Driving investment, trade and the creation

of wealth across Asia, Africa and the Middle East

29th Annual General Meeting

Annual Report 2014-2015

About us

Standard Chartered Bank Nepal Limited has been

in operation in Nepal since 1987 when it was initially

registered as a joint-venture operation. Today the Bank

is an integral part of Standard Chartered Group having

an ownership of 75% in the company with 25% shares

owned by the Nepalese public. The Bank enjoys the

status of the largest international bank currently operating

in Nepal.

We are a leading international banking group, with more

than 84,000 employees and a 150-year history in some of

the world’s most dynamic markets. We bank the people

and companies driving investment, trade and the creation of

wealth across Asia, Africa and the Middle East. Our heritage

and values are expressed in our brand promise, Here for

good.

Standard Chartered PLC is listed on the London and Hong

Kong Stock Exchanges as well as the Bombay and National

Stock Exchanges in India.

With 15 points of representation, 23 ATMs across the

country and more than 430 local staff, Standard Chartered

Bank Nepal Ltd. is serving its clients and customers through

an extensive domestic network. In addition, the global

network of Standard Chartered Group enables the Bank to

provide truly international banking services in Nepal.

Standard Chartered Bank Nepal Limited offers a full

range of banking products and services to a wide range

of clients and customers representing individuals, mid-

market local corporates, multinationals, large public sector

companies, government corporations, airlines, hotels as well

as the Development Organisation segment comprising of

embassies, aid agencies, NGOs and INGOs.

The Bank has been the pioneer in introducing ‘client

focused’ products and services and aspires to continue

leadership in introducing new products. It is the first Bank in

Nepal to implement the Anti-Money Laundering policy and

to apply the ‘Know Your Customer’ procedure on all the

customer accounts.

Corporate Social Responsibility is an integral part of

Standard Chartered’s ambition to become the world’s

best international bank and is the mainstay of the Bank’s

values. The Bank believes in delivering shareholder value in

a socially, ethically an environmentally responsible manner.

Standard Chartered throughout its long history has played

an active role in supporting those communities in which

its customers and staff live. It concentrates on projects

that assist children, particularly in the areas of health and

education. The Bank is also actively engaged with the

communities in raising awareness around Financial Literacy.

Subsequent to the devastating earthquake of April and May

2015, the Bank is engaging with its disaster relief partner

Habitat for Humanity in undertaking its rehabilitation and

reconstruction project.

Standard Chartered launched two major initiatives in 2003

under its ‘Believing in Life’ campaign- ‘Positive Living’ and

‘Seeing is Believing’. Various activities and initiatives under

this banner are ongoing in Nepal.

For further information please visit

www.sc.com/np

/StandardCharteredNP

Cover Photo: An evening view of Maitighar-Koteshwor road, Kathmandu.

1

Auditor’s Report 41

Balance Sheet 42

Profit & Loss Account 43

Profit & Loss Appropriation Account 44

Statement of Changes in Equity 45

Cash Flow Statement 46

Schedules 47

Significant Accounting Policies 78

Notes to Accounts 81

Disclosure as per Bank’s disclosure policy 91

Nepal Rastra Bank’s Approval and Directions 96

Five Years Financial Summary 97

Corporate governance

Strategic Report

Company overview

Corporate governance Financial statements and notes

What’s inside this report

Financial statements and notes

Performance Highlights 02

Operational Overview 03

Chairman’s Statement 04

CEO & Director’s Report 10

02-10

16-40

41-97

Our Approach to Corporate Governance 16

Additional Information 26

Board of Directors 28

Management Team 30

Sustainability 32

Our People 38

Standard Chartered Bank Nepal Ltd- Branches 40

2

Standard Chartered Annual Report 2014-2015

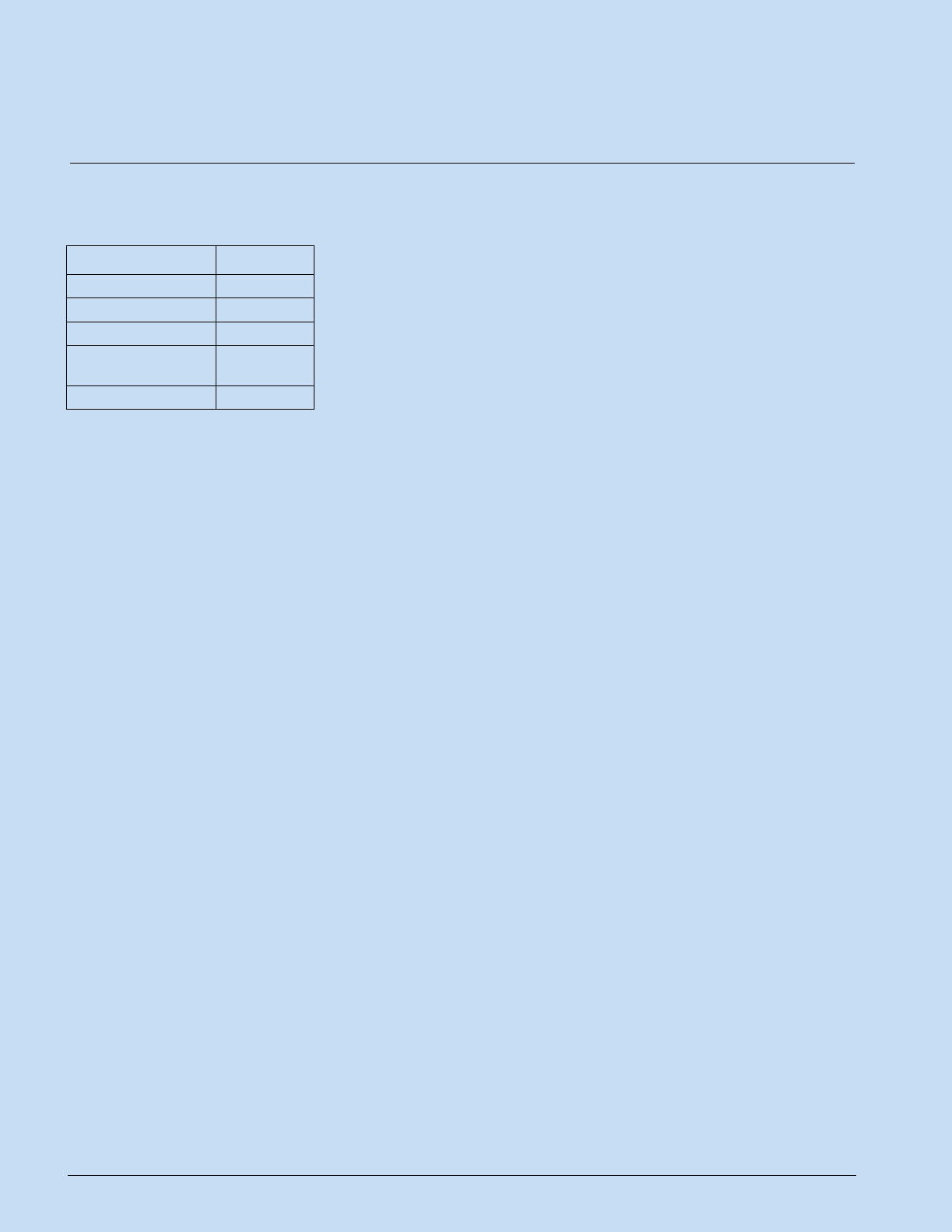

Performance highlights

Executing our refreshed strategy

Total Shareholders Equity

(Rs. Million)

Prot After Tax (Rs. Million)

Earning Per Share (Rs.)

Return on Total Assets (In %)

Market Value Per Share (Rs.)

Net Worth Per Share (Rs.)

3,678

4,122

4,618

5,088

2010/11

2011/12

2012/13

2013/14

5,949

2014/15

1,119

1,169

1,218

1,337

2010/11

2011/12

2012/13

2013/14

1,290

2014/15

69.51

72.60

65.70

65.47

2010/11

2011/12

2012/13

2013/14

57.38

2014/15

228

256

249

249

2010/11

2011/12

2012/13

2013/14

265

2014/15

1,800

1,799

1,820

2,799

2010/11

2011/12

2012/13

2013/14

1,943

2014/15

2.55

2.80

2.67

2.51

2010/11

2011/12

2012/13

2013/14

1.99

2014/15

2

Standard Chartered Annual Report 2014-2015

3

Operational overview

Strong foundation

Standard Chartered has continued to deliver consistent,

diverse and sustained growth while investing to underpin future

momentum and building balance sheet resilience.

Financial highlights

Operating Income

Capital Adequacy

Points of representation

n Stable income and operating

profit despite a scenario of

margin compression

n Broad based and diversified

income growth in both Retail

Banking and Corporate &

Institutional Clients

n Conscious decision to invest to

underpin future growth in both

the Businesses

Operating Profit

Rs.

Rs.

Rs.

Return on equity

Employees

Total Assets

Dividend

Non-financial highlights

Operational highlights

2,928m

13.10%

15

1,827m

21.69%

433

64,927m

44.21%

n Disciplined and proactive

approach to risk management

in Retail Banking and Corporate

& Institutional Clients

n Diverse, liquid, well capitalized

and robust balance sheet

composition

n Strong market capitalization of

~ Rs. 44 Billion reflecting high

shareholder confidence

Company overview

3

4

Standard Chartered Annual Report 2014-2015

Chairman’s statement

Well positioned to drive further value for shareholders

On behalf of the Board of Directors of the Bank, I take this

opportunity to report that Standard Chartered Bank Nepal

has put up a restrained performance during the Financial Year

2014/15. The year proved challenging primarily because of

persistently low interest rates, surplus liquidity, low volatility,

some regulatory implications and, towards the end of the

financial year, devastating earthquake leading to change in

market dynamics. It was a challenging year, but it was also a

year when we took decisive action to refocus our strategy and

to reposition the Bank for the future.

In our assessment, FY 2014/15 remained satisfactory from the

socio-political perspective; a sense of urgency was seen for

accelerating the growth momentum. Under the circumstances,

your Bank invested cautiously in enriching product suite and

services; the focus was also made in enhancing skills of our

people. The Bank continued to stick to the basics of good

banking and followed its strategy to grow and deepen long-

term relationships with its clients and customers.

As we see it, the Bank is fully positioned to take advantage of

the opportunities in our markets. We remain optimistic about

our future and our ability to perform and grow. Our strengths

lie in our uniqueness and networking capability; our worldwide

presence provides efficiency in enabling trade and investment

around the globe. We continue to fulfil our social purpose of

driving Nepal’s economic growth by assisting our clients and

customers in many ways.

We are acutely aware of the impact of our performance on you.

We remain focused on the interest of shareholders and other

stakeholders. Our priority has been to maintain well capitalised,

highly liquid and diverse balance sheet; this will continue. Our

focus also remains in delivering profitable, sustainable growth

within our risk appetite. We are conscious of our need to tighten

control over costs. All these steps will help us keep our earnings

resilient and the balance sheet, robust.

Our brand promise ‘Here for good’ signifies how we operate

as a bank and conduct our business. It is the essence of what

we are all about; we are there for the long run and remain

by the side of our clients and customers through good and

bad times. We stand for the progress and prosperity of the

community and society around us; we strive to do the right

things in the right manner. Our brand is deeply embedded in

our community and we are making all efforts to remain the best

brand in this market.

5

Results – A Synopsis

Financial Highlights

n Net Profit after tax was down by 3.5 percent to Rs. 1.290

billion compared to Rs. 1.337 billion in the previous year.

n Earnings per share has decreased by Rs. 8.09 to Rs. 57.38

due to increase in number of shares and decrease in profits.

n Risk Assets increased by 6.4 percent to Rs. 28.02 billion

compared to Rs. 26.33 billion last year.

n Deposits increased by 23.7 percent to Rs. 57.29 billion

compared to Rs. 46.30 billion last year.

Bank’s Performance

The Bank has been delivering a reasonable performance year

on year. The Bank has contributed an amount of Rs. 594

million to the Government Exchequer as compared to Rs. 574

million last year on account of corporate tax.

In accordance with the statutory and regulatory requirements,

the Board recommends a transfer of Rs. 24 million to

Exchange Fluctuation Reserve and transfer of Rs. 258 million

into the General Reserve Fund. Further, the Board has

proposed the dividend of 19.21 percent for which Rs 432

million has been appropriated towards dividend. Board has

also proposed to increase the capital by issuing 25 percent

bonus share for which Rs 562 million has been allocated from

current year profit.

Our Tier 1 and Tier 2 Capital Adequacy Ratios were 11.67

percent and 1.43 percent respectively with an overall ratio

of 13.10 percent, post appropriations. Our capital position is

more than adequate to meet our business needs and exceeds

the current Nepal Rastra Bank’s capital adequacy requirement

under the Basel II capital accord and also exceeds the

international norms.

Company overview

In accordance with the statutory

and regulatory requirements,

the Board recommends a

transfer of Rs. 24 million to

Exchange Fluctuation Reserve

and transfer of Rs. 258 million

into the General Reserve Fund.

6

Standard Chartered Annual Report 2014-2015

Economic Environment

Global Scenario

2015 was not an encouraging year for the world economy.

While the lack of momentum in the world economy is likely

to persist in 2016, market sentiment is expected to improve

as markets make efforts to readjust expectations. This should

provide time to regroup and prepare for a potential rebound in

confidence and emerging-market (EM) performance. Global

growth forecast for 2016 is expected to remain at ~2.5 percent.

US growth is expected to decelerate to 1.0 percent in 2016.

Given the current environment, the Federal Reserve is less

likely to hike interest rates again. While acknowledging an

instance of one more rate hike, it can be expected the cycle

to remain shallow. Monetary policy is less likely to boost the

economy, but low rates should buoy market sentiment.

Euro area is expected to grow by 1.4 percent in 2016;

this is likely to prove inadequate as Europe is in prolonged

stagnation. Monetary policy alone so far, has seen to be less

effective to boost sufficient growth. Furthermore, negative

interest rates could increase pressure on European banks.

The Euro area in particular needs fiscal stimulus.

China’s willingness to use fiscal policy to ensure growth above

6.5 percent is significant and positive. Although China does

not face the monetary policy limitations as the West does,

monetary policy alone may not prove to be enough to achieve

the growth target. Analysts believe that two factors viz. the

way China communicates its policy and the other, how China

manages its currency and capital outflows will remain crucial

for international investors.

India’s growth forecast for FY 2016/17 is expected to remain

at 7.4 percent reflecting a weaker external sector outlook and

persistent domestic headwinds. While India is a domestically

oriented economy, it is not immune to a global slowdown,

particularly one led by the US and the EU. These economies

together account for about 35% of India’s merchandise

exports, 80% of its services exports and 40% of inward

remittance flows.

Given the expectations on the US and China, it is expected

that the market sentiment and confidence will improve in

2016, particularly for emerging markets – even with a flat

global growth.

Nepal

The GDP growth remained lower in 2014/15 compared to

the previous year because of the contraction in the growth

rate of agriculture sector due to delayed monsoon and the

negative impact of the April 25 earthquake and subsequent

aftershocks. According to the preliminary estimates of the

Central Bureau of Statistics, the real GDP grew by 3.0 percent

at basic price and 3.4 percent at producers’ price in the

review year. Such growth rates were 5.1 percent and 5.4

percent respectively in the previous year.

According to the Post Disaster Needs Assessment (PDNA)

report published by the National Planning Commission, the

earthquake has made a total loss of about Rs. 706 billion to

the overall economy. The destruction of the earthquake is

estimated to be 57.8 percent in the social sector, 25.2 percent

in the manufacturing sector, 9.5 percent in the infrastructure

sector and 7.5 percent in the cross cutting issues. The total

destruction of the earthquake is accounted one third of the

real GDP of financial year 2014/15. The destruction made

a loss of Rs. 36.0 billion in the GDP resulting to around 1.6

percent shrinkage in the overall economy.

The balance of payment recorded a surplus of Rs. 144.85

billion in 2014/15 compared to surplus of Rs. 127.13 billion

in the previous year. Export decreased by 7.3% in 2014/15

which had increased by 19.6% the previous year. This is

due to lack of enhancement in productive capacity and the

development of relevant infrastructures. Imports increased by

8.4% in 2014/15, against an increase of 28.3% recorded for

the previous year. The growth in imports remained low mainly

due to the decline in the price of petroleum products as well

as the slowdown in imports of gold, betel-nut, coal, crude

soya bean oil, among others.

The trade deficit as at mid July 2014/15 increased by 10.8

percent compared to a rise of 29.7 percent recorded during

the same period previous year. Due to the rise seen in growth

of imports and a corresponding fall in exports, the ratio of

export to import declined to 11.0 percent during the review

period as compared to 12.9 percent recorded for the same

period previous year.

The current account posted a surplus of USD 1.07 billion as

on mid July 2014/15, compared to a surplus of USD 0.91

billion posted in the previous year. The increase in surplus

in the current account was primarily due to low growth of

goods imports, increase in remittance inflows and grants,

6

Standard Chartered Annual Report 2014-2015

Chairman’s statement

7

among others. Remittance inflows in Nepal during this period

increased by 13.6 percent to USD 6.19 billion as compared to

a growth of 25.0 percent recorded during the previous year.

The Gross foreign exchange reserves grew by 17.4 percent

to USD 8.15 billion as at mid July 2014/15. On the basis of

existing trend of imports, current level of reserves is sufficient

for financing merchandise imports of 13.0 months and

merchandise and service imports of 11.2 months.

As on mid July 2014/15, the wholesale price index increased

by 6.1 percent as against an increase of 8.3 percent recorded

during the same period previous year. Similarly, the Consumer

Price Index increased by 7.2 percent, as against an increase

of 9.1 percent recorded during the previous year.

Nepalese currency depreciated by 5.2% vis-à-vis US Dollars

as at mid-July 2015 against the level recorded during the

same period previous year. Nepalese rupee has a fixed parity

of 1:1.6 with the Indian rupee.

The Year Ahead

FY 2014/15 was a year of accelerated political activities which

resulted in promulgation of the new Constitution of Nepal.

The country faced significant challenges right before and

after the promulgation of the new Constitution because of the

prolonged agitation going on in the Terai region. The business

environments as well as the normal life of people were further

impacted by the obstruction created in movement of essential

supplies including fuel from the customs points adjoining

India. Together with the devastating earthquake that hit the

country in April and May, the business environment remained

extremely challenging which have had a bearing in our

performance.

Under the circumstances, your Bank delivered a restrained

performance during financial year 2014/15. Steady accretion

of risk assets in the balance sheet could not reflect in bottom

line growth mainly because of prolonged low interest rate

regime, surplus liquidity and low volatility. We, however,

are confident that the coming years will be stimulating and

productive for business opportunities. We continue to remain

in good shape to support our clients and customers, and

consider that the growth opportunities will remain compelling

in our markets. Our aim remains to exploit our competitive

strengths and opportunities and drive value for our

shareholders. In doing this, we will be guided by our strategy

by continuing to invest in our businesses. We are mindful that

there are significant factors impacting our performance which

cannot be ignored; the imperative to maintain our capital

levels across the industry; the investment need in enhancing

our technological capabilities, and the need to change the

shape of our business to fit the demands of the current

economic and regulatory landscape. Our actions will be

directed towards maintaining the long-term prospects of the

business.

We have identified a number of priority areas for the Bank

to reshape the business to restore performance and to fully

realise the opportunities in our markets; recent reorganisation

of our Retail Bank structure is one of them. As our markets

develop and get enriched, they will continue to change

and it is our aim to embrace the changes and align them

to our business models. We are stepping up the pace of

digitisation, automating and re-engineering key processes

and standardising technology platforms. The only way we

can manage the ever - increasing complexity of regulation

efficiently is through technology, so we are prioritising

investment in this area to achieve sustainable improvement

in both compliance and productivity. This is how we can

continue to remain successful. Our emphasis is on organic

growth with a long-term perspective and in building diverse

income streams. These actions will help us to get back to a

trajectory of sustainable and profitable growth in delivering

returns above our cost of capital and driving the share price.

Our balance sheet is in good shape: diversified, well

structured and liquid. We have been taking a conservative

approach in managing the balance sheet, maintaining a strong

liquidity and in maintaining the credit quality. This will pay

dividend to us in the medium to long run.

7

Company overview

The recently completed

reorganisation of our business

will make a difference, enabling

us to put sharper focus on

the key strategic priorities,

optimising the deployment of

capital and investment spend.

8

Standard Chartered Annual Report 2014-2015

The year 2015/16 looks ahead to be a good year for the

Bank; we have started with a good momentum. We own a

strong balance sheet and have a strong deal pipelines under

our Corporate & Institutional business. The balance sheet

has ample space to capture accelerated growth in the Retail

business. Rapid growth under a scenario of political stability

can be predicted.

The performance of agriculture sector is critical to our

economy; based on what we have experienced so far, we

can expect a mixed agricultural yield this year. However,

the changing trend of using modern agricultural tools and

technology and improvement in distribution of inputs &

services, we can assume that the sectorial contribution from

agriculture on the GDP is likely to improve. Similarly, an

improvement in operating and socio political environment is

also likely to benefit the industrial sector. National agenda

of `Rebuilding Nepal’ after the earthquake is likely to provide

impetus to the industrial sector by fuelling demand for

their outputs. Thrust of the government for accelerating

infrastructural spending is further likely to invigorate the much

needed growth momentum. All these will go in providing

respite to the economy. In addition, we also expect stability

in remittances flow from the Middle East and South East Asia,

which will further help in keeping the national economy active.

Although the Tourism sector has been impacted for the short

term, in the medium to long term, we are hopeful that Nepal

will continue to remain a preferred destination.

Corporate Governance

Governance across the Bank is robust. Strong governance

is also integral to our long-term success. As you may all

appreciate, banking is a relationship business, we highly value

the relationships that we have with our people, regulators,

clients and the other stakeholders; all efforts will be made to

further deepen this relationship.

We are committed to ensuring the integrity of governance. In

addition to the established committees, we have committees

on Diversity and Inclusion, Health and Safety, the Environment

and Community Partnership. The initiatives taken by these

committees have added value to our stakeholders and

delighted them. We believe good governance provides clear

accountabilities, ensures strong controls, instils the right

behaviours and reinforces good performance.

The Bank has been following the Risk Management Principles

and Practices of Standard Chartered Group which are in line

with the latest international best practices in the area of risk

management in banks.

The management of credit, cross-border, market, liquidity,

operational, reputational and other risks are inherent to the

bank’s business. The risk management principles followed

by the Bank include balancing risk and return, responsibility

and accountability, anticipation of risk and competitive

advantage from effective risk management. Similarly, the Bank

follows risk management governance structure of Standard

Chartered Group covering the Board, Audit Committee,

Risk Committee, Executive Committee, Business/Functional

level risk management etc. Roles and responsibilities for risk

management are defined under a Three Lines of Defence

model i.e. business/operations as first line of defence, risk

function under the business/operations as second line of

defence and the independent internal audit function reporting

to the Audit Committee as the third line of defence. In this way,

the risk management process involves active participation

from Board level to the business/operational level ensuring an

effective system of risk management in the bank.

The world is currently facing a new threat – terrorism.

Globalisation of standards for Anti-money laundering and

countering the financing of terrorism is required if Governments

have to collaborate to fight financial crime which includes the

financing of terrorism. Nepal is no longer isolated from these

risks; we believe the financial sector should be better equipped

to manage the implementation of FATF guidelines, CDD and

AML standards. Risks around Correspondent banking are

bound to increase, making this a high risk and costly channel,

unless banks are prepared to invest in infrastructure and staff

to manage and oversee client accounts.

Mr. Anurag Adlakha, Mr. Sujit Mundul and Mr. Joseph Silvanus

continue to represent Standard Chartered Grindlays Australia

and Mr. Krishna Kumar Pradhan as Professional/Independent

Director continues to be in the Board of the Bank. Ms. Amrit

8

Standard Chartered Annual Report 2014-2015

Chairman’s statement

We can achieve rapid growth under

a scenario of political stability;

and the near future seems to be

providing that opportunity for

us. Under the situation, financial

services industry is likely to grow

and develop into a strong pillar of

our national economy.

9

Kumari Thapa continues to be in the Board to represent the

public shareholders of the Bank. I, Sunil Kaushal, continue to

represent the Standard Chartered Bank, U.K. in the Board of

Standard Chartered Bank Nepal Limited.

As on the date of this report, the Board is made up of the Non-

Executive Chairman, one Executive Director and four Non-

Executive Directors of which one is Professional /Independent

Director appointed as per the regulatory requirement and one

of them is the Public Director representing General Public

shareholders as per the provisions of the Company Act.

In Conclusion

Our performance priorities are clear. We have taken range of

actions in response to the way our market has changed. We

expect to get back to a trajectory of sustainable and profitable

growth in boosting our performance. We firmly believe that

we can fulfil our aspiration to bank the people and companies

driving trade, investment and the creation of wealth.

We expect our market to do better in year 2015/16. The

political and social transitions do have a significant impact on

business confidence and we are positive about our market,

particularly after the progress achieved in the constitution

writing. This will help in ending the transition and in focusing

in the nations’ economic growth. The drivers of economic

growth viz. demographics, urbanisation and growth in

middle class as well as infrastructural investments, all stand

promising for us. However, there is an urgent need to tackle

critical challenges hindering our growth viz. power shortages,

widening trade deficit and the labour issues.

You will agree that the review period was not very encouraging

for us primarily because of prevalence of excess liquidity in the

market, pressure on margins, lower reinvestment yields and

low volatility. The natural calamity that struck towards the end

of the year put further pressure on our operating momentum.

However, we have opened the new financial year with renewed

hope and self assurance that the demand for financial services

is rising rapidly. Our challenge is to capture these opportunities

in a disciplined, return-focused way to drive shareholder value.

We do have a superb client franchise, a unique network and

a strong balance sheet. More importantly, we have fantastic

team of people - professional and collaborative, and truly

believing in, and committed to being, Here for good. Our

focus thus is directed in building sustainable, long-term

relationships with our clients and being their trusted adviser

and supporting their different needs. We operate with

sophisticated technology to provide products and services

of international standards to our clients; and our aim is to

continuously improve upon it. We are grateful to our clients &

customers, shareholders and other stakeholders for believing

in us; we value their trust.

I would also like to extend my sincere gratitude to the Ministry

of Finance and Nepal Rastra Bank for their invaluable support

and guidance provided to us. I appreciate their commitment in

raising the bar for financial industry in Nepal. I also extend my

gratitude to our investors for their strong faith and support.

Our people are much sought after by our competition, and

we are acutely conscious of the importance of retaining

and attracting the best talent and building their learning and

development capabilities. In line with our past practice, we will

reward our people for good performance as well as for their

good behaviours. We are a Bank with strong performance

and values culture. We continuously raise the bar on

conduct & compliance and reflect of being a force for good in

society. I thank all our staff for their hard work, sincerity and

commitment.

Bank’s Diversity and Inclusion (D&I) Council is playing an

important role in embedding our D & I agenda to address the

different strands of diversity in our work-force, our products

and our community. This will continue to remain our key

agenda.

I am proud of what we have achieved so far and am confident

about what the future holds for this great institution. We have

demonstrated resilience and an ability to adapt and reinvent.

We are in good shape to support our clients & customers and

remain focused on delivering profitable and sustainable growth

to drive further value for our shareholders. We believe that

the drivers of economic growth in our markets remain strong,

and the demand for financial services is rising rapidly. We are

therefore confident in delivering enhanced performance in the

years to come.

Sunil Kaushal

Chairman

9

Company overview

10

Standard Chartered Annual Report 2014-2015

The Bank continues to perform well and remains in good shape.

The CEO & Director presents this report together with the

Balance Sheet and statement of Profit and Loss for the year

ended 16 July 2015. The report is in conformity with the

provisions of the Companies Act, 2063 and Bank & Financial

Institution Act, 2063 including the directives issued by Nepal

Rastra Bank.

It is my pleasure to report that the Bank has delivered yet

another year of stable performance. Financial Year 2014/15

remained a challenging year in terms of socio-political

environment. Nevertheless, because of our consistent

and focused strategy, we have been able to deliver on

our promises. In the backdrop of a challenging business

environment, a slight fall in the net profit after tax of 3.5% to

Rs. 1.29 billion, can be considered satisfactory. This has been

achieved by persistent focus on cost and risk management

while pursuing business growth.

There is an increase in the volume of risk assets by 6.4 % to

Rs. 28.02 billion compared to Rs. 26.33 billion last year. The

Bank has been able to manage its credit portfolio better as

a result of which the Non-performing credit to Total credit is

0.34%. The provisions made are adequate to cover all the

potential credit losses as of the balance sheet date.

After transfer of Rs. 258 million to general reserve, Rs. 24

million to exchange fluctuation reserve, proposed dividend of

Rs.432 million and proposed bonus shares of Rs. 562 million,

total retained earnings as at 16 July, 2015 stood at Rs. 24

million. This performance reflects a good momentum in the

underlying businesses and disciplined management of risks

and costs.

Representation

As at 16 July 2015, the Bank maintained nineteen points

of representation which included fourteen branches and

five extension counters. In addition to this, services were

also extended to our customers through twenty three ATMs

located at different parts of the country.

Corporate & Institutional Clients (C&IC)

C&IC in line with its stated strategy has performed well

over the review period. After the Gorkha Earthquake, the

growth rate since has been muted, which has impacted our

performance towards the last quarter of FY 2014/15. On

a year-on-year basis, we recorded a growth in risk assets

volume of 13% over the review period as against the liability

growth of as high as 51%. Bulk of these deposits did come

post the aftermath of the earthquake and the balance has

been gradually declining. As anticipated, in the wake of

CEO and Directors Report

The Bank continues to perform well

and remains in good shape.

11

excess liquidity, our margins have been squeezed. The

increased liquidity is not only resulting in reduction in margins

but also creating unhealthy competition in the industry.

We are keen to invest in areas where there is accretive growth.

We are well positioned to take advantage of opportunities

post the promulgation of the Constitution. Our efforts continue

to engage with clients across the product spectrum. Against

the backdrop of continuously increasing competition and in

the absence of mechanism for pricing for risk, we are hopeful

of the industry getting matured. Our objective over this fiscal

year will be to focus on digitisation and e-channels to increase

efficiency in delivery. We will be more judicious about the

deployment of capital and will actively engage to increase the

Return on Risk Weighted Assets.

We have been deepening relationships with our existing

clients by offering various Cash Management solutions.

Our electronic banking solution (Straight 2 Bank) is a

unique e-banking platform that can cater to client’s cash,

trade & FX requirements in one single view. S2B allows

multiple-connectivity with clients through internet, mobile

and can be used for automation & straight through

processing of payments, trade transactions; it also extracts

reports, statements and advices and allows automation of

reconciliation for invoices with payments.

Collection products viz. RCMS, Virtual Account have been

tested and already offered to our clients. We have capabilities

to provide globally accepted payment solutions that provide

security & efficiency to our clients. Our Trade TING (Trade

Initiation Next Generation) is a world class solution for clients

to open Letter of Credits and Guarantees, electronically.

We have provided support to the banking industry by

providing trainings etc. through our network specialists. In the

space of RMB development, our Bank, with the help of Group

resources conducted sessions on emerging and changing

trade & payment landscape of RMB to the central bank,

commercial banks & clients. We have opened a CNY account

Company overview

Leading to this, the Business

has put up a decent

performance in all parameters.

RC business continued to

assist in maintaining good

liquidity position for the Bank.

12

Standard Chartered Annual Report 2014-2015

with SCB China to facilitate client’s payments & trade in RMB

currency.

Retail Banking

Positive signs were seen in Retail Banking business

subsequent to holding of the second Constituent assembly

elections and formation of the new government. The business

was able to deliver decent performance in all parameters with

Retail Banking continuing to contribute in maintaining good

liquidity position for the Bank. The devastating impact of the

earthquake on the country’s economy during the latter part

of the fiscal year had a resulting impact on the Bank’s overall

business. Despite this, the Bank was able to ensure service

to its clients with minimal disruption. Our branches were up

and running in the shortest possible time after the earthquake

to provide service to clients. However, the change in client

behaviour and shift in client priorities in the aftermath of the

earthquake had a significant impact on the Retail lending

business, particularly in the Auto and Mortgage products.

Our focus continues to remain on low cost deposits,

constituting Current and Savings Accounts (CASA). On the

lending front, we have maintained a good momentum and

our focus will continue in maintaining a good mix of secured

and unsecured portfolio. We have revamped our Employee

Banking proposition as it will be one of the key priorities in

driving the Retail Banking business further. Our Priority

Banking client value propositions will continue to provide

enhanced and valued added benefits to high value client base.

Our strong and dedicated team of Relationship Managers

provide the best in class service and client experience. Our

Lazimpat Branch is home to a unique banking experience

for our Priority Banking clients. The branch has an exclusive

lounge, created in an art gallery to provide our high net worth

clients much needed privacy and personalized service.

The cost of fund was managed well, representing one of

the best in the industry. A healthy net interest margin (NIM)

in lending products was maintained in spite of the fact that

our borrowing rates were amongst the lowest in the industry

within the retail lending space

We have renewed our focus on SME business, which is

emerging as the growth engine and a key area of thrust for

Retail Banking. Increasing the wallet share of non-funds based

income will be given due attention.

Our commitment to support the initiative of the Government

to encourage individuals for PAN card registrations continues.

The Auto and Mortgage products offered by the Bank are

CEO and Directors Report

13

therefore provided with a 0.25% discount on the published

rates to clients producing PAN Cards along with their loan

applications. In our continuous efforts to provide increased

benefits to our clients, Retail Banking plans to introduce

product variants in its existing suite of products both for

individuals and business.

Our 24X7 Client Care Centre provides easy access and

international standard service to our clients from anywhere

in the world. The increasing potential in the Retail Banking

business both from within our ecosystem and beyond will

be exploited to increase our reach and further improve our

performance. This will be done by continually striking a

balance between and risk and return to ensure achievement

of sustained growth of our Retail Banking business.

Client Experience

Delivering high-quality client experience is a priority for the

Bank; it underpins our brand promise – Here for good.

With an aim to drive superior service delivery, the Bank has

established various client experience service standards

viz Client Care Centre service level, online banking and

ATM uptime service level, complaint resolution metrics and

standard processing turnaround time, etc. In addition,

monthly performance measures have been introduced to

gauge our performance against the set standards.

Our global policies and procedures on complaint management

help us to ensure that complaints are identified and resolved

quickly in fair manner. Root cause analysis of the complaints

is conducted to understand the actual cause for occurrence

of the issue and actions are taken to prevent recurrence of

similar complaints and issues.

To assess clients’ experience in their day to day interactions

with the Bank, at recent transaction and frontline staff specific

level, monthly Client Satisfaction Surveys are conducted.

The outcomes of these surveys form a part of the frontline

performance scorecard, which has helped reinforce strong

service culture across the Bank. Similarly, Annual Loyalty

Surveys gauge whether our clients are our true advocates on

overall banking relationship across the overall Bank, Segments

and Products through Net Promoter Score (NPS).

We leverage on the set service standards, complaint metrics,

client interactions and surveys to understand client’s need,

trend and drive improvement opportunities.We continue to

focus on improving our productivity, through the removal

of pain points for the clients, improving our processes,

digitisation and also by standardising our operating rhythm.

The Bank’s NPS scores have improved significantly from +36

in 2011 to +80 in 2014/15. It is a testament to the numerous

service improvement initiatives that have been introduced

across the Bank.

The Bank believes that each member of the staff owns and

is accountable for client experience. We continue to focus

on trainings on products, soft skills and client experience for

our staff to ensure we are on track with our client focused

strategy.

Future Plans

Our objective remains to build stronger relationships with our

clients. To achieve this, we will continue to cater through

client-centric new and improved product offerings. The critical

driver is to move from basic lending to strategic products for

our clients.

We continue to remain highly liquid, strongly capitalized and

open for business. Our pursuit for growth will however be

closely influenced by the competitive landscape, regulatory

changes and economic fundamentals. We will continue to

engage with our stakeholders in line with our brand promise –

Here for good.

Over the last 12 months, we have gained significant

achievement in our drive of becoming the Digital Main Bank.

We will continue to strive for greater level of Digitisation of our

services including repositioning of social media and revamping

the Bank’s website. The objective of this drive is to improve

the service delivery on our part and for our clients to achieve

operational efficiencies. Our clients are already experiencing

our user-friendly features and benefits.

Company overview

14

Standard Chartered Annual Report 2014-2015

Both our businesses Corporate & Institutional Clients (C&I)

and Retail Banking (RB) have been coordinating and working

together in meeting the needs of our corporate and retail

clients. This collaboration is helping in addressing the clients’

needs more effectively and efficiently. Similarly, we are

also working closely with our network points for achieving

synergies in client referrals, initiation and conversions.

Like in the past, we continue to invest in training and development

of our people. Good performance is being recognised and

rewarded. We will be able to differentiate ourselves from the

competition only by enhancing our engagement with clients;

we already have an edge over our competitors by virtue of our

international expertise and knowledge base.

We are in good shape to support our clients & customers; we

have a highly liquid and strongly capitalised balance sheet.

We are equipped with a strong risk management culture.

These fundamentals will help attain higher growth in the

coming years.

Credit Environment

After 80 years, Nepal was hit hard by the devastating

earthquakes towards the end of FY 2014/15, which

dampened the business sentiments garnered during the year

and the business momentum was lost causing wide scale

damages to the economy.

According to the Post Disaster Needs Assessment (PDNA)

report published by the National Planning Commission (NPC),

the earthquake caused a total loss of Rs. 706 billion in the

economy. The damage of the earthquake is estimated at 57.8%

in the social sector, 25.2% in the productive sector, 9.5% in the

infrastructure sector and 7.5% in the cross cutting issues.

The agricultural sector, which contributes about one-third to

real GDP, witnessed a lower rate of growth on account of the

decline in the production of principal cereal crops - paddy

and maize owing to late monsoon, and losses in livestock and

CEO and Directors Report

The low capacity utilisation of the

manufacturing industries, narrow

export base and higher Y-o-Y import

growth resulting in ballooning trade

deficit increased the country’s

economic vulnerability.

15

some agro-products from the earthquake. Further, the service

sector, which contributes over 50% to country’s total GDP,

had an adverse impact from the earthquake. As a result of

this, the country’s economic growth rate fell sharply to 3% in

last fiscal year. The loss from the earthquake is estimated at

about one-third of GDP of FY 2014/15.

Though annual average credit growth during the year

remained higher than the previous FY, credit demand

dropped significantly after the earthquake due to impact in

manufacturing and service sectors. The industrial sector was

marred by labour shortage, physical damages caused by the

earthquake and sluggish demand for industrial production.

The obstruction in highways linking Nepal to China impacted

the trade business. The damage to the hydropower projects

in the crisis hit districts and the reduction in the power

production also impacted industrial activities.

The low capacity utilisation of the manufacturing industries

also due to perennial power shortage, reduced exports

and continued Y-o-Y import growth, which resulted in

ballooning trade deficit, further increased country’s economic

vulnerability. Higher cost and lack of competitiveness have

impeded expansion of export base. With the depreciation of

Rupee against US Dollar, the economy, therefore, faced more

challenges due to increasing import to export ratio though this

will prompt Nepalese workers working abroad to remit more

savings into the country.

The higher deposit growth during the FY mainly after the

earthquake because of excessive remittance inflows besides high

donations and grants resulted in excess liquidity in the banking

sector. The excess liquidity situation contributed to reduction in

interest rates impacting the interest earnings from both lending and

investment portfolios of the banks. The risk posed by the continual

excess liquidity in the financial market was a detriment to sustained

income growth of the banking sector.

The government’s capital expenditure was 67% of annual

budget estimate and remained below 4% of GDP during

the year. The capital expenditure was also impacted by the

earthquake in the last quarter when higher expenditure used

to be incurred historically. The low capital expenditure further

subsided the economic growth prospects.

The steadily increasing inflow of remittance from workers and

comfortable foreign exchange reserves, surplus in BOP as

well as current account, reduced debt to GDP ratio, etc. were

some reassuring factors for economy during the year under

review. The business confidence continued to remain weak

in the current fiscal year due to the impact from earthquake

and the long Bandhs and strikes in the Terai region which

started from the beginning of the FY 2015/16 and subsequent

blockades along the Indo-Nepal border adversely impacting

trade and transport. Despite having unprecedented

challenges in the economy, long term prognosis of the

economy appears positive expecting more stability in political

environment after the promulgation of new constitution and

the government’s reconstruction plans to re-build the nation

with strong commitments from the donors.

The Bank has largely been successful in achieving disciplined

growth in loans and advances and maintaining the credit

quality of the loan portfolio. Notwithstanding the uncertainties

in the credit environment, we are more resilient because

of our proactive risk management approach, system and

process for risk identification and measurement and focus

on risk management principles which include balancing risk

and return, responsibility and accountability in taking risk,

anticipation of material future risks, and our competitive

advantages. The Bank continues to take measured risks

and stands up for what is right. Standard Chartered Bank

Nepal is Here for good; Here for good in the sense of always

seeking to do the right things. Consistency of strategy and

disciplined and focused approach, strong relationship with

the clients, rigors around the portfolio quality, debate on risk-

return dynamics, vigilance and prompt actions, etc. are the

fundamentals of our risk culture.

Auditor

M/S S R Pandey & Co., Chartered Accountants, were

appointed as Statutory Auditors for FY 2014/15 by the 28th

Annual General Meeting of the Bank held on 4th December

2014. As per the recommendation of the Audit Committee,

this meeting will decide on the appointment of the auditor for

next financial year.

Proposed Dividend and Bonus Shares

The 340th meeting of the Board of Directors of the Bank has

proposed dividend and bonus shares to the shareholders

of the Bank for the year ended 16 July 2015 at the rate of

19.21% and 25% respectively.

Joseph Silvanus

Director and CEO

Company overview

16

Standard Chartered Annual Report 2014-2015

A Synopsis

Following are the steps taken by the management for

strengthening Corporate Governance in the organization:

• The Board of Standard Chartered Bank Nepal Limited

is responsible and accountable to the shareholders and

ensures that proper corporate governance standards are

maintained.

• The Audit Committee meets quarterly to review the internal

and external inspection reports, control and compliance

issues and provides feedback to the Board as appropriate.

• The EXCO represented by all Business and Function

Heads is the apex body managing the day to day

operations of the Bank. Chaired by the CEO, it meets at

least once a month for formulating strategic decisions.

• The Annual General Meeting is used as an opportunity to

communicate with all our shareholders.

• To ensure compliance with applicable laws and regulations

and enhance resilience to external events and avoid

reputational risk, the Board has adopted SCB Group

policies and procedures.

• Ultimate responsibility of effective Risk Management rests

with the Board supported by Audit Committee, Board Risk

Committee, EXCO, Executive Risk Committee and Asset &

Liability Committee (ALCO).

• Embracing exemplary standards of governance and ethics

wherever we operate is an integral part of our Strategic

Intent. The Group Code of Conduct is adopted to help

us meet this objective by setting out the standards of

behaviour we must follow with each other and with our

customers, communities, investors and regulators.

Analysis

The Board of Standard Chartered Bank Nepal Limited is

responsible for the overall management of the Company and

for ensuring that proper corporate governance standards are

maintained. The Board is also responsible & accountable to

the shareholders.

The Board has complied with the principles and provisions of

the Nepal Rastra Bank directives on Corporate Governance

and the provisions of Companies Act, 2063 and Banks and

Financial Institutions Act, 2063 (the “Corporate Governance

Code”). The directors confirm that:

• Throughout FY 2071/72, the Company complied with

all the provisions of the Corporate Governance Code. The

Company complied with the listing rules of Nepal Stock

Exchange Limited.

• Throughout FY 2071/72, the Company was in compliance

with the Securities Registration and Issuance Regulation,

2065.

Our approach to

Corporate Governance

17

• The Company has adopted a Code of Conduct

regarding securities transactions by directors on

further terms no less than required by the Nepal Rastra

Bank Directives and the Company Act and that all

the Directors of the Bank complied with the Code of

Conduct throughout FY 2071/72.

The Board

As on the date of this report, the Board is made up of

the Non-Executive Chairman, one Executive Director and

four Non-Executive Directors of which one is Professional

/ Independent Director appointed as per the regulatory

requirement and one of them is the Public Director

representing General Public shareholders as per the

provisions of the Company Act.

The Board composition complied with the regulatory

requirements. Four Directors including the Non-Executive

Chairman are nominated by the SCB Group to represent

it in the Board in proportion to its shareholding. The Board

meets regularly and has a formal schedule of matters

specifically reserved for its decision. These matters include

determining and reviewing the strategy of the Bank, annual

budget, overseeing statutory and regulatory compliance

and issues related to the Bank’s capital. The Board is

collectively responsible for the success of the Bank.

During the year under review, the Board held 13 board

meetings of which 7 were held by circulation. The Directors

are given accurate, timely and clear information so that

they can maintain full and effective control over strategic,

financial, operational, compliance and governance issues.

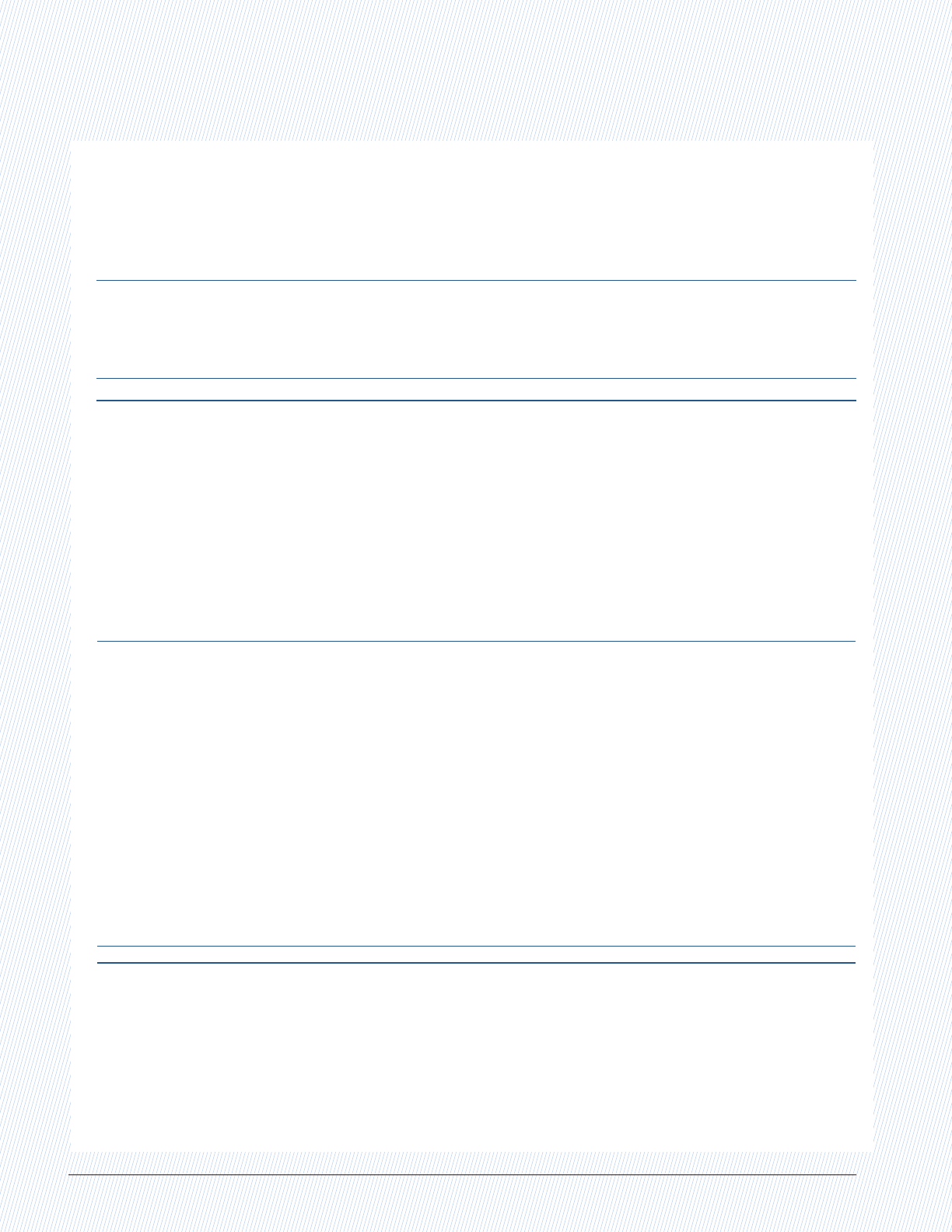

The following table illustrates the number of Board meetings

held during the FY 2071/72 and fee paid:

Board Members Scheduled

Meeting 13

1

Meeting fee paid

Sunil Kaushal

2

Chairman

13 Nil - Does not take

meeting fee

Anurag Adlakha

3

Director

12 Nil – Does not take

meeting fee

Sujit Mundul

4

Director

12 NPR 210,000

(inclusive of tax)

Krishna K. Pradhan

5

Professional Director

13 NPR 227,500

(inclusive of tax)

Amrit Kumari Thapa

Public Director

13 NPR 227,500

(inclusive of tax)

Joseph Silvanus

CEO & Director

13 Nil –Does not take

meeting fee

1

7 Board meetings were held by circulation out of 13 Board meetings

2

Attended 1 Board meeting through Video Conferencing out of 13 Board meetings.

3

Attended 2 Board Meetings through Video Conferencing out of 12 Board

Meetings.

Corporate governance

18

Standard Chartered Annual Report 2014-2015

Director Induction and Ongoing Engagement

Plans

We have a very extensive, robust and tailor-made induction

and ongoing development programme in place for our

Board members. We have been conducting induction for

the new directors representing in the Board. The induction

programmes are in-depth and cover areas such as the

basics of banking, including modules on sources of income,

geographic diversity, client distribution, and traditional and

modern banking services etc.

Board Committees

The Board is accountable for the long-term success of the

Bank and for providing leadership within a framework of

effective controls. The Board is also responsible for setting

strategic targets and for ensuring that the Bank is suitably

resourced to achieve those targets. The Board delegates

certain responsibilities to its Committees to assist it in

carrying out its function of ensuring independent oversight.

Committees play key role in supporting the Board.

The Bank has two Board Level Committees called Audit

Committee and Risk Committee constituted as required by

local law and regulation.

Our Board has made a conscious decision to delegate a

broader range of issues to the Board Committees. The

linkages between the committees and the Board are critical,

given that it is impractical for all non-executive directors to

be members of all the committees.

In addition to there being common committee membership,

the Board receives the minutes of each of the committees’

meetings. In addition to the minutes, the Committee Chairs

provide regular updates to the Board throughout the year.

We have effective mechanisms in place to ensure that there

are no gaps or unnecessary duplications between the remit

of each committee. The Bank also has clear guidance for the

committees in fulfilment of their oversight responsibilities.

Audit Committee

As mandated by the local regulations, the Board has formed

an Audit Committee with clear Terms of Reference (ToR).

The duties and responsibilities of the Audit Committee are

in congruence with the framework defined by Nepal Rastra

Bank Directives and Companies Act.

The Audit Committee is chaired by a non-executive director.

All other members of the Audit Committee are also non

executive directors thus ensuring complete independence.

The Composition of the Audit Committee as on July 16,

2015 was as below:

1. Mr. Sujit Mundul, Chairman

2. Mr. Anurag Adlakha, Member

3. Ms. Amrit Kumari Thapa, Member

4. Mr. Sanjay Ballav Pant, Country Head of Audit,

Member Secretary

The Audit Committee meets at least on quarterly basis

and reviews internal and external audit reports, control and

compliance issues, bank’s financial condition etc. Audit

Committee provides feedback to Board of Directors by

tabling Audit Committee meeting minutes at the subsequent

Board meeting for review. The Audit Committee also liaises

with Group Internal Audit to the extent necessary to ensure

that the conduct of Committee’s business is consistent

with and complementary to the practice and requirement of

Standard Chartered Group in this regard.

The following table illustrates the Audit Committee’s

attendance and meeting fees paid during FY 2071/72. A

total of 6 meetings were held during the period.

Audit Committee

Members

Scheduled

Meeting

Meeting fee paid

Sujit Mundul

1

Chairman

6 NPR 45,000

(Inclusive of tax)

Anurag Adlakha

2

Member

3 Nil – Does not take

meeting fee

Amrit Kumari Thapa

Public Director

6 NPR 30,000

(Inclusive of tax)

Sanjay Ballav Pant

Member Secretary

6 Nil – Does not take

meeting fee

1

Attended 1 meeting through Video Conferencing and 1 through audio

conferencing.

2

Attended all the meetings through video conferencing.

During the financial year 2071/72 (2014/15) Audit Committee

performed the following tasks, among others.

• Reviewed and reported to the Board on the Bank’s

internal control system;

• Reviewed the issues raised in the Internal Audit Reports

and directed the management for resolution;

• Reviewed the work performed by Internal Audit against

the country audit plan;

• Reviewed and approved the Committee’s Terms of

Reference;

• Reviewed and approved the changes to the Audit

Methodology;

• Reviewed and approved the Audit Charter of the Bank;

Corporate Governance

19

• Reviewed and approved the annual audit plan based on

the risk assessment and regulatory requirements;

• Reviewed the audit team resourcing and development

activities;

• Reviewed the findings of NRB Annual Onsite Inspection

Team and Statutory Auditor, and directed the management

for resolution of the issues raised in their reports;

• Reviewed the status of audit issues raised in Internal

Audit Reports, Statutory Audit Report and NRB

Inspection Report;

• Reviewed the results of Audit Quality Assurance;

• Recommended to the Bank’s Annual General Meeting

through the Board for appointment of Statutory Auditor

and fixation of remuneration;

• Reviewed quarterly and annual financial statements,

comparison of key financial indicators and adequacy of

loan loss provisions;

• Reviewed and discussed top risks, emerging risks and

themes of the country and the appropriateness of the

management action plan to mitigate these risks;

• Reviewed the Compliance Monitoring Report to

understand the regulatory developments, emerging

regulatory hotspots, regulatory breaches and state of

compliance of the Bank;

• Reviewed and approved Annual Compliance Plan;

• Reviewed the cases of fraud and loss to the Bank;

• Reviewed the Pillar 3 disclosure comprising of capital

structure, capital adequacy, risk exposures and risk

management function in the annual financial statements

of the Bank.

Board Risk Committee

Under Nepal Rastra Bank Directive on Corporate

Governance, the Board has established a Board Risk

Committee with clear terms of reference. The Board Risk

Committee is chaired by an Independent Non-Executive

Director (INED), Chairman of the Audit Committee is a

member and Senior Credit Officer & Chief Risk Officer

(“SCO&CRO”) is the member/Secretary. The Committee

meets four times annually. The committee oversees

and reviews the fundamental prudential risks including

operational, credit, market, reputational, capital, liquidity and

country cross border risk etc.

At the strategic level, risk in any business, but most especially

in a Bank’s business, is clearly owned by the Board. The

Board Risk Committee’s role is to advise and help, diving

deeply into issues of risk so that the Board is well placed to

perform its role as the ultimate owner of risk appetite.

For the Board Risk Committee to be truly effective, it needs to

be forward looking. We have explored with both management

and the risk function how best this can be achieved so that

the Committee has enough time for the horizon scanning.

Significant consideration has also been given to what

information needs to be provided to the Committee on the

current risk position and how this is changing, the likelihood

of it continuing to change and the underlying reasons. In

discharging its responsibilities, the Committee continues to

be vigilant against being overwhelmed with information, while

ensuring that it is provided with all the key data necessary to

fulfil its Terms of Reference.

The Composition of the Board Risk Committee as on July

16, 2015 was as below:

• Krishna Kumar Pradhan, Chairman

• Sujit Mundul, Member

• Gopi Bhandari, Member Secretary

The following table illustrates the number of Board Risk

Committee meetings held during the FY 2071/72 and fees

paid:

Board Risk Committee

Members

Scheduled

Meeting

Meeting fee paid

Krishna Kumar Pradhan

Chairman

4 NPR 22,500

(inclusive of tax)

Sujit Mundul

Member

4 NPR 22,500

(inclusive of tax)

Gopi Bhandari

Member Secretary

4 Nil - Does not

take meeting fee

Executive Committee (EXCO)

The Executive Committee (EXCO) represented by all key

Business and Function Heads of the Bank is the apex body

that manages the Bank’s operation on a day to day basis.

EXCO meets formally at least once a month and informally

as and when required. The strategies for the Bank are

decided and monitored on a regular basis and decisions are

taken collectively by this Committee. The CEO Chairs the

EXCO. As at the date of this report, the Bank’s Management

Committee comprised of the following:

Mr. Joseph Silvanus

Chief Executive Officer & Head Retail Banking

Ms. Bina Rana

Head Human Resources

Mr. Gopi Bhandari

Chief Risk Officer & Senior Credit Officer

Corporate governance

20

Standard Chartered Annual Report 2014-2015

Mr. Gorakh Rana

Head Commercial Banking and International Corporates

Mr. Shobha B Rana

Head Legal & Compliance

Mr. Sujit Shrestha

Chief Information Officer

Mr. Suraj Lamichhane

Financial Controller

Risk Governance

Through its risk management framework, the Bank seeks to

efficiently manage credit, market and liquidity risks which arise

directly through the Bank’s commercial activities as well as

operational, regulatory and reputational risks which arise as a

normal consequence of any business undertaking.

As part of this framework, the Bank uses a set of principles

that describe its risk management culture. The principles of

risk management followed by the Bank include:

• Balancing risk and reward.

• Disciplined and focused risk taking to generate a return.

• Taking risk with appropriate authorities and where there is

appropriate infrastructure and resource to manage them.

• Anticipating future risks and ensuring awareness of all risks.

• Efficient and effective risk management and control to gain

competitive advantage.

In order to enhance governance/oversight and to enable

earlier detection and mitigation of critical risks, a Small

Country Governance Framework (SCGF) has been

implemented in SCB Nepal Limited. The SCGF provides a set

of guiding principles covering the four key pillars of People,

Governance, Systems and Processes. It also includes a set

of tools which will enable small countries to more proactively

identify, assess and mitigate potential control failures.

The Executive Risk Committee (ERC) is represented by

the senior management team including the heads of the

concerned risk management units and Chaired by the

CEO. The committee meets normally in every two months

and reviews the Credit Risk, Operational Risk, Market Risk

and Reputational Risk; analyzes the trend, assesses the

exposure impact on capital and provides a summary report

to the Management Committee. Its objective is to ensure the

effective management of risks throughout the Bank in support

of the Bank’s Business Strategy.

The Bank’s Committee Governance structure ensures that

risk-taking authority and risk management policies are

cascaded down from the Board to the appropriate functional

and divisional committees. Information regarding material

risk issues and compliance with policies and standards

is communicated through the business and functional

committees up to the Group-level committees, as appropriate.

Credit Risk

Credit risk is the potential for loss due to failure of

counterparty to meet its obligations to pay the Bank in

accordance with agreed terms. Country Portfolio Standards

and the Retail Lending Policy govern the extension of credit

to Corporate & Institutional (C&I) Clients and Retail Clients

respectively. Each policy provides the framework for lending

to counterparties, global account management, product

approvals and other product related guidance, credit

processes and portfolio standards.

The Corporate & Institutional Clients Monitoring and Control

Policy and the Group Process Standards – Retail Clients

Credit MIS provide the outline for how credit risk should be

monitored and managed in the Bank.

All Corporate and Institutional borrowers, at individual and

group level, are assigned internal credit rating that supports

identification and measurement of risk and integrated into

overall credit risk analysis.

The Credit Issue Committee (“CIC”) is a sub-committee

of Executive Risk Committee (ERC). It is responsible for

overseeing clients in C&I and Business Clients (erstwhile SME)

segments showing signs of actual or potential weaknesses

and also for monitoring of agreed remedial actions for such

clients. The CIC reviews the existing Early Alert (“EA”) portfolio

and new accounts presented to the committee. It also reviews

Retail Portfolio to ensure credit issues / adverse trends in the

portfolio are identified and addressed through appropriate

actions. The CIC additionally reviews and monitors strategies

and actions being taken on accounts within GSAM’s portfolio.

It is chaired by the CEO and meets monthly.

For Retail exposures, portfolio delinquency trends are

monitored continuously at a detailed level. Individual

customer behaviour is also tracked and considered for

lending decisions. Accounts that are past due are subject to

a collections process, managed independently by the Risk

Function. Charged-off accounts are managed by specialist

recovery teams.

The credit risk management covers credit rating and

measurement, credit risk assessment and credit approval,

Corporate Governance

21

large exposures and credit risk concentration, credit

monitoring, credit risk mitigation and portfolio analysis.

Operational Risk

We define Operational Risk as the potential for loss resulting

from inadequate or failed internal processes, people and

systems or from the impact of external events, including

legal risks. We seek to minimize our exposure to operational

risk, subject to cost trade-offs. Operational risk exposures

are managed through a consistent set of management

processes that drive risk identification, assessment, control

and monitoring. Operational Risk Framework (ORF) adopted

by the Bank provides comprehensive risk management tools

for managing operational risk. The Operational Risk Framework

(ORF) defines how risks are managed, how Operational Risk

policies and controls are assured, how effective governance

is exercised as well as the key roles required to manage the

underlying processes.

The Executive Risk Committee, chaired by the CEO, oversees

the management of operational risks across the Bank. Each risk

control owner is responsible for identifying risks that are material

and for maintaining an effective control environment across the

organization. Risk control owners have responsibility for the

control of operational risk arising from the management of the

following activities: External Rules & Regulations, Liability, Legal

Enforceability, Damage or Loss of Physical Assets, Safety &

Security, Internal Fraud or Dishonesty, External Fraud, Information

Security, Processing Failure, and Model. Operational risks can

arise from all business lines and from all activities carried out

by the Bank. Operational Risk management approach seeks

to ensure management of operational risk by maintaining a

complete process universe defined for all business segments,

products and functions processes.

Products and services offered to clients and customers are

also assessed and authorized in accordance with product

governance procedures.

The OR governance structure is as follows:

• Operational Risk governance ensures consistent oversight

across all levels regarding the execution and effectiveness

of Operational Risk Framework (ORF).

• Risk Control Owners for all major Risk Types are appointed

as per the Risk Management Framework (RMF) and are

responsible for effective management of operational risk of

their respective control function.

• Operational risks are identified and graded at the

business/unit level. For all risk graded low and above along

with the treatment plan are agreed with the Risk Control

Owner before raising the risk in Phoenix and tabling the

risks in Country Executive Risk Committee for acceptance.

Mitigating controls are put in place and mitigation progress

monitored until its effectiveness.

• The Executive Risk Committee (ERC) ensures the effective

management of Operational Risk throughout the business/

functions in support of the Group’s strategy and in

accordance with the Risk Management Framework. The

ERC assigns ownership, requires actions to be taken

and monitors progress of risks identified, in addition to

confirming the risk grading provided at the business/unit

level.

• The Executive Risk Committee (ERC) accepts operational

risks arising in the country that have residual risk ratings

which are above ‘Low’ in the country materiality scale,

provided the residual risk rating is ‘low’ on the Group

materiality scale. Risks categorized as Medium, High or

Very High on the Group materiality scale are reported to

the Executive Risk Committee (ERC) for endorsement

and escalated to the Group Process Owner through the

relevant country process owner for acceptance through

the relevant Process Governance Committees (PGCs).

• The Group Risk Committee (GRC) provides oversight of

operational risk management across the Group.

• Process Governance Committee (PGC) provides global

oversight of all material operational risk arising from end-

to-end processes within their Process Universes.

Market Risk

Risks arising out of adverse movements in currency exchange

rates, interest rates, commodity price and equity prices are

covered under Market Risk Management. We recognize

Market Risk as the potential for loss of earnings or economic

value due to adverse changes in financial market rates or

prices. Our exposure to market risk arises principally from

customer driven transactions. In line with Risk Management

Guidelines prescribed by NRB, the Bank focuses on exchange

risk management for managing/computing the capital charge

on market risk.

Operational risk

exposures are managed

through a consistent

set of management

processes that drive

risk identification,

assessment, control and

monitoring.

Corporate governance

22

Standard Chartered Annual Report 2014-2015

In addition to the currency exchange rate risk, interest rate

risk and equity price risk are assessed at a regular interval

to strengthen market risk management. The market risk is

managed within the risk tolerances and market risk limits set

by the Board.

Liquidity Risk

Liquidity risk is the potential that the Bank either does not

have sufficient liquid financial resources available to meet all its