Petitioner/Joint Petitioner A:

Respondent/Joint Petitioner B:

FA-4139V, 12/22 Financial Disclosure Statement §767.127, Wisconsin Statutes

This form shall not be modified. It may be supplemented with additional material.

Page 1 of 7

This form is available in Spanish.

https://www.wicourts.gov/forms1/circuit/index.htm

(Este formulario está disponible en español.)

Enter the name of the

county in which this

case is filed.

STATE OF WISCONSIN, CIRCUIT COURT,

COUNTY

Enter the name of the

Petitioner/Joint

Petitioner A.

Petitioner/Joint Petitioner A

Name (First, Middle and Last)

and

On the far right, check

Petitioner/Joint Petitioner

A or Respondent/Joint

Petitioner B.

Financial Disclosure

Statement of

Petitioner/Joint Petitioner A

Respondent/Joint Petitioner B

Case No.

Enter the name of the

Respondent/Joint

Petitioner B.

Respondent/Joint Petitioner B

Name (First, Middle and Last)

Enter the case number.

This form must be filed with the court within the time period set by the court but no later than 90 DAYS after the service

of the Summons and Petition on the Respondent/Joint Petitioner B or the filing of a Joint Petition. Failure by either

party to complete and file this form or attachments as required will authorize the court to accept the statement of the

other party as the basis for its decisions. Deliberate failure to provide complete disclosure is perjury.

1.

PROOF OF INCOME

Attach a statement reflecting income earned to date for the current year.

Attach most recent W-2 Statement.

2.

GENERAL INFORMATION

Name

Address

Address

City

State Zip

Phone [Day]

Phone [Evening]

Alternative Phone

Social Security Number

Occupation

Employer

Address

Address

City

State Zip

Phone

Fax

Payroll Office

Same as employer

Address

Address

City

State Zip

Phone

Fax

3.

MEMBERS OF YOUR HOUSEHOLD

Enter the name and relationship of all people living in your household. Check yes or no to identify if they

contribute to payment of household expenses.

I live alone.

Name

Relationship

This person helps pay expenses

Yes

No

1.

2.

3.

Petitioner/Joint Petitioner A:

Respondent/Joint Petitioner B:

FA-4139V, 12/22 Financial Disclosure Statement §767.127, Wisconsin Statutes

This form shall not be modified. It may be supplemented with additional material.

Page 2 of 7

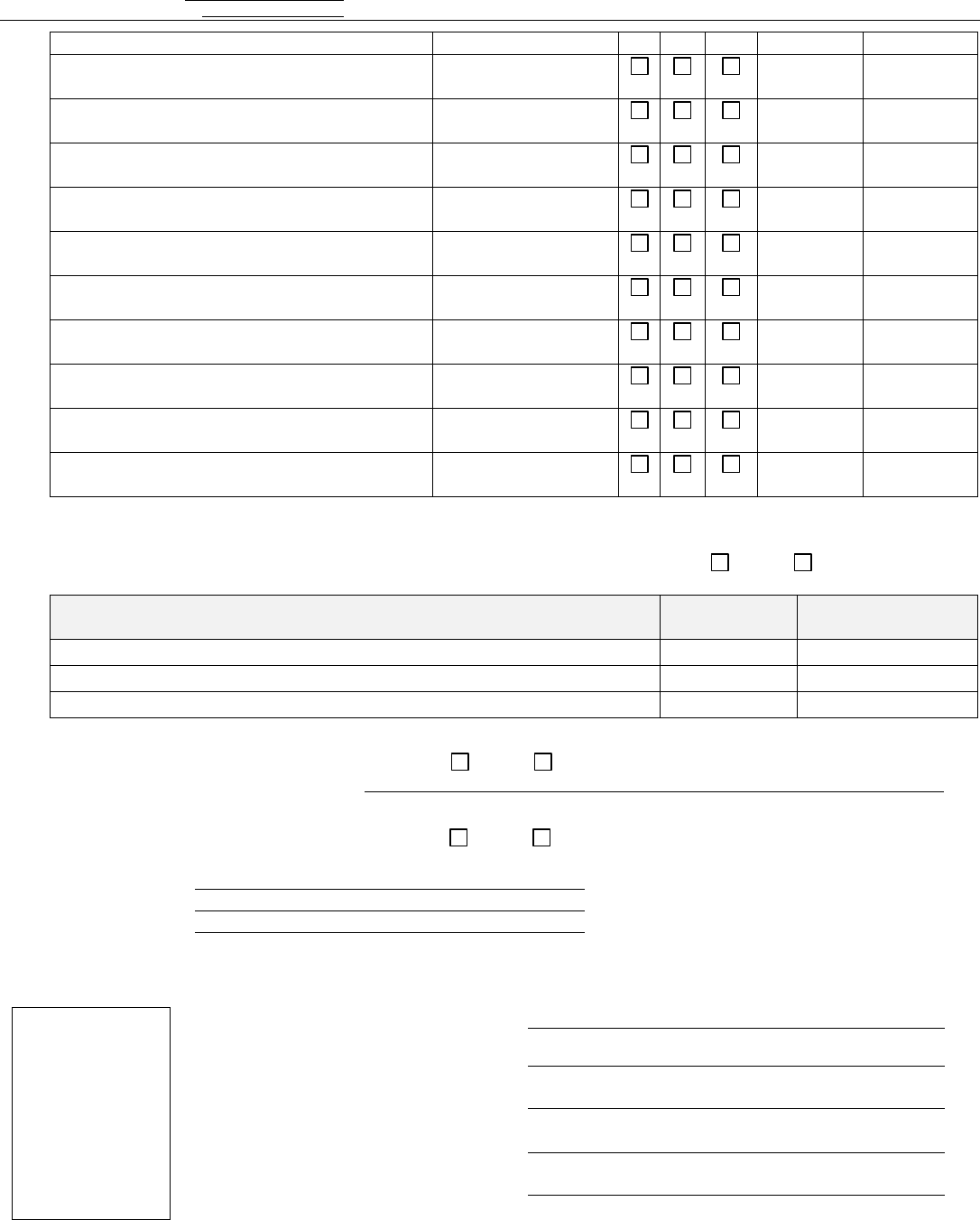

4.

5.

6.

7.

8.

4.

MONTHLY INCOME

Income from wages / salary is received: (check one)

To calculate monthly gross income use the multiplier shown:

weekly -multiply weekly income by 4.33 every other week (bi-weekly) multiply bi-weekly income by 2.17

monthly twice a month-multiply semi-monthly income by 2

MONTHLY GROSS INCOME

1.

Gross monthly income (before taxes and deductions) from salary and wages, including

commissions, allowances and overtime. (See above how to calculate.)

2.

Pensions and retirement funds received

3.

Social Security benefits received

4.

Disability and Unemployment Insurance received

5.

Public Assistance Funds received

6.

Interest and Dividends received

7.

7 Child Support and maintenance (spousal support) received from any prior

marriage/relationship

8.

Rental payments received (from property you rent to others)

9.

Bonuses received

10.

Other sources of income received: (please specify)

11.

12.

13.

Total Gross Income (add lines 1-12)

MONTHLY DEDUCTIONS

14.

Number of tax exemptions claimed

15.

Monthly federal income tax withheld

16.

Monthly state income tax withheld

17.

Social Security

18.

Medicare

19.

Medical insurance

20.

Other insurances

21.

Union or other dues

22.

Retirement or pension fund

23.

Savings plan

24.

Credit union

25.

Child support or spousal support payments

26.

Other deductions: (please specify)

27.

28.

Total Monthly Deductions (add lines 14 – 27)

MONTHLY NET INCOME (subtract line 28 from line 13)

5.

ANTICIPATED MONTHLY EXPENSES

My Monthly Expenses

1.

Rent or mortgage payment (primary residence)

2.

Real Estate Property taxes (residence)

3.

Repairs and maintenance (including maintenance of appliances and furnishings)

4.

Food (include eating out) and household supplies

5.

Utilities (electricity, heat, water, sewage, trash)

Petitioner/Joint Petitioner A:

Respondent/Joint Petitioner B:

FA-4139V, 12/22 Financial Disclosure Statement §767.127, Wisconsin Statutes

This form shall not be modified. It may be supplemented with additional material.

Page 3 of 7

6.

Telephone (local, long distance & cellular)

7.

Cable and Internet Services

8.

Laundry and dry cleaning

9.

Clothing and shoes

10.

Medical, dental and prescription drug expenses (not covered by insurance)

11.

Insurance (life, health, accident, auto, liability, disability, homeowner’s or renter’s-excluding

insurance that is paid through payroll deductions)

12.

Childcare (babysitting and day care)

13.

Child support or spousal support payments (due to previous marriage or relationship)

(Exclude payments made through payroll deductions)

14.

School expenses (child and adult education)

15.

Entertainment (include clubs, social obligations, travel, recreation)

16.

Incidentals (grooming, tobacco, alcohol, gifts, holidays and special occasions)

17.

Transportation (other than automobile)

18.

Auto payments (loans/leases)

19.

Auto expenses (gas, oil, repairs, maintenance)

20.

Newspapers, magazines, books

21.

Care and maintenance of pets (food, vet, grooming)

22.

Payments to any dependents not living in your home and not included in a category above

(including college age children)

23.

Hobbies

24.

Other taxes than those listed above (exclude payroll deductions)

25.

Other expenses (include expenses of other real properties owned, professional services

such as counseling and tax/legal advice, etc)

Other Monthly installment payments:

26.

Mortgage (other than primary mortgage)

27.

Other vehicle payments

28.

Credit card debt (total minimum monthly payments)

29.

Court ordered obligations

30.

Student loans

31.

Personal loans

TOTAL MONTHLY EXPENSES (Add lines 1-31)

6.

ASSETS: List ALL assets that you own individually and together with the other party without regard to

how they have been or will be divided later

If you do not have assets in an asset category, write “none” under the heading and enter “zero” in the

estimated value column. If you need more space, please attach additional sheets.

A = Joint Petitioner A

B = Joint Petitioner B T = Together

Ownership or Title

Held by

Current

Possession

Amount

Owed

Estimated

Value

Today

Household Items

A

B

T

A

B

T

Household furniture & accessories

Household appliances

Kitchen equipment

China, silver, crystal

Petitioner/Joint Petitioner A:

Respondent/Joint Petitioner B:

FA-4139V, 12/22 Financial Disclosure Statement §767.127, Wisconsin Statutes

This form shall not be modified. It may be supplemented with additional material.

Page 4 of 7

Jewelry

Clothing

Antiques

Art

Electronic equipment

Sports equipment

Recreational vehicles, boats

Tools

Other:

Other:

Automobiles:

Year, Make, Model

A

B

T

A

B

T

Amount

Owed

Estimated

Value

Today

Life Insurance

Name of Company & Policy #

A

B

T

Beneficiary

Face

Amount

Cash

Value

Today

Business Interests

Name of Business & Address

A

B

T

Type of

Business

% of

Ownership

Value MINUS

Indebtedness

Petitioner/Joint Petitioner A:

Respondent/Joint Petitioner B:

FA-4139V, 12/22 Financial Disclosure Statement §767.127, Wisconsin Statutes

This form shall not be modified. It may be supplemented with additional material.

Page 5 of 7

Securities: Stocks, Bonds, Mutual Funds,

Commodity Accounts

Name of Company & # of shares

Ownership or Title held by

Value

Today

A = Joint Petitioner A

B = Joint Petitioner B

T = Together

A

B

T

Pension, Retirement Accounts,

Deferred Compensation, 401K Plans, IRAs,

Profit Sharing, etc.

Name of Company & Type of Plan

A

B

T

% Vested

if known

Date of

Valuation

Value

Today

Cash and Deposit Accounts

(Savings and Checking)

Name of Bank or Financial Institution

A

B

T

Type of

Account

Account #

Last 4 digits

Balance

Today

Other Personal Property

Description of Asset

A

B

T

Type of

Property

Value

Petitioner/Joint Petitioner A:

Respondent/Joint Petitioner B:

FA-4139V, 12/22 Financial Disclosure Statement §767.127, Wisconsin Statutes

This form shall not be modified. It may be supplemented with additional material.

Page 6 of 7

Assets Acquired

Description of Asset

Ownership

Acquired by

Date

Acquired

Value

Today

A = Joint Petitioner A

B = Joint Petitioner B

T = Together

G - Gift

I - Inherited

B - Before Marriage

A

B

T

G

I

B

Real Estate

Parcel 1

Parcel 2

Parcel 3

Type of Property

Address: Street, City, State

Ownership/Title

A B T

A B T

A B T

Current Fair Market Value

Current Mortgage Balance

Other Liens

7.

MEDICAL, HOMEOWNERS/RENTERS, AUTOMOBILE, OTHER INSURANCE

What type of insurance policies do you have?

Name of Company, Group # & Policy #

A

B

T

Type of Insurance

Date Issued

8.

DEBTS: List ALL debts that you owe individually and together with the other party without regard to who

will be responsible for payment later.

If there are additional DEBTS, please attach a separate sheet of paper with the creditor’s name and address, the

type of obligation, who pays (A, B, T) and the current balance.

Creditor’s Name & Address

Type of Obligation

Who Currently

Pays

Monthly

Payment

Current

Balance

A

B

T

Petitioner/Joint Petitioner A:

Respondent/Joint Petitioner B:

FA-4139V, 12/22 Financial Disclosure Statement §767.127, Wisconsin Statutes

This form shall not be modified. It may be supplemented with additional material.

Page 7 of 7

9.

DISPOSAL OF ASSETS

Did you dispose of any assets (sold, given away, or destroyed) in the 12 months before the case was filed?

Yes No

If yes, complete chart below:

Property / Asset

Date of Disposal

Fair Market Value on

Date of Disposal

10.

CURRENT LITIGATION

Are you a party in any other lawsuit or litigation? Yes No

If yes, identify the lawsuit or litigation.

11.

BANKRUPTCY

Have you ever filed for bankruptcy? Yes No

If yes, identify the following:

Type of filing

Date of filing

Current status

12.

DECLARATION

I declare under the penalty of perjury that the above, including all attachments, are complete, true, and correct.

Sign and print your

name.

Enter the date on

which you signed

your name.

Note: This signature

does not need to be

notarized.

Signature

Print or Type Name

Address

Email Address Telephone Number

Date State Bar No. (if any)