U.S. Department of

Homeland Security

United States

Coast Guard

FINANCIAL RESOURCE

MANAGEMENT MANUAL

(FRMM)

COMDTINST M7100.3F

June 2019

Commandant

United States Coast Guard

US Coast Guard Stop 7618

2703 Martin Luther King Jr Ave SE

Washington, DC 20593-7618

Staff Symbol: CG-8

Phone: (202) 372-3470

Fax: (202) 372-8389

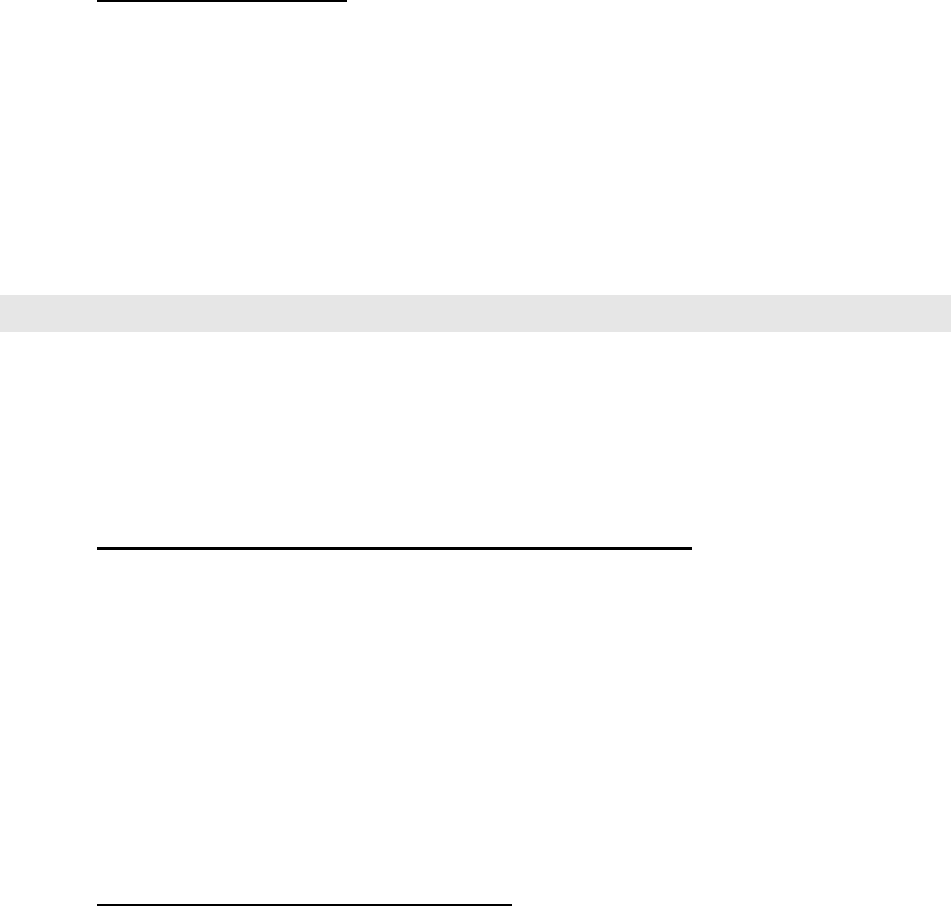

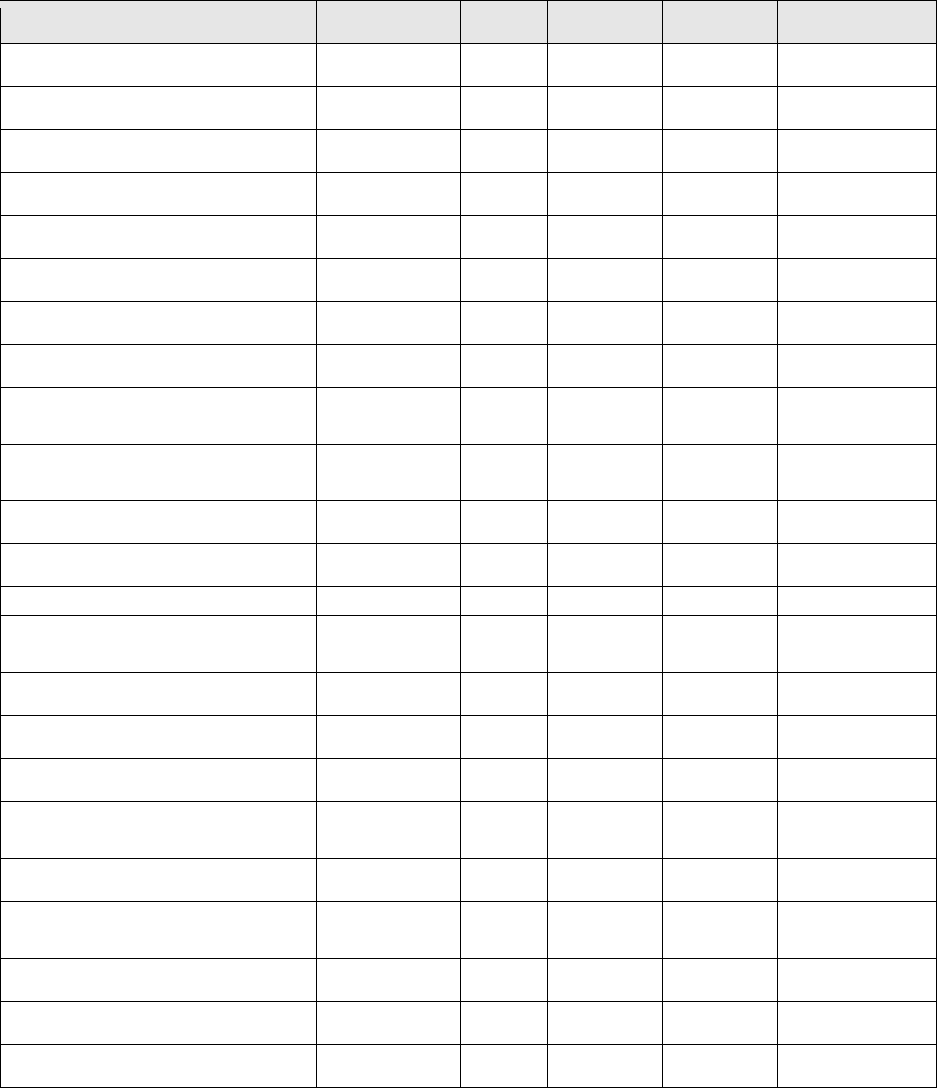

DISTRIBUTION – SDL No. 170

a b c d e f g h i

j

k I m n o p q r s t u v w x y z

A X X X X X X X X X X X X X X X X X X X

B X X X X X X X X X X X X X X X X X X X X X X X X X X

C X X X X X X X X X X X X X X X X X X X X X X X X X X

D X X X X X X X X X X X X X X X X X X X X X X X X X X

E X X X X X X X X X X X X X X X X X X X X X X X X

F X X X

G X X X X

H X X X X X X X

NON-STANDARD DISTRIBUTION:

COMDTINST M7100.3F

26 June 2019

COMMANDANT INSTRUCTION M7100.3F

Subj: FINANCIAL RESOURCE MANAGEMENT MANUAL (FRMM)

1. PURPOSE. This revision removes all financial procedures from Coast Guard policy for all

financial resource management matters and related issues. These procedures can now be

found in the Financial Resource Management Manual – Procedures (FRMM-P),

COMDTINST M7100.4A.

2. ACTION. All Coast Guard unit commanders, commanding officers, officers-in-charge,

deputy/assistant commandants, and chiefs of Headquarters staff elements shall comply with

the provisions of this Manual. Internet release is authorized.

3. DIRECTIVES AFFECTED. Financial Resource Management Manual (FRMM),

COMDTINST M7100.3E is cancelled.

4. DISCUSSION. This revision includes only Coast Guard financial policy in accordance with

Coast Guard rules, Federal Government regulations, generally accepted accounting principles

(GAAP), and generally accepted auditing standards (GAAS).

5. DISCLAIMER. This guidance is not a substitute for applicable legal requirements, nor is it

itself a rule. It is not intended to nor does it impose legally binding requirements on any

party outside the Coast Guard. It represents the Coast Guard’s current thinking on this topic

and may assist industry, mariners, the general public, and the Coast Guard, as well as other

Federal and State agencies, in applying statutory and regulatory requirements. All Coast

Guard personnel are required to ensure that current business practices are accomplished

within the guidelines of this policy.

COMDTINST M7100.3F

2

6. MAJOR CHANGES. Significant changes include: All Coast Guard financial procedures in

each of the ten chapters have been moved to The Financial Resource Management Manual -

Procedures (FRMM-P), COMDTINST M7100.4 (series).

In accordance with the DHS Common Appropriations Structure (CAS) implementation, CG

appropriation name changes and changes within/between appropriations have been updated

in this Manual.

7. ENVIRONMENTAL ASPECT AND IMPACT CONSIDERATIONS.

a. The development of this Manual and the general policies contained within it have been

thoroughly reviewed by the originating office in conjunction with the Office of

Environmental Management, Commandant (CG-47). This Manual is categorically

excluded under current Department of Homeland Security (DHS) categorical exclusion

(CATEX) A3 from further environmental analysis in accordance with the U.S. Coast

Guard Environmental Planning Policy, COMDTINST 5090.1, Environmental Planning

Implementing Procedures, and DHS Instruction Manual 023-01-001-01 (series).

b. This Manual will not have any of the following: significant cumulative impacts on the

human environment; substantial controversy or substantial change to existing

environmental conditions; or inconsistencies with any Federal, State, or local laws or

administrative determinations relating to the environment. All future specific actions

resulting from the general policy in this Manual must be individually evaluated for

compliance with the National Environmental Policy Act (NEPA) and Environmental

Effects Abroad of Major Federal Actions, Executive Order 12114, DHS NEPA policy,

Coast Guard Environmental Planning policy, and all other applicable environmental

mandates.

8. DISTRIBUTION. No paper distribution will be made of this Manual. An electronic version

will be located on the following Commandant (CG-612) websites. Internet:

http://www.dcms.uscg.mil/directives, and CGPortal:

https://cgportal.uscg.mil/library/directives/SitePages/Home.aspx

9. RECORDS MANAGEMENT CONSIDERATIONS. This Manual has been

thoroughly reviewed during the directives clearance process, and it has been determined

there are further records scheduling requirements, in accordance with Federal Records Act,

44 USC 3101 et seq., NARA requirements, and Information and Life Cycle Management

Manual, COMDTINST M5212.12 (series). This policy creates significant or substantial

change to existing records management requirements.

10. FORMS/REPORTS. The forms referenced in this Manual are available on the Internet:

http://www.dcms.uscg.mil/directives; and

CG Portal at https://cg.portal.uscg.mil/library/forms/SitePages/Forms.aspx. Department of

Defense forms are located here:

http://www.dtic.mil/whs/directives/infomgt/forms/formsprogram.htm. Department of

Homeland Security forms are located here: https://www.dhs.gov/dhs-forms-portal..

COMDTINST M7100.3F

3

Note: The Apportionment and Reapportionment Schedule, Form SF 132, and Report on

Budget Execution and Budgetary Resources, Form SF 133, have been incorporated into the

Federal Government’s electronic budgetary system; consequently, these forms are no longer

available as hard copies. The Apportionment and Reapportionment Schedule, Form SF 132,

is submitted using OMB’s secure web-based apportionment application system, and the

Report on Budget Execution and Budgetary Resources, Form SF 133, must be submitted

electronically through the Treasury’s Federal Agencies’ Governmentwide Treasury Account

Symbol Adjusted Trial Balance System (GTAS). For illustrative formats of these forms and

their proper use, see OMB Circular A-11, Sections 121 and 130, at the following website:

https://www.whitehouse.gov/omb/information-for-agencies/circulars/. In addition, guidance

for GTAS reporting can be found at:

https://www.fiscal.treasury.gov/fsservices/gov/acctg/gtas/gtas_home.htm.

11. REQUESTS FOR CHANGES. Units and individuals may recommend changes by writing

via the chain of command to:

COMMANDANT (CG-843)

ATTN: FINANCIAL MANAGEMENT POLICY DIVISION

US COAST GUARD STOP 7618

2703 MARTIN LUTHER KING JR AVE SE

WASHINGTON DC 20593-7618

T. G. ALLAN, JR. /s/

Rear Admiral, U.S. Coast Guard

Assistant Commandant for Resources

Chief Financial Officer

COMDTINST M7100.3F

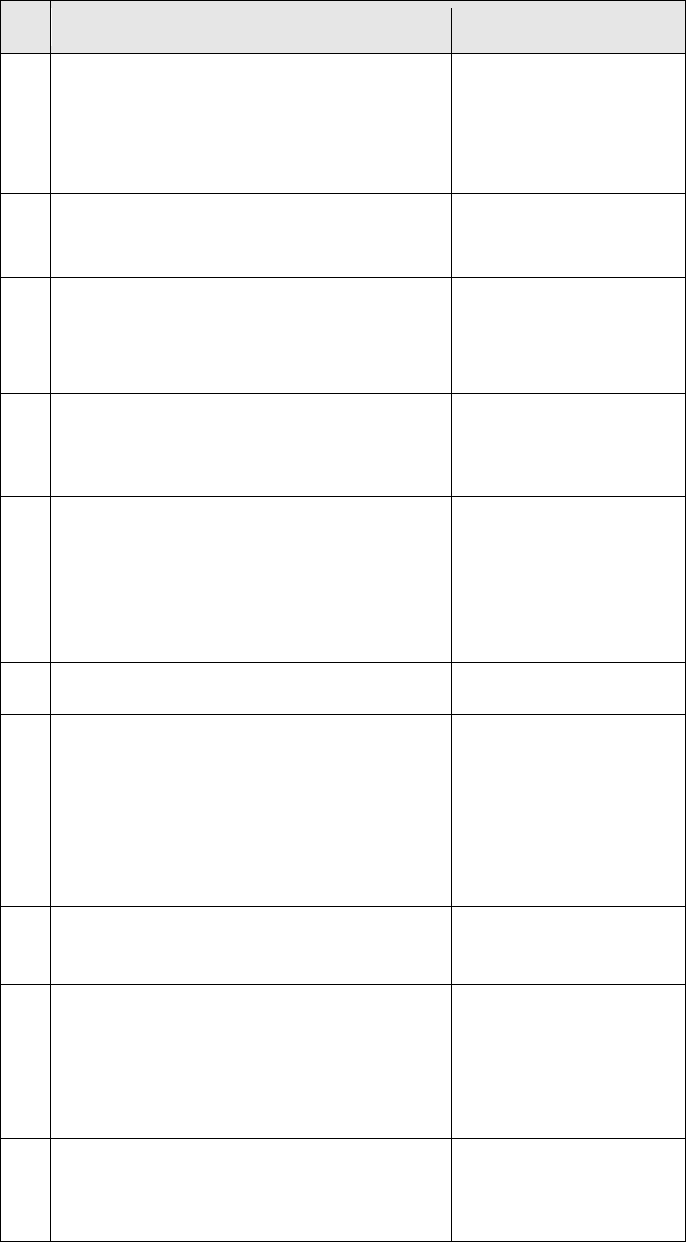

RECORD OF CHANGES

CHANGE

NUMBER

DATE OF

CHANGE

DATE

ENTERED

BY

WHOM ENTERED

COMDTINST M7100.3F

This page intentionally left blank.

COMDTINST M7100.3F

i

Table of Contents

Chapter 1. Introduction to Financial Resource Management 1-1

1.1 Purpose and Scope of this Manual ..................................................................................... 1-1

1.2 Financial Resource Management ....................................................................................... 1-1

1.2.1 Internal Controls .......................................................................................................... 1-1

1.2.2 Consideration of Fraud ................................................................................................ 1-4

1.2.3 Coast Guard Fraud Response Plan (FRP) .................................................................... 1-5

1.3 Financial Management Accounting Oversight Board (FMAOB) ................................... 1-5

1.3.1 Overview ...................................................................................................................... 1-5

1.3.2 Authorities ................................................................................................................... 1-6

1.3.3 Responsibilities ............................................................................................................ 1-6

1.3.4 Policy ........................................................................................................................... 1-8

1.4 The Budget Process ............................................................................................................. 1-9

1.4.1 Budget Formulation ................................................................................................... 1-10

1.4.2 Budget Execution ....................................................................................................... 1-11

1.5 Trademarks ........................................................................................................................ 1-11

Chapter 2. Coast Guard Budget Authority and Structure 2-1

2.1 Federal Agency Authority to Spend Funds ....................................................................... 2-1

2.2 Coast Guard Budget Authority .......................................................................................... 2-1

2.2.1 Regular Appropriations ................................................................................................ 2-2

2.2.2 Supplemental Appropriations ...................................................................................... 2-5

2.2.3 Continuing Resolutions ................................................................................................ 2-5

2.2.4 Operating with No Appropriations .............................................................................. 2-5

2.2.5 Revolving Funds .......................................................................................................... 2-6

2.2.6 General Gift Fund ........................................................................................................ 2-6

2.2.7 Sales, Fees, Fines, and Other Collections .................................................................... 2-6

2.2.8 Reimbursable Activities ............................................................................................... 2-7

2.2.9 Imprest Funds............................................................................................................... 2-7

2.2.10 Nonappropriated Funds (NAFs)................................................................................. 2-8

2.2.11 Cash and Property Recovered or Seized .................................................................... 2-8

2.2.12 Other Budget Authority ............................................................................................. 2-8

2.3 Subappropriation Accounts .............................................................................................. 2-25

2.3.1 Apportionment ........................................................................................................... 2-25

2.4 Operations & Support (O&S) Allowance Fund Control Codes .................................... 2-26

2.4.1 AFC-01 Military Pay ................................................................................................. 2-26

2.4.2 AFC-08 Civilian Pay.................................................................................................. 2-27

2.4.3 AFC-20 and AFC 21 Permanent Change of Station (PCS) ....................................... 2-27

2.4.4 AFC-30 Operating and Maintenance ......................................................................... 2-27

COMDTINST M7100.3F

Table of Contents

ii

2.4.5 AFC-34 Training and Recruiting Centers .................................................................. 2-27

2.4.6 AFC-36 Central Accounts .......................................................................................... 2-28

2.4.7 AFC-40 Other Activities ............................................................................................ 2-28

2.4.8 AFC-41 Aeronautical Engineering ............................................................................ 2-28

2.4.9 AFC-42 Command, Control, Communications, and Electronics Engineering .......... 2-28

2.4.10 AFC-43 Civil Engineering ....................................................................................... 2-28

2.4.11 AFC-45 Naval Engineering ..................................................................................... 2-28

2.4.12 AFC-56 Training ...................................................................................................... 2-29

2.4.13 AFC-57 Health, Safety, and Work-Life ................................................................... 2-29

2.4.14 AFC-75 Reimbursable/Refund Program .................................................................. 2-29

2.4.15 AFC-77 Reimbursable Execution Account .............................................................. 2-29

2.4.16 AFC-80 Reimbursements ......................................................................................... 2-29

2.5 Reserve Training (RT) Allowance Fund Control Codes ................................................ 2-30

2.6 Retired Pay (RP) Allowance Fund Control Codes ......................................................... 2-31

2.7 Coast Guard Supply Fund ................................................................................................ 2-31

2.7.1 Authorities ................................................................................................................. 2-32

2.7.2 Responsibilities .......................................................................................................... 2-33

2.8 PC&I Project Identification System ................................................................................ 2-35

2.9 Transfers ............................................................................................................................ 2-36

2.9.1 Refunds ...................................................................................................................... 2-36

2.9.2 Reimbursements ......................................................................................................... 2-36

2.10 The Investment Board ..................................................................................................... 2-36

2.10.1 The Resource Group ................................................................................................ 2-37

2.11 The Budget Review Board .............................................................................................. 2-37

2.11.1 Headquarters Unit – Financial Management Staff ................................................... 2-37

2.11.2 Field Unit – Commanding Officers ......................................................................... 2-37

2.11.3 Field Unit – Executive Officers ............................................................................... 2-38

2.11.4 Field Unit – Financial Managers .............................................................................. 2-38

Chapter 3. Administrative Control of Funds 3-1

3.1 Purpose ................................................................................................................................. 3-1

3.1.1 Policy Review .............................................................................................................. 3-1

3.2 Authority for Funds Control .............................................................................................. 3-1

3.3 Scope of Funds Control ....................................................................................................... 3-2

3.4 Responsibilities .................................................................................................................... 3-2

3.4.1 DHS Under Secretary for Management (DHS USM) .................................................. 3-3

3.4.2 DHS Chief Financial Officer (DHS CFO) ................................................................... 3-3

3.4.3 DHS Director, Office of Financial Management (OFM) ............................................. 3-3

COMDTINST M7100.3F

Table of Contents

iii

3.4.4 DHS Director, Budget Office....................................................................................... 3-3

3.4.5 Commandant (CG-00) ................................................................................................. 3-4

3.4.6 Assistant Commandant and Deputy Assistant Commandant for Resources

(CG-8/8D) ................................................................................................................... 3-4

3.4.7 Director of Financial Operations/Comptroller (CG-8C) .............................................. 3-5

3.4.8 Office of Financial Policy, Reporting, and Property (CG-84) ..................................... 3-5

3.4.9 Office of Resource Management (CG-83) ................................................................... 3-6

3.4.10 Funds Control Division (CG-831) ............................................................................. 3-6

3.4.11 Office of Procurement Policy & Oversight (CG-913) ............................................... 3-7

3.5 Antideficiency Act ............................................................................................................... 3-8

3.5.1 Violations of the Antideficiency Act ........................................................................... 3-9

3.5.2 Violations of Limitations That Do Not Per Se Violate the Antideficiency Act ........... 3-9

3.5.3 Antideficiency Act Employee Restrictions ................................................................ 3-10

3.5.4 Penalties ..................................................................................................................... 3-10

3.5.5 Antideficiency Act Violations Discovered by Coast Guard Employees.................... 3-10

3.5.6 ADA Violations Uncovered During Audits ............................................................... 3-11

3.5.7 Examples of ADA Violations .................................................................................... 3-11

3.5.8 Training of Financial Managers and Investigating Officials ..................................... 3-13

3.5.9 Reporting Violations .................................................................................................. 3-14

3.6 Apportionments ................................................................................................................. 3-14

3.6.1 Anticipated Reimbursements ..................................................................................... 3-14

3.6.2 Deficiency Apportionments ....................................................................................... 3-15

3.7 Policy on Allotments and Suballotments ......................................................................... 3-15

3.7.1 Restrictions ................................................................................................................ 3-15

3.8 Administrative Control of Funds Policy .......................................................................... 3-16

3.8.1 Administrative Control of Funds ............................................................................... 3-16

3.8.2 Formal Delegation of Budget Authority .................................................................... 3-17

3.8.3 Responsibility for Administrative Control of Funds .................................................. 3-17

3.8.4 Delegation of Authority within the Chain of Command ............................................ 3-17

3.8.5 Segregation of Duties ................................................................................................. 3-18

3.8.6 Accounting Support for Fund Control Systems ......................................................... 3-18

3.8.7 Allotment/Suballotment Managers ............................................................................ 3-19

3.8.8 Allowance Managers ................................................................................................. 3-19

3.8.9 Administrative Target Unit Commander, Commanding Officer, Director, or

Superintendent ........................................................................................................... 3-20

3.8.10 Program Element Managers ..................................................................................... 3-20

3.8.11 Civilian Employee Financial Resource Official (CEFRO) formerly

Performance Incentive Pay Officials (PIPO) ............................................................ 3-21

3.8.12 Civilian Resource Coordinators (CRC) ................................................................... 3-21

COMDTINST M7100.3F

Table of Contents

iv

Chapter 4. Budget Formulation 4-1

4.1 Overview ............................................................................................................................... 4-1

4.2 The Stages and Format of the Budget ............................................................................... 4-1

4.2.1 Budget Stages............................................................................................................... 4-2

4.2.2 Budget Format ............................................................................................................. 4-2

4.2.3 Budget Preparation – Participants ................................................................................ 4-2

4.2.4 Congressional Stage ..................................................................................................... 4-2

4.3 Public Disclosure ................................................................................................................. 4-3

4.3.1 Release or Withholding of Information ....................................................................... 4-3

4.3.2 Questions on Public Disclosure ................................................................................... 4-3

4.4 Preparation of the Congressional Stage Budget – President’s Budget

(Appendix) ....................................................................................................................... 4-3

Chapter 5. Budget Execution 5-1

5.1 Overview ............................................................................................................................... 5-1

5.1.1 Purpose ......................................................................................................................... 5-1

5.1.2 Scope ............................................................................................................................ 5-2

5.2 Authorities ............................................................................................................................ 5-3

5.3 Responsibilities .................................................................................................................... 5-6

5.3.1 Coast Guard Financial Management Organizations .................................................... 5-6

5.3.2 Coast Guard Central Management Organizations Other Than Financial .................... 5-8

5.3.3 All Coast Guard Employees Committing and Obligating Funds ................................. 5-9

5.4 Actions Taken Prior to the Start of the Fiscal Year ....................................................... 5-10

5.4.1 Updating and Synchronizing Coast Guard Budget and Accounting Coding

Structure .................................................................................................................... 5-10

5.4.2 Preparing Apportionments Required Prior to the Start of the Year ........................... 5-10

5.4.3 Monitoring the Status of Appropriation Bills ............................................................ 5-11

5.5 Actions Taken at the Start of the Fiscal Year ................................................................. 5-12

5.5.1 Establishing Funding under a Continuing Resolution ............................................... 5-12

5.5.2 Managing Operations under a Continuing Resolution ............................................... 5-12

5.5.3 Managing Operations in the Absence of Appropriations – Funding Hiatus .............. 5-14

5.5.4 Preparing Apportionment and Reapportionment Actions upon the Enactment

of Appropriations ...................................................................................................... 5-14

5.5.5 Establishing and Recording Apportionments, Allotments, and Suballotments ......... 5-15

5.5.6 Preparing the Final Financial Management Operation Plan (FMOP) ........................ 5-16

5.5.7 Meeting OMB Financial Plan Requirements ............................................................. 5-16

5.5.8 Meeting DHS Operating Plan Requirements ............................................................. 5-17

5.5.9 Establishing Operating Plans within the Coast Guard Funds Control Structure ........ 5-18

5.5.10 Coordinating Legal Requirements from Appropriations Language with the

Judge Advocate General & Chief Counsel (CG-094) ............................................... 5-20

COMDTINST M7100.3F

Table of Contents

v

5.5.11 Statutory and Administrative Ceilings – Ceilings in the Authorization Process ..... 5-21

5.5.12 Formulating and Establishing the Financial Management Operation Plan

(FMOP) ..................................................................................................................... 5-23

5.5.13 Revolving Funds ...................................................................................................... 5-25

5.6 Actions Taken during the Fiscal Year ............................................................................. 5-26

5.6.1 Availability of Funds by Purpose............................................................................... 5-26

5.6.2 Commitments – By Document Type and/or Object Class ......................................... 5-34

5.6.3 Recording, Monitoring, Validating, and Certifying Obligations ............................... 5-36

5.6.4 Reporting Violations of Informal Subdivisions of Budget Authority ........................ 5-43

5.6.5 Internal Controls for Budgetary Resource Management ........................................... 5-44

5.6.6 Reimbursable Programs (Coast Guard as Seller) ....................................................... 5-50

5.6.7 Refund Programs (Adjustments between Appropriations, 31 USC 1534)................. 5-63

5.6.8 Operating Expenses – Military and Civilian Pay/Cost of Living (COL) ................... 5-64

5.6.9 Operations & Support (O&S) – Adjustments and Miscellaneous ............................. 5-66

5.6.10 Use of Operations & Support (O&S) Funds ............................................................ 5-73

5.6.11 Research & Development (R&D) – Financial Management Operation Plan

(FMOP) ..................................................................................................................... 5-88

5.6.12 Procurement, Construction, and Improvement (PC&I) – Purpose .......................... 5-94

5.6.13 Reserve Training (RT) – General Responsibilities .................................................. 5-97

5.6.14 Environmental Compliance and Restoration (EC&R) ............................................. 5-97

5.6.15 Oil Spill Liability Trust Fund (OSLTF) ................................................................. 5-104

5.6.16 Alteration of Bridges (AB) – Reprogramming Guidelines .................................... 5-104

5.6.17 Retired Pay (RP) .................................................................................................... 5-104

5.6.18 Industrial Bases – Responsibilities ........................................................................ 5-104

5.6.19 Reprogramming ..................................................................................................... 5-106

5.6.20 Supply Fund ........................................................................................................... 5-110

5.6.21 Special Deposits, Funds, and Receipts ................................................................... 5-110

5.6.22 Accepting Gifts Offered by Non-Federal Sources ................................................. 5-110

5.6.23 Managing Changes in the Amounts of Budgetary Resources in an

Appropriation .......................................................................................................... 5-111

5.6.24 Managing Changes in the Application of Budgetary Resources Within an

Appropriation .......................................................................................................... 5-116

5.6.25 Monitoring the Status of Funds in Operating Plans and Financial Reporting ....... 5-122

5.6.26 Monitoring and Reporting Treasury Appropriation Fund Symbols (TAFSs) ........ 5-122

5.7 Actions Taken at the End of the Fiscal Year................................................................. 5-125

5.7.1 Managing Expired and Cancelled Accounts ............................................................ 5-125

5.7.2 Year-end Reporting and Closeout ............................................................................ 5-133

Chapter 6. Continuing Operations without Appropriations 6-1

6.1 Situation ............................................................................................................................... 6-1

6.2 Policy..................................................................................................................................... 6-1

COMDTINST M7100.3F

Table of Contents

vi

Chapter 7. Accounting Policies and Standards 7-1

7.1 Required Use of the U.S. Standard General Ledger ........................................................ 7-1

7.1.1 Overview ...................................................................................................................... 7-1

7.1.2 Authorities ................................................................................................................... 7-2

7.1.3 Responsibilities ............................................................................................................ 7-2

7.1.4 Policy ........................................................................................................................... 7-3

7.2 Obligations – By Document Type and/or Object Class .................................................... 7-4

7.2.1 Purpose ......................................................................................................................... 7-5

7.2.2 Responsibilities ............................................................................................................ 7-6

7.2.3 Policy ........................................................................................................................... 7-7

7.3 Fund Balance with Treasury (FBWT) ............................................................................. 7-28

7.3.1 Overview .................................................................................................................... 7-28

7.3.2 Authorities ................................................................................................................. 7-30

7.3.3 Overall Policy ............................................................................................................ 7-31

7.3.4 Reconciliation of Fund Balance with Treasury (FBWT) ........................................... 7-32

7.3.5 Edit Check Reconciliation ......................................................................................... 7-34

7.3.6 Analysis and Reconciliation of GL Account Relationships and Abnormal

Balances .................................................................................................................... 7-35

7.3.7 Analysis and Reconciliation of GL Control Accounts to Subsidiary and/or

Supporting Records ................................................................................................... 7-36

7.4 Reliance on Financial Data from Other Government Agencies .................................... 7-38

7.4.1 Overview .................................................................................................................... 7-38

7.4.2 Purpose ....................................................................................................................... 7-38

7.4.3 Scope .......................................................................................................................... 7-38

7.4.4 Authorities ................................................................................................................. 7-38

7.4.5 Responsibilities .......................................................................................................... 7-39

7.4.6 Policy ......................................................................................................................... 7-40

7.5 Financial Policy for Real and Personal Property ........................................................... 7-41

7.5.1 Authorities ................................................................................................................. 7-41

7.5.2 Responsibilities .......................................................................................................... 7-43

7.5.3 Recognition and Valuation of Real and Personal Property ........................................ 7-46

7.5.4 Asset Disposal Policy ................................................................................................ 7-48

7.5.5 Impaired Assets .......................................................................................................... 7-48

7.5.6 Oracle Asset Systems ................................................................................................. 7-49

7.5.7 Inventory – Capital Assets ......................................................................................... 7-49

7.5.8 Real Property ............................................................................................................. 7-49

7.5.9 Personal Property ....................................................................................................... 7-49

COMDTINST M7100.3F

Table of Contents

vii

7.6 Financial Policy for Operating Materials and Supplies ................................................. 7-50

7.6.1 Authorities ................................................................................................................. 7-50

7.6.2 Responsibilities .......................................................................................................... 7-51

7.6.3 Policy ......................................................................................................................... 7-52

7.7 Financial Accounting and Reporting of INV and OM&S for Coast Guard ICPs ....... 7-52

7.7.1 Purpose ....................................................................................................................... 7-53

7.7.2 Scope .......................................................................................................................... 7-53

7.7.3 Procedures Modifications and Changes ..................................................................... 7-53

7.7.4 Authorities ................................................................................................................. 7-53

7.7.5 Responsibilities .......................................................................................................... 7-54

7.7.6 Policy ......................................................................................................................... 7-57

7.8 Accounting for Coast Guard Internal Use Software ...................................................... 7-62

7.8.1 Overview .................................................................................................................... 7-62

7.8.2 Authorities ................................................................................................................. 7-63

7.8.3 Responsibilities .......................................................................................................... 7-63

7.8.4 Recognition and Valuation ........................................................................................ 7-64

7.9 Financial Policy for Revenue and Accounts Receivable ................................................ 7-69

7.9.1 Overview .................................................................................................................... 7-69

7.9.2 Authorities ................................................................................................................. 7-70

7.9.3 Responsibilities .......................................................................................................... 7-72

7.9.4 Revenue Policy .......................................................................................................... 7-75

7.9.5 Accounts Receivable Policy ...................................................................................... 7-79

7.10 Reimbursable Agreements ............................................................................................ 7-107

7.10.1 Reimbursable Agreements – Coast Guard as Buyer .............................................. 7-107

7.10.2 Reimbursable Agreements – Coast Guard as Seller .............................................. 7-108

7.11 Accounts Payable and Disbursements ......................................................................... 7-113

7.11.1 Overview ................................................................................................................ 7-113

7.11.2 Authorities ............................................................................................................. 7-114

7.11.3 Responsibilities ...................................................................................................... 7-116

7.11.4 Accounts Payable ................................................................................................... 7-117

7.11.5 Accruals ................................................................................................................. 7-119

7.11.6 Disbursements ........................................................................................................ 7-119

7.11.7 Advances and Prepayments ................................................................................... 7-127

7.11.8 Authorized Certifying Officers and Payment Approving Officials ....................... 7-131

7.11.9 Vendor and Contract Payments.............................................................................. 7-133

7.11.10 Purchase Cards ..................................................................................................... 7-136

7.11.11 DHS Fleet Cards .................................................................................................. 7-140

7.11.12 Government Travel Charge Cards ....................................................................... 7-143

7.11.13 Coast Guard Investigative Service (CGIS) Debit Cards ...................................... 7-144

COMDTINST M7100.3F

Table of Contents

viii

7.11.14 Imprest Funds....................................................................................................... 7-146

7.11.15 Grant Liabilities ................................................................................................... 7-149

7.11.16 Reimbursable Agreements ................................................................................... 7-151

7.11.17 Revolving Funds .................................................................................................. 7-154

7.11.18 Coast Guard Trust Funds ..................................................................................... 7-157

7.12 Intragovernmental Payment and Collection (IPAC) ................................................. 7-159

7.12.1 Authorities ............................................................................................................. 7-160

7.12.2 Policy ..................................................................................................................... 7-160

7.13 Accrual Policy ................................................................................................................ 7-161

7.13.1 Purpose ................................................................................................................... 7-162

7.13.2 Authorities ............................................................................................................. 7-162

7.13.3 Responsibilities ...................................................................................................... 7-163

7.13.4 Policy ..................................................................................................................... 7-164

7.14 Imputed Costs ................................................................................................................ 7-167

7.15 Unclaimed Monies ......................................................................................................... 7-167

7.15.1 Authority ................................................................................................................ 7-167

7.15.2 Responsibilities ...................................................................................................... 7-167

7.15.3 Policy ..................................................................................................................... 7-168

7.16 Actuarial Liabilities – Military Entitlement Programs .............................................. 7-168

7.16.1 Overview ................................................................................................................ 7-168

7.16.2 Authorities ............................................................................................................. 7-170

7.16.3 Responsibilities ...................................................................................................... 7-174

7.16.4 Policy ..................................................................................................................... 7-175

7.17 Contingent Legal Liabilities ......................................................................................... 7-178

7.17.1 Overview ................................................................................................................ 7-178

7.17.2 Authorities ............................................................................................................. 7-178

7.17.3 Responsibilities ...................................................................................................... 7-179

7.17.4 Policy ..................................................................................................................... 7-180

7.18 Environmental Liabilities ............................................................................................. 7-181

7.18.1 Overview ................................................................................................................ 7-181

7.18.2 Authorities ............................................................................................................. 7-182

7.18.3 Responsibilities ...................................................................................................... 7-183

7.18.4 Policy ..................................................................................................................... 7-185

7.19 Treasury Information Maintenance Process .............................................................. 7-185

7.19.1 Overview ................................................................................................................ 7-185

COMDTINST M7100.3F

Table of Contents

ix

7.20 Treasury Payment Confirmation Process ................................................................... 7-186

7.20.1 Overview ................................................................................................................ 7-186

7.20.2 Purpose ................................................................................................................... 7-186

7.20.3 Authorities ............................................................................................................. 7-186

7.20.4 Responsibilities ...................................................................................................... 7-188

7.20.5 Policy ..................................................................................................................... 7-188

7.21 Management of the CAS Outbox Holding Queue in FPD ......................................... 7-189

7.21.1 Overview ................................................................................................................ 7-189

7.21.2 Scope ...................................................................................................................... 7-190

7.21.3 Authorities ............................................................................................................. 7-190

7.21.4 Responsibilities ...................................................................................................... 7-190

Chapter 8. Financial Reporting 8-1

8.1 Monthly, Quarterly, and Year-End Reporting ................................................................. 8-1

8.1.1 Overview ...................................................................................................................... 8-1

8.1.2 Authorities ................................................................................................................... 8-2

8.1.3 Responsibilities ............................................................................................................ 8-3

8.1.4 General Policy .............................................................................................................. 8-6

8.2 Adjustments, Eliminations, and Other Special Intragovernmental

Reconciliations ................................................................................................................. 8-6

8.2.1 Overview ...................................................................................................................... 8-6

8.2.2 CG TIER Adjustments Responsibilities ...................................................................... 8-6

8.2.3 Authorities ................................................................................................................... 8-7

8.2.4 Responsibilities ............................................................................................................ 8-8

8.2.5 Access to CG TIER ...................................................................................................... 8-8

Chapter 9. Coast Guard Financial and Mixed Systems 9-1

9.1 Overview ............................................................................................................................... 9-1

9.1.1 Purpose ......................................................................................................................... 9-1

9.1.2 Scope ............................................................................................................................ 9-1

9.1.3 Definitions ................................................................................................................... 9-2

9.2 Authorities ............................................................................................................................ 9-2

9.3 Responsibilities .................................................................................................................... 9-3

9.3.1 Contracting & Procurement Directorate (CG-91) ........................................................ 9-3

9.3.2 Assistant Commandant for Resources (CG-8) ............................................................. 9-4

9.3.3 Assistant Commandant for Command, Control, Communications, Computers

and Information Technology (C4IT) (CG-6) .............................................................. 9-6

9.3.4 Headquarters, Area, and District Programs ................................................................. 9-8

9.3.5 Coast Guard Training Center Petaluma ....................................................................... 9-8

9.3.6 Coast Guard Training Center Yorktown ...................................................................... 9-8

9.3.7 All Coast Guard Units .................................................................................................. 9-8

COMDTINST M7100.3F

Table of Contents

x

9.4 CFO and CIO Cooperation ................................................................................................ 9-9

9.5 Financial and Mixed Systems Requirements .................................................................... 9-9

9.5.1 Financial Management Data Integrity .......................................................................... 9-9

9.5.2 Financial Systems ...................................................................................................... 9-11

9.5.3 Mixed Systems ........................................................................................................... 9-12

9.5.4 FPD Authorized for Service-Wide Use ..................................................................... 9-13

9.5.5 Inventory of Finance and Procurement Systems ........................................................ 9-13

9.5.6 Data Entry Transmission ............................................................................................ 9-13

9.5.7 Commercial Off-the-Shelf/Government Off-the-Shelf (COTS/GOTS) .................... 9-13

9.5.8 Standard Products ...................................................................................................... 9-13

9.5.9 Comparability and Consistency ................................................................................. 9-14

9.5.10 Integrated Financial Management Systems ............................................................. 9-14

9.5.11 U.S. Standard General Ledger at the Transaction Level .......................................... 9-14

9.5.12 Federal Accounting Standards ................................................................................. 9-14

9.5.13 Financial Reporting .................................................................................................. 9-15

9.5.14 Budget Reporting ..................................................................................................... 9-15

9.5.15 Functional Requirements ......................................................................................... 9-15

9.5.16 Computer Security Act Requirements ..................................................................... 9-15

9.5.17 Documentation ......................................................................................................... 9-15

9.5.18 Internal Controls ...................................................................................................... 9-16

9.5.19 Training and User Support ....................................................................................... 9-16

9.5.20 Licenses ................................................................................................................... 9-16

9.5.21 Maintenance ............................................................................................................. 9-17

9.5.22 Centralized User Administration (CUA) of the Finance and Procurement

Desktop (FPD) .......................................................................................................... 9-17

Chapter 10. Property, Plant, and Equipment (PP&E) 10-1

10.1 Introduction ..................................................................................................................... 10-1

10.2 Financial Accounting and Reporting of Capitalized Real Property ........................... 10-2

10.2.1 Purpose ..................................................................................................................... 10-3

10.2.2 Scope ........................................................................................................................ 10-3

10.2.3 Authorities ............................................................................................................... 10-3

10.2.4 Responsibilities ........................................................................................................ 10-4

10.2.5 Recognition and Valuation of Real Property (including CIP) ................................. 10-6

10.2.6 Improvements .......................................................................................................... 10-7

10.2.7 Costing Methodology ............................................................................................... 10-7

10.2.8 Project Establishment ............................................................................................... 10-8

10.2.9 Project Execution ..................................................................................................... 10-9

10.2.10 Asset Receipt, Acceptance, and Enrollment - Real Property (CIP) ....................... 10-9

10.2.11 Capitalization of Real Property Assets .................................................................. 10-9

COMDTINST M7100.3F

Table of Contents

xi

10.2.12 Asset Identification .............................................................................................. 10-11

10.2.13 CIP Project Closeout ............................................................................................ 10-11

10.2.14 Exchange of Nonmonetary Assets ....................................................................... 10-12

10.3 Financial Accounting and Reporting of Capitalized Personal Property .................. 10-12

10.3.1 Purpose ................................................................................................................... 10-13

10.3.2 Scope ...................................................................................................................... 10-13

10.3.3 Modifications to Policy .......................................................................................... 10-14

10.3.4 Authorities ............................................................................................................. 10-14

10.3.5 Responsibilities ...................................................................................................... 10-16

10.3.6 Policy ..................................................................................................................... 10-26

10.4 Deferred Maintenance and Repairs of Assets ............................................................. 10-60

10.4.1 Purpose ................................................................................................................... 10-61

10.4.2 Scope ...................................................................................................................... 10-61

10.4.3 Authorities ............................................................................................................. 10-61

10.4.4 Responsibilities ...................................................................................................... 10-62

10.4.5 General Policy ........................................................................................................ 10-63

10.4.6 Reporting of Deferred Maintenance and Repairs................................................... 10-64

10.4.7 Aviation (AFC-41) Depot-Level Deferred Maintenance ....................................... 10-64

10.4.8 Electronics (AFC-42) Depot-Level Deferred Maintenance ................................... 10-65

10.4.9 Shore Facility (AFC-43) Depot-Level Deferred Maintenance .............................. 10-65

10.4.10 Naval (AFC-45) Depot-Level Deferred Maintenance ......................................... 10-65

10.5 Cost Decision Table and Notes ..................................................................................... 10-66

10.6 Financial Accounting and Reporting of Capital and Operating Leases ................... 10-75

10.6.1 Overview ................................................................................................................ 10-75

10.6.2 Purpose ................................................................................................................... 10-76

10.6.3 Scope ...................................................................................................................... 10-76

10.6.4 Authorities ............................................................................................................. 10-76

10.6.5 Responsibilities ...................................................................................................... 10-77

10.6.6 Policy ..................................................................................................................... 10-80

10.7 Stewardship PP&E ........................................................................................................ 10-86

10.7.1 Overview ................................................................................................................ 10-86

10.7.2 Authorities ............................................................................................................. 10-87

10.7.3 Heritage Assets ...................................................................................................... 10-87

10.7.4 Stewardship Land................................................................................................... 10-88

COMDTINST M7100.3F

Table of Contents

xii

Glossary .......................................................................................................................................... i

Acronyms ....................................................................................................................................... i

Forms .............................................................................................................................................. i

COMDTINST M7100.3F

i

List of Tables

Table 1.1 Control Activities ...................................................................................................................... 1-3

Table 1.2 Timetable of the Congressional Budget Process ..................................................................... 1-10

Table 2.1 Submission of Super Surplus Proposals to Congressional Appropriations Timeline ............. 2-22

Table 2.2 Deliverable Timeline .............................................................................................................. 2-24

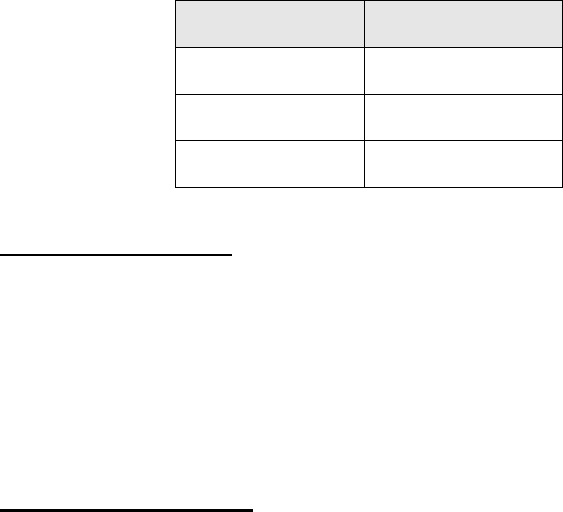

Table 2.3 Supply Fund Accounts ............................................................................................................ 2-32

Table 2.4 Explanation of PC&I Product Identification Numbers ........................................................... 2-36

Table 5.1 AFC Codes and Corresponding Managers.............................................................................. 5-72

Table 5.2 Appropriation Matrix .............................................................................................................. 5-90

Table 7.1 Classification of ICP Stock Items ........................................................................................... 7-57

Table 7.2 Required Valuation Documentation by Acquisition Type ...................................................... 7-59

Table 7.3 Accounting Treatment for Software Project Phases ............................................................... 7-65

Table 7.4 Delegations of Authority to Sign Reimbursable Agreements ............................................... 7-111

Table 7.5 Transaction Life Cycle for the Use of Budgetary Resources ................................................ 7-161

Table 7.6 Reporting Periods for Financial Events Requiring Accruals ................................................ 7-164

Table 7.7 Reconciliation of FBWT – ALC ........................................................................................... 7-192

Table 7.8 Reconciliation of FBWT – CG TIER ................................................................................... 7-192

Table 7.9 Reconciliation of FBWT – FINCEN .................................................................................... 7-193

Table 7.10 Reconciliation of FBWT – PPC .......................................................................................... 7-193

Table 7.11 Reconciliation of FBWT – Yard/SFLC .............................................................................. 7-194

Table 7.12 Edit Check Reconciliation – ALC ...................................................................................... 7-195

Table 7.13 Edit Check Reconciliation – CG TIER ............................................................................... 7-196

Table 7.14 Edit Check Reconciliation – FINCEN ................................................................................ 7-197

Table 7.15 Edit Check Reconciliation – Yard/SFLC ............................................................................ 7-198

Table 7.16 Reconciliation of GL Account Relationships and Abnormal Balances – ALC .................. 7-199

Table 7.17 Reconciliation of GL Account Relationships and Abnormal Balances – CG TIER ........... 7-201

Table 7.18 Reconciliation of GL Account Relationships and Abnormal Balances – FINCEN ............ 7-203

Table 7.19 Reconciliation of GL Account Relationships and Abnormal Balances – PPC ................... 7-205

Table 7.20 Reconciliation of GL Account Relationships and Abnormal Balances – Yard/SFLC ....... 7-207

Table 7.21 Reconciliation of GL Control Accounts to Subsidiary Records – ALC ............................. 7-208

Table 7.22 Reconciliation of GL Control Accounts to Subsidiary Records – CG TIER ...................... 7-209

Table 7.23 Reconciliation of GL Control Accounts to Subsidiary Records – FINCEN ....................... 7-210

Table 7.24 Reconciliation of GL Control Accounts to Subsidiary Records – PPC .............................. 7-211

Table 7.25 Reconciliation of GL Control Accounts to Subsidiary Records – Yard/SFLC................... 7-212

COMDTINST M7100.3F

List of Tables

ii

Table 7.26 Required Accruals by Document Type ............................................................................... 7-213

Table 10.1 Capitalization Thresholds – Real Property ......................................................................... 10-10

Table 10.2 Useful Life of Real Property ............................................................................................... 10-11

Table 10.3 Capitalization Thresholds – Personal Property ................................................................... 10-28

Table 10.4 Support Documentation for Asset Receipt and Acceptance ............................................... 10-34

Table 10.5 Documentation Required for Valuation of CIP Assets ....................................................... 10-36

Table 10.6 Initial Useful Life of New Assets for Existing Classes of Aircraft ..................................... 10-39

Table 10.7 Initial Useful Life of New Assets for Existing Classes of Vessels ..................................... 10-40

Table 10.8 Initial Useful Life (in years) of New Assets for Existing Classes of Boats ........................ 10-42

Table 10.9 Estimates of Useful Life for Other Boat Types .................................................................. 10-43

Table 10.10 Initial Useful Life of New Electronics Assets .................................................................. 10-43

Table 10.11 Initial Useful Life of New Assets of Other Personal Property.......................................... 10-44

Table 10.12 Tagging and Identification Requirements for Various Asset Types ................................. 10-44

Table 10.13 Asset Categories and Corresponding OPCOM/Program Offices ..................................... 10-52

Table 10.14 Cost Decision Table for Real and Personal Property Categories ...................................... 10-66

COMDTINST M7100.3F

i

List of Figures

Figure 5.1 Typical Coast Guard Business Card ...................................................................................... 5-75

COMDTINST M7100.3F

ii

This page intentionally left blank.

COMDTINST M7100.3F

1-1

Chapter 1. Introduction to Financial Resource Management

1.1 Purpose and Scope of this Manual

This Manual, Financial Resource Management Manual (FRMM-F), COMDTINST M7100.3

(series), prescribes Coast Guard financial resource management policy. It sets forth

responsibilities, guidelines, timetables, and some procedures for Headquarters (HQ) staffs, areas,

districts, logistics and service center commands, and Headquarters units involved in financial

resource management and administration.

Note: The procedures manual, Financial Resource Management Manual-Procedures (FRMM-

P), COMDTINST M7100.4 (series), was promulgated to provide enterprise-level procedures and

prevent the absence of documented procedures and misalignment of procedures across the Coast

Guard. Financial Resource Management Manual-Procedures (FRMM-P), COMDTINST

M7100.4 (series), includes detailed responsibilities and procedures and definitions.

There are chapters/sections in both the policy and procedure manuals that include duplicate

financial information. The language is placed in both manuals because it is deemed critical to the

process being discussed and/or is considered necessary to properly describe the respective policy

and procedures discussed.

1.2 Financial Resource Management

Financial resource management includes the diligent oversight of all actions that affect the use of

Coast Guard funds. These efforts include:

1. Obtaining funding to carry out the missions, duties, and responsibilities of the Coast

Guard;

2. Exercising good stewardship over the funds provided, by ensuring that they are used for

the purposes for which they were intended and in accordance with applicable laws, rules,

regulations, and policies; and

3. Maintaining audit-ready documentation in accordance with the Information and Life

Cycle Management Manual, COMDTINST M5212.12 (series).

1.2.1 Internal Controls

Management is fundamentally responsible for developing and maintaining effective internal

controls, as prescribed by Office of Management and Budget (OMB), Circular A-123,

Management’s Responsibility for Internal Control. The proper stewardship of Coast Guard

resources is an essential responsibility of financial managers and staff. Coast Guard employees

must ensure that programs operate and resources are used efficiently and effectively to achieve

desired objectives. Programs must operate and resources must be used consistent with the Coast

Guard’s missions, in compliance with laws and regulations, and with minimal potential for

waste, fraud, and mismanagement. Effective internal controls provide assurance that significant

weaknesses in the design or operation of internal controls, that could adversely affect the Coast

Guard’s ability to meet its objectives, would be prevented or detected in a timely manner.

COMDTINST M7100.3F

1-2

Internal controls include the policies, procedures, activities, and ethical values designed to

enhance and strengthen existing financial reporting, and ensure that actions are taken to address

risks. Internal control is a process affected by an entity’s oversight body, management, and other

personnel that provides reasonable assurance that the objectives of an entity will be achieved.

These objectives and related risks can be broadly classified into one or more of the following

three categories:

1. Operations - Effectiveness and efficiency of operations

2. Reporting - Reliability of reporting for internal and external use

3. Compliance - Compliance with applicable laws and regulations

Coast Guard’s internal controls are designed to address the following five areas:

1. Control Environment relates to the control consciousness of the people within the

organization.

2. Risk Assessment refers to the organization's identification, analysis, and management of

the risks that are related to financial statement preparation, in order to ensure the financial

statements are presented fairly and in accordance with generally accepted accounting

principles.

3. Information and Communication focus on the nature and quality of information needed

for effective control, the systems used to develop such information, and reports necessary

to communicate it effectively.

4. Monitoring involves assessing the quality and effectiveness of the organization’s internal

control process over time.

5. Control Activities are the policies and procedures that help ensure that management

directives are carried out and that management's assertions in its financial reporting are

valid. They help to ensure that necessary actions are taken to address risks to the

achievement of the entity’s objectives. Control activities (also known as process level

controls) include:

COMDTINST M7100.3F

1-3

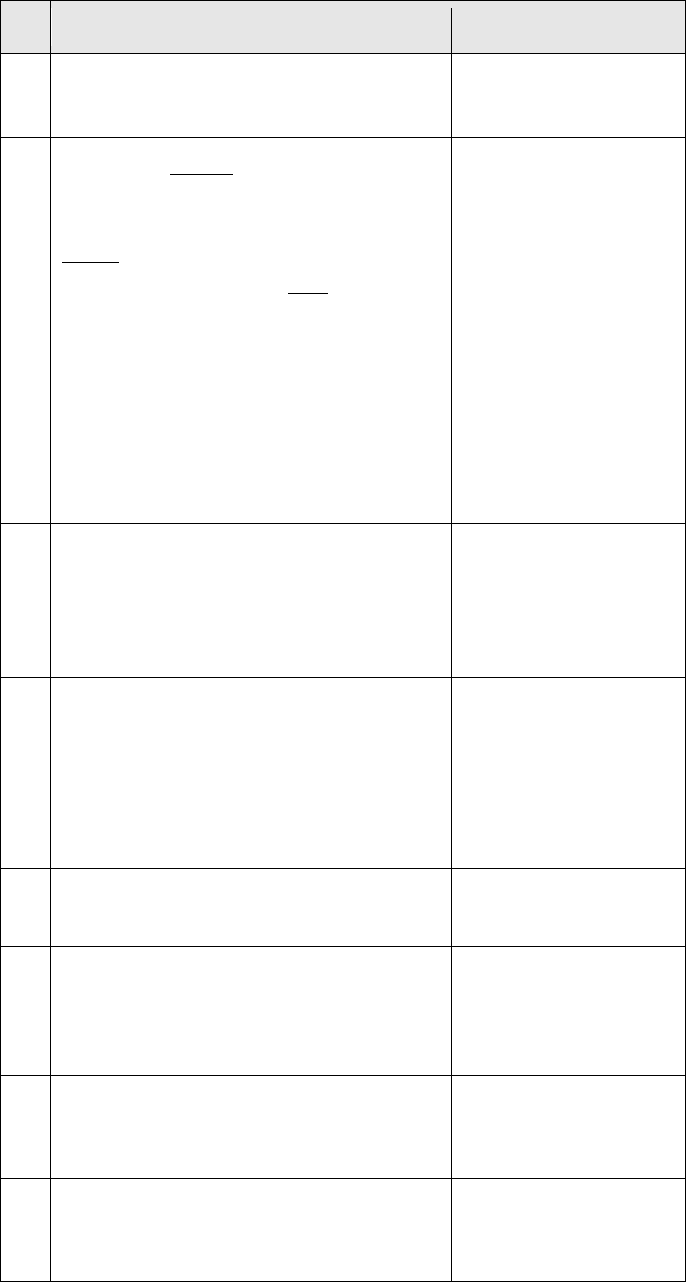

Table 1.1 Control Activities

Process Level Controls Explanation/Example

Management review

Ensures documentation/information is complete, accurate, appropriate,

consistent, and compliant and provides feedback on errors or uncertain issues.

Example: Review of expenditure transaction supporting an accurate

reconciliation.

Authorization

Ensures that the permission granted for financial decisions and transactions were

granted by the appropriate personnel.

Example: List of authorized approvers agree with the approval signature/sign-

off.

Approvals

Indicates the documents have been reviewed, approved, and considered accurate,

appropriate, and compliant.

Example: Signature/sign-off demonstrating approval of a properly processed

transaction.

Segregation of duties

Ensures that no one person controls a transaction or process from beginning to

end without the review or involvement of at least another person.

Example: One person should not process, approve and reconcile expenditures.

The approval and reconciliation duties should be segregated.

Interface controls

Ensures that data agree after being sent from one system to another.

Example: Verifying that account balances that interface with each other agree.

System configuration

Ensures that a system is correctly performing its features and functions as

designed.

Example: System totaling ledger account balances correctly.

Access controls

Prevents unauthorized access. Ensures that individuals obtain unique, individual

log-in credentials.

Example: Common Access Card coupled with a username and password for

computer log-in.

Reconciliation

Comparison of sources, a financial record and an independently controlled

record, which should result in an explained or zero difference.

Example: Account balances should be compared to control account balances.

Edit Checks

Prevents inappropriate data entry in data fields.

Example: Entering characters in a numeric field will prevent the user from

moving forward when recording the dollar value of a transaction.

Internal control over financial reporting is a process designed to provide reasonable assurance

regarding the reliability of financial reporting. Reliability of financial reporting means that

management can reasonably make the following assertions:

1. All reported transactions actually occurred during the reporting period and all assets and

liabilities exist as of the reporting date (existence and occurrence);

2. All assets, liabilities, and transactions that should be reported have been included and no

unauthorized transactions or balances are included (completeness);

3. All assets are legally owned by the agency and all liabilities are legal obligations of the

agency (rights and obligations);

4. All assets and liabilities have been properly valued, and where applicable, all costs have

been properly allocated (valuation);

5. The financial report is presented in the proper form and any required disclosures are

present (presentation and disclosure);

6. The transactions are in compliance with applicable laws and regulations (compliance);

7. All assets have been safeguarded against fraud, waste, and abuse; and

COMDTINST M7100.3F

1-4

8. Documentation for internal control, all transactions, and other significant events is readily

available for examination.

1.2.2 Consideration of Fraud

Fraud is an intentional act by one or more individuals among management, those charged with

governance, employees, or third parties, involving the use of deception that results in a

misstatement in financial statements that are the subject of an audit. Management has overall

responsibility for the design and implementation of a fraud risk management program, including:

1. Setting the tone at the top for the rest of the organization. An organization’s culture plays

an important role in preventing, detecting, and deterring fraud. Management creates a

culture through words and actions where it is clear that fraud is not tolerated, that any

such behavior is dealt with swiftly and decisively, and that whistleblowers will not suffer

retribution.

2. Implementing adequate internal controls — including documenting fraud risk

management policies and procedures and evaluating their effectiveness — aligned with

the organization’s fraud risk assessment.

3. All Coast Guard personnel should report to their superiors any witnessed or suspected

fraudulent or corrupt activity in accordance with The Coast Guard Fraud Response Plan

promulgated May 2015.

https://cg.portal.uscg.mil/units/cg84/Financial%20Management%20Policies%20%20Proc

edures/Forms/AllItems.aspx?RootFolder=%2Funits%2Fcg84%2FFinancial%20Managem

ent%20Policies%20%20Procedures%2FInterim%20Policies%20and%20Procedures%2F

Risk%20Management&FolderCTID=0x0120001FE18D38AD0A2D43AF058C48325C7

246&View={796C7D03-23B5-4873-B3D6-9F2E1F05B6F5}

Financial managers should obtain the financial staff’s knowledge and understanding of and

viewpoint on fraud. The financial manager should consider the following:

1. Whether the financial staff has knowledge of any fraud or suspected fraud affecting the

Coast Guard;

2. Whether the financial staff is aware of allegations of fraud or suspected fraud affecting

the Coast Guard, for example, received in communications from employees, former

employees, analysts, regulators, or others;

3. The financial staff's understanding about the risks of fraud in the Coast Guard, including

any specific fraud risks the Coast Guard has identified or account balances or classes of

transactions for which a risk of fraud may be likely to exist;

4. Programs and controls the Coast Guard has established to mitigate specific fraud risks the

Coast Guard has identified, or that otherwise help to prevent, deter, and detect fraud, and

how the financial staff monitors those programs and controls;

5. Whether (a) the nature and extent of monitoring of operating locations or business

segments, and (b) there are particular operating locations or business segments for which

a risk of fraud may be more likely to exist;

6. Whether and how the financial staff communicates to employees its views on business

practices and ethical behavior; and

COMDTINST M7100.3F