Disclaimer: This communication material was prepared as a service to the public

and is not intended to grant rights or impose obligations. It may contain

references or links to statutes, regulations, or other policy materials. The

information provided is only intended to be a general summary. It is not intended

to take the place of either the written law or regulations. We encourage readers

to review the specific statutes, regulations, and other interpretive materials for

a full and accurate statement of its contents. This document is published,

produced, and disseminated at U.S. taxpayer expense.

Medicare Shared Savings Program

ACO BANKING FORM

Instructions

March 2024

Version 9

Medicare Shared Savings Program | ACO Banking Form Instructions

ii

Revision History—Version 9

Title of Section & Revisions/Changes Description

(since last version)

Link to

Affected Area

Background Background

Requirements: Updated language Section 2.2

Completing and Submitting Form CMS-588: Updated language Section 2.1

Appendix A, Form CMS-588 Checklist Appendix A

Appendix B, Sample Form CMS-588 Cover Sheet: Removed

language

Appendix B

Appendix C, Sample Form CMS-588: Updated Language Appendix C

Appendix D, Samples Financial Institution Letter and Voided

Pre-printed Check: Updated Language

Appendix D

Appendix E, Sample Chain Home Office Letter: Added new sample Appendix E

Medicare Shared Savings Program | ACO Banking Form Instructions

iii

Table of Contents

1 Background .................................................................................................................. 1

2 Requirements ............................................................................................................... 1

2.1 Completing And Submitting Form CMS-588 ....................................................... 2

2.2 Form CMS-588 Updates ..................................................................................... 6

3 Form CMS-588 Review Process ................................................................................... 6

Appendix A: Form CMS-588 Checklist ................................................................................. 8

Form CMS-588 Cover Sheet ........................................................................................ 8

EFT (Form CMS-588) ................................................................................................... 8

Appendix B: Sample Form CMS-588 Cover Sheet ............................................................. 10

Form CMS-588 Request Type (Select Only One Request Type) ................................ 10

Appendix C: Sample Form CMS-588 ................................................................................. 11

Appendix D: Sample Financial Institution Letter and Voided Pre-Printed Check ................ 15

Appendix E: Sample Chain Home Office (CHO) Letter ...................................................... 17

Medicare Shared Savings Program | ACO Banking Form Instructions

1

1 Background

Each Medicare Shared Savings Program (Shared Savings Program) Accountable Care

Organization (ACO) must have an active bank account and must submit a completed Electronic

Funds Transfer (EFT) Authorization Agreement (Form CMS-588) to the Centers for Medicare &

Medicaid Services (CMS) per 42 CFR 424.510(d)(2)(iv). CMS uses the banking information,

business address, and taxpayer identification number (TIN) provided on this form to establish

vendor accounts for ACOs in the Healthcare Integrated General Ledger Accounting System

(HIGLAS). HIGLAS is a payment system that works with the U.S. Department of the Treasury

and deposits funds through EFTs to ACO vendor accounts. CMS deposits any shared savings

payments, if earned, and advance investment payments (AIP), if applicable, to the banking

account designated on Form CMS-588.

You must submit Form CMS-588, the accompanying Form CMS-588 cover sheet, and the

required supporting financial documentation to participate in the Shared Savings Program, even

if you already receive EFT payments from Medicare. Payments for the Shared Savings Program

are made through a different payment system than that used for other Medicare payments and

have no effect on EFTs set up for other Medicare payments.

2 Requirements

Each Shared Savings Program ACO must have an active bank account and submit

Form CMS-588, regardless of the ACO’s track.

1. Prior to completing Form CMS-588, an ACO must establish a bank account using either

the ACO’s legal business name (LBN) or legal entity name (LEN) and the TIN the ACO

established with the Internal Revenue Service (IRS) and used to establish the ACO with

the Shared Savings Program. The ACO must have an active bank account that CMS has

successfully validated to receive any advance investment payments and earned shared

savings payments. CMS validates the banking information before it makes EFT deposits

into the bank account listed on Form CMS-588. In addition, for ACOs that receive shared

savings payments or advance investment payments, CMS sends an IRS Form 1099 to the

address provided on Form CMS-588.

2. Form CMS-588 is required for all ACOs participating in the Shared Savings Program.

Additionally, ACOs must submit the Form CMS-588 cover sheet with the Form CMS-588

as well as supporting financial documentation (e.g., a voided, pre-printed check or a bank

letterhead from the financial institution) that validates the bank account included on the

form. CMS considers submissions that do not include all three required documents (Form

CMS-588, a Form CMS-588 cover sheet, and supporting financial documentation) to be

incomplete; these submissions will not be processed.

3. An ACO must update its banking information on file with CMS whenever any ACO

information submitted on Form CMS-588 changes (refer to Section 2.2). An update to the

Form CMS-588 is not required if the financial institution’s physical address has changed.

Medicare Shared Savings Program | ACO Banking Form Instructions

2

2.1 Completing And Submitting Form CMS-588

ACOs must complete and submit their Form CMS-588 as described below. The ACO’s

LBN/LEN and ACO TIN on Form CMS-588 must match the ACO’s information in the ACO

Management System (ACO-MS). For example, please be certain to include business

credentials, such as “LLC” or “Incorporated,” when completing the form, if applicable. Please

make certain all required information is provided on Form CMS-588. CMS does not accept

incomplete forms.

Step 1: Download Form CMS-588

Step 2: Download Form CMS-588 Cover Sheet

Step 3: Complete or Check the Following Entries:

Part I: Reason for Submission

• Initial applicants:

o On the Form CMS-588, check “New EFT Enrollment” and check “Individual” or “Group.”

o On the Form CMS-588 cover sheet, check “New EFT Enrollment.”

The verified bank account for CMS to pay shared savings is the same account for ACOs

eligible for AIP, if applicable. An ACO eligible for AIP must certify that all advance

investment payments are segregated from all other revenues by establishing and

maintaining a separate account into which all advance investment payments will be

deposited immediately and from which all disbursements of such funds are made only for

allowable uses.

Note, an ACO may need to notify the bank that maintains the account identified on its

Form CMS-588 of a pending deposit expected in January of its first performance year.

AIP ACOs should ensure that all accounts (including the account listed on the Form

CMS-588 and designated AIP account) are active and up-to-date in order to receive the

first and subsequent advance investment payment.

Complete information for ACOs eligible to receive advance investment payments can be

found in the Advance Investment Payments Guidance document.

TIP FOR SUCCESS: AIP ACOs

FOR RENEWAL APPLICANTS ONLY: The ACO is not required to submit a new Form CMS-588

package if the ACO legal entity name, ACO TIN, address, financial institution information, contact

person, or authorized/delegated official has not changed.

TIP FOR SUCCESS

Medicare Shared Savings Program | ACO Banking Form Instructions

3

• Currently participating ACOs and renewal applicants:

o On the Form CMS-588, check “Change to Current EFT Enrollment.”

o On the Form CMS-588 cover sheet, check “Change to Current EFT Enrollment.”

• Chain Home Organization (CHO): CMS will accept a Form CMS-588 listed under an ACO

participant’s TIN or parent/chain organization’s name.

o A Chain Home Office (CHO) is an entity that provides centralized management and

administrative services to the providers or suppliers under common ownership and

common control, such as centralized accounting, purchasing, personnel services,

management direction and control, and other similar services. If an ACO authorizes EFT

payments to the CHO of which the ACO is a member, a letter authorizing the contractor

to make payments to the provider of service maintained by the CHO must be submitted

with the other required documents. The letter must be signed by an authorized official of

the provider of service and an authorized official of the CHO.

o On the Form CMS-588, chec

k “If payment is being made to CHO.”

Note: Authorization Letter must be attached. See Appendix E for example of CHO.

Part II: Account Holder Information

• Provide entries for all items. All account holder information must match ACO-MS.

o ACO LBN/LEN name

The LBN/LEN must be the name provided on the IRS CP-575 form.

o ACO address

Note: Do not include PO Boxes.

o City

o State

o Zip code

o ACO TIN (nine digits only) as reported to the IRS

o Designate TIN type:

Social Security Number (SSN): Enrolling as an individual.

Federal Employer Identification Number (EIN): Enrolling as a group/organization

corporation.

o Note: A provider/supplier may only have one EFT account per enrollment.

National Provider Identifier (NPI) is not required if an ACO is not Medicare-enrolled.

Please note that the ACO TIN is not required to be Medicare-enrolled. However, if

the ACO TIN is Medicare-enrolled, enter the MIN assigned by a Medicare

Administrative Contractor (MAC). If more than one Medicare MIN is attached to the

NPI, include the MINs on the Form CMS-588.

Medicare Shared Savings Program | ACO Banking Form Instructions

4

Part III: Financial Institution Information

• Provide entries for all items:

o All fields in this section are required except the financial institution’s contact person field.

While this field is optional, CMS recommends including a point of contact at the financial

institution that CMS can contact in the event of issues with payments.

Note: Do not include PO Boxes.

• Provide supporting financial documentation that confirms the bank account information

provided on Form CMS-588.

o The supporting financial documentation can be either a voided, pre-printed check or a

bank letterhead from the financial institution. Form CMS-588 cannot be processed

without the supporting

financial documentation, so make sure to include it whenever

you submit Form CMS-588 to CMS. The ACO’s LBN/LEN on the supporting financial

documentation must match ACO-MS and Form CMS-588.

Note: The account name to which the EFT payments will be paid is to the name

submitted on Part II of the Form CMS-588.

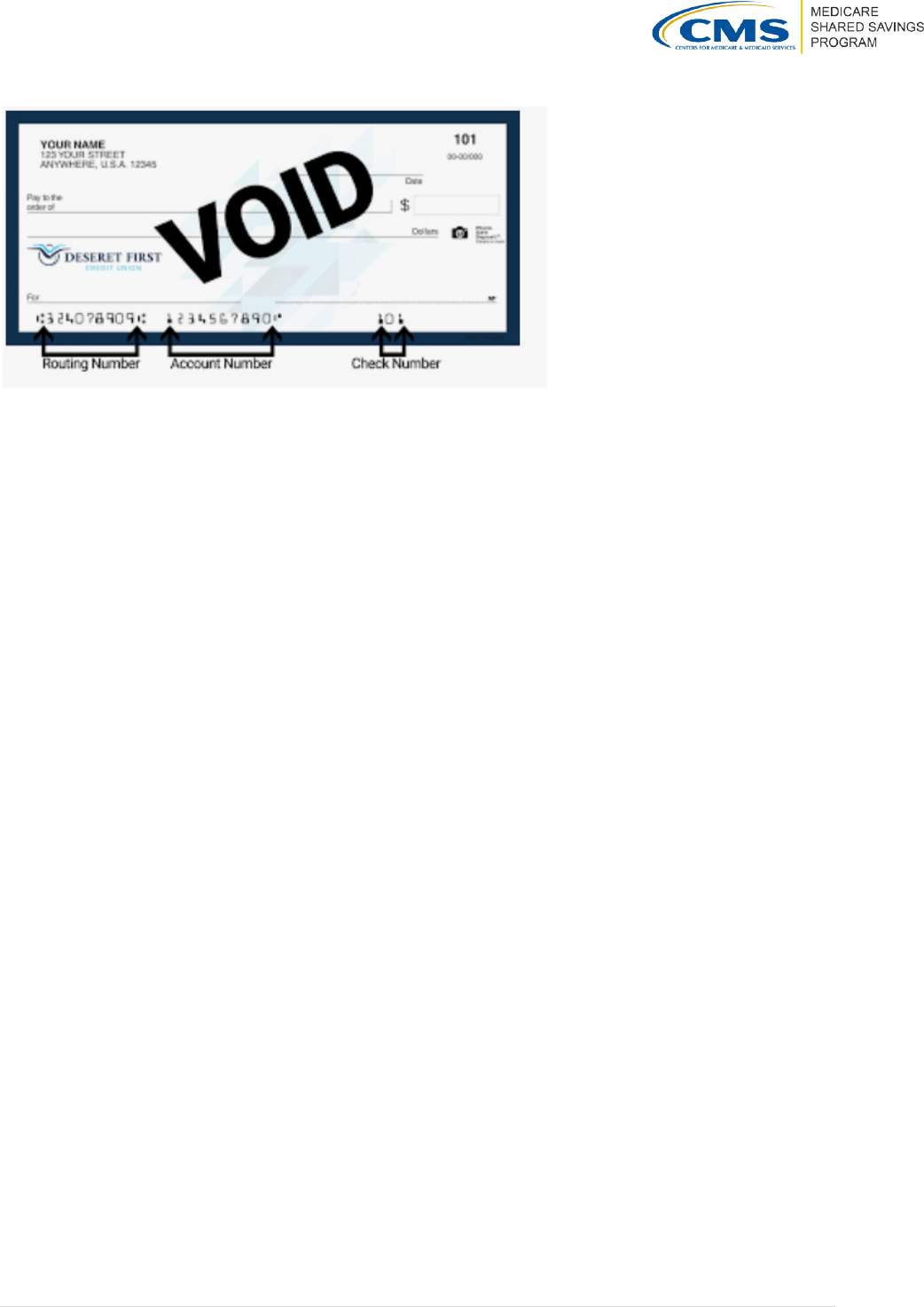

o If you are submitting a voided, pre-printed check, please note that CMS does not accept

starter checks. The ACO’s LBN/LEN must be printed on the check and must match

ACO-MS. When submitting the pre-printed check, the following must be included:

LBN/LEN on the account

Electronic Routing Number

Account Number and type (checking or savings)

The word “VOID”

o If you are submitting a bank letterhead from your financial institution, it must include the

following information and be consistent with the entries on Form CMS-588:

ACO LBN/LEN as the account holder

ACO TIN (nine digits only)

Bank official’s name and signature

Bank account number

Electronic routing transit number

Note: Supporting financial bank documents must be in the name of the ACO’s legal business/

entity, home office, or chain organization of which the ACO is a member.

Medicare Shared Savings Program | ACO Banking Form Instructions

5

Part IV: Contact Person

Enter the name of a contact

person who can discuss the form

if CMS has questions.

Part V: Authorization

Form CMS-588 must be signed by a person with the authority

to legally bind the ACO. Only one authorized person can sign the form. CMS encourages you to

have one of the following ACO-MS

authorized contacts sign the form:

• ACO Executive

• Financial Contact

• Authorized to Sign (primary or secondary)

An ACO must submit Form CMS-588

documentation in the form of a scanned PDF that is

manually signed or by way of a digital signature. The signature line must contain the

authorized/delegated official’s name, title, phone number, and email address.

Top Right Corner of Form CMS-588 and Each Page of Supporting

Documentation

The CMS Office of Financial Management (OFM) processes the Form CMS-588 and makes

payments to ACOs that earn shared savings payments and ACOs that are eligible to receive

AIP. To assist OFM with the processing of Form CMS-588, please indicate the ACO’s ACO ID

number (Axxxx) and the ACO’s tax status (Profit – “P” or Non-Profit – “NP”) in the blank area on

the top right corner of the first page of Form CMS-588. CMS provided the ACO with an ACO ID

(Axxxx) during the application process.

Step 4: Fill out the Form CMS-588 Cover Sheet

The Form CMS-588 cover sheet must be included with the ACO’s Form CMS-588.

Note: If the ACO does not submit a Form CMS-588 cover sheet with its submission, your

documents will receive a request for information (RFI) from CMS. Complete information for

ACOs who receive an RFI can be found in the Application Reference Manual.

If the ACO is an Initial Applicant, select “New EFT Enrollment.”

Complete the “Reason for Change to Existing Form CMS-588” section only if you are changing

an existing Form CMS-588 that CMS has on file. This field is relevant to Early Renewal,

Renewal, and Currently Participating ACOs.

Note: If the ACO selects CHO, the ACO must also select if they are an Initial Applicant or are

making changes to an existing Form CMS-588.

Step 5: Upload the Form CMS-588, Cover Sheet, and supporting financial

documentation to ACO-MS

Initial and Renewal applicants will submit their documents via Initial and Renewal task during

the application cycle. Currently participating ACOs submit via the Documents tab in ACO-MS.

CMS recommends the contact person

be identified as an ACO contact in

ACO-MS.

TIP FOR SUCCESS

Medicare Shared Savings Program | ACO Banking Form Instructions

6

2.2 Form CMS-588 Updates

If a currently participating ACO needs to update its existing Form CMS-588, it must complete

and upload a new Form CMS-588 as well as provide a Form CMS-588 cover sheet and

supporting financial documentation to ACO-MS.

All changes must appear in ACO-MS before the ACO can revise its Form CMS-588. If an ACO

requests a change to its ACO LBN/LEN and/or ACO TIN, CMS must notify the ACO once the

change is effective and provide instructions on how and when to update the

banking form.

Complete the following steps to update your Form CMS-588:

• Under “Part I: Reason for Submission,” check “Change to Current EFT Enrollment.”

• Complete the entries on the form and provide the supporting documentation following the

instructions in Section 2.1

of this document.

• On the Form CMS-588 cover sheet check “Change to Current EFT Enrollment.”

• Submit the Form CMS-588, the Form CMS-588 cover sheet, and the supporting financial

documentation by uploading to the Documents tab under the Form CMS- 588 field

within ACO-MS

.

3 Form CMS-588 Review Process

During the application or change request cycle,

an ACO must electronically upload the Form

CMS-588, the Form CMS-588 cover sheet, and

supporting financial documentation to start the

review process in ACO-MS. CMS reviews the

documentation to confirm that it matches the

information on file in ACO-MS. For example,

CMS ensures that the ACO LBN/LEN and ACO

TIN submitted on Form CMS-588 are the same as those in ACO-MS. CMS will identify

mismatched information or any discrepancies during the review process and contact you for

corrections. The ACO must correct any mismatched information and address any discrepancies.

CMS processes Form CMS-588 only after all discrepancies are resolved.

Prior to making any payments, CMS conducts a prenote authorization on the ACO accounts. A

prenote is a test transaction a banking institution uses to ensure that an account is open and

that the provided account number information is valid before setting up an automated clearing

house (ACH) transfer. CMS will contact you if the prenote fails to validate your account.

Form CMS-588 contains extra spaces in fields for responses such as TIN, account number, and/or routing

number. Remember to write out the appropriate nine-digit TIN, account number, and/or routing number,

excluding hyphens. Leave any unnecessary additional spaces blank.

TIP FOR SUCCESS

ACOs unsure if their banking information

with CMS is correct should validate their

banking information prior to the release of

the performance year financial

reconciliation results.

TIP FOR SUCCESS

Medicare Shared Savings Program | ACO Banking Form Instructions

7

There are several reasons for a prenote failure, including:

1. A discrepancy with an ACO LBN/LEN and/or ACO TIN

2. Inaccurate account information

3. A closed account

Please note that financial institutions may require a deposit to the bank account to maintain

active account status. CMS encourages ACOs to communicate with financial institutions to

ensure the bank account utilized within the Form CMS-588 remains active.

Note: CMS strongly recommends that if an ACO terminates its participation agreement, it

maintains at least one authorized signature contact to keep active within ACO-MS after

termination. This is important for any future financial reconciliation of an earned shared

savings payments.

Medicare Shared Savings Program | ACO Banking Form Instructions

8

Appendix A: Form CMS-588 Checklist

Form CMS-588 Cover Sheet

The ACO downloaded the correct Form CMS-588 cover sheet.

The ACO understands that if the Form CMS-588 cover sheet is not included with the package (Form

CMS-588, Form CMS-588 cover sheet, and supporting financial documentation), CMS will issue an RFI.

Request Type for the ACO meet the following requirements (only select one):

New EFT Enrollment (Initial ACOs only)

Change to Current EFT Enrollment (Early Renewal, Renewal, or Currently Participating ACOs if

there is a change to ACO LEN, TIN, address, financial institution information, contact person, or

authorized/delegated official).

If the ACO uses the CHO, the Authorization Letter is attached and the letter is signed by an

authorized official of the provider of service AND an authorized official of the CHO.

The LBN/LEN information for the ACO meets the following requirements:

Identification Number (A+4 digits)

ACO LBN/LEN matches legal documentation and ACO-MS.

ACO TIN is correct.

ACO Address matches ACO-MS.

ACO Tax Status (For-Profit or Nonprofit) matches ACO-MS.

The ACO has uploaded Form CMS-588 into ACO-MS.

EFT (Form CMS-588)

The ACO downloaded the most recent Form CMS-588.

The ACO selected only one reason for submission:

New EFT Enrollment

• Note: Select only one “Individual” or “Group”

Change to Current EFT Enrollment

EFT payment is being made to the CHO

• Note: A letter authorizing EFT payment must be attached

LBN/LEN matches ACO-MS.

If using the CHO Name—or Home Office LBN/LEN, my authorized letter is attached with signatures

from the authorized official AND an authorized official of the CHO.

CHO telephone number

Address (P.O. Boxes are not acceptable)

City

State

Medicare Shared Savings Program | ACO Banking Form Instructions

9

ZIP code

TIN

SSN (enrolling as an individual) or EIN (enrolling as a group/organization/corporation)

The ACO’s Financial Institution information is correct:

Name

Address (P.O. Boxes are not acceptable)

City

State

ZIP code

Routing number

Account number

Selected the correct type of bank account (checking or savings) and understands that CMS will not

accept starter checks.

Designated a contact person if CMS has any questions related to my documents submitted.

The ACO understands that the Form CMS-588 can only be signed and dated by the authorized

individuals (executive, financial contact, primary/secondary).

The ACO Form CMS-588 is signed manually or by way of digital signature.

(Select all revisions that apply)

☐

Name ☐ Contact P

erson

☐ TIN ☐ Authorization – Signature

☐ Financial Institution ☐ Other Information

UPLOAD BANKING INFORMATION TO ACO-MS

Initial and Renewal Applicants submit their documents via the Initial and Renewal task during the application

cycle. Currently participating ACOs submit via the Documents tab in ACO-MS.

MATERIALS

• Signed Form CMS-588

• Form CMS-588 cover sheet

• Supporting financial documentation in the form of a bank letterhead or

voided, pre-printed check

Medicare Shared Savings Program | ACO Banking Form Instructions

10

Appendix B: Sample Form CMS-588 Cover Sheet

Form CMS-588 Request Type (Select Only One Request

Type)

☒ New EFT

Enrollment

☐ Change to Current

EFT Enrollment

☐ EFT payment is being made to the

Chain Home Office (CHO) (Attach letter

authorizing EFT payment to CHO).

ACO LEGAL BUSINESS/ENTITY INFORMATION

ACO ID # (A+4 digits): A1234

ACO Legal Business/Entity Name:

5 Star ACO, LLC

ACO Taxpayer Identification Number (TIN): 123456789

ACO Tax Status: ☐

For-profit ☒ Nonprofit

REASON FOR CHANGE TO CURRENT FORM CMS-588

Complete only if you are revising an existing Form CMS-588.

(Select all revisions that apply)

☐ Name ☐ Contact Person

☐ TIN ☐ Authorization - Signature

☐ Financial Institution ☐ Other Information

UPLOAD BANKING INFORMATION TO ACO-MS

Initial and Renewal Applicants submit their documents via the Initial and Renewal task during

the application cycle. Currently participating ACOs submit via the Documents tab in (ACO-MS).

MATERIALS

• Signed Form CMS-588

• Form CMS-588 cover sheet

• Supporting financial documentation in the form of a bank letterhead or

voided, pre-printed check

Medicare Shared Savings Program | ACO Banking Form Instructions

11

Appendix C: Sample Form CMS-588

Medicare Shared Savings Program | ACO Banking Form Instructions

12

Medicare Shared Savings Program | ACO Banking Form Instructions

13

Medicare Shared Savings Program | ACO Banking Form Instructions

14

Medicare Shared Savings Program | ACO Banking Form Instructions

15

Appendix D: Sample Financial Institution Letter and

Voided Pre-Printed Check

December 17, 2024

5 STAR ACO, LLC

800 Your Street

Anytown, NJ 00000

Ref: Bank Confirmation Letter

To Whom It May Concern:

5 STAR ACO, LLC is a customer of YourBanker Institution. We are verifying the Account Name,

Account Number, SWIFT BIC and Domestic ABA Routing and Transit Number of the following

account:

Account Name: 5 STAR ACO, LLC

Bank Account Number: 1000000000001

Domestic ABA Routing: 000000000

ACO Tax Identification Number: (123456789)

Institution Name: Your Banker Institution

Institution Address: 111 Bank Lane Moneyville, NY 00000

Please call me if you have any questions. Thank you for your business and the opportunity to

serve you.

Sincerely,

Your Banker’s signature

Your Banker’s Name

Banker’s Phone Number (222) 222-2222

Yourbanker@ localbank.com

Client Service Sr. Associate

Your Bank

111 Bank Lane

Moneyville, NY 00000

Medicare Shared Savings Program | ACO Banking Form Instructions

16

Medicare Shared Savings Program | ACO Banking Form Instructions

17

Appendix E: Sample Chain Home Office (CHO) Letter

December 17, 2024

5 STAR ACO, LLC (LEN must match ACO-MS)

800 Your Street

Anytown, NJ 00000

Ref: Chain Home Office Letter

To Whom It May Concern:

This letter authorizes the Centers for Medicare & Medicaid Services (CMS) to make payment

due the provider of service to the account maintained by the Chain Home Office (CHO) 8

LAKERS WAY, LLC as identified on the Form CMS-588.

ACO Legal Business/Entity Name (LBN/LEN): 5 STAR ACO, LLC

ACO ID: A0824

ACO Tax Identification Number (TIN): (123456789)

Chain Home Office (CHO) Organization Name: 8 LAKERS WAY, LLC

CHO Tax Identification Number (TIN): (987654321)

If you have any questions, please reach out to “authorized official”.

Sincerely,

Printed Name of the Authorized Official of 5 STAR ACO, LLC (LEN)

Signature and Date of the Authorized Official of 5 STAR ACO, LLC

Printed Name of the Authorized Official of 8 LAKERS WAY, LLC

Signature and Date of 8 LAKERS WAY, LLC