2023 Annual

Report

Protecting America’s Pensions

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

i

F Y 2 0 2 3 | A N N U AL R E P O R T

A MESSAGE FROM OUR CHAIR

The Biden-Harris Administration continues to protect and strengthen the

retirement security of America’s workers, retirees, and their families. The

Pension Benefit Guaranty Corporation (PBGC) plays an important role in

these efforts by working with employers and unions to preserve their pension

plans and by providing a safety net for people whose pensions have failed.

Today, nearly 920,000 participants receive benefit payments of over $6

billion per year from the PBGC and more than 31 million of America’s

workers, retirees, and beneficiaries are in plans insured by the PBGC.

On behalf of the PBGC Board of Directors, I am pleased to present the

PBGC’s FY 2023 Annual Report, which provides important information

about the operations and finances of the PBGC Single-Employer and

Multiemployer Insurance Programs. The report highlights many of PBGC’s

accomplishments over this past fiscal year to preserve plans and protect pensions, including achieving its 31

st

consecutive unmodified audit opinion on its financial statements.

The PBGC Single-Employer Program’s financial status showed improvement and has been in a positive net

financial position, which is projected to grow over the next 10 years. The PBGC Multiemployer Program

improved during FY 2023 to a positive net position and is likely to remain solvent for more than 40 years,

primarily due to the enactment of the American Rescue Plan of 2021 and PBGC’s implementation of the

Special Financial Assistance (SFA) Program. The SFA Program provides funding to severely underfunded

multiemployer pension plans and will ensure that millions of America’s workers, retirees, and their families

receive the pension benefits they earned and can retire with dignity. As of the end of FY 2023, PBGC had

received 135 SFA applications requesting a total of $71.0 billion in SFA and had approved 100 applications

for $53.5 billion in SFA.

In FY 2023, PBGC continued its commitment to maintaining a diverse and inclusive workplace,

strengthening employee performance, and increasing leadership engagement. PBGC’s 2022 scores for

employee engagement; global satisfaction; and diversity, equity, inclusion, and accessibility ranked it as a Top

Agency among small agencies. Overall, PBGC ranked number two in the small agency category for Best

Places to Work in the Federal Government for 2022.

Retirement security plays a key role in providing opportunities for workers to reach their long-term financial

goals. My fellow Board members, Treasury Secretary Janet Yellen and Commerce Secretary Gina Raimondo,

and I are proud of the work PBGC has accomplished to provide a more secure future for America’s workers

and retirees. We are confident that PBGC will continue to work toward financially sound insurance programs

to ensure America’s workers and retirees have the secure, dignified retirement they deserve.

Julie A. Su

Acting Secretary of Labor

Chair of the Board

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

ii

F Y 2 0 2 3 | A N N U AL R E P O R T

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

iii

F Y 2 0 2 3 | A N N U AL R E P O R T

A MESSAGE FROM THE DIRECTOR

For nearly five decades, the Pension Benefit Guaranty Corporation

(PBGC), has steadfastly upheld its mission: safeguarding the retirement

security of over 31 million of America’s workers, retirees, and their families.

At PBGC, our enduring commitment to our mission drives our dedicated

team of talented professionals to meet the highest standards of customer

service, ensuring the stability of those who rely on private sector defined

benefit plans.

PBGC once again achieved the distinction of being ranked among one of

the best places to work in the federal government, securing the second-

place position among small federal agencies. In addition, PBGC ranked

number one in the following eight categories: Effective Leadership; Effective

Leadership: Empowerment; Teamwork; Innovation; Work-Life Balance; Diversity, Equity, Inclusion, and Accessibility

(DEIA); DEIA: Inclusion; Recognition; and Performance: Transparency. This accolade echoes the collective spirit of

teamwork, the depth of talent, and an unwavering pursuit of excellence.

For the third consecutive year, both PBGC’s Multiemployer and Single-Employer Insurance Programs ended

the fiscal year with positive net positions. The Multiemployer Program had a net positive position of $1.5

billion at the end of FY 2023, compared with $1.1 billion at the end of FY 2022. PBGC’s Single-Employer

Program remains financially healthy with a positive net position of $44.6 billion at the end of FY 2023,

compared with $36.6 billion at the end of FY 2022.

Due to the improved financial position of both insurance programs in recent years, the Government

Accountability Office (GAO) removed both of our insurance programs from its High-Risk List in its April

2023 High-Risk Series Report.

In adherence to the provisions of the American Rescue Plan Act of 2021, PBGC made substantial strides in

the Special Financial Assistance (SFA) Program. The SFA Program is pivotal in ensuring that millions of

America’s workers, retirees, and their families receive the pension benefits rightfully earned through years of

dedicated service. In FY 2023, PBGC approved over $45.9 billion in special financial assistance to 35 severely

underfunded multiemployer pension plans that cover nearly 615,000 participants. Our unwavering dedication

extends into the future, ensuring the realization of the SFA Program’s objectives in the months and years

ahead.

Simultaneously, PBGC has fortified its IT infrastructure, streamlined agency operations, and improved the

overall customer experience. Our proactive approach to strengthening cybersecurity is evident in high-level

FISMA ratings. Notably, for the third consecutive year, PBGC obtained an overall Office of the Inspector

General FISMA rating of “effective,” underscoring our enduring commitment to digital security.

The FY 2023 Annual Report is the 31st consecutive year the agency has received an unmodified audit opinion

on its financial statements and the eighth consecutive year of an unmodified audit opinion on internal control

over financial reporting. Additionally, as required by OMB Circular A-136, I am pleased to confirm with

reasonable assurance the completeness and reliability of the data presented in the FY 2023 Annual

Management Report and the FY 2023 Annual Performance Report, included in this Annual Report.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

iv

F Y 2 0 2 3 | A N N U AL R E P O R T

PBGC’s achievements in FY 2023 demonstrate our steadfast adherence to regulatory compliance, customer

service, and technological advancement. We remain unwavering in our commitment to securing the

retirement security of millions of America’s workers, retirees, and their families.

Gordon Hartogensis

Director

November 15, 2023

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

v

F Y 2 0 2 3 | A N N U AL R E P O R T

FISCAL YEAR (FY) 2023 ANNUAL REPORT

A MESSAGE FROM OUR CHAIR ............................................................................................................... i

A MESSAGE FROM THE DIRECTOR ...................................................................................................... iii

ANNUAL PERFORMANCE REPORT....................................................................................................... 1

OPERATIONS IN BRIEF ............................................................................................................ 2

STRATEGIC GOALS AND RESULTS ..................................................................................... 3

GOAL No. 1: Preserve Plans and Protect Pensions of Workers and Retirees ......... 3

GOAL No. 2: Pay Pension Benefits on Time and Accurately ..................................... 6

GOAL No. 3: Maintain High Standards of Stewardship and Accountability ............ 7

INDEPENDENT EVALUATION OF PBGC PROGRAMS ............................................................... 18

FINANCES ....................................................................................................................................................... 21

FISCAL YEAR 2023 FINANCIAL STATEMENT HIGHLIGHTS ................................. 23

MANAGEMENT’S DISCUSSION AND ANALYSIS ......................................................... 31

FINANCIAL STATEMENTS AND NOTES ......................................................................... 62

PAYMENT INTEGRITY INFORMATION ACT REPORTING .................................. 121

FISCAL YEAR 2023 ACTUARIAL VALUATION ............................................................. 124

INDEPENDENT AUDIT AND MANAGEMENT’S RESPONSE ................................................. 129

LETTER OF THE INSPECTOR GENERAL ..................................................................... 131

REPORT OF INDEPENDENT AUDITORS...................................................................... 133

MANAGEMENT’S RESPONSE TO REPORT OF INDEPENDENT AUDITORS . 142

ORGANIZATION ....................................................................................................................................... 143

This annual report is prepared to meet applicable legal requirements and is in accordance with and pursuant to the provisions of: the

Government Corporation Control Act, 31 U.S.C. Section 9106; Circular No. A-11, Revised, “Preparation, Submission and Execution

of the Budget,” Office of Management and Budget, August 11, 2023; and Circular No. A-136 Revised, Financial Reporting

Requirements (i.e., Government Corporations are only required to adhere to Section I.5 and Section V, and PBGC voluntary complies

with Section II.2.4) Office of Management and Budget, May 19, 2023. Section 4008 of the Employee Retirement Income Security Act

of 1974 (ERISA), 29 U.S.C. Section 1308, also requires an actuarial report evaluating expected operations and claims that will be

issued as soon as practicable.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

vi

F Y 2 0 2 3 | A N N U AL R E P O R T

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

1

F Y 2 0 2 3 | A N N U AL R E P O R T

ANNUAL PERFORMANCE REPORT

The Pension Benefit Guaranty Corporation (PBGC or the Corporation) protects the retirement security of

over 31 million of America’s workers, retirees, and beneficiaries in both single-employer and multiemployer

private-sector pension plans. The benefits of these participants are valued at more than $3 trillion. The

Corporation’s two insurance programs are legally separate and operationally and financially independent.

The Single-Employer Program is financed by insurance premiums paid by companies that sponsor defined

benefit pension plans, investment income from plan assets trusteed by PBGC and recoveries from companies

formerly responsible for the plans. The Multiemployer Program is financed by premiums paid by insured

plans and investment income. Congress sets PBGC premium rates.

In addition, the American Rescue Plan (ARP) Act of 2021 (Public Law 117-2) — a historic law passed by

Congress and signed by President Biden on March 11, 2021 — established the Special Financial Assistance

(SFA) Program for financially troubled multiemployer pension plans. The law addresses the solvency of the

Multiemployer Program, which was projected to become insolvent in 2026. The SFA Program provides

funding assistance to severely underfunded multiemployer defined benefit pension plans and will enable

millions of America’s workers, retirees, and their families to receive the pension benefits they earned through

many years of hard work. The SFA program is funded entirely by an appropriation from the General Fund of

the U.S. Department of the Treasury (Treasury).

Upon approval of an SFA application, PBGC will make a payment to an eligible multiemployer defined

benefit pension plan in the amount that is projected to enable the plan to pay all benefits through the last day

of the plan year ending in 2051. The SFA Program also assist such plans by providing funds to reinstate

previously suspended benefits, including back payments to retirees, and repaying financial assistance that was

received from PBGC’s Multiemployer Program.

The Corporation achieves its mission through three strategic goals:

1. Preserve plans and protect the pensions of covered workers and retirees.

2. Pay pension benefits on time and accurately.

3. Maintain high standards of stewardship and accountability.

PENSION BENEFIT GUARANTY CORPORATION

2 FY 2023 | ANNUAL REPORT

OPERATIONS IN BRIEF

Since enactment of the Employee Retirement Income Security Act of 1974 (ERISA), PBGC has strengthened

retirement security by preserving plans and protecting pensions for participants and their families. In FY

2023, the Corporation made benefit payments of over $6.0 billion to 917,185 participants in single-employer

plans and provided over $175.8 million in traditional financial assistance to multiemployer plans covering

122,082 participants, as highlighted in Table 1: FY 2023 Operations in Brief.

TABLE 1: FY 2023 OPERATIONS IN BRIEF

1

2023

Target

2023

Actual

2022

Actual

GOAL 1: Preserve Plans and Protect Pensions

Single-Employer Plan Participants Protected – Employers

Emerging from Bankruptcy During the Year

32,038 999

Single-Employer Plan Standard Termination Audits:

Additional Payments

$2.3M to 1,306

participants

$1.03M paid to 663

participants

Single-Employer Benefit Payments for Terminated Plans

Participants Receiving Benefits

920,000 960,000

Benefits Paid

Over $6.0B Over $7.0B

Participants Expected to Receive Future Benefits

473,000 496,000

Multiemployer Plan Traditional Financial Assistance $176M to 100 plans $226M

2

to 115 plans

Multiemployer Plan SFA Payments $45.6B $7.6B

Multiemployer Participants in Insolvent Plans

Participants Receiving Benefits

80,421 93,525

Participants Expected to Receive Future Benefits

41,661 46,480

GOAL 2: Pay Timely and Accurate Benefits

Estimated Benefits Within 10% of Final Calculation 95% 96% 97%

Average Time to Provide Benefit Determinations (Years) 4.5 4.4 4.1

Improper Payment Rates Within OMB Threshold

3

<1.5% Yes Yes

Applications Processed in 45 Days or Less 87% 98% 85%

GOAL 3: Maintain High Standards of Stewardship and Accountability

Retiree Satisfaction – ACSI Score

4

90 87 86

Participant Caller Satisfaction – ACSI Score 83 81 76

Premium Filer Satisfaction – ACSI Score 74 77 77

Single-Employer – Financial Net Position $44.6B $36.6B

Multiemployer – Financial Net Position $1.5B $1.1B

Unmodified Financial Statement Audit Opinion Yes Yes Yes

1

Some numbers in this report have been rounded.

2

The $226 million in 2022 includes a $9 million payment on a facilitated merger under the Multiemployer Pension Reform Act of

2014 (MPRA).

3

The Office of Management and Budget (OMB) threshold for significant improper payment reporting is as follows: amounts that

exceed (1) both 1.5% and $10 million in improper payments, or (2) $100 million in improper payments.

4

The American Customer Satisfaction Index (ACSI) uses a 0-100 scale; 80 or above is considered excellent.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

3

F Y 2 0 2 3 | A N N U AL R E P O R T

STRATEGIC GOALS AND RESULTS

PBGC’s FY 2023 Annual Performance Report highlights the Corporation’s achievements, accomplishments,

and performance results through the lens of its strategic goals. The Corporation’s priorities are to preserve

plans and protect pensions of workers and retirees, to pay timely and accurate benefits, and to maintain high

standards of stewardship and accountability.

GOAL NO. 1: PRESERVE PLANS AND PROTECT PENSIONS OF WORKERS AND

RETIREES

PBGC engages in activities to preserve plans and protect participants by administering two separate insurance

programs. The Multiemployer Program protects about 11.0 million workers and retirees in about 1,360

pension plans. The Single-Employer Program protects about 20.6 million workers and retirees in about

23,500 pension plans.

MULTIEMPLOYER PROGRAM

The Multiemployer Program covers defined benefit pension plans that are maintained through one or more

collective bargaining agreements between employers and one or more employee organizations or unions. The

participating employers are usually in the same or related industries, such as transportation, construction,

mining, or hospitality. PBGC provides financial assistance to insolvent plans to allow them to pay guaranteed

benefits and reasonable administrative expenses. PBGC refers to this financial assistance under the

Multiemployer Program as “traditional financial assistance.”

In FY 2023, PBGC provided $175.8 million in traditional financial assistance to 100 multiemployer plans

covering 80,421 participants (including beneficiaries) receiving guaranteed benefits. An additional 41,661

participants in the insolvent plans are eligible to receive benefits once they retire. Due to SFA payments made

under ARP in FY 2023, the number of participants relying on traditional financial assistance under section

4261 of ERISA has decreased by 7,483 for participants receiving guaranteed benefits and by 5,383

participants eligible to receive benefits once they retire. These participants are included in the FY 2023 counts

but will no longer be receiving traditional financial assistance in future years.

The Corporation initiated audits of seven insolvent multiemployer plans covering nearly 10,826 participants.

The objectives of the audits are to ensure timely and accurate benefit payments to all participants, compliance

with laws and regulations, and effective and efficient management of the remaining assets in terminated or

insolvent plans.

PBGC regularly provides informal consultations to plan sponsors and practitioners on partition and merger

applications, alternative withdrawal liability requests, plan insolvency, SFA applications, and ERISA Title IV

compliance issues to assist plans in making their formal requests to PBGC more efficient and effective.

Special Financial Assistance Program

ARP, enacted on March 11, 2021, added section 4262 of ERISA, which created the SFA Program for certain

financially troubled multiemployer plans. The amount of SFA to which an eligible plan may be entitled is the

amount required to pay all benefits due through 2051. The SFA payments are derived from appropriated

funds and financed by the general revenues of the Treasury.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

4

F Y 2 0 2 3 | A N N U A L R E P O R T

On July 8, 2022, PBGC published a final rule implementing changes to the SFA Program, which include

changes to permissible investments of SFA funds and the SFA calculation method. The rule also requires

plans to submit with their SFA applications documentation of a death audit to identify deceased participants.

The audit must be completed no earlier than one year before the plan’s SFA measurement date. It must

identify the service provider conducting the audit and include a copy of the results of the audit provided to

the plan administrator by the service provider. In the July 8, 2022, SFA final rule, PBGC requested comments

on the condition requiring a phased recognition of SFA assets for purposes of calculating withdrawal liability.

PBGC received seven comments, six of which discussed the withdrawal liability condition. PBGC published a

final rule in the Federal Register, effective on January 26, 2023, amending the SFA regulation to add an

exception process for the withdrawal liability conditions under narrow circumstances.

In FY 2023, PBGC updated the SFA application instructions and provided other guidance. On March 8,

2023, PBGC issued guidance on the application process for non-priority group plans. On July 19, 2023,

PBGC issued two sets of questions and answers. The first set clarifies and provides examples of permissible

investments of SFA funds, and the second set clarifies the calculation methodology under the withdrawal

liability phase-in condition for plans that paid make-up payments of previously suspended benefits. On July

27, 2023, PBGC released updates to several documents in the SFA information collection. These updates

include changes to the application instructions requiring the submission of census data to enable PBGC to

perform an independent death audit to identify deceased pension plan participants and the submission of an

assumptions’ summary. In addition, PBGC has provided a process for plans to request expedited processing

of revised applications and a process for plans to submit revised lock-in applications in limited circumstances.

As of September 30, 2023, PBGC had received 135 SFA applications requesting a total of $71.0 billion in

SFA and had approved 100 applications for $53.5 billion in SFA. Twenty-five applications, requesting a total

of $8.5 billion, were under PBGC review as of September 30, 2023, and another 10 applications had been

withdrawn but not yet resubmitted as of September 30, 2023. During FY 2023, PBGC paid $45.6 billion in

SFA, of which $1.4 billion was paid pursuant to applications approved under the interim final rule (i.e.,

applications received prior to August 8, 2022), and $44.2 billion was paid under the final rule (including $1.8

billion in supplemented SFA for plans that initially applied under the interim final rule).

Special Financial Assistance Program Litigation

In FY 2023, the Board of Trustees of the Bakery Drivers Local 550 and Industry Pension Fund sued PBGC,

challenging PBGC’s determination that the plan was not eligible for SFA. The plan terminated by mass

withdrawal in 2016. PBGC denied the application based on its conclusion that a plan terminated by mass

withdrawal cannot be restored and is therefore not eligible for SFA. After September 30, 2023, on October

26, the New York Federal District Court ruled in favor of PBGC in this lawsuit. The matter is ongoing.

Multiemployer Plan Withdrawal Liability, Plan Mergers and Transfers

PBGC approval is required for a multiemployer plan to adopt an alternative method for allocating unfunded

vested benefits in determining withdrawal liability. PBGC began FY 2023 with two pending requests for

approval of alternative rules. At the end of the fourth quarter, two requests were pending and two were

approved.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

5

F Y 2 0 2 3 | A N N U A L R E P O R T

A multiemployer plan may adopt alternative terms and conditions for satisfaction of withdrawal liability if

those terms and conditions are consistent with ERISA and PBGC regulations. Plans sometimes request

PBGC’s determination that proposed alternative terms are consistent with ERISA and PBGC regulations.

PBGC began FY 2023 with one pending request, which remains under review. Special withdrawal liability

conditions apply to multiemployer plans that receive SFA.

Under a statutory exception, an employer that withdraws from a construction or entertainment industry plan

is generally not subject to withdrawal liability. PBGC may, by regulation, authorize plans in other industries to

adopt a similar rule if PBGC determines it is appropriate to do so and doing so would not pose a significant

risk to PBGC. The Corporation began FY 2023 with one pending request. No requests were received during

FY 2023. As of the end of the fourth quarter, one request is pending.

A multiemployer plan merging with or transferring assets and liabilities to another multiemployer plan must

provide PBGC with notice (in accordance with applicable statutory and regulatory provisions). The plan

trustees may request a compliance determination from PBGC, which, if granted, provides a safe harbor from

certain prohibited transaction provisions of Title I. In FY 2023, PBGC received 15 notices of merger, 14 of

which were accompanied by a request for a compliance determination. By the end of the fourth quarter,

seven compliance determinations were issued, three were withdrawn, and seven remain under review. The

Corporation began FY 2023 with two pending transfer compliance determination requests. Both were

withdrawn in the first quarter. PBGC did not receive any notices of transfer during FY 2023. Special

conditions apply to transfers or mergers involving multiemployer plans that receive SFA.

SINGLE-EMPLOYER PROGRAM

The Single-Employer Program covers defined benefit pension plans that generally are sponsored by a single

employer. When an underfunded single-employer plan terminates, PBGC steps in to pay participants’ benefits

up to legal limits. This typically happens when the employer sponsoring an underfunded plan liquidates in

bankruptcy, ceases operation, or can no longer afford to keep the plan going. PBGC takes over the plan’s

assets, administration, and pays benefits up to the legal limits.

As part of its risk mitigation activities, PBGC monitors and identifies transactions and events that may pose

risks to participants and beneficiaries. The Corporation works collaboratively with employers to better

safeguard pension benefits.

Standard Terminations

A standard termination is a termination of a single-employer pension plan that has enough money to pay all

benefits owed to participants and beneficiaries. If a plan has enough money to pay all benefits owed to

participants and beneficiaries, the plan sponsor can choose to terminate a plan by filing a standard

termination. In a standard termination, PBGC does not become responsible for benefit payments.

In FY 2023, 1,868 plans, covering approximately 315,540 participants, filed standard terminations with

PBGC. The number of filings in FY 2023 is 12 percent more than the average number of terminations filed

in the five years prior to that.

Approximately 1,510 plans with an aggregate of more than 226,700 participants completed standard

terminations in FY 2023 by paying full plan benefits to participants and beneficiaries in the form of annuities

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

6

F Y 2 0 2 3 | A N N U A L R E P O R T

or lump sums. Some of the larger standard terminations were J.C. Penney Corporation, Inc. Pension Plan,

Electrolux Home Products, Inc. Pension Plan, Louisiana-Pacific Corporation Retirement Account Plan, and

Western Union Pension Plan.

PBGC completed 232 standard termination audits in FY 2023 to verify plan administrators’ calculation of

benefits upon plan termination. These audits discovered errors that have since been corrected by the plan

administrators, resulting in more than $2.3 million in additional benefits distributed to 1,306 participants and

beneficiaries in these plans.

Plans Saved

When plan sponsors enter bankruptcy proceedings, PBGC encourages continuation of pension plans.

Although bankruptcy forces tough choices, it does not mean that pensions must terminate for companies to

succeed. In FY 2023, these plans were among those that continued after the bankruptcies of their sponsors or

controlled group members, protecting the benefits of participants and beneficiaries:

• Scouts BSA.

• Revlon, Inc.

• Avaya Holdings Corporation.

• Talen Energy Corporation.

Mediation Program

PBGC’s Mediation Program offers mediation to facilitate resolution of fiduciary breach

1

cases, negotiations

with ongoing plan sponsors as part of its Early Warning and Risk Mitigation Program, and with former plan

sponsors to help resolve their pension liabilities after termination of underfunded pension plans.

PBGC’s practice is to resolve early warning issues, termination liability claims, and fiduciary breach cases on a

consensual basis without the need for litigation. This gives plan administrators, plan sponsors, and fiduciaries

of terminated plans the opportunity to resolve these cases with a neutral, professional, and independent

mediator in a timely and cost-effective manner. PBGC had no mediations in FY 2023.

GOAL NO. 2: PAY PENSION BENEFITS ON TIME AND ACCURATELY

Nearly 1.4 million current and future retirees in trusteed single-employer pension plans rely on PBGC for

their pension benefits. PBGC’s benefits administration and plan processing teams are committed to paying

benefits accurately and on time.

Benefits Administration

The PBGC assumes the role of trustee for single-employer pension plans when plan sponsors lack the

resources to pay benefits according to their plan’s provisions. In FY 2023, PBGC trusteed 26 single-employer

plans, which provide pension entitlements to approximately 4,500 current and future retirees. Upon

1

As the statutory trustee of a terminated single-employer pension plan, PBGC has authority under Title IV to collect amounts due the plan and to bring suits on

behalf of the plan. Pursuant to this authority, PBGC pursues recovery actions against former fiduciaries to recover amounts lost by the plan as result of a breach

of fiduciary duties..Before filing an action in court, PBGC offers mediation to the former fiduciaries in an effort to reach a settlement.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

7

F Y 2 0 2 3 | A N N U A L R E P O R T

trusteeship, PBGC’s foremost responsibility is to ensure uninterrupted benefit payment to existing retirees. In

FY 2023, PBGC successfully maintained uninterrupted benefit payment to nearly 2,100 retirees.

Over the course of FY 2023, PBGC disbursed more than $6.0 billion in benefits to nearly 920,000 retirees in

single-employer pension plans. Additionally, over 28,000 new retirees applied for benefits during the fiscal

year. The PBGC achieved an impressive 98 percent rate for processing all applications within 45 days,

surpassing its target rate of 87 percent.

After PBGC becomes trustee of a terminated pension plan, it begins a multifaceted, multi-year endeavor that

involves the valuation of plan assets, comprehensive analysis of plan and participant data, and calculation of

benefits payable by the PBGC. At the end of the process, participants are notified of their benefit

determination. Prior to the completion of this process and as eligible participants request to commence their

benefits, PBGC pays estimated benefit amounts. In FY 2023, over 96 percent of benefit determinations

issued were within 10 percent of the estimated benefit amount.

PBGC has concentrated its efforts on the thorough review of payable benefit amounts associated with the

oldest plans in its portfolio, an endeavor that has achieved significant success. Notably, PBGC has shortened

the average age of benefit determinations issued from 5.9 years in FY 2021 to 4.4 years in FY 2023,

outperforming its target of 4.5 years.

Reviews and Appeals

When participants and beneficiaries in trusteed single-employer plans do not agree with PBGC’s

determination of their benefit, they have the right to bring their concerns to PBGC’s Appeals Board.

Employers and plan sponsors may also appeal certain PBGC determinations. The Appeals Board

independently reviews each appeal and provides a detailed written explanation for each decision. In FY 2023,

the Corporation started with 47 open appeals, accepted 147 new appeals, and closed 72 appeals, with 122 still

open at the end of the year. More information about PBGC’s Appeals Board is available at PBGC.gov.

GOAL NO. 3: MAINTAIN HIGH STANDARDS OF STEWARDSHIP AND

ACCOUNTABILITY

Accountability: Measuring and Monitoring Performance

PBGC continuously monitors how well it performs and serves customers using a wide range of performance

measures. Among them are how quickly and seamlessly the Corporation pays retirees, accurately calculates

benefits, and invests assets. PBGC conducts surveys to help improve the coordination and cooperation

essential to meeting customer service goals.

Each quarter, PBGC leadership participates in data-driven discussions covering the Corporation’s progress in

operations, stewardship and accountability, customer satisfaction, and building and maintaining a model

workplace. The strategic use of performance data better informs planning and execution of operations, as

well as corporate and program area decision-making.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

8

F Y 2 0 2 3 | A N N U A L R E P O R T

PB G C ’ S OWN FINAN C ES MUST BE SOU N D

PBGC’s operations are financed by insurance premiums set by Congress and paid by sponsors of PBGC-

insured defined benefit pension plans and by investment income. In addition, the Single-Employer Program

is funded by assets from pension plans trusteed by PBGC and recoveries from the companies formerly

responsible for the plans. The Corporation pays benefits based on federal law and the provisions of the plans

it trustees. In 2021, ARP added section 4262 of ERISA, which created the SFA Program, covering both

administrative and operating expenses, for certain financially troubled multiemployer defined benefit pension

plans. This Special Financial Assistance will enable eligible multiemployer plans to pay retirement benefits

without reduction for many years into the future. The SFA payments are derived from appropriated funds

and financed by general revenues of the Treasury.

Financial Position

The financial status of the Single-Employer Program showed improvement and achieved a positive net

position of $44.6 billion at the end of FY 2023. The Single-Employer Program’s financial status has evolved

to a positive net financial position which is projected to grow over the next 10 years.

The net financial position of the Multiemployer Program improved during FY 2023 to a positive net position

of $1.5 billion. Estimates from PBGC’s FY 2022 Projections Report show that the Multiemployer Program is

likely to remain solvent for more than 40 years, primarily due to the enactment of ARP and PBGC’s

implementation of the final rule for SFA. The SFA Program is expected to protect the benefits of millions of

participants in financially troubled plans and to reduce the demand on PBGC to provide traditional financial

assistance to insolvent plans.

Financial Soundness and Financial Integrity

The Corporation protects the pensions of over 31 million participants whose plan benefits are valued at more

than $3 trillion. PBGC’s two insurance programs, one for single-employer plans and one for multiemployer

plans, are designed to protect a guaranteed amount of participants’ pension benefits when plans fail. The

programs differ significantly in the extent to which plan benefits are funded as well as in the structure and

level of PBGC’s premium rates and guarantees. In addition to collecting premiums, PBGC exercises care in

the management of approximately $135 billion in total assets. In FY 2023, PBGC attained its 31

st

consecutive

unmodified audit opinion on its financial statements.

Collecting Premiums

Premium rates are set by statute. The Bipartisan Budget Act of 2013, the Multiemployer Pension Reform Act

of 2014 (MPRA), the Bipartisan Budget Act of 2015, and the SECURE 2.0 Act of 2022 specify premium

rates or premium increases for certain years. In FY 2023, combined premium cash receipts collected totaled

$4.942 billion. Single-Employer Program premium cash receipts collected were $4.595 billion. Separately,

Multiemployer Program premium cash receipts in FY 2023 were $347 million.

In FY 2023, PBGC continued to enhance the new version of My Plan Administration Account (My PAA),

PBGC’s online premium filing website, by prioritizing practitioner-based feedback with multiple system

updates throughout the fiscal year. Specifically, this included: adding and increasing capability for an

authorized plan filing coordinator to establish a filing team member’s access and user role permissions to

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

9

F Y 2 0 2 3 | A N N U A L R E P O R T

multiple plans in a single request; revamping the upload process to streamline the submission process if

filings are error free; customizing the plan list view to allow users to view, search, and find information from

each plan’s most recent filing; creating a customizable routing feature that allows filing team members to send

or receive a filing notification email indicating the action required to complete the filing submission; and

adding the My PAA payment ID to the Filing Details webpage.

Investing Prudently

PBGC investment assets are administered by investment management firms subject to PBGC’s investment

policies and oversight procedures. Procedures for internal controls, due diligence, and risk management are

subject to periodic review. Regular and detailed communication with management firms enables the

Corporation to stay informed on matters affecting its investment program. For more information, refer to

Section VIII Investment Activities.

OUTREACH AND CUSTOMER SERVICE

Central to PBGC’s mission are its valued customers. In its unwavering commitment to offering the highest

level of service, PBGC relies on surveys to actively engage customers, identify opportunities for

enhancement, implement procedural refinements, and continually assess satisfaction levels. Survey scoring

methodology aligns with the criteria of the American Customer Satisfaction Index (ACSI). In FY 2023,

PBGC took proactive measures based on customer feedback to enhance the quality of services rendered.

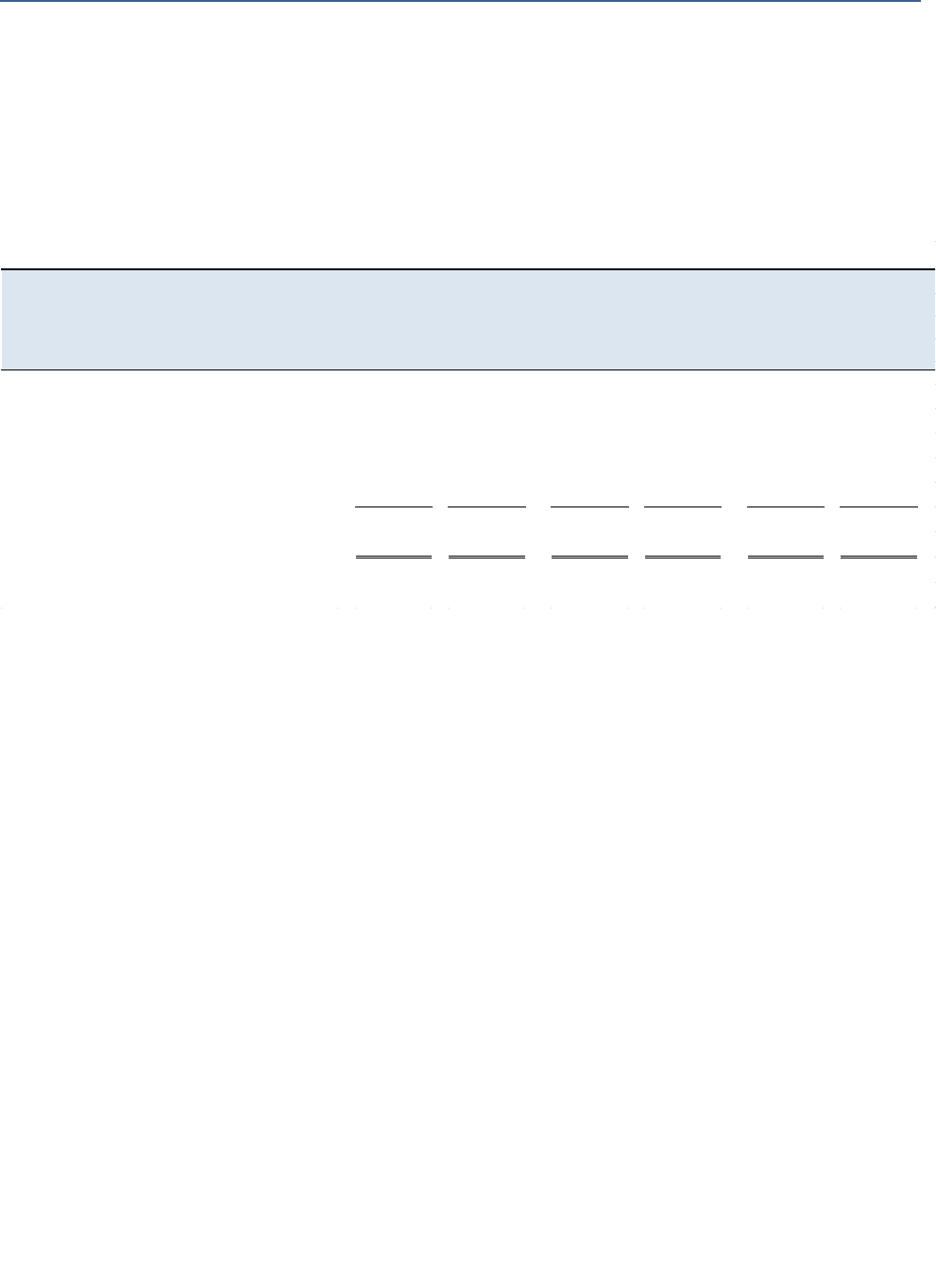

Retirees and Participants

PBGC’s satisfaction score among retirees

remains consistently high. Satisfaction surveys

indicate that retirees receiving monthly

payments from PBGC rated their satisfaction at

87 out of 100.

Pension plan participants who engaged with

PBGC by phone and participated in a survey

provided an overall satisfaction rating of 81 out

of 100. This marks a notable improvement over

the FY 2022 score of 76. In FY 2023, the

increased staffing level of PBGC’s Customer

Contact Center (CCC) reduced wait times and helped to significantly improve the satisfaction score in

comparison to FY 2022.

In FY 2021, PBGC increased the security of its online portal, My Pension Benefit Access (MyPBA), by

instituting a multi-factor authentication sign-on solution sponsored by Login.gov. MyPBA achieved a

satisfaction score of 54 out of 100 in FY 2023. The improvement of this score over the FY 2022 score of 45

was achieved through the implementation of user-friendly navigation and additional support for users facing

challenges in establishing a Login.gov account. PBGC continues to provide constructive feedback to

Login.gov while simultaneously seeking avenues for further improvement of the login experience for

customers.

83

84

84

81

76

76

81

91

89

91

89

88

86

87

70

69

68

65

63

66

60

80

100

2017 2018 2019 2020 2021 2022 2023

American Customer Satisfaction Index

Retiree and Participant Caller Satisfaction

PBGC Participant Callers PBGC Retirees

Federal Government Aggregate

80 = Threshold of Excellence

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

10

F Y 2 0 2 3 | A N N U A L R E P O R T

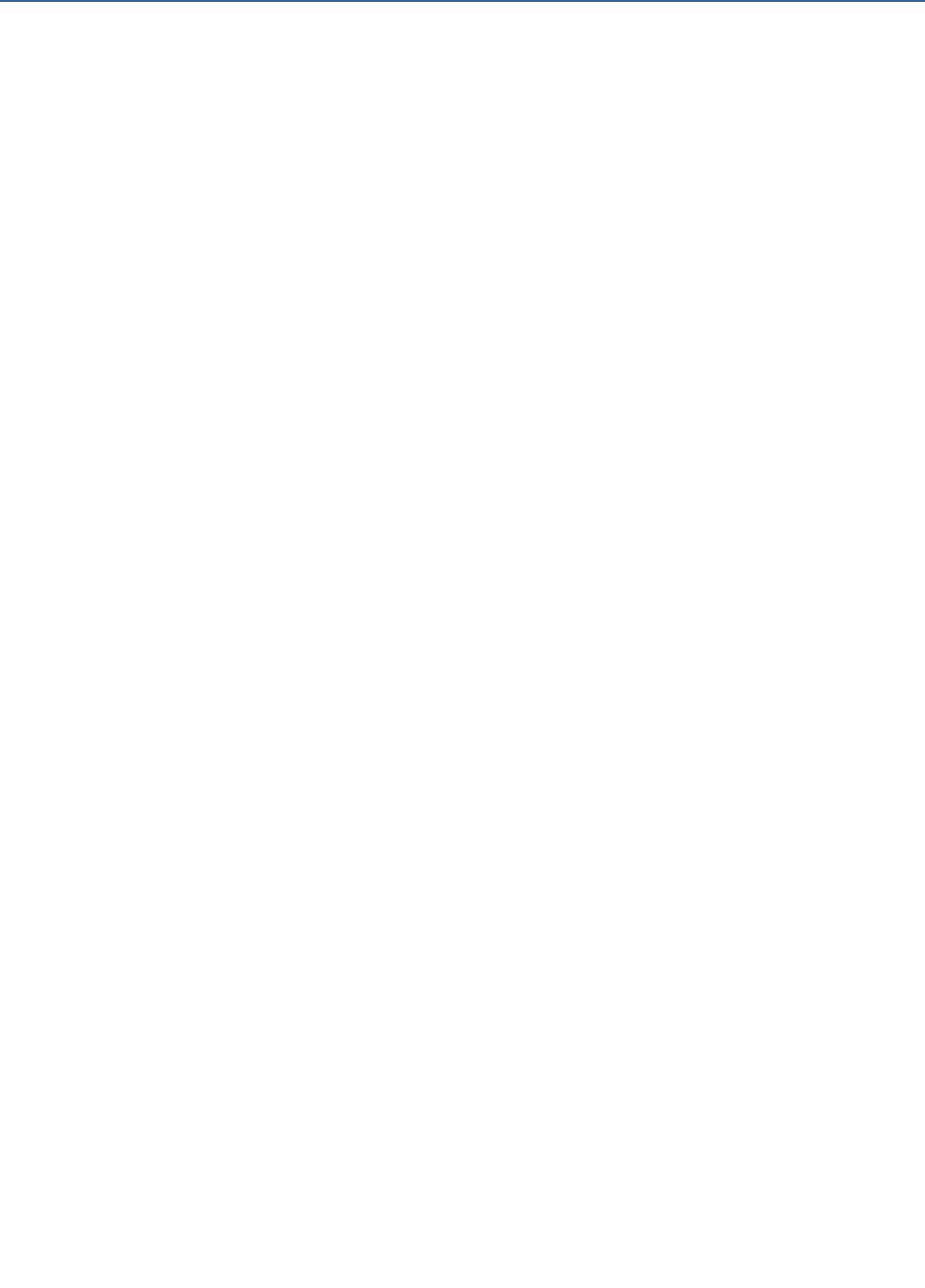

Premium Filers

Pension plan sponsors and their practitioners who

file premiums with PBGC gave a FY 2023 annual

premium filer satisfaction score of 77 out of 100

(same as last year), exceeding the target of 74. This

score compared very well to similar functions, such

as Internal Revenue Service small-business and self-

employed tax filers (65) and large-business and

international tax filers (62). Filers gave excellent

scores to PBGC’s personal service, written

communication, and filing process.

My Plan Administration Account (My PAA) is an online application for pension plan practitioners to file

premium information and payments with PBGC. The FY 2023 satisfaction score was 69 out of 100 (down

three from last year). This score is below the target of 78. Based on My PAA online survey responses, the

lower score is due primarily to practitioners continued challenges with the updated My PAA system, especially

for infrequent users who use the system once a year.

In FY 2023, PBGC continued to implement new system enhancements to My PAA for the practitioner

community. The Corporation made these enhancements to improve the user experience and better align My

PAA with information technology industry standards and security upgrades.

ENGAGING WITH CUSTOMERS AND STAKEHOLDERS

PBGC regularly communicates with customers about ongoing activities and news updates. The Corporation

uses several communication tools, including PBGC.gov and email notifications to reach its various audiences.

As part of the Corporation’s ongoing SFA Program efforts, PBGC continuously published new and updated

SFA content on PBGC.gov. In FY 2023, there were nearly 55,000 visits to the Corporation’s SFA page.

PBGC also published more than 60 SFA-related news releases regarding program activities and plan

application approvals. Additionally, the Corporation hosted a webinar on the SFA application filing process

for non-priority groups.

PBGC also responded to numerous inquiries from members of Congress — many writing on behalf of their

constituents — and various stakeholders.

SUSTAINING THE PROGRAMS

PBGC serves as a source of information about pension and retirement policy. The Corporation implements

strategies to strengthen its programs’ financial health and continues to successfully manage risks by actively

monitoring and reporting on its insurance programs and other relevant information.

Research and Analysis Activities

The Corporation regularly produces analyses and reports on its programs and policy alternatives to its Board

of Directors, policymakers, and external stakeholders, including the public. The Pension Insurance Data

77

76

74

76

77 77 77

64

66

6

67

65

63

61

60 60

64

62

60

40

60

80

100

2017 2018 2019 2020 2021 2022 2023

American Customer Satisfaction Index

Premium Filer Satisfaction

PBGC Premium Filers IRS Small Bus. & Self-Emp. Filers

IRS Large Bus. & Int'l Filers

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

11

F Y 2 0 2 3 | A N N U A L R E P O R T

Table — a collection of data on PBGC and its insurance programs — is published annually. The Data Table

includes multiyear data and statistics about the broader private defined benefit pension system.

PBGC’s Projections Report is an annual actuarial evaluation of its future operations and financial status. The

report provides 10-year projections of the financial status of both insurance programs under a range of future

financial scenarios.

Improvements to the Pension Insurance Modeling System and Related Reports

PBGC’s primary forecasting model is the Pension Insurance Modeling System (PIMS). The model is

periodically evaluated through a congressionally mandated peer review by outside experts, required under the

Moving Ahead for Progress in the 21st Century Act (MAP-21). In FY 2023, PBGC initiated a comprehensive

Model Risk Management and governance review of its PIMS forecasting models in an effort to assess and

support its model-related goals of conceptual soundness, operational validity, efficacy in functionality and

performance, transparency and sufficiency in documentation, and effectiveness in model governance.

The peer reviews provide recommendations to improve the data assumptions and modeling methodology

used to produce the PIMS projections. PBGC uses these reviews to improve PIMS. The Corporation also

uses PIMS to generate results reported in its annual Projections Report and the budget process, to illustrate

the effects of proposed changes to pension law, and to provide other technical assistance to policymakers.

PBGC has undertaken a multiyear effort to improve the speed and performance of PIMS.

Enterprise Risk Management

During FY 2023, the Corporation continued to maintain its risk management framework and conducted its

annual agency-wide risk assessment, in accordance with Office of Management and Budget (OMB) Circular

A-123. As a part of the effort, PBGC assessed entity-specific known and anticipated risks, uncertainties,

future events/conditions, and trends that could significantly affect the agency’s future financial or operating

performance and developed mitigating strategies to address the challenges. This process was in-line with the

requirements of OMB Circular A-136.

One of the Corporation’s recently identified top entity-wide risks related to the rapid pace and magnitude of

change across the government and at PBGC, was precipitated by the relocation of PBGC’s headquarters.

Additional top risks were associated with the SFA Program, recruiting and retaining staff, technology

modernization, and continuing trends away from defined benefit plans. Program offices throughout PBGC

worked to review, mitigate, and continuously monitor these risks.

The results of the annual risk assessment found that the Multiemployer Program insolvency and operational

planning uncertainty risk were reduced. Additionally, the Government Accountability Office (GAO) removed

the high-risk designation for PBGC’s insurance programs.

Regulatory and other Guidance Activities

In FY 2023, PBGC issued regulations and other guidance under the SFA Program. PBGC published a final

rule, effective on January 26, 2023, that amended the SFA regulation to provide an exception process for the

withdrawal liability conditions imposed on plans that receive SFA. PBGC also released on July 19, 2023,

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

12

F Y 2 0 2 3 | A N N U A L R E P O R T

questions and answers that provide guidance on the investment of SFA funds and calculation methodology

under the withdrawal liability phase-in condition, and on July 27, 2023, updated the SFA instructions.

PBGC continued to develop other rulemakings and guidance to protect plan participants and minimize

burdens on pension plans and plan sponsors.

PBGC published a proposed rule on October 14, 2022, that would prescribe actuarial assumptions under

section 4213(a)(2) of ERISA that may be used by a multiemployer plan actuary in determining a participating

employer’s withdrawal liability. The comment period closed on December 13, 2022, and PBGC plans to

publish a final rule that responds to public comments received on the proposed rule.

PBGC published a final rule on July 11, 2023, to increase transparency of PBGC benefits administration for

terminated single-employer pension plans that PBGC trustees. The final rule, which became effective on

August 10, 2023, makes clarifications and codifies policies involving benefit payments and valuation of plan

assets.

On August 7, 2023, PBGC issued Technical Update 23-1, a one-time waiver of the 4010-filing requirement

(annual financial and actuarial information reporting requirements under section 4010 of ERISA and 29 CFR

part 4010 of PBGC’s regulations). The waiver of the reporting requirement for filers meeting specified criteria

recognizes the atypical market conditions of late 2022 and early 2023 and the way those conditions impacted

plan assets and liabilities for purposes of determining whether a 4010 filing is required. This is a one-time

waiver of the reporting requirement for filers meeting specified criteria.

Lastly, PBGC published a proposed rule on August 18, 2023, which would amend its regulation on Allocation

of Assets in Single-Employer Plans to update the interest, mortality, and expense assumptions used to

determine the present value of benefits for a single-employer pension plan ending in a distress or involuntary

termination. The assumptions are also used for certain multiemployer withdrawal liability calculations and for

other purposes. The rulemaking included a 60-day public comment period that closed on October 17, 2023.

STRENGTHENING A DIVERSE WORKFORCE AND LEADERSHIP

PBGC continues to be committed to maintaining a diverse and inclusive workplace that ensures alignment

with strategic goals and outcomes. In FY 2023, the Corporation continued to focus on strengthening

employee performance, increasing leadership engagement, expanding health and wellness programs, and

continuing efforts to recruit and retain disabled veterans.

Federal Employee Viewpoint Survey

The 2022 FEVS was administered May 30, 2022, through July 15, 2022. The agency’s response rate was 70

percent, up from 66 percent of employees who completed the survey in 2021. The results not only show how

PBGC employees rate employee engagement; global satisfaction; and diversity, equity, inclusion, and

accessibility (DEIA); but that PBGC ranked number one in each index for small agencies and government

wide. PBGC’s employee engagement index score, which measures areas including employee development,

was 86 percent. The score for this index increased from previous years. The agency’s global satisfaction index

score, which measures employee satisfaction with jobs, pay, organization, and if they would recommend

PBGC as a good place to work, was 83 percent, which also increased from the previous year. The agency’s

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

13

F Y 2 0 2 3 | A N N U A L R E P O R T

DEIA index score was 86 percent. As a result of the high index scores, PBGC ranked as Top Agency among

small agencies in these categories.

As a result of the FEVS scores, PBGC ranked number two in the small agency category for Best Places to

Work in the Federal Government for 2022.

Additionally, PBGC had three business units that ranked in the top 10 subcomponent category out of 432

agency subcomponents:

• The Office of Negotiations & Restructuring ranked number 1.

• The Office of Benefits Administration ranked number 7.

• The Office of Information Technology ranked number 8.

Recruitment and Outreach

As a result of ARP, PBGC continues to expeditiously hire highly skilled employees. The Corporation

successfully filled almost 90 percent of the positions. These new positions support the maintenance of the

SFA Program, ensuring that retirees in multiemployer plans that receive SFA continue to receive their full

plan benefit payments.

PBGC’s recruitment efforts include participating in the Office of Personnel Management’s (OPM) efforts to

improve the Pathways Internship Program. As a result, PBGC has enhanced the experience for interns that

will promote growth within the Corporation, leading to an increased number of interns filling permanent

federal positions. Additionally, the Corporation’s Disabled Veterans Affirmative Action Program (DVAAP)

participated in the virtual U.S. Department of Veterans Affairs Job Fair.

PBGC has a robust Workplace Flexibilities Program. In 2023, the Corporation continued increasing its focus

on employee services and benefits, and expanding wellness activities to include stress, mental health,

childcare, and caregiver tools.

Diversity, Equity, Inclusion, and Accessibility

In FY 2023, the Corporation submitted updates to OMB, OPM, and the Domestic Policy Council (DPC) for

the Action Plan for Advancing Racial Equity and Support for Underserved Communities.

The Corporation continued publishing bi-monthly editions of the “Diversity, Equity, Inclusion and

Accessibility (DEIA) Digest” to managers and supervisors, with articles highlighting best practices,

knowledge of what other agencies are doing, and videos to reinforce DEIA principles and upcoming cultural

events.

PBGC delivered 13 DEIA awareness and cultural events.

PBGC conducted a series of listening sessions with the DEIA Council members to gather ideas and

information for FY 2024 agency-wide DEIA activities and initiatives. The DEIA Council along with

leadership explored ways of “Viewing Diversity Through Various Lenses” to educate and connect the

workforce with DEIA. This included two days of enriching videos, facilitating discussions, and engaging

dialogues.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

14

F Y 2 0 2 3 | A N N U A L R E P O R T

PBGC offered 33 DEIA trainings.

To attract a diverse applicant pool, PBGC conducted outreach with organizations serving underrepresented

populations, such as Historically Black Colleges and Universities and professional associations. To recruit a

workforce representing the Nation’s diversity, PBGC continues to attend minority serving events, internship

career fairs, and Veterans career fairs to market federal employment opportunities.

Performance Management

PBGC is a performance-based organization. The Corporation’s Performance Management Program is

focused on more than just the end of year appraisal. PBGC prides itself on translating goals into results, and

creating an environment that sustains a healthy and effective results-oriented culture. It all starts with a solid

performance plan which is the foundation of a rigorous performance management program. In FY 2023,

PBGC reviewed 100 percent of its departments performance plans and provided feedback to managers on

plans needing improvements. Additionally, training modules were developed for both employees and

managers on performance management to aid in ensuring the employees were educated and well informed on

performance matters.

Management and Leadership Development

The Corporation continued its commitment to training and developing its workforce to ensure employees

were prepared for the rapid changes in technology and policy. In FY 2023, PBGC’s Management &

Leadership (M&L) Development Program designed and offered four major learning events that focused on

preparing PBGC leadership for leading hybrid teams, addressing the challenges posed by the future of work,

and building trust and promoting collaboration in a remote work environment. The Leadership/Executive

Coaching Program continues to be popular and highly successful.

Equal Employment Opportunity

The Office of Equal Employment Opportunity (OEEO) is responsible for providing leadership in the

development, implementation, and evaluation of the Equal Employment Opportunity (EEO) programs and

services within PBGC. The office provides technical guidance, advice, and equal opportunity support services

to PBGC employees and job applicants, regarding the federal government's equal opportunity program.

OEEO continues to build a Model EEO Program.

The Corporation met its annual requirements to conduct barrier analysis in an effort to identify and mitigate

barriers to equal employment opportunity and to develop programs that support equal employment

opportunity.

The Affirmative Employment Program (AEP) sponsored by the OEEO continued to promote equal

employment opportunity by identifying discriminatory employment policies, practices, and procedures that

impede equal employment opportunity for all workforce demographics.

The AEP Team presented numerous PBGC-wide events and activities that support equal employment

opportunity, including the innovative YOUniversity, a Bias Awareness Program administered by OEEO.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

15

F Y 2 0 2 3 | A N N U A L R E P O R T

SA F EGUARDING CU ST O M ER S’ INTERESTS

Participant and Plan Sponsor Advocate

The PBGC Participant and Plan Sponsor Advocate (the Advocate), selected by PBGC’s Board of Directors

(the Board) and responsible to the Board and Congress, acts as a liaison among PBGC, sponsors of insured

defined benefit plans, and participants in PBGC-trusteed plans. The duties of the Office of the Advocate

include advocating for the full attainment of the rights of participants in trusteed plans, as well as assisting

participants and plan sponsors in resolving disputes with the Corporation. The Advocate also identifies areas

where participants and plan sponsors have problems dealing with PBGC and may propose changes in

PBGC’s administrative practices and recommend legislative changes to mitigate problems.

The Advocate submitted the statutorily required annual report to PBGC’s congressional committees of

jurisdiction, the Board, and PBGC’s Director on December 31, 2022. The report noted that PBGC had made

many changes and improvements over the years in response to the Advocate’s recommendations and

observations, yet certain systemic issues persist, presenting themselves in different forms through various

participant and plan sponsor assistance requests. Additionally, the report noted that the Corporation needs to

understand internal inefficiencies and how interdepartmental coordination can be maximized. The report also

noted that understanding this will enhance the Corporation’s ability to review PBGC’s critical processes and

procedures to ensure that participant and plan sponsor cases are resolved in a timely and transparent manner,

particularly when a matter involves multiple departments within the Agency. The report also indicated that

PBGC has done good work in implementing its SFA Program.

Strengthening E-Government and Information Technology

PBGC’s Office of Information Technology (OIT) published the FY 2022-2026 PBGC IT Strategic Plan.

Driven by evidence and data, the plan aligns with PBGC’s strategic vision and goals, and reflects IT support

for PBGC’s business units short and long-term plans. As described in the plan, OIT focusses on strategic

thinking, collaborative business partnerships, and innovative IT solutions that support the PBGC’s mission.

Partnering with the Workplace Solutions Department (WSD), OIT played a pivotal role supporting the

PBGC’s Return to Office initiative at the new Portals II headquarters in FY 2023. From entering the building,

to workspace arrival, to circulating and navigating around the building, OIT and WSD organized the

headquarters environment to welcome returning workforce and to mitigate and manage risks. For example,

OIT and WSD released episodes of the Portals II headquarters animated mini-series that provided employees

and contractors with workplace protocols to include workspace direction, navigating Portals II security, and

geographically familiarizing PBGC workforce with the new internal and external environment.

Further demonstrating partnerships and adaptation to flexible work strategies, OIT and the Office of

Management and Administration collaboratively developed a customized Reservation Onsite Workspace

system for PBGC workspace reservation management. The solution supports the Corporation’s telework

strategy through enabling as-needed workspace reservations.

Ensuring all pertinent IT systems were functioning properly, OIT adapted the IT infrastructure to facilitate

the transition to Portals II headquarters, to include relocating technology and infrastructure and modernizing

the IT in workspaces, conference rooms, and common areas.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

16

F Y 2 0 2 3 | A N N U A L R E P O R T

OIT bolstered its modernization efforts by successfully completing Phase 3 of the Benefit Calculation and

Valuation (BCV) project. Modernizing BCV improved participants customer service, enhanced application

security, and optimized PBGC internal operation efficiencies. Additionally, significant progress was made

with IT Modernizations such as Case/Legal Management System, BCV Phase 4 which included online benefit

estimates capability for select participants, and replacing U.S. Environmental Protection Agency’s

FOIAOnline system with a new solution which are scheduled to go live by year end. Continued progress is

being made with the Transformational Pension Insurance Modeling System and Acquisition Management

System modernizations. Detailed modernization data are available at IT Modernization Projects on

PBGC.gov.

PBGC’s Chief Data Officer (CDO) and the Data Governance Board (DGB) continued to implement the

Foundations for Evidence Based Policymaking Act. To improve the Corporation’s ability to leverage data as a

strategic asset and account for data assets across the Corporation, the CDO and DGB developed

a comprehensive data inventory (CDI). The CDI supports the Corporation’s data maturation efforts through

unifying agency data and enabling opportunities for traditional and emerging analytical methods.

OIT completed all quarterly and annual OMB FY 2023 Annual Federal Information Security Modernization

Act (FISMA) Reports. Notably, for the third consecutive year, PBGC obtained an overall Office of Inspector

General (OIG) FISMA rating of “Effective/Managed-Risk” for its information security program.

Ensuring Ethical Practices

In FY 2023, PBGC continued to ensure that all employees received initial ethics training within 90 days of

their date of hire and that separating employees had the opportunity to meet with an ethics counselor to

discuss the rules on post-employment activities. All public financial-disclosure filers and other designated

employees received annual ethics training during the fiscal year. PBGC’s ethics team continued its “Ethics in

Brief” email notices to all PBGC employees on ethics issues arising out of holiday activities and provided

informational guidance regarding the Hatch Act.

Protecting Privacy Interests

PBGC’s Privacy Program implements the requirements that all federal agencies must meet under the Privacy

Act, which governs the collection, maintenance, use, and dissemination of information about individuals that

is maintained in systems of records by federal agencies. PBGC’s Privacy Program protects the personally

identifiable information (PII) it maintains on participants, beneficiaries, employees, and contractors by

educating its workforce on the applicable laws and regulations, implementing various controls, and limiting

the amount of PII collected and maintained.

As the primary means of achieving this goal in FY 2023, the Privacy Office continued embedding privacy

experts within various integrated project teams related to ongoing and new technology modernizations, data

migrations, and commercial software/technology procurements. The Privacy Office has partnered with the

OIT in assessing emerging technologies such as generative artificial intelligence products for use at PBGC.

The Privacy Office also established a new Privacy Common Control baseline that is aligned with the recent

update to the NIST 800-53 Rev 5, “Assessing Security and Privacy Controls for Information Systems and

Organizations.” Additionally, the Privacy Office continued its partnership with PBGC’s Enterprise

Cybersecurity Department which strengthens the relationship between security and privacy by ensuring the

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

17

F Y 2 0 2 3 | A N N U A L R E P O R T

right controls are working and effective. Going forward, the Privacy Office will prioritize privacy-related

performance measures and technology-enabled strategies and develop more specific metrics and performance

measures.

Strengthening Transparency & Disclosure

PBGC continued its commitment to transparency and accountability by ensuring agency-wide compliance

with the Freedom of Information Act (FOIA). In FY 2023, PBGC received 2,682 and processed more than

2,643 requests while maintaining a median processing time of 17 working days, three days under the statutory

time-limit. The Disclosure Division continued a 10-year history of ending the fiscal year with zero backlogged

requests or appeals; less than 0.01 percent of requests were appealed and no initial disclosure determinations

were completely overturned. The division conducted 45 virtual training sessions to promote efficiency and

accuracy, and co-created corporate-wide outreach and awareness, achieving cultural compliance with FOIA.

The Disclosure Division was recognized by the Department of Justice, which awarded the Disclosure

Division the 2023 Exceptional Service Award in appreciation of exemplary performance by a team of agency

professionals in helping to carry out the agency’s administration of FOIA, while receiving a score of 100

percent from DOJ for compliance.

The Disclosure Division continued to focus on citizen-centered service by maximizing the use of technology

and human capital management to maintain agency transparency. The Disclosure Division continued to

support the SFA Program’s transparency efforts by conducting commercial, financial, and PII reviews of 103

SFA applications prior to publishing the applications to PBGC.gov.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

18

F Y 2 0 2 3 | A N N U A L R E P O R T

INDEPENDENT EVALUATION OF PBGC PROGRAMS

PBGC programs are regularly subject to independent evaluations that help the Corporation remain true to its

mission and accountable for services provided to the public. To maintain high standards of stewardship and

accountability, PBGC continues to strengthen controls over operations and compliance with laws and

regulations.

Office of Inspector General

PBGC places a strong emphasis on diligently addressing the OIG’s audit recommendations. To facilitate

timely completion and closure of such recommendations, regular status reports are issued to executive

management to assist in monitoring corrective actions. Once work on recommendations is completed, the

Corporation provides evidence documenting the corrective actions taken for the OIG review.

PBGC is committed to addressing the OIG recommendations in a timely manner. During FY 2023, PBGC

closed 34 audit recommendations. Also, during FY 2023, PBGC received 33 new audit recommendations,

resulting in 34 open at the end of FY 2023.

PBGC’s OIG oversaw the annual financial statement audit completed by independent public accounting firm,

Ernst & Young LLP. In addition, during FY 2023, the OIG performed other audits and evaluations,

including the following:

• Audit of the Pension Benefit Guaranty Corporation’s Fiscal Year 2022 and 2021 Financial

Statements (AUD-2023-02), issued November 15, 2022. In this report, the OIG stated this is the 30th

consecutive unmodified financial statement audit opinion.

• Evaluation of Hotline Compliances Regarding a PBGC Contract (EVAL-2023-04), issued

November 22, 2022. The OIG received two hotline complaints that alleged fraud regarding a PBGC

Contract. The OIG determined the fraud allegations in the complaints were unsubstantiated. However,

the OIG found two concerns related to PBGC’s oversight of the labor-hour contacts that warrant

management action. Specifically, a contracting officer’s representative (COR) approved invoices without

verifying supporting documentation. As a result of the lack of adequate COR oversight, the labor hours

charged to the two task orders and paid by PBGC may not be accurate. The OIG made two

recommendations to the Corporation. Corrective actions to address one of the recommendations has

been completed and submitted to the OIG for review and the corrective actions are ongoing for the

remaining recommendation.

• PBGC Should Exclude Deceased Terminated Vested Participants from SFA Calculations

(EVAL-2023-05), issued March 22, 2023. PBGC continues to strengthen its internal controls, policies,

and procedures, to maintain high standards of stewardship, accountability, and integrity within its

programs. Furthermore, PBGC has revised its guidance and application instructions to strengthen the

Special Financial Assistance (SFA) Program. The OIG made six recommendations to the Corporation,

three of which are closed. Corrective actions for two of the recommendations have been submitted to the

OIG for review and corrective actions are ongoing for the remaining recommendation.

• PBGC Should Improve Its Special Financial Assistance Review Procedures (EVAL-2023-08),

issued February 24, 2023. Since the OIG’s review, PBGC completed its risk assessment of the SFA

Program and refined its SFA application review procedures. The OIG made eight recommendations to

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

19

F Y 2 0 2 3 | A N N U A L R E P O R T

the Corporation, four of which are closed. Corrective actions for the four remaining recommendations

have been submitted to the OIG for review.

• Evaluation of PBGC’s Fiscal Year 2022 Compliance with the Payment Integrity Information Act

of 2019 (EVAL-2023-09), issued May 18, 2023. As required by the Payment Integrity Information Act

of 2019 (PIIA), the OIG reviewed PBGC’s compliance with improper payment reporting requirements.

For FY 2022, the OIG determined that PBGC complied with the applicable PIIA requirements outlined

in M-21-19, Transmittal of Appendix C to OMB Circular A-123, Requirements for Payment Integrity

Improvement, dated March 5, 2021. However, PBGC did not include a hyperlink to

PaymentAccuracy.gov in the Annual Financial Report for access to the accompanying materials. The

OIG made one recommendation and corrective actions are ongoing.

• Audit of PBGC’s Review of Initial Special Financial Assistance Applications (AUD-2023-11),

issued June 30, 2023. OIG assessed whether PBGC adequately reviewed applications for SFA prior to

approving them. For the three applications reviewed, OIG found that PBGC had many procedures in

place to review SFA applications, including eligibility checks, completeness checks, actuarial and business

assumption reviews, actuarial calculation reviews, legal reviews of plan amendments, and reviews by

upper management. Upon examining application files in PBGC’s TeamConnect system, OIG verified all

three plans in its sample submitted documentation required by PBGC. OIG also verified PBGC

performed its eligibility checks, completeness checks, and legal reviews of plan amendments, and

documented these steps in the concurrence packages. Finally, OIG confirmed that each of the three

plans was eligible for SFA. However, OIG found the following areas for PBGC to improve in its review

of SFA applications. First, PBGC should better document its analysis of potential application issues and

management concurrence regarding the resolution of those issues to better ensure management

oversight. Second, to improve PBGC’s ability to detect discrepancies in plan calculations for suspended

benefits and a plan’s reported Contribution Base Unit (CBU) history, the Corporation should develop

and implement additional controls to assess plan calculations for previously suspended benefits and a

plan’s reported CBU history. The OIG made three recommendations and corrective actions are ongoing.

For more information about the OIG’s work in promoting accountability in PBGC operations, visit

oig.pbgc.gov.

Government Accountability Office (GAO)

In its April 2023 High-Risk Series Report, GAO removed the insurance programs from the High-Risk List.

In that Report, GAO noted that while currently financially healthy, the Single-Employer Program will

continue to face potentially substantial financial risks and that PBGC’s experience shows that the financial

position of the program can change quickly and precipitously. Similarly, GAO noted that although SFA

significantly extended the life of the Multiemployer Program, the Multiemployer Program still faces

fundamental financial risks, such as inadequate plan funding, premiums that do not fully cover the cost of

insurance, and uncertainty regarding future investment returns. GAO stated that it will continue to monitor

the insurance programs’ finances and other issues. PBGC also monitors progress in addressing GAO

recommendations. As of September 30, 2023, PBGC had no open GAO recommendations. For more

information about GAO’s work on pensions and retirement security issues, visit GAO.gov.

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

20

F Y 2 0 2 3 | A N N U A L R E P O R T

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

21

F Y 2 0 2 3 | A N N U A L R E P O R T

FI NANC ES

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

22

F Y 2 0 23 | A N N U A L R E P O R T

P E N S I O N B E N E F I T G U A R A N T Y C O R P O R A T I O N

23

F Y 2 0 23 | A N N U A L R E P O R T

FISCAL YEAR 2023 FINANCIAL STATEMENT HIGHLIGHTS

The Pension Benefit Guaranty Corporation (PBGC or the Corporation or the agency) is a federal corporation

established under the Employee Retirement Income Security Act (ERISA) of 1974, as amended. It guarantees

payment of basic pension benefits earned by over 31 million of America’s workers and retirees participating

in more than 24,500 private-sector defined benefit pension plans. In accordance with the American Rescue

Plan (ARP) Act of 2021, the Corporation received appropriations from the U.S. Treasury General Fund to

help severely underfunded multiemployer plans that meet ARP’s eligibility criteria. This new funding assisted

in remedying the Multiemployer Program’s deficit in FY 2021 by reducing the future amount needed for

traditional financial assistance. The Multiemployer Program’s deficit would have remained significant through

FY 2023 if not for the favorable impact of the ARP which resulted in the program achieving a surplus in each

fiscal year since enactment. PBGC receives no funds from general tax revenues for its Single-Employer

Program or the traditional multiemployer financial assistance program. Operations are financed by insurance

premiums set by statute and paid by sponsors of defined benefit plans, investment income, assets from

pension plans trusteed by PBGC, and recoveries from the companies formerly responsible for the plans.

FINANCIAL POSITION

PBGC’s Memorandum Total

Financial Position

PBGC includes Memorandum Totals for its two independent insurance programs solely for an entity-wide

informational view of its financial statements. Most importantly, under Section 4005(g) of ERISA, the Single-

Employer and Multiemployer Programs are separate by law; and, therefore, PBGC is required to report the

financial results of operations separately.

PBGC’s Memorandum Total cumulative results of operations increased by $8,439 million, resulting in the

Corporation’s Memorandum Total cumulative results of operations of $46,068 million as of September 30,

2023, from a balance of $37,629 million as of September 30, 2022. The increase in the Memorandum Total

cumulative results of operations is due to $45,925 million in contributed transfer appropriation income,