Andrea Hölzlwimmer

Optimizing Value Flows with SAP

®

ERP

Bonn

�

Boston

298 Book_TIGHT.indb 3 12/4/09 3:47:29 PM

Contents at a Glance

1 Introduction ................................................................ 17

2 The Concept of Integrated Value Flows ...................... 25

3 Basic Principles of Integration in SAP ERP ................. 41

4 Procurement Process ................................................... 85

5 Sales and Distribution Process ................................... 159

6 Production Process ..................................................... 221

7 Closing and Reporting in SAP ERP .............................. 299

8 Reporting with SAP NetWeaver BW .......................... 353

9 Optimizing Value Flows by Implementing the

SAP General Ledger — A Real-Life Example ............... 379

A Sample Closing Procedure Document ......................... 401

B Transactions and Menu Paths ..................................... 407

C The Authors ................................................................. 425

298 Book_TIGHT.indb 5 12/4/09 3:47:29 PM

7

Contents

Acknowledgments ....................................................................... 13

Foreword ..................................................................................... 15

1 Introduction ................................................................. 17

1.1 Content and Structure ................................................... 18

1.2 Lederwaren-Manufaktur Mannheim .............................. 20

2 The Concept of Integrated Value Flows ...................... 25

2.1 Explanation of the Term “Integrated Value Flow” .......... 25

2.1.1 Value Flow ....................................................... 26

2.1.2 Integration ....................................................... 28

2.2 Models for Representing Enterprise Processes ............... 30

2.2.1 Porter’s Value Chain Model .............................. 30

2.2.2 SCOR Model .................................................... 31

2.3 Extending the SCOR Model .......................................... 36

2.4 Interaction Between Process Design and

Controlling Approach .................................................... 37

2.5 Summary ...................................................................... 39

3 Basic Principles of Integration in SAP ERP ................. 41

3.1 Structure of SAP Systems .............................................. 42

3.2 Entity Model ................................................................. 43

3.2.1 Organizational Elements in the SAP System ...... 44

3.2.2 Organizational Elements and Enhancements

of the Standard SAP System ............................. 51

3.2.3 Excursus: The SAP General Ledger and

Changes to the Organizational Structure ........... 52

3.3 International Requirements ........................................... 53

3.3.1 Parallel Accounting using the Classic

General Ledger ................................................. 54

3.3.2 Options of the SAP General Ledger for the

Parallel Rendering of Accounts ......................... 56

298 Book_TIGHT.indb 7 12/4/09 3:47:29 PM

8

Contents

3.4 Value Flow-Oriented Master Data Concept ................... 58

3.4.1 General Ledger Account and Cost Element ....... 59

3.4.2 Chart of Accounts ............................................. 63

3.4.3 Material Master ................................................ 65

3.4.4 Requirements Class .......................................... 71

3.5 CO-PA as a Central Reporting Tool ................................ 73

3.5.1 Forms of CO-PA ............................................... 74

3.5.2 Structure of Costing-Based CO-PA .................... 75

3.6 Summary ...................................................................... 83

4 Procurement Process ................................................... 85

4.1 Procurement Process in the SCOR Model ...................... 86

4.2 Vendor Master as an Integrative Element ...................... 89

4.3 Purchase Order as the Basis of the

Procurement Process .................................................... 92

4.3.1 Purchase Requisition ........................................ 92

4.3.2 Purchase Order ................................................ 92

4.4 Updating Commitments ................................................ 98

4.5 Integration of MM and Financial

Accounting/Controlling ................................................. 104

4.5.1 Basic Settings ................................................... 105

4.5.2 Valuation Class Settings .................................... 109

4.5.3 Determining Transactions ................................. 114

4.5.4 Rebuild Process for Account Determination ...... 123

4.6 Goods Receipt .............................................................. 128

4.7 Invoice Verication ....................................................... 130

4.7.1 Invoice Verication Process .............................. 131

4.7.2 Considering Tolerances ..................................... 138

4.7.3 Automatically Releasing Blocked Invoices ......... 141

4.8 GR/IR Account .............................................................. 142

4.8.1 Posting to the GR/IR Account ........................... 142

4.8.2 Clearing the GR/IR Account .............................. 143

4.9 Integration of Accounts Payable Accounting ................. 147

4.9.1 Invoice Receipt Without MM Integration ......... 148

4.9.2 Outgoing Payments .......................................... 149

4.10 Mapping the Tax on Sales/Purchases ............................. 154

4.11 Summary ...................................................................... 157

298 Book_TIGHT.indb 8 12/4/09 3:47:29 PM

9

Contents

5 Sales and Distribution Process .................................... 159

5.1 Sales and Distribution Process in the SCOR Model ........ 160

5.2 Sales Order as the Basis of Further Account

Assignment ................................................................... 162

5.2.1 Prot Center Derivation ................................... 163

5.2.2 Deriving a Segment .......................................... 164

5.3 Price Determination as the Basis of Value

Determination .............................................................. 166

5.3.1 Conditions and Costing Sheet ........................... 166

5.3.2 Price-Determining Elements ............................. 170

5.3.3 Costing-Based Elements ................................... 173

5.3.4 Special Business Transactions ............................ 175

5.4 Goods Issue .................................................................. 178

5.5 Presentation of Receivables .......................................... 182

5.5.1 Customer Account ............................................ 183

5.5.2 Determining the Reconciliation Account .......... 186

5.5.3 Integration of SD and Accounts Receivable ...... 193

5.5.4 Mapping of Secondary Businesses .................... 194

5.5.5 Dunning ........................................................... 195

5.5.6 Incoming Payment ........................................... 196

5.6 Mapping Sales Revenues ............................................... 204

5.6.1 Time of the Revenue Recognition ..................... 204

5.6.2 Presentation of Sales Revenues ......................... 205

5.6.3 Transfer to Overhead Cost Controlling .............. 216

5.6.4 Troubleshooting for Revenue Account

Determination .................................................. 218

5.7 Summary ...................................................................... 219

6 Production Process ...................................................... 221

6.1 Production Process in the SCOR Model ........................ 223

6.2 Basic Product Cost Controlling Data .............................. 225

6.2.1 Logistical Master Data ...................................... 225

6.2.2 Prerequisites in Controlling ............................... 229

6.2.3 Basic Product Cost Controlling Settings ............ 231

6.3 Product Cost Planning ................................................... 241

6.3.1 Types of Product Cost Planning ........................ 241

298 Book_TIGHT.indb 9 12/4/09 3:47:30 PM

10

Contents

6.3.2 Material Cost Estimate with

Quantity Structure ............................................ 244

6.3.3 Simulation and Base Planning Object ............... 251

6.4 Cost Object Controlling ................................................ 257

6.4.1 Cost Object Controlling Functions in SAP ERP ... 257

6.4.2 Period-End Closing ........................................... 262

6.4.3 Period-Related Product Controlling .................. 281

6.4.4 Order-Related Product Controlling ................... 287

6.4.5 Product Cost by Sales Order ............................. 292

6.5 Summary ...................................................................... 297

7 Closing and Reporting in SAP ERP .............................. 299

7.1 Innovations in SAP General Ledger ............................... 300

7.1.1 Activating Different Scenarios ........................... 300

7.1.2 Effect of Real-Time Integration of Controlling

with Financial Accounting ................................ 302

7.2 HR Data Transfer ........................................................... 312

7.3 Inventory ...................................................................... 315

7.4 Activities in Asset Accounting ....................................... 317

7.4.1 Settlement of Assets Under Construction .......... 317

7.4.2 Depreciation Posting Run ................................. 320

7.4.3 Periodic APC Values Posting ............................. 323

7.4.4 Asset Accounting Inventory .............................. 324

7.4.5 Technical Processing ......................................... 324

7.4.6 Creating the Asset History Sheet ....................... 325

7.5 Period Control .............................................................. 326

7.5.1 Period Closing for the Material Master ............. 327

7.5.2 Opening and Closing Posting Periods ............... 327

7.6 Foreign Currency Valuation ........................................... 329

7.7 Reclassication of Receivables and Payables .................. 333

7.8 Value Adjustment to Receivables .................................. 334

7.9 Balance Carryforward .................................................... 335

7.10 Manual Postings ........................................................... 336

7.11 Assessments and Distributions ...................................... 338

7.12 Reconciliation ............................................................... 341

7.12.1 Accounting Reconciliation ................................ 341

7.12.2 Intercompany Reconciliation ............................ 342

298 Book_TIGHT.indb 10 12/4/09 3:47:30 PM

11

Contents

7.12.3 Reconciliation Between Financial Accounting

and Inventory Management ............................. 343

7.12.4 Reconciliation Between Financial Accounting

and Controlling ................................................ 344

7.13 Reporting ..................................................................... 345

7.13.1 Reporting in General Ledger Accounting .......... 345

7.13.2 Reporting in Open Item Accounting ................. 349

7.13.3 Reporting in Controlling ................................... 349

7.14 Summary ...................................................................... 351

8 Reporting with SAP NetWeaver BW ........................... 353

8.1 Basic Principles of Business Intelligence ........................ 353

8.1.1 Business Explorer Suite—Reporting with

SAP NetWeaver BW ......................................... 361

8.1.2 Business Content .............................................. 364

8.2 Data Acquisition Examples ............................................ 369

8.2.1 Financial Reporting .......................................... 369

8.2.2 Protability Analysis ......................................... 373

8.3 Summary and Outlook .................................................. 378

9 Optimizing Value Flows by Implementing the

SAP General Ledger — A Real-Life Example ............... 379

9.1 Project Charter .............................................................. 379

9.1.1 Preliminary Considerations ............................... 380

9.1.2 Actual Project Scope ........................................ 384

9.2 Project Plan .................................................................. 385

9.2.1 Project Plan ...................................................... 387

9.2.2 Test Phases ....................................................... 388

9.3 Redesigning Value Flows ............................................... 391

9.3.1 Concept for Segment Derivation ....................... 391

9.3.2 Value Flows in the Procurement Process ........... 393

9.3.3 Value Flows in the Sales Process ....................... 394

9.3.4 Value Flows in Financial Accounting and

Controlling ....................................................... 396

9.4 Project Review .............................................................. 397

9.5 Summary ...................................................................... 397

298 Book_TIGHT.indb 11 12/4/09 3:47:30 PM

12

Contents

Appendices ........................................................................ 399

A Sample Closing Procedure Document ..................................... 401

B Transactions and Menu Paths ................................................. 407

B.1 Controlling .................................................................... 407

B.1.1 Application ...................................................... 407

B.1.2 Customizing ..................................................... 410

B.2 Financial Accounting ..................................................... 413

B.2.1 Application ...................................................... 413

B.2.2 Customizing ..................................................... 416

B.3 Materials Management ................................................. 419

B.3.1 Application ...................................................... 419

B.3.2 Customizing ..................................................... 419

B.4 Production .................................................................... 421

B.4.1 Application ...................................................... 421

B.4.2 Customizing ..................................................... 422

B.5 Sales and Distribution ................................................... 422

B.5.1 Application ...................................................... 422

B.5.2 Customizing ..................................................... 423

B.6 SAP NetWeaver BW – Customizing in SAP ERP ............. 424

B.7 Miscellaneous ............................................................... 424

C The Authors ........................................................................... 425

Index ............................................................................................. 429

298 Book_TIGHT.indb 12 12/4/09 3:47:30 PM

85

Three critical processes run in an enterprise. This chapter analyz-

es the rst important process, the purchasing process. You should

not underestimate its signicance, because the products you gen-

erate can only be as good as the materials you purchase.

Procurement Process4

The focus of business value added is usually on production, which requires

various input factors such as material and labor. From the logistics perspec-

tive, the procurement process should provide the correct input factors in

the correct quality and quantity at the correct location at the correct time.

Although the tasks of procurement can be summarized in a plain and sim-

ple sentence, it comprises numerous aspects. This chapter discusses the

different aspects of the procurement process as well as the related effects

on the enterprise’s value ows.

First, it describes how the procurement process is integrated with the

operational performance. In this context, the extended SCOR model plays

a signicant role. Afterward, you learn how to statistically update and

trace commitments in cost accounting during the procurement process to

allow for early budget controlling. Additionally, this chapter focuses on

account determination from Materials Management (MM account deter-

mination) because this considerably affects the interface between logistics

and accounting. The descriptions on the goods receipt and invoice receipt

then lay the foundation for discussing “genuine” value ows.

The explanations on mapping and further processing the resulting pay-

ables in accounting conclude the integration with logistics. Usually, the

payables are what are called payables for goods and services (PGS). An out-

look on the closing process rounds off this chapter.

We will now take a look at the steps and different design options in the

procurement process. For this purpose, the adapted SCOR model from

Chapter 2, Section 2.2.2 is used again as an example.

298 Book_TIGHT.indb 85 12/4/09 3:47:53 PM

86

4

Procurement Process

Procurement Process in the SCOR Model4.1

Within the SCOR model the “purchasing” part (source) that comprises the

ordering process and warehouse management is also the part that includes

the procurement process. Depending on the production approach, the

SCOR model differentiates between three basic procurement process types

(see Figure 4.1).

Procurement

Scheduling

Goods Receipt

Goods

Receipt

Quality

Check

Stocked

Goods

Sales-Order-

Related

Production

Engineer-to-

Order

Production

* Not Part of the Original SCOR Model.

Release

of the

Payment

Scheduling

Goods Receipt

Goods

Receipt

Quality

Check

Release

of the

Payment

Vendor

Selection and

Scheduling

Goods

Receipt

Quality

Check

Placement

in Storage

Payment*

Release

of the

Payment

Placement

in Storage

Placement

in Storage

Payment*

Payment*

Procurement Process in the Adapted SCOR ModelFigure4.1

As you can see, we added the payment process to the standard model (see

Figure 2.5 in Chapter 2, Section 2.2.2, SCOR Model). Regarding logistics,

it would be sufcient to consider the process complete after the payment

for the invoice has been released. However, because this book focuses on

the value ow, it is supposed to guide you through the complete ow, that

is, up to paying the vendor invoice.

In addition to this aspect, Figure 4.1 shows that the SCOR model differ-

entiates between three procurement process types, which depend on the

organization of the production:

Procurement for make-to-stock production

Procurement for sales-order-related production

Procurement for projected sales-order-related production

It is apparent that the three process types only differ in the rst module.

For make-to-stock production and sales-order-related production, the pur-

chasing department is responsible for scheduling the goods receipt in the

SCOR model

Process types in

the SCOR model

Vendor selection

298 Book_TIGHT.indb 86 12/4/09 3:47:53 PM

87

Procurement Process in the SCOR Model 4.1

continuous process. For project production, this also includes the task of

selecting the vendor, which also needs to be done for the rst two pro-

cess types. The difference is that selecting the vendor is only necessary

for make-to-stock and sales-order-related production if new or modied

products are used. For continuous replenishment orders, the purchasing

department usually collaborates with known vendors with whom outline

agreements may have been worked out.

For us, it is not relevant if and to which extent the purchasing department

has to select the corresponding vendors for individual ordering processes

because this does not generate value ows. It is also not important what

kind of event has triggered the purchase requisition: reaching a minimum

amount of raw materials in stock, a sales order, or the completion of proj-

ect planning. From the perspective of accounting and cost accounting, this

is not a transaction you can express in values.

However, the process type affects the procedure in cost accounting. This

involves the question of which objects are used to assign the accounts for

purchase orders, goods receipt, and invoice receipt. For more information,

refer to Section 4.3.2, Purchase Order.

You already know that vendor selection is not relevant for the value ow.

You can take adequate measures in cost accounting only if a purchase req-

uisition or a purchase order is being created. You can now account the

open purchase requisitions to possible existing budgets to be able to iden-

tify overruns at an early stage.

In most cases, the goods receipt is the rst event you have to include in the

nancial statement. Here, you must post a receipt in stock or, for goods

that are not subject to inventory management, an expense. From the logis-

tics view, the goods receipt consists of several substeps. After you have

received the goods, you have to check the quality of the procured goods

or repack them until they can be stored. From the accounting and cost

accounting view, only the process of entering the stock in the system is rel-

evant because it results in Financial Accounting and Controlling postings.

In an SAP system, you usually do not post the goods receipt to payables

but to the goods receipt/invoice receipt account (GR/IR account). Received

invoices are also posted to this account. This means that it serves as a buf-

fer between the two processes (goods receipt and invoice receipt) and

consequently enables you to separate the ow of goods from the value

ow. This also provides additional benets, which are discussed in detail

in Section 4.8, GR/IR Account. It is not until the vendor invoice is received

Reducing budgets

for purchase orders

Goods receipt

Invoice receipt

298 Book_TIGHT.indb 87 12/4/09 3:47:53 PM

88

4

Procurement Process

and posted that the open item is created in accounts payable accounting.

Depending on the specic case, you must additionally post currency dif-

ferences or other deviations.

The open item is usually cleared within a payment run. From the account-

ing perspective, this is the last operation of the value ow in the procure-

ment process.

The different stages of the procurement process may lead to values in

Financial Accounting and Controlling. Figure 4.2 provides an overview of

the possible documents.

MM

FI

Goods Receipt Doc.

–Stock Posting

Invoice

–Payable

–Tax

–Expense/Stock

CO

CO-OM Document

– Update

Commitment

CO-OM Document *

–Material Costs

Ordering Process Goods Receipt Invoice Receipt Outgoing Payment

CO-OM Document *

–Material Costs

Outgoing Payment

–Cash Disbursement

–Clearing of the

Payables

CO-OM Document *

–Cash Discount

–Expense

Reduction

Goods Receipt Doc.

–Stock Posting

–Stock Change

* Optional

Invoice Receipt

in MM

Value Flow of the Procurement ProcessFigure4.2

The updates of commitments within the ordering process takes on a spe-

cial role in Figure 4.2. Here, in contrast to all other processes, only statistic

values and no actual values are updated.

Before discussing the details of the procurement process, we will take a

look at the involved master data. First, there is the material master. Because

it is not only critical in procurement but also in production and sales and

distribution, it was already described in Chapter 3, Section 3.4.3, Material

Master. The use of the vendor master, which is detailed in the following

section, is usually restricted to the procurement process. It is indispensable

for both logistics and accounting.

Outgoing

payments

Creation of values

298 Book_TIGHT.indb 88 12/4/09 3:47:54 PM

89

Vendor Master as an Integrative Element 4.2

Vendor Master as an Integrative Element4.2

To meet the different requirements of the purchasing department and

accounts payable accounting, the SAP system splits up the vendor master

into three parts:

General part

Accounting view

Purchasing data

For every vendor for which the system should map business relationships,

at least the general part must be created. This part stores all information

that is relevant and clear for both the purchasing department and account-

ing. Here, you can nd the vendor number, the name and address of the

vendor, the corresponding tax information as well as all bank details. The

benet is that you have to maintain the bank details only once, even if the

vendor exists in several company codes.

In the accounting view, you maintain all data based on the company code.

The example of the reconciliation account clearly illustrates the benet of

this procedure.

The reconciliation account is the link between accounts payable account-

ing and general ledger accounting. In general ledger accounting, it maps

the payables. As soon as a posting is made for a vendor, the posting is also

implemented on the reconciliation account in general ledger accounting

(see Figure 4.3).

In the example, an invoice of EUR 1,190.00 shipment costs (gross) from

vendor 90100 is received. To generate a posting to the vendor account, a

reconciliation account must to be dened in the vendor master to ensure

integration with the general ledger. In this case, account 160000 is speci-

ed in the vendor master. If you now specify the vendor number when

entering the incoming invoice, the system generates a posting item of

EUR 1,190.00 on the vendor account and on reconciliation account 160000.

For an offsetting account assignment to the input tax account and freight

account, the document in the general ledger balances to zero. In accounts

payable accounting, only the open item for vendor 90100 in the amount

of EUR 1,190.00 is shown.

General part

Accounting view

“Reconciliation

account” example

298 Book_TIGHT.indb 89 12/4/09 3:47:54 PM

90

4

Procurement Process

Accounts Payable Accounting

General Ledger Accounting

Customer: 90100

Reconciliation

Account: 160000

Invoice Receipt: EUR 1,190.00 for Delivery Costs

160000 PGS 154000 Input Tax

Vendor 90100

231100 Freights

EUR 1,190.00

EUR 1,190.00

EUR 1,000.00EUR 190.00

Posting Techniques for Reconciliation AccountsFigure4.3

A typical structuring for the mapping of payables in general ledger account-

ing is the following:

Payables for goods and services, third-parties, domestic

Payables for goods and services, third-parties, foreign

Payables for goods and services, afliated enterprises, domestic

Payables for goods and services, afliated enterprises, foreign

Mapping Payables in the Reconciliation Account of Lederwaren-

Manufaktur Mannheim

Let us take our sample enterprise Lederwaren-Manufaktur Mannheim as an

example and assume that all required ostrich leather is procured exclusively

from one wholesaler in Frankfurt, Germany. The purchasing department has a

decentralized organization; that is, each of the producing plants (Mannheim,

Milan, and Brussels) has created the German wholesaler as a vendor.

For the German plants, the vendor is a domestic vendor; for all other plants,

it is a foreign vendor. Whereas the German plant denes account 160000

(domestic vendor payables) in the vendor master, account 161000 (foreign

vendor payables) must be specied for Belgium, France, and Italy.

Because you maintain the reconciliation account separately for each

company code, this differentiation can be made without any problem.

Additional accounting view data includes the terms of payment and the

payment method. The accounting terms of payment are only relevant if

the vendor invoice is directly entered in accounting and not via the MM

component.

Mapping of

payables

298 Book_TIGHT.indb 90 12/4/09 3:47:55 PM

91

Vendor Master as an Integrative Element 4.2

In the SAP world, payment methods are the different methods you can use

to pay—for example, check or bank transfer—and you can assign more

than one payment method to a vendor. This is useful, for example, if you

want to pay large invoices via check and all invoices up to EUR 10,000.00

via bank transfer.

Check Function for Duplicated Invoices or Credit Memos

The accounting view of the vendor master also contains an indicator you

can use to have the system check for invoices or credit memos that have

been entered twice. If the indicator is set, the SAP system checks whether

the document already exists when you enter an invoice or credit memo. It

assumes that the document has been entered twice if elds such as the ex-

ternal document number, vendor, and amount correspond to the elds of an

already existing document.

If this is the case, the system outputs a message to inform the user of the risk

of a duplicate entry. You can customize this message using Transaction OBA5,

for example. However, it should be an informational message and not an er-

ror message and should only inform the user of the risk of a duplicate entry

and not prohibit entering the invoice.

If you want to use this system support, you have to dene the Check For

Duplicate Invoice indicator as a mandatory eld in the Customizing of the

vendor master.

The purchasing data of the vendor stores all information that you require

for a smooth purchasing process but that does not affect the accounting

processes. Here, you maintain the purchase order currency and the term

of payment, for example, that are should be used for purchase orders for

this vendor by default.

For vendors that are only required in accounting but for which no purchase

order is entered in the system, you only have to create the general and the

accounting view. Examples include employees to which travel expenses

were paid via bank transfer. You also do not have to provide an account-

ing view for vendors that are required for the purchasing process but not

for accounting. This includes, for example, potential vendors from which

you request a quotation but for which no purchase order is generated. Of

course, the purchasing department does not obtain a quotation for its own

sake. Usually, a requirement is determined within the enterprise, for exam-

ple, in production, in materials planning, or in stock. When the purchasing

department receives the requirement, the ordering process starts.

Payment methods

Purchasing data

Required views

298 Book_TIGHT.indb 91 12/4/09 3:47:55 PM

92

4

Procurement Process

Purchase Order as the Basis of the 4.3

Procurement Process

In the context of the ordering process, this section focuses on two docu-

ments: purchase requisition and purchase order.

Purchase Requisition4.3.1

You can transfer the requirements either manually without system sup-

port or, particularly if the SAP system works with MRP procedures, auto-

matically. In the SAP world, the document that triggers the purchase order

later on is called purchase requisition. Depending on the method of how

the purchasing department is informed about a requirement, a purchase

requisition can be entered directly; that is, manually, or indirectly; that is,

via another SAP component.

A purchase requisition already contains all of the necessary information for

the purchasing department. First, it denes a requisitioner. For every item,

it also species the purchase order quantity and, preferably, the material

number. Alternatively, a material group can be maintained.

Material Group

A material group is a grouping of materials for which no material may exist.

You can derive the account assignment from the material group; that is, it

supports automated processing.

A purchase requisition is an internal document. It is a request to the purchas-

ing department to procure a material or service. After its release, you can ful-

ll a purchase requisition with a purchase order or an outline agreement.

You may have to determine a source of supply before creating a purchase

order. Here, the SAP system also supports the purchaser: You can create

requests and enter the quotation afterward as well as access existing pur-

chase orders and conditions in the system. By comparing the different

quotations in the SAP system, you can determine the best vendor and then

create the purchase order.

Purchase Order4.3.2

Like many other documents in the SAP system, a purchase order consists

of a header that is supplemented with individual items. Except for the

stock transfer order, all purchase orders are sent to a vendor. The respec-

Determining the

source of supply

Header data of the

purchase order

298 Book_TIGHT.indb 92 12/4/09 3:47:55 PM

93

Purchase Order as the Basis of the Procurement Process 4.3

tive vendor number is entered in the purchase order header. As a result,

the system proposes various values from the vendor master, as follows:

Ordering address, invoice address, and delivery address

Terms of payment

Incoterms (terms of freight)

More interesting than the header information are the purchase order items.

Their behavior—as well as the required information for each item—is con-

trolled by what is called an item category . The type and attributes of the

item category determine critical de nitions (see Figure 4.4).

Item Category De nitionsFigure4.4

First of all, you have to de ne whether the corresponding purchase order

item allows for, enforces, or prohibits specifying a material number or

additional account assignments (see

Material Required eld group in

Figure 4.4). For materials, you can additionally select whether inven-

tory management is possible (

Inventory Management eld group). This

de nes whether the material is stock material for which you may want to

know at a later stage whether and how much material is in stock.

Here, you can also specify critical de nitions for the goods receipt. You

can de ne whether goods receipt is expected and whether this setting can

be changed in the purchase order maintenance. You can also determine

whether the goods receipt is non-valuated and also whether this setting

can be changed (

Control: goods receipt eld group). For example, for

Purchase order

item—item

category

Account

assignment

Goods receipt

298 Book_TIGHT.indb 93 12/4/09 3:47:56 PM

94

4

Procurement Process

vendor consignments, if the goods receipt is non-valuated, the invoiced

value of goods is directly indicated as an expense (and not as stock) in the

nancial statement.

The item category also states whether an invoice is expected and whether

this invoice is binding. You can also determine whether this setting can be

changed in the purchase order (

Control:invoice receipt eld group).

You cannot congure item categories; that is, you cannot create new or

modify existing categories. The only option you have is to assign an exter-

nal item category (a category that is visible to the user) to the internal item

category of the SAP system. Table 4.1 contains a list of the most important

item categories.

Item

Category

Description

Usage

Int.

Ext.

0

Standard

purchase order

Externally procured goods

GR and IR possible

1

B

Limit purchase

order

Denition of a max. value

Neither quantity nor delivery data is

dened

IR is mandatory

2

K

Consignment

order

Material required

Procurement based on consignment

GR is mandatory

3

L

Subcontracting

Ordering nished products at ven-

dors

Non-valuated GR is mandatory

4

S

Third-party

Purchase order triggered by enter-

prise, delivery to customer

No GR, but IR mandatory

7

U

Stock transfer

Initiating a stock transfer from plant

to plant

Item Categories with DescriptionsTable4.1

A purchaser must also specify the agreed price of the purchase order item.

This process can be automated using purchasing info records. These records

Invoice receipt

Purchase order

item—purchasing

info record

298 Book_TIGHT.indb 94 12/4/09 3:47:56 PM

95

Purchase Order as the Basis of the Procurement Process 4.3

link vendors and materials, and its critical elements are the purchase order

and price conditions. A purchasing info record always refers to only one

vendor and one material. This enables you to maintain different purchase

prices for a material for each vendor. The purchasing info record is addi-

tionally characterized by its high level of integration within the SAP sys-

tem. You can also use it for product cost controlling, for example.

Because material numbers are not always available, the material group is

very useful and serves various purposes in materials management. In the

basic view, a material group is assigned to a material master; the material

group serves to combine materials with similar properties. In reporting,

you can then carry out evaluations according to these material groups.

For the integrated value ow, however, the fact that you do not have to

enter a material master in the purchase order if you specify a material

group in the purchase order item is much more interesting. This option is

useful for low-value consumption goods (such as coffee for the employee

break room) for which no material master exists.

When the purchaser creates a purchase order without material, he must

generally decide to which expense account the purchase order item should

be assigned. Using material groups is the solution because they can be

linked to MM account determination, which allows for automated assign-

ment of G/L accounts. This means that the purchaser does not have to

determine the account manually, a process that often leads to posting

errors.

Risk of Incorrect Account Assignments with Manual Input

If the system does not automatically determine the G/L account, the risk of

an incorrect account assignment increases considerably! The reason is that

you cannot reduce the G/L accounts the system lists for selection.

Purchase orders with a material master record in the purchase order items

that are not delivered to stock but directly provided for consumption are

referred to as purchase orders with account assignment. Here, an account

assignment category that requires the specication of a respective account

assignment for the item is assigned to a purchase order item.

The following are the most important account assignment categories in a

purchase order:

Internal order

Cost center

Material group

Purchase order

with account

assignment

Account

assignment

categories

298 Book_TIGHT.indb 95 12/4/09 3:47:56 PM

96

4

Procurement Process

Project

Asset

Production order

Sales order

Customer individual stock

The account assignment categories for internal orders, cost centers, proj-

ects, production orders, sales orders, and sales order stock are not unique;

they require the specication of the respective account assignment object.

This object must exist and be valid when the purchase order is entered.

Here, the common rules for the use of Controlling account assignments

apply. This means that you can dene only one genuine account assign-

ment object.

To assign an account to an asset, you need a main asset number and an

asset subnumber. This is the problem with this category: The asset number

must be available even before the asset is available. There are two solutions

to this problem:

Access via a dummy asset

The purchaser/creator of the purchase requisition creates the asset

When using the access via a dummy asset, you usually work with an

asset under construction (AuC) with line item settlement to which all asset

acquisitions are assigned. Using an AuC has the advantage that line items

posted to this asset can be settled individually to a capitalized asset or to

an expense account.

Alternatively, you can also directly use a capitalized asset for account assign-

ment. For new acquisitions, this also means that the purchasing depart-

ment is allowed to create capitalized assets. However, when creating a

capitalized asset, you must make decisions regarding the mapping in the

nancial statement, for example, on the asset class and consequently on

the account assignment and on depreciation parameters. If you decide to

use this account assignment variant for assets, you should ensure that your

employees are able to create the assets properly, for example, by providing

training and the corresponding documentation.

You can also have the purchasing department request a new asset number

from the asset accounting department in these cases. The asset account-

ing department would then have the corresponding competence to make

a decision about the correct assignment of the asset, create a number, and

Asset account

assignment

category

Access via

“asset under

construction“

Access via

capitalized assets

298 Book_TIGHT.indb 96 12/4/09 3:47:57 PM

97

Purchase Order as the Basis of the Procurement Process 4.3

forward the number to the purchasing department. However, this vari-

ant may require time-consuming internal communication, which can be

a problem.

When using purchase requisitions, you should create the asset when creat-

ing the purchase requisition and not when issuing the purchase order. This

way, you reach the highest level of integration. This also means that the

creator of the purchase requisition must already possess the know-how to

create the asset properly.

Because these two solutions for the account assignment of assets can lead

to speci c problems, you can consider prohibiting this account assignment

category as a third solution.

Technically, you can easily implement this constraint by simply not pro-

viding this category. This is possible because Customizing de nes for each

order type which account assignment categories are allowed and which are

not allowed. You can nd this setting in the Implementation Guide under

Materials Management

•

Purchasing

•

Purchase Order

•

De ne Doc-

ument Types

. If you want to use this variant, post the invoice receipt to a

clearing account. Then, the asset accounting department must make man-

ual transfer postings for the values from the clearing account to an asset.

In addition to the decision of which account assignments can or must

be transferred, you can make further decisions under

De ne Document

Types

. Figure 4.5 shows an example.

Account Assignment Category De nitionsFigure4.5

Prohibiting the

item category

Further de nitions

in the account

assignment

category

298 Book_TIGHT.indb 97 12/4/09 3:47:57 PM

98

4

Procurement Process

Here, you can see the Customizing for the Asset account assignment cat-

egory to which you can also navigate via Transaction OME9 (

Change

Account Assignment Category

).

As for the item category, here, you also dene whether and what type of

goods and invoice receipt is required for the account assignment category.

Sections 4.6, Goods Receipt, and Section 4.7, Invoice Verication, describe

the corresponding effects of these denitions in more detail. Goods receipt

and invoice receipt are the rst events in the procurement process that

affect Financial Accounting.

From the cost accounting perspective, however, it would be negligent to

start monitoring the budget only when the invoice has been received. If

you determine at this stage that a budget has been exceeded, it is too late

to take action. Ideally, you therefore start monitoring the budget when

you create the purchase requisition or, at the latest, when you create the

purchase order. As you could already see in Figure 4.2, the Controlling

document for the commitment update is the only document that is already

generated when the purchase requisition and purchase order are created.

Updating Commitments4.4

The SAP system provides a Commitments Management function. A com-

mitment is understood as a scheduled (purchase requisition) or contrac-

tual (purchase order) commitment that will result in costs. Costs can be

incurred in the form of goods or invoice receipt. This means commitments

are prebooked sales that you can check against approved budgets.

Although you can also integrate commitment updates with the general led-

ger, asset accounting, and funds management, Commitments Management

in Controlling is frequently used. You activate this function at the control-

ling area level (see Figure 4.6).

You can navigate to the Controlling area maintenance using Transaction

OKKP. The activation of the

Commitments Management component

enables you to manage commitments for cost centers and internal orders.

You can also initiate that commitments are updated to sales orders in Trans-

action OKKP by selecting the

W. Commit. Mgt (With Commitment Man-

agement) checkbox in the

Sales Orders section. These options indicate

that commitments can only be updated for purchase orders with account

assignment.

Budget monitoring

Commitment

Activating

Commitments

Management

298 Book_TIGHT.indb 98 12/4/09 3:47:57 PM

99

Updating Commitments 4.4

Commitments Management ActivationFigure4.6

In addition, you have to con gure commitment updates for order types

and cost center categories.

For internal orders, you can enable these updates by selecting the

W. Com-

mit. Mgt

checkbox in the individual order types. To do so, you can use

Transaction KOT2_OPA . When the checkbox is selected, this de nition

immediately applies to all orders of this order type that exist in the system.

This is also indicated in the master record of the order in the

Control

data

eld group. Figure 4.7 displays an example.

Order Master for Enabled Commitments ManagementFigure4.7

The logic for cost centers is different. Here, the Commitment block indica-

tor is set for all cost center categories for which no commitment update is

desired. Commitments are updated for all cost center categories for which

this indicator is not set. Figure 4.8 displays the speci cations for the two

Commitment

update for order

types

Commitment

update for cost

centers

298 Book_TIGHT.indb 99 12/4/09 3:47:58 PM

100

4

Procurement Process

cost center categories 4 (Administration) and 5 (Management). For cost

center category 4, commitments should be updated; for category 5, they

should not be updated.

Blocking Commitment UpdatesFigure4.8 for Cost Center Categories

You can implement the commitment update settings for the cost center

categories in the Implementation Guide under

Controlling

•

Cost Cen-

ter Accounting

•

Master Data

•

Cost Centers

•

De ne Cost Center

Categories

.

However, because these settings for the cost center categories are only

default values for the creation of master data, you can also individually

modify Commitments Management in the respective cost center master

when creating a new cost center (see Figure 4.9).

No Effect on Existing Cost Centers

Keep in mind that changes to the Customizing of the cost center category do

not affect existing cost centers. Therefore, the SAP system behavior for cost

centers differs from the behavior for internal orders.

Changing the Commitment Update Figure4.9 Settings in the Cost Center Master

298 Book_TIGHT.indb 100 12/4/09 3:47:59 PM

101

Updating Commitments 4.4

You can reduce commitments in two alternative ways:

Reduction based on values of the goods receipt

Reduction based on values of the invoice receipt

Here, the system behavior depends on whether a valuated goods receipt

exists. If the goods receipt is valuated, the corresponding goods receipt

data is used. and prices are taken from the purchase order.

If there is no goods receipt or if it is non-valuated, the commitment is

reduced upon invoice receipt.

De ning a G/L Account as the Cost Element

To generate commitments, the G/L account to which the purchase order is

assigned must be de ned as the cost type when the goods or invoices are

received.

Let’s take a look at a budgeted order of Lederwaren-Manufaktur Man-

nheim and the ordering and budget reduction process. A budget of

EUR 1,200,000.00 was assigned to marketing order 400237. A purchase

requisition and—based on this—a purchase order with an amount of

EUR 5,850.00 were created. Figure 4.10 illustrates the ow and the previ-

ous use of the budget.

Budget Evaluation for Marketing Order 400237Figure4.10

You can see that an expense of EUR 1,200,000.00 is planned from which

EUR 1,194,150.00 are available. At the time the query was issued, the

Actual column reads EUR 1,170.00. Where does this value come from?

To answer this question, you have to take a look at the development of

the purchase order.

Reducing

commitments

“Commitment

calculation”

example

298 Book_TIGHT.indb 101 12/4/09 3:48:00 PM

102

4

Procurement Process

Development of Purchase Order 4500018746Figure4.11

In Figure 4.11, you can see that two pieces were posted as goods receipt.

According to the purchase order with EUR 585.00/piece, a total of

EUR 1,170.00

1

was valuated.

However, three pieces at EUR 585.00 were invoiced; that is, the invoice

was EUR 1,755.00 in total

2

. Therefore, in this case, the goods receipt

values were used for the budget usage. Because the purchase order is

EUR 5,850.00

3

in total, but goods of only EUR 1,170.00 were received,

a commitment of EUR 4,680.00

4

still exists.

Total Value of Purchase Order 4500018746Figure4.12

The budget evaluation (see Figure 4.10) includes the total value in the

Assigned column. You can also determine it using the Actual and Com-

mitment

columns.

This example illustrates that Commitments Management is a simple but

powerful tool that enables you to implement cost accounting even before

the costs actually incur. Generating the commitment with the purchase

requisition allows for an early interaction from the cost accounting side—

for example, by blocking the purchase order or increasing the budget.

The topic of reducing a commitment goes beyond the scope of mere bud-

geting. Only an accounting-relevant document—that is, the valuated goods

receipt or invoice receipt—allows for a reduction of the commitment.

Section 4.5, Integration of MM and Financial Accounting/Controlling,

describes how the system generates accounting documents.

However, mapping the budget and commitment ow is only one side of

the story. At least as important is the system behavior in the event of a

“Commitments

Management” tool

Availability control

298 Book_TIGHT.indb 102 12/4/09 3:48:00 PM

103

Updating Commitments 4.4

budget overrun or what is called availability control . The bad news is that

the standard SAP system can prohibit postings because of budget overruns

for internal orders or projects only. It does not allow for triggering an error

message for account assignments to a cost center.

Availability Control for Account Assignments to Cost Centers

SAP Note 68366 (Active Availability Control for Cost Centers) provides a so-

lution using a substitution.

You can in uence the behavior for budget overruns for internal orders and

projects using Customizing. You can nd the settings for internal orders in

the Implementation Guide under

Controlling

•

Internal Orders

•

Bud-

geting and Availability Control

. Here, you rst create a budget pro le

and then assign it to the order types. Additionally, you determine whether

availability control is implemented in the case of an account assignment to

a budgeted internal order. You can also de ne tolerances here.

Availability Control TolerancesFigure4.13

Figure 4.13 shows an example of a three-level check. This is controlled

via the speci cation of the budget usage in percentages (

Usage in % ) and

absolute amounts for the variance (

Absolute variance ) if necessary. The

Action column enables you to control the system behavior. In our exam-

ple, the following control is implemented:

Action

1

When you reach 80 percent of the budget, the system generates a warn-

ing message for the goods/invoice receipt.

Action

2

At 90 percent, the system generates another warning and additionally

sends an email to the person responsible.

Action

3

In the event of a budget overrun, the system generates an error mes-

sage. You can no longer post a document with account assignment to

the budget (for example, via an internal order).

298 Book_TIGHT.indb 103 12/4/09 3:48:01 PM

104

4

Procurement Process

Integration of MM and Financial 4.5

Accounting/Controlling

Figure 4.2 illustrated which documents are generated during the procure-

ment process. In this context, you learned that value ow-relevant proce-

dures always result in multiple documents:

Material document

Financial Accounting document

Controlling document (optional)

For the goods receipt, it is easy to understand why a document needs to be

generated in MM. The MM document posts the receipt and the accounting

documents map the corresponding values. The purpose of the MM docu-

ment for the logistics invoice verication is not clear at rst glance. Keep

in mind that the logistics invoice verication in SAP has more tasks than

simply posting the payables and implementing the respective offsetting

account assignment.

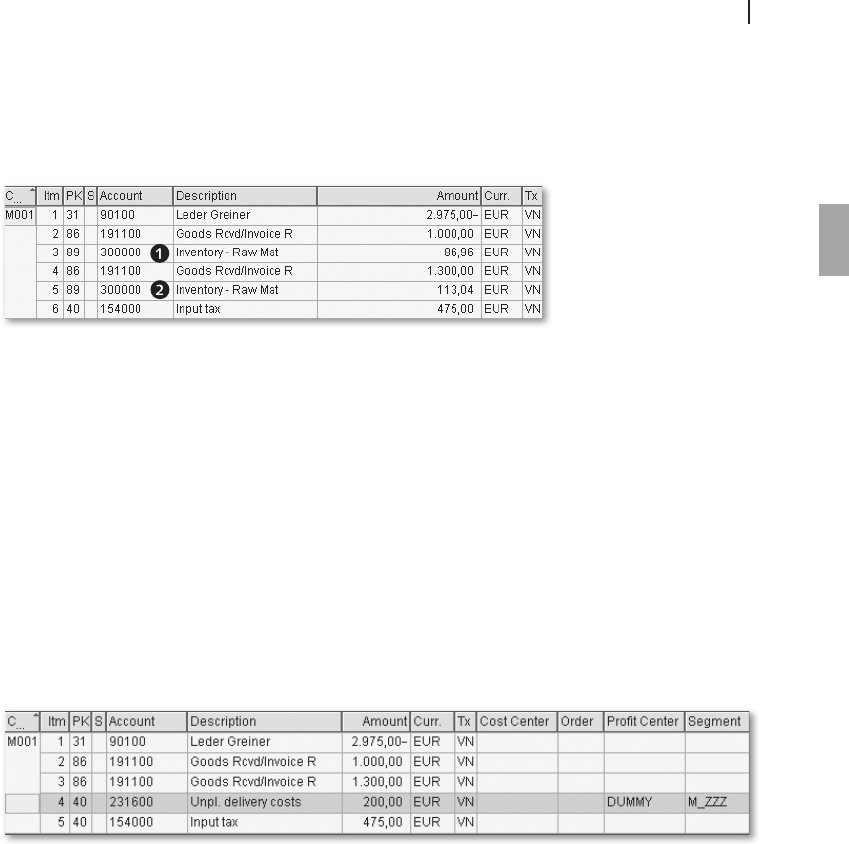

The invoice verication is characterized by a high integration with MM.

The system can compare the invoice of the purchase order with the goods

receipt and can consequently automatically answer the question of whether

the existing invoice seems to be justied and correct. For this purpose, how-

ever, it requires detailed information from the purchase order and the goods

receipt if necessary. Technically, this information is solely available in MM.

All stock-relevant processes are therefore rst mapped by a material docu-

ment in the inventory management (MM component). Here, the informa-

tion ow is generated along the material ow, as you already know from

Chapter 2, Section 2.1.1, Value Flow. The material document contains all

of the pieces of information you need for proper inventory management

and detailed evaluations of goods movement:

Material number

Storage data such as storage location or stock type

Movement type

This information serves as the basis for the structure of the documents in

Financial Accounting and Controlling that represent the value ow. The

interface from MM to Financial Accounting/Controlling is characterized

by a high degree of automation, which can be achieved thanks to what is

called MM account determination. The MM account determination can be

Document ow

Content of the

MM document

MM account

determination

298 Book_TIGHT.indb 104 12/4/09 3:48:01 PM

105

Integration of MM and Financial Accounting/Controlling 4.5

considered complex rules for the derivation of account assignments. It is

restricted, however, to the determination of G/L accounts and does not

affect Controlling account assignments such as cost centers or orders.

The prospect of newly implementing MM account determination makes

most consultants moan. First, you have to congure account determina-

tion yourself; then, you have to explain the logic of account determination

to the user departments, which are general ledger accounting and cost

accounting in this case. The latter is usually quite time-consuming and

might require strong nerves. If you look at the steps of MM account deter-

mination separately, however, you can see that it is not rocket science. It

is complex, but has a logical structure. We will therefore begin with an

overview and then go into details.

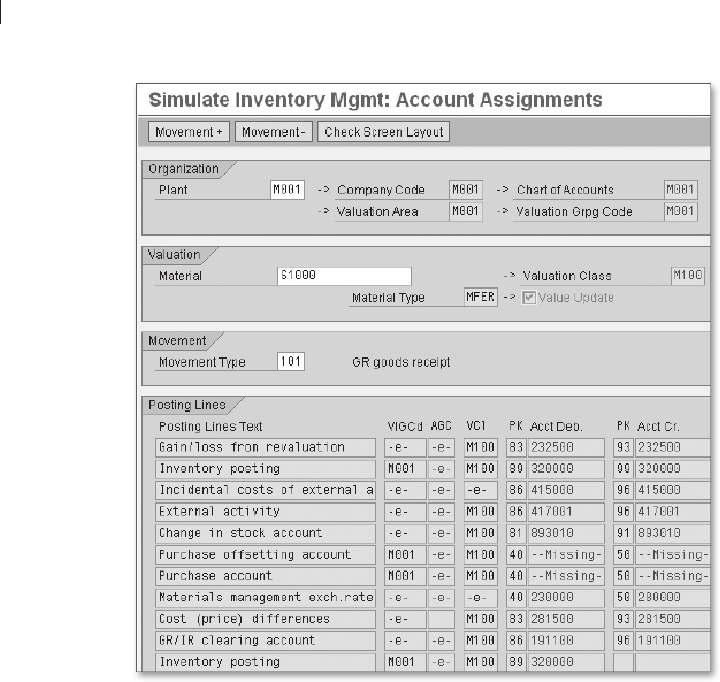

As the name implies, the goal of MM account determination is to deter-

mine a G/L account in Financial Accounting. As you can see in Figure 4.14,

you can categorize the numerous relationships into three groups.

Basic Settings:

– Valuation Grouping Code

– Valuation Level

– Valuation Area

Valuation Class:

– Material Type

– Account Category Reference

– Valuation Class

Transaction:

– Movement Type

– Valuation Rule

– Account Grouping

– Transaction

G/L Account

Overview of the Settings for MM Account DeterminationFigure4.14

The basic settings dene the valuation class and the transaction, which in

turn dene the G/L account. The following sections discuss the individual

groups in detail.

Basic Settings4.5.1

Let us start with the basic settings, which enable you to inuence the MM

account determination behavior as a whole. Here, the central question is at

General structure

Valuation level

298 Book_TIGHT.indb 105 12/4/09 3:48:01 PM

106

4

Procurement Process

which level you want to in uence the account determination and thus the

mapping of goods movements in the nancial statement. You can choose

between plant and company code. The rather simple setting and selection,

which are illustrated in Figure 4.15, have far reaching effects.

The valuation level de nes whether the account determination is identical

for all plants of a company code or whether you can set the account deter-

mination for each plant individually. After the going-live of the client using

standard means, you can no longer change the decision you made. Because

this setting applies centrally, you can also nd it in the Implementation

Guide under

Enterprise Structure

•

De nition

•

Logistics – General

•

De ne Valuation Level.

De ning the Valuation LevelFigure4.15

Not Reversible and Client-Wide

The valuation level setting is irreversible and applies across all clients.

You should always select the plant level, even if no deviating account deter-

mination is planned for individual plants at the time of the speci cation.

You have to set the plant as the valuation level if you want to use the PP

(Production Planning) component or Product Cost Planning in Controlling.

This selection consequently allows for a multitude of options.

In addition to controlling the account determination, the valuation level

has further effects. It de nes if the accounting view in the material mas-

ter is maintained per plant or per company code. This is also the level at

which the valuated price of a material is updated. The term accounting view

is therefore misleading.

Accordingly, you usually de ne the plant as the valuation level. Although

multiple plants are de ned in your company code, you may still want to

specify an account determination at the company code level. One of the

reasons for this could be that you want to maintain the account determina-

tion speci cally for each country, which is a rather common procedure in

Plant level

recommendation

Updating the price

Valuation area

298 Book_TIGHT.indb 106 12/4/09 3:48:02 PM

107

Integration of MM and Financial Accounting/Controlling 4.5

international enterprises. To map this, the SAP system provides the valua-

tion area classication criterion.

The valuation area corresponds to the individual attributes of the selected

valuation level. At the “plant” valuation level, each plant corresponds to

a valuation area. If you want to work with the “company code” valuation

level, the system proposes the company code that exists in the client as

the valuation area.

To avoid that you have to assign different account determination to each

valuation area, you need to group the valuation areas. For this, you must

enable the use of the valuation grouping code (VGC). You can do this in the

Implementation Guide under

Materials Management

•

Valuation and

Account Assignment

•

Account Determination

•

Account Determi-

nation Without Wizard

•

Dene Valuation Control.

Missing Connection to the Automatic Transport System

At this point, note that the activation of the VGC, along with the denition

of the valuation area, is stored in the TCURM table. This table is not con-

nected to the automatic transport system. Consequently, you enable the VGC

directly in the target system. If the target or live SAP system is still initial, for

example, in the event of a new system implementation, you can manually

bundle the settings in a transport.

For this purpose, you need to include the following entries in the transport

request:

Program ID R3TR

Object type TABU

Object name TCURM

Specify the client as the key.

This missing connection to the transport system is a security measure of

the SAP system to avoid that this setting will be overwritten.

You can implement groupings via the

Materials Management

•

Valua-

tion and Account Assignment

•

Account Determination

•

Account

Determination Without Wizard

•

Group Together Valuation Areas

Customizing path. Figure 4.16 shows a corresponding example.

The rst column,

Valuation Area (see Figure 4.16) indicates the valuation

areas. In this example, these are the plants that exist in the client because

here, plants serve as the valuation area (see Figure 4.15). The next two

columns,

Company Code and Company Name, display the ID and the

name of the company code to which the respective plant is assigned. SAP

Valuation grouping

code

Grouping of the

valuation areas

298 Book_TIGHT.indb 107 12/4/09 3:48:02 PM

108

4

Procurement Process

uses the company code to determine the operating chart of accounts that

is valid for the account determination for goods movements. Accordingly,

the account determination is speci c to the charts of accounts.

Grouping of the Valuation AreasFigure4.16

In the last column, Valuation Grouping Code (see Figure 4.16), you can

view the valuation grouping code . Here, the entries can be freely selected.

You should use clear logic, for example, the country code at the rst two

places and then ascending numbers.

As our example illustrates, Lederwaren-Manufaktur Mannheim has created

speci c plants for logistics processing in Belgium, France, and Italy. Each

plant of Lederwaren-Manufaktur Mannheim you can see in Figure 4.16 is

located in another country. Because you work with country-speci c VGCs,

each plant has its own VGC: plant M100 in Belgium uses BE01, M200 in

France uses FR01, M300 in Italy uses IT01. The two plants that are located

in Poland, PL01 and PL02, of the 0006 and 0005 company codes both use

the PL01 VGC and are thus treated identically in the MM account deter-

mination. The gure is therefore an example of how you should de ne the

VGC: The numbering consists of a country code and a counter.

You will then implement all account determination settings at the VGC

level only. The settings will apply to all assigned valuation areas.

VGC Assignment

You should only assign company codes with the same chart of accounts

to a common VGC to avoid unnecessary complexity for the account

determination.

At rst, it does not seem to be useful to work with VGCs for, for example,

SAP implementations with a single plant/company code. However, for

future-oriented project approaches and if the enterprise might continue

to grow, you should work with VGCs right from the start. This does not

involve much additional effort but considerably facilitates expansion.

Assigning the VGC

298 Book_TIGHT.indb 108 12/4/09 3:48:02 PM

109

Integration of MM and Financial Accounting/Controlling 4.5

You are now familiar with the basic settings for MM account determina-

tion, which are summarized in Figure 4.17. This schematic illustration

shows that the basic settings are complex only at rst glance.

Valuation Grouping

Code

Valuation Level Valuation Area

Grouped

Determined

Schematic Illustration of Basic MM Account Determination SettingsFigure4.17

For the sake of completeness, the option of split valuation should also be

mentioned. This enables you to further divide the valuation areas for a

material. A common criterion for the division of prices and account deter-

mination for a material and its stock is the batch. Batches of a material can

have different prices and can be mapped in different ways in the nancial

statement. This is the case, for example, if the product quality at the end

of a production process cannot be absolutely dened and the batches can-

not be compared or exchanged. Because this is a topic that is critical in

individual industries but not relevant to the majority of enterprises that

use SAP, it is not further discussed here.

Instead, we will take a step forward in the MM account determination and

turn to the categorization of materials. Because not all materials should be

managed in one material stock account in the nancial statement, a distin-

guishing criterion is required for the account determination. SAP provides

the valuation class for this purpose.

Valuation Class Settings4.5.2

From the MM account determination view, you can consider the valuation

class a grouping of materials. It is dened in the accounting view of every

material that is managed on a value basis. Materials with the same valua-

tion class are subject to the same account determination. When designing

the account determination, you can dene a separate valuation class for

Split valuation

Valuation class

298 Book_TIGHT.indb 109 12/4/09 3:48:03 PM

110

4

Procurement Process

each material stock account you want to map in the nancial statement.

Usually, the following materials are mapped separately:

Raw materials

Semi-nished products

Finished products

Trading goods

Operating supplies

In addition, you may want to evaluate certain materials or goods—especially

valuable raw materials or goods with high price uctuations—separately.

Customizing enables you to dene which valuation classes are provided

for selection in the maintenance of a material. This way, you can reduce

the risk of incorrect entries in the material master.

For this purpose, you can group the valuation classes into what are called

account category references. For example, if you use multiple valuation

classes to map raw materials, you can combine them in the “raw materials”

account category reference. When you then create a new material master

for a raw material, you can select from all of the valuation classes for raw

materials. Every valuation class is assigned to exactly one account category

reference; that is, it is an n:1 relationship.

The account category references, in turn, are assigned to the material types.

Every material type is assigned exactly one account category reference; that

is, it is a 1:n relationship. If you use account category references, not all of

the materials of one material type have to use the same account determina-

tion. Moreover, materials of different material types can be subject to the

same account determination.

Figure 4.18 again illustrates the relationships between material type,

account category reference, and evaluation class.

SAP combined the entire Customizing of the valuation class in one Cus-

tomizing item. You can nd it in the Implementation Guide under

Mate-

rials Management

•

Valuation and Account Assignment

•

Account

Determination

•

Account Determination Without Wizard

•

Dene

Valuation Classes. From there, you can navigate to the three necessary

operations: the editing of

Account Category Reference, Valuation

Class

, and Material Type. Figure 4.19 shows the initial screen.

Account category

reference

Assignment to the

material type

Valuation class

Customizing

ch04_5571.indd 110 12/7/09 12:22:41 PM

111

Integration of MM and Financial Accounting/Controlling 4.5

Account Category

Reference

Material Type

Valuation Class

Grouped

Assigned

Schematic Illustration of the Valuation Class DeterminationFigure4.18

Customizing of the Valuation ClassesFigure4.19

Using the Account Category Reference/Valuation Class view, rst

de ne the

Account Category References, that is, the link between valu-

ation classes and material type (see Figure 4.20).

De nition of the Account Category ReferencesFigure4.20

298 Book_TIGHT.indb 111 12/4/09 3:48:04 PM

112

4

Procurement Process

Then, you can create the Valuation Classes and immediately assign them

to an account category reference. This is illustrated in Figure 4.21.

Creating and Assigning Valuation ClassesFigure4.21

In the third and last step, you assign the account category references to the

Material Types (see Figure 4.22).

Assigning the Account Category ReferenceFigure4.22 to the Material Type

For the inventory management of the materials in the SAP system, the

material type assumes a major role. Chapter 3, Section 3.4.3, Material

Master, already discussed some material master settings that are essential

for the value ow. The material type was not mentioned there, because it

does not directly affect the value ow. But as you know now, the material

type is a critical MM account determination element.

You can nd the material type Customizing in the Implementation Guide

under

Logistics – General

•

Material Master

•

Basic Settings

•

Mate-

rial Types

•

De ne Attributes of Material Types.

The material type also de nes whether quantities and/or values are updated

for the materials that are assigned to the material type. You can generally

activate or deactivate quantity and value updates or even make this deci-

sion at the valuation area level. There are certainly reasons for controlling

Material type

Customizing of the

material type

Quantity update

and value update

298 Book_TIGHT.indb 112 12/4/09 3:48:04 PM

113

Integration of MM and Financial Accounting/Controlling 4.5

the quantity and value updates of the material types in the individual valu-

ation areas in different ways. In real life, however, this is an exception.

Figure 4.23 displays the corresponding settings for the MFER material type

(LWM – nished products), which you can nd in the Implementation

Guide under

Logistics – General

•

Material Master

•

Basic Settings

•

Material Types

•

De ne Attributes of Material Types.

Quantity/Value Updates of the Material TypeFigure4.23

As you can see in Figure 4.23, our material type does not clearly de ne

whether quantities or values are updated. It depends on the settings in the

individual valuation areas, which are shown in Figure 4.24.

This gure also indicates that a decision about the quantity and value

update at the valuation area level actually means that the materials in the

individual plants/company codes behave differently. Based on our exam-

ple, this means that quantities and values are updated for MFER in all valu-

ation areas, except for valuation area QMTR.

Quantity/Value Updates for Every Valuation AreaFigure4.24

MM account determination is only relevant for materials that are subject

to value updates. However, you should trust in the SAP standard and only

create new material types by copying a standard material type and chang-

ing it according to your requirements.

Usually, the MM component administrators/consultants design and imple-

ment the material types. Afterward, the material types should be assigned

New material

types

298 Book_TIGHT.indb 113 12/4/09 3:48:05 PM

114

4

Procurement Process

to the account category references by the persons who are responsible for

the MM account determination.

Regarding the account category references, this section introduced the

standard-related solution. In this context, the system only provides a part

of the valuation classes (namely, the account category reference) when you

create a material.

Alternatively, you can also assign all valuation classes to one account cat-

egory reference. As a result, the material maintenance then provides all

classes of the client for the valuation class selection. One of the benets

of this method is that you can decide for each material how it should be

mapped in the nancial statement. The disadvantage is that a wrong valua-

tion class may be selected due to the large number of options. If the wrong

valuation class is selected, all movements of this material will be mapped

incorrectly in accounting and cost accounting.

You now know that the denition of valuation classes is no problem at

all. All that remains is the last subject area: determining transactions and