity pervading housing markets over

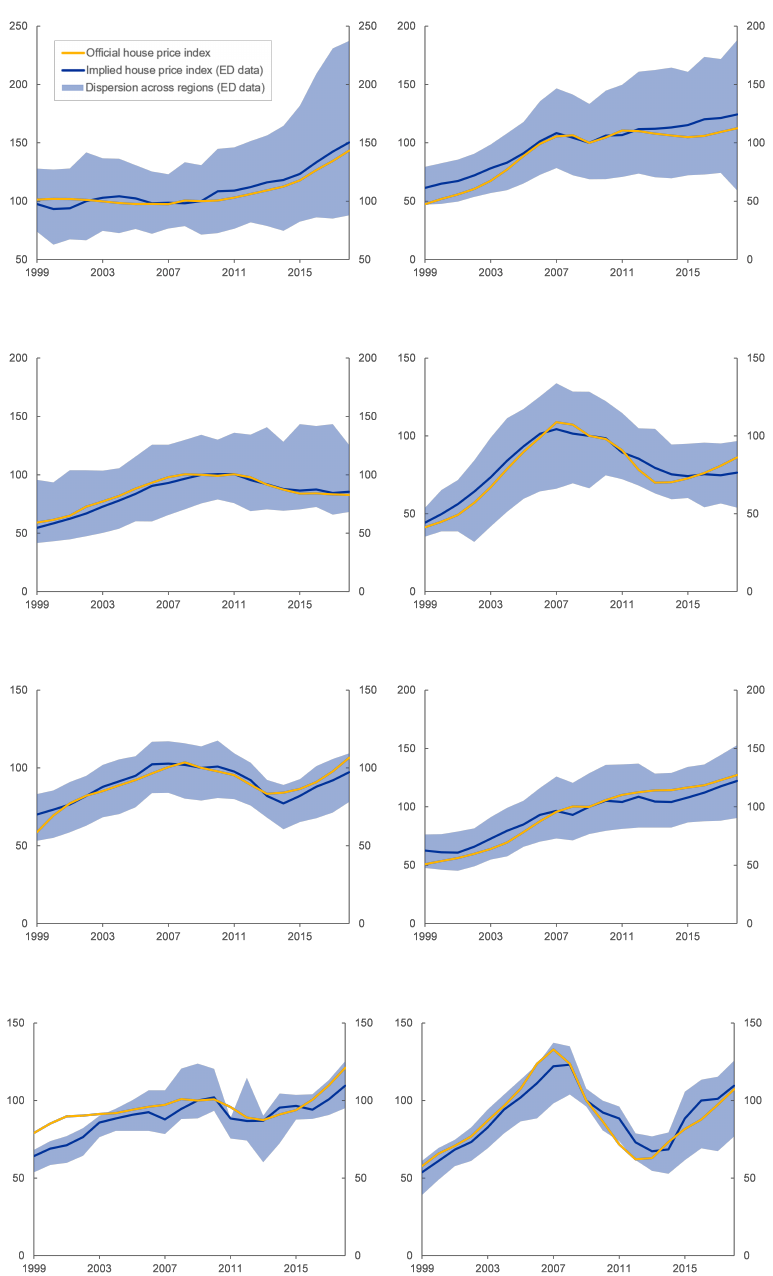

the first twenty years of the euro area (Figure 1).

6

This indicates that the information content

1

For a discussion of financial integration challenges in the euro area, see European Central Bank (2022). For

the implications of regional heterogeneity for monetary policy in the euro area, see Cœuré (2019).

2

See, for instance, The Economist (2016) and Cœuré (2018).

3

Among the earliest concerns, see The Economist (2013) and The Financial Times (2015a).

4

On the features of the housing market, see the comprehensive study by Piazzesi and Schneider (2016).

5

To name a few recent examples, see, in the media, The Financial Times (2021) and, in policy circles, OECD

(2020), Schnabel (2021), Battistini et al. (2021) and European Commission (2021).

6

A simple measure of the information content specific to within-country (relative to cross-country) heterogene-

ity can be computed, for each variable, as the ratio of the cross-country average of the within-country standard

deviations to the cross-country standard deviation of the within-country averages. All the considered variables

exhibit a sizeable degree of relative within-country variation, especially construction share (85 percent), followed

ECB Working Paper Series No 2752 / November 2022

4

Figure 1: Regional heterogeneity in euro area housing markets

Source: ARDECO, Eurostat, European DataWarehouse and authors’ calculations.

Notes: Labour income is measured as compensation of employees divided by number of employees (average 1999-

2018). Housing wealth is computed as house price level (average 1999-2018) multiplied by homeownership rate

(share of households living in owner-occupied dwellings) in 2011. Construction share is calculated as construction

value added divided by total value added (average 1999-2018). Loan-to-value ratio is computed as the amount of

the mortgage loan divided by the value of the underlying property (average 1999-2018).

of our regional dataset extends beyond that of a typical cross-country panel, confirming the

pronounced local dimension of housing markets.

Our second contribution is to consider monetary policy through its conventional and un-

conventional transmission mechanisms. To this end, we tap the Euro Area Monetary Policy

Database (Altavilla et al., 2019b) to construct a measure of monetary policy surprises. To iso-

late the impact of “genuine” monetary policy surprises, we adopt a high-frequency identification

and impose sign and zero restrictions on high-frequency changes in OIS interest rates and stock

prices around the ECB’s monetary policy announcements (Jarociński and Karadi, 2020). We

by homeownership rate and labour income (both 55 percent) and LTV ratio (36 percent).

ECB Working Paper Series No 2752 / November 2022

5

assume that the conventional transmission mechanism of monetary policy has mainly operated

through short-term rates, whereas long-term rates were primarily related to the unconventional

transmission mechanism of monetary policy in the aftermath of the Global Financial Crisis.

Third, using our regional dataset and our measure of conventional and unconventional

monetary policy, we design a methodology to assess the role of the housing market in the trans-

mission of monetary policy to the real economy. Using a structural panel vector autoregression

(SPVAR) model with regional GDP, employment and house prices as endogenous variables, and

euro area monetary policy shocks as exogenous variable, we first assess the average impact of

monetary policy on GDP, employment and house prices across regions. Accounting for the en-

dogenous reaction of GDP to employment and house prices, we further quantify the role of the

employment and the housing channels in conveying monetary stimulus.

Our results show a significant, positive impact of a monetary policy easing on GDP, em-

ployment and, to a lesser extent, house prices. Further, monetary policy stimulus to the overall

economy transmits mainly through the employment channel, in line with Hauptmeier, Holm-

Hadulla and Nikalexi (2020), with a rather limited role for the housing channel, consistently

with findings in Slacalek, Tristani and Violante (2020) and Lenza and Slacalek (2021). However,

unconventional monetary policy is estimated to induce significantly larger responses in house

prices, relative to conventional monetary policy, thereby amplifying the housing channel.

Finally, we provide an anatomy of the long-term drivers of the diverse impact of monetary

policy across euro area regions. The region-specific estimates of our benchmark SPVAR model

allow us to dissect the role of several housing-related economic and institutional characteristics.

We find that monetary policy has a larger impact on the economy of regions with lower labour

income and a higher homeownership rate. This suggests that poorer regions stand to benefit the

most from expansionary monetary policy, but can also be more negatively affected from a policy

tightening.

Overall, our results point to an effective, yet widely heterogeneous transmission of monetary

policy across the euro area, with monetary policy stimulating economic activity mainly through

labour income, compared with housing wealth. Nevertheless, the housing channel becomes more

relevant in the unconventional transmission of monetary policy. Moreover, as monetary policy is

found to impact poorer regions the most, policy-makers should carefully monitor the risks of an

increase in cross-regional inequality as monetary policy normalises, especially in the case of resur-

gent fragmentation risks. Our findings suggest that a proper assessment of the monetary policy

ECB Working Paper Series No 2752 / November 2022

6

transmission should not neglect the housing market, with its multiple sources of propagation and

its pronounced local dimension.

The remainder of this paper is structured as follows. Section 2 describes the data. Section 3

lays out the theoretical and empirical frameworks. Section 4 presents a quantitative assessment of

the housing channel of monetary policy. Section 5 analyses the role of economic and institutional

characteristics in explaining the heterogeneous impact of monetary policy across regions. Section

6 conducts robustness tests on our main results. Section 7 draws concluding remarks.

2 Data

2.1 Regional dataset

Our regional dataset has annual frequency and spans the period from 1999 to 2018. It covers

106 regions of eight euro area countries (Belgium, Germany, Spain, France, Ireland, Italy, the

Netherlands and Portugal) accounting for around 90 percent of euro area gross domestic product

(GDP). We consider NUTS2 regions for Belgium, Spain, France, Ireland, Italy, the Netherlands,

and Portugal and NUTS1 regions for Germany.

7

Regional data on real GDP, real gross value

added (GVA) for the construction and manufacturing sectors, real compensation of employees,

as well as employment and population are obtained from the ARDECO database, which is

maintained and updated by the Joint Research Centre of the European Commission. Moreover,

we collect regional data on homeownership rate (share of households living in owner-occupied

housing) and population density (persons per square kilometre) from Eurostat.

8

Crucial for our analysis, house price indices, loan-to-value (LTV) ratios and the share

of variable-rate mortgages at the regional level are derived via loan-level data provided by the

European DataWarehouse (ED). The ED is a securitisation repository that collects, validates and

makes available detailed, standardised and asset class-specific loan-level data for asset-backed

securities (ABS) transactions. For our purposes, only residential mortgage-backed securities

7

Very small regions (Ceuta and Melilla in Spain; Madeira and Azores in Portugal; overseas departments in

France) are excluded. In line with the Italian Constitution, we consider the provinces of Trentino and Alto

Adige/Südtirol a single political region, although they are two different NUTS2 areas. Therefore, the variables

available for these two provinces at the NUTS2 level are aggregated or averaged at the regional level. We consider

NUTS1-level regions for Germany in order to have a number of regions (16) similar to that of France (22), Italy

(20), and Spain (17). The use of NUTS2 regions for Germany (which are 38) would have led this country to be

over-represented in the aggregate estimates. As regards the other countries, we consider 11 regions for Belgium,

12 for the Netherlands, 5 for Portugal and 3 for Ireland.

8

Regional data on homeownership rates are available from Eurostat only for a few, distant years at irregular

intervals. Hence, we only consider 2011 data, which broadly corresponds to the middle of our sample.

ECB Working Paper Series No 2752 / November 2022

7

Figure 2: Key variables in our dataset

Notes: Demeaned log variables. The yellow line depicts euro area aggregate data, while the dark blue line

the cross-regional mean of the variable. The dark (light) blue shading indicates 10th and 90th (1st and 99th)

percentiles of the regional distribution.

(RMBS) transactions are used. Note that ED data dictate our choice on the country coverage

and the level of geographical disaggregation. First, within the euro area, ED data are available

only for the countries included in our sample. Second, NUTS3-level geographical units (NUTS2

in Germany) would not ensure that the sample is sufficiently representative, as only a relatively

small number of loans may be recorded at such granular level in some regions. For more details

on how ED data are processed, see Appendix A.

Our key variables (i.e. GDP, employment and house prices) are transformed as follows.

We consider real GDP and employment in per capita terms. We do this to make our estimates

comparable to other empirical studies and consistent with assessments based on standard DSGE

models, where the population is typically normalised to unity and economic aggregates are thus

in per capita terms. Moreover, we take the log of GDP, employment and house price indices.

Finally, we demean these variables in order to remove region-specific fixed effects in the data.

9

A closer look at our regional dataset confirms its suitability to investigate the role of

the housing market in the euro area. Figure 2 shows indeed that the cross-region mean of

each variable, computed across the 106 regions in the eight countries in our sample, tracks well

the corresponding euro area aggregate over time. Moreover, the cross-region dispersion of house

prices is significantly higher than that for the other variables, confirming that the housing market

is indeed a regional phenomenon. Lastly, the dispersion across regions, especially between the

1st and 99th percentiles, seems to widen in the second half of the sample, possibly reflecting

the impact of the Global Financial Crisis and the Sovereign Debt Crisis. This pattern is already

9

Note that our methodology based on mean-group estimation deals with further potential fixed effects in the

transmission of monetary policy by estimating region-specific parameters.

ECB Working Paper Series No 2752 / November 2022

8

Table 1: Summary statistics of the key variables

Mean Median Minimum Maximum Standard deviation

GDP regional 29467 28052 14181 65785 9267

national 32019 33480 17474 45529 8872

Employment regional 43.63 43.00 31.24 65.17 6.84

national 45.10 43.19 40.95 52.38 4.41

House prices regional 146.01 145.84 97.68 193.39 23.23

national 149.35 153.18 114.76 180.03 21.87

Notes: Real GDP and employment are in per capita terms. National GDP and employment are calculated

as cross-regional aggregate of all regions within a country. National house prices are given by GDP-weighted

cross-regional means of all regions within a country.

documented in Hauptmeier, Holm-Hadulla and Nikalexi (2020) for GDP, while we observe similar

dynamics for house prices.

Table 1 shows descriptive statistics on the cross-region and cross-country distributions of

our variables over the sample period. For all variables, we find a higher degree of heterogeneity

on the regional vis-à-vis the national level. On average over the entire period, GDP per capita

ranges at the national level between 17,474 EUR in Portugal and 45,529 EUR in Ireland, while

the regional minimum is 14,181 EUR in Norte (Portugal) and the maximum is 65,785 EUR

in Région de Bruxelles-Capitale (Belgium). Regarding house prices, we also find a large cross-

regional dispersion with a minimum house price index of 97.7 in Sachsen-Anhalt (Germany) and a

maximum of 193.4 in País Vasco (Spain). The national house price indices range between 114.8

in Germany and 180.0 in Spain. Comparing these statistics over three different time periods

(1999-2008, 2009-2012 and 2013-2018) reveals differences in the dispersion of the variables over

time (see Table B.1 in Appendix B). While all variables show the lowest regional dispersion

before the Global Financial Crisis, the standard deviation of GDP and employment is the largest

between 2013 and 2018. In contrast, the standard deviation of regional house prices is the largest

during the Global Financial Crisis and decreases thereafter.

2.2 Monetary policy shocks

We identify monetary policy shocks by means of high-frequency changes in OIS interest rates

and stock prices around the ECB’s monetary policy decisions. A narrow time window around

monetary policy events allows us to measure exogenous changes in the monetary policy stance

(i.e. monetary policy surprises). For this purpose, we use the Euro Area Monetary Policy

ECB Working Paper Series No 2752 / November 2022

9

Database (EA-MPD) by Altavilla et al. (2019b) containing high-frequency movements in OIS

interest rates and EURO STOXX 50 around the ECB’s monetary policy announcements. The

EA-MPD differentiates between three time windows: the publication of the press release, the

press conference, and the union of these two windows, referred to as “monetary policy event”. In

our analysis, we consider the window of the monetary policy event as a reference period (Enders,

Hünnekes and Müller, 2019, Holm-Hadulla and Thürwächter, 2021).

10

2.2.1 Pros and cons of event-based monetary policy surprises

The use of an event-based identification of genuine monetary policy shocks comes with some

caveats, but also clear advantages. On the one hand, as any event-based identification, this

strategy is successful insofar as it captures all the relevant monetary policy events. During

speeches, interviews and other public occasions, monetary authorities may partly signal policy

shifts before the monetary policy events (i.e. press releases and conferences). The measured mon-

etary policy surprises in our dataset ultimately reflect the changes in the risk-free yield curve and

stock prices within a narrow event window due to deviations of the actual announcements from

market expectations (Rostagno et al., 2021). Hence, this event-based identification strategy may

over- or under-estimate monetary policy surprises taking shape in a period stretching beyond the

event window if, for example, the relevant events are already “discounted” by market participants

or if there are delayed market adjustments to the policy announcements.

On the other hand, this identification strategy is insulated from other problems afflicting

conventional approaches (Ramey, 2016). Unlike empirical approaches relying on observed inter-

est rates, monetary policy surprises identified from high-frequency event-studies are exogenous

to economic conditions, which are already part of the market participants’ information set at the

time of the announcement. Further, unlike DSGE models or structural VAR models, the the-

oretical assumptions needed to capture monetary policy shocks in high-frequency event-studies

are minimal. This comes with important benefits. First, the risk of estimation issues due to

model misspecification is low. Second, any possible time dependence in the reaction function

used by monetary authorities is already taken into account, at least to the extent that market

10

In our sample, Governing Council meetings took place in regular intervals of six weeks. At 13 : 45 CET a

press release provides the policy decision and at 14 : 30 CET, the president explains the rationale of the decision

in a press conference in more detail. The change of the financial market variables due to the monetary policy

event is given as the change of the median value in the pre-release window (13 : 25 CET to 13 : 35 CET) and the

median value in the post-conference window (15 : 40 CET 15 : 50 CET).

ECB Working Paper Series No 2752 / November 2022

10

participants have incorporated this variation when interpreting monetary policy announcements.

The identification of our monetary policy shocks poses two main challenges, namely the

selection of “genuine” shocks and the aggregation of surprises from an event-based frequency to

an annual frequency. We explain how we address both challenges in the next two subsections.

2.2.2 Identification of genuine monetary policy shocks

OIS interest rate changes around monetary policy events do not only reflect how market partici-

pants assess whether and how the ECB adjusts its policy instruments, but also their perception

of potential superior information on the state and prospects of the economy the ECB might have.

For instance, if the monetary authority announces an interest rate hike and market participants

see it as a true monetary policy tightening, this will be accompanied by a negative stock price

reaction. This is a so-called genuine monetary policy shock. Conversely, if market participants

perceive this increase as a sign of buoyant economic prospects, this will have a positive impact

on the stock price. This is a so-called central bank information shock (see Jarociński and Karadi,

2020).

We disentangle (genuine) monetary policy shocks and (central bank) information shocks

by imposing sign and zero restrictions on high-frequency changes in OIS interest rates and stock

prices. In line with Jarociński and Karadi (2020), high-frequency OIS interest rate changes

are assumed to be uncorrelated with their own past values and with current and past values

of other variables, since they are measured in a narrow time window around monetary policy

announcements. We extend the same modelling assumption to stock price movements, as these

are measured over the same narrow window.

11

Hence, we can use the series of OIS interest rate

and stock price changes as reduced-form residuals and impose sign restrictions directly on their

covariance matrix to identify monetary policy and information shocks.

12

To capture the movements across the term structure, we use OIS interest rate changes at

different points of the yield curve. We focus on the 3-month and 10-year maturities to ensure

sufficient liquidity in the underlying instruments. Our focus on distant maturities (3 months and

11

This assumption differs from other approaches in the literature, who measure other financial variables over a

longer time span (e.g. a month) and thus cannot rule out their endogenous reaction to high-frequency interest rate

changes. These studies typically impose further structure on the model to extract the shock from co-movements

between interest rate changes and other financial variables (Jarociński and Karadi, 2020).

12

We implicitly use flat priors on the covariance matrix of our reduced-form residuals. When comparing meth-

ods, Jarociński and Karadi (2020) argue that their results with a Bayesian approach are similar to the frequentist

results by Gertler and Karadi (2015).

ECB Working Paper Series No 2752 / November 2022

11

10 years) is also justified by the fact that they are less prone to be affected by both conventional

and unconventional monetary policy measures, compared with intermediate maturities.

Our identification strategy allows us to disentangle conventional and unconventional mon-

etary policy shocks. We impose the following sign and zero restrictions.

CM P

d

UM P

d

INF

d

∆OIS3M

d

+ 0 +

∆OIS10Y

d

0 + +

∆SP

d

- - +

In the table above, ∆OIS3M

d

, ∆OIS10Y

d

and ∆SP

d

denote the change in the 3-month

OIS interest rate, the 10-year OIS interest rate and the EURO STOXX 50 index at event date d,

while CMP

d

, UM P

d

and INF

d

refer to conventional monetary policy, unconventional monetary

policy and information shocks, respectively. Finally, we compute total monetary policy shocks

as the sum of conventional and unconventional monetary policy shocks. Our restrictions imply

that a positive conventional (unconventional) monetary policy shock induces an increase in the

3-month (10-year) OIS interest rate, a decrease in the stock price and no movement in the 10-year

(3-month) OIS interest rate, while a positive information shock is associated with an increase in

all variables.

13

Our identification strategy warrants an explanation of how to interpret conventional and

unconventional monetary policy shocks. On the one hand, the reaction of OIS interest rates at

the short end of the yield curve should uniquely reflect conventional monetary policy measures up

to 2008. Thereafter, as standard measures stopped affecting the short end of the term structure

due to an effective lower bound on risk-free rates, the ECB sought to enhance the conventional

transmission of its monetary policy through non-standard measures, such as fixed-rate tenders

with full allotment, forward guidance, and negative interest rate policy (see, for example, the

discussion in Gambacorta, Hofmann and Peersman, 2014, and Falagiarda and Reitz, 2015). On

the other hand, the reaction of long-term OIS interest rates should primarily encompass the effects

of several unconventional measures implemented since 2011, such as asset purchase programmes,

longer-term refinancing operations and some types of forward guidance. Hence, our approach can

capture the impact of monetary policy through its conventional and unconventional transmission

13

Our main findings are largely unchanged if T M P

d

is estimated directly by imposing a negative co-movement

between the sum of the 3-month and the 10-year OIS interest rate changes and stock price changes, with infor-

mation shocks inducing a positive co-movement between these two variables.

ECB Working Paper Series No 2752 / November 2022

12

mechanisms, rather than the impact of the conventional and unconventional measures per se.

2.2.3 Temporal aggregation of event-based monetary policy shocks

To account for the annual frequency of our regional dataset, we apply a weighting procedure.

Specifically, we assign theoretical weights to monetary policy shocks depending on the distance

of the day of the event from the first day of the reference year. Formally, to calculate a monetary

policy shock for year t, we consider all monetary policy shocks in year t and t − 1 and give a

higher weight to shocks at the beginning of year t and at the end of year t − 1 compared with

shocks at the end of year t and the beginning of year t − 1, that is:

w

d,t

= 1 −

d

t

− d

1

t

365

W

d,t

=

w

d,t

P

N

i=1

w

i,t

(1)

MP

t

= N

N

X

d=1

W

d,t

MP

d

,

where w

d,t

denotes the theoretical weight attached to the monetary policy event on day d in year

t or t − 1 given the reference year t, W

d,t

its normalised value such that

P

N

d=1

W

d,t

= 1, N the

number of monetary policy events in year t and t − 1, d

1

t

the first day of year t and M P

t

our

final measure of (total, conventional or unconventional) monetary policy shock in year t.

Intuitively, Equation (1) aligns the monetary policy surprises identified at high frequency

with the concomitant economic developments, then building consistent low-frequency monetary

policy shocks. To give an example, consider a monetary policy surprise in the fourth quarter of

year t − 1, such as the monetary tightening observed on 3 December 2015, reflecting financial

markets’ disappointment about the increase of the size of the ECB’s asset purchase programme

(The Financial Times, 2015b). To the extent that this monetary policy shock has a relatively

larger impact on the contemporaneous growth rates of economic variables, this impact will be

more visible in year t, i.e. 2016, than in year t − 1, i.e. 2015.

14

Figure 3 shows the implied time series for our total, conventional and unconventional

monetary policy shocks. Looking at the total monetary policy shocks, monetary tightening

14

This follows from a simple accounting exercise, which implies that 25 and 75 percent of the quarterly growth

rate of any economic variable in the fourth quarter of year t − 1 contribute to its annual growth rates in years

t − 1 and t, respectively. Our theoretical weights, calculated at daily frequency, are largely consistent with these

quarterly weights.

ECB Working Paper Series No 2752 / November 2022

13

Figure 3: Monetary policy surprises

Notes: The chart shows the time series of the (genuine) monetary policy shocks at annual frequency resulting

from the weighting procedure.

starting in 2008 to curb rising inflation is followed by monetary accommodation in 2010 and

2011 to fight the Global Financial Crisis and then again in 2014 and 2015 as a reaction to the

Sovereign Debt Crisis. As of 2015, when the large-scale APP are launched, the main impulse from

monetary accommodation switches from the conventional to the unconventional transmission

mechanism.

15

3 Methodology

This section presents the theoretical framework and the empirical strategy adopted. First, we

outline the channels of monetary policy that we aim to capture in our empirical assessment.

Then, we describe our benchmark SPVAR model and discuss how we disentangle the channels

of interest. We finally present a simple econometric framework to link the estimated monetary

policy impact to housing-related economic and institutional characteristics at the regional level.

15

Due to data availability in the EA-MPD, where monetary policy surprises for the 10-year tenure are recorded

as of 7 July 2011, unconventional monetary policy shocks only start in 2011. Although a non-standard monetary

policy tool, such as the Securities Markets Programme (SMP), had already been activated for a year, we believe

that this should not significantly affect our results. Indeed, the objective of the SMP was “to ensure depth and

liquidity” and “restore an appropriate monetary policy transmission”, thus clearly falling under our definition of

a conventional transmission mechanism.

ECB Working Paper Series No 2752 / November 2022

14

3.1 The transmission of monetary policy through the housing channel

Monetary policy propagates to the real economy through several direct and indirect channels.

For illustrative purposes, we consider a closed economy with households, firms, financial interme-

diaries and a central bank. This framework is consistent with a broad class of general equilibrium

models used to analyse the role of the housing market in the transmission of monetary policy,

including models with collateral constraints (Iacoviello, 2005; Guerrieri and Iacoviello, 2017),

non-rational expectations (Adam and Woodford, 2021) and household heterogeneity (Kaplan,

Moll and Violante, 2018).

Let us assume that the central bank engenders an expansionary monetary policy shock,

i.e. risk-free rates decline more than expected. This directly improves supply conditions on

the credit market, inducing financial intermediaries to expand their lending to the private sec-

tor. This in turn supports households and firms’ current spending decisions, thus stimulating

aggregate demand across the consumption, housing, capital and labour markets. At the same

time, as the central bank announces the monetary easing, private sector agents adjust their ex-

pectations to internalise the improved future economic prospects. Positive expectations exert

upward pressures on financial and non-financial asset prices. In turn, house price increases boost

homeowners’ wealth, thus increasing private consumption. As house prices grow compared with

construction costs, favourable Tobin’s Q effects make housing investment more attractive. To

the extent that housing is posted as collateral, an increase in house prices relaxes borrowing

constraints and allows homeowners to smooth consumption over the life cycle, further boosting

aggregate demand. Overall, monetary accommodation expands the resources available for the

private sector, generating positive income and wealth effects for both households and firms and

supporting activity.

In a first step, our SPVAR analysis identifies a subset of the various general equilibrium

effects of monetary policy at play. Specifically, we consider household income sources, especially

housing wealth, proxied by house prices and capturing the housing channel, and labour income,

proxied by employment and capturing the employment channel. Our focus on the comparison

between the housing and the employment channels is motivated by the growing evidence, both

in the theoretical (Kaplan, Moll and Violante, 2018) and the empirical (Hauptmeier, Holm-

Hadulla and Nikalexi, 2020; Lenza and Slacalek, 2021) literature, pointing to a larger role for

labour income relative to housing wealth in transmitting monetary policy to the real economy.

ECB Working Paper Series No 2752 / November 2022

15

Given the scope of our analysis and the limited availability of regional data on other variables,

the residual effect of monetary policy includes the net effect of several other channels identified

in the literature, such as intertemporal substitution, net interest rate exposure, net nominal

balance sheet positions, stock market wealth (Slacalek, Tristani and Violante, 2020), as well as

other income sources supporting corporate, public and net foreign demand.

In a second step, our empirical analysis lays out an anatomy of the impact of monetary

policy on economic activity across regions. By means of formal econometric regressions, we

dissect the regional impact of monetary policy along several dimensions related to the housing

market, such as labour income, housing wealth, the construction share of total value added and

the share of variable-rate mortgages. The mean-group estimation used in our first step becomes

instrumental to this analysis, as it provides us with region-specific impacts of monetary policy.

This approach is different from subsample analysis or quantile (auto)regressions (Koenker and

Hallock, 2001; Koenker and Xiao, 2006), as it fully exploits the heterogeneity in the data and

does not impose additional structure.

3.2 A Structural Panel VAR for the housing channel

We first consider the following reduced-form VAR model in companion form:

Y

i,t

= B

i

Y

i,t−1

+ C

i

X

t

+ u

i,t

, (2)

where Y

i,t

is a vector of unit-specific endogenous variables for region i at time t = 1, ..., T , X

t

a vector of common exogenous variables (including a constant and a trend) and u

i,t

a serially

uncorrelated vector of errors with zero mean and a constant positive definite variance-covariance

matrix. Matrices B

i

and C

i

denote reduced-form parameters.

The equivalent representation in structural form is given by:

A

i

Y

i,t

= B

i

Y

i,t−1

+ Γ

i

X

t

+ ∆

i

i,t

, (3)

where A

i

, B

i

, Γ

i

and ∆

i

are matrices of structural parameters, which are related to the reduced-

ECB Working Paper Series No 2752 / November 2022

16

form parameters as follows:

A

−1

i

B

i

= B

i

A

−1

i

Γ

i

= C

i

(4)

A

−1

i

∆

i

i,t

= u

i,t

.

In our analysis, we focus on the effect of common exogenous variables Γ

i

and the contemporaneous

relationships among endogenous variables A

i

, while we do not investigate the impact of region-

specific structural shocks implied by ∆

i

.

The benchmark SPVAR model includes three endogenous variables Y

i,t

= [GDP

i,t

, Employment

i,t

, House prices

i,t

],

where GDP

i,t

is measured as real GDP divided by population, Employment

i,t

as number of em-

ployees divided by population and House prices

i,t

as average house price index. We include as ex-

ogenous variable X

t

the relevant measure of monetary policy shock, either total monetary policy

X

t

= T M P

t

or, simultaneously, conventional and unconventional shocks X

t

= [CM P

t

, UM P

t

].

Considering similar regional data, Beetsma, Cimadomo and Van Spronsen (2021) argue that

common, national and regional factors all play an important role in explaining regional business

cycles. In particular, they find that one common (euro area) factor, mostly related to monetary

policy, one national factor and one idiosyncratic factor can account for regional dynamics. To the

extent that the lagged endogenous variables net out the impact of country- and region-specific

developments, our benchmark specification appropriately disentangles the impact of common

(conventional and unconventional) monetary policy shocks. As a robustness check, we also in-

clude other explanatory variables, focusing on the part of cross-sectional averages unexplained

by our total monetary policy shocks, and find broadly similar results (Section 6).

Note that the vector of reduced-form coefficients C

i

represents the overall impact of a

monetary policy shock on GDP, employment and house prices. To disentangle the contribution

of the housing and employment channels, we need to identify the structural coefficients in A

i

and

Γ

i

denoting the contemporaneous relationships among endogenous variables. Once we estimate

the reduced-form parameters with standard OLS, we use the scoring algorithm (Amisano and

ECB Working Paper Series No 2752 / November 2022

17

Giannini, 1997) to impose the following identifying restrictions:

A

i

=

1 α

i,12

α

i,13

0 1 α

i,23

0 0 1

(5)

and

Γ

i

=

γ

i,1

γ

i,2

γ

i,3

, (6)

which imply a recursive structure, with the first variable as the most endogenous variable. Using

Equation (4), we obtain the following vector of structural coefficients:

C

i

= A

−1

i

Γ

i

=

1 −α

i,12

−α

i,13

+ α

i,12

α

i,23

0 1 −α

i,23

0 0 1

γ

i,1

γ

i,2

γ

i,3

=

γ

i,1

− α

i,12

γ

i,2

− (α

i,13

+ α

i,12

α

i,23

)γ

i,3

γ

i,2

− α

i,23

γ

i,3

γ

i,3

,

(7)

which allows us to disentangle the housing and employment channels from other direct and

indirect channels. Specifically, looking at the impact of monetary policy on GDP in the first

element of C

i

, the three terms reveal the contribution from unidentified direct and indirect

channels, γ

i,1

, the contribution from the employment channel, −α

i,12

γ

i,2

, and the contribution

from the housing channel, −(α

i,13

+ α

i,12

α

i,23

)γ

i,3

.

Note that our identification strategy only aims to disentangle the contribution of the em-

ployment and housing channels to the transmission of monetary policy to economic activity. As

such, our identification affects neither the interpretation nor the estimated impact of monetary

policy shocks. In our benchmark specification, we focus on a Cholesky structure among en-

dogenous variables, with GDP ordered as the most endogenous variable and house prices as the

most exogenous one. In this way, our estimates account for all the potential contemporaneous

effects of the housing and the employment channels on the transmission of monetary policy to

the business cycle. As the contemporaneous contributions tend to assign a larger weight to the

ECB Working Paper Series No 2752 / November 2022

18

less reactive (or more exogenous) variables, the estimates from our benchmark model should be

considered as an upper bound of the contribution of the employment and the housing channels.

16

We estimate our SPVAR model with one lag for each region i and apply the mean-group

(MG) estimation procedure proposed by Pesaran and Smith (1995) to obtain an average response

across regions. Our choice of the number of lags is standard considering the frequency of our

data, and ensures the use of a consistent model across regions.

17

3.3 Analysing the regional heterogeneity of housing markets

In a second step, we provide an anatomy of the diverse impact of monetary policy across euro area

regions. More specifically, it is formally tested which housing-related economic and institutional

characteristics contribute the most to explain the regional impact of monetary policy. To that

purpose, we estimate the following regression:

y

i

= α +

N

X

n=1

β

i,n

x

i,n

+

M

X

m=1

γ

i,m

z

i,m

+

i

, (8)

where the dependent variable y

i

represents the region-specific long-term (5-year) cumulative

monetary policy impact as estimated via the mean-group procedure, α, β

i

and γ

i

are param-

eters, x

i,n

corresponds to the nth explanatory variable (n = 1, ..., N), z

i,m

corresponds to the

mth demographic, country and country-group control variable (m = 1, ..., M) and is an error

term. The set of regional economic and institutional explanatory variables x

i,n

includes labour

income (measured as compensation per employee), housing wealth (homeownership rate times

average house price level), construction and manufacturing shares of total value added, the share

of variable-rate mortgages and a measure of lending activity. The demographic controls include

total employment and population density at the regional level. Consistently with the depen-

dent variable, which reflects the average estimated impact of monetary policy, all regressors are

averaged over the sample period, except for the homeownership rate, only available for 2011.

16

This is confirmed when we invert the ordering of the variables (see Section 6).

17

Assuming two lags, the SPVAR model produces largely comparable results in qualitatively and quantita-

tively terms. However, the impulse response functions become less smooth and more volatile compared with our

benchmark specification, hence impairing the interpretation of our findings.

ECB Working Paper Series No 2752 / November 2022

19

4 The housing channel of monetary policy

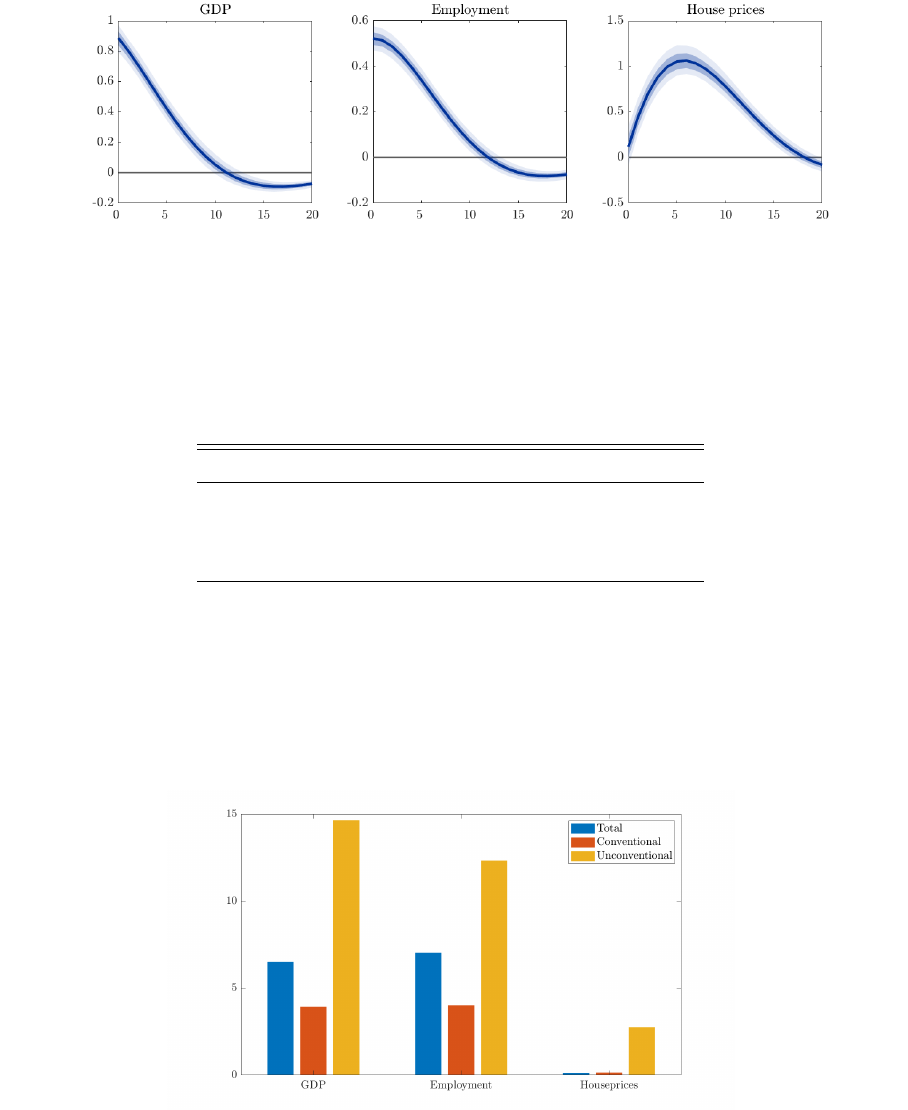

Based on the mean-group estimates of our SPVAR model, Figure 4 shows the responses of GDP,

employment and house prices to an expansionary monetary policy shock, standardised to its

mean absolute value.

18

We differentiate between responses to a total monetary policy shock

(first row), conventional and unconventional monetary policy shocks (second row). As suggested

by economic theory, GDP, employment, and house prices increase after a monetary policy easing

shock, with the statistical significance at least at the 68 percent level. However, for house prices,

the response on impact is not statistically different from zero. On average, total monetary policy

shocks lead to an increase in (detrended) GDP and employment levels by 0.7 and 0.4 percent on

impact, respectively, gradually declining over time. House prices exhibit instead a hump-shaped

reaction, with a positive peak response of 0.15 percent after three years before fading out over

the remainder of the horizon.

19

The responses to conventional and unconventional monetary policy shocks are significantly

different for all the variables. For GDP and employment, the effect of conventional monetary

policy shocks is larger compared to unconventional shocks. For house prices the opposite occurs,

with the peak response to unconventional shocks being around twice the response to conven-

tional shocks (almost 0.3 after 1 year versus slightly more than 0.1 percent after three years,

respectively). The impact of a conventional monetary policy shock on house prices reported in

the literature generally varies between 0 and 0.6 percent, with our estimate being close to the

lower end of this range (see, e.g., Musso, Neri and Stracca, 2011; Nocera and Roma, 2017; Zhu,

Betzinger and Sebastian, 2017; Huber and Punzi, 2020; Hülsewig and Rottmann, 2021).

By estimating the contemporaneous responses of our endogenous variables to a monetary

policy shock on GDP as described in Equation (7), it is possible to examine the role of the

housing and the employment channels. Figure 5 compares the share of the GDP response to a

total, conventional and unconventional shock explained by house prices and employment at the

5-year horizon. With a share of less than 4 percent, the housing channel plays only a minor role

in the transmission of a total and conventional monetary policy shock. In contrast, around 16

percent of the explained part in the transmission of unconventional monetary policy shocks to

18

We choose to set the size of the monetary policy shocks to their mean absolute value since, although their

mean value is not necessarily zero over the sample, this metric is a better gauge of their average estimated impact.

19

Corsetti, Duarte and Mann (2020) find a smaller difference in the impact of monetary policy on GDP and

house prices (with the long-term impact on GDP being almost twice that on house prices), while a similar impact

is documented in Rosenberg (2020).

ECB Working Paper Series No 2752 / November 2022

20

Figure 4: Impulse response functions to an expansionary monetary policy shock

Notes: The size of the monetary policy shock is calculated as its mean absolute value, which is 5.2 basis points for

the total, 4.6 basis points for the conventional and 1.7 basis points for the unconventional monetary policy shock.

The y-axis reports the percentage change in (detrended) levels of each variable over the considered horizon. The

x-axis reports the years. Solid lines denote point estimates and light (dark) shaded areas 95 percent (68 percent)

confidence bands.

economic activity can be attributed to the housing channel.

A forecast error variance decomposition provides insight regarding the contribution of

a monetary policy shock to fluctuations in GDP, employment and house prices at the 5-year

horizon. As shown in Figure 6, total monetary policy shocks explain about 7 percent of the

variation in both GDP and employment. When conventional and unconventional monetary policy

shocks are included separately, conventional shocks account for about 4 percent of the variation

in GDP and employment, while unconventional monetary policy shocks can explain 15 percent

and 12 percent of fluctuations in GDP and employment, respectively. However, monetary policy

shocks explain a relatively small share of house price fluctuations. Approximately 0.1 percent

of the variations in house prices can be attributed to a total and conventional monetary policy

shock and 2.7 percent to an unconventional shock.

These results are confirmed by a historical decomposition of GDP and house prices. As

shown in Figure 7, contractionary monetary policy shocks played an important role in the de-

velopment of GDP between the years 2003 and 2005 as well as between 2012 and 2014. By

ECB Working Paper Series No 2752 / November 2022

21

Figure 5: Importance of housing and employment channels

Notes: The y-axis shows the share of the contribution of employment and house prices out of the sum of their

contributions to the GDP response to a total, conventional and unconventional monetary policy shock.

contrast, expansionary monetary policy shocks – in particular unconventional ones – are key fac-

tors supporting economic activity in the latter part of the sample. In particular, out of the total

increase by 7.7 percent in the (detrended) level of (cross-regional average) GDP between 2013

and 2018, unconventional monetary policy contributed to 39 percent and conventional monetary

policy only to 3 percent. House prices are instead affected only to a small extent by monetary

policy throughout the sample period and their dynamics are mostly explained by other (non-

identified) factors. However, monetary policy plays a larger role in the later years of the sample.

Out of the total increase by 5.2 percent in the (detrended) level of (cross-regional average) house

prices between 2013 and 2018, unconventional monetary policy contributed to 41 percent and

conventional monetary policy induced a negative contribution by about 3 percent.

Overall, our results are in line with the small multipliers of house price changes on con-

sumption typically found in the empirical macroeconomic literature. However, due to our use

of a broad measure of economic activity and, hence, the presence of several other channels, our

results hint to a less pronounced role for house prices in the transmission of monetary policy

ECB Working Paper Series No 2752 / November 2022

22

Figure 6: Forecast error variance decomposition

Notes: The y-axis reports the contribution of a total, conventional and unconventional monetary policy shock to

variations in GDP, employment and house prices at the 5-year horizon.

compared with other studies. Elbourne (2008) and Ozkan et al. (2017) state that 12-15 percent

for the UK and 20 percent for the US of the drop in aggregate consumption after a contrac-

tionary interest rate shock can be attributed to changes in house prices. Moreover, Aladangady

(2017) and Garbinti et al. (2020) estimate a consumption multiplier of about 5 percent in the

US and between 1 and 4 percent across euro area countries, to changes in home values. Both

studies report larger responses for households with little wealth, suggesting that looser borrowing

constraints are a primary driver of the marginal propensity to consume (MPC) out of housing

wealth.

5 The regional heterogeneity of housing markets: An anatomy

A major advantage of the chosen estimation technique applied to our dataset is that it allows us

to analyse the heterogeneous response of economic activity and house prices to monetary policy

across regions and to link it to several economic and institutional features. To assess the role of the

housing channel relative to other relevant channels, we explore how the effectiveness of monetary

ECB Working Paper Series No 2752 / November 2022

23

Figure 7: Historical decomposition of GDP and house prices

Notes: The y-axis reports the (detrended) level of (cross-regional average) GDP (upper chart) and house prices

(lower chart) as well as the contributions of conventional and unconventional monetary policy shocks and other

(unidentified) factors.

policy relates to different long-term characteristics across regions, including households’ income

levels (labour income and housing wealth), the production structure of the economy (in terms

of construction and the manufacturing share of total value added),

20

and other key housing-

related economic and institutional features, such as households’ tenure status (homeownership

rate), indebtedness (LTV ratio) and type of mortgages (share of variable-rate mortgages). The

relationship between some of these factors (averaged over the sample period) and the estimated

monetary policy impact is depicted in Figure 8. One can notice that the transmission of monetary

policy to the economy is particularly heterogeneous across euro area regions. This unequal

geography of monetary policy transcends the cross-country perspective, as the range of monetary

policy effects on GDP spanned by dots of the same colour is wide.

21

A potentially important driver of the heterogeneous impact of monetary policy across euro

area regions is households’ income, most notably housing wealth and labour income. A significant

20

In fact, sectors producing durable goods are key in the transmission of monetary policy via the user-cost-of-

capital and interest-rate channels.

21

We focus on the long-term (5-year) impact of monetary policy on real GDP. Note that using a shorter (1-year)

horizon would yield qualitatively similar results.

ECB Working Paper Series No 2752 / November 2022

24

Figure 8: Monetary policy impact on real GDP and regional factors

Notes: The y-axis reports the cumulative percentage change in (detrended) levels for GDP 5 years after an

accommodative monetary policy shock. The x-axis reports the regional housing wealth (thousand euros per

household), labour income (euros per employee, at 2015 prices), construction share (percent of value added), LTV

ratio (percent), share of variable-rate loans (percent of total loans). Each dot represents a region.

relationship between the monetary policy impact and these two variables would allow us to infer

whether an easing of monetary policy exacerbates or mitigates regional income inequality. As

shown by the weakly positive correlation in the scatter plot in the upper left panel of Figure

8, monetary policy appears to be somewhat more effective at stimulating economic activity in

regions with higher housing wealth.

22

At the same time, monetary policy seems to be more

effective in lower-income regions, given the negative correlation shown in the second panel of

Figure 8. These results indicate that the ultimate impact of monetary policy on income inequality

masks countervailing forces. On the one hand, a loosening of monetary policy may reduce regional

inequality by stimulating activity more in regions at the bottom of the labour income distribution.

On the other hand, it may also contribute to a larger regional dispersion by supporting activity in

regions at the top of the housing wealth distribution. However, housing wealth reflects both the

diffusion of wealth across the population (measured by the homeownership rate) as well as the

22

This relationship is stronger when considering the effect of monetary policy on house prices, as shown in

Figure B.1 in Appendix B.

ECB Working Paper Series No 2752 / November 2022

25

concentration of wealth among owner-occupying households (measured by average house prices).

In our econometric analysis below, we formally test the relative importance of each driver of

housing wealth.

Moreover, we investigate the relationship between the impact of monetary policy and

three further dimensions of the housing market. First, we consider the production structure of

the economy and explore how the region-specific construction intensity, measured by the share

of construction value added in total value added, affects the effectiveness of monetary policy.

As shown in Figure 8, the share of the construction sector relative to the overall economy is

positively correlated with the impact of monetary policy on real economic activity.

23

Second, we investigate how households’ indebtedness relates to the impact of monetary

policy. Figure 8 suggests that the level of indebtedness, measured by the LTV ratio, is only

weakly correlated with the impact of monetary policy across euro area regions.

24

Third, the diverse impact of monetary policy across regions can be given by heterogeneous

mortgage market characteristics, such as the share of variable-rate mortgages. In countries where

most mortgages have adjustable rates, policy-induced changes in interest rates have an almost

immediate effect on household cash flows. As illustrated in the last panel of Figure 8, the

impact of monetary policy on GDP is indeed larger in regions with a higher share of variable-

rate loans. These regions are concentrated in Italy, Spain, Ireland and Portugal. This result

is in line with the model simulations by Calza, Monacelli and Stracca (2013), who document a

stronger impact of monetary policy on consumption in those countries where mortgage contracts

are predominantly of the variable-rate type, and Pica (2022), who finds that a higher share of

adjustable-rate mortgages and a higher homeownership rate interact to amplify the effects of

monetary policy on economic activity in the euro area. However, given the decrease in the share

of variable-rate mortgages observed over the second half of the sample period (especially in those

countries where variable-rate contracts are traditionally prevailing), homeowners’ interest-rate

sensitivity fell in recent years (see, for example, Bech and Mikkelsen, 2021).

23

This suggests a role for the construction sector in conveying monetary policy shocks to the overall economy,

in line with evidence on the user-cost-of-capital and interest-rate channels of monetary policy in affecting the

production of durable and capital goods (Dedola and Lippi, 2005; Peersman and Smets, 2005).

24

The positive relationship with the LTV ratio at the regional level is consistent with the evidence pointing to a

different transmission of monetary policy for liquidity-constrained and non-constrained households (Aladangady,

2017, Guerrieri and Iacoviello, 2017). By including an endogenously estimated threshold variable (i.e. the LTV

ratio at the regional level) in our baseline model, we find indeed a non-linear transmission mechanism for monetary

policy on housing and macroeconomic variables, with a significantly stronger impact when the LTV ratio is above

a certain level. The results are available from the authors upon request.

ECB Working Paper Series No 2752 / November 2022

26

We carry out a formal analysis in order to shed more light on the link between the mone-

tary policy effectiveness and economic and institutional characteristics across euro area regions.

Besides the variables mentioned above, we include controls commonly found to be important

determinants of the transmission of monetary policy to the business cycle, such as the manu-

facturing share of value added and a measure of lending activity to households. Panel (a) of

Table 2 reports the results of various regression specifications that link our estimated long-term

impact of total monetary policy shocks on real GDP to the key variables discussed above. In the

most parsimonious specifications, the regression coefficients of these variables have the expected

sign (as in the graphical overview discussed above) and are found to be statistically significant,

except for housing wealth and lending activity. The significance is robust to the inclusion of

demographic factors. When housing wealth is replaced by its determinants, the homeownership

rate is estimated to play a significant role.

25

When all variables are considered, labour income,

the share of construction, the share of manufacturing and lending activity display a statistically

significant coefficient. For labour income and the share of manufacturing the coefficient remains

significant even after the inclusion of country and country-group dummies.

26

Similar findings

are observed when considering the impact of conventional monetary policy (panel (b) in Table

2), except that the share of manufacturing is no longer significant. Focusing on unconventional

monetary policy (panel (c) in Table 2), lending activity (proxied by the product of regional av-

erage house prices and LTV ratios) becomes statistically significant. This confirms the role of

bank lending in supporting the effectiveness of (unconventional) measures and thus restoring the

functioning of the monetary policy transmission mechanism after the Sovereign Debt Crisis (for

more details, see Altavilla et al., 2019a and Adalid and Falagiarda, 2020).

We perform the same exercise considering the impact of monetary policy on house prices

as dependent variable (Table B.2 in Appendix B). Besides confirming the importance of labour

income, the results of these regressions highlight the role of housing wealth in the propagation

of monetary policy, particularly in the case unconventional monetary policy shocks.

25

This result relates to the work by Paz-Pardo (2021), who shows that increases in labour income inequality

and uncertainty are key drivers for a decrease in homeownership among younger households in several major

advanced economies, suggesting that the evolution of homeownership rates is closely intertwined with labour

markets, housing markets and financial conditions.

26

The Vulnerable dummy variable splits the regions into two large groups according to a conventional assessment

of “vulnerability”. In the academic and policy literature, this assessment typically considers a certain type of

macroeconomic imbalances, such as government debt-to-GDP ratios and current account deficits, and implies a

division between more and less vulnerable countries (sometimes also referred to as periphery and core countries,

respectively). The more vulnerable group contains all regions in Spain, Ireland, Italy and Portugal, and the less

vulnerable group consists of all regions in Belgium, Germany, France and the Netherlands.

ECB Working Paper Series No 2752 / November 2022

27

Table 2: Relationship between monetary policy impact on real GDP and regional factors

(a) Dependent variable: (1) (2) (3) (4) (5) (6) (7) (8)

Impact of TMP shock

Compensation per employee -4.934*** -4.316*** -4.253*** -4.470*** -4.060**

Housing wealth 0.639 -1.011 -0.733 0.704

Homeownership rate 0.028**

House price level 0.299

Share of construction in GVA 0.581*** 0.214* 0.200* 0.014

Share of manufacturing in GVA 0.063** 0.057** 0.057** 0.069***

Share of variable-rate mortgages 0.027*** 0.002 0.013 0.020

Lending activity 0.598 1.511* 1.328 -0.437

Demographics controls X X X X X X X X

Vulnerable dummy - - - - - - X -

Country dummies - - - - - - - X

Observations 105 105 105 105 105 105 105 105

R-squared 0.424 0.439 0.189 0.324 0.015 0.494 0.501 0.538

(b) Dependent variable: (1) (2) (3) (4) (5) (6) (7) (8)

Impact of CMP shock

Compensation per employee -3.903*** -3.932*** -3.494*** -3.412*** -3.747*

Housing wealth 0.187 1.141 1.036 1.612

Homeownership rate 0.006

House price level 0.424

Share of construction in GVA 0.560*** 0.373*** 0.378*** -0.022

Share of manufacturing in GVA 0.038 0.027 0.026 0.042

Share of variable-rate mortgages 0.018*** -0.003 -0.007 0.006

Lending activity -0.094 -0.579 -0.510 -0.650

Demographics controls X X X X X X X X

Vulnerable dummy - - - - - - X -

Country dummies - - - - - - - X

Observations 105 105 105 105 105 105 105 105

R-squared 0.268 0.270 0.172 0.149 0.014 0.322 0.323 0.451

(c) Dependent variable: (1) (2) (3) (4) (5) (6) (7) (8)

Impact of UMP shock

Compensation per employee -1.874** -1.934** -3.792*** -4.051*** -4.741**

Housing wealth 1.010 -1.701 -1.368 -1.316

Homeownership rate 0.014

House price level 1.214

Share of construction in GVA 0.114 -0.090 -0.106 -0.134

Share of manufacturing in GVA 0.060** 0.075*** 0.076*** 0.076**

Share of variable-rate mortgages 0.010** -0.014 -0.001 -0.006

Lending activity 1.032** 3.240*** 3.021** 1.770

Demographics controls X X X X X X X X

Vulnerable dummy - - - - - - X -

Country dummies - - - - - - - X

Observations 105 105 105 105 105 105 105 105

R-squared 0.116 0.115 0.079 0.085 0.076 0.217 0.227 0.251

Notes: The table present regressions of the cumulative monetary policy impact on real GDP at the regional level (as estimated in

section 4) on regional factors (compensation per employee in logs, housing wealth in logs, homeownership rate in percent, the average

house price level in logs, the share of construction and manufacturing in GVA, the share of variable-rate mortgages in percent, and a

proxy for lending activity). Housing wealth is computed as the product of the homeownership rate and the average house price level.

The proxy for lending activity is computed as the product of housing wealth and the LTV ratio. Demographics controls include total

employment and population density at the regional level. The Vulnerable dummy is a binary variable that takes value one for regions

of Italy, Spain, Portugal and Ireland, and zero for regions of Germany, France, the Netherlands and Belgium. A constant is included.

An outlier is excluded. *** p <0.01, ** p<0.05, * p<0.1

ECB Working Paper Series No 2752 / November 2022

28

Overall, as the coefficient on compensation per employee remains significant across all

specifications, our findings point to the effectiveness of monetary policy in reducing regional

inequality by stimulating economic activity more in regions with lower labour income. Together

with the absence of a clear predominance of one of the two determinants of housing wealth

(diffusion of owner-occupying housing and home valuations), this suggests that monetary policy

easing has an overall beneficial impact on cross-regional inequality.

Our results add to a growing literature on monetary policy and inequality. Most contribu-

tions examine the issue at the household or individual level. Some studies find that expansionary

monetary policy can mitigate income inequality as lower-income households disproportionately

benefit from positive effects via the stimulus to economic activity and employment, which out-

weigh those via financial markets (for the US, see Coibion et al., 2017; for the euro area, see

Casiraghi et al., 2018, Lenza and Slacalek, 2021 and Altavilla et al., 2021). This stands in con-

trast to Amberg et al. (2021), who show that the income response to monetary policy in Sweden

is U-shaped, and to Andersen et al. (2020), who find that monetary easing in Denmark raises

income shares at the top of the income distribution while reducing them at the bottom, hence

leading to higher income inequality. The impact of monetary policy on wealth inequality is also

a subject of debate. Lenza and Slacalek (2021) state that monetary policy has only a negligible

impact on wealth inequality. A U-shaped response of wealth inequality is found by Casiraghi

et al. (2018), while according to Andersen et al. (2020) monetary easing is more beneficial to the

net wealth of higher income households, thereby increasing wealth inequality.

Little attention has been given to the geographical dimension of inequality and how it

is affected by monetary policy. An outstanding exception is the work by Hauptmeier, Holm-

Hadulla and Nikalexi (2020), who focus on the heterogeneity of the impact of monetary policy

across euro area regions. The authors find that monetary easing shocks have a significantly more

pronounced and persistent effect on output in poorer than in richer regions, implying a mitigation

of regional inequality. Besides confirming this result, our study differentiates between income

sources, i.e. housing wealth and labour income. Focusing on the US, Beraja et al. (2019) examine

the transmission of monetary policy via mortgage markets at the regional level. In contrast to

previous recessions, they find that, during the Global Financial Crisis, depressed regions reacted

less to interest rate cuts, thus increasing regional consumption inequality.

ECB Working Paper Series No 2752 / November 2022

29

6 Robustness Checks

6.1 Additional common components

To check the robustness of our findings, we first extend the set of exogenous variables in our

baseline VAR model. As shown, for example, by Vansteenkiste and Hiebert (2011) and Campos,

Fidrmuc and Korhonen (2019), there are significant interlinkages among regional housing markets

and business cycles in the euro area. Hence, the set of exogenous variables, which in the baseline

model only includes the monetary policy shocks, is expanded to include the euro area GDP,

employment and house prices. Following Chudik and Pesaran (2015), these euro area variables

are calculated as cross-sectional means of all the regions within our dataset, namely Y

∗

t

=

N

−1

P

N

i=1

Y

i,t

, where Y

i,t

denotes the vector of endogenous variables in our SPVAR model defined

in Equation (3). Insofar as these variables are endogenous to monetary policy changes, they

incorporate to some extent our monetary policy shock. To avoid double-counting, we first regress

the cross-sectional averages of GDP, employment and house prices on total monetary policy

shocks. Formally, we posit the following linear relation between common components and total

monetary policy shock:

27

Y

∗

t

= Ω

0

+ Ω

1

T M P

t

+ ω

t

(9)

where ω

t

∼ N(0, σ

ω

). The non-monetary policy common components are then extracted by

subtracting the product of the estimated coefficient

ˆ

Ω

1

and the total monetary policy shock

from the cross-sectional averages, namely

˜

Y

∗

t

= Y

∗

t

−

ˆ

Ω

1

T M P

t

. Finally, we introduce these

non-monetary policy common components as additional exogenous regressors in the SPVAR by

augmenting the vector X

t

= [MP

t

,

˜

Y

∗

t−d

] where MP

t

denotes T M P

t

or [CM P

t

, UM P

t

].

28

When including these additional exogenous variables, the results of the baseline SPVAR

model estimation are broadly confirmed (Figure B.2 in Appendix B). An accommodative mone-

tary policy shock has a positive impact on GDP and employment. The impact on house prices

is initially negative, albeit insignificant, and fades to zero subsequently. Unlike in the baseline,

27

We do not perform this regression on conventional and unconventional monetary policy shocks, since their

combined information corresponds to the one contained in the total monetary policy shock.

28

For the purpose of our analysis, we assume a delay parameter d = 1, aligning the timing of non-monetary policy